Kraken is one of the well-known crypto exchanges out there.

The exchange allows you to trade in the spot market, margin trading market and futures market. Along with that, you get other features, too, like NFT marketplace, staking, and others.

However, when it comes to effectively trading, a trader must take positions in both directions of the market. While going long on a crypto trade is easy. Short-selling a trade can be confusing.

But to help you out, our how to short Bitcoin (BTC) crypto on Kraken guide will help you out:

How To Short Bitcoin (BTC) Crypto On Kraken?

Short via Kraken Margin Trading

You can start short selling via margin trading on Kraken. Margin trading refers to borrowing funds from third-party and using the funds to open trading funds. And after you exit from a trade, you repay your borrowed funds.

It is similar to spot Trading. But the key difference is that you will be using borrowed funds for your trades.

Also, it comes with other elements of trades, such as leverage and margin, which helps you to maximize your profit on each Trade.

- Create an Account

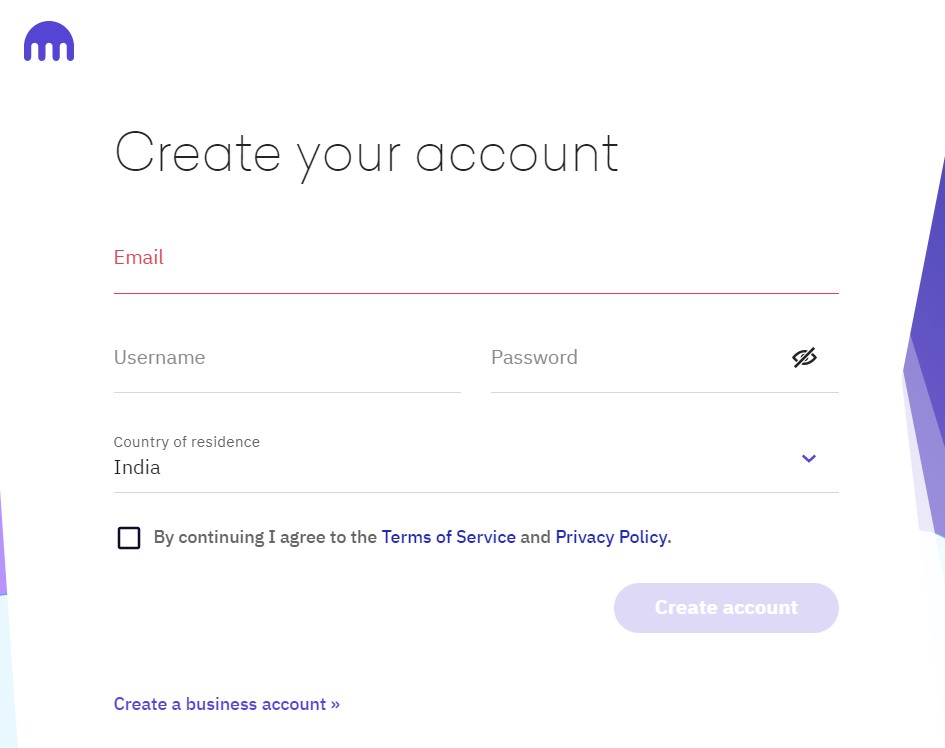

First, start by creating a Kraken account if you don’t have one already.

To create an account, head over to Kraken.com and click on the Create Account button and then enter your details, and you are good to go. Also, to start trading with Kraken, you are required to complete KYC.

- Add Funds

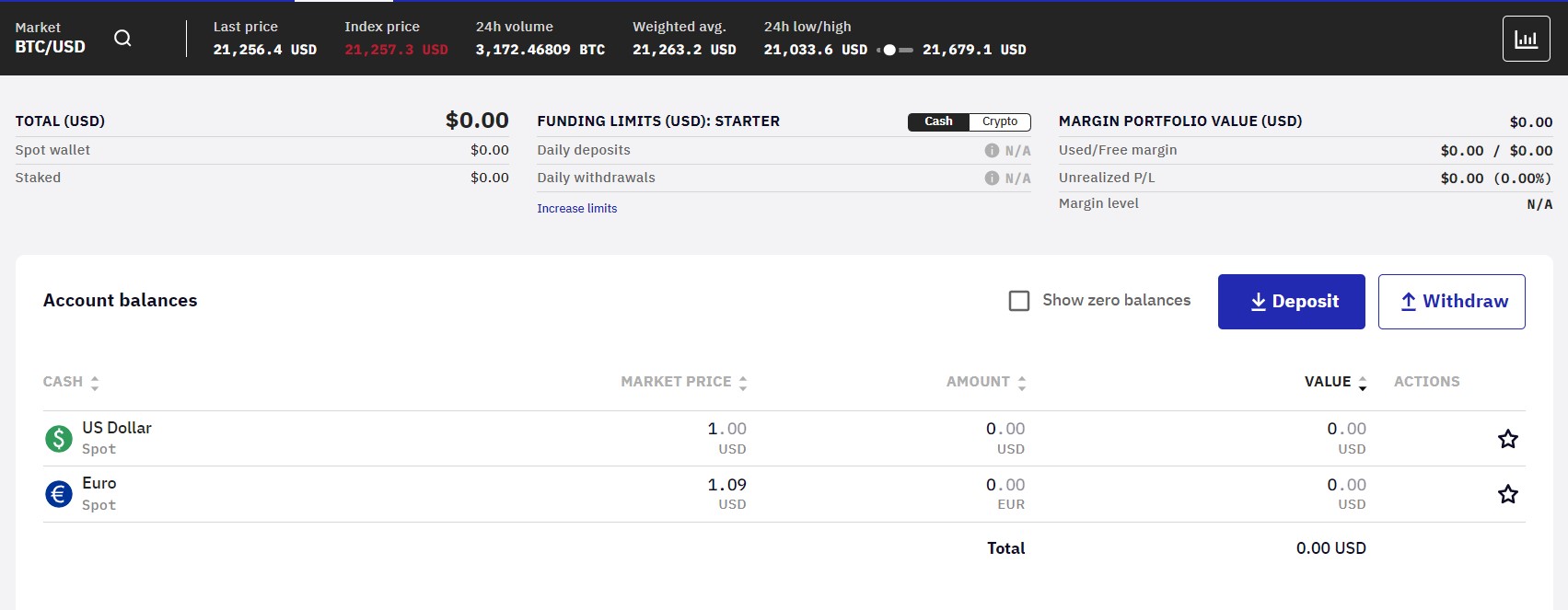

The next step is to add funds to your Account. There are two ways to add funds to your Kraken account. First, you can either use supported payment methods to purchase crypto.

Alternatively, you can transfer funds from other exchanges or wallets to the exchange. To buy crypto, you must click on the Buy Crypto button in the navigation bar.

To deposit funds, go to Funding and then click on the Deposit button to deposit crypto to your Kraken account.

- Short Crypto

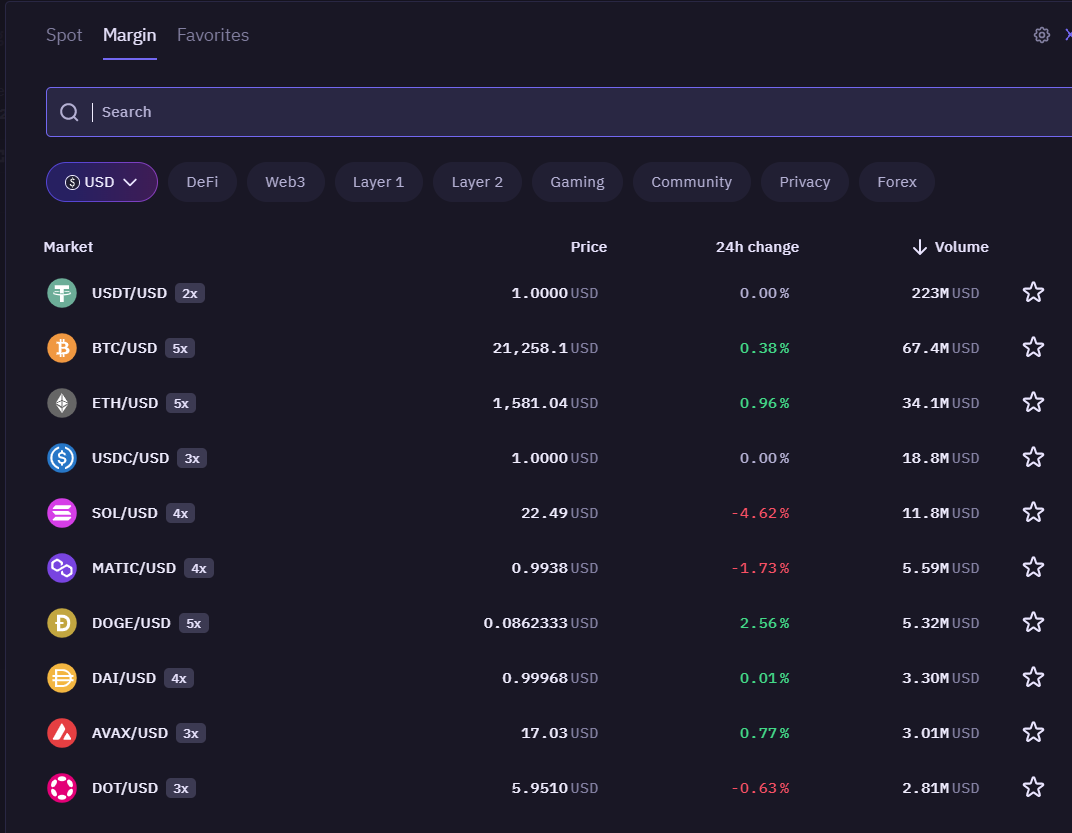

Instead of Margin trading, Kraken offers you Spot margin trading, which enables you to trade crypto with up to 5x leverage. As a result, you can trade crypto at spot prices with leverage which will limit both your profits and risks.

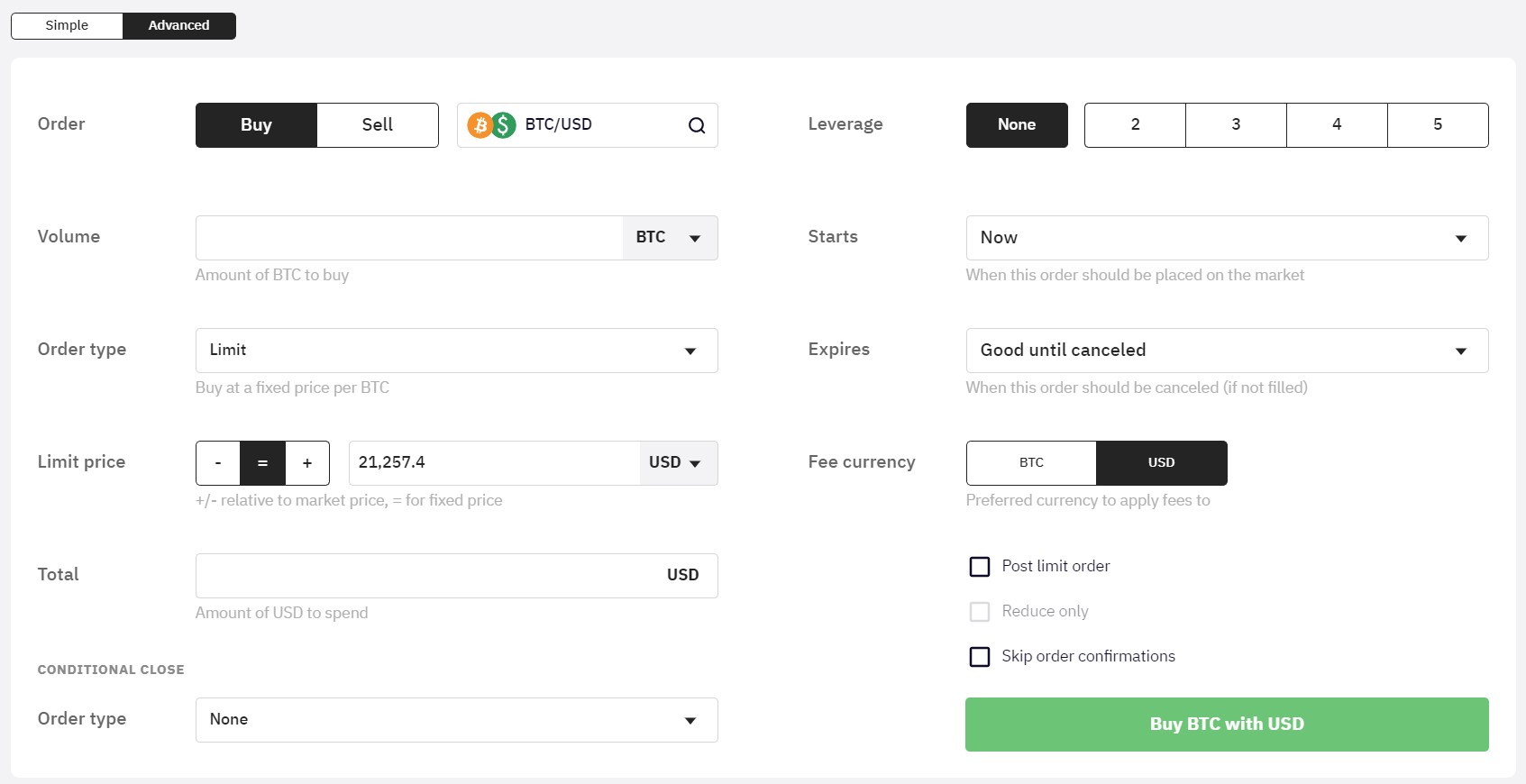

To start Spot margin trading, you need to click on Trade from the navigation bar, and a basic trade window will open up.

From here, switch to the Advanced section, and it will open a basic order form where you can enter your volume, order type, price, and set leverage.

However, to trade more efficiently, I would recommend you switch to pro.kraken.com, which is an extended version of the trading terminal.

In the Pro Kraken terminal, you will first find the BTC/USD button. So click on it and switch to the Margin tab. Over here, you will find all the available margin trading pairs. Click on any of the pairs, and its chart will open up. But for this example, we will stick to BTC/USD only.

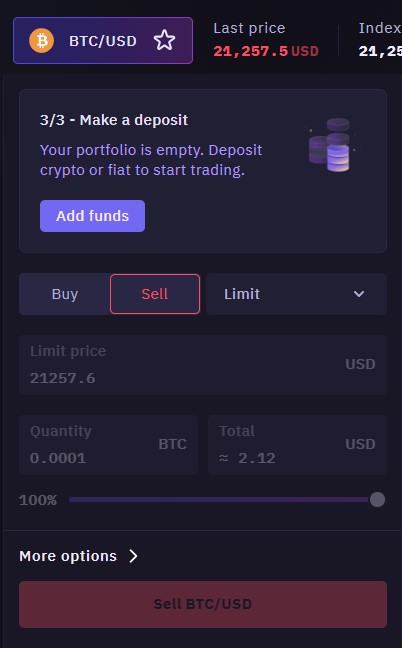

On the left side of your screen, you will find the order form. Now to short-sell, you have to select Sell, then use the Limit dropdown menu to select the order type.

Below that, enter the price you want your Trade to be executed. Also, you can use the 100% slider to adjust the leverage.

Once you have entered your order details, click on the Sell BTC/USD 5x button to open your Trade.

Also, below the technical chart, you will find an Open orders tab. From here, you can close, modify and cancel your trades.

Furthermore, as Kraken offers you spot margin trading with leverage, there is no need to worry about repaying funds.

Short Via Kraken Future Trading

Unlike other popular exchanges, Kraken requires you to sign up on a different platform to trade futures. To get started with this, follow the below steps:

- Sign-In Kraken Futures Account

As Kraken has a separate platform for futures trading, you must go to the futures.kraken.com website. Then click on the Sign in button and then click on Sign In with Kraken SSO.

This will help you to connect your existing Kraken account to the Kraken futures. Also, the sign-in would only work when you have funds in your Kraken account. So make sure to deposit funds and then sign up for Kraken futures.

- Select A Trading Pair To Short

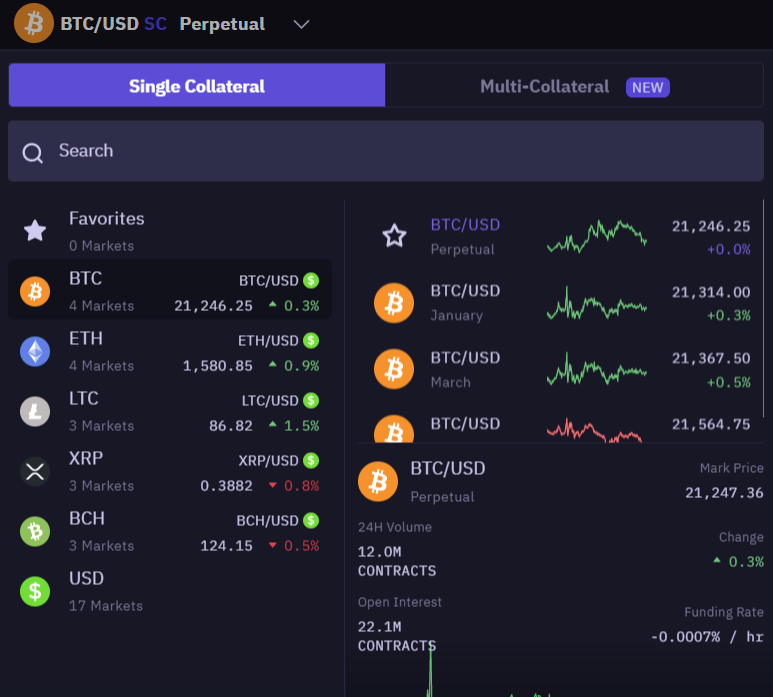

The next step is to select a trading pair. For this, click on BTC/USD, and a small Window will open up. Over here, you will find two options: Single collateral and Multi-Collateral.

The single collateral pairs can be traded with a single collateral currency like BTC, ETH, LTC, BCH, and XRP. But with Multi-collateral, you can trade with multiple collateral currencies. Apart from this, the other features remain almost the same.

So choose to trade from either single collateral or multi-collateral, and its chart will open up.

- Short Kraken Futures

Next, on the left side of your screen, you will find the order form. To place a short order, you first need to select the Sell option.

Then from the type, select your order type, such as market order, limit order, stop limit order, etc. Right below it, you will find a slider to select the leverage. The different futures contract has different leverage, so you are required to adjust the leverage before you trade.

The next step would be to enter your order details. Such as margin and how much you want to bet on your trade.

Once you have placed your order details, click on the Sell button to place a short sell order. And once the order is placed, you will find all the details right below the chart under the open positions tab. From here, you can edit, cancel or close your trades.

What is shorting on Kraken?

Generally, when you open a trading position, your goal is to buy at a lower price and sell the trade at a higher price. And the difference between your entry and exit price would be your profit.

However, when you short-sell a trade, you are supposed to sell the underlying asset at first and buy the asset at a lower price.

New to trading crypto? Learn What are long and short orders in detail

In theory, you are borrowing crypto from the exchange and selling it on the exchange at the current market price. Then you buy the same asset when the market price of it goes down, and you return your borrowed funds to the exchange.

FAQs

- How long can you hold a margin position on Kraken?

Kraken offers Spot margin trading, which is different from traditional margin trading. As a result, you are allowed to hold your trade for as long as you want.

However, you need to ensure that you are meeting the margin requirement to keep the trade open. If the trade crosses the margin requirement, then your account will get liquidated. Meaning your trade will get auto-closed, emptying your whole account.

- Can you long and short at the same time on Kraken?

Opening long and short positions simultaneously is a hedging strategy. However, Kraken doesn’t allow you to have both long and short trade options on margin at the same time.

You need to close your existing trade to take the opposite trade on the same trading pair. However, you are allowed to have multiple long or short positions on margin.

Plus, Kraken allows indirection hedging, which allows you to hold spot positions on margin in different directions for the same asset as long as the positions are opened on different order books.

- What does 5x mean on Kraken?

5x or any value that ends with x stands for leverage across cryptocurrency exchanges. Leverage trading allows you to increase your trade size by allowing you to borrow funds from the exchange.

The 5x leverage stands for your trade capital increased by 5x. For example, if you are betting $5 per trade and using a 5x leverage, then your trade size would be $25.

The higher leverage you use, the higher capital you will have access to and the bigger profit you will make.

Also, it will increase your losses because you are trading using borrowed funds, and you have to return the funds to your exchange when the trade is closed.

Conclusion

Shorting Bitcoin on Kraken is a pretty straightforward process.

The key rule is to sell first and buy it at a lower price to make a profit. Kraken allows you to short trade in both Spot margin trading and futures trading.

However, in the spot market, you are not allowed to short-sell.