Cryptocurrency futures are one of the lucrative markets for traders. Crypto futures are available for a wide range of cryptocurrencies.

But out of them, Bitcoin is one of the prominent ones. Most exchanges do have high liquidity, offer huge leverage and other features that make Bitcoin futures trading super easy.

But should you really trade BTC futures? Well, to help you out, here are some reasons why Bitcoin is the best coin for futures trading:

7 Reasons Why Bitcoin Is The Best Coin For Futures Trading

#1. Leverage

Leverage is one of the key reasons why many prefer to trade Bitcoin futures. When you trade in the spot market, you can take trades based on your total capital, which doesn’t let you make a significant profit.

But for Bitcoin futures, many crypto exchanges like ByBit and Phemex offer anywhere between 125x to 100x leverage.

As a result, your $10 investment becomes $1000 of capital. This way, you get to open high-value positions in the market and book a significant amount of profit.

However, high leverage comes with high risks as it will increase both your profit and losses. Plus, there is a good chance that your account will get liquidated because of a lack of funds. So make sure to follow proper money management while trading bitcoin futures.

#2. Liquidity/High Trading Volume

Bitcoin is one of the most famous cryptocurrencies out there. Hence, there are many traders just like you who are actively participating in the market through buying and selling.

Thanks to the high buying and selling activity, a continuous supply and demand chain is created, resulting in liquidity.

Since Bitcoin futures have huge liquidity, it will be easy for you to buy and sell the asset at your desired price. You can enter or exit the market at any given price without needing to hold your assets for a longer duration.

Also, a high liquidity market refers to a less volatile market. So you don’t have to worry about getting your account liquidated if the market doesn’t move as you assumed it.

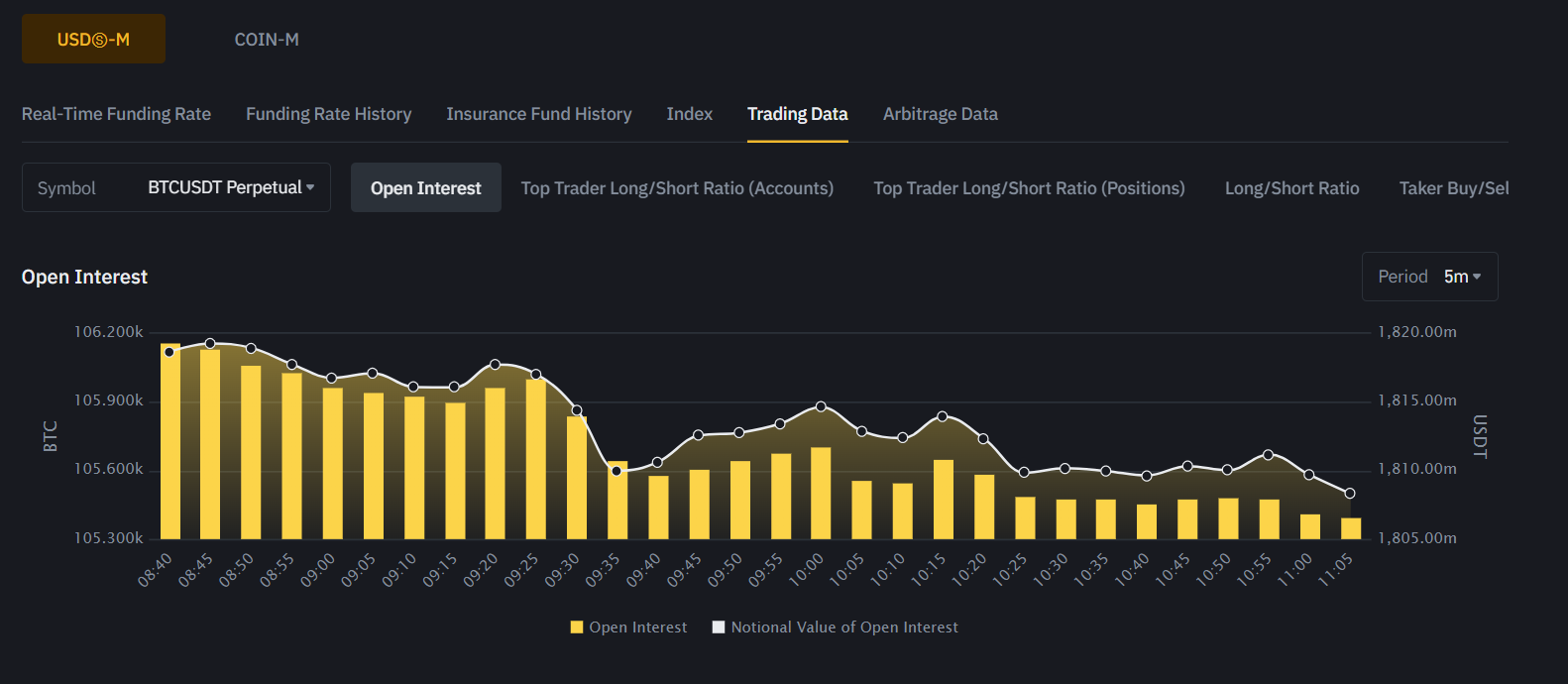

#3. High Open Interest

Open Interest is one of the most critical indicators for trading crypto. It can tell you the health of a particular interest’s futures and options market.

Open Interest or OI, indicates capital flowing in and out of the market. As capital flows into a futures contract, open interest increases. If the capital flows out of the market, it will result in lower OI.

And if you look at BTC, you will find a high open interest. This means a lot of cash flows into the market, and the futures contract is actively getting traded.

Since the market has a high number of traders’ presence, the market will continuously make trading opportunities. And you don’t have to trade in a dead market condition where you don’t find any trading opportunities.

#4. Trade In Any Direction

One of the biggest drawbacks of the crypto spot market is that you cannot sell high and buy low. It only works on the buy low and sell high principle.

But Bitcoin futures allow you to trade open both long and short trading positions. So no matter what the market conditions are, you can open a trading position.

For instance, if the market is positive, you can open a long position which is to buy low and sell high. If the market sentiment is negative, you can first sell BTC and buy it when the price is lower than your entry price (this is known as shorting the market).

Thanks to this flexibility, this is suitable for active traders who prefer crypto day trading or participate in swing trading.

#5. Hedging

Bitcoin Futures also allows you to hedge, which helps you limit your losses. Hedging is one of the popular trading strategies, and traders consider it as insurance that protects them from the market’s negative sentiment.

In hedging, traders take a position opposite the current open position in a particular asset. For instance, if you are long on Bitcoin but think that the price will not go up for a short period of time. In this case, you decide to trade a cryptocurrency like Ethereum that’s falling.

This way, even if you are losing money in your Bitcoin trade, you are getting to recover your losses from your ETH trade. This way, you will be able to lower your losses or make a profit with your secondary trade.

#6. Speculate

Another reason to trade Bitcoin futures is that you get to speculate on the future price of Bitcoin.

When you trade futures, you don’t hold any assets, but you trade a contract. So you can bet on whether the contract price will go up or down in the future.

Depending on your speculation, you will get to book a significant amount of profit.

Also, there is no need to hold a contract forever or till the time it expires. You can make an exit from the market whenever you are satisfied with your profits and losses.

#7. Easy Access To The Market

Getting into the Bitcoin futures market is pretty straightforward. You don’t need to invest large amounts of funds when trading futures.

Starting with Bitcoin Futures Trading? Know How much money do you need to trade BTC futures?

You don’t need to worry about buying contracts on a specific date or knowing about the expiry date or anything.

One can trade BTC futures day to day through perpetual swaps (this is the most common type of futures contract available across exchanges like Binance, ByBit, and OKX).

You can buy and sell the value of Bitcoin without needing to own the asset. Plus, perpetual swaps do not expire, and one can take an entry and exit at any point in time.

Plus, these contracts offer you high leverage and have different trading features, which are super easy for newbie traders to understand and get started with.

Which Coin Is Best For Futures Trading & Why ?

So those were a couple of the reasons why Bitcoin is the best coin for futures trading.

Bitcoin Futures offers high leverage and liquidity, and it continuously creates buying and selling opportunities in the market.

As a result, traders can trade the asset in the short term and book significant profits.