Choosing the right cryptocurrency exchange is the first step to take when starting crypto trading. And with new exchanges regularly entering the market, finding the best one has only become difficult.

The battle of Bybit vs Phemex is that of two relatively new cryptocurrency exchanges that have significantly influenced the crypto world.

Bybit is the third-largest crypto derivatives exchange in daily trading volume, while Phemex has recently slipped to 20th according to CoinMarketCap but is one of the biggest names in the space.

Both offer various trading options, attractive leverage, a good trading experience, and intuitive trading platforms.

So, which is the best to trade cryptos and why?

Let’s find out.

Phemex vs. Bybit: Overview of Crypto Derivatives Product Offerings & Leverage

Phemex is a crypto derivative and altcoin exchange that allows users to trade the following products:

- Perpetual contracts

- Spot/Fiat token trading pairs for the leading crypto and altcoins

When it comes to crypto Futures, it has more than 150 contracts in just the USDT variants. You can find more contracts if you want to trade in USD or Coin denominated pairs.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

In May 2020, Phemex launched its spot trading services. Currently, you can trade close to 200 cryptocurrencies against USDT. These include BTC, ETH, LTC, ADA, XRP, LINK, BCH, ONT, NEO, and TRX.

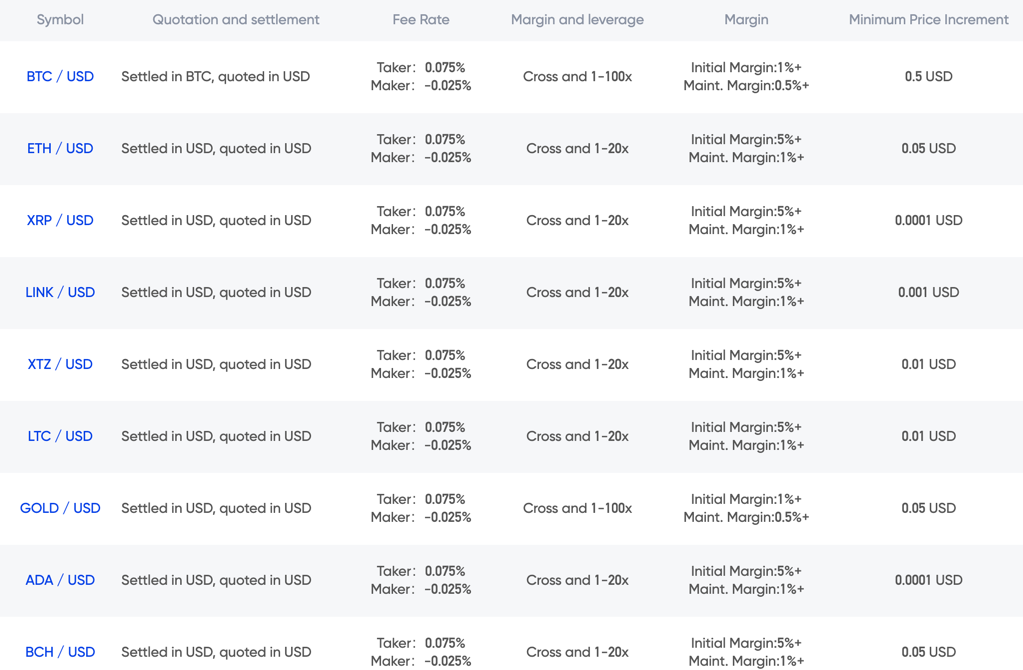

Phemex has a daily trading volume of USD 3.82 billion. It also has up to 100x leverage on the BTCUSD pair and up to 20x leverage on other crypto pairs.

On the other hand, Bybit offers the purchase and sale of more than 200 Futures contracts, including:

- BTCUSD

- ETHUSD

- EOSUSD

- XRPUSD

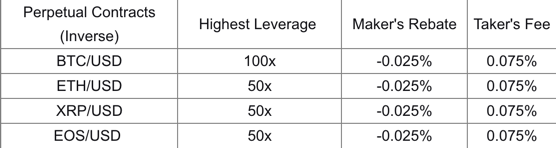

It also has USDT perpetual contracts, and inverse perpetual contracts that can be used for hedging purposes. Bybit has a daily trading volume of USD 9.2 billion which is well over the 1 billion they had at the end of 2018.

Bybit offers up to 100x leverage on BTCUSD and BTCUSDT Futures contracts, while it allows up to 50x leverage on the other trading pairs.

Verdict: It’s a tie. Phemex has more trading pairs, while Bybit is one of the few that provide the highest leverage on all trading pairs.

Phemex vs. Bybit Trading Fees

Both Phemex and Bybit implement a market maker-taker fee structure. Traders that place orders that enter the order book, add liquidity, and thus, are known as market makers.

Traders who place Market orders that execute immediately take away liquidity from the market, Therefore, they are known as market takers.

Phemex charges a 0.06% fee from market takers and 0.01% to market makers. For spot trading, the maker and taker fees are 0.1 % either way. It used to offer a rebate of 0.025 % for market makers but looks like they have discontinued that program.

Bybit makes takers pay a 0.06% fee for the convenience of immediate trade execution and provides a 0.01% fee to makers.

Verdict: It’s a tie. Both Phemex and Bybit have a similar fee structure for Futures trading.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Phemex vs. Bybit Funding Fees

All crypto exchanges that offer perpetual swaps implement a funding rate mechanism to ensure that the Futures price trades close to the index price.

Both exchanges use the same formula to calculate the funding rate:

- Funding Rate = Premium Index + (Interest Rate – Premium Index)

Then, the Funding Fee is calculated by the following formula:

- Funding Fee = Funding Rate x Position Size

Now, how does the funding rate work? Here’s a quick explanation.

Traditional Futures contracts have a weekly or monthly expiry. So, even if they trade away from the index price, they’ll converge on the day of expiry. But perpetual swaps have no expiry date, and thus, they can trade away from the index price forever.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

To avoid this, a funding rate mechanism is implemented.

When the perpetual swap is trading above the index price, buyers pay funding fees to sellers. When it is trading below the index price, sellers pay funding fees to buyers.

The funding rate refreshes every eight hours (3 times a day) on both exchanges. Follow this link to check the funding rate history of Bybit and Phemex.

Verdict: It’s a tie. Both implement a similar funding mechanism.

Phemex vs. Bybit Deposit & Withdrawal Fees

You can deposit and take out funds from your Phemex account without incurring any charges.

It doesn’t charge any deposit or withdrawal fee. However, blockchain fees are payable and decided dynamically based on blockchain load.

Bybit doesn’t charge any deposit fee, but it charges a flat withdrawal fee of 0.0005 BTC. Furthermore, there is a daily limit of 500 BTC.

Let’s also talk about the deposit and withdrawal methods available.

Bybit allows you to deposit and withdraw funds in the form of BTC, XRP, ETH, USDT, and EOS. You can also deposit and withdraw funds in the form of fiat currencies via third-party fiat gateways.

Phemex allows deposits and withdrawals in BTC, ETH, USDT, LTC, and LINK. It also supports fiat deposits and withdrawals via Banxa’s third-party gateway.

Verdict: Phemex is the winner as it doesn’t charge any withdrawal fee.

Phemex vs. Bybit Trading Platform Comparison

There’s not much difference between the two platforms. Both exchanges have a platform that offers robust trading systems that offer all the tools needed for seamless analysis. However, there are a few nuances that you might want to know.

Let’s draw a head-to-head comparison between the trading platforms of Phemex and Bybit.

- Phemex

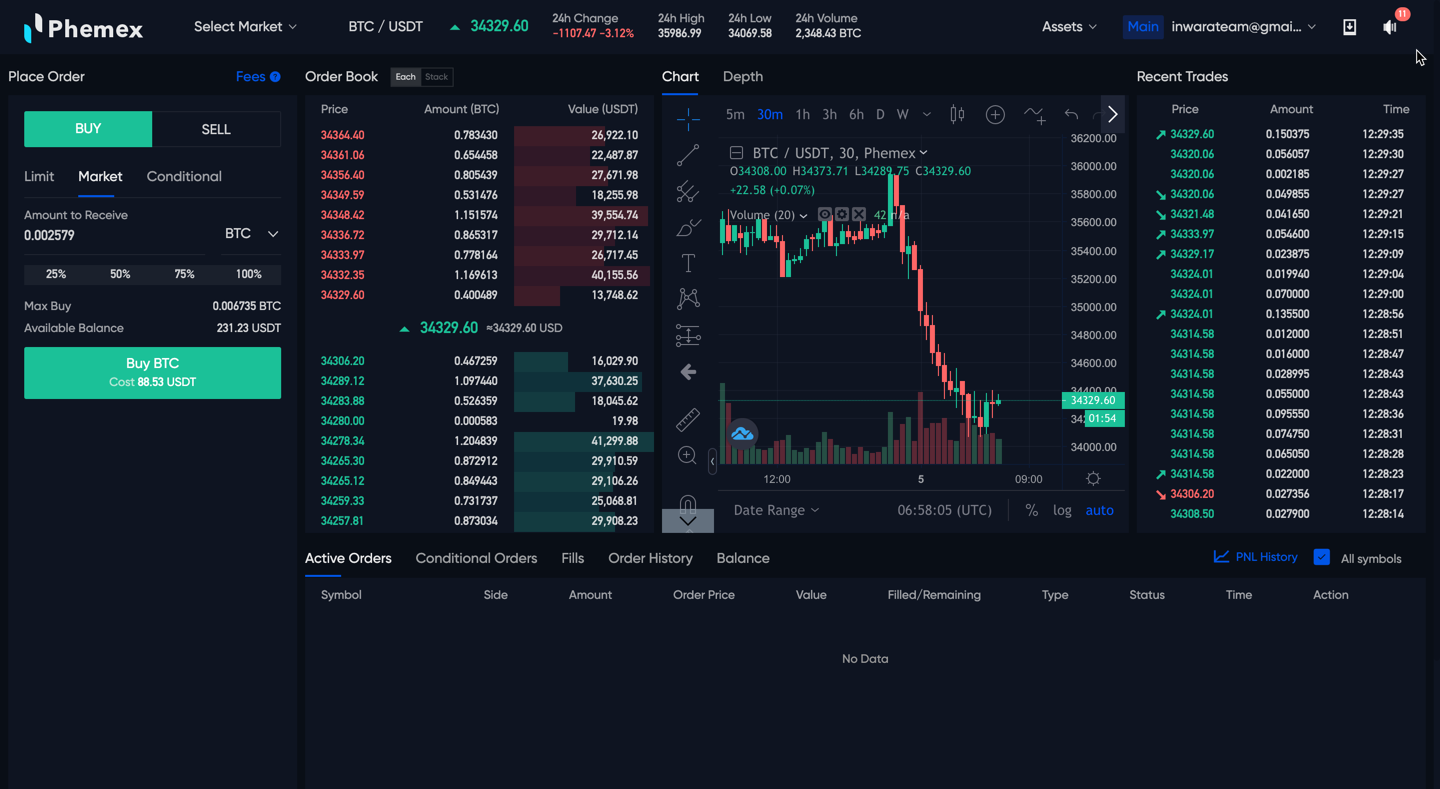

Phemex has one of the best trading platforms in the crypto space. It has a user-centric trading system in place to ensure that up to 300,000 trades per second can be supported. Furthermore, it has a latency of less than one millisecond, ensuring immediate order execution.

It implements the TradingView charting platform that offers various chart types, multiple timeframe analyses, and built-in indicators for seamless technical analysis.

Phemex offers all order types, including Market, Limit, Stop-Loss, and Take-Profit, along with Conditional and other advanced order types. However, Conditional and Advanced orders are available for premium users only.

It also has an intuitive mobile app that comprises all the features and functionalities available on the desktop trading platform. There is also API access for those that like to trade with code.

New to Phemex exchange? Do check our guide on How to Leverage Trade Crypto with Phemex and kickstart your trading journey.

- Bybit

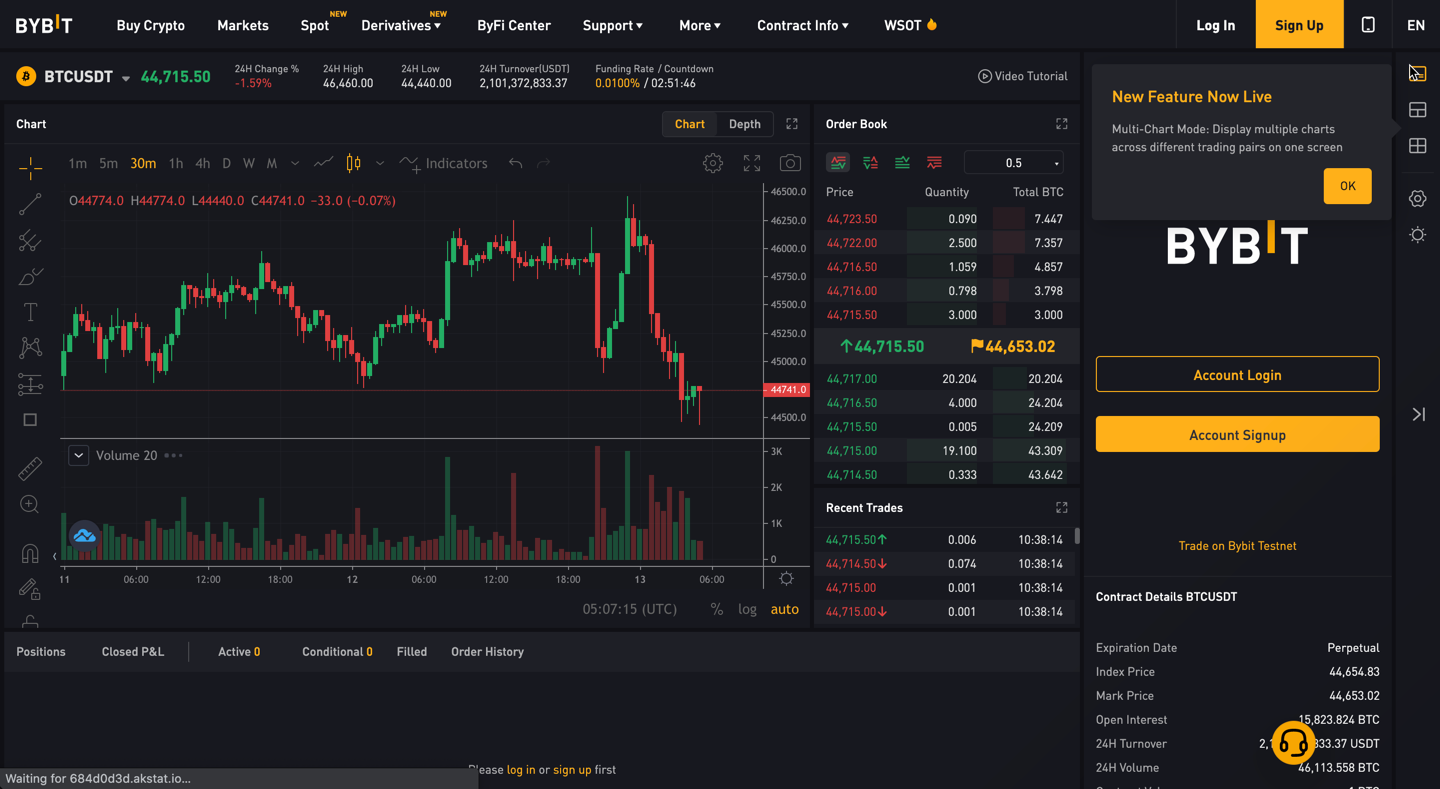

Bybit also has one of the top trading platforms in the crypto industry and was established in March 2018. The platform is intuitive and user-friendly, providing a seamless experience to traders of all proficiency levels.

Bybit also implements a TradingView charting interface and the platform offers the same features, trading tools, and functionalities as Phemex. It also supports all the major order types, including Limit, Market, Stop-Loss, Take-Profit, Conditional, and Advanced order types.

However, unlike Phemex, Bybit doesn’t require any premium subscriptions to unlock all order types.

Bybit also offers mobile apps available on Android and iOS that ensure every user is allowed to place and manage their trades anytime and from anywhere.

Verdict: It’s a tie. While the Phemex trading platform is more robust, Bybit has a more user-friendly and intuitive platform.

Want to be Familiar with the Bybit exchange? Here’s How to get started with Margin Trading Crypto with Bybit

Phemex vs. Bybit Account Opening Process

Both Bybit and Phemex offer a seamless account opening process.

Phemex

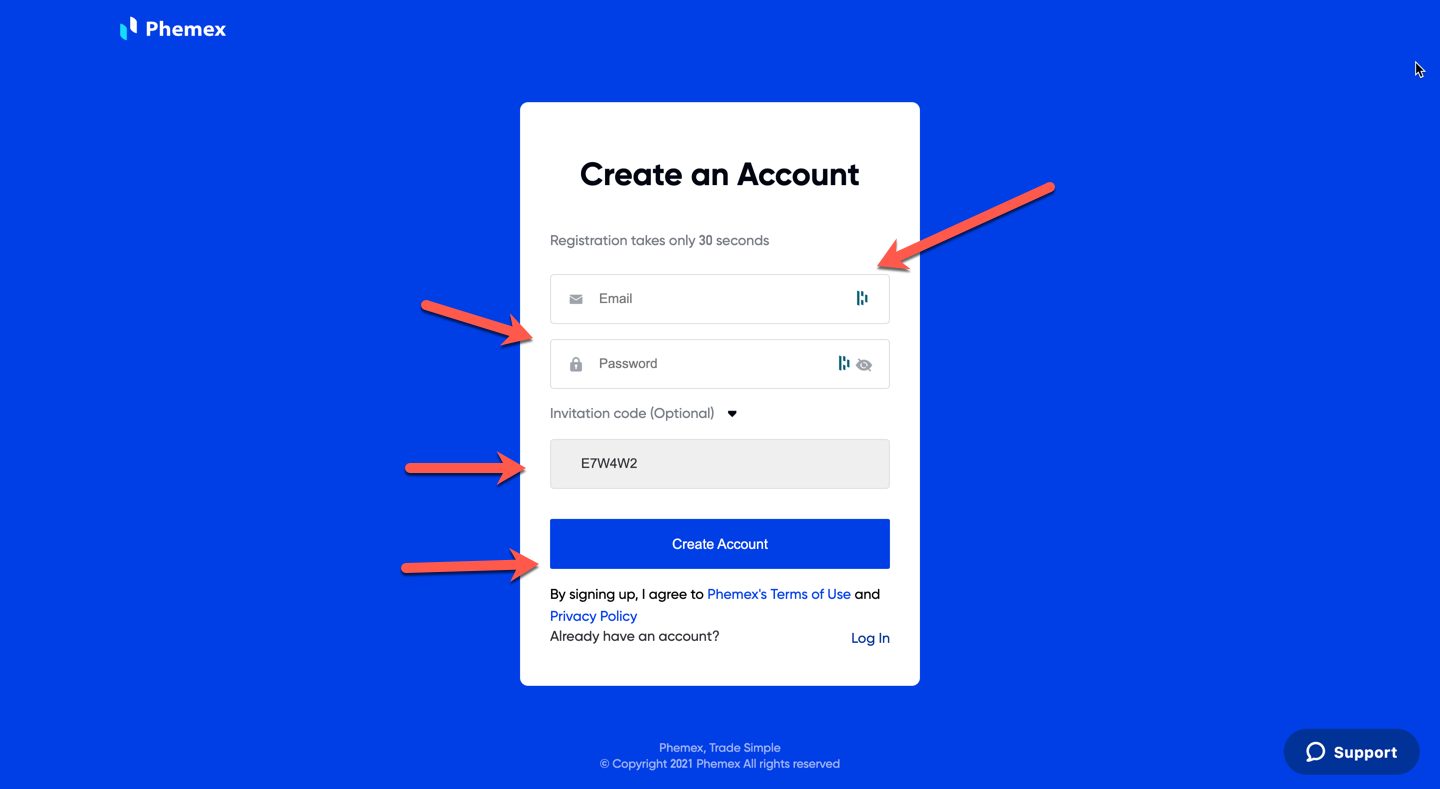

Phemex is an anonymous cryptocurrency exchange and doesn’t require any KYC. It helps users retain their anonymity which is an important tenet of the crypto revolution. To register, visit phemex.com and click Register. Enter your email address and password. Verify your email (via verification code), and you’ll be ready to start trading.

Also, you can our Invitation code, to get the Phemex deposit bonus.

However, if you want to deposit fiat currencies, you’ll need to use the Banxa payment gateway, which requires KYC.

When you register on Phemex, you get a seven-day Premium trial where you can avail the benefits like access to Advanced orders, no withdrawal fee, and zero-fee spot trading.

Let’s look at the benefits you get with a premium account.

- Zero spot trading fee

- Support conditional orders

- Hourly withdrawals (as opposed to thrice a day)

- No withdrawal limits (as opposed to 2 BTC)

- Gift a premium trial

Bybit

For informational purposes, Bybit requires you to verify your identity if you are going to be trading with them at all.

Tip: Please check out other crypto exchanges that don’t require any identity verification.

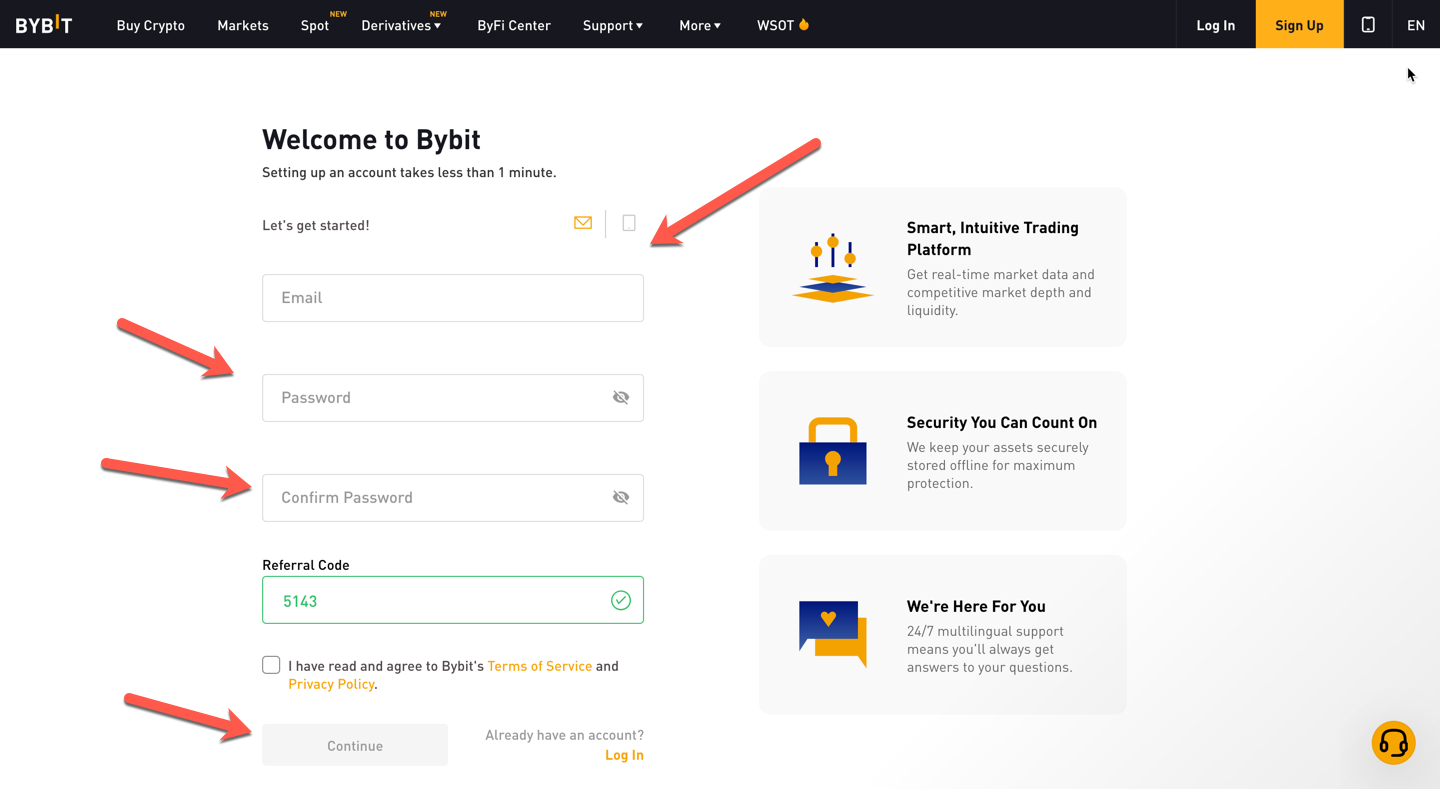

You can visit the Bybit Registration page and sign up using your email address/phone number and password. You can also use our Referral code to get the Bybit first-time signup bonus.

After verifying your email address/phone number and going through their KYC procedures, you’ll be able to deposit funds and start trading.

Like Phemex, Bybit also supports fiat currencies via third-party fiat payment methods, which require KYC.

Verdict: It’s a tie, as both exchanges offer a seamless registration process. However, Phemex has Standard and Premium account types, which can be confusing. Getting started on Bybit is more straightforward.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Phemex vs Bybit Customer Support

Customer support is an essential factor to consider when selecting a cryptocurrency exchange. Let’s compare the support of Phemex and Bybit.

- Phemex

Phemex offers 24/7 multilingual support via live chat on its website. You can also contact the customer support team through email. Additionally, it has a Telegram group, along with a vast knowledge base, to help its users.

- Bybit

Bybit is a trading platform that offers customer support similar to Phemex. It has 24/7 multilingual live chat support on its website. In case of detailed issues, you can send them an email. You can also contact their team on Telegram, Twitter, and Reddit.

Verdict: It’s a tie, as both exchanges offer support via live chat and email.

Phemex vs Bybit Security Features

Apart from customer support, security is another crucial factor to consider when choosing a cryptocurrency exchange. Let’s compare the security features of Phemex and Bybit.

Phemex

Phemex deploys comprehensive security protocols to ensure the security of all user accounts. Let’s look at the key security features implemented by Phemex.

- It uses a Hierarchical Deterministic Cold Wallet System. It’s a unique type of cold wallet system that provides cutting-edge wallet security. Withdrawals are allowed only three times a day, with each of the withdrawal requests vigorously audited manually.

- It uses Amazon Web Services (AWS) cloud to secure its networks, machines, and systems.

- It implements various other security features, like IP whitelisting, penetration testing, encryption, and two-factor authentication (2FA), to further enhance its security and check for any vulnerability.

Bybit

Bybit also has a similar security system in place. Here are the key security features implemented by Bybit.

- It stores 100% of its users’ funds in a cold-storage wallet and only keeps its own funds in a hot wallet to support trading operations. The withdrawal process comprises manual verification.

- It encourages its users to activate two-factor authentication to avoid any unauthorized logins.

- It also implements IP whitelisting, encryption techniques, and other security protocols.

- They have also introduced bank-level double-entry bookkeeping measures to make sure that the liabilities and assets are balanced.

Verdict: It’s a tie, as both Phemex and Bybit implement robust security features to maintain user account security.

Phemex vs Bybit Liquidation Mechanism

Liquidation isn’t something you, as a trader, would want to experience. It refers to closing an open position of cryptocurrency derivatives if the initial margin in an account hits the maintenance margin. This process is also known as auto-deleveraging (ADL).

Both Bybit and Phemex deploy a Dual-Price mechanism to prevent the forced closing of traders’ positions and to maintain a fair price. It also avoids forced closing of position due to malicious market fluctuations and market manipulation.

Both exchanges have insurance funds to help protect traders’ initial margins.

Verdict: It’s a tie, as both Bybit and Phemex implement a Dual-Price mechanism.

Phemex vs Bybit: Which exchange is better in 2023?

You can go with Phemex or Bybit, as they are both top-notch cryptocurrency exchanges and share a lot of features.

In all fairness, they have the same trading fee structure, implement the same security features, and offer the same customer support services.

However, there are certain areas where Bybit has a slight edge.

Bybit is more straightforward to use than Phemex, which has standard and premium account types. Bybit has a more intuitive trading platform, making it a better choice for professional traders.

Lastly, Bybit is the third-largest crypto exchange in daily traded volume, ensuring that you never face liquidity issues.

Don’t take this as official investment advice, but whether you’re a beginner or a professional trader, Bybit will be a better choice than Phemex.

Learn how does Phemex and Bybit stack up against the competition.