More people than ever are using bots to automate their cryptocurrency trading strategies.

If you’re new to bot trading, finding the best crypto trading bot is the first thing you need to do. TradeSanta and 3Commas are two popular cryptocurrency trading bots in the market.

TradeSanta is cloud-enabled cryptocurrency trading software that lets you implement and automate strategies and benefit from market fluctuations. 3Commas, on the other hand, is a smart trading terminal providing access to various cryptocurrency bots.

So, which of the two solutions are better for automated cryptocurrency trading and why? Let’s compare the two platforms in-depth to find out.

Introduction: TradeSanta Vs 3Commas

- TradeSanta

Both TradeSanta and 3Commas support a wide range of cryptocurrency exchanges and trading pairs. Let’s talk about 3commas first.

TradeSanta currently supports the following exchanges: Binance (along with Binance US and Binance Futures), HitBTC, Coinbase Pro, Huobi, UPbit, and OKEX. Coming to trading pairs, TradeSanta supports over 6,000 trading pairs — one of the highest among bot platforms.

You can trade almost all cryptos across all fiat currencies and also against each other. If you like options, TradeSanta will be an excellent pick for you.

- 3Commas

On the other hand, 3Commas supports 23 major cryptocurrency exchanges at the time of writing. Some popular names include Coinbase Pro, Binance, BitMEX, Bitstamp, Kraken, and Bittrex.

3Commas doesn’t mention the trading pairs it supports; however, reviews by 3Commas users suggest that the platform supports all the major cryptocurrency pairs. You can trade crypto against fiat currencies like USD or other cryptocurrencies like USDT and BTC.

Looking for another crypto trading bot? Check these 3Commas Alternative trading bots

Verdict: 3Commas is the winner, as it supports more exchanges than TradeSanta.

Trading Tools, Strategies, Platform Features Comparison

TradeSanta and 3Commas are both feature-rich platforms with a wide range of features and functionalities. Here is comprehensive comparison between the platform features, tools, and strategies supported on TradeSanta and 3Commas.

Let’s now look at 3Commas’s features and functionalities.

- Smart Trade

If you want more control over your trades, you can use the Smart Trade feature to buy and sell crypto manually. Smart Trade comes with a plethora of helpful features, such as concurrent take profit and stops loss, multiple targets, take profit and stop loss trailing, and smart cover.

3Commas also offers charts, indicators, and signals powered by TradingView. You can leverage various chart types, timeframes, and indicators to identify trading opportunities and make informed trading decisions.

- Bot Trading

3Commas has excellent bot trading functionality with its Trading Bot. You can use a single-pair bot to run one trading pair or a multi-pair bot to trade multiple pairs. The bot uses long and short algorithms, along with deal close signals based on RSI, ULT, and TA.

In addition, 3Commas allows users to test and analyze bots for their performance and accuracy. You can also copy bots and strategies.

- Portfolio Management

If you’re a cryptocurrency investor, you can use 3Commas’s portfolio dashboard to better manage your investments. The platform allows you to create portfolios and view your income. Furthermore, you can balance your portfolio by optimizing coin ratios.

- Marketplace

3Commas has a marketplace feature where you can use signals from Crypto Quality Signals and Cartelsignals to make informed buying and selling decisions.

- Other Features

3Commas also has various other features, such as push notifications, API access, and mobile apps to improve your trading experience.

- Strategies

3Commas allows you to implement similar strategies as TradeSanta. These include DCA, grid trading bot, and long/short strategies.

Let’s look at TradeSanta’s features first.

- Martingale

In TradeSanta, Martingale refers to an automatic increase in the volume of a cryptocurrency by 1.5x or 2x, helping the underlying asset regain the value lost earlier. Experienced traders can use this strategy to profit from price fluctuations due to change in volume.

- Purchase Coins for Commission

If you want to place an order but don’t have enough balance between fulfilling it, TradeSanta will automatically buy coins worth 5 USD for a commission. This option is turned on by default, and you can turn it off in your account section. Once turned off, you’ll need to have the full balance in your account to cover the commission.

- Market Orders

TradeSanta bot allows you to enter a trade immediately at the current market price. This way, you can ensure that you don’t miss profit opportunities due to minor price changes. However, please note that the time of order execution depends on the volume of the exchange.

- Stop-Loss Orders

Trade Santa bot enables you to place stop-loss orders to better manage your risk while trading. You can either set stop-loss orders manually or let the bot handle it automatically.

- Technical Indicators

TradeSanta supports three major indicators that help you implement and execute strategies seamlessly. The supported indicators are MACD, RSI, and Bollinger signals. Based on these indicators, you can use various strategies in all types of markets.

- Extra Orders

TradeSanta has an extra orders feature that lets you place orders against your initial trades if they don’t turn out to be profitable. For instance, the bot places extra to buy or sell orders if the price goes against your direction.

- Strategies

TradeSanta supports two types of strategies.

The first is GRID and DCA bot strategies. In grid trading, the bot places a series of orders in either direction of the price, allowing you to make small profits and minimal losses. On the other hand, DCA averages the price of all your orders.

The second type of strategy is the long/short strategy. TradeSanta enables you to place long and short orders simultaneously, allowing you to make a profit regardless of where the price goes.

Verdict: 3Commas is the winner, as it offers additional features like portfolio management and a marketplace which are missing in TradeSanta.

Pricing & Subscription Structure Comparison

Both TradeSanta and 3Commas are cloud-based trading platforms, and therefore, they have similar pricing and subscription structure. Each platform has various monthly subscription plans, and you can choose the one that best fits your needs.

Let’s compare the pricing structures of the two platforms.

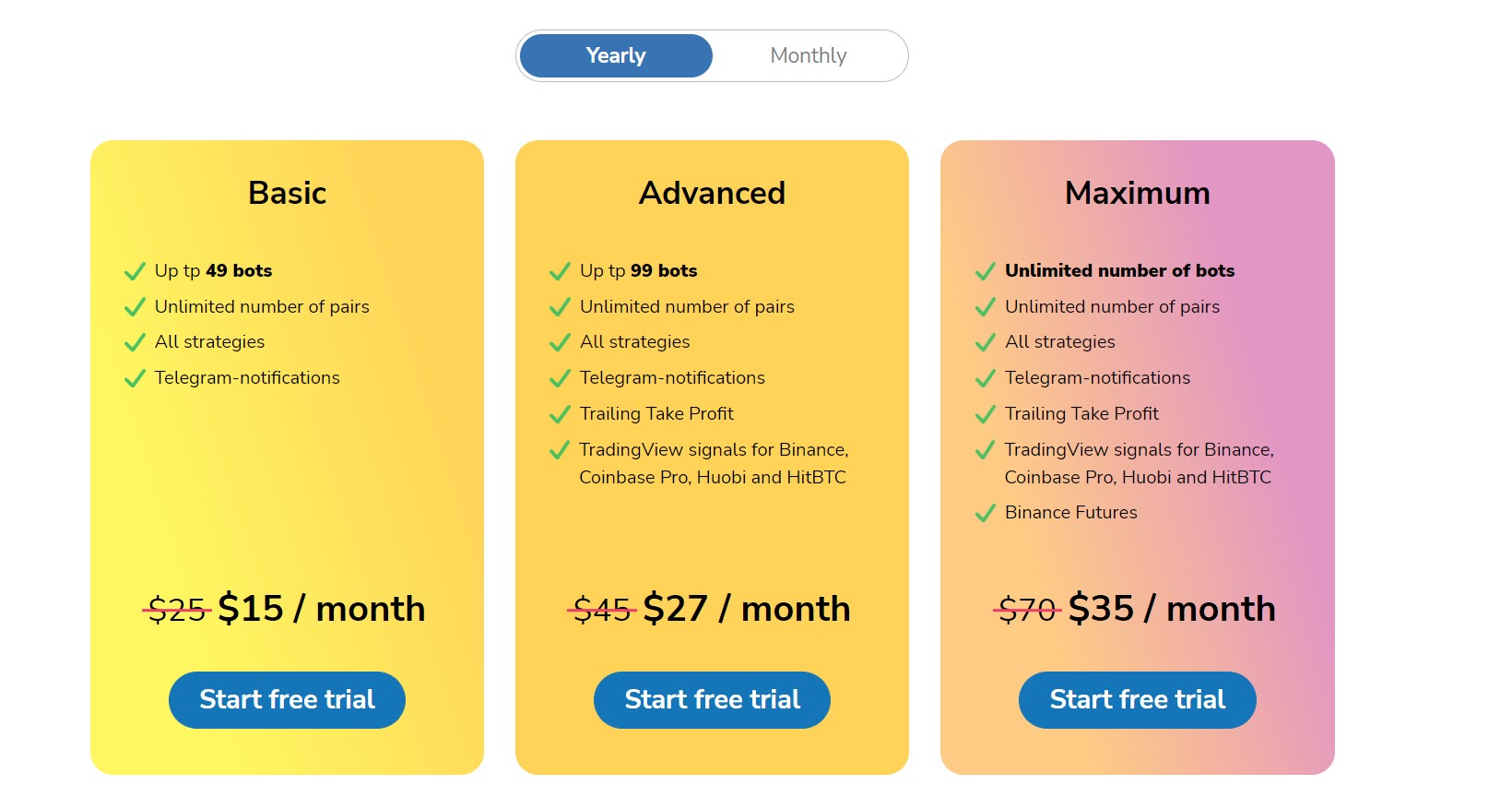

TradeSanta

TradeSanta has three subscription plans:

- Basic: This plan allows you to use up to 49 bots. It supports an unlimited number of pairs and all strategies. It’s priced at $14 per month when purchased annually.

- Advanced: This plan includes everything in the Basic plan, along with support for up to 99 bots, trailing take profit, and TradingView signals for all exchanges. It’s priced at $20 per month when purchased annually.

- Maximum: This plan includes everything in the Advanced plan, along with an unlimited number of bots, custom TradingView signals, and Binance Futures. It’s priced at $30 per month when purchased annually.

TradePanda has no free plan. However, you can enjoy a 3-day free trial for the Maximum plan. The platform accepts payments in BTC, ETH, USDT, and USDC.

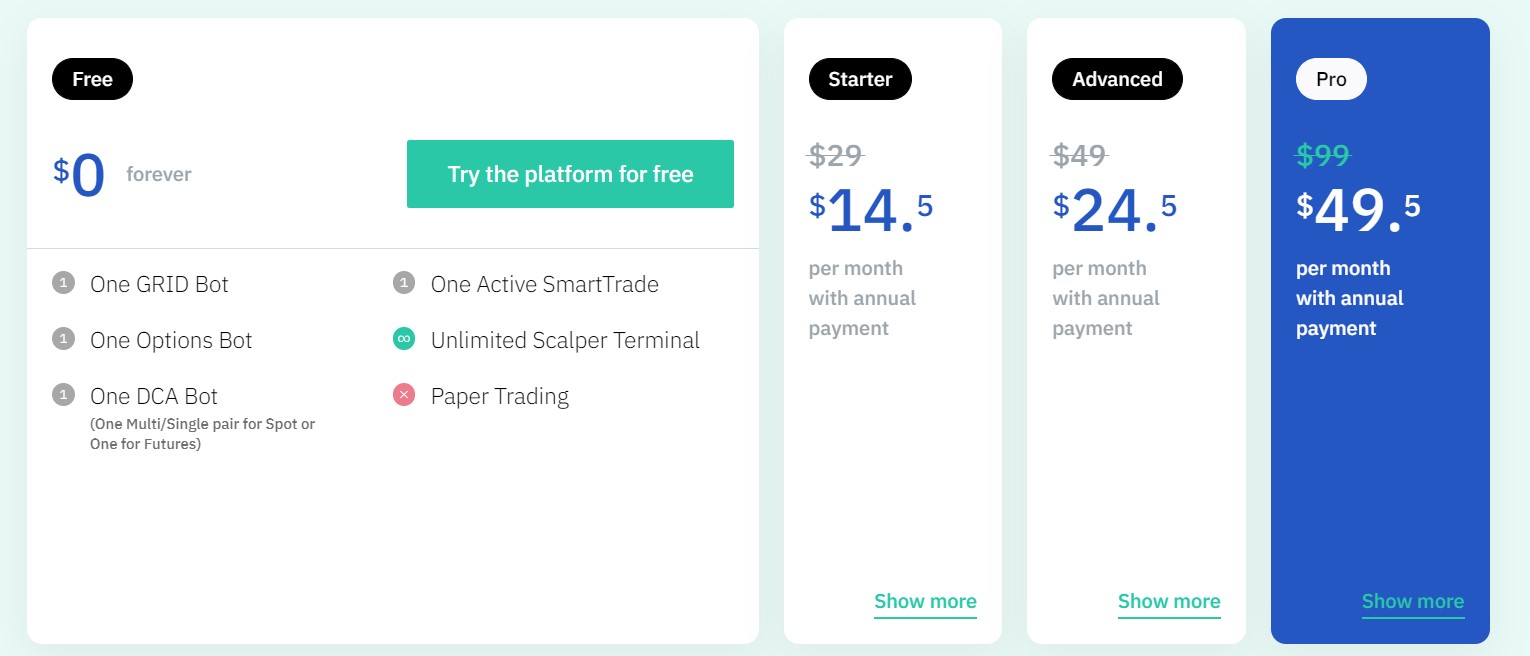

3Commas

3Commas has four plans:

- Free: There’s a free plan with one Active Smart Trade bot, one grid bot, one DCA bot, one options bot, and an unlimited scalper terminal.

- Starter: The starter plan has everything available in the free plan, along with unlimited Active Smart Trade and paper trading. It’s priced at $29 per month if paid monthly and $14.5 per month if paid annually.

- Advanced: This plan has everything included in the Starter plan, along with unlimited DCA bots. It’s priced at $49 per month if paid monthly and $24.5 per month if paid annually.

- Pro: This plan has everything included in the Advanced plan, along with unlimited grid bots and options bots. It’s priced at $99 per month if paid monthly and $49.5 per month if paid annually.

All the plans come with support for 18 exchanges, TradingView integration, free mobile apps, portfolio management, and 20+ trading features.

3Commas also has an enterprise plan. You can contact the sales team and build a plan as per your needs. The price will depend on the features and functionalities you opt for.

3Commas accepts VISA, MasterCard, PayPal, and Bitcoin for payments.

Verdict: It’s a tie. TradeSanta has cheaper plans, whereas 3Commas provides better value for money.

Customer Support & Product Security

Security and customer support are crucial factors to consider when choosing a trading platform of any kind. It’s essential to find a platform that takes the measures needed to ensure the safety of not only your funds but personal information.

Both TradeSanta and 3Commas do a great job here. Since these tools connect with exchanges through APIs, they don’t store any funds or information. Hence, the security of the exchange you connect with matters more.

3Commas has a live chat feature on its website. You can connect with the customer support team instantly and resolve your queries. Apart from live chat, you can connect with 3Commas via email, Telegram, Twitter, and Facebook. They also have a YouTube channel.

TradeSanta offers customer support primarily through email. You can write to the TradeSanta team at [email protected]. The team is also available on Telegram, and TradeSanta has a YouTube channel as well.

When it comes to customer support, both platforms do a decent job.

Conclusion

Let’s quickly wrap up this comparison by discussing the pros and cons of TradeSanta and 3Commas.

TradeSanta is a lightweight and easy-to-use trading bot platform that lets you automate your trading strategies. It supports grid, DCA, and long and short strategies and connects with various exchanges.

New to crypto bot trading? Have a look at these TradeSanta Alternatives

3Commas is also a trading bot platform, but it comes with some robust features like portfolio management and marketplace. It also comes with TradingView charts and signals.

Overall, TradeSanta is an excellent tool for automating your trades. If you’re looking for more powerful features and functionalities, 3Commas will be a better choice.

Check out how TradeSanta & 3Commas compares to other crypto bots: