Are you weighing your options between Huobi and Binance for your crypto trading needs?

In this detailed review, I dissect both platforms to help streamline your decision.

Given their robust offerings, the platforms offer a wide range of trading features, and a strong industry presence, picking one can be daunting.

Nonetheless, I’m here to help.

By examining critical features like trading options, security measures, fee structures, and customer support, I aim to give you a clear perspective on what each exchange offers.

Let’s kick-start this exploration to determine if Huobi or Binance aligns better with your trading requirements.

I’ll unravel these two leading exchanges’ nuances and pros and cons with a meticulous comparison approach.

Huobi vs Binance: At A Glance

Binance is known to be the largest cryptocurrency day trading exchange out there and has been operational since 2017.

Both exchanges have a wide selection of cryptocurrencies and support Spot trading, Margin, Futures, Options, and more.

You can also enjoy other crypto features like DeFi staking, NFT marketplace, P2P trading, crypto loans, liquidity farming, and more.

Binance is suitable for both beginners and advanced traders.

Huobi Global is also one of the top cryptocurrency exchanges operational since 2018.

Huobi supports a large number of cryptocurrencies.

Plus, it lets you trade in all sorts of markets, Spot, Margin or Futures.

The Huobi platform supports many other features, such as copy trading, dual investment, staking, crypto loans, launchpad, and more.

Huobi vs Binance: Types Of Trading Markets

When it comes to market availability, both of the exchanges stand in an equal position.

So as a trader, you can choose the crypto market type that suits you best.

Product offerings of Binance Include:

- Spot Market Trading

- Margin Trading with 3x leverage for cross and 10x leverage for isolated trades.

- USD-M Futures: Crypto Futures contracts settled in USDT or BUSD.

- Coin-M Contracts: Perpetual and Quarterly Futures contracts settled in cryptocurrencies.

- Crypto Options

Regarding leverage, Binance offers maximum leverage of up to 125x for both USD-M and Coin-M Futures contracts on BTC.

For an ETH contract, the maximum leverage is 100x. The leverage varies from trading pair to pair.

Product offerings of Huobi Global Include:

- Spot Trading

- Margin Trading with 5x leverage.

- USDT-M Perpetual and Quarterly Futures.

- Coin-M Perpetual and Quarterly Futures.

- Crypto Options

Coming to leverage, Huobi also offers Futures contracts that support maximum leverage of up to 200x.

However, you will only get 125x, 150x, and even 200x leverage for BTC and ETH contracts on Huobi Futures.

Verdict: Overall, Binance is a better choice regarding market availability because of the Margin trading using leverage.

Huobi vs Binance: Supported Cryptocurrencies & Leverage

A lot of users don’t just use a crypto exchange for trading.

They also want to invest and grow their crypto portfolio, and this is where supported tokens can be a crucial factor.

If an exchange has many coins, it allows users to expand their crypto portfolio and invest in coins that they think can go somewhat higher in price.

When it comes to supported crypto tokens, there are more than 500 cryptocurrencies listed on Binance.

You will find a list of cryptocurrencies, including altcoins.

You can trade all sorts of coins, some of which are:

- BTC

- MATIC

- ETH

- BNX

- SOL

- SHIB

- PERP

On the other hand, Huobi offers more than 1,000 different crypto coins that include primary crypto tokens like:

- BTC

- ETH

- LTC

- HT

- SHIB

- DOGE

- SOL

- USDT

Verdict: The bottom line is that, on both exchanges, you will find significant cryptocurrencies. But from an investment perspective, if you want to invest in newer coins, Huobi can be a great help.

Huobi vs Binance: Trading Fees

Trading fees are crucial for any trader as they can impact overall profits or losses.

Hence, an exchange with a low trading fee would be beneficial.

Huobi and Binance have a tiered fee structure for the Spot and Futures markets.

So the larger your 30-day trading volume is, the less you have to pay as the trading fee.

Spot Market Trading Fee

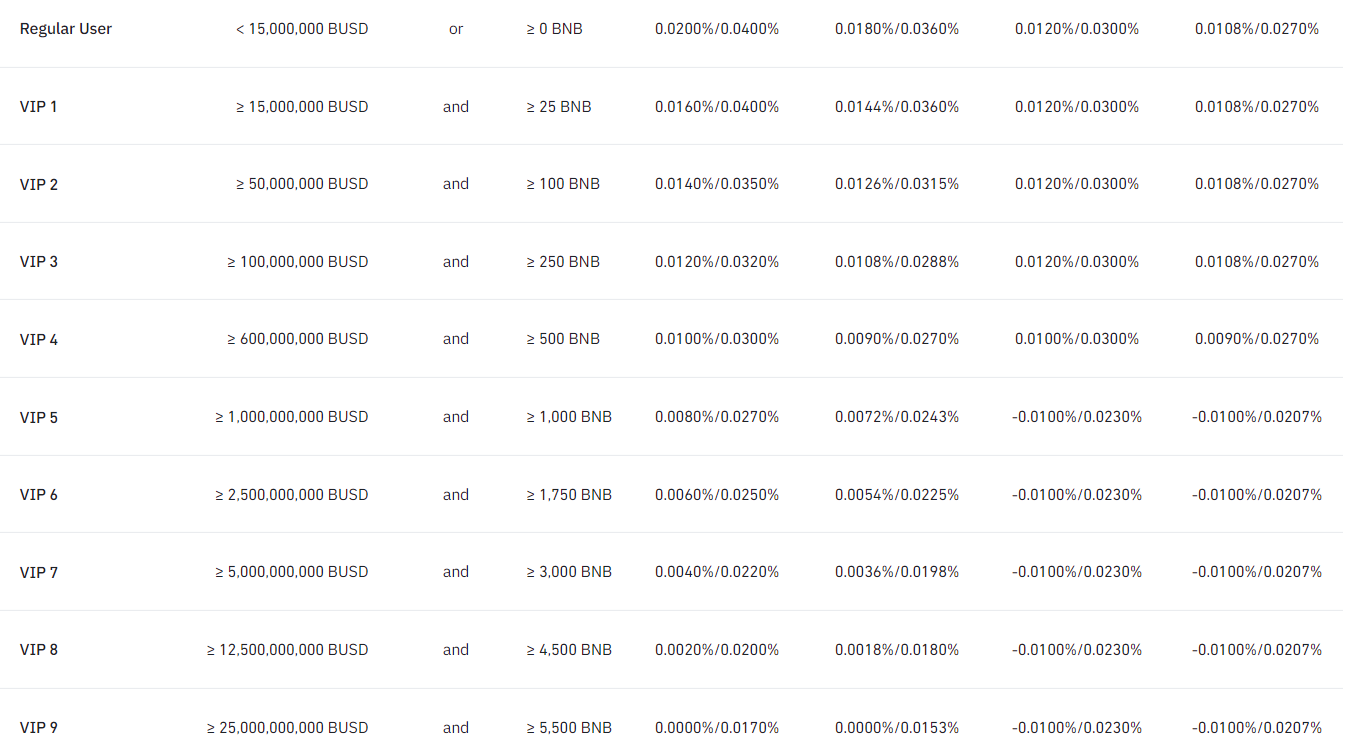

Fees on Binance for Spot trading have different levels.

Regular users with a 30-day trading volume of less than 1,000,000 $BUSD will be charged a maker-and-taker fee of 0.1000%.

However, Binance offers you 25% off on trading fees if you pay the fee using $BNB.

If you do that, the maker and trading fee for you would be 0.0750%.

If you talk about Binance’s highest level of VIP 9, it requires your 30-day trading volume to be 4,000,000,000 $BUSD and have 5,000 $BNB in your account.

In that case, your maker and taker fee would be 0.012% and 0.024%, respectively, and for $BNB discounted trading fee, it would be 0.009% and 0.018%.

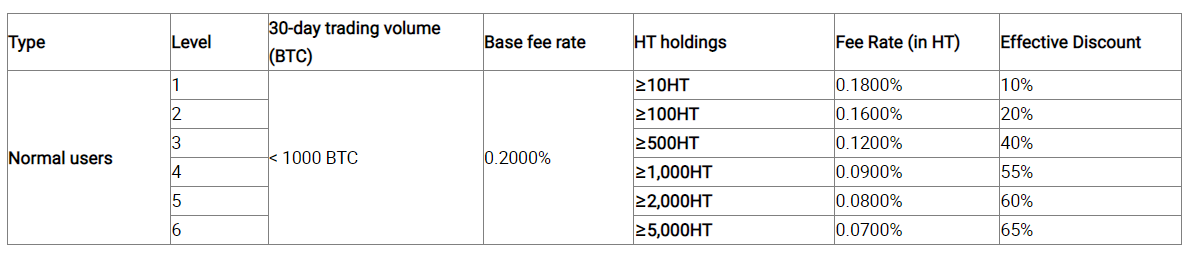

On the other hand, the fees on Huobi are in a tiered fee structure. Typical users are charged about 0.2000% as the base fee rate.

But just like Binance, if you hold $HT tokens, the native tokens of the exchange, you can avail of discounts ranging from 10% to 65%.

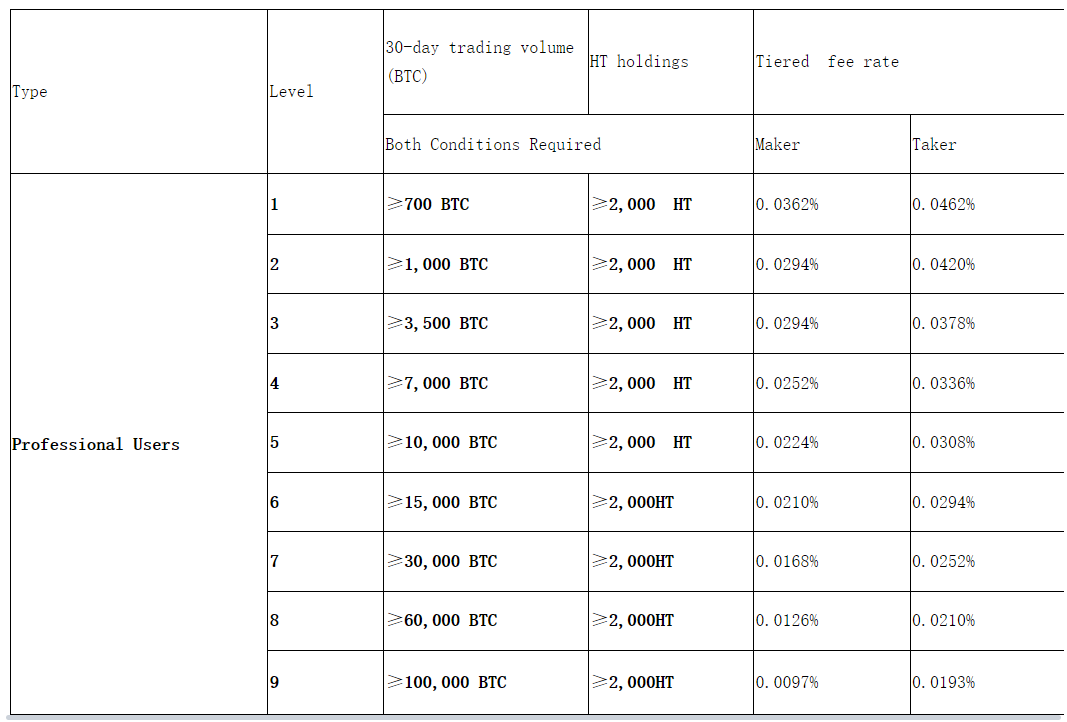

Huobi also has a professional trader tired fee structure where the level 1 user must trade 700 BTC volume over a 30-day trading period and have 2,000 $HT tokens.

Then the charges would be 0.0362% as the maker and 0.0462% as the taker fee.

Futures Trading Fees

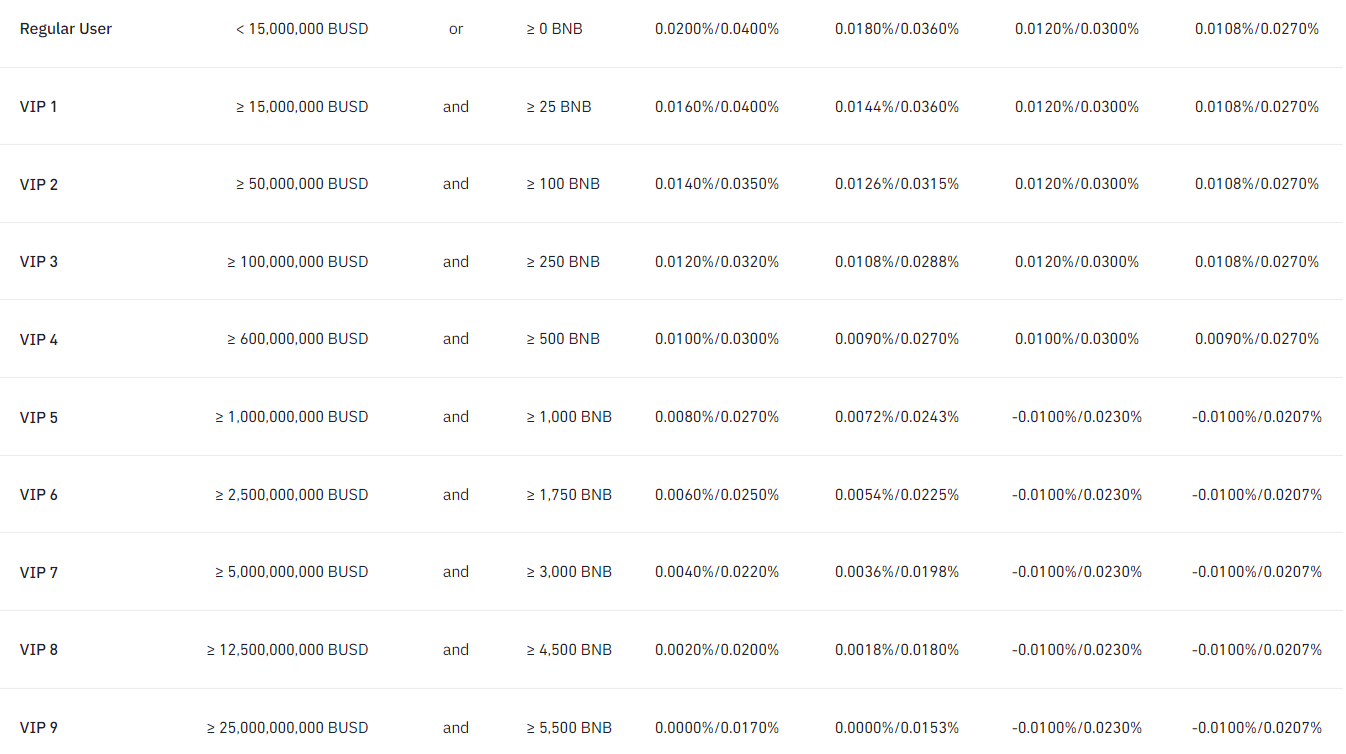

Binance’s Futures trading fee has a similar fee structure for USD-M and COIN-M futures.

The regular users are charged about 0.0200% and 0.0400% as the maker and taker fee, and with BNB, you can avail of 10% off.

So the revised maker and taker fee would be 0.0180% and 0.0360% when you trade using USDT.

If you trade using BUSD, the maker and taker fees would be 0.0120% and 0.0300%.

With the 10% fee discounts you get by using the native $BNB token, it would be 0.0108% and 0.0270% as the maker and taker fees.

On the other hand, for Futures trading, Huobi charges you a standard fee structure of 0.02% as the maker and 0.04% as the taker fees.

There is also a delivery fee, which only occurs if you fail to close your position before the contract’s expiry date.

In that case, you must pay 0.015% for BTC contracts and 0.05% for any other Futures contract.

Deposit and Withdrawal Fees

Coming to deposit fees, Binance doesn’t charge you for deposits.

However, if you choose to deposit fiat, a transaction fee will occur depending on your payment method selection.

The same goes for withdrawal fees; if you withdraw fiat, there is no need to pay any withdrawal fees for certain currencies.

But for some coins, Binance does charge you a trading fee.

Also, if you are withdrawing crypto, it will be subject to a network fee.

Huobi fees for deposits are zero. But for fiat deposits, there is a transaction fee.

Also, you will be charged with dynamic withdrawal fees, which are charged according to the current network conditions.

Verdict: So the winner, in this case, would be Binance. It has a pretty clean fee structure, easier for newbies to understand than Huobi’s fee structure split between normal and professional traders. It also has lower fees than Huobi.

Huobi vs Binance: KYC Requirements

Thanks to the ongoing rules and regulations, KYC is made mandatory for many cryptocurrency exchanges, including Binance.

To start using Binance Futures, you must complete the KYC verification process, which will unlock the account when you submit your identification document, like your driving license.

When you sign up on the exchange, it will ask you to verify your account.

Without verifying your account, you won’t be able to access the dashboard, deposit funds, or trade.

On the other hand, using Huobi KYC is not mandatory.

Many features can be accessed without needing to complete KYC on Huobi.

KYC Limitations

Talking about KYC limitations, Binance made KYC mandatory.

So to use the exchange, you must verify your account using a government ID.

On the other hand, Huobi can be used without KYC to an extent. But there are certain limitations.

First, you cannot deposit or withdraw fiat without completing KYC.

You can still trade on the platform by depositing crypto from a wallet or exchange.

Secondly, if you wish to deposit or withdraw funds using P2P, then other buyers/sellers often require verified accounts.

Verdict: In this case, the winner would be Huobi, which allows you to trade without completing KYC.

Huobi vs Binance: Account Funding Methods

Both Binance and Huobi Global offer various methods to fund your accounts. The most common one across both exchanges is P2P.

P2P can be used for depositing and withdrawing funds without additional charges and uses your local available payment methods.

Or you can deposit crypto tokens from a wallet or any other exchange to the respective crypto exchange’s wallet.

Binance

- Method 1: Directly deposit fiat (USD, EUR, GBP) using Bank cards (Visa) like debit/credit or bank transfer, but it will incur a 1.8% transaction fee.

- Method 2: Use third-party payment options, such as Advcash Account Balance. The third-party payment option would vary depending on where you are located.

Huobi Global

- Method 1: You can deposit fiat using your debit or credit card, but depending on your chosen currency, there will be charges.

- Method 2: Alternatively, you can use any third-party payment option like Skrill.

Finally, both exchanges have similar options for depositing fiat currencies and charges.

The charges and payment method would depend on your fiat currency.

Verdict: This is a tie, as both exchanges have similar account funding methods.

Huobi vs Binance: Trading & Platform Experience

Both the crypto future trading platforms are super easy to use.

You will find similar features, order types, leverages for different crypto trading pairs, easy-to-use mobile apps, and two-factor authentication.

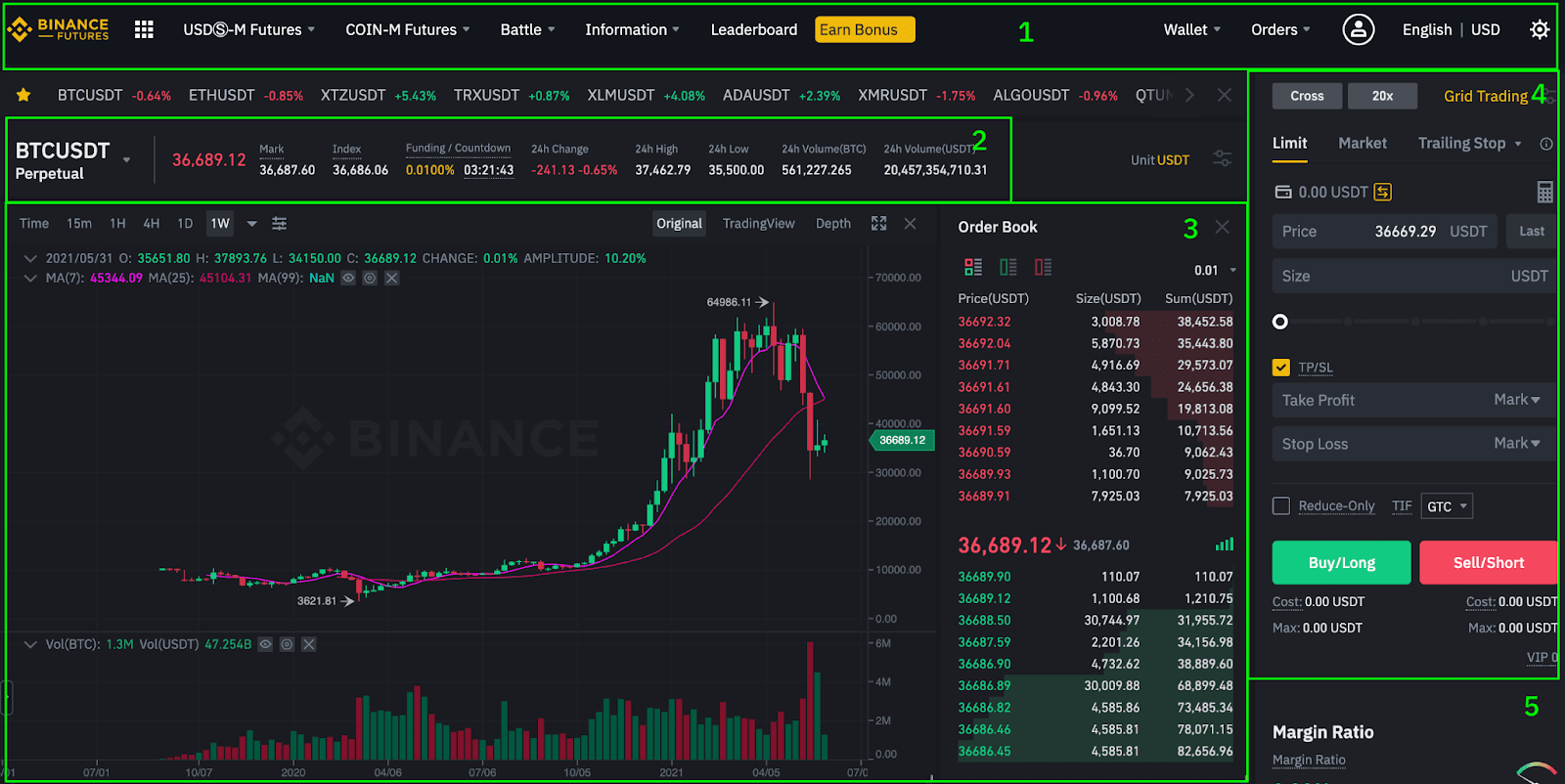

If you talk about Binance, it has a high-quality, robust trading platform.

Being one of the largest trading platforms, it offers you deep liquidity, which allows you to execute your trades instantly and at your desired price.

Moreover, Binance also can handle up to 1.4 million transactions per second.

Some of the features that Binance offers are:

- Charts & TradingView with indicators

- Order book & Order menu

- Order history

- Trading pair details

- Mobile app

To know more, here is a guide on how to trade futures on Binance.

On the other hand, Huobi is also a pretty powerful trading platform.

It offers you 100% uptime and can handle 100k transactions per second.

On top of that, you get other features, mark and index price, order book, and deep liquidity for a smoother trading experience.

Some of the features that Huobi Global offers are:

- Charts & TradingView with indicators

- Order book

- Transaction history

- Position History

- Mobile app

To know more about the exchange, here is a quick guide on how to short Bitcoin on Huobi.

Verdict: The winner would be Binance, and you’ll get deep liquidity and a solid trading platform for both web and mobile devices.

Huobi vs Binance: Customer Support

Finally, it comes down to customer support; both exchanges are excellent.

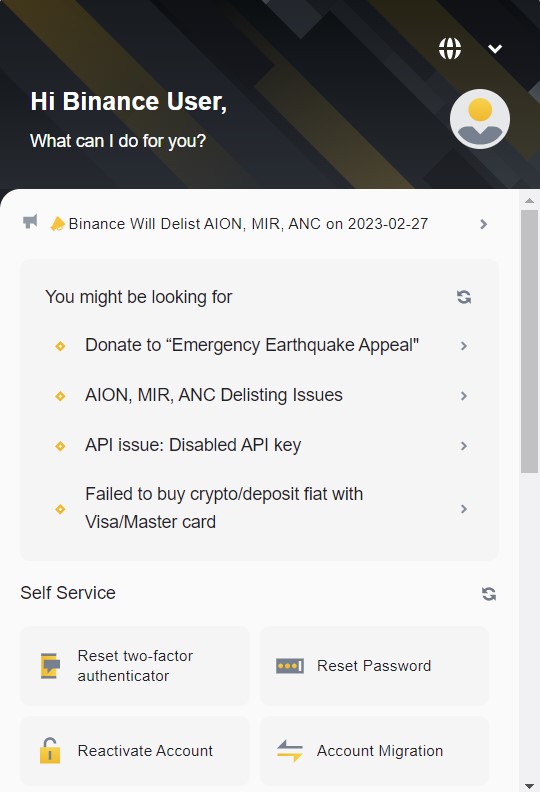

Binance offers support through its live chat portal, where the Binance bot will help you solve your everyday problems. You can also talk to a live support agent for further help.

Besides chat support, Binance extends its support through Twitter and other social media channels.

You can reach out to them at their Twitter channel @BinanceHelpDesk.

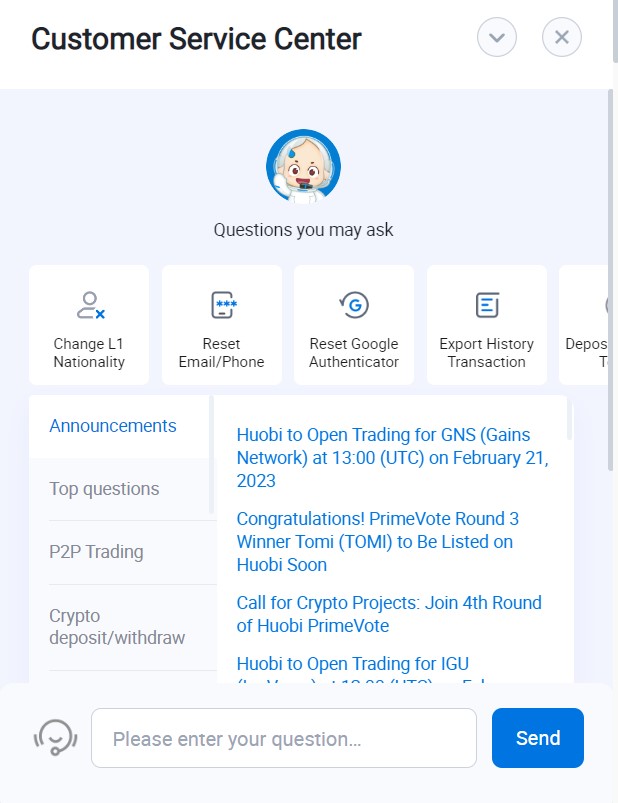

On the other hand, Huobi offers you a support chat option where you will find answers to the most common questions.

Or the chat can be used to connect with a support agent.

However, they don’t have any particular Twitter account from which you can seek support, but you can email them.

Verdict: Overall, both exchanges are equal when offering their support. However, Binance has more channels for providing help and has fewer response times than Huobi.

How to Open a Huobi Account?

- Go to Huobi.com and click on the Signup button.

- Enter your email or phone number and signup to get your welcome bonus

- Verify your email account, and you are all set to start trading.

How to Open a Binance Account?

- First, go to Binance.com and click on the Register button.

- Next, fill in your details like Email and password, and follow the onscreen steps to create your account.

- Now complete your primary verification by following all the onscreen steps.

- Once done, you are all set to start trading.

Conclusion

Between Binance vs Huobi Global, Binance stands out as the clear winner. First, it is the largest crypto exchange that comes with deep liquidity.

Secondly, over the years, the exchange has built its name and has a lesser risk of being closed than other exchanges. Plus, it offers you competitive trading fees. So go ahead and create a Binanace account and start trading.

But I don’t see Huobi as a loser.

The crypto exchange is also pretty solid and has all the features Binance offers. But its complex fee structure is its downside.

See how Binance & Huobi Global compares to other similar crypto exchanges:

- Binance vs Kraken

- Binance vs eToro

- Binance vs StormGain

- Huobi Global vs BingX

- Huobi Global vs MEXC

- Huobi Global vs OKX