Both StormGain and Coinbase are bigwigs in crypto exchange offerings at affordable rates with bulletproof security. But choosing one among them is quite a task and confusing.

But don’t worry; I am here to ease it for you.

I will tell you everything you need to know to start your trading journey on these platforms and help you select the one ultimate exchange that would fit your trading strategies at affordable pricing and top-notch security.

So, without further delay, let’s start with an overview of them.

StormGain vs Coinbase: Introduction

StormGain has tremendously grown in the crypto market in a brief period. Launched in mid-2019, registered in Seychelles and headquartered in London, England, this crypto exchange has captured the market with an average trading volume of over $750 million.

The way it has grown in such a brief span is just phenomenal. StormGain has been repeatedly mentioned on many renowned mainstream news websites and nominated as an emerging fintech start-up.

The exchange offers a 50,000 USDT-funded free demo account and is a member of the Blockchain Association of the Financial Commission.

Coinbase, on the other hand, was founded in 2012 to send and receive Bitcoin. It is a decentralized exchange with no main headquarter. This exchange is available in more than 100 countries, with approximately a whopping $440 billion in trading volume per quarter.

With over 103 million verified users on the platform and 245,000 ecosystem partners’ trust, the company lets you securely invest, spend, save, earn and use crypto anytime and anywhere. Coinbase is building the crypto-economy, a more fair, accessible, efficient and transparent financial system enabled by crypto.

StormGain vs Coinbase: Supported Cryptocurrencies

StormGain

StormGain offers all the major cryptocurrencies in its broad collection of supported assets. These include BTC, ETH, EOS, USDT, XRP, DOGE, SOL and many more. All these assets integrate with all the products on the platform seamlessly.

Coinbase

On the other hand, Coinbase offers a broader range of digital assets, more than 200 in total. With such a large asset base, you will indeed find your favourite crypto asset to trade on Coinbase.

Verdict: Coinbase offers a broader range of crypto assets; hence it is a clear winner in this segment.

StormGain vs Coinbase: Product Offerings

StormGain

StormGain offers a vast product range that aids you in exploring the market and taking maximum benefit. These products are:

- Over-the-Counter Crypto Trading

- Leverage Trading

- Multi-Currency Crypto Wallet

- Options & Futures Trading

- Crypto Indices

It offers floating leverage of up to 500X on the BTC/USDT pair and 100X leverage on LTC/USDT, BCH/USDT, ETH/USDT, XAU/USDT, XAG/USDT, and three different crypto indices.

For the other trading pairs, it offers up to 50X leverage. StormGain puts minimum leverage of 5X on all trading pairs.

Check out complete StromGain Review here !!

Coinbase

On the other hand, Coinbase also offers a broad offering of crypto trading products. These are:

- Buy and Sell Crypto

- Coinbase Wallet

- Crypto Earn

- Coinbase Card

- Private Client

- Crypto Borrow

- Margin Trading

- Crypto Rewards

- Derivatives Platform

Coinbase offers maximum leverage of up to 3x through its margin trading intuitive platform, Coinbase Pro, which comes with FDIC insurance, 533 active trading pairs and industry-leading API.

Verdict: Coinbase offers a broader range of product selections, making it the winner in this segment.

StormGain vs Coinbase: Order Types

StormGain and Coinbase come with standard order types giving you an optimized trading experience on their platforms. These are:

StormGain

- Market Order

- Limit Order

- Stop-Limit Order

Coinbase

- Market Order

- Limit Order

- Stop Order

- Good Till Cancelled (GTC)

- Immediate or Cancel (IOC)

- Fill or Kill (FOC)

Verdict: Coinbase offers a broader range of types, making it the winner in this segment.

StormGain vs Coinbase: Fees Comparison

Both platforms offer competitive fee structures; let’s discuss them quickly now.

StormGain

- Trading Fees

StormGain’s fee structure follows a flat-fee pricing model; when it comes to trading fees, there is zero commission for OTC trading. However, a profit share of 10% is taken only from profitable trades.

- Debit/Credit Cards deposit commissions

The platform charges 5% as deposit commission when you deposit funds via your debit/credit card. The maximum deposit amount depends on the currency you deposit in.

- Crypto deposits/withdrawals

There is no deposit fee when you deposit funds in crypto. However, when withdrawing, a fee is charged depending upon the currency. There is an additional fee of 0.1% charged on each withdrawal.

Coinbase

In the case of Coinbase, for spot trading, the fee structure follows a maker/taker fee model being 0.60%/0.40% when you trade between $0-10k. Additionally, a network transaction fee is also charged, and the withdrawal fees depend on the withdrawal method.

To understand more about the spot trading fees in more detail, refer to the table below:

| Pricing Tier | Taker Fee | Maker Fee |

| Up to $10k | 0.60% | 0.40% |

| $10k-$50k | 0.40% | 0.25% |

| $50k-$100k | 0.25% | 0.15% |

| $100k-$1m | 0.20% | 0.10% |

| $1m-$20m | 0.18% | 0.08% |

| $20m-$100m | 0.15% | 0.05% |

| $100m-$300m | 0.10% | 0.02% |

| $300m-$500m | 0.08% | 0.00% |

| $500m+ | 0.05% | 0.00% |

Verdict: StormGain has more transparent, simple, yet affordable pricing. Therefore it is the winner in this segment.

StormGain vs Coinbase: Account Funding Methods

StormGain

StormGain supports 2 methods for funding. These are:

- Method 1: Direct deposit from an existing crypto wallet.

- Method 2: Through credit card using the SIMPLEX service.

You can quickly fund your account, go to the wallet section and select the cryptocurrency. Then click the ‘Get’ option and next select the preferred method of funding using the ‘address’, QR code or credit card.

Coinbase

- Method 1: Bank Account transfers, which are best for large and small investments, are usually settled within 3-5 working days, and Coinbase charges a 1.49% fee for each transaction.

- Method 2: Instant payouts to bank accounts which are best for small payouts and are settled instantly.

- Method 3: Through debit/credit card, which is best for small investments and payouts, are settled instantly as well, and the platform charges a 3.99% fee for each transaction.

- Method 4: Wire Transfers can also be settled within 1-3 business days and are best for notable investments.

- Method 5: Online payment portals like PayPal, Apple Pay, Google Pay and others can also be used instantly for small investments and cashouts.

StormGain vs Coinbase: Trading Platform Comparison

StormGain

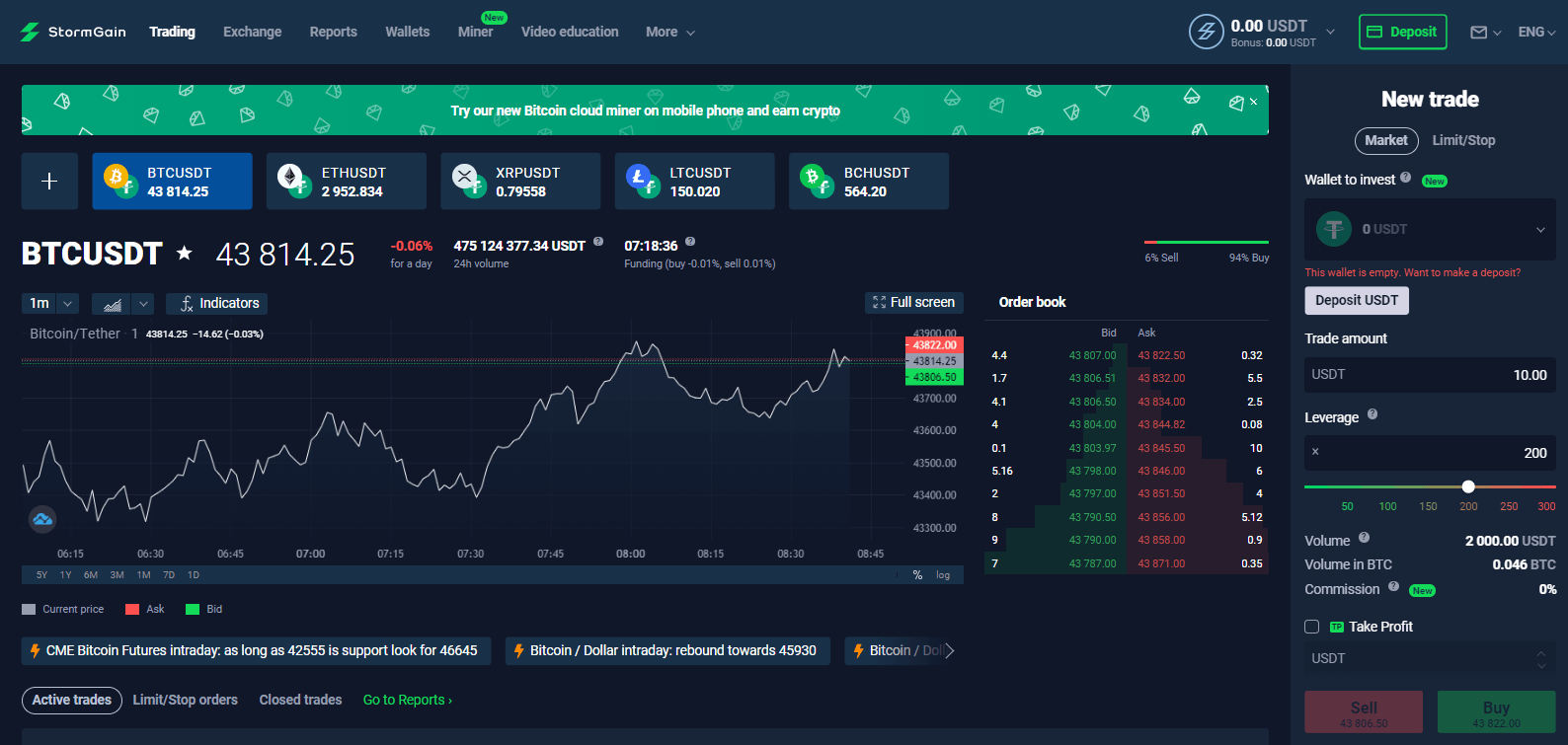

StormGain has a powerful interface that works seamlessly without any lag. It includes four different windows;

- Technical Analysis Charts

- Order Book

- Recent Trade Widgets

- Order Form

Making the platform easy to understand for beginners and sophisticated enough for advanced traders. Select the trading pair and click ‘Open Order’ to start trading.

Moreover, you can place various order types as well as use customizable layout options, technical indicators and trading tools for advanced technical analysis. For your convenience, the indicators are categorized by trends, oscillators and volatility.

The platform also features a professional chart, where you can select bar, line as well as candle chart types for viewing and choose from 9 different time-frames ranging from 1 min to 1 month for a comprehensive analysis.

It also comes with a sentiment meter that offers the sentiment data of a particular trading pair based on active trades, which helps determine the market sentiment and price trends and further places a long or short trade accordingly.

Coinbase

The platform allows you to easily buy, sell, and trade cryptocurrencies through its intuitive yet subtle interface. It is user-friendly for beginners as well as sophisticated enough for advanced traders.

The trading dashboard allows you to trade crypto without any hassle. Advanced trade is also provided, where you can trade at a deeper level. In this section, a long list of trading pairs is available, which you can simply select to start trading.

The charting system of Coinbase is pretty basic, with basic trading tools that you will need. However, there is no TradingView integration. But it will do the job.

StormGain vs Coinbase: Account Types

StormGain

On StormGain, there are just two types of accounts: Real Account and Demo Account. To be eligible to trade on StormGain, you must submit your identification details and get verified by the exchange.

However, you can also opt for anonymous trading, with no KYC documentation but limited access and withdrawal limits.

The KYC procedure on StormGain consists of providing

these details:

- Full name

- Day of birth

- Address

- Nationality

- ID or passport scan

Coinbase

In contrast, Coinbase doesn’t give you the option of anonymity, and it is compulsory to go through the account verification procedures. You must submit a government-issued ID and photo verification through your device’s camera to get verified.

Ensure you allow access to your device’s camera and microphone for the Coinbase app. Once the account is verified (in 2-3 minutes), you’ll be directed to the ‘Your Document’ page.

Verdict: StormGain gives an option of anonymous trading that Coinbase doesn’t. Therefore, StormGain is the winner in this segment as well.

StormGain vs Coinbase: How to get started?

StormGain

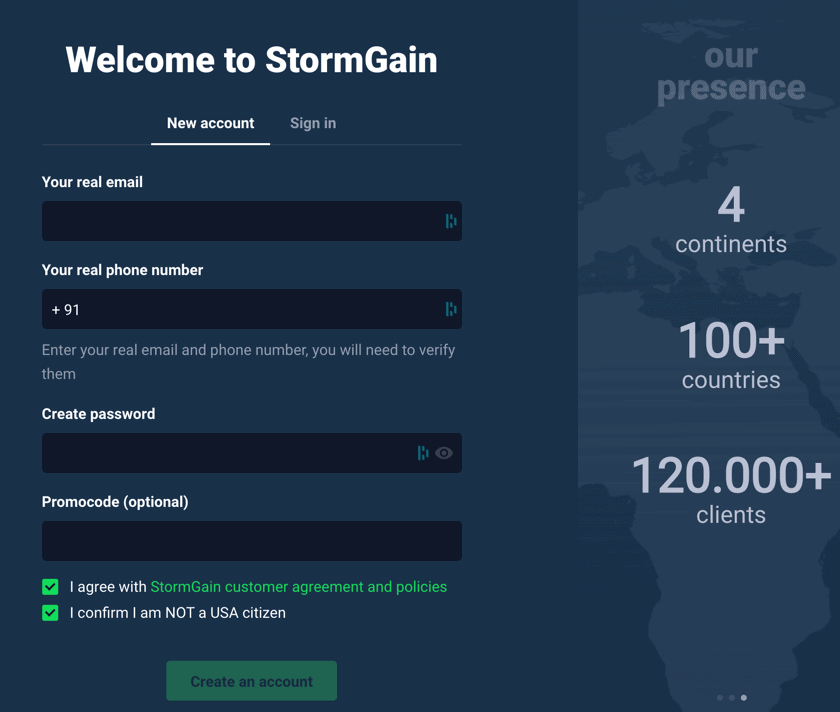

To get started and register yourself on StormGain, follow these steps:

- Click “Create an account” in the top right corner of the website.

- Enter your valid email, phone number, and password. Accept the mentioned terms and conditions, and then confirm that you are not a US citizen.

- Click the ‘Register’ button, and your account registration process completes. Then a verification link will be sent to your registered email address; click to verify your account.

Coinbase

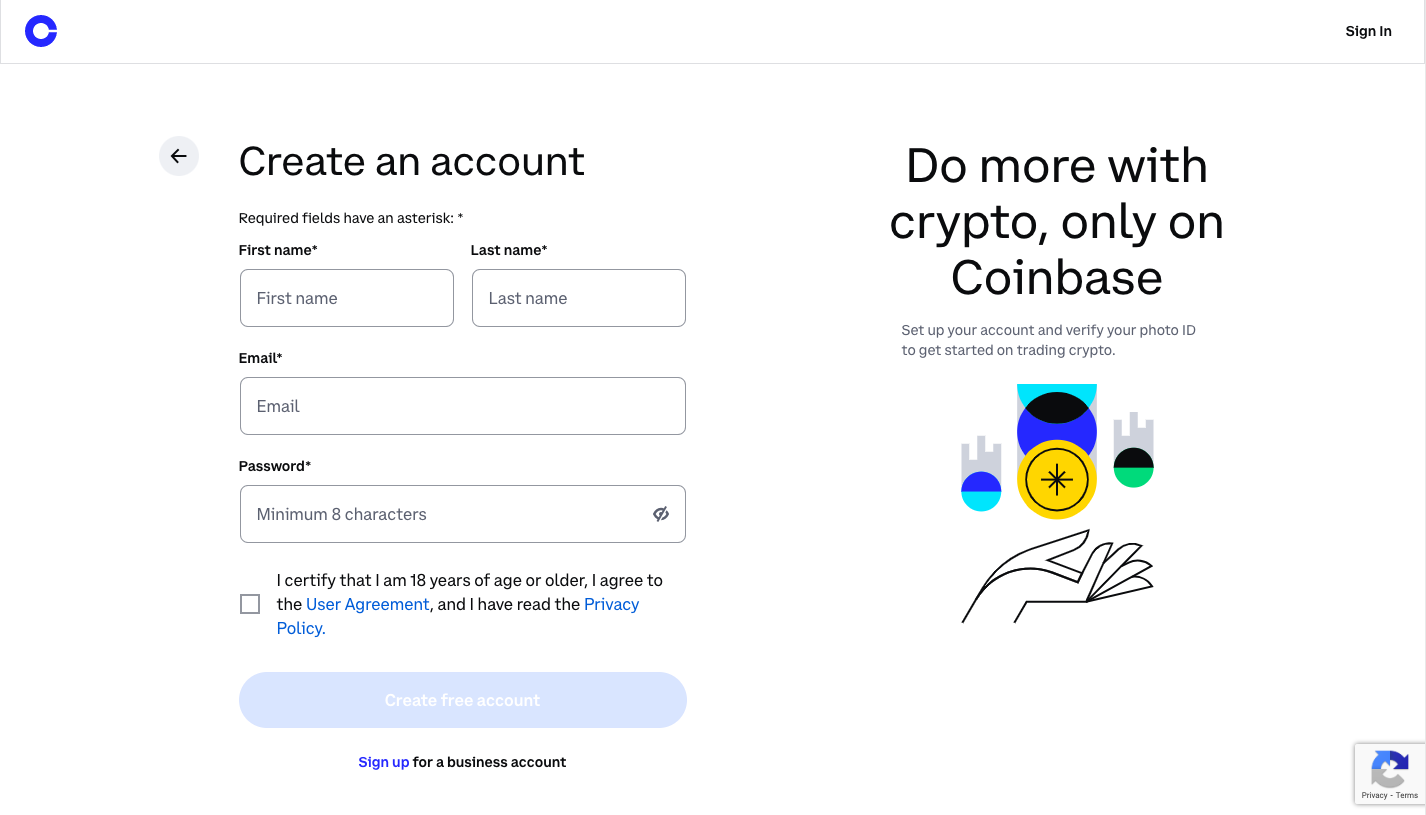

Register and verification

- Click or tap the ‘Get Started button. A window pops up; type in your full legal name, email address, secure password and state.

- Go carefully through the platform’s policy, then click ‘Create Account.

- Now, verify your account through your registered email address; clicking the link will send you back to the Coinbase homepage. Then, sign back in using your email and password, and the verification process will be completed.

- You must verify your phone number by entering the seven-digit code that Coinbase will send you via SMS.

- After verification, you must add your personal information by submitting your government-issued photo ID, including your permanent address.

Now, you need to answer a questionnaire:

- What do you use Coinbase for?

- What is your source of funds?

- Current Occupation

- Employer

- Last 4 digits of the SSN

- Now, click ‘Continue’ to finish the process.

StormGain vs Coinbase: Customer Support

StormGain

StormGain has 24×7 online customer support via email with a pretty quick response time. It also offers video tutorials and a knowledge base where you can learn more about the platform’s features and find all the common issues they face.

Coinbase

Similarly, Coinbase also offers 24×7 customer support through ticket and live chat. It also provides support via phone calls for regions like the USA, UK, India and Ireland. Coinbase has a comprehensive help center where you will find answers to common queries.

StormGain vs Coinbase: Security Features

StormGain

Security on StormGain is undoubtedly impenetrable. It is integrated with all the industry’s best security features. Equipped with systems like SSL encryption, PCI-DSS and GDPR compliance, Real-time monitoring, quarterly security audit and two-factor authentication, making the platform a fortress.

Coinbase

On the other hand, Coinbase also offers industry-leading security features. The platform stores 98% of the user’s funds in cold storage and offers optional two-factor authentication with biometric verification for security keys. It also provides FDIC insurance coverage up to $250,000.

- Is StormGain safe?

StormGain is not only a safe and legit crypto trading platform but has the most user-friendly trading platform for both advanced and beginner traders.

- Is Coinbase safe?

Coinbase is also a safe crypto exchange with a mandatory KYC verification policy and keeping 98% of the funds in cold storage; it offers you user-centric security features like 2FA, security keys and others.

Conclusion

So these were the two excellent tools of the cryptosphere offering the best features and functionalities. When comparing these exchanges in detail, both of them provide distinguishable offerings.

StormGain offers an intuitive trading ecosystem by offering bonuses on multiple levels and is an excellent tool for crypto-cloud mining as well as OTC trading. Still, it lacks a wide range of crypto and products.

Coinbase offers these but lacks Trading View, which can be disheartening for many, as it is often considered essential. Therefore I can say that StormGain will be a better option to have.

It offers top-notch features and affordable pricing, which you should definitely take advantage of. So what are your waiting for? Get your hands on any of these platforms and witness their profitability.

Some more suggested options to explore & compare !!