The cryptocurrency futures trading segment has surged significantly over the past few years, paving the way for new cryptocurrency exchanges to enter the market.

Today, let’s compare two of the most popular cryptocurrency exchanges in the crypto space: Bybit and BitMEX. Bybit is a relatively new crypto exchange and crypto futures platform founded in 2018.

On the other hand, BitMEX is the elephant in the room. Founded in 2014, BitMEX is one of the oldest Bitcoin exchange platforms that enables the P2P trading of cryptocurrencies.

So, how does BitMEX stand against its new alternative, Bybit? Stay tuned as we compare the two exchanges on multiple criteria, including available contracts, fees, trading platform, security, customer support, and more.

Bybit vs. BitMEX Trading Pairs & Contracts Offerings

Bybit only offers perpetual swaps for four coins. The perpetual contracts available on Bybit are:

- BTCUSD

- ETCUSD

- EOSUSD

- XRPUSD

In addition, Bybit has BTCUSDT futures contracts for hedging purposes.

The daily trading volume on Bybit is USD 10.39 billion.

Bybit provides up to 100x leverage on BTCUSD and BTCUSDT contracts, while the maximum leverage is limited to 50x for the other three trading pairs. Also, you can avail sign-up exchange by using Bybit’s referral code.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

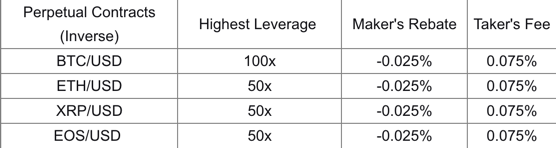

On the other hand, BitMEX offers perpetual swaps and futures. On BitMEX, perpetual swaps are available on the following coins:

- XBT

- ETH

- XRP

BitMEX also enables traditional futures contracts on the following coins:

- XBT

- ETH

- BCH

- EOS

- LTC

- TRX

- XRP

- ADA

The daily trading volume on BitMEX is USD 1.72 billion.

Coming to leverage offerings, BitMEX offers up to 100x leverage on all XBT contracts, up to 50x leverage on XRP and ETH contracts, and 20x leverage on all other coins. The leverage limit is 50x and 33.33x, respectively, for ETH and LTC traditional futures.

Verdict: It’s a tie. Both the exchanges offer perpetual swaps. While BitMEX provides more margin trading options, Bybit offers the highest leverage.

BitMEX Offer: Crypto traders who sign-up using this exclusive link will receive a 10% fee discount for six months and believe me, 10% is a lot when you see it over a period of time. |

Trading Fees Comparision

Both Bybit and BitMEX follow a market maker-taker trading fee structure. Here’s a quick overview of how this structure works.

When you place an order that enters the order book instead of immediately getting executed, it adds liquidity to the exchange, thereby increasing market depth and “making” the market. Thus, such orders are known as market maker orders.

Contrarily, orders that are immediately executed take away liquidity from the exchange. Such orders are known as market taker orders.

With that said, BitMEX charges a 0.075% taker fee and provides a 0.0025% rebate for all its perpetual swaps and XBT traditional futures. BitMEX charges a taker fee of 0.25% for other traditional futures and provides a rebate of 0.050% to market makers.

Bybit has a flat trading fee structure. It charges a 0.075% taker fee and provides a 0.025% rebate on all its futures contracts.

Verdict: It’s a tie, as both exchanges have a similar trading fee structure.

Funding Fees

Funding occurs every eight hours on both BitMEX and Bybit. All cryptocurrency exchanges implement a funding mechanism to ensure that the price of perpetual futures is anchored to the reference index price.

When the contract price is higher than the index price, buyers pay funding fees to sellers. When the contract price is lower than the index price, sellers pay funding rate to buyers.

BitMEX vs. Bybit Deposit & Withdrawal Fees

Neither Bybit nor BitMEX charges a deposit fee. Deposits are, therefore, free on both exchanges.

Bybit charges a withdrawal fee of 0.0005 BTC, which is highly competitive and 40% lower than the global industry average. BitMEX doesn’t charge any withdrawal fee, and thus, you can withdraw your funds for free.

Please note that the Bitcoin mining fee is payable irrespective of the exchange.

Bybit also has some limitations when it comes to daily withdrawals. The daily individual account withdrawal limit is 500 BTC. Check withdrawal limits for other coins here. On the other hand, BitMEX has no withdrawal limits.

Let’s also talk about the deposit and withdrawal methods available on both exchanges.

BitMEX is a crypto derivatives platform. Hence, traders can make deposits and withdrawals in Bitcoin only. Bybit is also a cryptocurrency derivatives exchange platform and supports deposits and withdrawals in BTC and ETH.

Bybit allows you to deposit fiat currencies via third-party fiat payment gateways. However, you’ll need a KYC (more about it later) to access this feature. Also, third-party payment gateway fees may apply.

Verdict: It’s a tie. While Bybit has a nominal withdrawal fee and limit, it compensates by supporting multiple deposit and withdrawal methods, along with fiat deposits.

BitMEX vs. Bybit Trading Platform Comparison

Now, let’s talk about one of the most critical aspects of choosing a trading platform: the trading experience. Let’s conduct a head-to-head trading platform comparison to determine which exchange offers a superior trading experience.

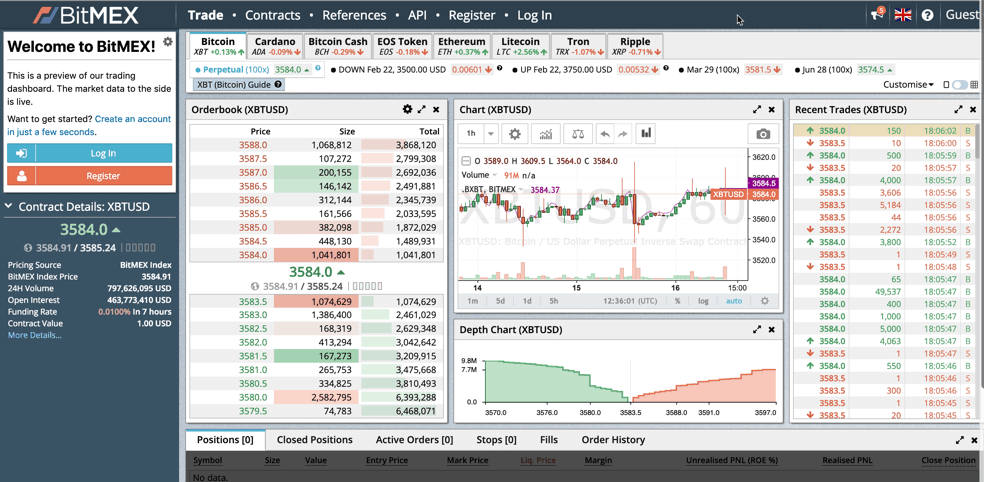

- BitMEX

BitMEX has a top-notch trading system with all the essential features needed for crypto trading. It uses the TradingView charting system to offer best-in-class trading features to its users. You get access to features like:

- Various types of charts

- Multiple time frames

- Built-in indicators

- Depth chart and trading volume analysis

- Real-time contract details

- Multiple order types

Additionally, BitMEX offers APIs that allow you to integrate third-party tools and apps into its trading system.

Unfortunately, BitMEX doesn’t have the most intuitive and trader-friendly trading system. While the platform is simple, trader-friendly, and feature-rich, beginners could find it to be a bit cumbersome.

The user interface looks outdated and is prone to trading volume issues, overload errors, login issues, etc. To know more about the exchange, you can check this comprehensive BitMEX tutorial.

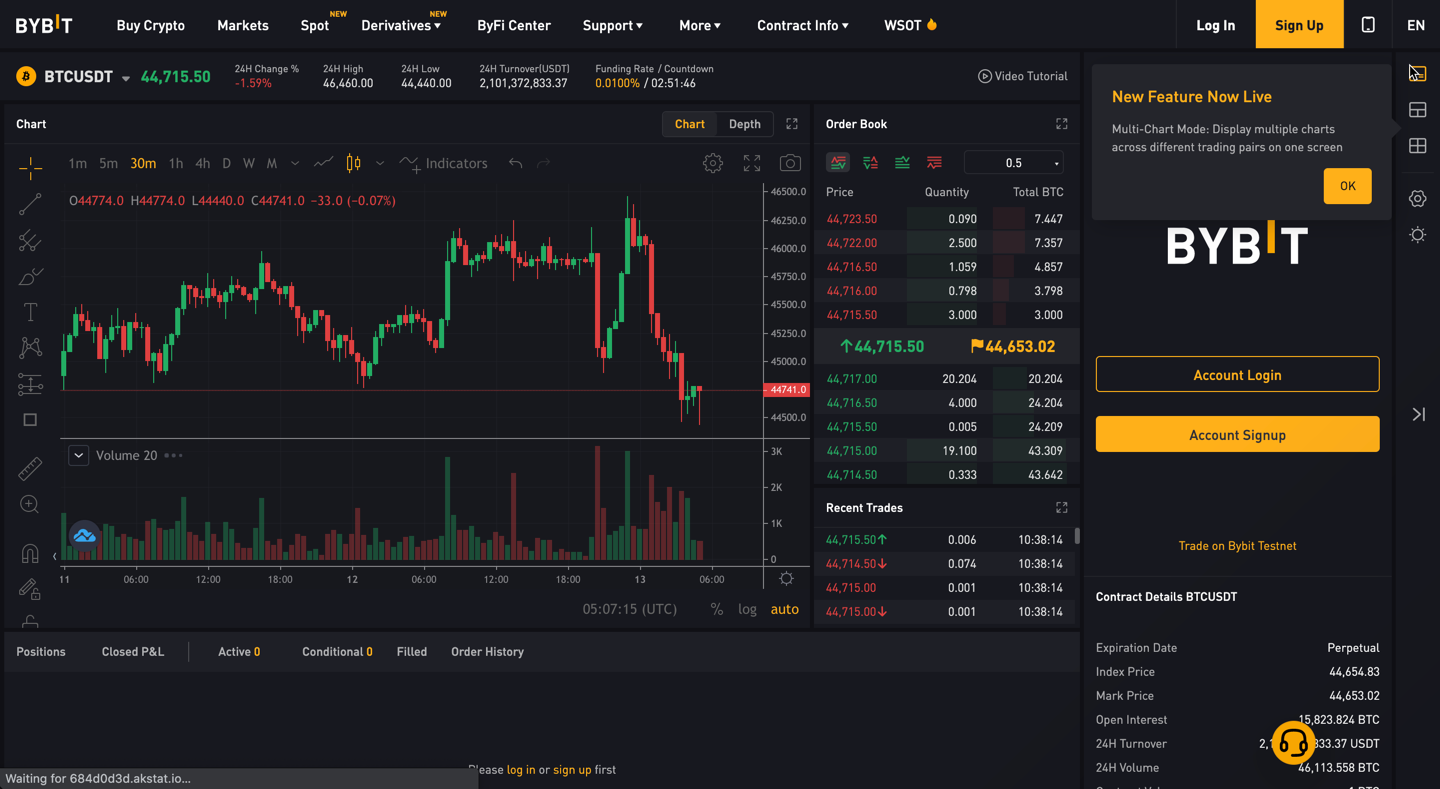

- Bybit

Bybit has one of the most powerful trading platforms in the crypto space. Bybit also uses the TradingView charting system, and thus, it comprises all the features and functionalities available on BitMEX. These include multiple chart types and time frames and technical analysis tools.

On top of that, it has an intuitive and well-laid-out interface that makes trading a seamless and enjoyable experience for both experienced and beginner traders.

Bybit also has robust APIs that allow you to integrate third-party tools and enhance your trading experience even further.

BitMEX vs. Bybit: Order Types

Both Bybit and BitMEX offer the following orders: Limit, Market, Stop-Loss, and Take-Profit.

Let’s talk about these order types in brief.

- Limit Order: In a limit order, you place an order to be executed at a particular price. The order will only be executed if the trading price reaches your entered price.

- Market Order: In a market order, you place an order to be executed at the current market price.

- Stop Limit Order: A stop market or stop-limit order is a type of exit order. You place an order at a particular price in the opposite direction of your trade. These orders help you limit your losses in case your trade goes south. You can also use a trailing stop with these orders.

- Take-Profit Order: A take-profit market order is the opposite of a stop-loss order. You place an order at a particular side in the same direction of your trade. These orders help you secure your profits so that you don’t miss out on them.

In addition, both Bybit and BitMEX support advanced order types.

Bybit offers Conditional Orders, along with advanced order functions, including good-till-cancelled, fill-or-kill, and immediate-or-cancelled.

BitMEX also has advanced orders, including Hidden orders, Iceberg orders, and Post-Only orders.

While both the exchanges offer similar order types, Bybit’s order book is more intuitive and user-friendly. BitMEX has an outdated, unresponsive, and flashy order book, which many traders may not appreciate.

Verdict: Bybit is the winner, as it has a more intuitive and user-friendly order book.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

BitMEX vs. Bybit Account Opening Process

Both Bybit and BitMEX offer a seamless account opening process. Let’s see how you can start margin trading on the two exchanges.

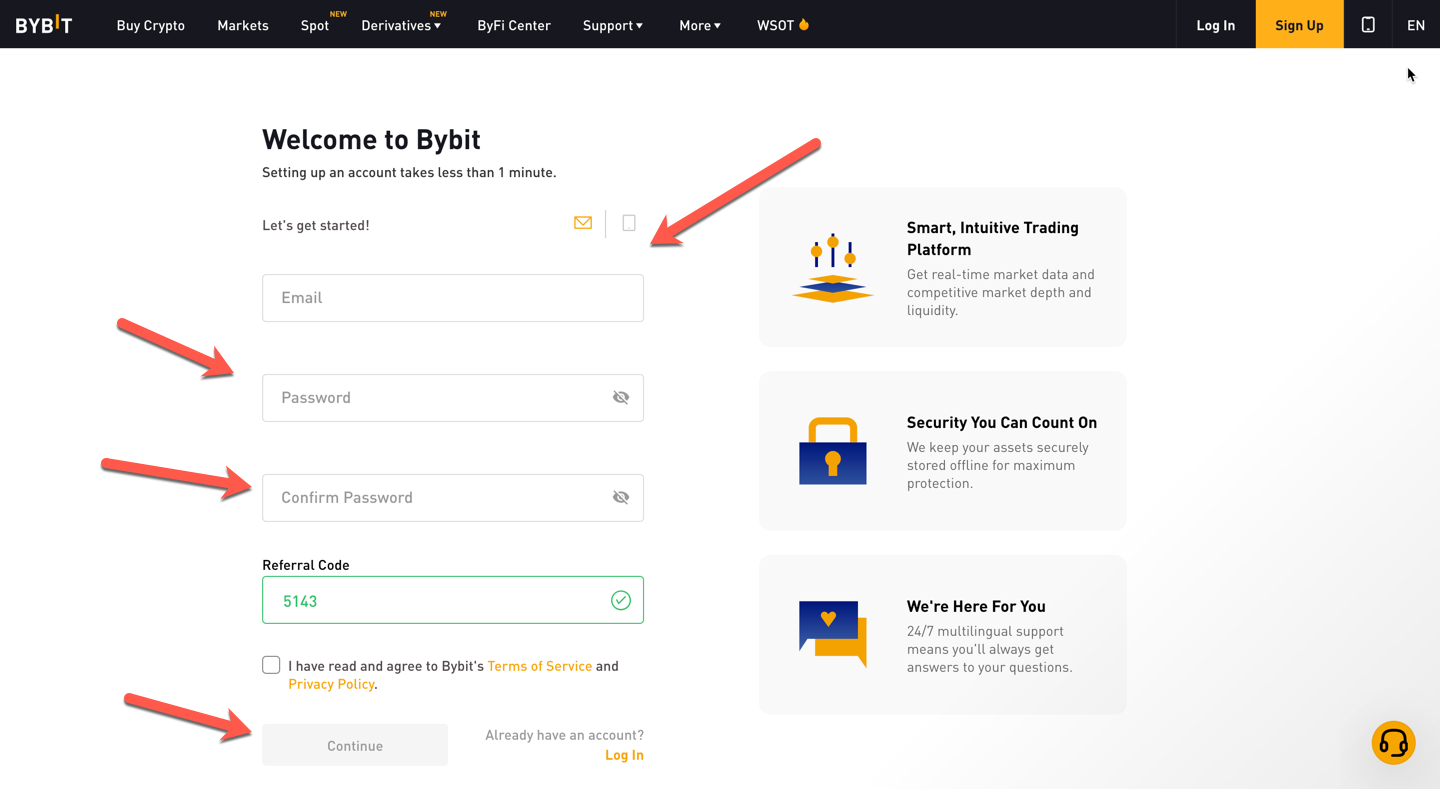

- Bybit

Since Bybit is a non-KYC exchange, you don’t need to undergo any identity verification process. You can visit the Bybit Registration Page and create an account with your email address and password. You can also use your phone number instead of your email address.

Once you finish the registration process, you can head to the “My Assets” section to deposit funds. After adding funds to your account, you can start trading pairs.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

- BitMEX

Till September 15, 2020, BitMEX didn’t require any KYC process, and you could open an account within a minute like you can on Bybit.

However, amid allegations by the US government, BitMEX launched a verification program, which required all existing and new traders to complete identity verification.

As of now, if you want to open an account on BitMEX, you’ll need to complete identity verification. While KYC has its benefits, it can be time-consuming.

Once registered, you can add funds to your BitMEX trading account and start trading.

Verdict: Bybit is the winner as it doesn’t require any KYC.

BitMEX Offer: Crypto traders who sign-up using this exclusive link will receive a 10% fee discount for six months and believe me, 10% is a lot when you see it over a period of time. |

BitMEX vs. Bybit Customer Support

Here’s a quick comparison between the customer support offered by the two exchanges.

- Bybit

Bybit is known for its world-class customer support. It offers multi-lingual live chat customer support that is accessible 24/7 from their website. You can also write them at [email protected] for specific queries. Bybit also offers support on Telegram, Reddit, and LinkedIn.

In addition, Bybit has a vast knowledge base that comprises blog posts, FAQs, and videos.

- BitMEX

BitMEX provides email-based customer support. There is no live chat feature, and you have to rely on email support for all your queries. However, the response times are low, and you can expect a response within a few hours in most cases.

In addition, BitMEX has a presence on Twitter and Reddit, where you can communicate with them.

Verdict: Bybit is the winner. Its live chat support makes it one of the best margin trading platforms out there.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

BitMEX vs. Bybit Security Features

Security can be a dealbreaker when it comes to selecting the right margin trading exchange. Let’s compare the security features of Bybit and BitMEX.

- Bybit

Bybit stores almost 100% of its users’ funds in a multi-sign cold wallet, and only a minuscule portion of the funds are kept in the hot wallet to facilitate trading procedures.

The exchange allows users to enable two-factor authentication (2FA) to make logins more secure. Bybit also implements IP whitelisting, encrypted communication channels, and other security features.

- BitMEX

Like Bybit, BitMEX stores most of its funds in a multi-sig cold wallet, and it also has a withdrawal scheme for wallet security. They implement world-class security systems by Amazon Web Services (AWS).

The BitMEX platform is coded in kdb+ for enabling secure communications and enhancing the exchange’s stability and security.

However, in 2019, BitMEX suffered a security breach when all its customers’ data were accidentally leaked online.

Verdict: It’s a tie, as both the exchanges deploy robust security mechanisms.

BitMEX vs. Bybit Liquidation Mechanism

Both exchanges use a Mark Price liquidation mechanism to close orders automatically when the price comes close to the bankruptcy price.

With that said, Bybit also implements a dual-price mechanism to make its liquidation process more effective. The mechanism avoids liquidations caused by malicious market manipulations.

Verdict: Bybit has a two-level liquidation process, giving it a slight edge over BitMEX.

- Is Bybit better than BitMEX?

While Bybit and BitMEX offer similar functionalities, Bybit has a better trading platform, customer support, and liquidity mechanism, making it a better exchange to trade perpetual swaps.

- Is Bybit a good exchange?

Yes. Bybit has all the qualities and features needed to be the go-to exchange for everyone, from beginner traders to professional and institutional traders.

BitMEX vs. Bybit: Conclusion

Both BitMEX and Bybit are excellent choices if you’re looking for a derivatives crypto exchange. Both the exchanges have a high daily volume, customizable UI, low trading fees, and robust security.

However, there are some areas in which Bybit takes the lead, the most important of which is customer support. In addition, Bybit doesn’t have any KYC requirements and has a better trading system than BitMEX. It also has a better liquidation mechanism.

In all, Bybit- the new exchange, is a clear winner if customer support, liquidity, and trading experience are your priorities.

If you’re looking for a straightforward exchange to trade perpetual swaps and traditional futures contracts, BitMEX can be an ideal pick.

Check out how BitMEX & Bybit stack up against the compettion:

- BitMEX vs Binance

- BitMEX vs Coinbase

- BitMEX vs PrimeXBT

- Bybit vs Kraken

- Bybit vs Delta Exchange

- Bybit vs Bitget