When it comes to trading crypto – Binance and eToro are two of the leading names. On one side, Binance Futures is a full-fledged crypto trading platform, while eToro allows you to trade in multiple markets.

So as a crypto trader, which one should you choose between Binance vs eToro?

The decision can be confusing. However, to help you out, I have compared both trading platforms below at various key factors.

So it would be easy for you to understand the similarities and differences. Sounds good? Let’s jump into the comparison right away:

Binance vs eToro: At A Glance Comparison

In today’s time, Binance stands out as the largest yet most popular cryptocurrency day trading platform around the globe.

The exchange was founded in 2017, and it offers every service related to crypto. Be it crypto trading, staking, crypto loans or any other service, Binance has you covered.

With Binance, you can trade in various markets like spot, crypto options, margin and futures. On top of that, it is known for having one of the lowest trading fees with deep liquidity.

eToro is one of the oldest crypto CFD brokers out there. The company was founded in 2017, and it is a popular choice for both beginners and advanced traders.

With eToro, one can trade and invest in markets like stocks, commodities, or cryptocurrencies. Also, it offers you other crypto features like copy trading staking.

Furthermore, eToro is also well-regulated and holds licenses from multiple authorities. Overall, it is one of the trustworthy platforms to get started with trading.

Binance vs eToro: Trading Markets, Products & Leverage Offered

Binance

Binance being a crypto-focused trading platform, offers you more features than platforms offering services in multiple markets.

Binance is a good choice for both beginners and advanced traders and investors. It offers you all sorts of markets with high leverage. The product offerings include:

- Spot Trading

- Spot Margin Trading (leverage between 5x to 10x)

- Derivatives trading in USDT, USDC & Crypto (leverage between 1x to 125x leverage)

- Crypto Options

- Binance Leveraged Tokens

- P2P Trading

eToro

- Crypto CFD Trading with (up to 30x leverage)

- Crypto Staking

- Crypto Copy Trading

Verdict: Binance is undoubtedly a better choice in terms of trading markets and leverage. The exchange has higher leverage compared to eToro and allows you to explore all the different crypto markets.

Binance vs eToro: Supported Cryptocurrencies

Binance

On Binance, you would find a wide range of crypto tokens and derivatives trading pairs.

Binance has a list of more than 500+ crypto tokens and trading pairs across different trading markets. Also, the exchange is at the forefront when it comes to launching new tokens. Some of the listed tokens are:

- BTC

- SOL

- USDT

- ADA

- SYN

- BEL

eToro

eToro is quite low on numbers when it comes to supported tokens.

The exchange has about 80+ crypto tokens for you to trade and invest in. But be assured that it has all the majorly traded tokens along with a few emerging tokens. Some of the listed tokens are:

- BTC

- ADA

- ETH

- BNB

- IOTA

- LTC

Verdict: Binance is the clear winner. The exchange allows you to invest or trade in different crypto tokens and diversify both your trading and investing portfolio.

Binance vs eToro: Trading Fee & Deposit/Withdrawal Fee Compared

Binance Spot Trading Fee

Binance comes with a pretty straightforward fee structure. It follows the usual maker-and-taker fee model and has different tiers.

The tier is decided by your 30days trading volume. Also, it offers you an additional 25% discount on your spot trading fee when you pay the fee using BNB.

| Regular Fee | 25% Discounted Fee | |

| Maker Fee | 0.1000% | 0.0750% |

| Taker Fee | 0.1000% | 0.0750% |

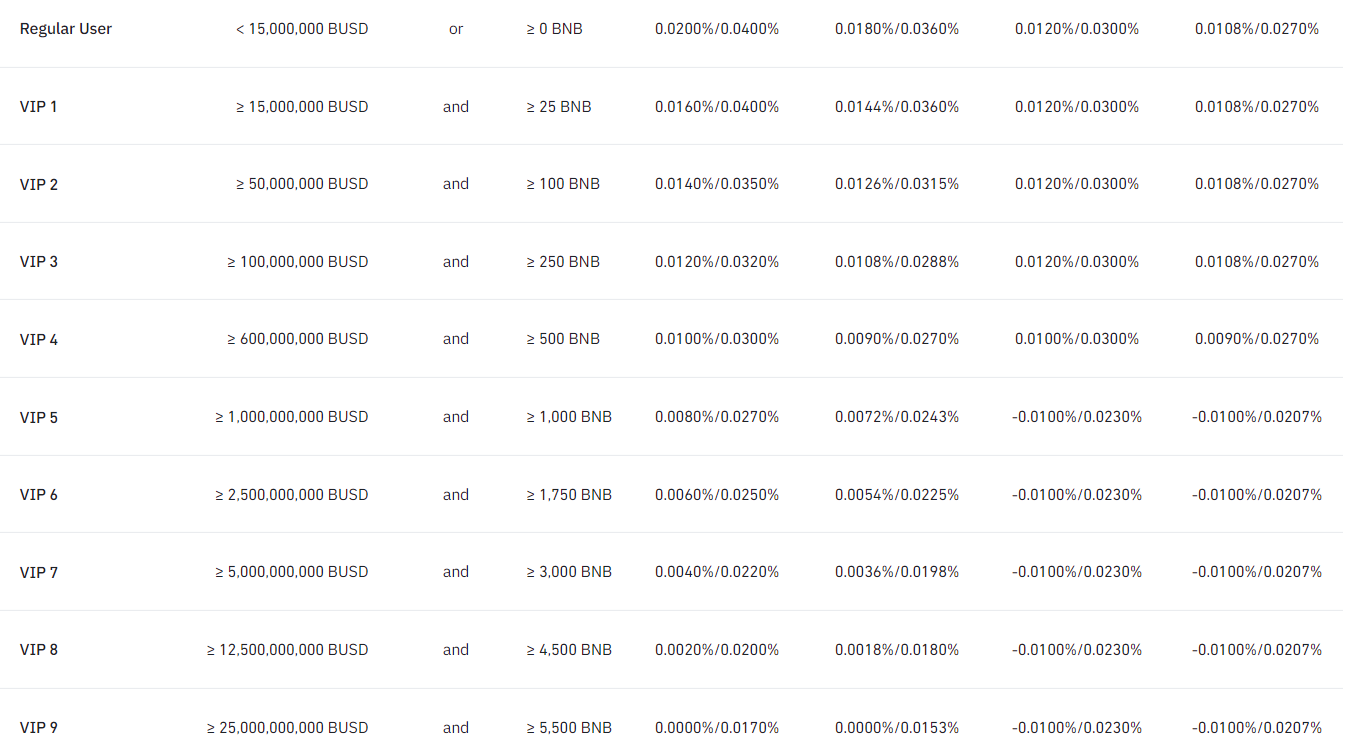

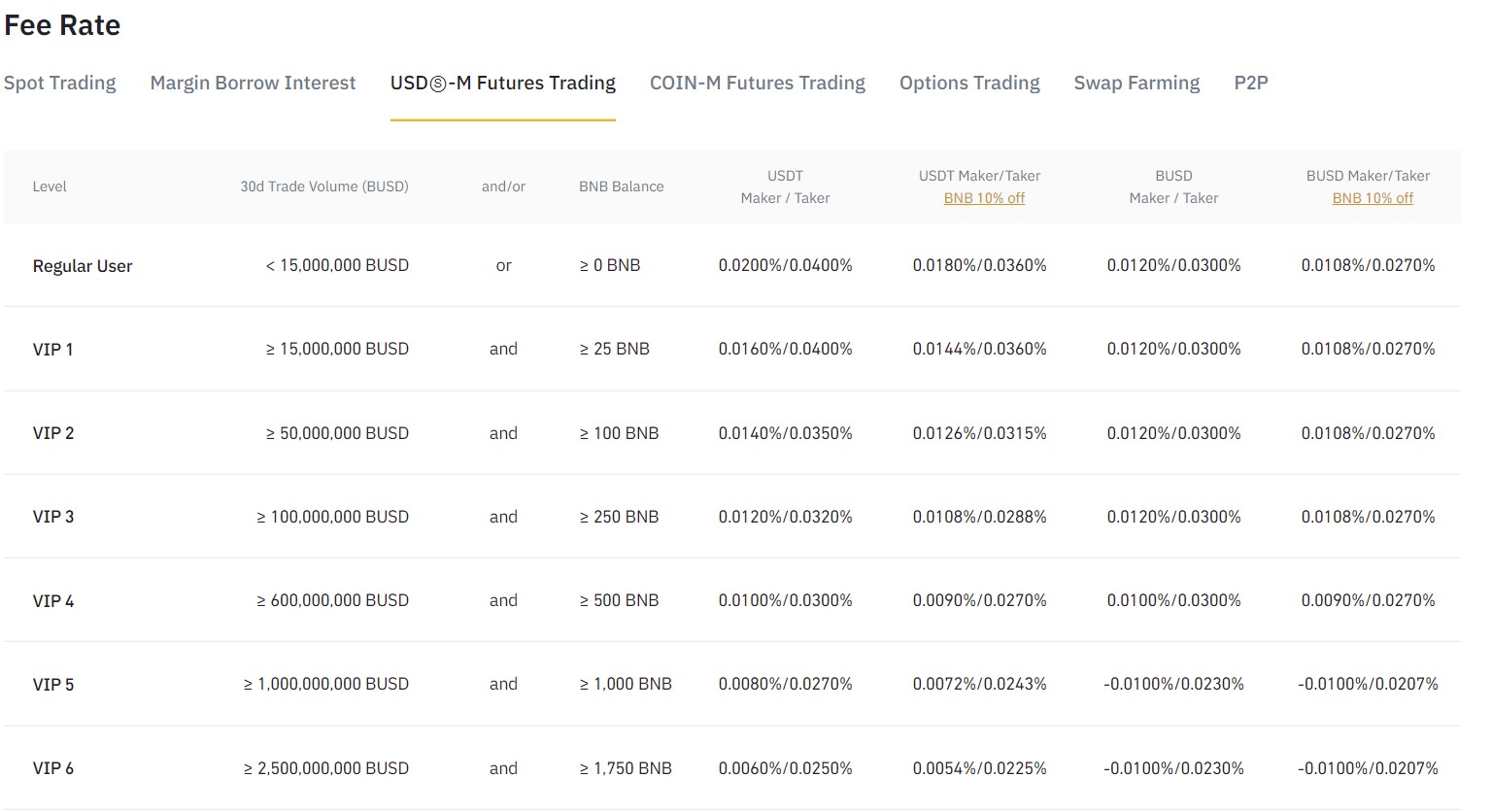

Binance Futures Trading Fee

For Binance futures trading, you get to see a similar tiered fee structure with a 10% additional discount on USDT futures contracts only.

| USD-M Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0180% | 0.0108% |

| Taker Fee | 0.0360% | 0.0270% |

| BUSD Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0120% | 0.0108% |

| Taker Fee | 0.0300% | 0.0270% |

| Coin-M Futures Fee | Regular Fee | |

| Maker Fee | 0.0100% | |

| Taker Fee | 0.0500% | |

| Binance Options Trading Fee | Regular Fee | |

| Maker Fee | 0.020% | |

| Taker Fee | 0.020% |

Binance Deposit & Withdrawal Fees

The deposit and withdrawal fee varies from one deposit/withdrawal method to another one.

For instance, when it comes to crypto token deposits from another wallet or exchange – there is no fee. But for crypto token withdrawal, you have to pay a certain fee. The fee varies from one currency to another.

The same goes for fiat deposits and withdrawals. For certain deposit/withdrawal methods, you would have to pay a transaction or processing fee.

But on Binance, you have P2P trading, which enables you to enjoy free deposits and withdrawals of funds.

eToro Trading Fees

eToro has a flat fee for both maker and transaction fees. When you buy/sell crypto assets on eToro, you are charged a simple and transparent fee of 1%.

- Trading Fee: 1% on buy/sell orders

Furthermore, if you convert one crypto token to another one, it will occur a conversion fee of 0.1%.

eToro Deposits & Withdrawal Fees

There are no fees when it comes to depositing funds on eToro. However, you must meet the minimum deposit requirements.

However, for withdrawals, eToro charges you $5 per withdrawal request. On top of that, the minimum withdrawal limit is set to $30.

Additionally, as there is no availability of P2P trading – you don’t have any option to deposit or withdraw funds free of charge.

Verdict: Binance is the clear winner because of its plain fee structure. Also, the exchange has the lowest trading fee compared to eToro.

Binance vs eToro: Order Types

Binance

- Limit

- Market

- Stop Limit

- Stop Market

- Trailing Stop

- Post Only

- TWAP

eToro

- Limit Order

- Market Order

- Stop-loss Order

Verdict: Binance has some of the advanced order types that eToro doesn’t have. That’s why Binance is the winner for this section.

Binance vs eToro: KYC Requirements & KYC Limits

Binance

Binance made it mandatory to complete identity verification before you can start trading on the platform.

Without verifying your account, you won’t be able to deposit/withdraw. Also, it doesn’t allow you to trade in any markets.

KYC LImits

- Verified: A daily fiat Limit of 50K USD Daily.

- Verified Plus: A daily fiat Limit of 2M USD Daily.

- Verified Plus (2): Unlimited Fiat Transactions.

eToro

eToro also requires you to complete your identity verification before you can participate in any trading activities. However, without verifying your account, you are free to explore the platform and see its product offerings.

But for deposits/withdrawals and trading, you need to verify your account. Also, unlike Binance, it doesn’t have any KYC tiers.

Verdict: As both trading platforms require you to go through the KYC process, it is a tie between Binance and eToro.

Binance vs eToro: Deposits & Withdrawal Options

Binance

- Method 1: First, you can buy crypto using a credit/debit card, bank transfer, or any other supported payment method.

- Method 2: You can deposit or withdraw crypto from a crypto wallet or exchange.

- Method 3: For free deposits and withdrawals of funds, you can use P2P trading.

eToro

- Method 1: You can deposit and withdraw funds via various ways, such as credit/debit card, bank transfer, Klarna / Sofort, EWallets (PayPal), eToro money, or Trustly online banking.

Verdict: As Binance has more options to deposit and withdraw funds compared to eToro, it is the winner.

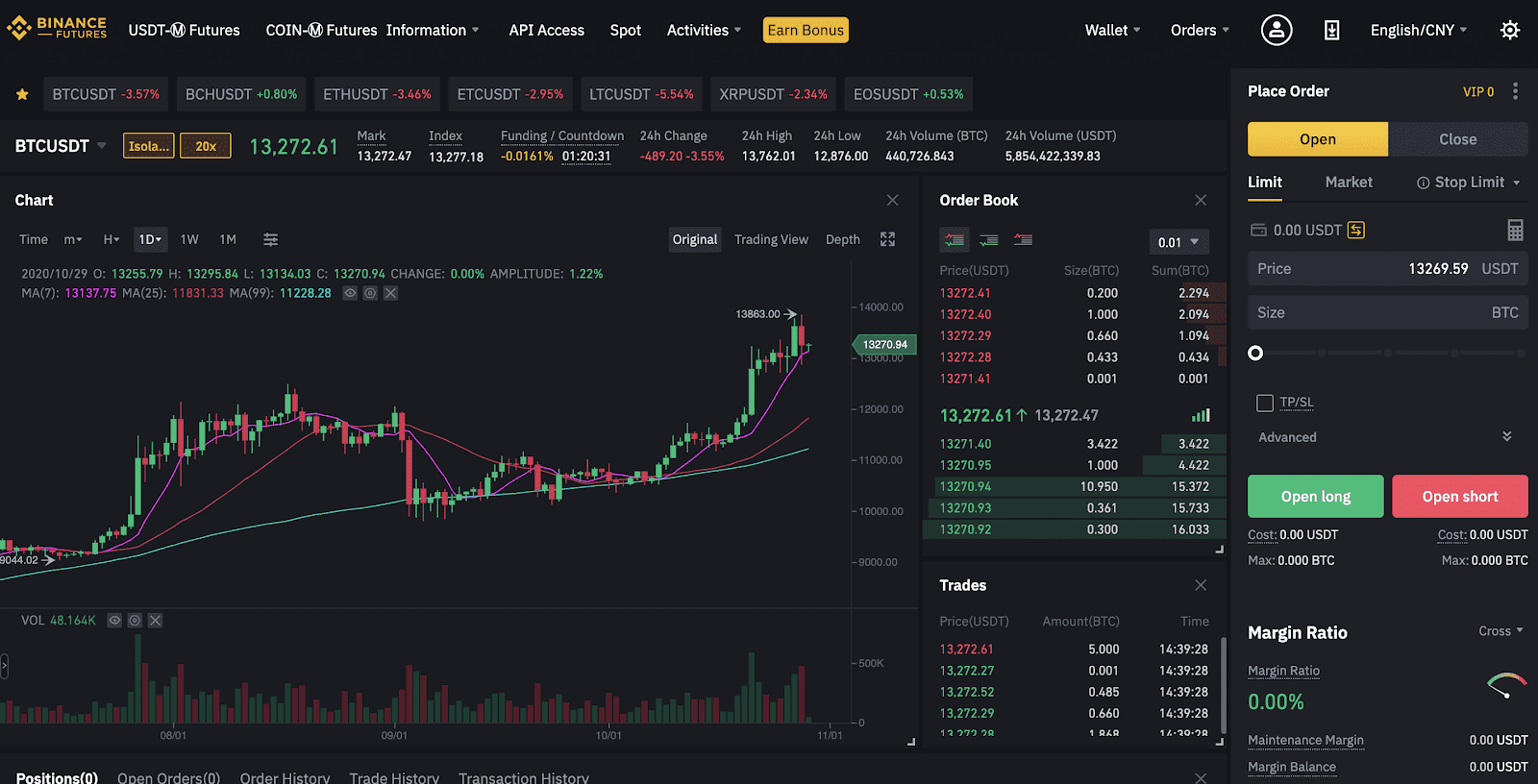

Binance vs eToro: Trading & Platform Experience Comparison

Binance

Binance is pretty advanced when it comes to the overall trading experience. It has all the essential tools and a great mobile app to take care of all your trading requirements. Also, the trading platform is suitable for both beginners and advanced traders. With Binance, you are getting features like:

- Multiple technical chart options, including TradingView

- Pair details

- Order book

- Easy-to-use order form

- Trade history, open orders, PnL records

- User-friendly mobile app

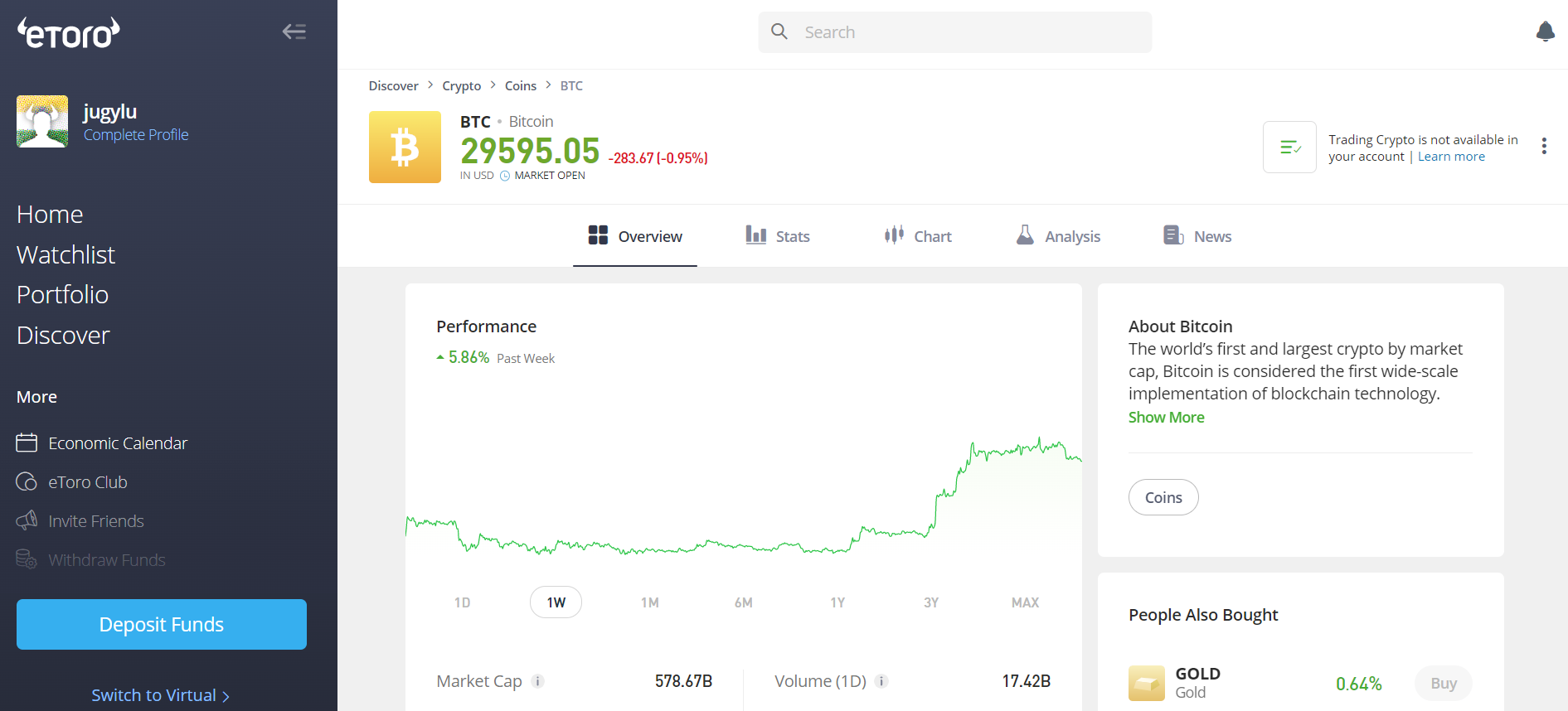

eToro

The overall trading experience of eToro is pretty basic. But you are getting all the essential tools like charts, stats, trading pair details, and more.

The exchange is more of an investing platform than a trading platform – hence the overall trading experience is designed to cater to investors mainly. However, here are some of the features that you are getting:

- Technical chart by TradingView

- Overview, stats & news of the assets

- Easy-to-use order form

- Mobile app

Verdict: Binance is a better choice in terms of the overall trading experience. It offers you a pretty great trading experience across the web and mobile phones, whereas eToro has limited trading features.

Binance vs eToro: Customer Support

Binance

Binance offers you help through its live chat support. It instantly connects you with a support agent. Also, the exchange has a faster response time. The live chat can also be used for accessing different help guides.

Furthermore, you can also get through email. Or you can reach out to Binance on Twitter at @BinanceHelpDesk.

eToro

With eToro, you can get support via its live chat and email. eToro is known for its quick response time and solves your queries at the soonest.

Along with that, the trading platform also has a comprehensive FAQ section where you can find answers to commonly asked questions and has a lot of other content which will help you solve your queries solve by yourself.

Verdict: As both trading platforms offer their support in a similar manner – it is a tie between the two.

Binance vs eToro: Security Features

Binance

- Keeps funds in cold storage

- Two-factor Authentication

- Passkeys and biometrics

- Real-time monitoring

- Advanced-data encryption

- One-stop withdrawal

- Withdrawal whitelist

- Anti-phishing code

- Device management

eToro

- Two-factor Authentication

- Phone verification

Verdict: Binance is the winner once again. It offers you multiple features to protect your account. But with eToro, you are only getting a few limited options.

Is Binance Safe & Legal To Use?

Binance is a popular choice that is trusted by millions of users worldwide. The company is registered in Malta and complies with all the rules and regulations in its registered country.

Along with that, the exchange also has implemented several measures to protect user funds, such as two-factor authentication, SSL encryption, and cold storage of user funds. Plus, Binance doesn’t have any history of security breaches.

Is eToro Safe & Legal To Use?

eToro is one of the oldest, safest, and most legal platforms to trade different trading instruments. eToro is regulated by several reputable financial authorities.

Such as FCA, ASIC, and CySEC. The platform also implements various security measures, such as two-factor authentication, SSL encryption, and segregated user funds.

Binance vs eToro Conclusion: Why not use both?

Binance is the ultimate winner at the end of this comparison.

Binance excels in providing all sorts of services and features that you need to trade crypto specifically. The exchange helps you with low trading fees, different markets, high leverage, and deep liquidity.

But eToro is also a pretty solid platform. You can use the exchange if you are looking for a copy trading exchange. Plus, with a single platform, you can trade in multiple markets like stocks, commodities, or crypto.

However, if you are looking to trade crypto especially – there is no better option than Binance.

Check out how Binance & eToro is giving a tough competition to it’s competitors:

- Binance vs Bybit

- Binance vs Bitfinex

- Binance vs Deepcoin

- Binance vs Delta Exchange

- eToro vs PrimeXBT

- eToro vs Bybit