Stablecoins act like anchors in the digital storm of crypto, with waves crashing into Bitcoin prices and altcoins bobbing like buoys.

These special coins are pegged to a stable currency like the U.S. dollar.

This means they can maintain a stable value, no matter how crazy the storm gets.

They can be someone’s haven to cash out their tokens or a reliable way to buy a cool NFT you’ve been eyeing.

Ready to set sail on this adventure?

I have done my homework extensively, so don’t fret.

Let’s go!

What Makes Stablecoins Work?

Think of them as undercover agents disguised as a digital asset but hiding something: a stable price.

Unlike their volatile cousins, including Bitcoin in the crypto industry, the price of stablecoins does not move like Bitcoin.

The value of stablecoins is pegged to something steady, like your trusty Dollar, the Euro, or like gold.

On one side, you have regular cryptocurrencies, bouncing up and down like a pogo stick.

On the other hand, you have stablecoins, a medium of exchange whose value is anchored to that steady peg.

The magic behind them is a secret recipe with different types and using different ingredients.

We’ll explore these secret formulas later, but remember that the situation is unique with stablecoins as they have a hidden superpower – price stability.

They’re the calm in the crypto storm, ready to take you on a smoother, steadier ride through the popular stablecoins.

New to crypto trading? Know What is a Crypto Trading Pair?

Stablecoins: Unmasking the Anchors of a Digital Asset

Stablecoins aim to keep their value locked, unlike traditional fiat currencies.

Let’s unravel why an asset like an algorithmic stablecoin maintains its market value.

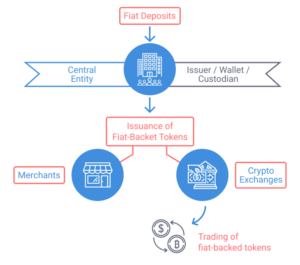

- Fiat-collateralized stablecoins: This type of stablecoin pegged to the U.S. dollar or pegged to a currency like euros or pounds is held in reserves.

Every stablecoin in circulation is backed by an actual dollar tucked away in a safe vault somewhere, sometimes by centralized exchanges like Coinbase or Bybit.

This ensures their value stays roughly equal to their peg, like a trusty anchor tethering the chest to the ground.

Popular examples include Tether (USDT), TerraUSD, DAI stablecoin, and USD Coin (USDC). - Crypto-collateralized crew: These treasure chests hold other cryptocurrencies instead of cash.

In this case, stablecoins are a cryptocurrency whose value is pegged and backed by Ethereum or another type of cryptocurrency.

Imagine a delicate balancing act where the value of the stablecoins is kept steady by holding a basket of other digital coins from the broader crypto market.

If it dips below its peg, the stablecoin issuers use an algorithm where some collateral is automatically sold to buy it back and restore the balance.

Dai (DAI) is a famous example of using this dynamic system to stay anchored to the dollar. - Algorithmic Stablecoins: Finally, last in the list of types of stablecoins are algorithmic stablecoins.

There is no cash or crypto in their chests, just clever algorithms and code that adjust how the stablecoins work supply in real-time based on market conditions.

While promising, stablecoins are typically relatively new and carry higher risks due to their complex nature.

Fiat-backed offers stable value but is centralized.

Crypto-backed are more decentralized but prone to price fluctuations.

Algorithmic ones are cutting-edge but still evolving, just like stablecoin regulation.

Under the Hood: How Stablecoins Keep Their Cool

So, you’ve seen the different vaults where the secret sauce is, but how does the magic of collateralized stablecoins work?

Let’s find out how these coins work and are pegged to another asset class.

Imagine you’re buying a pizza with your stablecoins.

Here’s the behind-the-scenes action:

1. Transaction Initiated: You send your stablecoins from your digital wallet to the pizza place’s address over the blockchain.

2. Peg Verification: The stablecoin issuer or smart contract, like a watchful bouncer, ensures it’s the real deal, worth exactly one slice of pizza (or one dollar, depending on your gap between fiat currency and the peg).

3. Settlement: This is where things get interesting. Depending on the stablecoin type:

-

Fiat-backed: The issuer dips into their vault, grabs a real dollar, and hands it to the pizzaiolo. Your digital frisbee is retired, and everyone’s happy!

-

Crypto-backed: If the price falls, some digital coins in its basket are automatically sold to buy back more stablecoin, restoring the value balance.

-

Algorithmic: The factory kicks into gear, printing just enough new coins to keep the overall value of stablecoins in circulation stable.

4. Pizza Time! You munch on your delicious reward, confident that your stablecoins maintain their cool throughout the transaction, thanks to the hidden mechanisms keeping them anchored.

Remember, this is a simplified picture, and this article makes no representations or warranties about the specific steps to complete the transaction depending on the stablecoin and platform.

But the core idea remains the same: stablecoins are cryptocurrencies that use a combination of reserves assets as collateral, algorithms, and smart contracts to maintain their peg.

Recommended Read: What is a crypto arbitrage trade?

Safe Harbor in the Crypto Storm: Why Stablecoins are Worth a Look

Imagine the crypto market as a wild ocean, with Bitcoin waves crashing and altcoin currents swirling.

It’s exciting, sure, but sometimes you want a calm bay where things don’t rock the boat.

That’s where stablecoins appear, acting like trusty life vests in this digital storm.

But beyond just keeping you afloat, stablecoins offer some cool perks that make them attractive for crypto holders even in calmer waters.

Here’s why you might want to consider this crypto crew:

-

Hedging Against the Hype: Remember those Bitcoin roller coasters? Stablecoins may act like anchors, keeping the value of cryptocurrency roughly steady while the rest of the market goes on a sugar rush or suffers a caffeine crash. If a person wishes to cash in, he can park his profits in a stablecoin haven.

-

Interest in Your Coins? Sign Me Up! Unlike traditional bank accounts that offer peanuts, a stablecoin is a cryptocurrency whose feature is that you earn interest just for holding it. Think of it like putting your coins in a digital piggy bank that gets fatter over time, even while you sleep!

-

Real-World Purchases Made Easy: Forget the hassles of converting crypto to cash. Stablecoins are often like bridges between the digital and physical worlds, letting you pay for real-world stuff like coffee without the major financial volatility drama.

-

Smoother Trading: Stablecoins are a type of neutral ground in the crypto market, making it easier to trade other coins without worrying about their market capitalization or wild price swings. Imagine using them as your starting point to explore the benefits of crypto, like a stable launchpad for your rocket ship.

Remember, stablecoins aren’t perfect.

They might not offer the sky-high returns of some risky crypto investments, and there are still uncertainties about how to regulate them.

But for those seeking a calmer, more practical way to interact with crypto, these digital anchors are worth a closer look.

Recommended Read: Different Types of Cryptocurrency Tokens

Riding the Crypto Waves: The Not-So-Sunny Side of Stablecoins

Sure, stablecoins offer a haven in the wild crypto ocean, but even paradise has hidden thorns.

Before diving in headfirst, knowing the potential challenges and risks lurking beneath the calm surface is important.

-

Centralization Concerns: Imagine putting all your trust in one person to hold your life vest. Some fiat-backed stablecoins raise concerns about centralization, where the issuer holds all the reserves. If they stumble, so might your stablecoins.

-

Algorithmic Wobbles: Think of those self-driving cars still in beta. Algorithmic stablecoins issued rely on complex code to maintain their peg. If there’s a glitch or unexpected market event, things might get rocky, potentially causing value swings.

-

Regulatory Shadows: The crypto world is like a Wild West town, with regulations of stablecoins still being figured out. This creates uncertainty, which might face stricter rules in the future, impacting their use, market cap, and value.

-

Hacking Hijinks: No digital treasure is truly safe from pirates. Stablecoins are a juicy target for hackers, and security breaches could threaten your precious digital coins.

-

Limited Returns: Remember, stability comes at a price. Unlike those high-flying coins promising moon missions, stablecoins generally offer lower returns. They’re more like a reliable savings account than a get-rich-quick scheme.

Don’t let these challenges put you off entirely.

Just like navigating any new terrain, awareness and caution are key.

Research thoroughly, choose reputable issuers, and understand the risks before setting sail.

Recommended Read: How many cryptocurrencies are there?

Charting the Future: The Evolving Landscape of Stablecoins

Stablecoins are still a thrilling work in progress, constantly riding the waves of innovation and adaptation.

New mechanisms are emerging, like hybrid models blending different types of coins collateralized by other cryptocurrencies, and decentralization is taking center stage.

Governments are also shaping the future with regulations to ensure stability and protect consumers.

This might bring some bumps along the way.

But ultimately, it paves the way for a more responsible and sustainable ecosystem.

So, buckle up and enjoy the ride!

Remember, stablecoins offer a unique blend of stability and utility.

This opens up exciting possibilities for the future of finance.