Cryptocurrency futures have become the most popular segment to trade among crypto traders.

In July 2019, the monthly traded volume of crypto futures markets stood at USD 1,605 billion, and it has only increased multifold since then.

With a daily derivatives margin trading volume of USD 65.7 billion, Binance is the biggest crypto futures exchange in the world. Binance offers a wide range of products, though Binance futures are the most popular and readily traded.

If you want to start crypto trading on Binance, you are at the right place. Here is all you need to know about trading Binance futures.

Binance Futures Trading Guide Introduction

Binance futures are crypto futures that enable traders to trade digital currencies without actually possessing the underlying assets. Futures in cryptocurrency work similarly to futures in equities and stock indices.

Binance futures derive their future price from the underlying crypto asset, like Bitcoin, Ethereum, Bitcoin Cash, Litecoin, etc.

Types of Futures Exchange Contracts

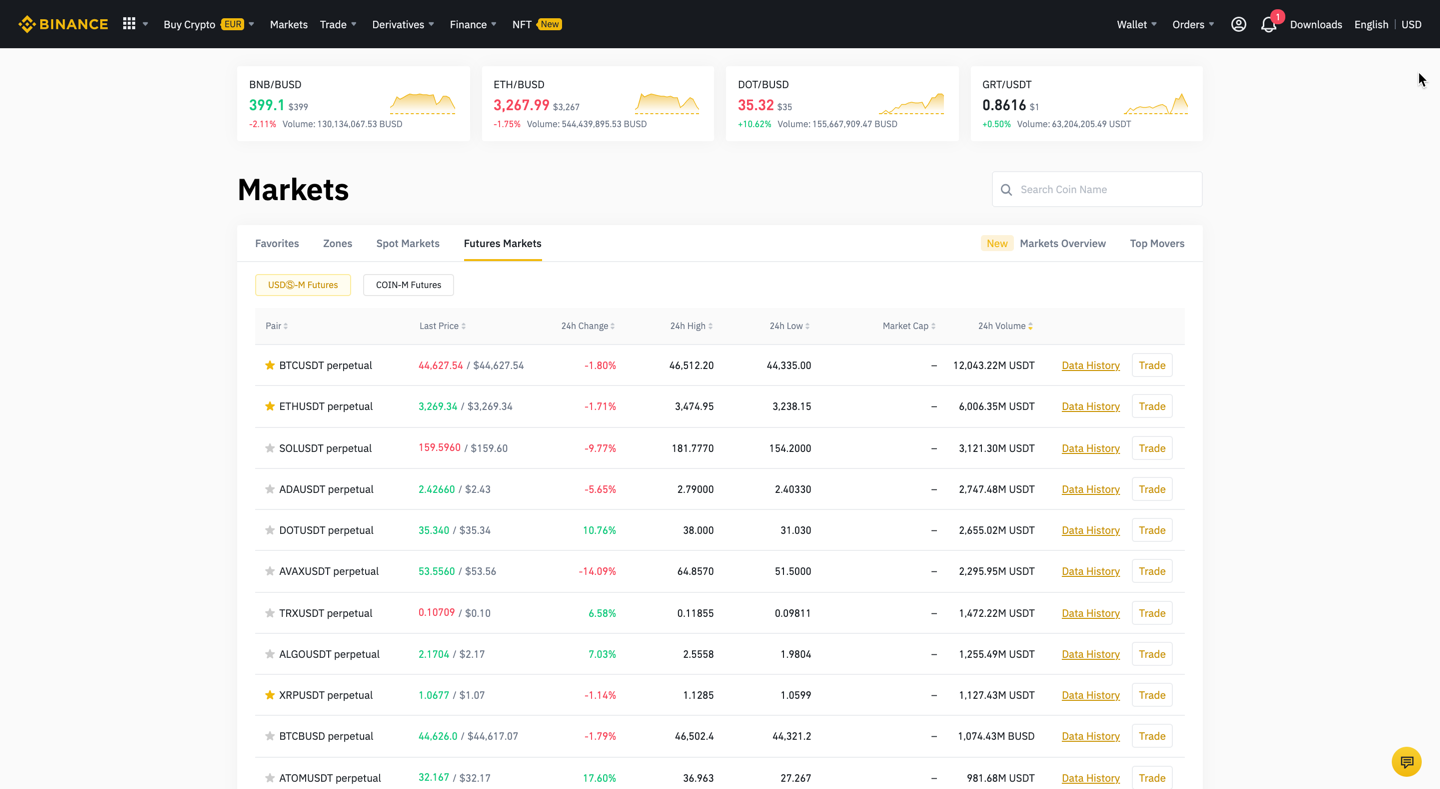

Binance offers two types of futures contracts:

- Coin-M Futures: These are perpetual or quarterly contracts settled in Cryptocurrency Perpetual Delivery

- USD-M Futures: These are perpetual or quarterly contracts settled in USDT or BUSD.

In case you’re not familiar with perpetual and quarterly futures contracts, here is a quick explanation.

These are quarterly contracts that come with a three-month expiry. Thus, they expire every three months.

Perpetual contracts are a new type of futures contract that has no expiry date. Therefore, traders can hold these contracts for as long as they want to do.

New to Binance? Learn about Which is better Binance Margin or Futures?

Leverage Trading

Leverage is an important element of Binance trading. Binance offers up to 125x leverage on Binance futures. This means you can take a position 125x larger than your initial margin.

For example, if you have an initial margin of 1 BTC, you can hold futures worth 125 BTC. This multiplies your profitability by 125x. But on the downside, it also exposes you to a potential loss of 125x. Therefore, high leverage is better for risk-averse traders.

Furthermore, crypto derivatives are subject to high volatility and price fluctuations. Therefore, leverage trading futures contracts can involve significant risks of losses. It’s essential to effectively manage risk-reward when trading derivatives with leverage.

Binance currently offers more than 90 contracts across USDT and coin-margined instruments.

![]() How Do Binance Futures work?

How Do Binance Futures work?

Binance futures work the same as equity and stock indices futures. Futures (along with options) are known as derivatives, as they are derived from the underlying crypto asset. Derivatives allow you to leverage crypto price changes to earn profits without actually holding the assets.

If you already know about how futures work, you can skip to the next section. If not, then hang in there, as we’re going to discuss the working of Binance futures with a real-life example.

Suppose you believe that a crypto asset – suppose Bitcoin – will surge by USD 1,000 in value over the next month, but you don’t hold any Bitcoin. One option is to buy Bitcoin and wait for its value to surge directly. The next option is to buy its futures contract (BTCUSD).

Please note that the underlying asset (Bitcoin) and its futures contract (BTCUSD) are different products and trade at different prices.

New to crypto trading? Learn if you can lose more than you invest in Crypto Futures?

Binance Futures Pricing Explained

In case you’re curious, here’s how crypto futures price is calculated:

- Crypto Futures Price = Crypto Spot Price x [1 + Rf (x/365)]

Here, Rf is the annual risk-free rate, and x is the number of days to expiry.

Since a perpetual futures contract doesn’t have an expiry date, Binance (along with other exchanges) implements a funding rate mechanism to ensure that the futures entry price stays close to the spot price. Futures contract buyers and sellers need to pay a funding fee for that.

While futures are supposed to trade close to the spot’s price, it’s not always the case. Sometimes, it may trade at almost the same price as the underlying asset. And sometimes, it may deviate significantly from the spot price.

The differences occur because the crypto market is subject to immense volatility and sudden price fluctuations. But let’s assume that, for the most part, the futures price stays close to the spot price.

Now, let’s return to buying Binance futures. So, suppose you feel that Bitcoin’s price will increase by USD 1,000, so you buy five BTC futures contracts.

If your prediction turns out to be true and Bitcoin surges by USD 1,000 and the futures entry price also increases by USD 1,000, you’ll earn a profit of USD 5,000. And you made this profit without holding any Bitcoin at all.

That is, in a nutshell, how Binance futures work.

Binance Futures vs. Direct Tokens

Now, let’s answer the question: Why not buy Bitcoin directly?

For starters, you need dedicated wallets to buy and store crypto. While Binance allows you to buy Bitcoin directly, not many exchanges support direct crypto buying.

Second, you don’t get leverage when buying cryptos directly. As discussed, Binance offers up to 125x leverage on futures. No such leverage is available for buying crypto assets.

It makes a huge difference. Suppose BTC is currently priced at USD 35,000. To buy 5 BTC, you’ll need USD 175,000. Not many people will have such an amount handy for crypto trading.

If you use 125x leverage to buy a BTC futures contract trading at USD 35,000, you’ll be able to buy five contracts for just USD 1,400. Of course, leverage on Binance decreases as the trading amount increases, but you will still get attractive leverage.

Hence, you can trade on Binance futures for a much lesser investment while enjoying the same level of benefits. That’s why the majority of traders prefer derivatives trading on Binance over spot trading.

Learn about Binance Leveraged Tokens

How To Trade Futures Contracts on Binance?

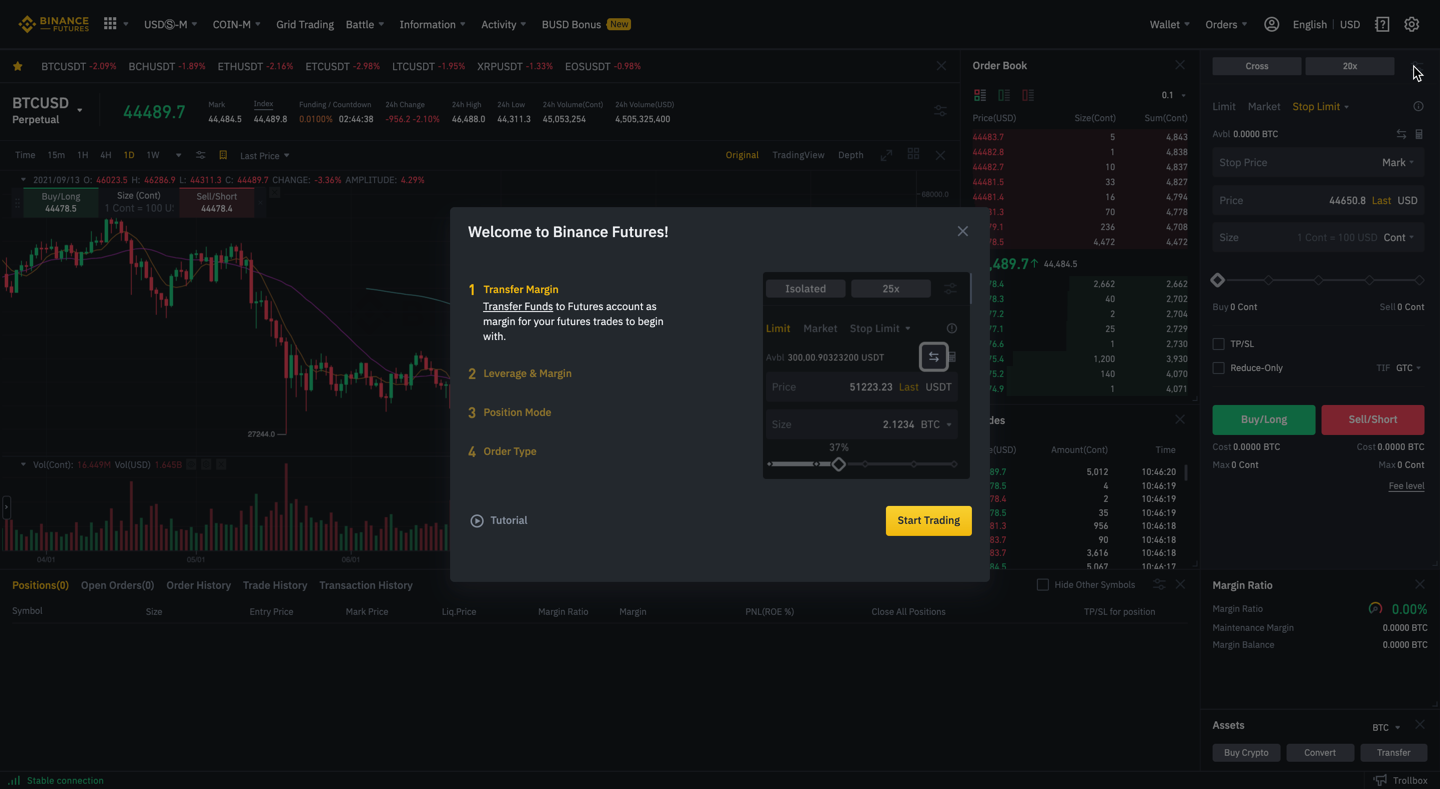

Now that you’ve understood what Binance futures are and how they work let’s talk about the registration process and how you can start trading futures.

To day trade on Binance futures, you’ll need a Binance Futures account. To open that account, you’ll need first to open a regular Binance account. You can click here and create a regular Binance account with your email address.

Once you are logged into your Binance account, select “Derivatives” and then select the futures category (USD-M futures or COIN-M futures) you want to trade. You’ll find an “Open Now” option. Click on it, and your Binance futures account will be activated. You’re now ready to trade Binance futures.

The next step is to fund your Binance futures account. Please note that Binance has a distinct Futures wallet. However, you can easily transfer funds from your Exchange wallet to the Futures wallet.

You can fund your Binance futures account with cryptocurrencies or fiat currencies. Once you have funds in your Futures account, you can start trading futures.

Please note that Binance doesn’t charge any deposit and withdrawal fees. However, blockchain network fees are payable when withdrawing funds from your Binance account.

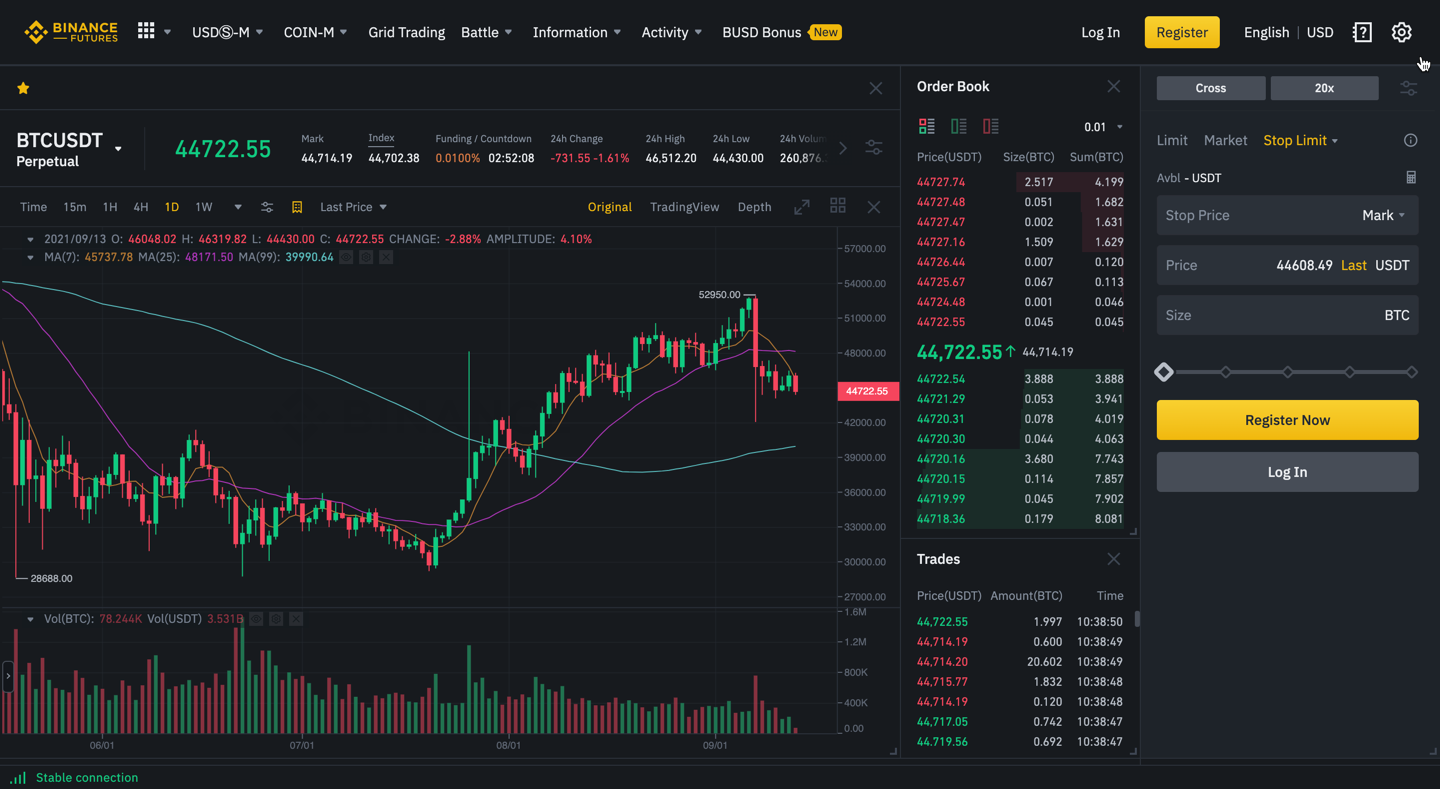

Now, head to the Derivatives tab and click on the futures you want to trade. You’ll be directed to the Binance futures platform, where you’ll find the price chart of the BTCUSD contract by default. You can click on the contract name to change the futures contract you want to trade.

From here, you can buy or sell futures, select order types, set leverage, conduct technical analysis, etc.

Binance has ten Binance futures account levels (VIP 0 to VIP 9) based on 30d trade volume and/or BNB balance. Based on the account level, Binance charges trading fees. Binance uses a market maker-taker fee structure for USD-M and COIN-M futures.

How to Use the Binance Futures Platform?

Binance uses a sophisticated Binance futures trading platform in the crypto space. Let’s quickly walk through how the Binance futures platform operates and utilize them to make your trading more effective.

Futures Trading Platform

Binance’s trading terminal comprises an advanced price chart that comes with all the essential features and functionalities. Binance uses two charting systems – one is its proprietary charting system, and the other is TradingView.

Both charting systems are equally good, have an intuitive Binance futures trading interface, and share similar features, including:

- Multiple chart types – line, bar, candlesticks, Heikin-Ashi

- Multiple time frames

- A comprehensive suite of technical indicators

However, TradingView offers some extra tools and indicators, making it ideal for professional traders.

The trading terminal also provides information such as:

- Mark price

- Index price

- 24h change

- 24h high and 24h low

- 24h volume

- Time do delivery

- Market depth

Dashboard – Binance Futures Account

The trading dashboard enables you to manage all your trading activities from one place. It allows you to adjust leverage, place and exit orders, add funds to your Futures wallet, add/reduce your positions, etc.

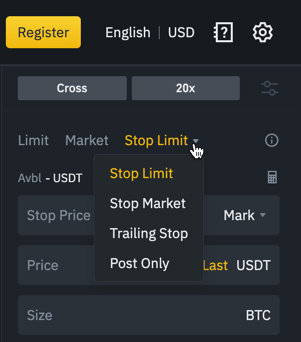

Binance supports the following order types:

- Limit order

- Market order

- Stop Limit order

- Stop Market order

- Trailing Stop order

- Take Profit order

- Post Only order

However, if you’re a beginner, market orders, limit orders, and stop-loss/take-profit orders will be the best for you.

Additionally, the dashboard also shows the margin ratio, maintenance margin, and margin balance.

Order Books

The order book provides a real-time view of buy and sell orders entering the order book. You can also track your positions, open orders, order history, trade history, and transaction history in this section.

Additional Features

Apart from the features discussed above, the Binance futures platform offers customization features to help you customize your dashboard and trading terminal as per your preferences. For example, you can edit the tickers based on what information you want to see regularly.

You can also customize your dashboard to edit the features you need when placing orders.

There’s also an Assets section where you can buy crypto and convert and transfer your positions.

Binance Futures Support

Binance offers world-class customer support to its users. You can contact the support team via live chat on the website or send them an email by raising a ticket. Binance also has a social media presence, and you can connect with them on Telegram and Reddit.

Liquidation Mechanism

As a new trader, liquidation is something you want to avoid. It refers to the automatic liquidation of open positions when your available margin is insufficient to fulfill the leveraged position.

Binance uses a Mark Price liquidation mechanism to set the liquidation price intelligently. The Mark Price liquidation mechanism protects traders from forced liquidation and incurring big losses.

Highly Secure Trading System

Binance implements top-of-the-line security features to provide a secure trading experience to all users. It uses a multi-sig cold wallet system and manually authorizes all withdrawal requests. Other security features include two-factor authentication, IP whitelisting, encryption, etc.

Binance Futures Trading Tips

By now, you must have a clear idea of how the Binance futures platform works. The chances are that you might be feeling confident in trading futures.

What most new traders do here is that they fund their Binance futures accounts, take positions, and “hope” for their trades to work out. Often, they incur losses and give up on trading before even getting started properly.

This is the wrong approach, especially if you’re serious about trading. You need to follow a system and strategy that gives you an edge in the market.

While getting good at trading is essentially a matter of experience, you can kickstart your trading journey by following these futures trading tips.

Get a Knack for the Fundamentals

You shouldn’t be trading cryptos if you don’t know how the entire crypto space operates. If you want to trade Bitcoin futures, you should know what Bitcoin (and cryptocurrencies) is, how blockchain works, smart contracts and Defi, etc.

Get a basic understanding of the crypto world so you’re not shooting in the dark.

- Learn How Binance Futures Trading Works

First, understand the difference between trading and investing. Trading means taking positions for a few minutes to a few months.

Investing, on the other hand, means taking positions for years. In trading, the asset should be fundamentally strong, whereas, in trading, technical analysis plays a more important role.

Trading also has various types, such as scalping, positional trading, intraday trading, swing trading, etc. Ensure that you’re familiar with how all of this works.

- Prioritize Risk Management

Risk management is the holy grail of trading, regardless of what you trade. When you take a trade, it can either go in your way and give a profit, or it can go south and end up in a loss. No matter how good a trader you are, losses are possible.

Therefore, it’s essential to determine how much loss you are willing to take on each trade. Ideally, it shouldn’t be more than 1-2% of your trading capital.

For example, if your trading capital is USD 10,000, you should not risk more than USD 100 on one trade. This way, you can manage the risk you take on each trade.

- And Prioritize Position Sizing

Along with risk management, position sizing is another crucial element to consider when trading Binance futures. Position sizing is all about determining the amount of your total Binance futures trading cryptocurrencies capital you use in one trade. Ideally, it shouldn’t be more than 10%.

So, if your total trading capital is USD 10,000, you shouldn’t put more than USD 1,000 in one trade.

- Set Stop Loss and Take-Profit Orders

Stop-loss and take-profit orders ensure that you exit your positions at the right time. If a trade goes against you, a stop market order helps you limit the loss you incur. And if a trade goes in your favor, a take-profit order enables you to exit the trade at a trigger price or the exit price/target price with the desired profit.

Traders, whether new or experienced, should always trade with stop-loss and take-profit orders.

- Get Rid of FOMO

Fear of missing out (FOMO) is common in trading, especially among new traders. You shouldn’t try to grab every opportunity you get to trade. Trading is all about letting go of good opportunities to find the perfect opportunity. Avoid over-trading and get rid of FOMO.

- Establish Trading Strategies

If you take a trade just because the market price plunged by 2%, you’re simply gambling. Several factors, such as traded volume, market sentiment, price action, etc., determine the price movement of any asset. Knowing technical analysis is crucial to becoming a successful trader.

Once you learn technical analysis, build trading strategies or adopt the strategy of successful traders to increase your chances of success.

- Hang In There

Lastly, give yourself time. Trading is a skill that takes time to develop and master. Profits and losses are a part of the game. So, instead of making quick money, focus on the process and strive to become a better trader.

How do you do long or short on Binance futures contracts?

Binance offers a straightforward trading interface, and longing and shorting Bitcoin futures is quite easy. All you need to do is head to the trading platform and select the futures you want to trade.

Once you are on your dashboard, select the type of order you want to place – market or limit. Also, select the size of your position as well as the leverage you want to use. If you’re a new trader, avoid using too much leverage as high leveraged trading can expose you to a big loss.

Once you have selected the position size, order type, and leverage, you can click on “Buy” or “Sell.”

Here, “Buy” means going long, and “Sell” means going short.

If your analysis shows that the price of the cryptocurrency futures contract will increase, you need to go long. Contrarily, if you feel the price will go down, you need to go short.

If you place a futures market order, your order will (almost) execute immediately. For limit orders, you’ll need to specify the price at which you want your order to trigger. Once your order reaches that price, it will automatically execute.

How do you close a futures Binance?

Once your order is executed, it will show up in the order book in the “Positions” section. If you want to close your position, you can select the order and click on “Exit.”

You’ll need to place stop-loss or take-profit orders and specify the prices at which you want your orders to execute. Or, you can also close your position by exiting your order at the market price.

Conclusion

If you’re new to futures, Binance futures are the right starting point for you. Binance is the biggest and one of the most trusted crypto exchanges out there. Plus, the Binance exchange platform is beginner-friendly and enables new traders to get started without any hassles.

Simultaneously, the Bitcoin futures platform is robust and institutional-grade, making it an ideal pick for professional traders.

Other factors such as a wide trade of trading products, low trading fees, numerous deposit methods, and high leverage make Binance one of the best exchanges to trade crypto futures.