BitMEX and Coinbase are two of the most talked-about crypto exchanges, and together they control a significant percentage of the market.

Also, they have been around longer than most others, and many seasoned traders started off trading in one of these two exchanges.

BitMEX vs. Coinbase: Introduction

BitMEX is a Seychelles-registered peer-to-peer crypto trading platform with offices in Hong Kong and the USA. The company started in 2014 and has a highly liquid market with its 24-hour trading volumes averaging around $1 billion.

On the other hand, Coinbase is an American-registered company that has been in operation since 2012 and boasts of having over a million traders registered on its platform. Coinbase is even more liquid as 24-hours trade volumes average at around $2 billion.

For traders still unsure which platform to use between these two, this side-by-side comparison highlighting the key points that set them apart will be beneficial.

BitMEX vs. Coinbase: Product Offerings

While many modern crypto trading platforms offer a diverse market with a wide variety of products for the traders, BitMEX and Coinbase seem to focus on a single product offering. However, this does not mean there are limited trading options for either.

BitMEX focuses on the trade of cryptocurrency derivatives, with futures and margin trading taking up a massive chunk of their daily trading volumes. The platform offers both futures and perpetual contracts, and traders can go long or short on both contracts. For these product offerings, BitMEX provides leverage of up to 100x.

BitMEX Offer: Crypto traders who sign-up using this exclusive link will receive a 10% fee discount for six months and believe me, 10% is a lot when you see it over a period of time. |

Since BitMEX focuses more on derivatives and leveraged trading, it is best suited for more experienced traders. These products do not work well for those looking to buy and sell small volumes of crypto.

Coinbase is a spot market that allows traders to exchange over 50 different currencies. It is a more traditional platform for buying and selling cryptos, meaning anyone can quickly figure things out. The platform also includes a stablecoin with a stable value of $1, and you can trade it with 11 different cryptocurrencies.

BitMEX vs. Coinbase Trading Fees

Trading fees significantly affect your trading margins regardless of the asset, so you cannot afford to overlook them. When deciding the cryptocurrency exchange to use, it is essential to compare the expected trading fees for your projected trading volumes.

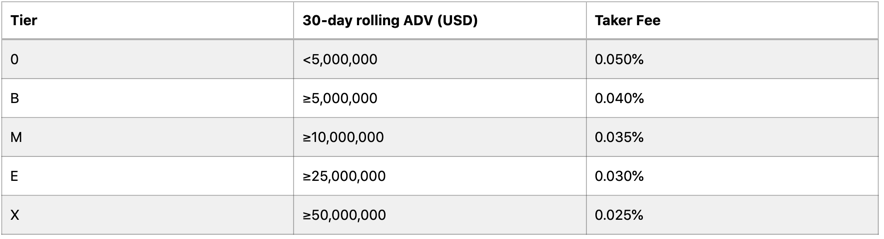

BitMEX charges low trading fees, but the actual amount you part with depends on the cryptocurrency involved and the contract. The platform offers different contracts like perpetual and futures contracts. Like any other P2P crypto exchange, the fees are in three categories; maker, taker, and settlement fees.

BitMEX will charge a 0.025% maker fee, 0.075% taker fee, and a settlement fee that ranges between 0.00% and 0.05% for most cryptos and contracts.

With Coinbasse, the cryptocurrency sales and purchases attract a spread fee of around 0.5%. But, the actual spread fee you end up paying when trading will often be higher or lower than this, given that it is highly dependent on cryptocurrency price market fluctuations.

The only other trading fee you can expect to pay with Coinbase is pegged on the total transaction amount and also your region.

BitMEX vs. Coinbase Deposit & Withdrawal Fees

You need to make sure you get as much value for your money as possible when depositing to start trading and withdrawing from the platform. One way to ensure this is to choose a platform with zero or minimal withdrawal and deposit fees.

BitMEX will not accept any deposits in fiat currency as it is only a crypto leverage platform. Traders need first to buy BTC from a spot market and then deposit them into the exchange. Some of these spot markets have specific fees like miner’s fee for traders, meaning first-time users have to pay one way or another to deposit on BitMEX.

However, there are no direct deposit or withdrawal fees when using BitMEX. For the withdrawals, the only charge is the minimum BTC network fee set by the blockchain load.

When on the Coinbase platform, there are no deposit fees when using the Coinbase card for your transactions. But, for other transaction types using different channels, the traders must part with a flat fee of 2.49%. Any additional withdrawal and deposit fees will depend on the payment modes you are using and the country.

BitMEX vs. Coinbase Trading Platform Comparison

The trading platform tools, interface, and functionalities are crucial elements of any exchange as they have a considerable impact on the overall trade experience. But, with both BitMEX and Coinbase, this should be the least of your worries as they give traders the best experience.

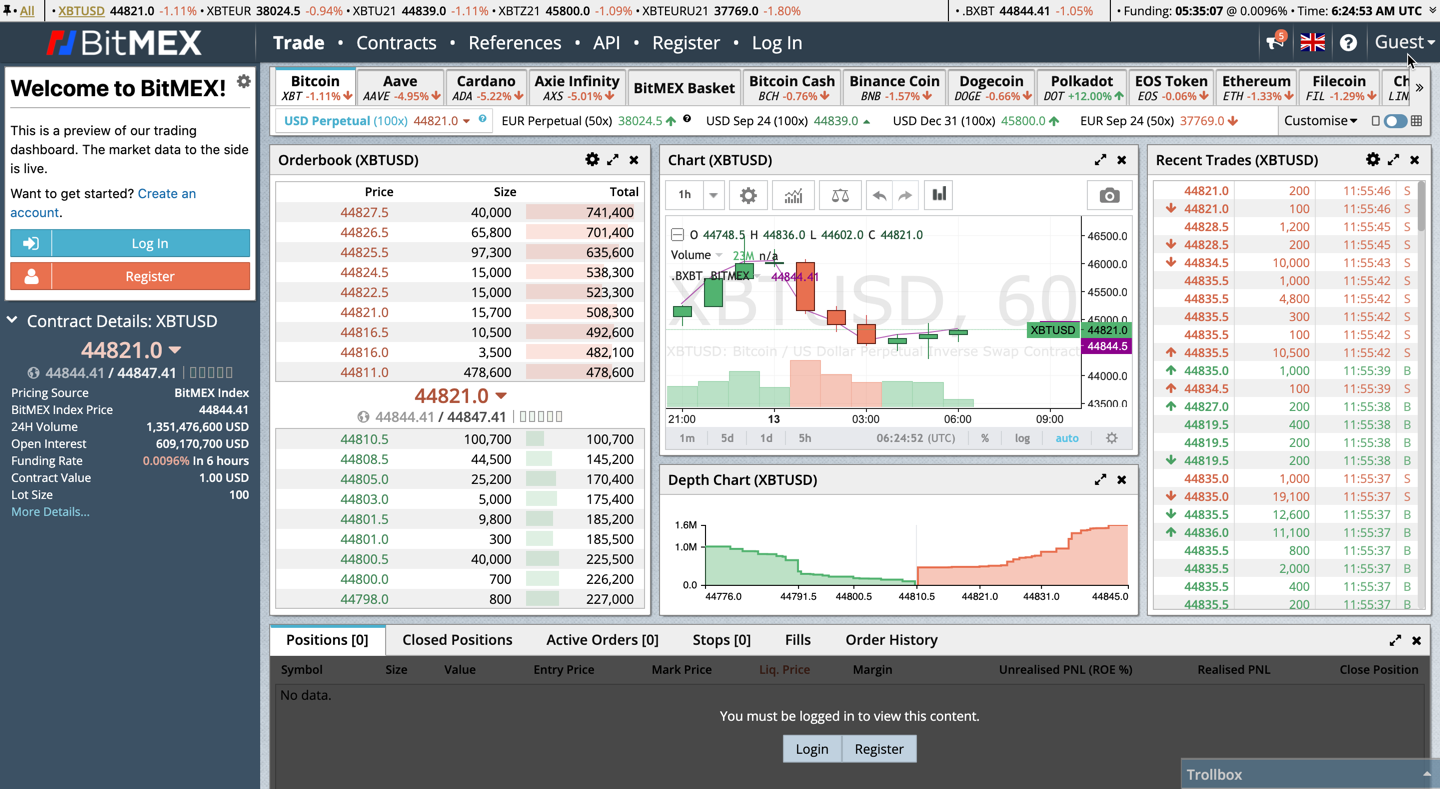

BitMEX has a well-laid out and highly intuitive interface that welcomes you every time you log in. A static top bar ensures you can quickly get back to functions like trade window and account view. Also, you can check this detailed BitMEX guide to know more about the exchange.

For the charting package, BitMEX uses TradingView, which is famous for smooth and highly responsive charts for traders. These charts help traders maximize profits by providing several tools to help you track trends and several time frames. All in all, there is everything on the interface you need to trade effectively and profitably.

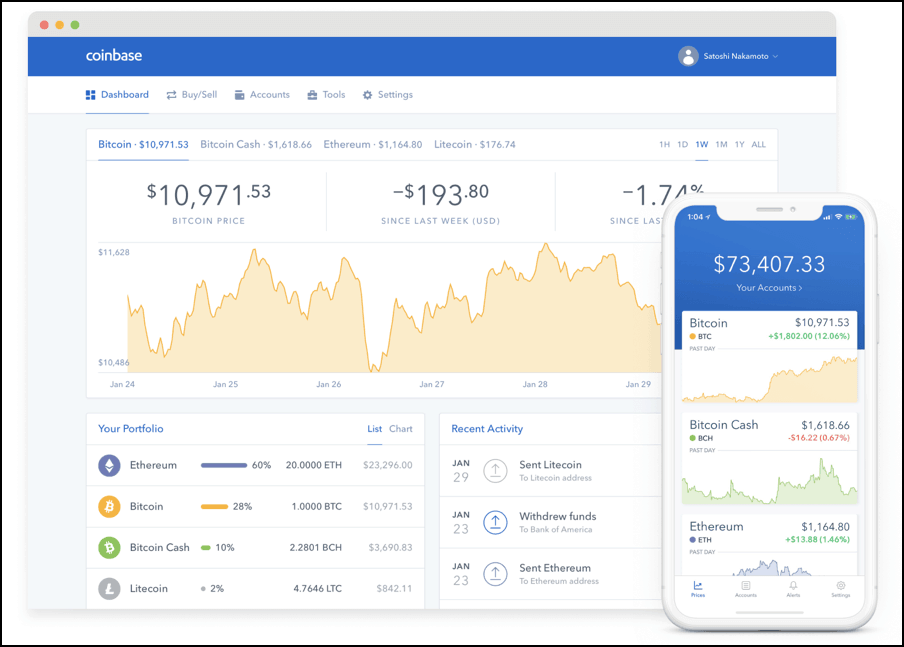

Coinbase keeps things simple with its trading platform, which is why many beginners will love this platform. However, despite the intuitive and straightforward design, the platform still provides all the tools you need to trade profitably. There are some robust charting tools, and everything on the interface is well-organized for easy navigation.

One more thing traders seem to love about this trading platform is the ease of accessibility. Since the platform is accessible through both Android and iOS, traders have the freedom to trade from anywhere.

BitMEX vs. Coinbase Account Opening Process

Setting up your account to start trading needs to be as easy as possible so you can pay more attention to learning how to trade and making profits. With both BitMEX and Coinbase, there are only a few easy steps to follow.

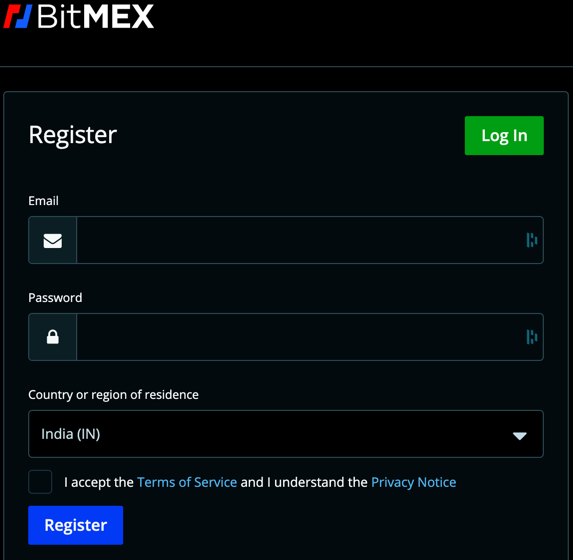

How to Open BitMEX Account

- Go to bitmex.com

- Enter email and name on the registration window

- Verify the email

- Fund your trading with BTC, and you are ready to trade

BitMEX Offer: Crypto traders who sign-up using this exclusive link will receive a 10% fee discount for six months and believe me, 10% is a lot when you see it over a period of time. |

How to Open Coinbase Account

- Go to coinbase.com

- Create an account on the registration window

- Verify your email

- Add your phone number and verify it

- Fill in the required personal data

- Verify identity and 2-step verification

- Make a deposit and start trading

BitMEX vs. Coinbase Customer Support

BitMEX offers customer support through rich online resources on their website to solve most customer issues. However, they also have a ticket system that traders can use for more personalized support.

Once you submit a ticket, you can expect a quick response from the customer support team. Also, they offer multilingual support given their global presence. Traders can get help in English, Chinese, Japanese, Russian and Korean.

Coinbase offers a live chat for their customer support, which is available throughout the US’s working hours. Traders can also send emails if the live chat does not work for them. With the Coinbase email support, you never have to worry about late responses, given the platform commits to responding to all emails within 24 hours.

BitMEX vs. Coinbase Security Features

Given the security issues on some cryptocurrency exchange platforms over the years, traders need to be extra careful when joining any platform. No one wants to end up losing their hard-earned cash to hackers.

BitMEX takes security seriously, and the company goes to great pains to ensure trader funds are secure enough. They use secure multi-signature wallets to ensure that the hackers will not get the necessary keys to steal the cryptos even in an extreme hack episode. Furthermore, the withdrawals are verified manually,

Personal privacy is also a guarantee on BitMEX, given that you do not need to provide personal information when signing up. Also, the platform does not have any trader geographical location restrictions.

Coinbase ensures user security by first making unauthorized access to your account almost impossible with their 2-step verification and biometric logins. Additionally, the company stores up to 98% of trader funds in a cold wallet, putting them out of reach for hackers.

One more security element that should give traders peace of mind is that Coinbase has an insurance policy covering the trader funds and assets.

Conclusion

Both BitMEX and Coinbase have particular elements that make them stand out, and they are what should guide you when deciding which one to use.

Overall, BitMEX makes a fantastic option for traders looking for a platform for cryptocurrency derivatives, while Coinbase is perfect for spot trading.

But, if this still does not solve the dilemma for you, BitMEX is ideal for those who want to maintain anonymity when trading, while Coinbase works well for those who prefer complete ID verification. Furthermore, you can look for Coinbase alternatives to find any other suitable crypto exchange.

The bottom line is that you cannot easily tell the right crypto exchange platform for you before you give it a try and understand its pros and shortcomings.

Here is How BitMEX & Coinbase Compares To Other Crypto Exchanges

- BitMEX vs Bybit

- BitMEX vs Kraken

- BitMEX vs Deribit

- Coinbase vs Bybit

- Coinbase vs Swyftx

- Coinbase vs WazirX