Fundamentally, Margin trading and Futures trading have some similarities, like allowing a trader to amplify their profits with the use of leverage, but also some basic differences.

Now that you have decided to take Margin and Futures trades, it is time that you understand the intricacies of both.

This article will take you through an understanding of both trading methods, and by the end, you should be able to decide which method is best for your trading strategy.

Binance Margin vs Futures

- Margin Trading

Margin Trading is similar to spot trading in the sense that the underlying assets are owned and traded by you.

- The biggest difference from spot trading is that you can borrow funds from the exchange and use leverage to increase your position size. A larger position size then increases the scale of any profits or losses that come from the price movements.

- Any funds borrowed from the exchange will attract a rate of interest depending on the asset, and this will be paid to the lender. In order to open a margin position on Binance, you have to put up what is called the initial margin for your position.

- Your margin trade will remain open in perpetuity as long as the trade goes in your favour or if you answer the ‘margin call’ by investing more margin to prevent the liquidation of the position.

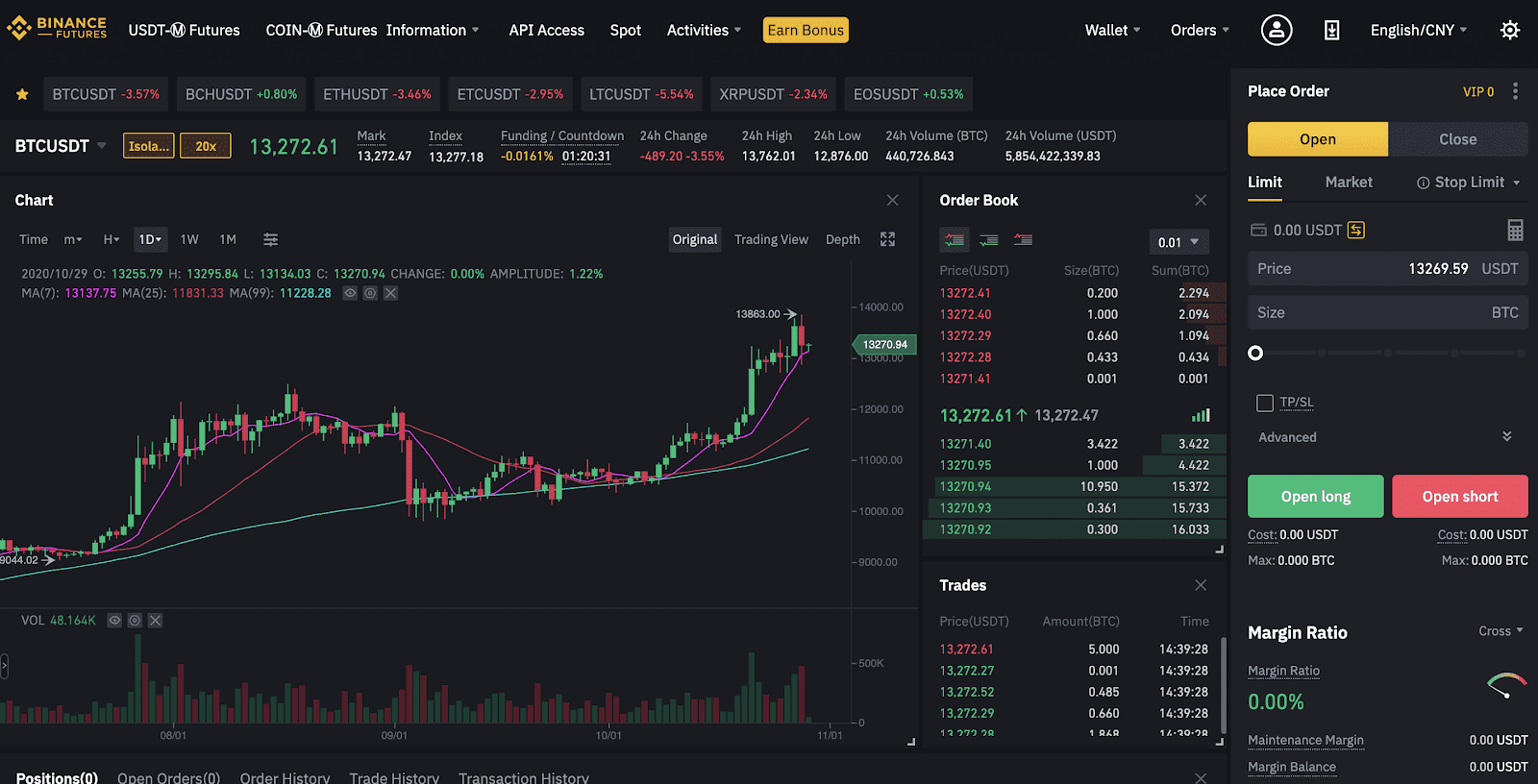

For example, you want to buy 1 Bitcoin at its market price of $16,800 using 10x leverage.

To take this trade, your initial margin will be $1,680, while the rest of the $15,120 will be borrowed from the exchange. When the price of Bitcoin reaches your target of $18,000, you can close your position.

Then the borrowed $15,120, along with interest, is returned to the exchange. So, by investing $1,680, you were able to make close to $1,200 in profit. This is the power of margin trading.

New to margin trading? Learn Cross vs Isolated Margin

- Futures Trading

Rather than buying and selling the actual asset using leverage and borrowed funds, Futures trading on Binance Futures allows you to exchange contracts that represent the value of the cryptocurrency itself.

- You don’t end up owning any of the currency itself but only a binding agreement to buy or sell it at a predetermined price on a future date.

- Futures contracts are used as a hedge against the volatility of the asset and any quick price movements in the cryptocurrency market. You still have leverage available to you when you want to day trade Futures.

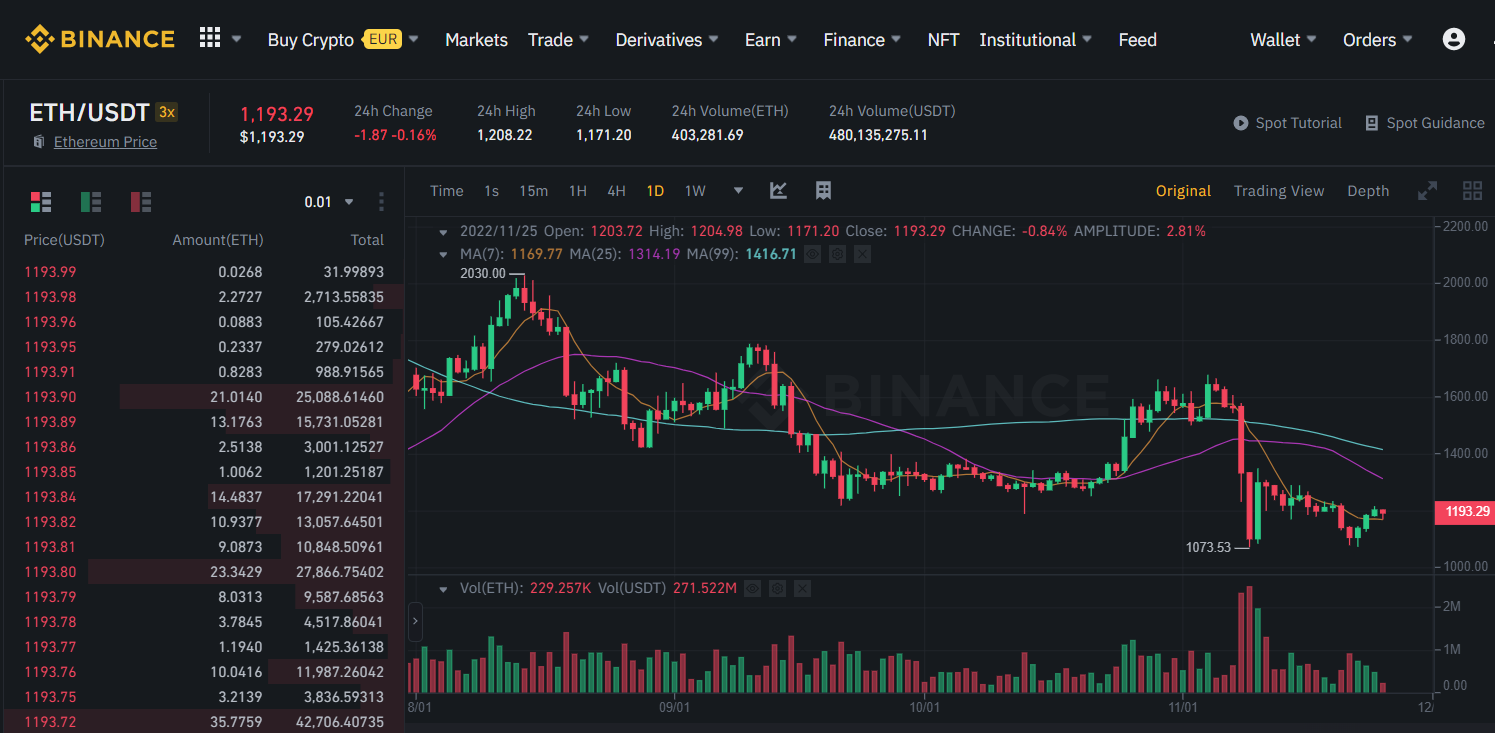

Take, for example, you buy an Ethereum Perpetual Futures contract at $1,200 today with 10x leverage.

Your margin will only be $120, and the other $1,080 will be borrowed from the exchange. In this example, you are betting that the price will go down according to the market sentiment and your trading thesis.

This means that you have a short position on Ethereum. When it reaches your price target of, say, $800, you will close your position and pocket the $400 in profit, and get back your initial margin of $120.

Such behaviour happens with cash-settled perpetual Futures contracts.

In case you choose to trade a deliverable contract with an expiry date, you will be able to sell Ethereum at $1,200 when your contract expires, hence making the same $400 in profit.

Learn how to how to short Bitcoin on Binance?

Difference Between Trading Margin and Trading Futures On Binance

- Daily payments – First and foremost, traders using Margin or Futures trading need to understand the concept of daily interest payments (Margin Trading) or Funding rate (Futures Trading).

When you take a leveraged position, the money for the rest of your position, apart from the initial margin, is borrowed from the exchange or a lender.

For this, you must pay the exchange until the position is held open. With Margin trading, there is no way around this, but if you choose to trade quarterly Futures, there is no funding rate. Hence no money is spent to keep the position open.

So, when a position is kept open for a long time, the interest or funding payments can add up and eat into the eventual profit. Thus, Quarterly Futures contracts are ideal for long-term holders.

- Exotic trading pairs – Margin trading allows traders to access trading pairs that would otherwise not be available. For example, you will not find a BTC/ETH pair in your Futures trading panel. In this pair, you are speculating on the performance of Bitcoin against Ethereum. Trading this pair might not be for everyone, but seasoned traders can look for opportunities and make money on these, also.

- Expiry dates – With Margin and perpetual Futures positions, there is no concept of expiry dates, as these can be traded till the trader sees fit. This allows traders with a large risk appetite and long-term targets to keep their trades open and make larger profits while keeping their leverage low. This kind of trading is ideal for swing traders.

If trading with an expiry date is your style, you should opt for Quarterly Futures contracts instead.

Which One Should You Use?

Understanding your level as a trader and knowing how much capital you are willing to deploy will decide which trading style you will use.

If your analysis tells you that Solana will be outperformed by Bitcoin in the near term, you will use Margin trading to take a position on the SOL/BTC pair. This pair is not available in the Futures trading console.

Futures contracts, on the other hand, are more intuitive and better suited to beginner traders. When trading Futures, a trader does not need to worry about borrowing or repaying loans to fund their positions.

It is as simple as paying your initial margin and deciding which direction you are betting the asset’s price will move in.

Conclusion

If you are new to this field, take some time to understand the intricacies of both trading styles, as they have their pros and cons. There is no one-size-fits-all solution to this, and what works for me might not work for you.

Even though leverage can be a blessing as it allows you to take larger positions with minimal capital investment, if the price of the asset moves against you, the losses are magnified as well.

If you do not want to buy or sell the asset itself, Futures trading is where you should focus.

But if you are looking to trade currency pairs other than the USDT-denominated ones, you should develop strategies for Margin trading.