Diving into cryptocurrency can be exhilarating but it’s not just about buying, holding, and selling coins.

There’s a complex, yet rewarding universe of crypto Futures waiting to be explored.

Ever heard of terms like Contango and Backwardation?

If you’re scratching your head, don’t worry.

These terms are pivotal in understanding the dynamics of the crypto Futures market.

In this comprehensive guide, I’ll unravel these concepts, dissect their implications, and equip you with insights to navigate this intricate terrain with confidence.

Ready to elevate your crypto game?

Understanding Futures Contracts in Crypto

It’s now time to enter the world of Futures contracts – a game changer in crypto where spot and Futures trading reign supreme.

In essence, Futures contracts are agreements to buy or sell a specific amount of cryptocurrency at a predetermined price on the expiry date.

These contracts allow traders to speculate on the future price of cryptocurrencies, opening doors to potentially significant profits.

With great potential rewards come substantial risks.

Contango Explained

Contango is one of those terms that can make the crypto Futures market seem like a complex puzzle.

But worry not, I’m here to simplify it for you.

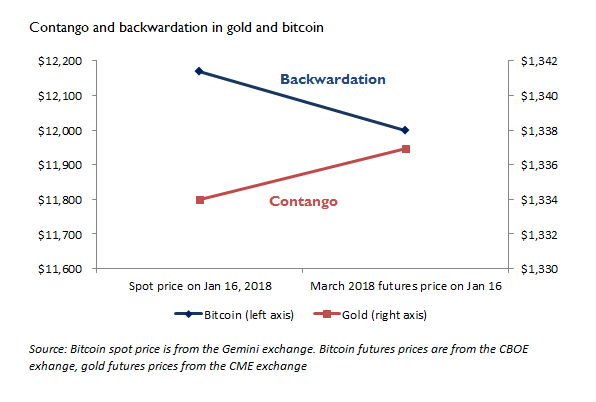

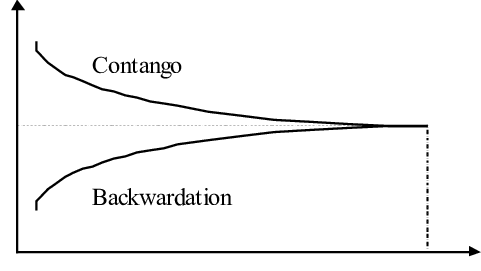

Contango occurs when the Futures price of a cryptocurrency is higher than its expected future spot price.

Imagine this: you’re eyeing Bitcoin, and notice its higher Futures price is more expensive than what you predict the expected spot price will be in the front month.

A front month, which is also called a near or spot month, is the nearest expiration date for a Futures or Options contract.

Because the Futures price must converge on the expected future spot price, contango implies futures prices are falling over time as new information brings them into line with the expected future spot price.

An inverted market occurs when the near-maturity futures contracts are priced higher than far-maturity futures contracts of the same type.

Contango tends to cause losses for investors in commodity ETFs that use Futures contracts, but these losses can be avoided by purchasing ETFs that hold actual commodities.

Well, this scenario can offer unique opportunities and risks for hedgers and traders.

Backwardation Unveiled

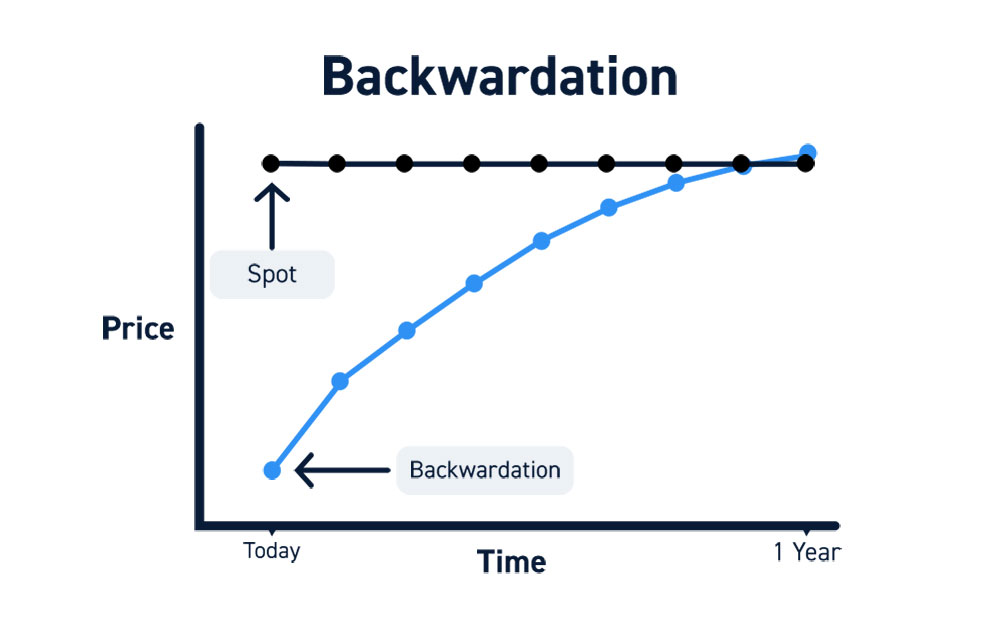

Now that you’ve got a grip on Contango, let’s flip the script and dive into normal Backwardation.

It’s where the future price of a cryptocurrency is lower than the expected future spot price.

Picture this: you’re scanning the cryptocurrency Futures market, and Bitcoin Futures contract price is looking cheaper than your projections.

Bingo, the market is in Backwardation.

It’s a phenomenon that can signal various market conditions, including potential shortages or increased demand for the commodity’s supply.

Sometimes backwardation is caused by a manipulation of a commodity’s supply, like oil, by a country or organization.

Decisions by the Organization of Petroleum Exporting Countries (OPEC), for example, the market for oil would be in backwardation.

We could say fundamentals like storage cost, financing the cost—the cost of carry—and convenience yield inform the supply and demand of commodity exchange-traded funds (ETF).

Understanding Backwardation can offer insights that can refine your contract’s trading approach.

Key Differences Between Contango and Backwardation

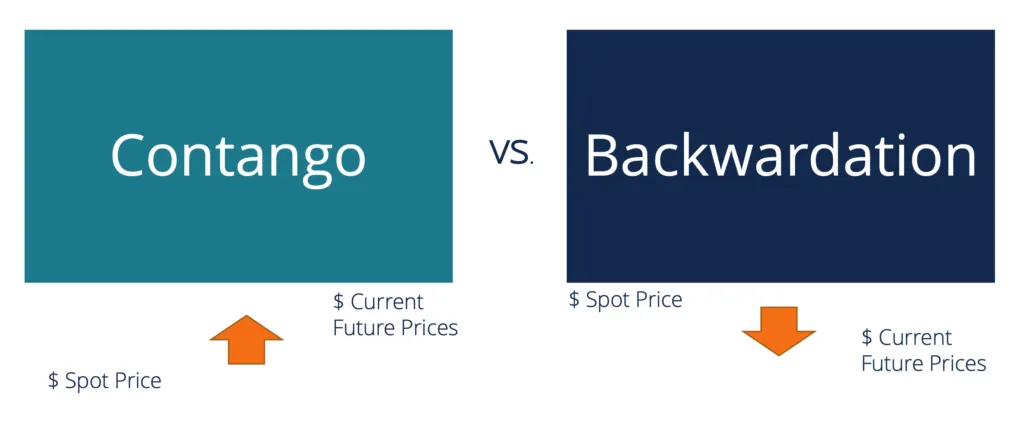

In the red corner, we have Contango, where future prices are higher than the spot trading price.

It’s like a hopeful glance into a future where the value of cryptocurrencies is on the up and up.

Now, in the blue corner, there’s Backwardation, the exact opposite of Contango.

It’s a scenario where the future prices are lower, indicating a potential dip in value or higher demand, a situation where the difference between the spot price of an asset, and short-term Futures will converge toward the spot price as we get close to the expiration date.

These two aren’t just polar opposites; they’re indicators of underlying market sentiments of spot and future prices.

Contango often rears its head in a well-supplied derivative market, while Backwardation is a telltale sign of a market in deficit.

It’s like a dance between supply and demand, each taking the lead at different moments.

Savvy traders keep a keen eye on these movements of Futures and spot prices.

Why?

It’s like having a crystal ball that provides clues that can guide informed decision-making depending on whether the market is in Contango vs Backwardation.

Implications for Crypto Traders

If you’re a crypto trader, the terms Contango or Backwardation are signals, loud and clear, echoing the sentiments of the market.

Imagine being able to read these signals and understanding how it is different from a normal Futures curve or an inverted Futures curve.

Sounds enticing?

In the Contango scenario, opportunities to use Futures contracts and buy low and sell high are as golden as they come.

It’s a trader’s paradise, where the bullish market sentiment can translate into handsome profits when buying Futures contracts.

In anticipation of a bull market, you will see new listings appear and they will include white papers for new projects.

Also, keep an eye on offers that appear on trading platforms.

Backwardation includes the real drama.

Let me tell you what’s the difference.

It’s a world where prices are expected to rise, and the race to buy before that spike can be as thrilling as a roller coaster ride.

It’s about the stories they tell and the opportunities they unveil for price moves.

Are you ready to listen?

New To Crypto Trading? Learn How Long can you hold crypto futures contracts?

Historical Trends: Contango and Backwardation in Action

Diving into the annals of trading history, it’s clear that Backwardation and Contango aren’t just theoretical concepts.

In the golden eras of the Contango market of commodity Futures and specifically Crude Oil Futures, markets hum with optimism, future prices soar, and traders may bask in the glow of anticipated gains.

It is a time of abundance, where the future looks as bright as a midsummer’s day, and investors are willing to pay more for a commodity than the actual value of a particular asset to see it rise over time.

But there’s another side to this coin.

A realm where the future price of an asset is lower than that of the spot market, a signal that stirred a mix of anxiety and opportunity for actual commodities.

Every era of Contango and Backwardation is a chapter in the grand narrative of buyers and sellers trading.

Are you ready to turn the page?

Strategies for Navigating Contango and Backwardation

In Contango, where future prices are set to eclipse the current spot price, savvy investors often look to long-term holds.

It’s like planting a seed and patiently waiting for it to blossom with rosy views about the future.

But remember, patience is key.

Now, let’s flip the script and step into the realm called Backwardation.

Here, it’s all about capitalizing when the future price drops compared to the higher spot price.

But caution – this world is as unpredictable as it is lucrative and it pays to know the difference.

Equip yourself with the latest market trends, and keep an eagle eye on global events.

And remember, in the dynamic dance of Contango and Backwardation, adaptability is your most trusted ally.

Risks and Opportunities

Stepping into the world of Contango and Backwardation is akin to embarking on a thrilling yet unpredictable journey.

But there’s more to it than meets the eye.

In the golden lanes of Contango, opportunities to buy low and sell high are as abundant as they are alluring.

But beware – it’s not all sunshine and rainbows.

The fluctuating market can turn the tables, transforming potential gains into unforeseen losses.

Now, enter Backwardation, a world where the astute can capitalize on future price reductions.

The volatile nature of the crypto market can make predicting price movements as tricky as nailing jelly to a wall.

Recommended Read: How do bitcoin futures contracts affect bitcoin prices?

Future Outlook: Predicting Market Movements

As we peer into the crystal ball of crypto Futures, one thing is clear: unpredictability is the only constant.

In the dance of prices, where Contango and Backwardation take turns leading, savvy traders understand the difference and are always on their toes, eyes peeled for the slightest hint of a market swing.

Here’s the golden nugget: technology and data analytics are becoming the trader’s best allies.

With advancements in AI and machine learning, predicting market movements is no longer a shot in the dark using crypto trading bots.

It’s evolving into a science, refined and more accurate.

The future is not written in stone, but with the right tools, it’s yours to shape.

Conclusion: Mastering the Crypto Futures Landscape

Contango and Backwardation are pivotal elements shaping your trading journey.

Armed with insights, strategies, a situation where the spot price is likely to be higher or lower than what you have agreed to pay, and a keen eye on market trends, you’re not navigating uncharted waters.

As the landscape evolves, so do you.

Ready to turn every challenge into an arbitrage opportunity?

In crypto Futures, the informed and adaptable aren’t just surviving; they’re thriving.

Your mastery in this intricate dance of numbers and trends is not just possible – it’s imminent.

Welcome to the future of trading, where every step is a leap towards unprecedented possibilities.