Struggling to decide which among Abra and Binance will be the best for you? Or do you want to know about various aspects of these exchanges?

Don’t worry; I am here to answer all of your questions.

Not only will I be comparing these crypto brokers with leverage to their core, but also I will be telling you everything you need to know before you get your hands on them.

So, without any further delay, let’s start with some basic information about what these exchanges actually are.

Binance vs Abra: At A Glance Comparison

Binance

Beginning with Binance Futures, a China-based crypto exchange founded in 2017, it is the world’s largest crypto exchange by trading volume. This decentralized exchange holds more than 120 million registered users and it allows you to trade in spot, options, margin and futures.

Committed to user protection with strict protocols and an industry-leading trading engine that is capable of processing more than $38 billion worth of trades each day.

Abra

Abra was founded in 2014, with its headquarters in Mountain View, California, as an online non-custodial crypto wallet. The platform holds more than 2 million registered users enjoying top-notch OTC trading capabilities.

Now let’s discuss and compare them on the trading markets, products and leverage offered by them or whether or not they offer it.

Binance vs Abra: Trading Markets, Products & Leverage Offered

Binance

Beginning with Binance, this crypto exchange has one of the broadest variety of crypto trading products for both beginners and experienced traders, ranging from:

- Spot Trading: Includes all your favourite ones like BTC, ETH, SOL, XRP and many more.

- Futures Trading: For futures trading, you can choose from:

- Coin-M Futures: Perpetual or quarterly futures contracts settled in crypto coins.

- USD-M Futures: Perpetual or quarterly futures contracts settled in USDT or BUSD.

- Leverage Trading: Take advantage of the maximum leverage of up to 20x.

- P2P Trading: Trade TetherUS (USDT) with the lowest transaction fees of <0.10% for all markets and 700 payment methods.

- Binance Earn: Enjoy flexible DeFi staking with up to 6.38% and an additional 1.5% APR.

Abra

- Spot Trading: Includes a variety of assets integrating BTC, ETH, XRP and many more.

- Crypto Staking: Upto 10% interest, the highest in the industry.

- Lend and Borrow: Borrow at 0% interest rates by using your crypto as collateral.

Verdict: Binance is the clear winner in this segment, with a lot more products offered for crypto trading.

Binance vs Abra: Supported Cryptocurrencies

Now let’s discuss how many cryptos are supported on these exchanges.

Binance

Starting with Binance, this advanced crypto exchange has more than 350 crypto assets supported on the platform. The list includes:

- Bitcoin

- Ethereum

- Ripple

- Litecoin

- Binance Coin

- Cardano

- Cosmos

- Dash

Abra

On the other hand, Abra has an essential crypto assets list counting more than 75 of them. Though it might look a lot less than Binance, they include all the essential ones, including:

- Bitcoin

- Ethereum

- Ripple

- Cardano

- Dash

- Cosmos

- Dogecoin

Verdict: Binance is the clear winner in this segment, with a lot more crypto assets to choose from.

Binance vs Abra: Trading Fee & Deposit/Withdrawal Fee Compared

Now coming to one of the most important factors, so let’s discuss how much trading on these exchanges will cost you.

Binance

Starting with Binance, this industry leader, is commendable when it comes to its overall fee structure. Its fee structure includes the following:

Trading Fees

Binance charges a standard fee of 0.1%; however, if you hold BNB tokens, there is a 25% flat concession on the overall trading fee.

Deposit and Withdrawal Fees

In terms of deposits, there is no fee, but when it comes to withdrawal fees, it depends on the asset you are trading with. For instance, BTC withdrawals charge 0.0002 BTC.

Abra

Coming to Abra, the deposit and withdrawal fee is the crucial element of its fee structure which varies on various aspects; refer to the table below to understand them better.

|

Deposits |

|

| Add funds via a US or PH bank (ACH) |

Free |

|

Add funds via Wires (US only) |

Abra Wire Program |

| Add funds via a Guatemalan bank | |

|

Add funds via Visa or MasterCard via the app |

Simplex |

| Add funds via Visa or MasterCard via the website | |

|

Add funds via teller (Philippines) |

Up to 2% |

| Add funds via Crypto deposit |

Free |

|

Withdrawals |

|

| Withdraw via US or PH bank |

Free Some banks in the Philippines may charge a small fee for incoming transfers; there is no fee for Union Bank. |

|

Withdraw via teller (Philippines) |

Up to 2% Tambunting 1 branch fees (both deposit and withdrawal) to 1.25%. Tambunting 2, 3 and 4 will lower their branch fees (both deposit and withdrawal) to 1.5%. Other tellers may charge up to 2%; for additional information, please contact the teller directly. |

|

Exchange between currencies |

|

| An exchange between any 2 currencies | |

|

Send funds |

|

| Send funds to another Abra wallet |

Free |

Abra does not follow the traditional maker and taker spot fees; instead, it relies on MoonPay as a third-party integration for its exchange capabilities charging $4.99 + 3.5% for purchases below $141 and a 7% commission for purchases above that amount.

Verdict: Binance undoubtedly has a more affordable fee structure making it the winner in this segment.

Binance vs Abra: Order Types

Coming to order types is another essential aspect to go through because this is how you can take advantage of the market trends.

Let’s see what these exchanges have to offer.

Binance

Starting with Binance, the exchange includes all the industry essentials as well as advanced ones, which include:

- Limit Order

- Market Order

- Stop Limit Order

Advanced Order Types:

- Stop Market Order

- Trailing Stop Order

- Post Only Order

- Time Weighted Average Price (TWAP)

Abra

On the other hand, Abra offers basic but all the essential order types, which include:

- Market Order

- Limit Order

- Stop Limit Order

Binance vs Abra: KYC Requirements & KYC Limits

Binance

Binance doesn’t allow anonymous trading, and when it comes to KYC, this crypto exchange is relatively rigid with its regulations.

There are 3 KYC levels that decide the limit of withdrawal of your account. These levels include:

- Basic: $300 Lifetime Buy Crypto & Fiat Deposits/Withdrawal Limit and Max. 0.06 BTC withdrawal limit.

Requirements:

Personal information

- Intermediate: $50,000 Daily Buy Crypto & Fiat Deposits/Withdrawal Limit, Max. 100 BTC withdrawal limit and P2P/OTC/Binance Card Perks.

Requirements:

Basic Information

Government ID

Facial Verification

- Advanced: $200,000 Daily Buy Crypto & Fiat Deposits/Withdrawal Limit, No BTC withdrawal limit, and P2P/OTC/Binance Card Perks.

Requirements:

- All intermediate requirements

- Proof of address

- 10 days review time

Abra

Similarly, to trade on Abra, you need to be KYC compatible as well; there are two steps on the exchange which include:

-

Global KYC

Required Documents

- US/International Users: Driver’s License, Government ID or Passport and Voter ID.

- Philippines Users: Government ID (SSS UMID Card), Driver’s License, Passport, and Voter ID card.

Once this is done, you can now move over to the next step, which is:

-

Prime Trust Application

Required Documents

- The document must be entirely legible (i.e., all four corners must show, no parts cut-off, no glare covering information)

- The identification number is fully displayed

- Full name

- Date of birth

- The expiration date is present and has not expired

- For US: your present address

- For the US: Drivers license preferred

- If the ID requires a signature, please make sure it is signed

- For International: Passport Only (this may change later)

Binance vs Abra: Deposits & Withdrawal Options

Binance

This crypto exchange offers a wide variety of account funding methods that includes:

- P2P Trading

- Credit/Debit Cards

- Direct Crypto Transfers

Abra

Similarly, Abra also offers a wide range of options for account funding and withdrawing; these include:

- Bank transfers

- Direct Crypto Deposits

- Credit/Debit Cards

Binance vs Abra: Trading & Platform Experience Comparison

Another important aspect of crypto trading is their trading platform experience which includes specific insides of their UI and UX, which I will now be telling you about.

Binance

Starting with Binance, is equipped with a powerful trading engine which is armed with all advanced trading toolsets and is capable of handling high-volume trades with ease.

So of the highlighting tools include:

- Order Book

- Recent Order

- TradingView

- Easy-to-use order menu

- Multiple Order types with advanced orders

- Easy-to-use mobile app

You can learn more about the exchange, by looking at this how to trade crypto futures on binance guide.

Abra

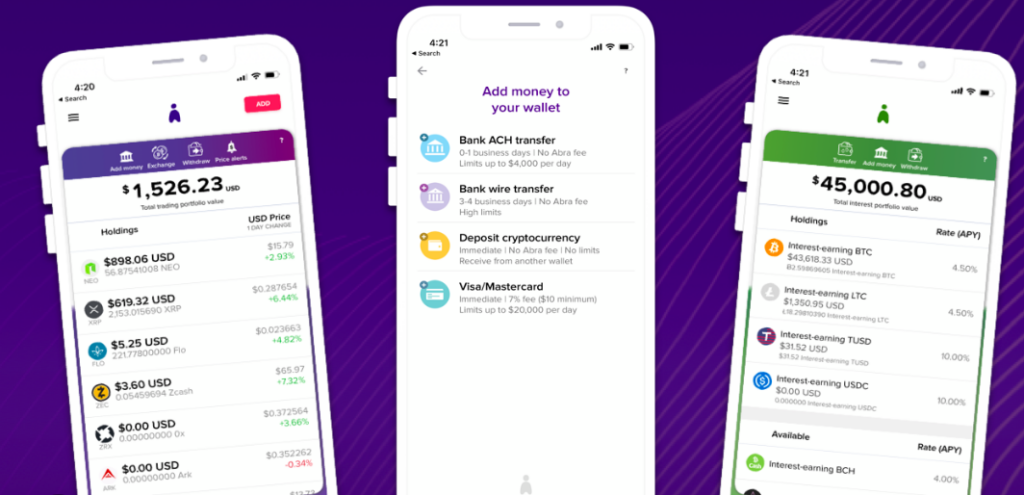

On the other hand, Abra is known for its crypto lending and borrowing capabilities. When it comes to spot trading, the exchange offers limited features and functionalities.

Though it is equipped with a quite decent charting system and tools when compared with Binance, the interface seems a little diminished.

Abra exchange interface is quite user-friendly, though and offers all the essential features readily on the trading window for you to access them at your fingertips.

Binance vs Abra: Customer Support

Now let’s discuss what customer service can you expect and how to reach them if things go south or you need someone’s help to answer your queries.

Binance

Customer Support at Binance is quite renowned and highly rated by its users.

Probably which is the reason behind its massive user base, the team is available 24×7, and you can reach them via live chat support and even through email.

Moreover, you can even reach out to them via their social media handle on Twitter, and it comes with a comprehensive knowledge base via its FAQ section.

Abra

Similarly, Abra also offers extensive customer support via its application as well as its website. To reach out to them on the app, select the ‘Contact Us’ widget on the bottom right corner of the screen.

Just type in your question and tap enter, and you will be suggested some FAQs; if you still don’t find the answer you were looking for, then you can reach them via email, and they will get back to you from 6 am-6 pm Pacific M-F.

Now let’s discuss another crucial segment of comparison which is the security aspect of these exchanges.

Binance vs Abra: Security Features

Binance

Beginning with Binance, this exchange is equipped with top-notch security features.

And, of course, they should have them; an exchange of this size which is often considered a brand among crypto exchanges, must have this level of security.

Most of their highlighting features include:

- Real-Time Monitoring

- Secure Cold Storage

- Multi-Factor Authentication

- Organisational Security

- Regular Audits

- Advanced-Data Encryption

Abra

Similarly, Abra is nowhere behind when it comes to the security of the platform.

Abra exchange offers all of the standard security features of the crypto market, including multi-factor authentication, anti-money laundering systems and many more.

Abra employs a state-of-the-art enterprise risk management framework that enforces KYC policies for better security of the interface and your funds.

Is Binance a Safe & Legal To Use?

The clear answer to this is that, yes, Binance is for sure a safe and legitimate platform. With top-notch security features and global licenses, Binance is undoubtedly a 100% legitimate crypto exchange.

Is Abra a Safe & Legal To Use?

Similarly, Abra is also a safe crypto exchange, as it not only comes with all the industry’s standard security features but also is licensed by SEC, making it a completely legitimate platform.

Abra vs Binance Conclusion: Why not use both?

Both Abra and Binance are among the renowned crypto derivative exchanges of the cryptoverse.

Both of them have a huge user base with unique crypto trading capabilities, but when it comes to selecting one among them, then things get confusing.

But going through the comparison above, you will surely be able to draw a line between them.

If you are a beginner trader and looking for an exchange that is spot trading specific with all the basic features to experiment with, then Abra will be the best choice for you.

On the other hand, if you want an exchange that will help you to get to the crypto market’s core and trade through various crypto trading products, then Binance is the way to go.

So choose the best crypto exchange that focuses on your trading needs and start your trading journey with these ultimate crypto exchanges today.

Check out how Binance & Abra gets compared to other crypto exchanges:

- Binance vs KuCoin

- Binance vs Kraken

- Binance vs Poloniex

- Binance vs Bitmex

- Binance vs Bitso

- Binance vs Gate.io