Imagine finding the Air Force 1s on one platform for half the price compared to another platform!

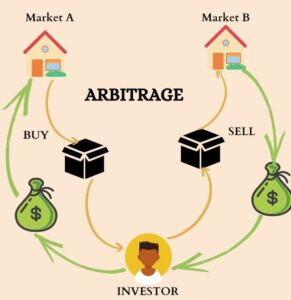

Cryptocurrency arbitrage lets you profit from these price differences in how a crypto asset is valued in the free market.

Sometimes, a digital asset isn’t priced the same across different online stores, called crypto exchanges.

This is where crypto arbitrage works to buy crypto cheaply and sell it for more elsewhere or within the same platform.

The grease keeps supply and demand in motion, ensuring exchanges calculate cryptocurrency prices and stay fair and balanced.

If you play your cards right as a trader, you can take advantage of price and snag some extra crypto assets for yourself!

Of course, crypto arbitrage trades come with their challenges.

We’ll explore those later, but remember that understanding cryptocurrency arbitrage and trading crypto assets on exchanges is like unlocking a secret door.

So buckle up, grab your detective hat, and dive deeper into this hidden underbelly of cryptocurrency arbitrage traders!

How A Cryptocurrency Arbitrage Trade Makes You Profitable

Okay, you’re hyped about crypto arbitrage, but how does it work?

Remember the treasure chests from before?

Think of each chest as a different crypto exchange, holding digital goodies inside but maybe with slightly different price tags.

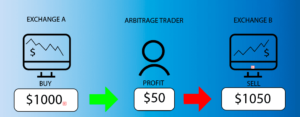

Sometimes, one exchange, Exchange A, might have the price of Bitcoin at $30,000, while Exchange B has it at $30,250 for the same shiny coin.

This is where you step in, one of the many crypto arbitrage traders.

You use your detective skills to spot the gap in prices across exchanges, then pounce!

As a crypto trader, you buy the cheaper Bitcoin from A, then sell it at $30,250 on B.

Boom! Instant profit!

There are different ways to do this, but the basic idea is to buy low and sell the same cryptocurrency for a higher value.

You can even use fancy crypto trading bots to help you find the best deals and execute trades lightning-fast.

Of course, the crypto exchanges may play sneaky tricks like fees and changing prices.

But you’ve already cracked the first code as crypto arbitrageurs by understanding the basics.

Next, we’ll explore this trading strategy’s different “flavors” so you can pick the one that suits your style the best!

Conquering the Coin Kingdom: Types of Crypto Arbitrage Strategies

Let’s look at the three main types of crypto arbitrage strategies:

- Cross-Exchange Arbitrage: You spot a discrepancy in cryptocurrency prices between two exchanges. You buy the cheaper crypto, including Bitcoin, on one exchange, then sell it for more on the other. Boom! Instant profit before the recent price changes its mind.

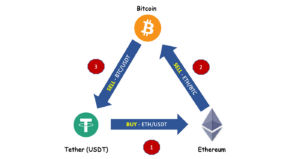

- Triangular Arbitrage: This one’s like navigating a treasure maze, using three different exchanges and cryptocurrencies. Triangular arbitrage is a trading approach that is a bit trickier. You start with one coin, swap it for another on one exchange, and then swap that for a third on another centralized exchange until you end up back with the first coin. It’s all about chaining together smart trades to squeeze out that price difference.

- Statistical Arbitrage: This is for the tech-savvy treasure hunters who love math and algorithms. Consider using numbers and probabilities to find arbitrage opportunities. You use computer programs to sniff out tiny price discrepancies across different exchanges and currencies, then automate lightning-fast buy and sell orders to exploit them.

Remember, each of the trading strategies has its risks.

Cross-exchange might be simpler, but prices of crypto assets on exchanges usually move fast.

Triangularity requires more planning, but the rewards can be bigger.

Statistical is high-tech, but transaction fees and unexpected market changes can bite.

New to crypto trading? Know What is a Cryptocurrency Airdrop?

Dig for Crypto Gold: A Beginner’s Guide to Arbitrage Adventures

Now, let’s take the gold-digging expedition step by step!

Every adventure is different, but this will give you the basic toolkit for different markets.

Step 1: Spot the Price Glitches: First, you must be a hawk-eyed treasure hunter, scanning different crypto exchanges for those juicy discrepancies in crypto asset prices. Tools and websites can help you sniff out these gaps, but a keen eye always wins.

Step 2: Plan Your Dig: Once you’ve spotted a price difference between exchange A and B, figure out the smartest way to exploit it. Cross-exchange? Triangular? Then, calculate how much you can realistically buy and sell before the price changes.

Step 3: Dive into the Exchange: Log in to the exchange with the cheaper crypto (exchange A) and order your buy. Be quick. Once your buy orders are filled, it’s time to head to exchange B.

Step 4: Sell Your Sparkly Find: Place sell orders for a specific price for your newly acquired crypto on exchange B. Remember, you want to sell high, so price your treasure competitively without getting greedy.

Step 5: Enjoy Your Booty! Once your sell order executes, congratulations! You’ve successfully exploited a price discrepancy and earned some profit. Rinse and repeat this trading method. Always be cautious and ready to adapt your strategy to execute crypto arbitrage trades.

This is a basic roadmap; every treasure hunt has twists and turns.

But with practice and caution, you can use crypto arbitrage to add a profitable edge to your digital coin collection.

Recommended Read: What is a Crypto Trading Pair?

Crypto Arbitrage: Sweet Loot or Risky Rollercoaster?

So, you’re tempted to dive into crypto arbitrage, but hold on!

Like any treasure hunt, there’s glittering gold and hidden dangers to consider.

Let’s weigh the benefits and risks before you unleash yourself on the market and check crypto asset prices across trading platforms.

Shining Brights: The Benefits of Arbitrage:

- Profit Palooza: Crypto arbitrage can potentially boost your digital coin collection. Imagine finding something you have meant to buy for half the price at another store – that’s the kind of profit magic arbitrage can offer with crypto prices!

- Market Magician: When you exploit price discrepancies, you help smooth out the cryptocurrency market as the coin balances with its trading pair, making it fairer and more stable for everyone.

- Skill Sharpening: Mastering arbitrage can hone your trading skills, teaching you valuable lessons about market analysis, timing, and even a dash of coding if you use automated bots.

Beware the Beasties: The Risks of Arbitrage:

- Market Mayhem: The crypto market is a wild beast, with prices changing faster than a chameleon’s skin. If you’re not quick enough, that juicy price discrepancy might vanish before you can say “Bitcoin”!

- Fee Fi Fo Fum: Exchanges love fees and can gobble up a big chunk of your potential profit. Consider them as pesky trolls guarding the bridge to treasure – negotiate wisely!

- Technical Terror: Some arbitrage strategies, like statistical or spatial arbitrage, require serious tech skills and fancy algorithms. If you’re not a coding wizard, these paths might be more like treacherous mountain climbs than treasure hunts.

Gear Up for Your Crypto Adventure: Essential Tools and Resources

Ready to unleash your inner crypto arbitrageur?

You’ll need the right tools for the job!

Price Checkers: Websites and apps like CoinMarketCap and CryptoCompare are your eagle-eyed scouts, constantly scanning exchanges for those juicy price discrepancies between a trading pair. Think of them as radar systems pinging hidden treasure chests!

Arbitrage Bots: For the tech-savvy decentralized arbitrage traders, automated arbitrage bots can execute trades or add them to the order book system lightning-fast, taking advantage of fleeting price gaps before they disappear. They’re like your robotic pit crew, keeping your engine running at peak efficiency.

Exchange Guides: Navigating different exchanges can be tricky compared to a single exchange. Guides and reviews can help you compare exchange rates, withdrawal fees, trading fees, trading volumes, and security features, ensuring you choose the right digital marketplace (centralized or decentralized exchanges) for your treasure hunt.

Community Connections: As an exception to this trading style, connecting with other crypto arbitrage enthusiasts online can be a goldmine of information. You can learn new strategies, share tips, and even team up for more complex arbitrage hunts. Teamwork makes the treasure hunt dream work!

Recommended Read: What is a Stablecoin?

The Future Glows: Where’s Crypto Arbitrage Headed?

So where next?

While crypto arbitrage is a trading strategy that might evolve as fast as a chameleon on rainbow Skittles, its future shines bright.

New techs like AI, automated market makers, decentralized crypto, and lightning-fast blockchain networks could fuel even quicker trades.

Remember, the market never sleeps, and arbitrage is not a trading strategy that will remain unchanged.

But with your skills honed and your treasure map close, you’ll be ready to navigate whatever the future of crypto arbitrage throws your way!