Navigating the crypto trading space can be a daunting task with the myriad of available crypto exchanges with leverage.

Today, I dive deep into two significant players: eToro and Huobi.

In our comprehensive comparison, I’ll explore various aspects, including supported cryptocurrencies, trading fees, KYC requirements, user experience, and more.

Our aim?

To arm you with the crucial details necessary to choose the platform that suits your trading needs best. Let’s delve into this comparison of eToro and Huobi.

eToro vs Huobi: At A Glance Comparison

| Features | eToro | Huobi |

| Founded In | 2007 | 2013 |

| Headquarters | Israel | China |

| Available Cryptocurrencies | 60+ | 700+ |

| Trading Features | Spot, CopyTrading, Staking | Spot, Staking, Futures and Margin Trading |

| Fees | Spread fee, withdrawal fee | Maker/taker fee, withdrawal fee |

| Payment Methods | Credit/Debit card, PayPal, Bank transfer | Credit/Debit card, Cryptocurrency transfer |

| Customer Support | Email, Live Chat, Help Center | Email, Live Chat, Help Center, Hotline |

| KYC Required | Yes | Yes |

| Security Features | Two-factor authentication, encryption | Two-factor authentication, encryption, cold storage |

eToro vs Huobi: Trading Markets, Products & Leverage Offered

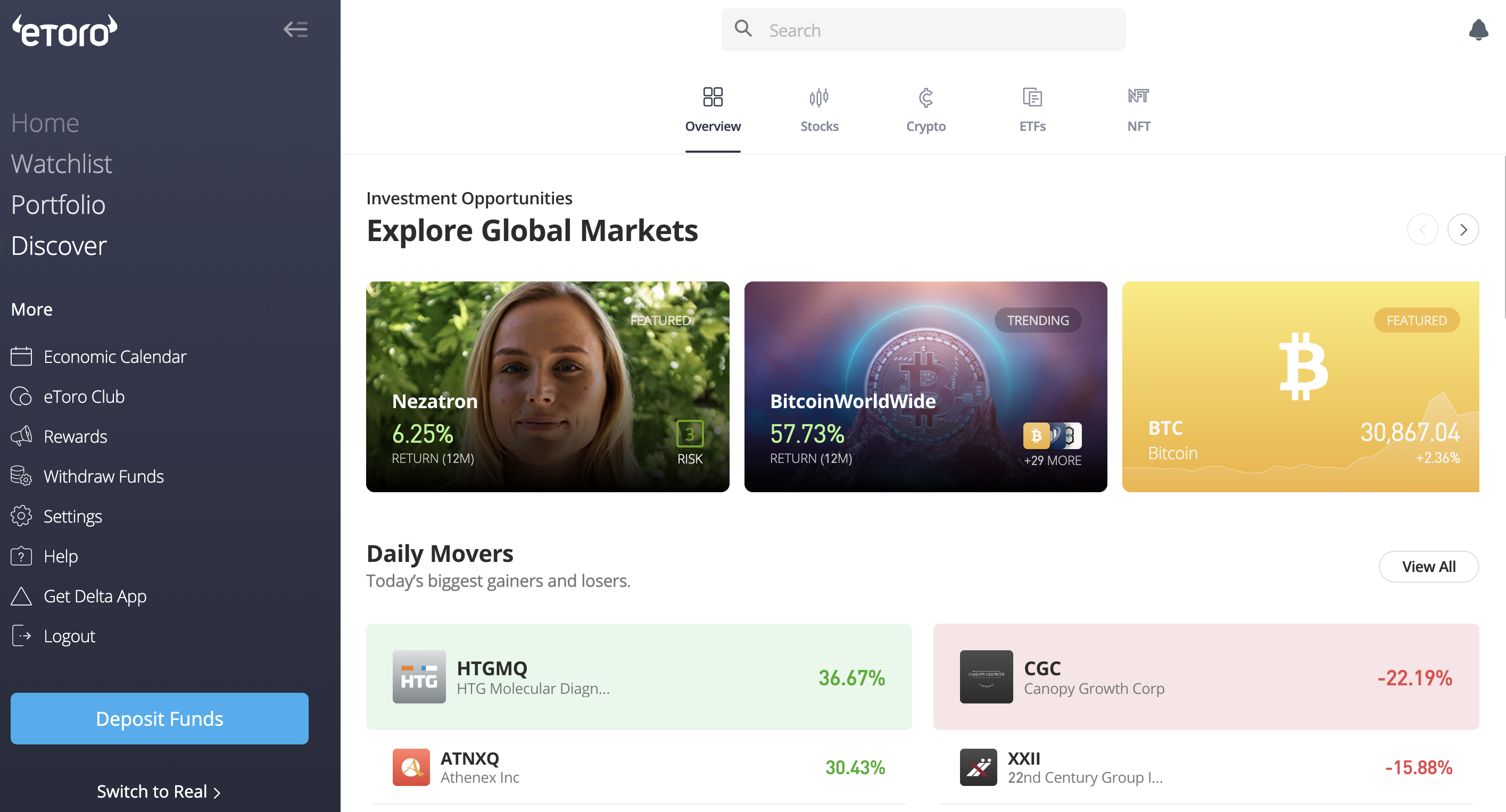

eToro is widely known for its social trading feature, where users can follow and copy the trades of successful traders.

This CopyTrading system, combined with a user-friendly interface, makes eToro an excellent choice for beginners. The platform supports trading in cryptocurrencies, stocks, commodities, indices, ETFs, and fiat currency pairs.

However, when it comes to cryptocurrencies, eToro offers spot trading and staking services but does not provide Crypto Futures or Options trading at the moment.

Additionally, leverage trading for cryptocurrencies is not available for users based in the UK and the US due to regulatory restrictions.

On the other hand, Huobi is a dedicated cryptocurrency exchange that offers a wider array of services for the crypto trader.

In addition to spot trading, Huobi supports Futures, margin trading, and even Options for certain cryptocurrencies. The platform also offers staking services, similar to eToro.

Huobi is particularly attractive for those interested in leverage trading, as it offers up to 5x leverage on Margin trading and up to 125x on Futures contracts, depending on the cryptocurrency pair.

Verdict: Huobi has the upper hand, especially for dedicated crypto traders seeking diverse trading options, including Futures and Options. eToro shines in its unique social trading feature and might be more appealing to those interested in trading a broader range of asset types.

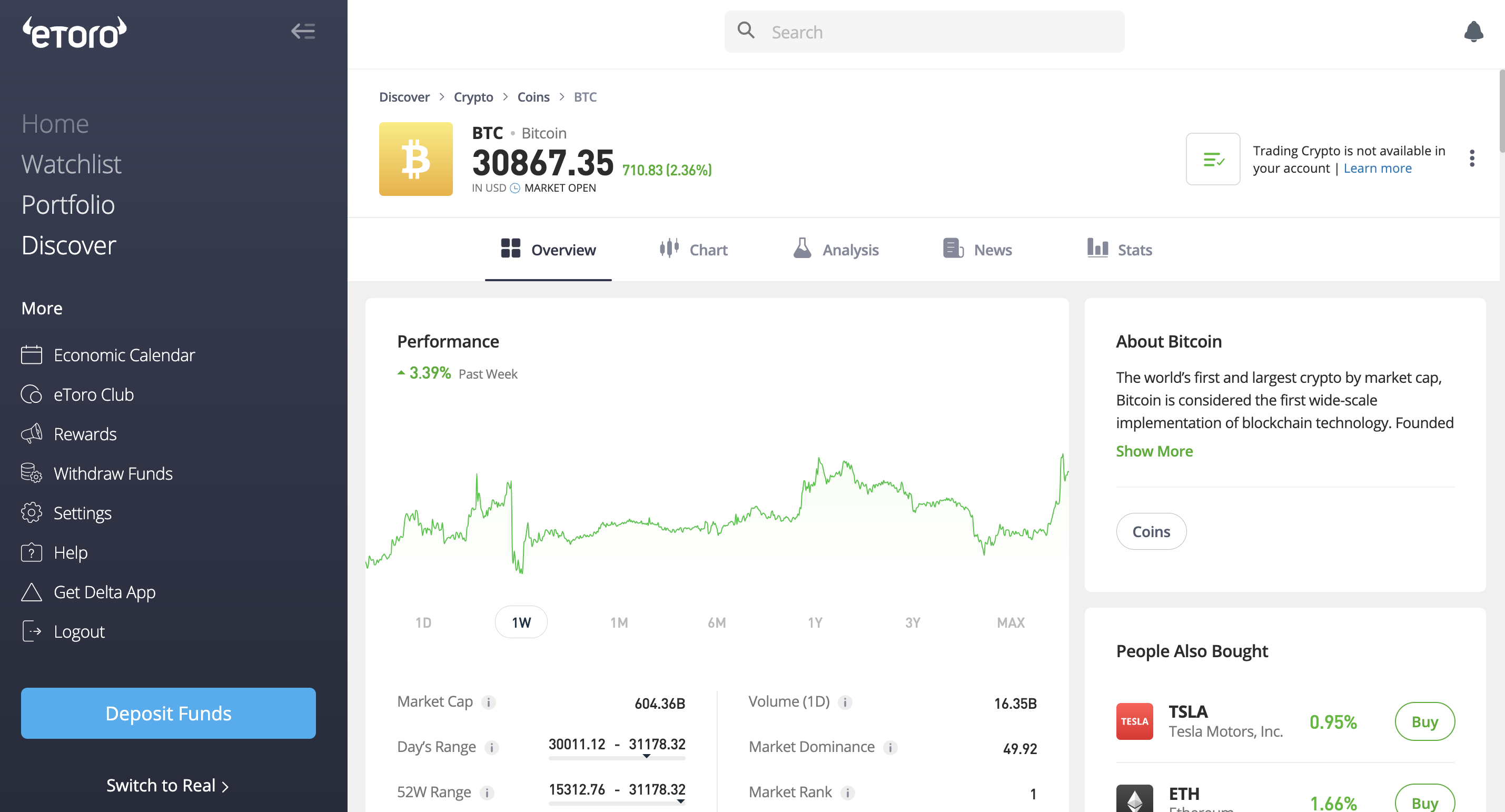

eToro vs Huobi: Supported Cryptocurrencies

eToro, while primarily a CFD trading platform, has made significant strides in cryptocurrency support over the years. As of the time of writing, eToro supports more than 60 cryptocurrencies for trading.

The list includes popular digital assets like Bitcoin, Ethereum, Ripple, Bitcoin Cash, and Litecoin, alongside other altcoins such as Cardano, Dash, and NEO.

They have been steadily adding more cryptocurrencies to their platform over time.

In contrast, Huobi, being a pure cryptocurrency day trading exchange, supports a far more extensive range of cryptocurrencies.

With over 700 cryptocurrencies listed, Huobi caters to both mainstream crypto traders and those interested in less-known altcoins.

Major cryptos like Bitcoin, Ethereum, and Ripple are well-represented, but there is also a vast array of smaller altcoins and DeFi tokens available for trading.

Verdict: If your trading strategy involves a broad range of cryptocurrencies, including less popular altcoins, established coins, and DeFi tokens, then Huobi’s extensive offering is a clear winner.

eToro vs Huobi: Trading Fee & Deposit/Withdrawal Fee Compared

eToro operates on a flat fee model for trading, meaning the cost of trades is included in the buy and sell prices.

It charges a 1% flat fee for every transaction so when you open a new position it will always show a loss.

This is because it includes the 1% fee you paid for the buy transaction and the 1% fee you will pay for the consequent sell transaction.

eToro does not charge any deposit or withdrawal fees and only the blockchain fees are applicable. There is also a conversion fee of 0.1% for crypto-to-crypto conversions.

Huobi uses a maker-taker fee model. The fees start at 0.2% for both makers and takers and can go down based on the user’s 30-day trading volume and their Huobi Token (HT) holdings.

It’s possible to reach as low as 0.07% for makers and takers if you hold more than 5,000 HT.

When it comes to deposits, Huobi doesn’t charge any fees. For withdrawals, the fees vary depending on the specific cryptocurrency.

Verdict: High-volume traders may benefit more from Huobi’s tiered fee structure. eToro’s fee structure, while simpler, can be costlier, especially for certain cryptocurrencies. However, the flat withdrawal fee can be beneficial for users withdrawing larger amounts.

eToro vs Huobi: Order Types

eToro provides a straightforward interface with a limited number of order types. You can place market and limit orders, which are quite fundamental for most traders.

A Stop Loss order and a Take Profit order can be set up to manage risks and lock in profits, respectively.

The lack of more complex order types, like trailing stops or one-cancels-the-other (OCO) orders, might leave some advanced traders wanting more.

In contrast, Huobi offers a broader range of order types, including market orders, limit orders, stop-limit orders, and trigger orders.

This variety allows for more sophisticated trading strategies. The availability of these order types, however, may depend on the specific trading pair and whether you’re trading on the spot or Futures market.

Verdict: If you’re a beginner or intermediate trader, eToro’s simple interface and basic order types might be all you need. However, for more advanced traders seeking greater flexibility and control over their trades, Huobi’s wide range of order types is likely to be a more attractive option.

eToro vs Huobi: KYC Requirements & KYC Limits

As a regulated entity in multiple jurisdictions, eToro requires all users to complete a KYC process. This process includes providing personal information, proof of identity, and proof of address.

This allows eToro to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

For Huobi, the KYC process is tiered.

You can start trading without KYC verification, but your withdrawal limit will be capped at 2 BTC per day, you will not be able to withdraw or deposit fiat, and some P2P sellers do not transact with non-verified accounts.

To increase this limit and access additional features, you need to complete their KYC process, which involves providing similar personal information and documents as eToro.

Verified users enjoy a higher withdrawal limit and other features.

Verdict: For those valuing privacy and wishing to trade without completing KYC, Huobi provides more flexibility. On the other hand, eToro requires KYC from the get-go but offers unlimited trading once completed.

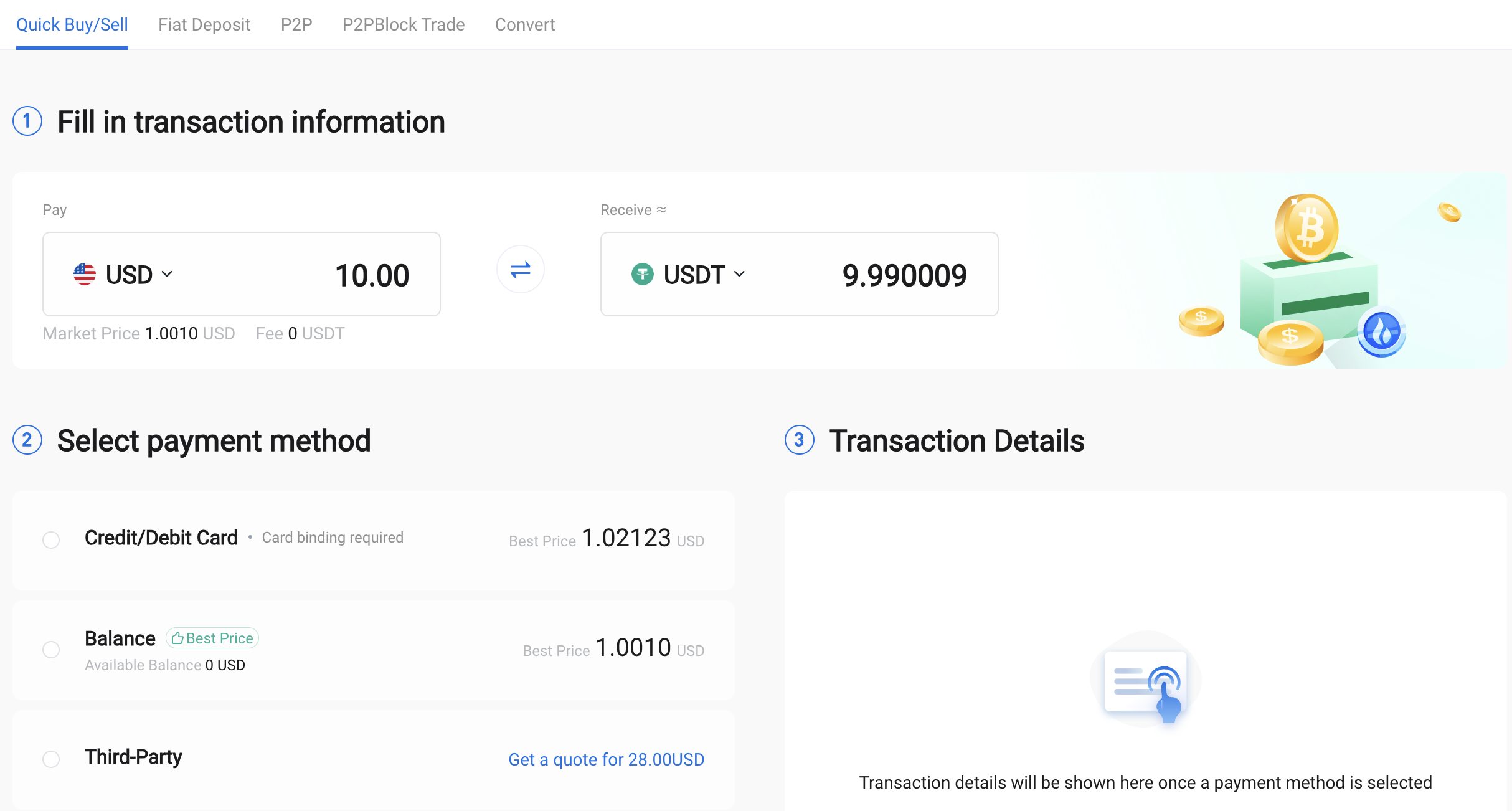

eToro vs Huobi: Deposits & Withdrawal Options

eToro provides a multitude of deposit options. You can fund your account using credit/debit cards, PayPal, Neteller, Skrill, Webmoney, Yandex, and wire transfers, among others.

The minimum deposit varies based on the region and deposit method but generally starts at $50.

Withdrawals on eToro are relatively straightforward, with a flat fee of $5 per withdrawal. The minimum withdrawal amount is $30.

You can withdraw funds to your credit/debit card, bank account, or e-wallets like PayPal, Skrill, and Neteller.

Huobi, as a crypto-focused exchange, mainly accepts deposits in cryptocurrencies. You can deposit any of the supported cryptocurrencies into your Huobi wallet.

Recently, Huobi has also started to accept fiat deposits via wire transfer in select regions.

When it comes to withdrawals, Huobi allows you to withdraw your funds in any of the supported cryptocurrencies.

The fees and minimum withdrawal amounts vary depending on the specific cryptocurrency.

Verdict: eToro offers more diversity in deposit and withdrawal methods for those who prefer to use fiat. This makes eToro more user-friendly for beginners. However, Huobi could be more attractive for seasoned crypto traders, particularly those who already own crypto assets.

eToro vs Huobi: Trading & Platform Experience Comparison

eToro’s platform is designed with user-friendliness in mind, targeting beginner to intermediate traders. The platform is web-based, with a clean, intuitive design that makes navigation easy.

It also provides features like social trading, where users can copy the trades of successful traders.

In terms of mobile experience, eToro has a well-designed app available for both iOS and Android. The app mirrors the functionality of the web platform, ensuring a seamless trading experience across devices.

Huobi’s trading interface is more sophisticated, catering to the needs of advanced traders. It offers a full suite of trading tools and charts to facilitate in-depth market analysis.

However, the platform’s complexity may be overwhelming for beginners.

Huobi’s mobile app, available for both iOS and Android, offers a wide range of features, including real-time market data, professional charts, and different order types. To help you know more, here is a quick guide on how to short Bitcoin on Huobi.

It’s highly functional, though perhaps less intuitive than eToro’s.

Verdict: eToro’s platform is better suited for beginners and those who prefer a simple, user-friendly interface. Its social trading feature is a standout. On the other hand, Huobi provides a more comprehensive toolset suitable for advanced traders. Your choice would depend on your trading experience and needs.

eToro vs Huobi: Customer Support

eToro’s customer support includes a comprehensive Help Center with answers to common questions. For more specific inquiries, you can submit a ticket via their customer service platform.

They promise to respond to tickets within 14 days, which is lengthy for urgent issues. There’s also a live chat option, but it’s limited to certain hours and days.

Unfortunately, eToro doesn’t offer phone support.

Huobi’s customer support offers several options. Like eToro, they have a Help Center for self-guided help. For direct support, they offer 24/7 live chat, which typically responds within a few minutes.

In addition, they provide email support.

Verdict: In terms of customer support, Huobi appears to have a more comprehensive and responsive system. Their 24/7 live chat and phone support offer immediate assistance, which could be crucial in time-sensitive situations.

eToro vs Huobi: Security Features

eToro employs a high level of security for its users.

This includes industry-standard practices such as two-factor authentication (2FA), encryption of data, and periodic security audits.

eToro is also fully regulated in all jurisdictions where it operates, adding another layer of security for its users.

Huobi has a strong focus on security, implementing strategies such as cold storage for funds, 2FA, encryption, and anti-DDoS protection.

Moreover, Huobi has set up a User Protection Fund, which acts as insurance against potential losses due to system issues.

Huobi also has a Security Response Center that offers rewards for identifying vulnerabilities in the system.

Verdict: Both eToro and Huobi prioritize the security of their users and employ numerous measures to safeguard user accounts and funds.

Is eToro Safe & Legal To Use?

eToro is widely recognized as one of the safest and most transparent online trading platforms.

They are fully regulated in all jurisdictions in which they operate. In the United States, eToro USA LLC is registered with the Financial Crimes Enforcement Network (FinCEN) as a Money Services Business.

In Europe, it operates under the regulatory oversight of the Cyprus Securities Exchange Commission (CySEC).

The platform employs industry-standard security measures to protect user funds and data.

eToro also operates with complete transparency regarding their fees, which are clearly laid out on their website.

Additionally, eToro is an active participant in various global financial and blockchain conferences, further demonstrating its commitment to legitimacy and transparency.

Is Huobi Safe & Legal To Use?

Huobi is one of the largest and most well-known cryptocurrency exchanges in the world, and it has taken numerous measures to ensure the safety of its users, as discussed in the Security Features section above.

As for legality, Huobi Global is registered in Seychelles, and its affiliated companies are registered and comply with the regulatory requirements in multiple jurisdictions globally.

The platform is known for its strict compliance with international laws and regulations.

Huobi can be considered a safe and legal platform in the jurisdictions where it is permitted to operate.

eToro vs Huobi Conclusion: Why not use both?

eToro is particularly well-suited to beginner and intermediate users who want a seamless trading experience that bridges the gap between cryptocurrencies and traditional financial markets.

Huobi, with its wide array of supported cryptocurrencies and robust trading tools, is an ideal platform for seasoned traders looking for more in-depth crypto-to-crypto trading.

If you’re new to the trading world, you may find eToro’s easy-to-use platform and educational resources more beneficial.

If you’re an experienced trader looking to dive deep into the crypto markets with advanced tools, Huobi might be more up your alley.

See how eToro & Huobi compares to other similar crypto exchanges: