Caught at the crossroads between choosing KuCoin or Kraken for your cryptocurrency trading?

I’ll dissect both platforms in this detailed review to facilitate your decision-making process.

With their formidable offerings and established reputations, picking one might seem overwhelming.

However, I aim to simplify this for you.

I’ll equip you with the necessary insights by scrutinizing crucial elements like trading options, security protocols, fee structures, and customer service.

Let’s determine whether KuCoin or Kraken best aligns with your trading goals.

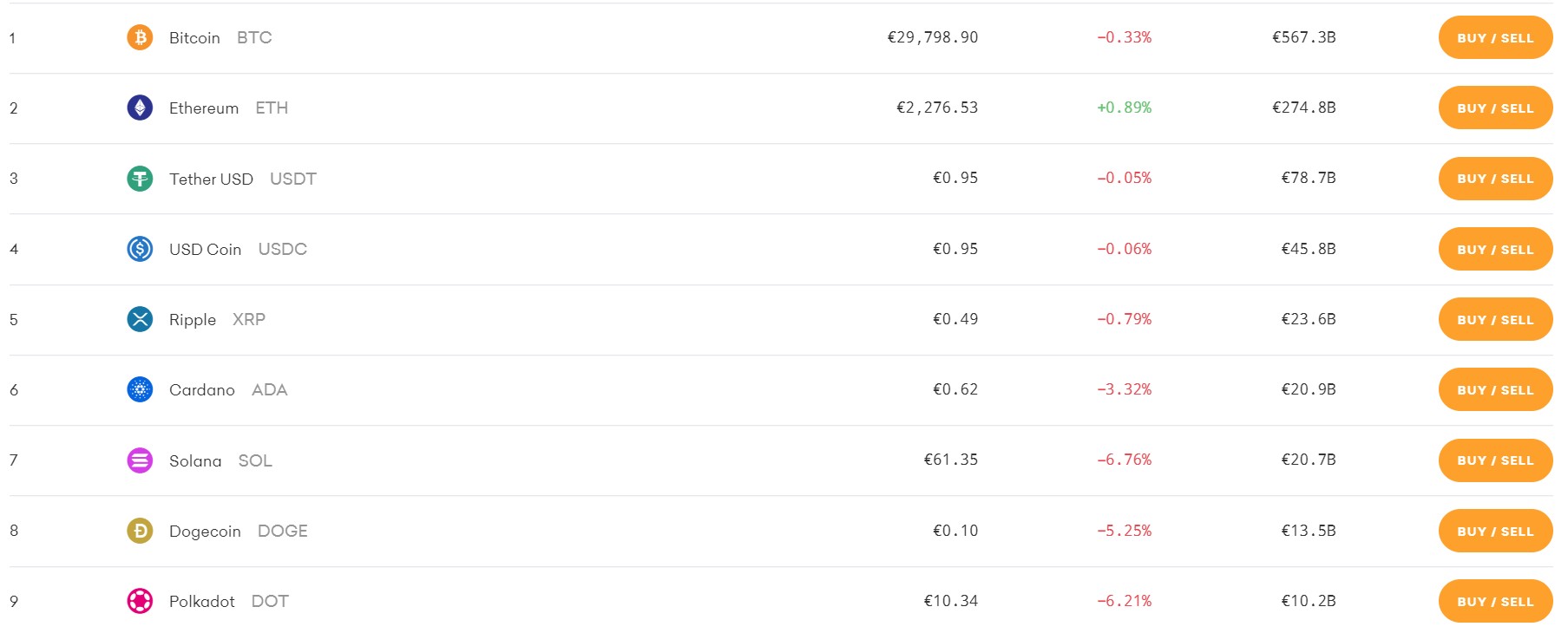

KuCoin vs Kraken: Supported Cryptocurrencies

KuCoin has a combined spot and derivatives trading volume of over $1.7 billion, making it one of the top five cryptocurrency exchanges worldwide.

Kraken has slowly been gaining popularity.

It has a 24h spot trading volume of $388 million (3rd highest) and a derivatives trading volume of $66 million (8th highest).

KuCoin has an exhaustive range of cryptocurrencies to choose from. At the time of writing, it offers over 700 cryptocurrencies.

This includes everything from popular cryptocurrencies like Bitcoin and Ethereum to the cryptocurrency you want to buy because you saw the hype on Twitter.

Hence, you get a lot of options to choose from when you want to purchase crypto.

Kraken doesn’t offer this much diversity for crypto traders.

It offers 200+ cryptocurrencies at the time of writing, including all popular cryptos like Bitcoin, Ethereum, Polkadot, etc.

You get a lot of options when it comes to choosing the cryptocurrency and the asset you want to trade it against.

Verdict: It’s a tie. Even though KuCoin supports more cryptocurrencies, Kraken also provides many options.

Trading Fees

Kraken and KuCoin both have a tiered fee structure.

However, there are certain nuances you should know about.

Let’s compare the fee structures of the two exchanges.

Kraken

Kraken charges fees based on the actions you take on the platform.

For example, Kraken charges a 0.2% fee for buying stablecoins and for other cryptos or FX pairs.

If you are a Kraken Pro user, a tiered fee structure will apply, where the trading fee will depend on your 30-day trading volume.

Kraken Pro has ten tiers.

The calculation of the Kraken fee is based on a 30-day trading volume.

The maker charge for Futures trades will be 0.02%, and the taker cost will be 0.05% percent at Level 1 (trading volume up to $100,000).

The transactions attract lower fees as the 30-day trading volume increases.

Generally, trading fees are lower for margin and Futures trades.

Additionally, transactions on both exchanges may attract a blockchain processing fee.

The fee goes to crypto miners, and the exchange has nothing to do with it.

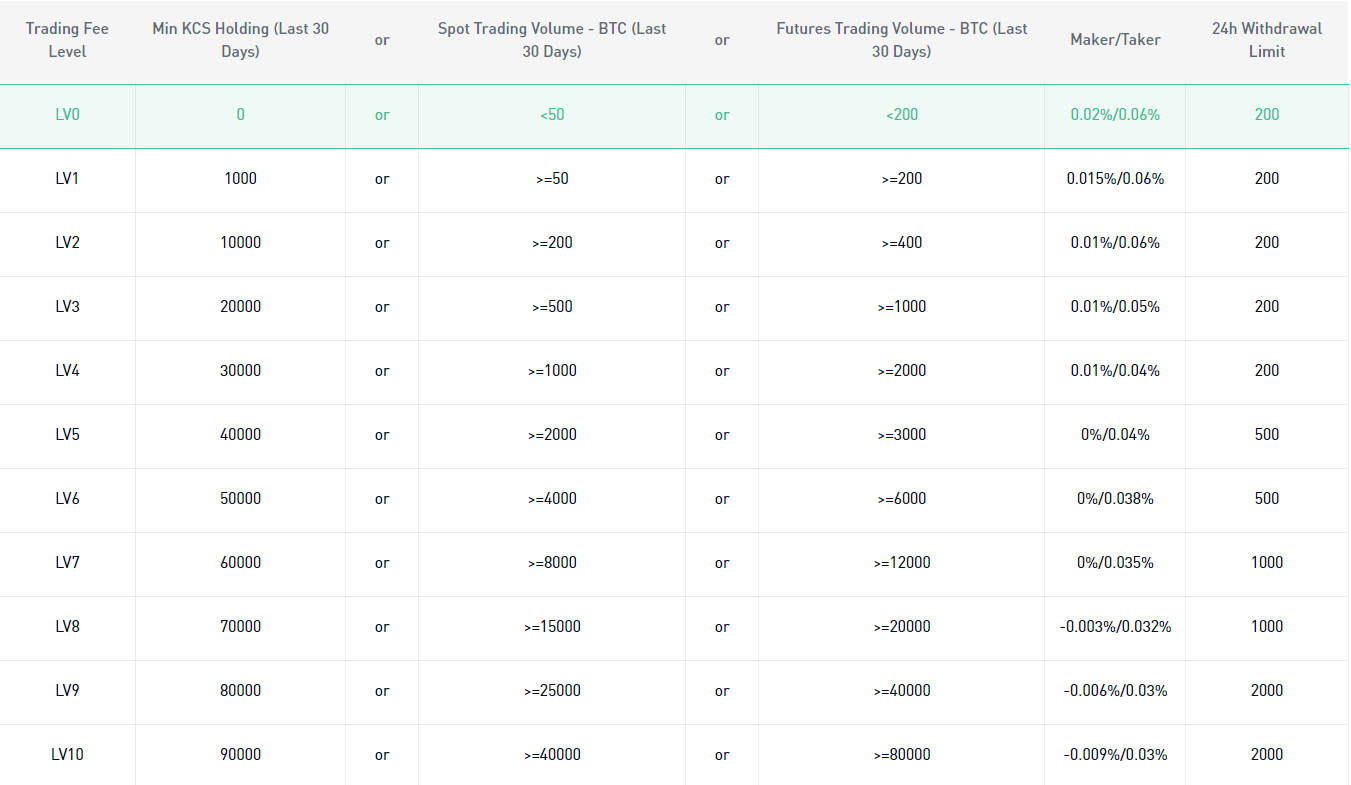

KuCoin

KuCoin has a tiered fee structure, further divided into classes depending on the cryptocurrencies you trade.

KuCoin classified all cryptocurrencies on its platform into three classes for spot trading: Class A (0.1%/0.1%), Class B(0.2%/0.2%), and Class C(0.3%/0.3%).

Class A comprises popular cryptos like BTC, ETH, ADA, 1INCH, etc.

Class B includes ABBC, BASIC, CFG, and KOK, and Class C has BURP, COMB, LITH, and MEM.

Coming to the tiers, KuCoin has 13 tiers: Level 0 to Level 12, depending on your 30-day spot trading volume or minimum $KCS holding.

For instance, users with a $KCS holding of under 1,000 $KCS, a spot trading volume of under 50 BTC, or a Futures trading volume of under 100 BTC fall into Level 0.

For Level 0 users, the spot market maker/taker trading fee is 0.1%/0.1% to -0.005%/0.025%, and the Futures trading fee is 0.02%/0.06% to -0.015%/0.03% per trade.

You can get further low fees if you pay it in $KCS, the exchange’s native token.

KuCoin is similar to Kraken in that it does not charge for deposits and has a minimal fee for the on-chain transaction.

Verdict: It’s a tie. Kraken and KuCoin have a tiered fee structure and similar low trading fees.

Funding Fees

Funding fees, often called deposit or withdrawal fees, are significant when choosing between exchanges.

For traders, these fees can add up over time and substantially impact their net returns.

On Kucoin, deposit fees for cryptocurrencies are generally free.

However, withdrawal fees vary depending on the specific cryptocurrency.

For instance, withdrawing Bitcoin incurs a fee of 0.0004 BTC at the time of writing.

On the other hand, Kraken also doesn’t charge deposit fees for most cryptocurrencies.

Withdrawal fees also vary, with Bitcoin withdrawals costing 0.00015 BTC, which is comparatively lower than Kucoin.

Verdict: While both exchanges have competitive fee structures, Kraken has the edge regarding lower withdrawal fees for some cryptocurrencies like Bitcoin.

Liquidation Mechanism

In the volatile world of cryptocurrency trading, liquidation mechanisms are crucial safety measures to protect traders from extreme market fluctuations.

Kucoin’s Futures platform utilizes a Fair Price Marking mechanism.

This mechanism calculates the Mark Price (the price at which the system evaluates positions to determine if liquidation is necessary) to avoid unnecessary liquidations in volatile markets.

Furthermore, Kucoin also uses an Auto-Deleveraging (ADL) system that minimizes the possibility of clawback.

On the other hand, Kraken employs a robust liquidation mechanism that integrates an automated system to close positions when necessary.

This is combined with the Margin Call Level and the Margin Liquidation Level, designed to keep risk at bay.

When a user’s Margin Level falls below the Margin Liquidation Level, their whole margin position will be liquidated.

Verdict: Kucoin and Kraken have robust liquidation mechanisms to protect their users. Kucoin’s Fair Price Marking and ADL system can potentially avoid unnecessary liquidations during extreme market volatility, which can benefit some traders.

Kraken’s Margin Call and Liquidation levels also provide clear thresholds for traders to manage risks.

As such, the choice between the two may come down to personal preference, trading strategy, and risk tolerance.

Account Funding Methods

Kraken and KuCoin support deposits through cryptocurrencies and fiat currencies.

Fiat funding options on KuCoin and Kraken depend on the currency you want to deposit.

Let’s compare the account funding methods on KuCoin and Kraken.

KuCoin allows you to deposit funds in three ways: Fast Buy, P2P, and Third-Party. In Fast Buy, you can buy USDT or other supported fiat currencies directly using a Debit/Credit card.

In P2P, you can transfer funds using bank transfer, PayPal, Revolut, and 20+ other options for a slightly higher fee.

Lastly, you can use third-party payment gateways like Banxa and Simplex to transfer USD and EUR funds amongst other supported currencies.

The payment options depend on your currency, location, and other factors.

Kraken also offers a wide range of funding options to choose from. You can fund your account using the cryptocurrencies available on the platform.

Payment methods for depositing fiat money will depend on the cryptocurrency you deposit.

You can use Fedwire, SWIFT, SEN, Etana, and wire transfer to deposit USD. SEPA bank transfer, Etana, and wire transfer are available for EUR.

Verdict: It’s a tie. Both KuCoin and Kraken offer a wide range of funding methods and options.

Opening Account & Account Limits

Both Kraken and KuCoin offer seamless account opening processes.

Let’s compare the procedure of the two exchanges.

KuCoin

To open an account on KuCoin, visit the website and click Sign Up in the top right corner. A registration form will appear.

Fill out that form and confirm your account using the OTP you’ll receive.

That’s it.

You can fund your account and start trading.

KuCoin has mandatory KYC requirements, and you cannot trade without that, though there are limitations.

Verified users can withdraw up to 200 BTC per day.

Kraken

Kraken has two levels that require you to go through KYC procedures: Basic and Pro.

Kraken Pro is designed specifically for advanced traders.

It consolidates its existing spot trading platform, margin trading, and Futures trading platforms for professional trading along with its industry-leading staking services.

Behind the scenes, it’s the same order book, one of the largest exchanges, reputable and reliable, and world-class security that Kraken is known for.

Verification unlocks deposit and withdrawal limits, and you can access advanced features like OTC desk trading, Futures trading, etc.

Verdict: It’s a tie, as KuCoin and Kraken have mandatory KYC verification. You can unlock limits and access more features by verifying your identity.

Ease of Use & Interface

KuCoin and Kraken both offer full-fledged trading platforms with advanced features and functionalities.

Let’s draw a head-to-head comparison between the two to determine which one is better.

- KuCoin

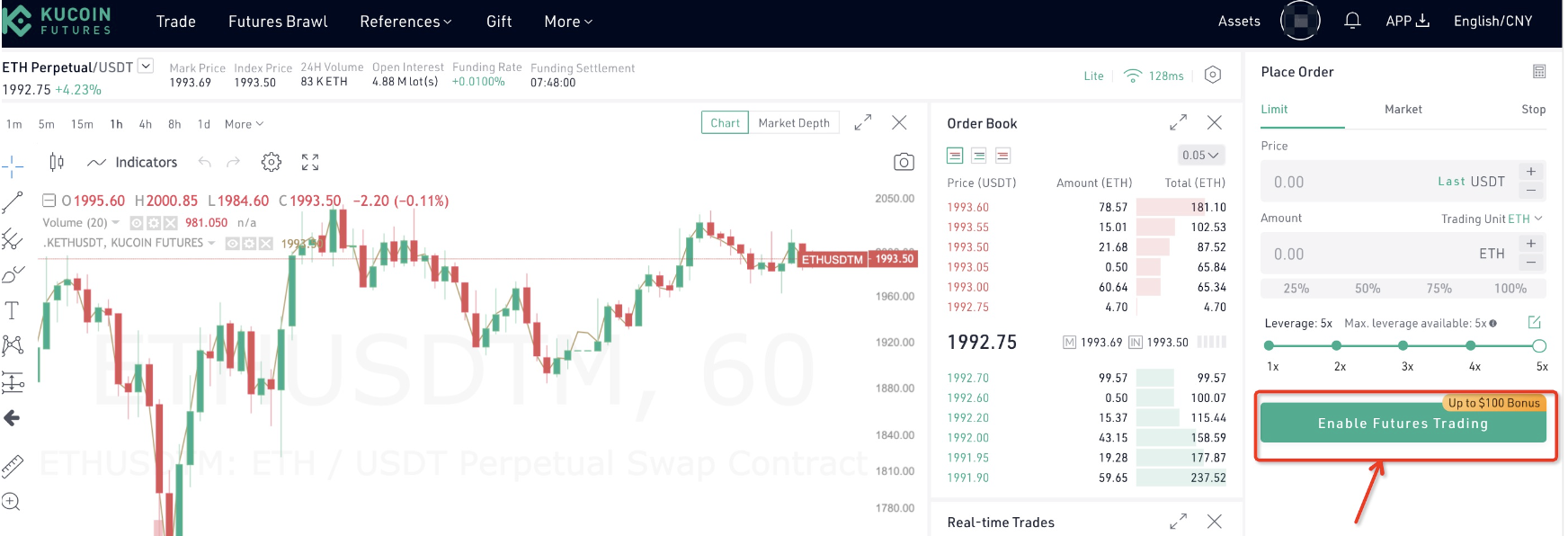

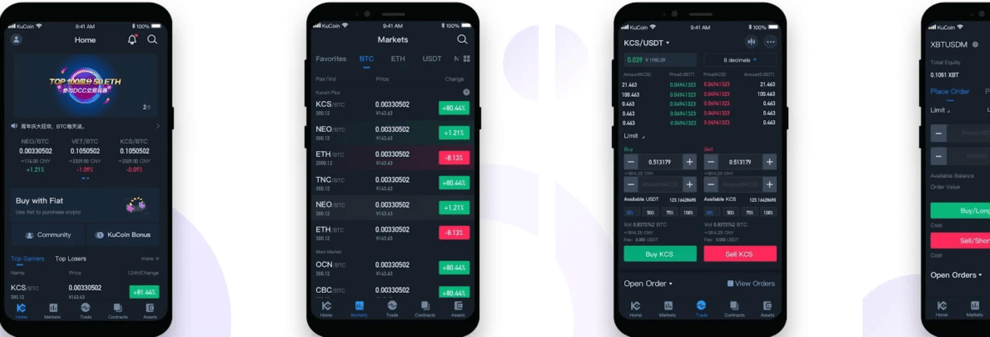

KuCoin has a powerful and feature-rich Futures trading platform.

The center of the trading terminal has a charting system powered by TradingView.

You get multiple timeframes, ranging from 1 minute to 1 week.

Coming to chart types, KuCoin allows you to choose among bars, candles, hollow candles, Heikin Ashi, line, area, and baseline.

In addition, you get hundreds of indicators to choose from to enhance your technical analysis.

KuCoin has an intuitive ordering of its trading interface. You get up to 10x leverage on margin trading and 100x leverage on Futures trading.

The platform offers limit, market, and spot limit orders.

You can also see your past and present buy or sell orders.

Overall, KuCoin’s platform is powerful and intuitive. It’s easy to use and has a minimal learning curve.

If you’re a complete beginner to crypto trading, KuCoin users may take a few days to get accustomed to some of the more advanced trading features.

Also, to help you get onboard faster, here is a KuCoin tutorial.

However, If you have used trading platforms before, you won’t face any difficulties in buying and selling your crypto holdings.

KuCoin also offers more advanced trading tools and a large range of trading pairs which you might want to check out.

- Kraken

Kraken’s margin trading platform is very similar to that of KuCoin.

The left half of the trading terminal is entirely covered by Kraken’s proprietary charting system.

The charting system is robust and has all the features you see in TradingView and other systems.

You can perform multiple timeframe analyses with timeframes ranging from 1 minute to 1 week.

The platform additionally has drawing tools and over 50 indicators to choose from.

The number of indicators may be less, but it has almost all the indicators you’ll need.

The right side of the terminal has the order book, watchlist, volume overview, and order book. The order book is simple and intuitive.

You can choose from various orders, including market, limit, stop-limit, and stop-market.

You can also place conditional orders.

To know more about the exchange, you can check out this Kraken tutorial.

Verdict: It’s a tie, as both exchanges have robust trading platforms.

NFT Marketplace

Non-Fungible Tokens (NFTs) have dramatically changed the landscape of the digital asset market.

These unique tokens, representing ownership of specific items or content on the blockchain, range from digital artwork to virtual real estate with over a million users.

Regarding supporting NFT trading, both KuCoin and Kraken offer dedicated marketplaces catering to this booming market.

They offer a range of NFTs, from beginners to advanced traders.

Let’s delve deeper into their offerings.

KuCoin NFT Marketplace

KuCoin has emerged as an active participant in the NFT arena by offering a comprehensive marketplace where users can buy, sell, and trade various NFTs.

The platform supports a diverse array of digital assets, allowing users to explore unique and innovative NFT offerings.

Whether you’re interested in digital art, virtual real estate, or other unique tokens, KuCoin provides the platform to dive into these investments.

Kraken NFT Marketplace

Not to be left behind, Kraken has launched its NFT marketplace, further diversifying its crypto offerings.

Kraken’s NFT marketplace provides a user-friendly platform for users to discover, buy, and sell a wide range of NFTs.

From rare digital collectibles to innovative art pieces, users can navigate and explore the evolving NFT landscape.

Kraken’s NFT marketplace is designed with simplicity and usability in mind.

The user interface is clean and intuitive, making it easy for beginners and experienced traders to navigate.

Users can quickly sort and filter NFTs, making discovering and acquiring new tokens straightforward and enjoyable.

Verdict:

Both KuCoin and Kraken have made significant strides in integrating NFT trading into their platforms, each offering a robust marketplace teeming with diverse digital assets. The decision between the two could come down to individual preferences and trading requirements.

If you prioritize user interface and simplicity, Kraken’s NFT marketplace could be more appealing, given its straightforward and user-friendly design.

Security Features

Let’s compare the security features of the two exchanges.

KuCoin

KuCoin is a safe and secure cryptocurrency exchange that implements various crypto industry-standard security features.

Some essential security features of KuCoin are:

- Multi-signature cold storage wallets

- Two-factor authentication

- IP whitelisting

- Manual monitoring and authorization of withdrawal requests

- Anti-phishing safety phrase and login safety phrase.

Please note that KuCoin was hacked once in late 2020, causing a monetary loss of $250 million.

However, 84% of the lost money was recovered, and the users weren’t impacted.

Despite one hacking instance, KuCoin remains a safe crypto exchange.

Kraken

Security measures taken by Kraken are similar to that of KuCoin.

It stores 95% of the user’s funds in cold storage wallets, ensuring complete protection.

Other security features include two-factor authentication, SSL encryption, and IP whitelisting.

Kraken also has a Global Settings Lock (GSL) available after you set up two-factor authentication.

Verdict: It’s a tie, as KuCoin and Kraken take similar security measures.

Customer Support

If you’ve never traded crypto before, you could initially face some issues.

For example, your orders may go through, or your position may cut in a loss automatically.

In such cases, you’ll need a skilled and helpful customer support team to answer your questions.

Let’s compare the customer support and service of KuCoin and Kraken.

KuCoin is one of those exchanges that has fantastic customer support.

It has a comprehensive knowledge base with articles, blog posts, and frequently asked questions.

You can also learn how to earn interest on crypto, how to use trading bots, and their NFT marketplace.

If you want to reach a customer service agent, you can do that by live chat or email.

Your Kraken account, on the other hand, is one of the few cryptocurrency exchanges that offer phone support.

You can contact the support team by chat, phone support, and email.

Additionally, the exchange has a vast help section to answer your questions.

Verdict: Kraken is the winner, as it additionally offers phone support.

Is KuCoin a Safe Exchange?

Yes, KuCoin is a safe exchange.

It implements all security measures, like cold storage wallets, two-factor authentication, and KYC verification, and you can use KuCoin to trade and buy crypto without worrying.

KuCoin is also one of the most renowned cryptocurrency exchanges in the world.

Is Kraken a Safe Exchange?

Yes, Kraken is a safe cryptocurrency exchange with some of the most advanced security features and functionalities.

It has features like cold storage wallets, multi-factor authentication, global settings lock, etc.

So, users can trade on one of the biggest crypto exchanges without losing sleep over it.

Conclusion

KuCoin and Kraken are similar cryptocurrency exchanges. Both offer almost the same features, so choosing a winner is difficult.

KuCoin wins the game because it can cater to people looking for more options in coin pairs such as USDC, USDT, BTC, and ETH.

It has over 700 cryptocurrencies and features like crypto lending, a mining pool, a daily interest rate for users to earn on their staked and secure crypto, and more.

The advantage of Kraken is its phone support, which translates to better and more prompt customer support.

Both KuCoin and Kraken are amazing exchanges with top-notch features and security. You can choose an exchange you like for trading cryptocurrencies.

See how KuCoin & Kraken compares to other crypto exchanges:

- KuCoin vs Binance

- KuCoin vs Huobi

- KuCoin vs Phemex

- Kraken vs Binance

- Kraken vs Bitmex

- Kraken vs Bitfinex