Boasting a spot trading volume of close to $308 million (~13,509 BTC) in the last 24 hours, according to CoinMarketCap, Huobi is one of the more well-known centralized exchanges in the cryptocurrency trading circles.

Huobi’s biggest advantage is that it supports Initial Coin Offerings natively on the platform, which helps its users get in on the ground floor of a project whose future they are very confident about.

This can yield great results if done right.

In this article, we are going to look at how you can use Huobi to make money when the price of Bitcoin is falling.

You can use either Margin trading, Futures contracts, or Options trading, as shown below.

Shorting Bitcoin on Huobi with Margin Trading

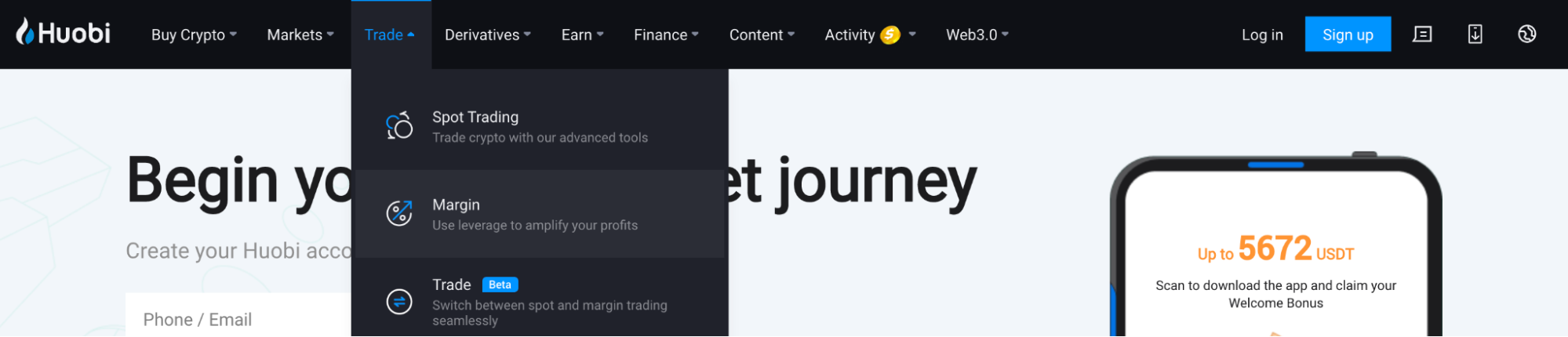

On the Huobi Global main page, hover over the ‘Trade’ option in the navigation bar and click on ‘Margin’ to get to the Margin Trading page.

The first decision you will have to make in this process is whether you want to trade with Isolated or Cross Margin. If you are unsure what these words mean, let me briefly introduce you.

Let’s assume you have $10,000 in your Huobi wallet.

If you decide to take a short position on Bitcoin, according to your analysis with an Isolated Margin, in case you are liquidated, you will lose only the $1,000 you initially used to take the position.

If you had decided to take this position with Cross Margin, your liquidation price would be high, but actual liquidation will cause the loss of all the $10,000 in your wallet.

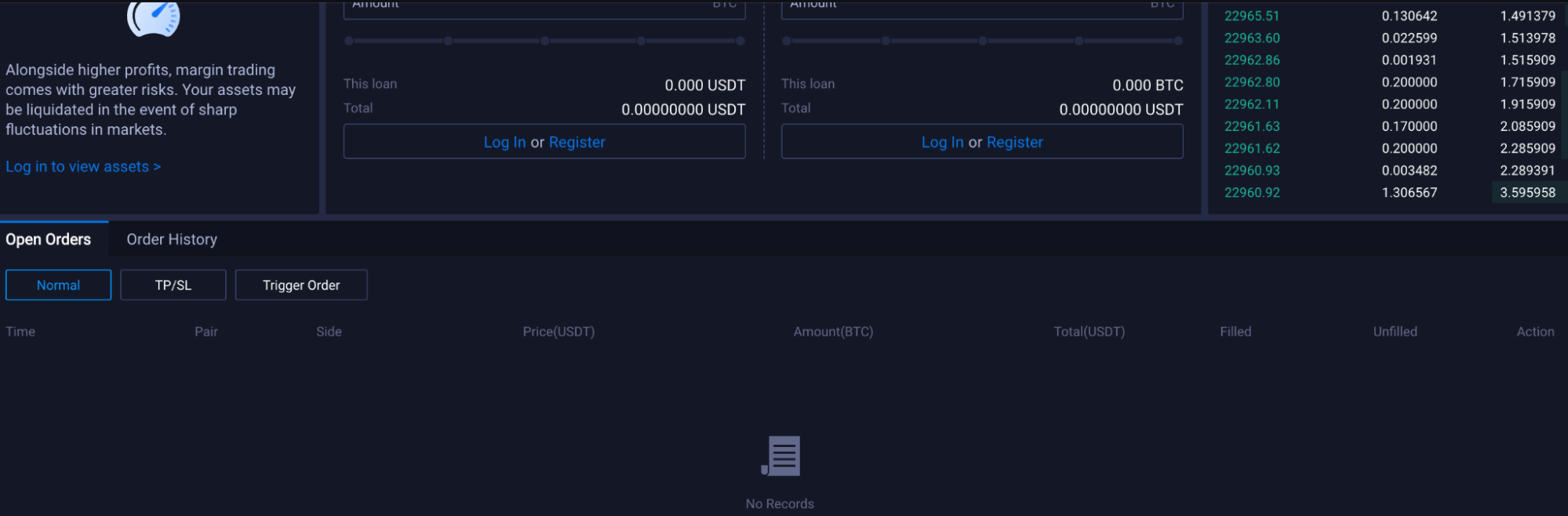

Next, you will choose the trading pair you want to Long or Short. For the purpose of this article, we will pick the BTC/USDT pair with Cross Margin trading. You can use the search bar if the pair you are looking for is not visible in the list.

You can also see the allowed leverage next to the name of the trading pair.

In our case, it is 3x, so if you take a position worth 0.33 BTC, the leverage makes your position in the market worth 0.99 BTC, which will multiply your profits and, unfortunately, your losses.

To borrow margin from the exchange, you will first have to transfer your assets from another wallet on the exchange or from wherever you have stored them.

To do this, click the ‘Transfer’ button and follow the on-screen instructions.

Once you have the initial collateral in your Margin Trading wallet, you can go ahead and borrow the margin from the exchange.

Huobi has a maximum of 3:1 margin ratio for its cross-margin contracts, denoted by the 3x next to the trading pair’s name.

If you are taking Isolated Margin trades, you have a margin ratio of 5:1.

So if you have $10,000 in your wallet, you can borrow a further $20,000 from the exchange, giving you a total of $30,000 in the margin to trade with. To do this, click the Loan button and follow the on-screen instructions.

Once you have the required amount in your wallet, you can use the different types of orders to begin shorting BTC.

You can pick from Limit, Market, Stop-Limit, and Trigger Order to make sure your order is filled at the correct price, and you can maximize your profits. The logic remains the same as it is for spot trading.

For example, if you enter a Limit order at 22,830 USDT to take a short position on BTC with a quantity of 1 BTC.

Once this order is filled, you will be able to see your PnL numbers in the window shown below. Now you will close your position when it comes to your price target, which is 19,000 USDT for this example.

This will make you a profit of (22,830 – 19,000) * 1 = 3,830 USDT, out of which you still have to pay the exchange’s fees and interest for borrowing the 20,000 USDT.

The last step after closing your position is returning the borrowed margin back to the exchange. To do this, you can click the ‘Repay’ button and follow the instructions.

You can also use the ‘Automatic Loan’ option to take positions according to the maximum margin your wallet balance and chosen trading pair is eligible for.

Note: Make sure to keep an eye on the Risk Rate in the window. When this rate reaches close to 110%, the exchange will be forced to liquidate your positions to pay the interest and the borrowed coins.

Shorting Bitcoin on Huobi with Futures Trading

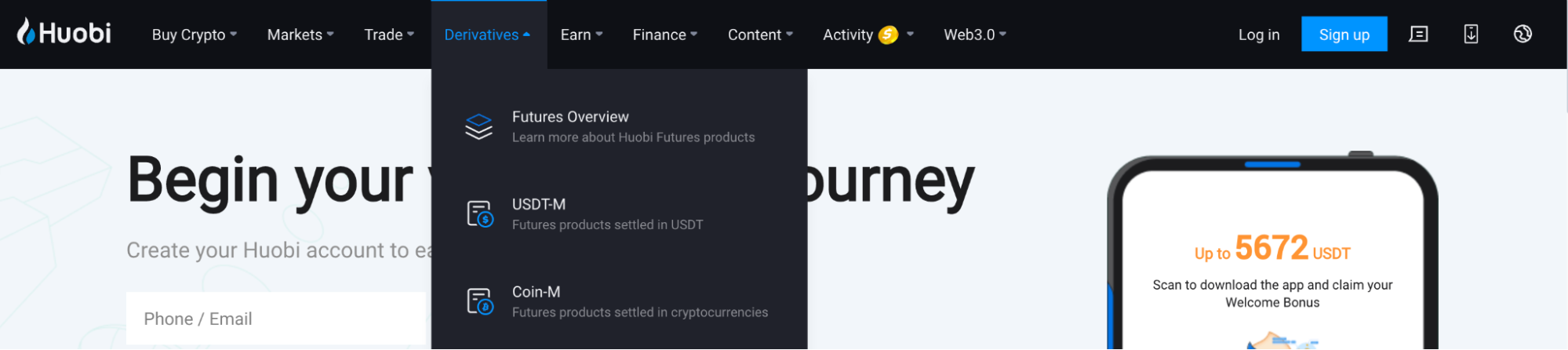

To access the Futures Trading part of the Huobi exchange, go to the ‘Derivatives’ button on the navigation bar on the home page and select whether you want to trade the USDT-M or Coin-M contracts where the USDT-M ones use USDT as the collateral for any positions and Coin-M contracts use a coin like BTC or ETH as collateral.

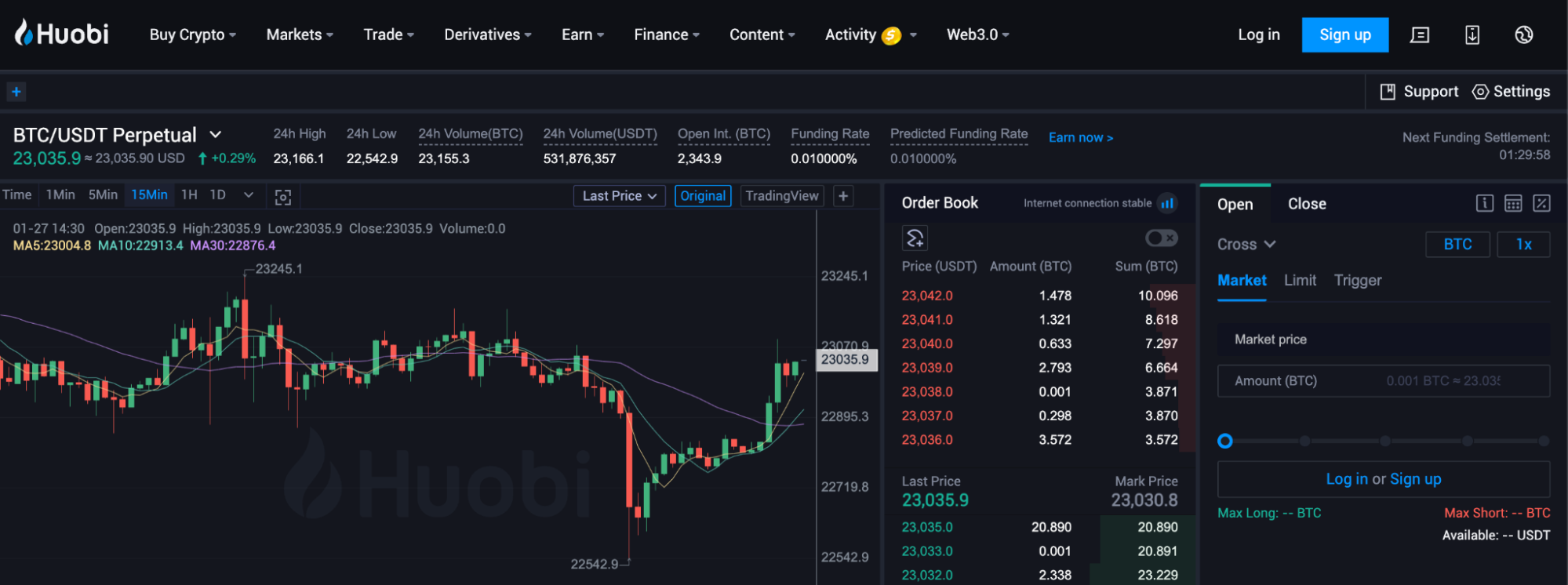

In this case, we will use the USDT-M contracts to open our first Futures trade on Huobi. Once you get to the page shown below, you will decide whether you want your margin to be Cross Margin i.e. use the balance in your wallet as additional margin when your position is close to being liquidated or the Isolated Margin mode where only the margin you used to take the position is what you are willing to lose if you get liquidated.

Then you can choose the pair you want to trade by clicking on the down arrow next to the trading pair’s name. In our case, it is the BTC/USDT pair so we don’t need to change anything in this step.

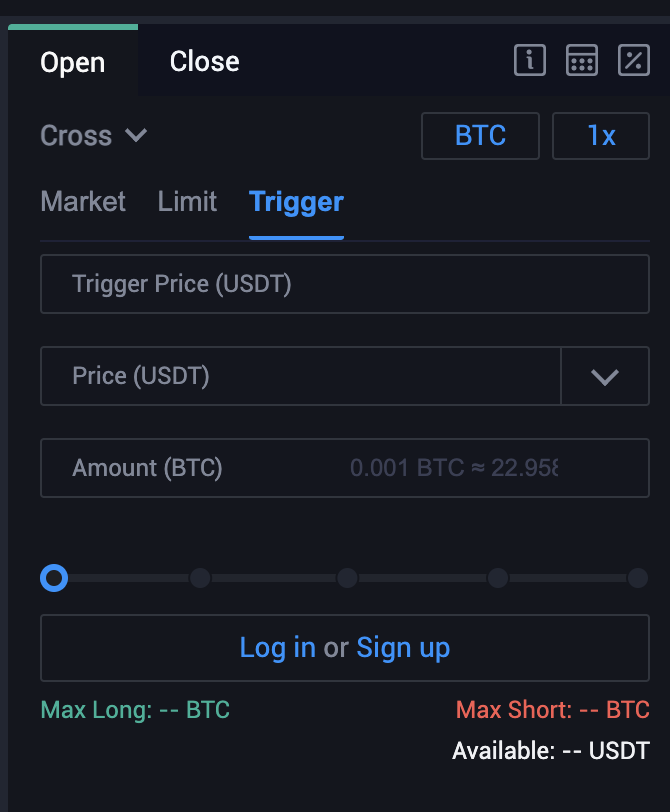

After this, you will select the order you want to place. The options you have are Market, Limit, and Trigger orders. For this example, you will learn how to place a Trigger order.

Click the ‘Trigger’ button on the Futures trading interface. Here, your order will be automatically added to the order book once the trigger price is reached. So you will first place a trigger price for your order which in this case is 23,000 USDT.

You can either manually choose a price to get your order filled or choose Optimal 5, 10, or 15, which will place your order at the best possible price that the next 5, 10, or 15 open trades in the order book will allow.

Next, you will choose what quantity of BTC you would like to short and the amount of leverage you are comfortable with.

Here, we are shorting 1 BTC at 5x leverage. Again, the higher the leverage, the higher the risk of forced liquidations when the price moves against your intended direction.

After filling in these details, you can click the ‘Open Short (Sell)’ button. This will add your order to the exchange’s list of orders which will then get added to the order book when the trigger price is reached.

Then you need to monitor your trade and either place a Limit order at the price target so that you don’t have to track it or place a Market order to close your position when you want to. In this case, we will place a Market buy order at 20,000 USDT to close the position and make a profit.

Your profit from this position will be (23,000 – 20,000) * 1 = 3,000 USDT before you pay exchange fees.

Shorting Bitcoin on Huobi with Options Trading

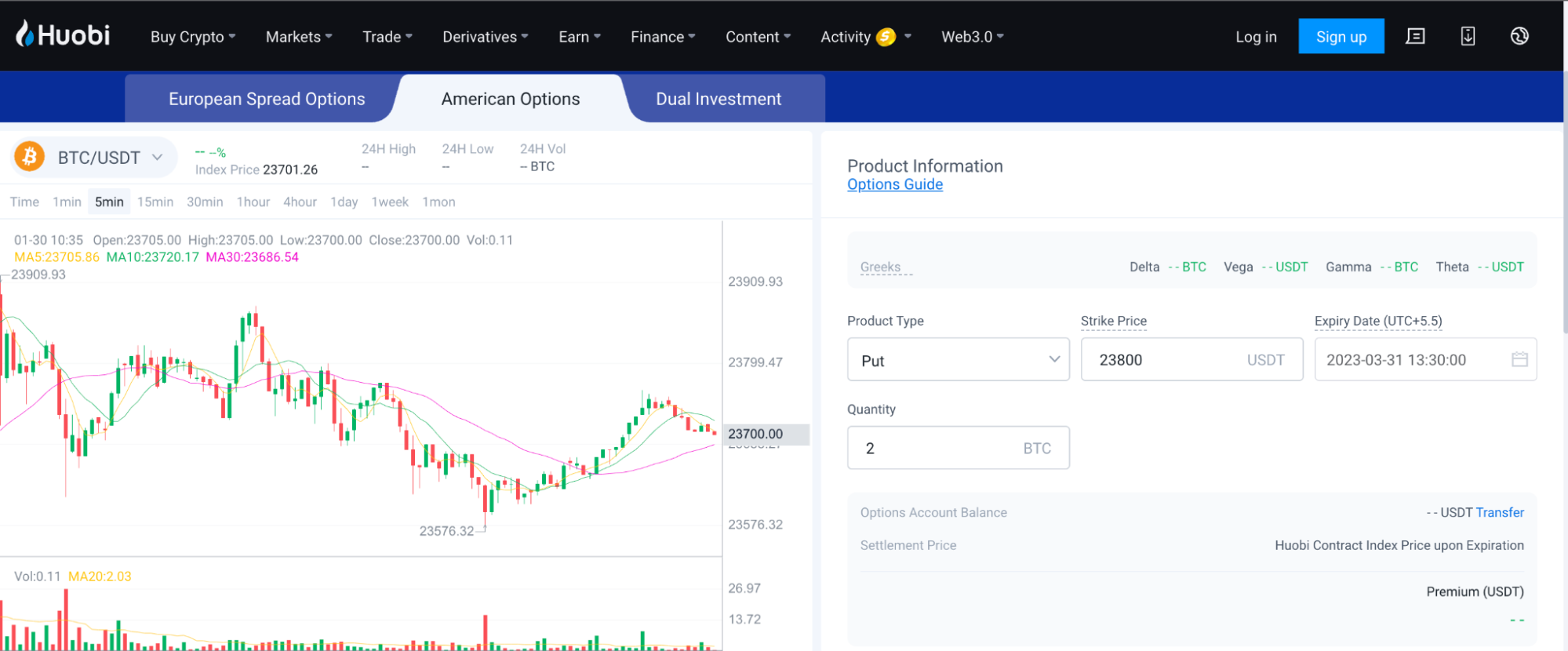

Huobi provides its traders with the chance to trade both American-style and European-style options on the exchange.

So your first decision to make will be which of the ones you would like to trade. For the uninitiated, American-style options can be exercised at any time before the expiry date of the contract.

European-style options, on the other hand, can only be exercised at expiration. We will trade American-style put options on the BTC/USDT pair in this example.

Here, we have an order for a Put option contract with a strike price of 23,800 USDT, an expiry date of 31 March 2023, and a quantity of 2 BTC. Let’s assume that the premium for being able to take this contract is 500 USDT.

On Huobi, you can choose the expiry date for your Options contract.

When the contract is exercised at or before the expiry date, there is no profit from the position if the settlement price is more than or equal to the strike price.

Otherwise, if the settlement price is lower than the strike price, the profit is calculated as Order Quantity * (Strike Price – Settlement Price).

In this example, let our price target by 20,000 USDT if you decide to exercise your contract on February 25 2023, when the price of BTC reaches our price target.

When the settlement is done, your profit will be calculated as 2 * (23,800 – 20,000) = 7,600 USDT.

The contract’s settlement price is Bitcoin’s index price at the time the contract is exercised.

Conclusion

As one of the biggest exchanges for cryptocurrency trading, Huobi provides its traders with a lot of opportunities to make money.

The traders only need to be skilled enough to take advantage of these. There are three different ways in which you can make money off of the falling price of Bitcoin.

The exchange has plenty of other features you can explore, like copy trading, which allows you to follow your favourite traders and take the same trades as their account does.

It is prudent to remind yourself regularly that you should only invest what you can afford to lose when it comes to cryptocurrencies.

The market is extremely volatile and can cause you to lose your investment completely.

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023