Poloniex is one of the oldest names in the cryptosphere, which has launched its services in around 2014. Over time, it has forayed into multiple marketplaces including spot trading, margin trading, lending, and staking.

Currently, it offers trading in over 100 markets and is a highly liquid platform. It provides services through the web, mobile apps, WebSocket, and HTTP APIs.

However, due to the exchange’s poor customer support, slow interface, lower leverage levels, few advanced order types, etc make it a less favored option among new-age users.

But, there many suitable alternatives to Poloniex, that offer enhanced trading experience and advanced functionalities.

Best Poloniex Alternatives

(Editor's Choice For 2023) |

| Get Upto $30,000 Bonus |

- Deposit in: Bitcoin & altcoins - Store funds in cold wallet | Joining Bonus $25 | |

- Can also trade with Forex, Commodities, Indices - No-KYC Exchange | Get +35% on Your First Deposit |

#1. PrimeXBT

PrimeXBT is a crypto margin trading platform established in 2018 and in a very short duration it has become one of the leading crypto margin trading platforms in the world. It gets an average daily trading volume of over $1 billion.

Apart from crypto margin trading, it offers to trade in stock indices, commodities, and forex. All contracts are settled in bitcoin. Currently, it supports trading in nine different crypto trading pairs and offers a leverage of up to 100X.

PrimeXBT has a flat fee rate structure and charges a trading fee of 0.05% per contract. The daily funding rate for a long and short position is adjusted depending on the liquidity position.

It supports only BTC deposits and users are not required to undergo the KYC verification process means it supports full anonymity.

Why choose PrimeXBT?

- Advanced trading platform

- High liquidity and leverage levels

- Ultra-fast trade execution

- Competitive trading fee

- No KYC-verification

#2. OKEx

Established in 2014, OKEx is one of the largest global cryptocurrency exchanges by trading volume. It gets an average daily trading volume of over $2 billion. OKEx is not just any crypto exchange, but an entire ecosystem that promotes its growth.

It offers spot and margin trading, derivatives trading, onchain wallet, and mining pools. Under the derivatives segment, it offers trading in perpetual swaps, traditional crypto futures and options contracts. The maximum leverage offered is 10X under margin trading.

OKEx supports a wide range of crypto coins, the list is in hundreds and includes all the major cryptocurrencies. It is one of the few exchanges that support fiat currencies and accepts payment through credit & debit cards, bank transfer, and SEPA.

Regarding trading fees, OKEx has a tiered fee structure based on the user’s OKB coin holdings. For Level 1 users, holding 500 or fewer OKB coins, the maker fee is 0.10% and the taker fee is 0.15%. Users with more no. of coins qualify to pay lesser fees on each trade. OKB is the native cryptocurrency of OKEx.

OKEx does not charge a deposit or withdrawal fee.

You should note, OKEx doesn’t support anonymity, and users need to undergo the KYC verification process at the time of registration.

Why choose OKEx?

- Supports a wide range of cryptocurrencies and multiple marketplaces

- Fiat support

- Intuitive trading interface

- Competitive trading fee

- Good customer support

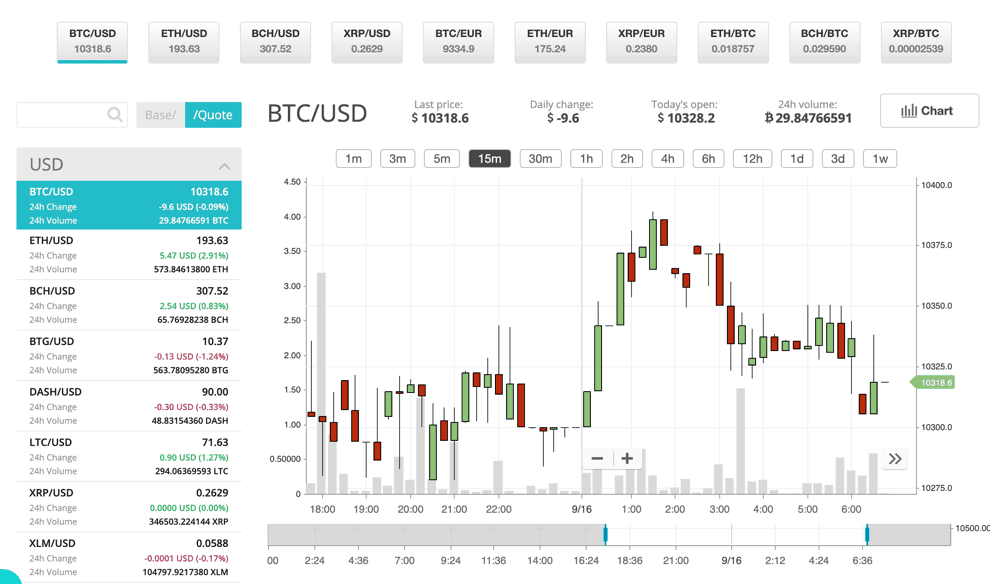

#3. CEX.io

CEX.io was established in 2013, is one of the oldest crypto exchanges with over 3 million registered users throughout the world. Initially, it was a cloud mining platform known as GHash.io but terminated its operation in 2015 due to low BTC prices. It now only functions as a cryptocurrency exchange.

It recently launched the margin trading segment (CEX.io broker) providing an opportunity for leveraged trading.

CEX.io has three product categories, Instant Buy, where you buy all the major coins instantly using a credit card in USD, EUR, GBP, RUB. The CEX.io Exchange is the spot exchange, where you can trade in over 100 crypto trading pairs. And, the CEX.io Broker is the margin trading platform which offers to trade in seven different markets with up to 10X leverage.

The transaction fee is based on the last 30day trading volume and it starts from 0.16% as maker fee and 0.25% as taker fee. The user in the highest level of the fee schedule is charged 0.10% as taker fee and nil maker fee.

CEX.io requires its users to undergo the KYC verification process at the time of the registration process.

Why choose CEX.io?

- Established and reputed exchange

- Clean and intuitive trading interface

- Competitive pricing structure

- Fiat support

- Good customer support

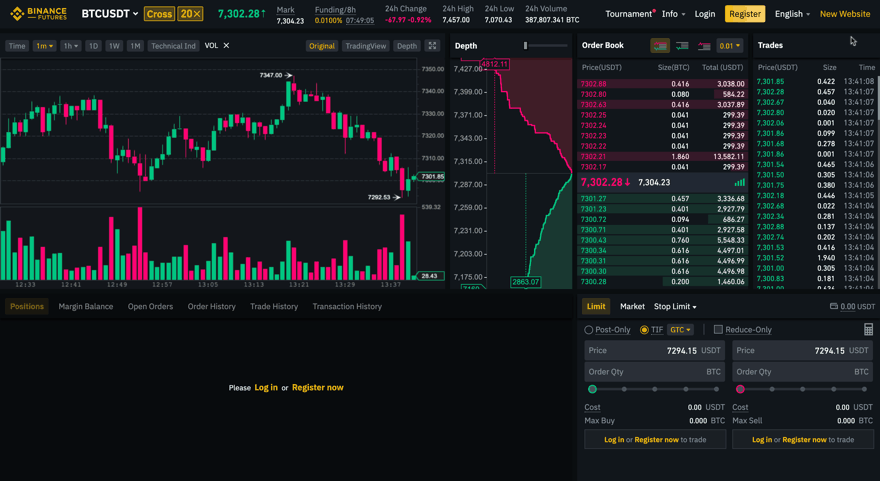

#4. Binance

Binance Futures is the strongest brand in the cryptosphere and is leading the crypto revolution from the front. Founded in July 2017, Binance is now the world’s largest cryptocurrency exchange by trading volume. It gets an average daily trading volume of over $4 billion, which indicates its brand strength.

Binance is not just a crypto exchange platform but is an ecosystem within an ecosystem. It offers spot trading, derivatives trading, staking, mining pool, crypto debit cards, P2P trading and lending.

BNB token is the native token of Binance, which fuels its ecosystem. It only supports crypto-to-crypto trading pairs and allows trading in over 100s of different markets.

In the futures segment, you can trade perpetual futures contracts and offer up to 125X leverage, highest in the industry. And, is also the most liquid crypto margin trading platform.

Trading on the Binance platform is the cheapest. The fee is based on the last 30-day trading volume and follows a tiered fee structure. The maker fee and taker fee for the initial level is 0.10% for both. You are entitled to 25% if you use BNB tokens.

You can get access to spot trading without KYC verification but its other services including futures trading require KYC verification of users.

Why choose Binance?

- Reputed exchange

- Highly liquid platform

- Wide range of products and services

- Easy to use

- Lowest trading fee in the industry

#5. Kraken

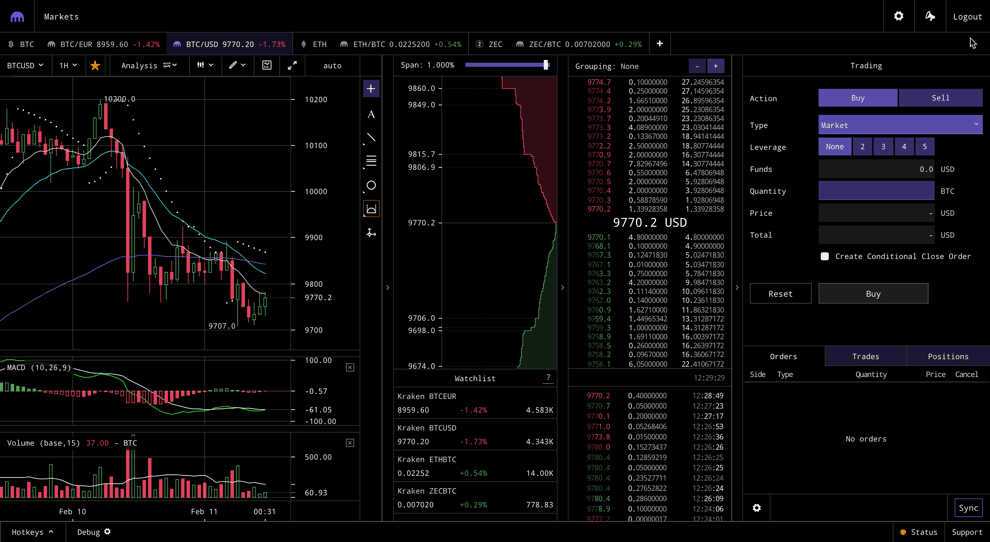

Kraken is a US-based exchange that was founded in 2011 and is one of the early believers in the potential of cryptos and its underlying technology. It provides an advanced trading platform that supports futures trading, margin trading, and OTC trades. Apart from these, it also provides the staking function, where you can earn passively.

Kraken is a highly liquid platform and offers trading in close to 150 markets. It supports 16 different cryptocurrencies in the margin trading segment and can supercharge your trades by up to 5X.

Concerning the trading fee, Kraken has the lowest fee for leveraged cryptos and only charges 0.02% for open positions and up to 0.02% ( per 4 hours) as rollover fees. For spot trading, it too follows a tiered fee structure, with rates starting from 0.16% as maker fee and 0.26% as taker fee.

Kraken also supports fiat currencies including USD, EUR, GBP, CAD, JPY, and CHF.

It supports non-KYC accounts, but the withdrawal limits are low. If you want to deposit/withdraw or wish to trade in futures, you need to undergo KYC verification.

Why choose Kraken?

- Trusted and established crypto exchange

- Clean and clutter-free trading interface

- Low trading fees and fiat support

- Good customer support

Conclusion

Poloniex is also a good platform to trade with, but due to lack of advanced functionalities and good support makes it a little unattractive.

The alternatives discussed above are some of the best, but if you take my opinion, Binance stands apart and offers you a superior trading experience in both spot and margin trading segments. But, if you are specifically looking for margin trading, you can consider PrimeXBT.

If you’ve any thoughts, do write it in the comment box below.