Finding the right cryptocurrency derivatives exchange to trade cryptocurrency futures can be difficult. With hundreds of best crypto derivatives exchanges to choose from, finding an exchange that offers numerous trading pairs, good leverage, amazing security, and effortless customer support can be challenging.

Today, let’s compare two popular cryptocurrency derivatives exchanges: Deribit and BitMEX.

Deribit is a Bitcoin derivatives exchange founded in 2016. It offers traditional futures and perpetual swaps with an attractive isolated margin.

On the other hand, BitMEX is one of the oldest crypto exchanges founded in 2014. It offers futures trading on Bitcoin and other trading pairs.

So, which exchange is better to trade crypto derivatives, and why? Here’s a detailed comparison to help you make the right decision.

BitMEX vs. Deribit: Futures Contracts, Perpetual Swaps, and Leverage Offerings

BitMEX offers both perpetual swaps and traditional futures contracts. It provides perpetual swaps in three coins: Bitcoin (XBT), Ripple (XRP), and Ethereum (ETH). Its traditional futures contracts are available in XBT, BCH, ADA, ETH, LTC, TRX, and XRP.

BitMEX has a 24h derivatives trading volume of USD 1 billion, making it the 13th-largest cryptocurrency derivatives exchange in terms of trading volume.

BitMEX provides a maximum leverage of 100x on XBT perpetual and traditional contracts, while the maximum leverage available on ETH contracts is 50x. For other contracts, BitMEX offers up to 20x leverage.

BitMEX Offer: Crypto traders who sign-up using this exclusive link will receive a 10% fee discount for six months and believe me, 10% is a lot when you see it over a period of time. |

Deribit is also a derivatives-only exchange and supports trading BTC and ETH perpetual swaps, traditional futures, and options.

Deribit has a 24h derivatives trading volume of USD 678 million, making it the 17th-largest crypto derivatives in terms of traded volume.

Deribit offers up to 100x leverage on perpetual and traditional futures contracts, while the leverage is limited to 10x for options.

Verdict: BitMEX is the winner, as it offers more trading options, better liquidity, and higher leverage.

BitMEX and Deribit Trading Fees

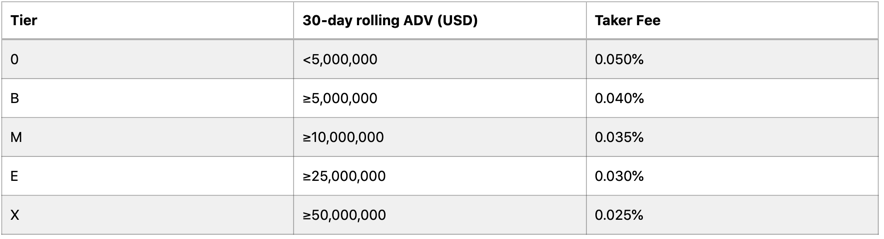

Both BitMEX and Deribit follow a market maker-taker fee structure. Neither of the two exchanges has a tiered pricing model, so the trading fees apply to all users.

BitMEX charges a flat fee structure. It offers a 0.025% rebate to market makers and charges a 0.075% taker fee from market takers.

Deribit, on the other hand, offers a 0.01% maker rebate and charges a 0.05% taker fee on BTC weekly futures contracts. For other BTC and ETH futures (traditional and perpetual), Deribit charges a 0.01% maker fee and 0.05% taker fee.

In case you’re new to the market maker-taker fee structure, here’s a quick explanation.

Orders that enter the order book add liquidity to the market. These orders “make” the market, and hence, they’re called market maker orders. Limit orders come under market maker orders.

On the other hand, orders that are executed immediately take away liquidity from the market. Hence, these orders are called market taker orders. Market orders and IOC orders come under market taker orders.

Verdict: BitMEX is a winner, as it charges a low fee.

BitMEX vs. Deribit Funding Fees

Since Deribit and BitMEX offer perpetual swaps, they have a funding rate mechanism to ensure that a perpetual contract’s price remains close to the spot price.

Both the exchanges implement a Mark Price mechanism to calculate the funding rate. Additionally, both the exchanges refresh the funding rates every eight hours.

Deribit doesn’t disclose its funding rate history. You can check the funding rate history on BitMEX here. If you’re curious about how funding works, follow this explanation.

Crypto futures, just like stock futures, derive their price from the underlying assets. While their price mostly remains close to the underlying asset’s price, it can deviate significantly in some instances.

Now, a traditional futures contract comes with a weekly, monthly, or quarterly expiry. So, no matter how far away from the spot price is the futures price, it will converge on the day of expiry.

However, perpetual swaps have no expiry, and thus, they can trade away from the spot price forever. This makes it difficult for traders to identify the market trend. Furthermore, predicting price action also becomes challenging.

That’s where the funding rate comes into the picture. When the futures contract is trading away from the spot price, traders pay a funding fee to each other.

For instance, buyers will pay a funding fee to sellers if the futures price is above the spot price. If the futures price is below the spot price, sellers will pay a funding fee to buyers. The payable funding fee is calculated by multiplying the funding rate by the number of futures contracts traded.

Verdict: It’s a tie, as both the exchanges implement a Mark Price mechanism and refresh the funding rate every 8 hours.

BitMEX vs. Deribit Deposit & Withdrawal Fees

You can deposit and withdraw funds from your Deribit account for free without any limitations. Deribit doesn’t charge any deposit or withdrawal fee. Deribit doesn’t charge any deposit or withdrawal fee. However, blockchain network fees may apply.

Deribit doesn’t accept fiat deposits or withdrawals. Only BTC and ETH are supported for depositing funds.

BitMEX also doesn’t charge any deposit or withdrawal fee. BitMEX doesn’t support fiat deposits, and users can deposit funds in the form of BTC only.

Verdict: It’s a tie. Both the exchanges don’t charge any deposit or withdrawal fee.

BitMEX vs. Deribit Trading Platform Comparison

Whether you’re a new trader or an experienced trader, the trading platform of exchange is one of the most important things to consider. A feature-rich, intuitive, and user-friendly platform can make a huge difference in your trading.

Let’s compare the trading platforms offered by Deribit and BitMEX.

- Deribit

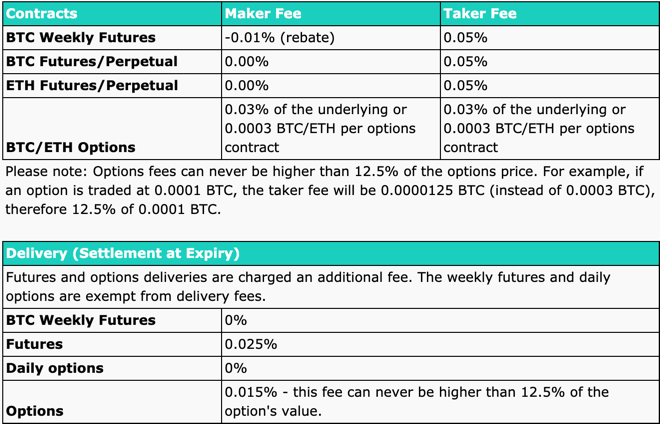

Deribit has a robust trading platform, and Deribit claims it to be the fastest exchange platform in the entire crypto space. It has a latency of less than 1 ms, providing ultra-fast trade execution and minimal downtime.

On the surface, Deribit’s platform looks similar to any other crypto trading platform. You’ll find a TradingView charting system that enables seamless fundamental and technical analysis. Key features of the charting system include:

- Multiple chart types, including line, area, candlesticks, Heikin-Ashi, etc.

- Multiple timeframes, ranging from 1 minute to 1 day

- Hundreds of built-in indicators for seamless technical analysis

Deribit has a mobile app that allows traders to manage their trading requirements from their smartphones. Deribit supports four order types, including:

- Limit order

- Market order

- Stop-limit order

- Stop-market order

Recently, Deribit gave its platform a major overhaul, making it one of the best trading platforms in the crypto space. Also, to learn more about the exchange, you can check out this how to trade crypto futures on Deribit tutorial.

- BitMEX

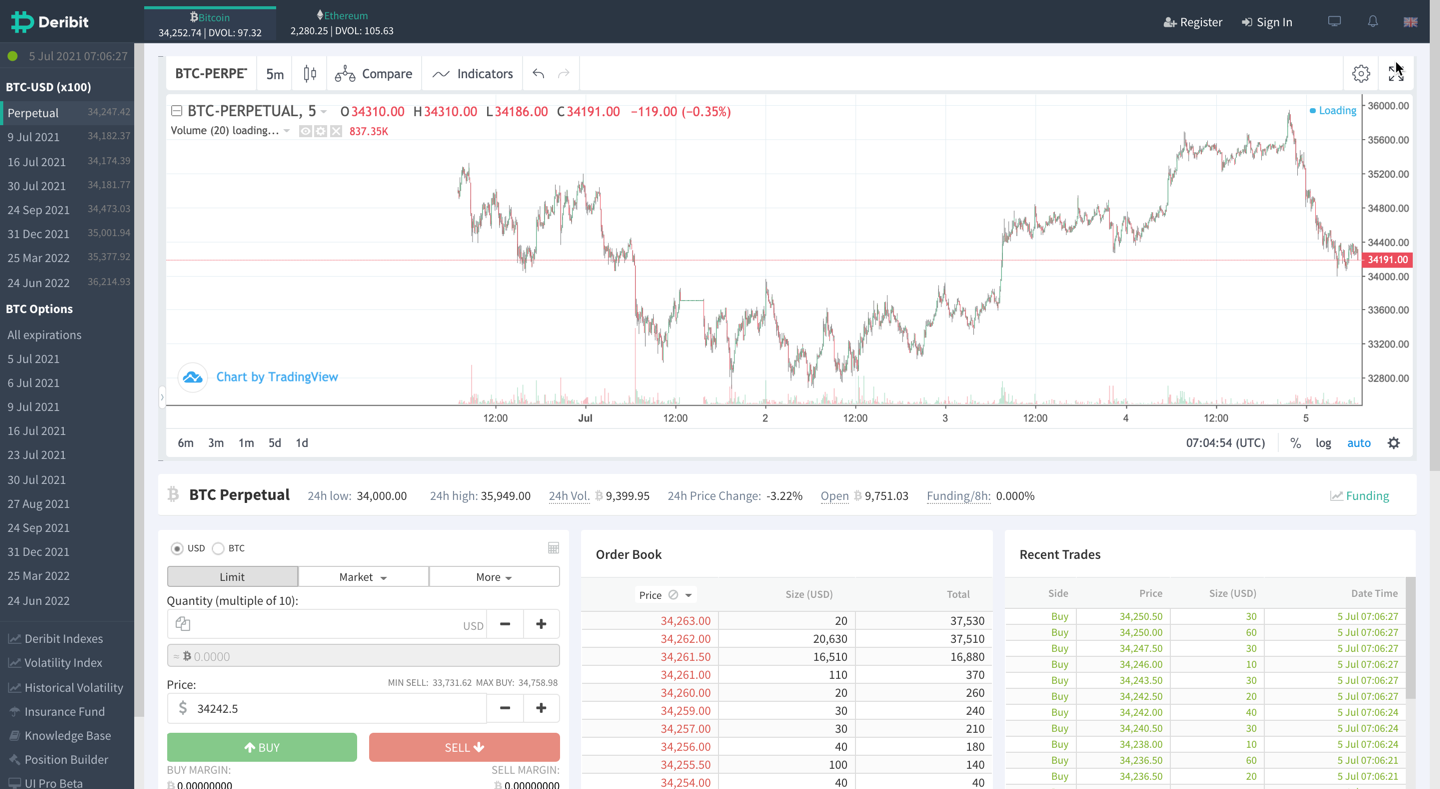

BitMEX also has an intuitive trading platform with a simple user interface, but traders have reported issues like power outages, login issues, etc. But keeping these occasional issues aside, BitMEX’s platform shares the same features as Deribit.

It has a TradingView charting system and comes with multiple chart types, time frames, and indicators. It supports seven order types: market, limit, stop-market, stop-limit, trailing stop, take profit, and take-profit market.

BitMEX also has a mobile app that allows you to trade on the go. To learn more about the exchange, you can check this BitMEX tutorial.

Verdict: Deribit has a slight edge as BitMEX’s platform has a history of performance issues.

Deribit & BitMEX Account Opening Process

Deribit requires all its users to obtain a KYC. There are four levels of KYC requirements. Let’s discuss the requirements associated with each level.

- Retail Level 0 – ID document and proof of residence

- Retail Level 1 – Proof of residence

- Corporate Level 0 – Incorporation documents, ownership structure, ID documents and proof of residence of directors, and register of shareholders and directors

- Corporate Level 0 – Same as Corporate level 1

BitMEX also requires all its users to complete a KYC to use the platform. However, unlike Deribit, BitMEX doesn’t have KYC levels. You can complete the straightforward KYC process and start using the platform.

Verdict: BitMEX is the winner. While both BitMEX and Deribit require KYC, BitMEX’s process is more straightforward.

BitMEX and Deribit Customer Support

If you’re a new trader, customer support should be one of the key factors to consider when selecting a crypto contract trading platform. Here’s a head-to-head comparison of the customer support provided by the two exchanges.

- Deribit

Deribit offers support mainly via email. You can reach them at [email protected] for any queries and technical issues. Deribit also has a Telegram group where you can connect with the support team.

- BitMEX

BitMEX also offers support primarily through email, and they provide support in English, Chinese, Japanese, Korean, and Russian languages. You can visit their Help & Support page and raise a ticket.

Apart from email, BitMEX provides support on Telegram and Twitter.

Verdict: BitMEX is the winner. Its multilingual customer support gives it a slight edge over Deribit.

BitMEX and Deribit Security Features

Before starting margin trading, you might want to get the assurance that your information and funds will remain safe. Thankfully, both Deribit and BitMEX implement robust security features that guarantee safe crypto trading of Bitcoin futures.

Let’s compare the security features of the two exchanges.

- Deribit

Deribit deploys industry best practices to safeguard its platform from cyberattacks and other security challenges. It uses a multi-signature cold storage wallet for depositing 95% of the users’ funds.

Other security features implemented by Deribit include two-factor authentication, IP pinning, encryption, etc. BitMEX

- BitMEX

BitMEX also has a solid security infrastructure. It uses a multi-signature cold storage wallet to store users’ funds and encourages them to use two-factor authentication. Additionally, BitMEX manually authorizes each withdrawal request to avoid unauthorized withdrawals.

Other security features include IP whitelisting and encryption. BitMEX uses Amazon Web Services to enhance the security of its platform further.

Verdict: BitMEX is the winner, as it manually authorizes withdrawal requests and uses AWS security infrastructure.

Deribit vs. BitMEX Liquidation Mechanism

Liquidation refers to the process of selling assets for cash. Forced liquidation, also known as auto-deleveraging, is a common instance in the crypto futures trading space.

It is the automatic closing of a trader’s open positions when their initial margin is less than the margin required for the leveraged positions. In any case, forced liquidation of a position is something a trader wouldn’t want to see.

Deribit implements an insurance fund and socialized loss system to protect traders from sudden, huge losses.

BitMEX also has a sophisticated liquidation process. It attempts to avoid forced liquidation by lowering risk limit tiers or canceling open orders that take up margin. There is an insurance fund as well that helps traders prevent big losses.

Verdict: It’s a tie. Both Deribit and BitMEX have a similar liquidation mechanism, and both exchanges implement best practices to avoid forced liquidations.

-

Is Deribit safe?

Deribit has never been hacked, and it is one of the safest cryptocurrency exchanges in the market. As discussed, Deribit implements industry-standard security features and practices to secure its users’ secure trading experience.

With features like multi-sig cold storage wallet, two-factor authentication, IP pinning, and encryption, Deribit’s platform is completely safe. You can open an account on Deribit without worrying about security and safety.

-

Is BitMEX a good exchange?

BitMEX is one of the oldest crypto derivatives exchanges in the crypto space. Till 2020, it was the biggest crypto derivatives exchange in the world in terms of daily traded volume.

However, as numerous new exchanges have entered the market, the popularity of BitMEX has declined. For example, exchanges like Bybit and Phemex are newer exchanges that offer everything that BitMEX has to offer, along with some extra benefits and functionalities.

With that said, BitMEX is still one of the best cryptocurrency exchanges out there. It has a high daily trading volume, thereby enabling seamless high-frequency trading. It offers various trading pairs and a competitive isolated margin, making it ideal for beginners and professional traders.

Conclusion

By this time, you might’ve decided which exchange is the best for you to trade Bitcoin and other futures. If not, this quick recap will help.

For starters, Deribit and BitMEX share a lot of features in common. They both are derivatives-only exchanges. They offer up to 100x leverage, and both of them have robust security and customer service.

However, there are a few areas where the two exchanges differ. BitMEX, for instance, offers more trading pairs and 100x leverage on more pairs. It also has an edge in liquidity in comparison to Deribit.

Deribit, on the other hand, has a more powerful trading platform, making it a preferred choice for professional derivatives traders.

In all, if you’re looking for more trading options and broader leverage, BitMEX will be a better choice. If platform performance is your priority, Deribit can be a better pick.

Check out how Deribit & BitMEX is giving a tough competition to it’s competitors: