BitMEX and Binance are two of the most prominent names in the crypto space. BitMEX is one of the oldest crypto exchanges out there, founded in 2014 and headquartered in Seychelles.

Binance is a relatively new exchange founded in 2017 and established in Cayman Islands and Seychelles. But in a period of four years, Binance has become the largest crypto exchange in the world in terms of daily traded volume.

So, how do the two crypto giants compare against each other, and which one is better to trade cryptos? Let’s compare the two exchanges based on trading products, leverage offerings, fees, security, performance, and more.

BitMEX vs. Binance: Contracts & Leverage Offerings

BitMEX is a futures-only trading exchange and offers both traditional futures contracts and perpetual swaps.

Traditional futures contracts are available in the following cryptocurrencies and altcoins: Bitcoin (XBT), Ethereum (ETH), Bitcoin Cash (BTC), Ripple (XRP), Dogecoin (DOGE), and Stellar (XLM).

Perpetual swaps are available in Bitcoin (XBT), Ripple (XRP), and Ethereum (ETH). Please note that BitMEX uses XBT as a ticker for Bitcoin instead of BTC. Both are the same.

BitMEX has a 24h daily derivatives trading volume of USD 1.6 billion – the 11th highest in the market.

BitMEX provides a maximum leverage of 100x on XBT traditional futures contracts and perpetual swaps. The maximum leverage on ETH and XRP perpetual contracts is 50x, and the leverage on remaining contracts is 20x-33.33x.

Binance, on the other hand, offers a comprehensive range of products, including:

- COIN-M Futures: Traditional and perpetual futures contracts settled in BTC

- USDT-M Futures: Traditional and perpetual futures contracts settled in USDT

- Binance Leveraged Token: Take 1.25-4x leveraged positions on cryptocurrencies and trade them on the spot market

- Binance Vanilla Options: European-style BTC/USDT options contracts

Binance has a 24h derivatives trading volume of USD 54 billion – the highest in the crypto market. Binance offers maximum leverage of up to 125x on all futures contracts.

Verdict: Binance is the clear winner as it has more trading products and offers better leverage.

BitMEX vs. Binance Trading Fees

Both Binance and BitMEX follow a market maker-taker fee model. However, the fee structures of the two exchanges differ significantly.

-

BitMEX

BitMEX has a flat trading fee structure. It offers a 0.025% market maker rebate and charges a 0.075% market taker fee on all traditional, perpetual, and Quanto futures contracts.

-

Binance

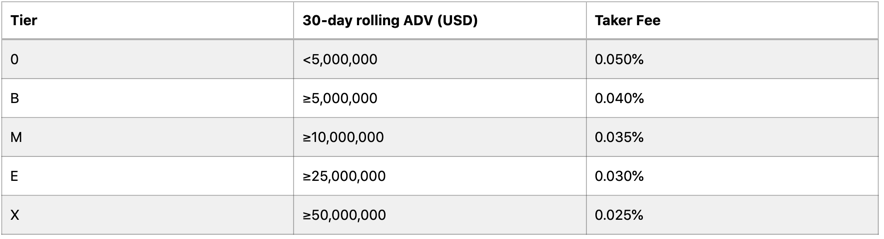

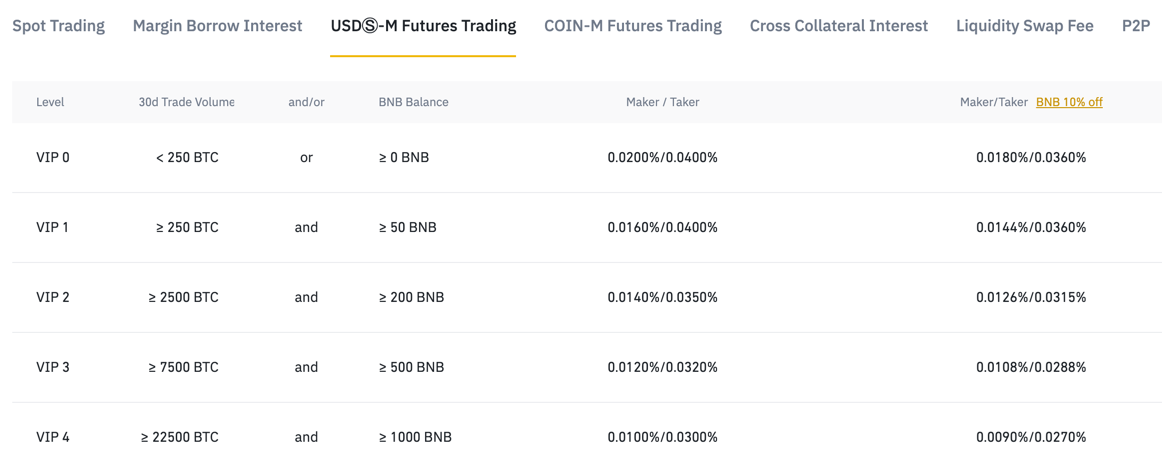

Binance also follows a maker-taker fee model, but it has a tiered fee structure instead of a flat fee structure.

Binance has ten account levels (VIP 0 – VIP 10) based on the last 30d traded volume and/or BNB balance. Traders with the last 30d trading volume of less than 250 BTC and/or BNB balance of less than 50 BNB fall into VIP 0.

For VIP 0 traders, the market maker and market taker fees for USD-M futures are 0.020% and 0.040%, respectively. For COIN-M futures, the fees are 0.010% and 0.050%, respectively.

Similarly, traders with the last 30d trading volume of more than 750k BTC and/or BNB balance of more than 11,000 BNB fall into VIP 9. For these traders, the maker/taker fee is 0.0%/0.0170% for USD-M futures and –0.009% (rebate)/0.024% for COIN-M futures.

Additionally, traders who use the BNB token for USD-M futures trading get an additional 10% discount on the maker and taker fee.

Verdict: BitMEX is the winner, as it charges lower fees and has a simpler fee structure.

BitMEX vs. Binance Funding Fees

Both BitMEX and Binance Futures use the Mark Price mechanism to calculate the funding rate. It is calculated using two components: interest rate and premium. The funding rate is unique for each futures contract and refreshes every eight hours.

It’s essential to note that traders pay funding fees to other traders, and the exchange has no direct involvement. Feel free to check the funding rate history of BitMEX and Binance.

The funding rate is essential because, unlike traditional futures contracts, perpetual swaps don’t have an expiry date. Hence, they can continue to trade away from the spot price for a long time.

This increases the risk of sudden fluctuations and makes it difficult to predict the trend and market movement.

Verdict: It’s a tie, as both the exchanges follow the same funding rate mechanism and refresh the funding rate every eight hours.

BitMEX vs. Binance Deposit & Withdrawal Fees

Deposits and withdrawals are free on both BitMEX and Binance. However, the blockchain network fee will apply when withdrawing funds from either of the two exchanges. Hence, you can deposit and withdraw funds without any extra costs.

Let’s also discuss the deposit methods offered by the two exchanges. Since BitMEX is a derivatives-only exchange, it accepts deposits in Bitcoin only. On the other hand, Binance supports 150+ coins, along with 19 fiat currencies.

Verdict: Both the exchanges don’t charge any deposit and withdrawal fee. However, Binance has a slight edge because of the more deposit methods.

BitMEX vs. Binance Trading Platform Comparison

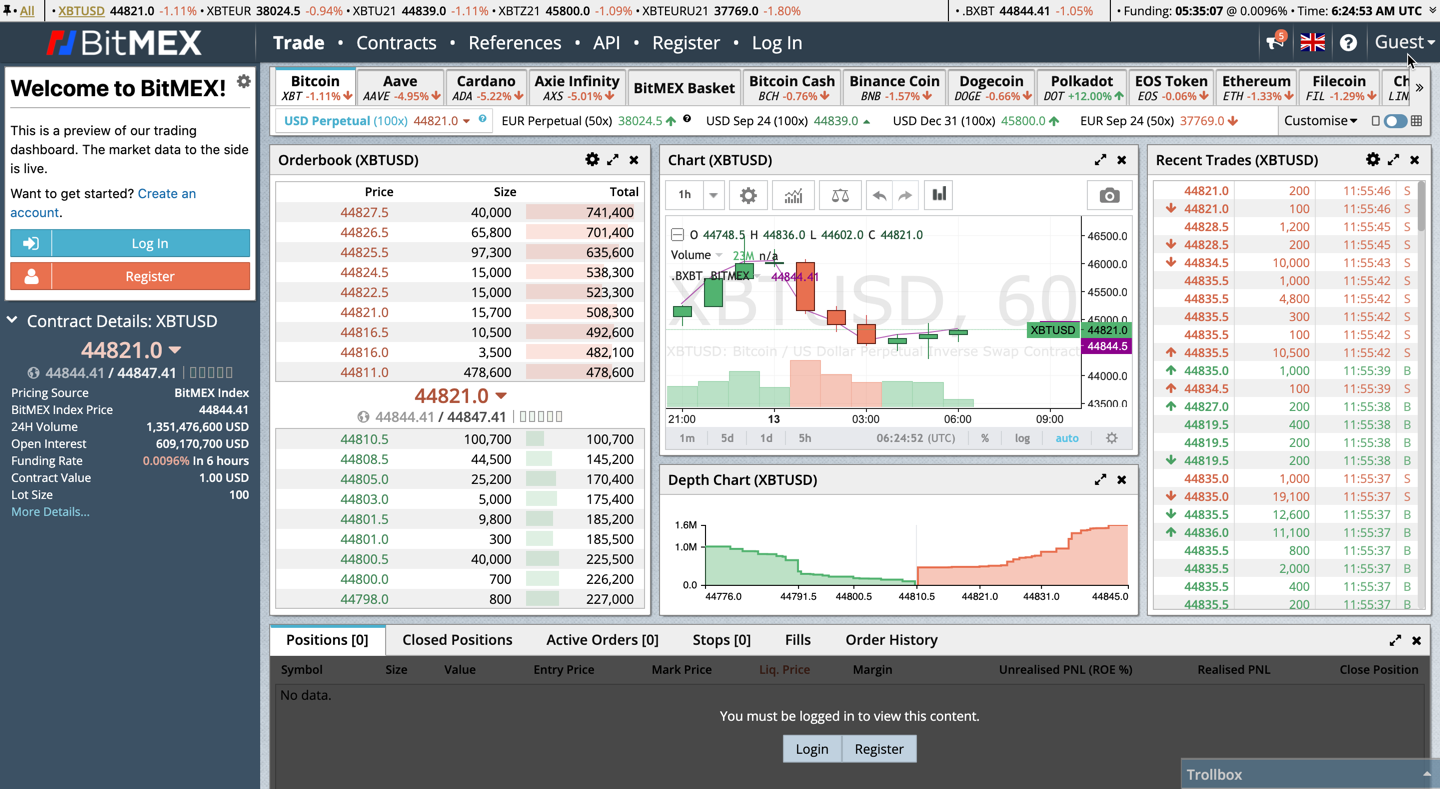

BitMEX and Binance have robust trading platforms; however, there are some subtle differences that new traders must know about. Here’s a head-to-head comparison between BitMEX and Binance’s trading platforms.

BitMEX

BitMEX is an old player in the crypto space, and hence, it understands the importance of a good trading platform. The platform runs on the kdb+ database, which several banks and financial institutions use for high-frequency trading.

The trading panel is neat, user-friendly, and easy to use. The learning curve is small, and new traders can easily get used to the platform.

BitMEX has a TradingView charting platform and comes with all the fundamental and technical analysis tools, including:

- Real-time order book

- Historical chart data

- Multiple chart types, including line, area, candlesticks, Heikin-Ashi, etc.

- Hundreds of built-in indicators and screeners

- Multiple time frames

Additionally, BitMEX supports various order types, including limit orders, market orders, stop-limit orders, stop market orders, trailing-stop orders, take-profit limit orders, and take-profit market orders.

BitMEX has a mobile trading platform available for Android and iOS. Therefore, traders can take and manage traders from their mobile phones.

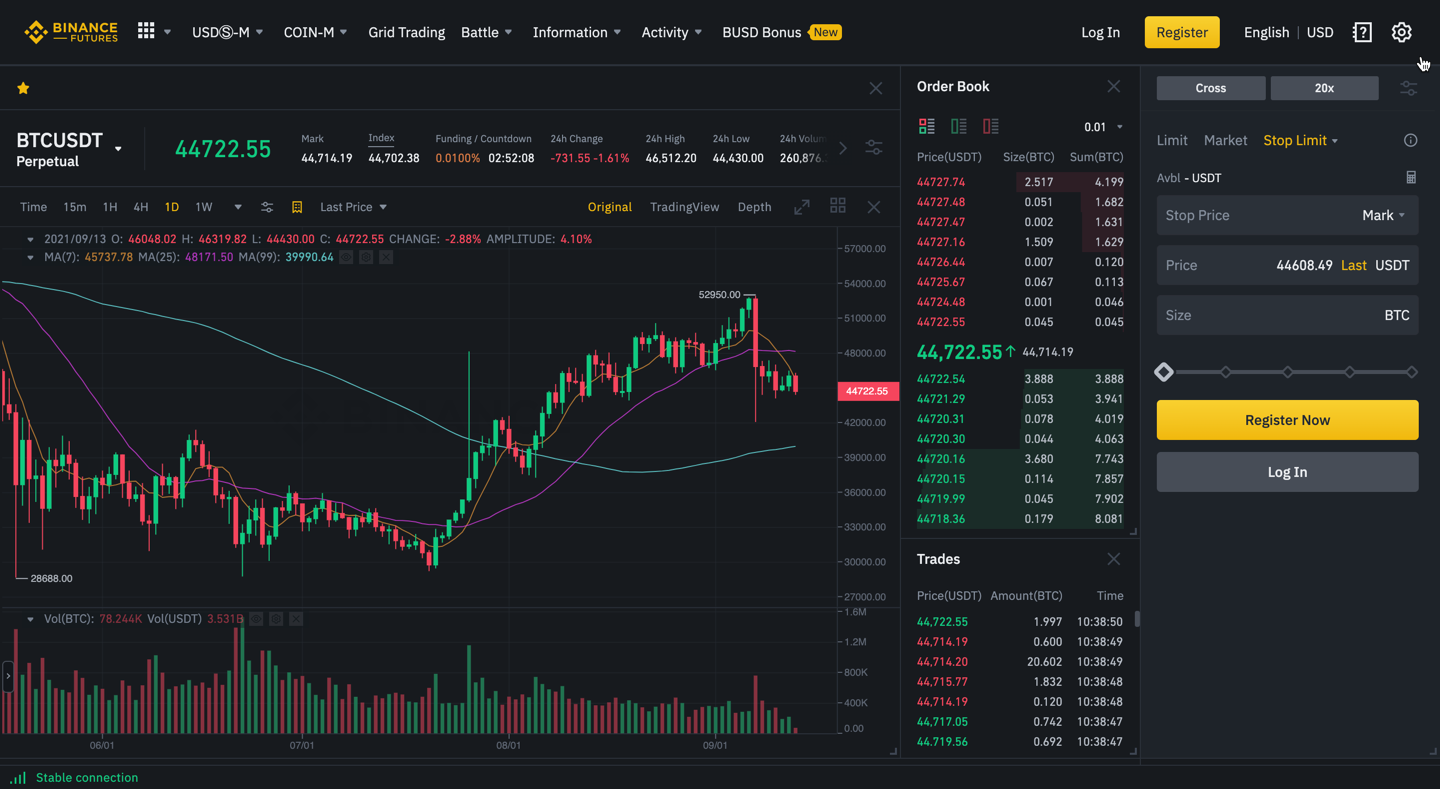

Binance

Binance has one of the most powerful and intuitive trading platforms in the crypto space. It has a latency of less than 5 ms and can execute over 1.4 million trades per second.

Binance also uses the TradingView charting system. Hence, it shares the same features as BitMEX, such as multiple chart types, indicators, and time frames.

It also supports numerous order types, including limit orders, market orders, stop-limit orders, stop market orders, trailing-stop orders, and post-only orders.

Binance also has an intuitive mobile app that has all the features available on the desktop version.

Verdict: Binance is the winner, as its platform is more responsive and intuitive.

BitMEX vs. Binance Account Opening Process

BitMEX and Binance have effortless account opening processes. Let’s compare the two.

-

BitMEX

BitMEX requires all its users to complete KYC to use the platform and start trading. The KYC process is simple and takes a few minutes. You can visit the BitMEX registration page to create your account and complete the KYC process.

Once your KYC is completed, you can deposit funds and start trading. While the KYC process is seamless, it could take a few hours to approve, which could be a hassle for some users.

-

Binance

Binance also has KYC, but it isn’t mandatory. KYC is mandatory if you intend to deposit funds using fiat currency. Crypto-only users can also complete their KYC to enjoy greater benefits, such as lower fees and higher withdrawal limits.

But if you want to create an account on Binance, deposit crypto, and start trading, you can do that without KYC. Feel free to register on the Binance registration page.

Verdict: Binance is the winner, as it doesn’t have a mandatory KYC.

BitMEX vs. Binance Customer Support

Customer support is one of the most important factors to consider when choosing a cryptocurrency exchange. Let’s compare the customer support services of BitMEX and Binance.

-

BitMEX

BitMEX provides customer support via email only. The support offered is multilingual, supporting the following languages: English, Japanese, Chinese, Russian, and Korean. BitMEX also has a Telegram group where you can interact with the community.

Additionally, BitMEX has a vast knowledge base consisting of blog posts, FAQs, etc.

-

Binance

Binance has a 24/7 virtual chatbot on its website that can help you resolve common queries. For further assistance, you can send them an email. Binance also has a comprehensive knowledge base that provides answers to a lot of common questions.

Verdict: Binance is the winner, as it offers a virtual chatbot and a more comprehensive knowledge base.

BitMEX vs. Binance Security Features

Security is another critical factor new crypto traders should consider before choosing an exchange. Here’s a head-to-head comparison of the security features implemented by BitMEX and Binance.

BitMEX

Being one of the oldest crypto exchanges globally, BitMEX implements leading-edge security features to provide a secure experience to traders. It has a mandatory KYC requirement to prevent issues like alleged money laundering.

Additionally, it deploys security features like:

- Multi-signature cold wallet to store funds

- Manual authorization of withdrawal requests

- PGP encryption

- IP whitelisting, two-factor authentication, and other security measures.

Binance

Binance doesn’t have a mandatory KYC requirement. It also implements the same security features as BitMEX, including a cold wallet system, authorization of withdrawal requests, IP whitelisting, encryption, etc.

Verdict: It’s a tie, as both BitMEX and Binance implement similar security features.

BitMEX vs. Binance Liquidation Mechanism

BitMEX has a sophisticated liquidation mechanism that attempts to reduce the risk of forced liquidation. It also uses fair price marking to protect users from forced liquidations due to malicious market fluctuations.

Binance uses a Smart Liquidation protocol to avoid the complete liquidation of positions. It also has insurance funds to protect traders from losses due to sudden market fluctuations. Additionally, Binance has a socialized loss system to distribute the losses of bankrupt positions among profitable traders.

Verdict: It’s a tie, as both the exchanges implement measures to avoid forced liquidations.

Conclusion

BitMEX and Binance are both excellent exchanges for new and professional traders. They share similarities on many fronts. For example, both offer leading-edge customer support and implement robust security features.

However, there are some differences traders must keep in mind.

BitMEX is a futures-only exchange and supports traditional and perpetual futures contracts only. However, it has a simpler fee structure. The number of cryptocurrencies offered is also limited.

On the other hand, Binance allows a wide range of trading options and cryptocurrencies to choose from. It also offers higher leverage than BitMEX.

Binance also has a more powerful and intuitive day trading platform.

Overall, Binance is a better exchange than BitMEX, as it has a higher trading platform, more trading products, better leverage, and better overall trading experience.

Here is How BitMEX & Binance Compares To Other Crypto Exchanges

- BitMEX vs Phemex

- BitMEX vs PrimeXBT

- BitMEX vs Bybit

- Binance vs Huobi

- Binance vs Bithumb

- Phemex vs Binance