Leading crypto exchanges like Binance Futures always look for ways to help traders earn more from their crypto assets without making huge capital investments. One such method is through is margin trading.

Margin trading allows you to trade using borrowed capital by depositing your crypto assets as collateral. Therefore, you can open large positions than what you have in your wallet allows you. Better yet, you can also use leverage to increase your position and potential gains further.

However, there is more to margin trade on Binance than just borrowing funds. This guide looks at it in more detail to help potential traders know what they are getting into.

How Does Margin Trading Work On Binance?

Margin trading in Binance is more like speculating on crypto assets’ performance like if you want to take a long or short Bitcoin trade. Also, like spot trading, it will involve the trade of digital coins like BTC and ETH. However, unlike spot trading, it hinges on borrowed capital to increase the value of your position.

Because traders can borrow funds from third parties like other traders in Binance, they stand to gain more if the market goes their way, but they also lose more if it does not. The traders will enjoy the gains made from the trade but have to pay back the funds plus interest.

Also learn about What are binance leveraged tokens?

Besides knowing how the margin trade works, you also need to understand how to trade with margin on Binance. Here is a step-by-step guide.

Step 1: Create an Account and Complete Identity Verification

First, you will need to create an account on Binance Futures by going to https://www.binance.com and clicking on the yellow “Register” button at the top right corner.

Binance requires you to enter your email address and create a password when signing up. Also, you will need to verify your email address using the code they will send to the email.

Other essential steps worth mentioning when creating your account are setting up 2FA and doing KYC verification. Both are vital for securing your crypto assets and removing limits from your account, and so you should not overlook them.

Step 2: Open Margin Trading Account

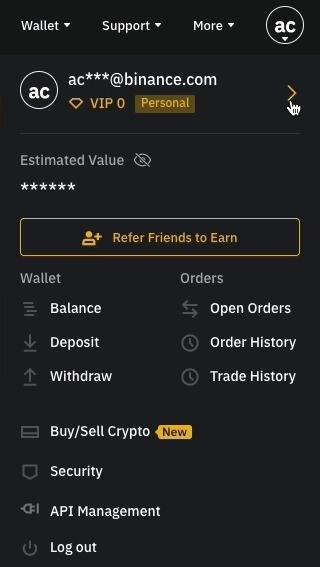

After registration, you can now open your margin trading account. And to do this, you should start by hovering the mouse over the profile icon at the top right of the home screen.

A drop-down menu will open, and you should then click on your email address to open your Binance account dashboard. Here is how the dashboard will look:

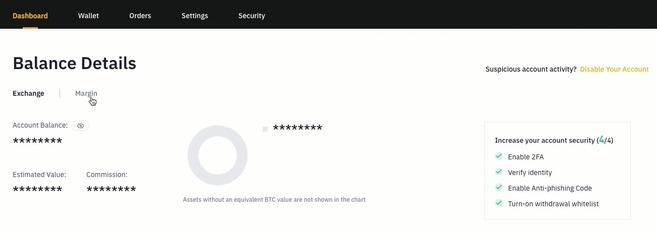

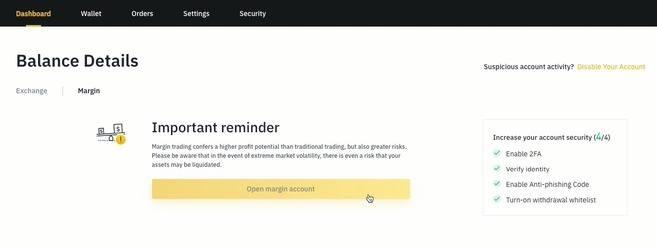

Next, you need to open the “Balance Details” window and then click on “Margin” to start the process of creating your margin account.

Before you proceed, you will get a message reminding you of how risky margin trading is, and after reading it, you should click the “Open Margin Account” button.

Note: With the account set up, you should also spare some time to read and understand the Margin Account Agreement. While it might not look necessary, it is an essential step that you should not skip because it is vital to know what to expect and what the platform expects from you.

Step 3: Transfer Funds to Margin Trading Account for Collateral

Once your margin trading account is active, you can now transfer money from your Binance wallet to the account to use as collateral when you start trading.

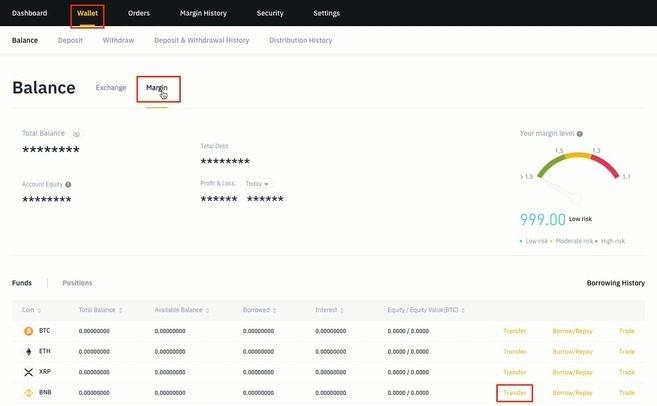

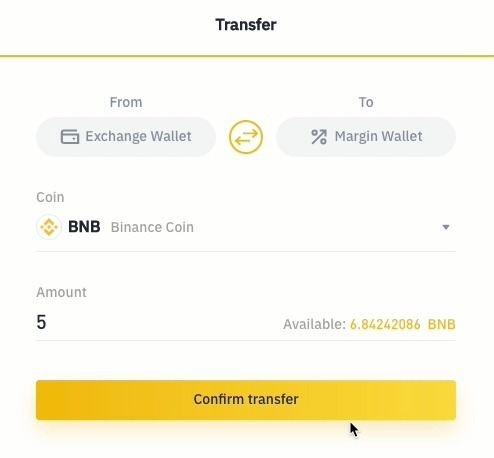

To make the transfer, you need to click on the “Wallet” tab on your account. When the window opens, click on “Margin”, which is just above your balances. Next, click on “Transfer”, which then displays the funds in your wallet, which is what is available for transfer.

You have to choose the coin you want to transfer from your list and also input the amount you want to move before clicking on the “Confirm Transfer” button at the bottom.

Step 4: Borrow Funds

The coins in your margin trading account will act as collateral for borrowing funds for your margin trade. Therefore, the amount you transfer to the wallet will determine the loan size you get and hence the position size you can open for your margin trade.

Typically, you will get a 5:1 fixed rate, which means you can borrow up to five times the balance you have. For example, if you transfer 2 BTC, the maximum you can use to open your position is 10 BTC as you can only borrow 8 more BTC.

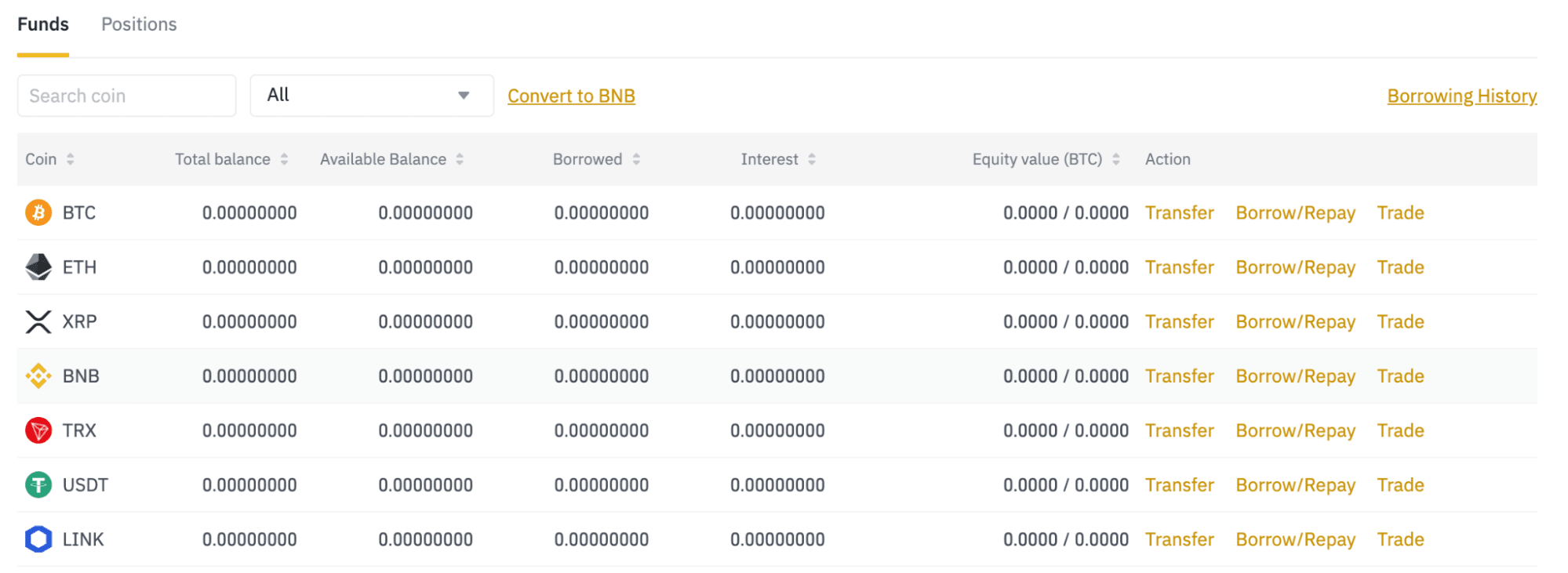

Here you will first need to decide the coin you want to borrow and then click “Borrow/Repay”, which is on the right side just after “Transfer”.

A new window will then pop up to enter the amount of the particular coin you want to borrow. After entering the amount, click “Confirm Borrow” to complete the process.

After confirmation, your margin trading account will be credited with the asset you have borrowed. However, you can still check your margin account wallet to ensure the loan went through. Also, you can keep track of the debt you owe plus the interest rate (which is updated every hour) in the “Margin” tab on your wallet.

Step 5: Open a Trade

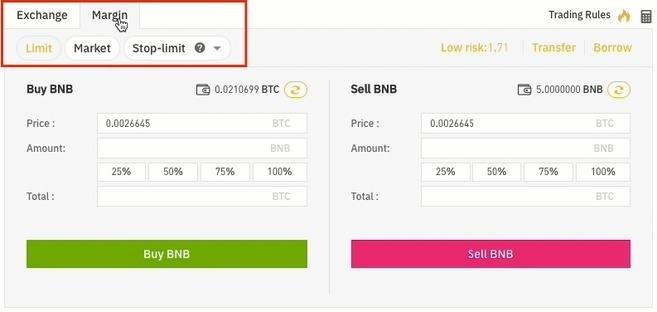

When you want to use the borrowed funds to trade, you should start by going to the Exchange page and selecting “Margin”. You can then trade just as you trade with the assets you own using the orders that Binance supports.

Note: Remember to keep track of your margin level as you trade because if it drops to 1:1, it will trigger liquidation and force Binance to sell your asset to settle the debt and interest.

Binance Margin Trading Assets

Binance is one of the largest crypto exchanges in the world based on its daily trading volumes and number of users. Therefore, one can rightfully expect them to support more trading assets for all its markets.

The company supports over 500 different cryptocurrencies for its global traders. The number is much lower for the US-based traders, but you can expect at least 60 supported digital assets.

For margin traders, they allow you to use most of these assets from BTC and ETH to BNB and USDT for your trade. The fact that you can trade over 600 different pairs for their margin trading is enough indication that they have more than enough assets for you to use.

The only problem with some assets will be finding a lender when you want to borrow the asset. However, this should never be a problem with primary coins like BTC and ETH, as there is almost always some you can borrow on the platform.

Binance Margin Trading Fees

Binance uses a tiered structure when charging fees, and it aims to ensure the higher your 30-day trade volume, the lower the costs you will pay. The tiers range from VIP 0 to VIP 9, and the fees will reduce as you move up the level.

Since margin trading will just be regular crypto trading, with the only difference being that you are using borrowed funds, the fees will be the same.

VIP 0 traders will pay 0.0750% in maker and taker fees, while the large volume VIP 9 traders will part with just 0.0150% maker fees and 0.0300% taker fees.

Besides these trading fees, it is also essential to keep the margin borrow interest in mind as it can quickly add up. Binance also applies their tiered system, and the interest depends on the coin you borrow. For example, a VIP 0 trader that borrows 1INCH will pay 0.050000%, while a VIP 9 trade pays 0.040000%.

Isolated Margin Trading in Binance

Isolated margin trading uses historical transactions to calculate your cost and profit or loss. It can be very useful in ensuring you make a wise investment decision for your Binance margin trade.

This trading position will not depend on your borrowing behavior or even the funds you have in your account currently.

Cross Margin Trading in Binance

Binance allows each trader to open just one cross margin account. All the trading pairs will be available for this account, and all your positions will share the same assets.

Unlike isolated margin trading that uses historical transactions, cross margin uses the total asset value and total debt to determine your margin level.

When you activate cross margin trading on Binance, the system will keep checking and updating you when the margin level goes down, and you need to add more margin or close the position.

It is crucial to keep in mind that if you enable cross-margin trading in Binance, you risk losing everything (your entire margin balance and all open positions) in case of a liquidation.

How to Repay Binance Margin?

At some point, you will need to repay your Binance margin as you cannot trade with a debt infinitely. Also, the interest can add up in the long run as the platform calculates it on an hourly basis.

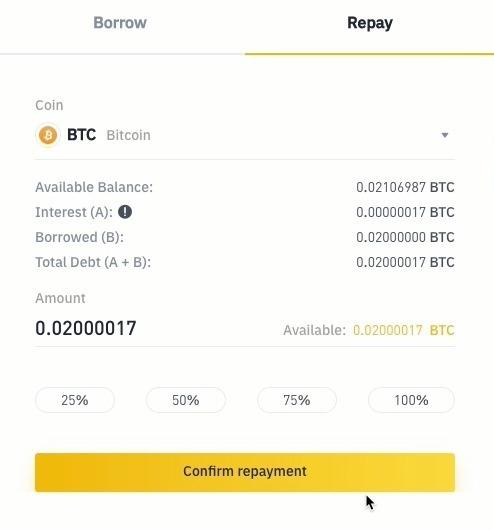

When it is time to repay your margin, you should click the “Borrow/Repay” button next to the asset you borrowed and then choose the “Repay” tab.

The total amount you need to pay will be the assets you borrowed plus the interest rate. Therefore, it is vital to make sure you check what you owe and ensure your account has enough funds to cover it.

For the repayment, you should pick the coin that you owe and the amount you want to repay. You will also get a breakdown of the total debt, and if everything is okay, click on “Confirm Repayment.”

What is Maintenance Margin in Binance?

When trading with leverage, you have to maintain a specific margin level to sustain your position, which is what is referred to as the maintenance margin.

When your account falls below the maintenance margin level, you will get a margin call to add more funds to your position. If you do not add the funds in time, it will lead to liquidation, and the Binance trade engines will close your position.

The maintenance margin you require will depend on the size of your position, notional position value, maintenance margin rate, and the maintenance amount. Here is the formula for calculating maintenance margin.

Maintenance Margin = Notional Position Value x Maintenance Margin Rate – Maintenance Amount

What is Initial Margin in Binance?

The initial margin is the minimum amount that a trader must deposit to open a margin position on Binance. The specific amount you need for your initial margin will depend on the position size you want to open.

Besides the position size, the initial margin requirement depends on the notional positional value and the leverage level you intend to use. Here is the formula to use when calculating the initial margin requirement.

Initial Margin = Notional Position Value/ Leverage Value

Binance Margin Trading Pros & Cons

Margin trading is profitable, but it has many risks like every other form of making money with digital assets. If you are still not sure whether to give it a try or not, understanding the pros and cons of this trading always makes the decision an easier one

- Pros

1. Higher Potential Gains

If you can read the market well and things go your way, you can make more money from margin trading than spot trading. Traders can open positions with 2x to 10x leverage meaning there is potential to double any gains you make or even multiple them by 10, which is enormous.

2. Portfolio Diversification

Traders can use margin trading as a form of hedge investment, which gives them a more diverse portfolio. With a diverse portfolio that includes hedged positions, you get some protection from market downturns.

3. Reduced Capital Requirements

One of the main things that hold many traders back is the lack of capital to open large positions. With margin trading, you can work around this by borrowing some of the funds you need. For example, if you want to trade with 5 BTC, you only need to have one and borrow the other 4 coins you need.

- Cons

1. Amplified Volatility

Although margin trading is similar to spot trading since you will buy and sell tokens or coins, the volatility is amplified. Therefore, even smaller investments are much riskier in margin trading than spot trading as the loss can be huge.

2. Interest Rates

Besides the usual trading fees you have to pay when trading on Binance, margin trading also means you have to pay interest rates for the funds you borrow. The interest rates make the trade more expensive and eat up your profits.

New to Margin Trading? Learn the difference between Binance Margin or Futures trading

Conclusion

Margin trading on Binance makes it possible to open large positions and make more significant gains without adding a lot of capital to your account.

With margin trading, you get exposure to opportunities that you would otherwise miss out on in other forms of trade.

While the risks and costs are also higher, if you do it with purpose, read the market well, and use trading tools like stop-orders, things should work out well for you.

New to Crypto Trading? Learn about the Best indicators for crypto day trading