KuCoin is your one-stop shop for crypto gems if you do not want to wade into the world of on-chain transactions and decentralized exchanges.

So if you are looking for a small market cap coin that you can’t find on Binance or Bybit, you might want to take a look at whether KuCoin has it listed.

Just like the low market cap coins, KuCoin provides you with further ways to make money, aka shorting Bitcoin and other assets in four different ways depending on your trading strategy.

How To Short Bitcoin (BTC) Crypto On KuCoin?

Shorting via Kucoin Margin Trading

To use the Margin Trading feature on KuCoin, you will have to follow these four steps:

- Transfer

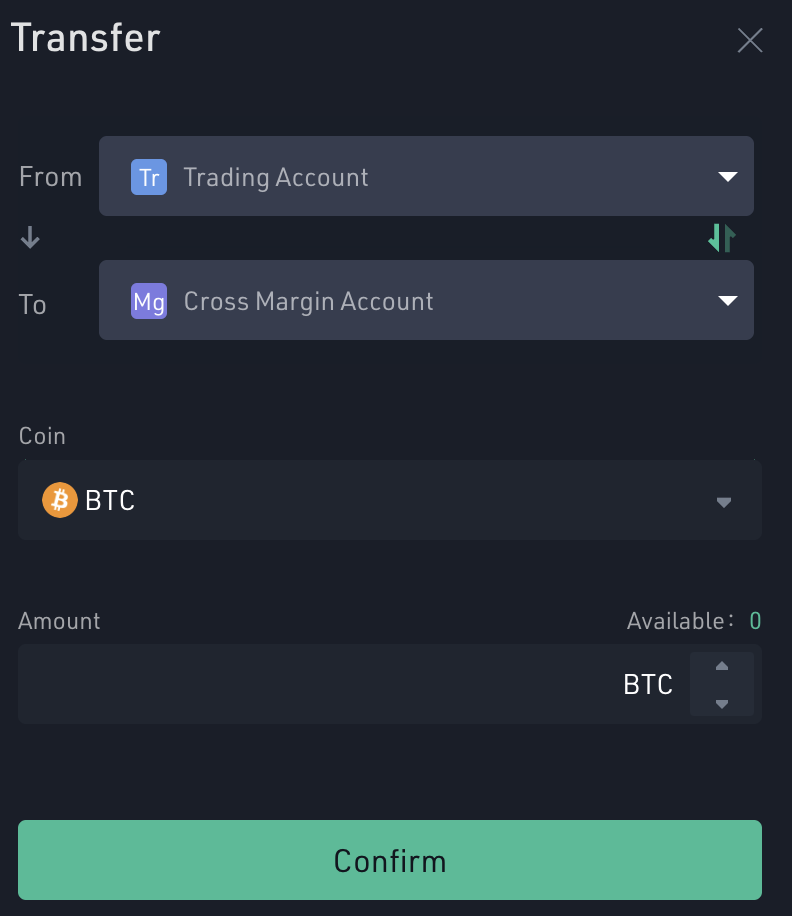

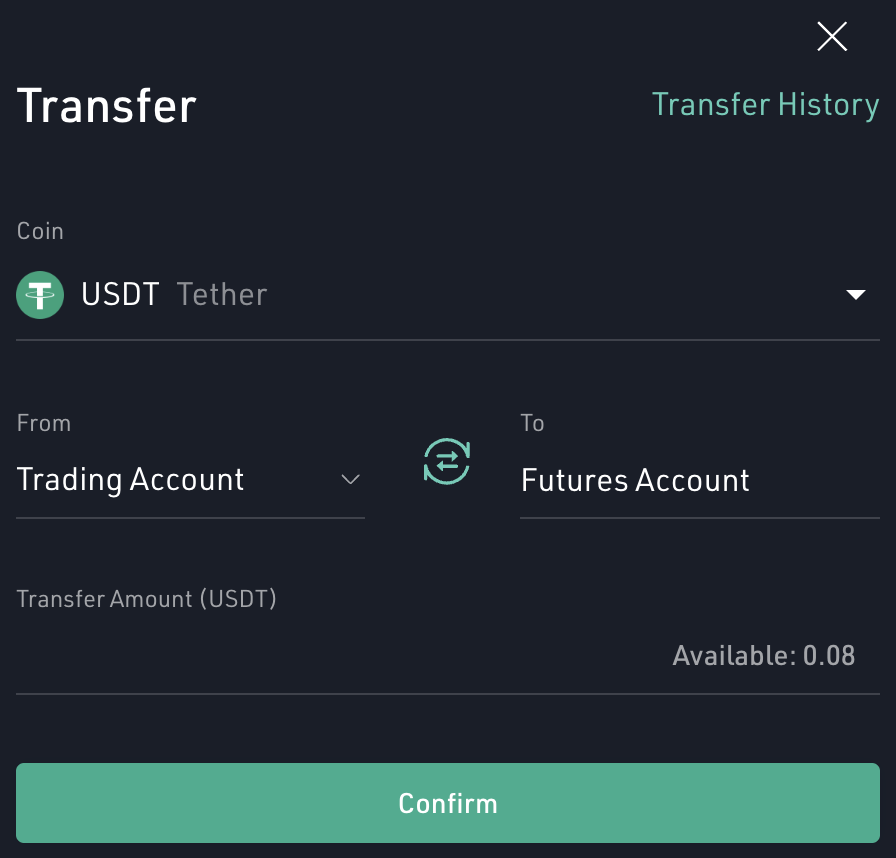

After enabling Margin Trading on your account, the next step is to transfer any crypto that you might have on another wallet in the same account to your Cross Margin or Isolated Margin wallet.

You can do this by clicking the Transfer button at the bottom of the Margin trading screen.

Any currency that is supported in the Margin Trade feature can be transferred into these wallets to be used to borrow funds.

For the purpose of this article, we will take a Cross Margin short on Bitcoin from its current market price. The price of 1 Bitcoin is close to 22,730 USDT.

In the Cross Margin trading mode, any coin/token can be used as the margin.

- Borrow

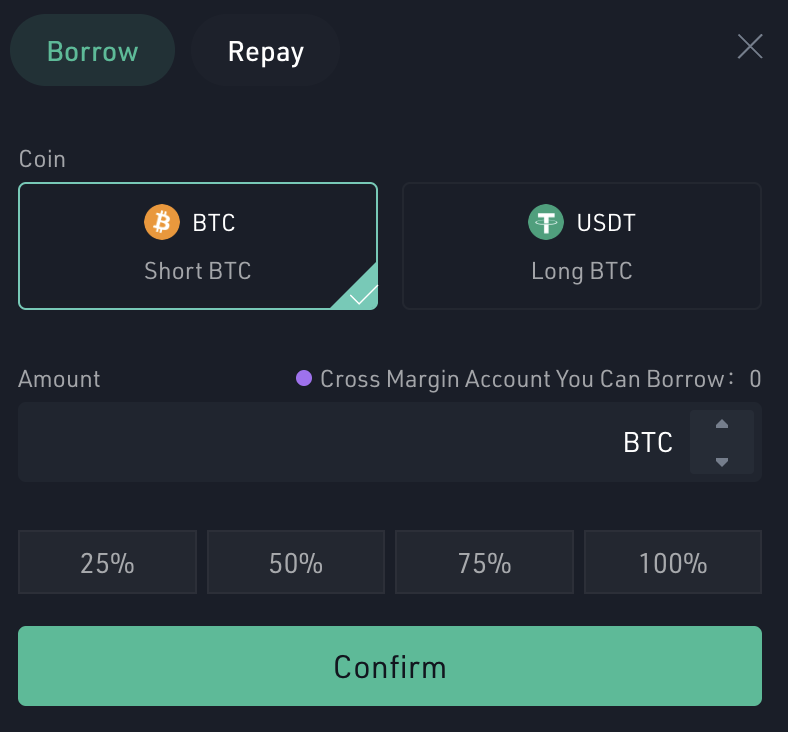

Once you have the funds in your Cross Margin wallet, click the ‘Borrow’ button next to ‘Transfer’ to bring up the window as shown in the screenshot below.

Here you can borrow funds from the exchange depending on the quantity of the asset in your wallet. The maximum amount you can borrow is 9x your deposited margin. Enter the amount of BTC you would like to borrow from the exchange here and click ‘Confirm’.

Because we are looking to short BTC in this example, we will go ahead and borrow an additional 2 BTC from the exchange. Now, after you click ‘Confirm’, there will be 4 BTC in your Cross Margin account.

You can also enable Auto-Borrow to authorize the system to automatically borrow funds for you.

- Trade

Execution of trades in this trading mode is the same as that of spot trading. This mode also shares the market depth with the Spot market.

To take a short position on Bitcoin at its current market price, we will place a Market order with the 4 BTC that we have borrowed from the exchange in return for USDT. Now, we have completed the ‘sell high’ part of the shorting process.

Next, when the price of Bitcoin reaches your price target, you will set an order to buy back the BTC with the USDT you received in the previous step.

For example, the Market order for 4 BTC was filled at 22,730 USDT per Bitcoin. This is a position size of 22,730 * 4 = 90,920 USDT. Your price target for this trade is 20,000 USDT so you will place a Limit order to buy 4 BTC at 20,000 USDT per Bitcoin.

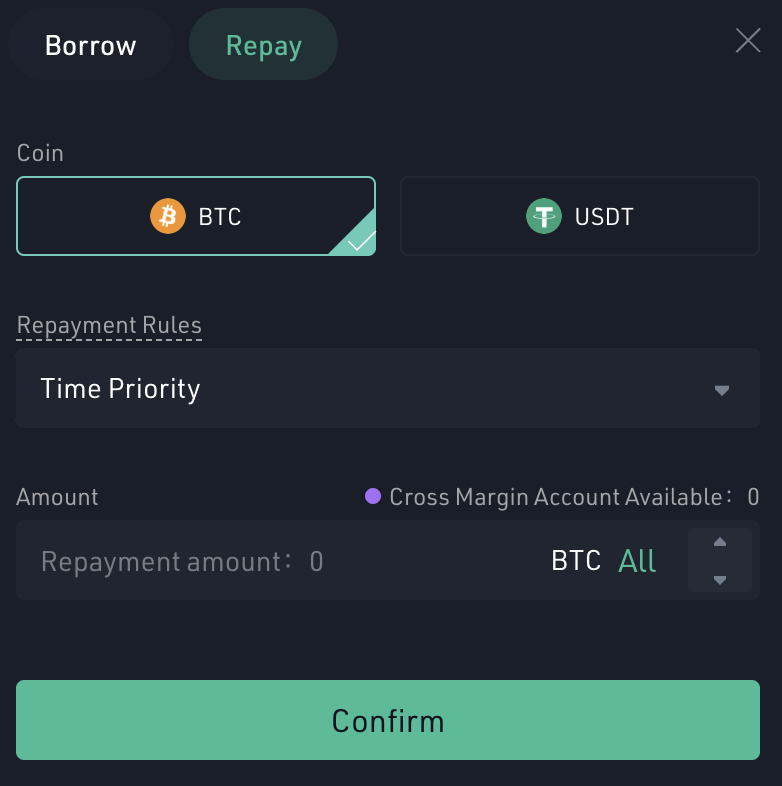

- Repay

When it comes to repaying what you borrowed from the exchange, you will be able to set the rules from the Repay window. You have two options:

Time Priority: In this option, the loans with the closest maturity dates are repaid first.

Rate Priority: In this option, loans with the highest interest rates are repaid first. Also, the loans that have the same interest rates are repaid based on which loan has a maturity date coming up first.

The 2 BTC and interest for the time you borrowed it from the exchange need to be returned before this transaction can be completed.

When your buy order is filled, your position will be closed and there will be the 4 BTC in your account. The rest of the USDT (after fees and interest are deducted) is your profit from the trade.

The profit can roughly be calculated as (22,730 – 20,000) * 4 = 10,920 USDT

Shorting Via KuCoin Futures Trading (Classic)

KuCoin has two ways that you can use Futures contracts to make money off of the falling price of Bitcoin. One of the methods is the Futures Classic method which looks a lot like the interface you would see on big centralized exchanges like Binance or Bybit.

The steps to take your first short trade on Bitcoin using KuCoin Futures Classic Trading interface are as follows:

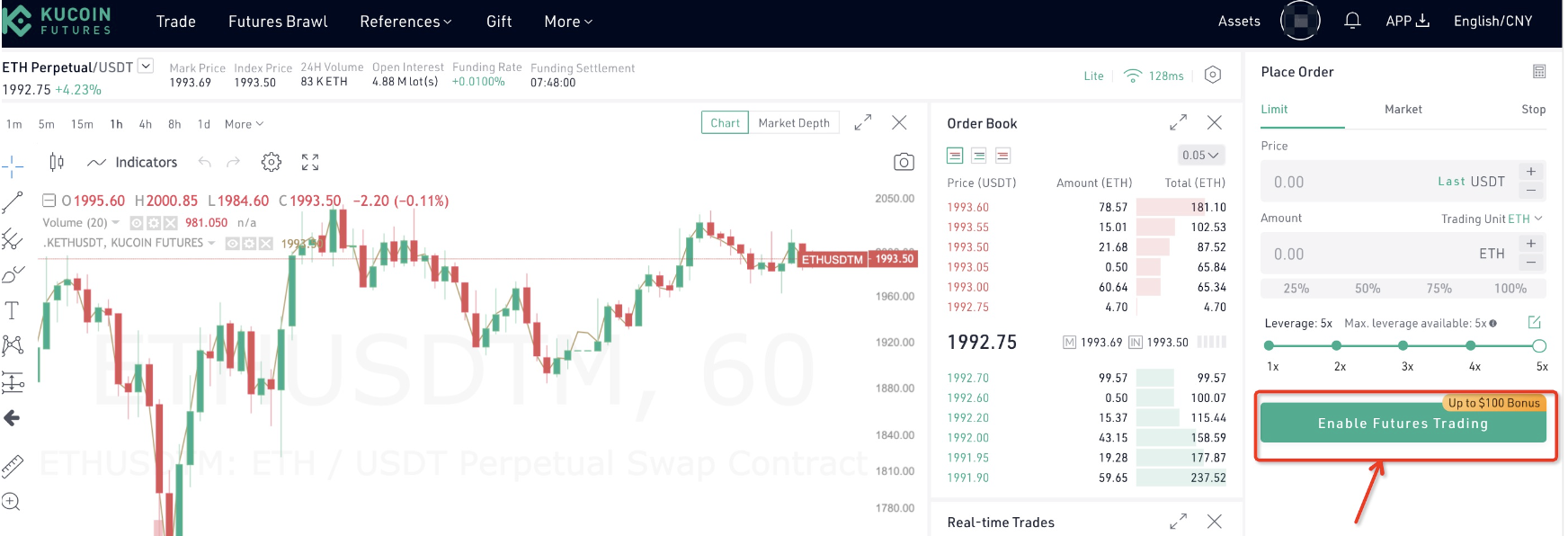

- Enable Futures trading

Enabling Futures trading on KuCoin is as easy as navigating to the ‘Derivatives’ button in the navigation bar, and then clicking ‘Futures Classic’ to show the following screen.

Here you can click ‘Enable Futures Trading’ and then go through the agreement on the screen before ticking ‘I Have Read and Agree’.

Once this is done, you will be asked to set a 6 digit trading password.

- Transfer funds to Futures Account

The next step is to transfer funds to your Futures account which you can do by clicking the green icon next to the ‘Available Balance’. This will take you to a window where you can move funds from your Trading Account to your Futures Account.

In case you do not have funds on KuCoin, you should either transfer funds from an external wallet or buy crypto on the exchange itself.

- Take a Long or Short position based on Market trends and analysis

As per your current understanding of the market, decide whether you want to take a Long position or Short position on the price of your asset. In this case, we are going to take a short position on Bitcoin.

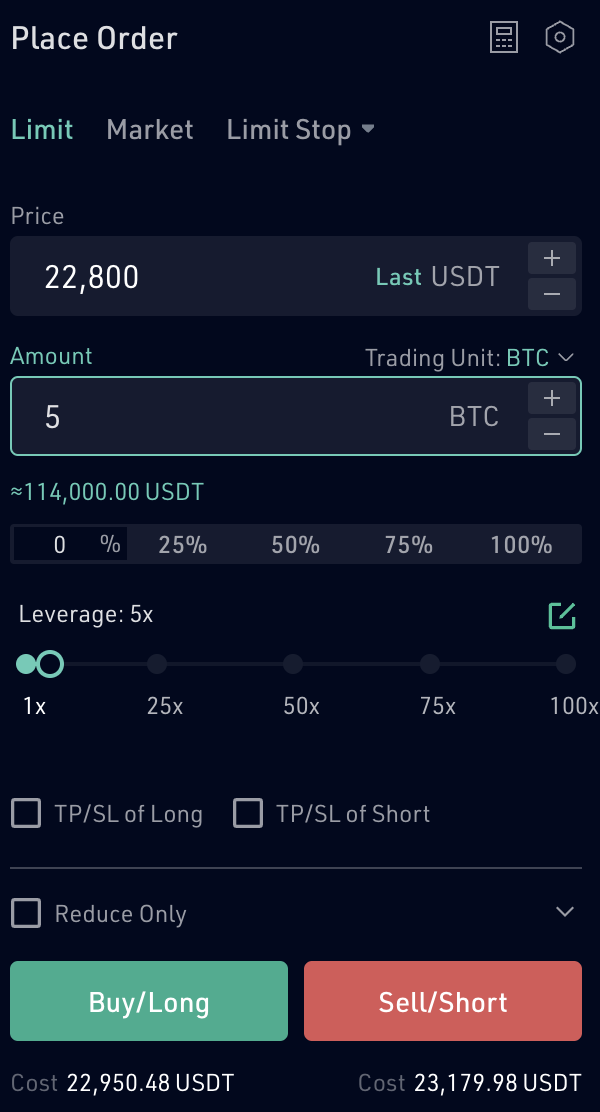

When we want our position to be filled at a certain or better price, we use what is called a Limit order.

Here we will have some bids for a Bitcoin short order when the price reaches 22,800 USDT per Bitcoin. The quantity of Bitcoin in this trade is 5 BTC.

The leverage for this trade will be 5x as we are cognizant that high leverage can liquidate positions rather quickly.

According to the above details, you will need to pay (22,800 * 5) / 5 + fees = 23,179 USDT to take this short position on the BTC Perpetual/USDT pair.

- Close your position at target price

If the target price for this trade according to your calculations is 19,500 USDT, then you will either place a Limit order to buy a Long position at 19,500 USDT for 5 BTC to cancel out the previous short, close the position, and get the principal margin and profits in your wallet.

New to futures trading? Know How much money you need to trade Futures

Or the other way is to place a Market Buy order for 5 BTC when price is close to 19,500 USDT target. For this method, you have to be paying attention to the market whereas for the Limit order, you can set it and forget it.

When you do this, the profits for the position can be calculated as (22,800 – 19,500) * 5 = 16,500 USDT or an ROI of 72.37%

Shorting via Kucoin Futures Trading (Lite)

For audiences that are not well versed with Order Books and Order Depth, KuCoin has come up with a new and simpler interface that gives you some relevant information without overwhelming you with it.

If you have not enabled Futures trading from the KuCoin Futures interface you will see a ‘Enable Contract Trading’ button that you can use to get started.

Once done, you will follow the steps mentioned above to transfer or deposit crypto assets into your Futures Wallet. Those funds will then be visible on this screen if they are in USDT.

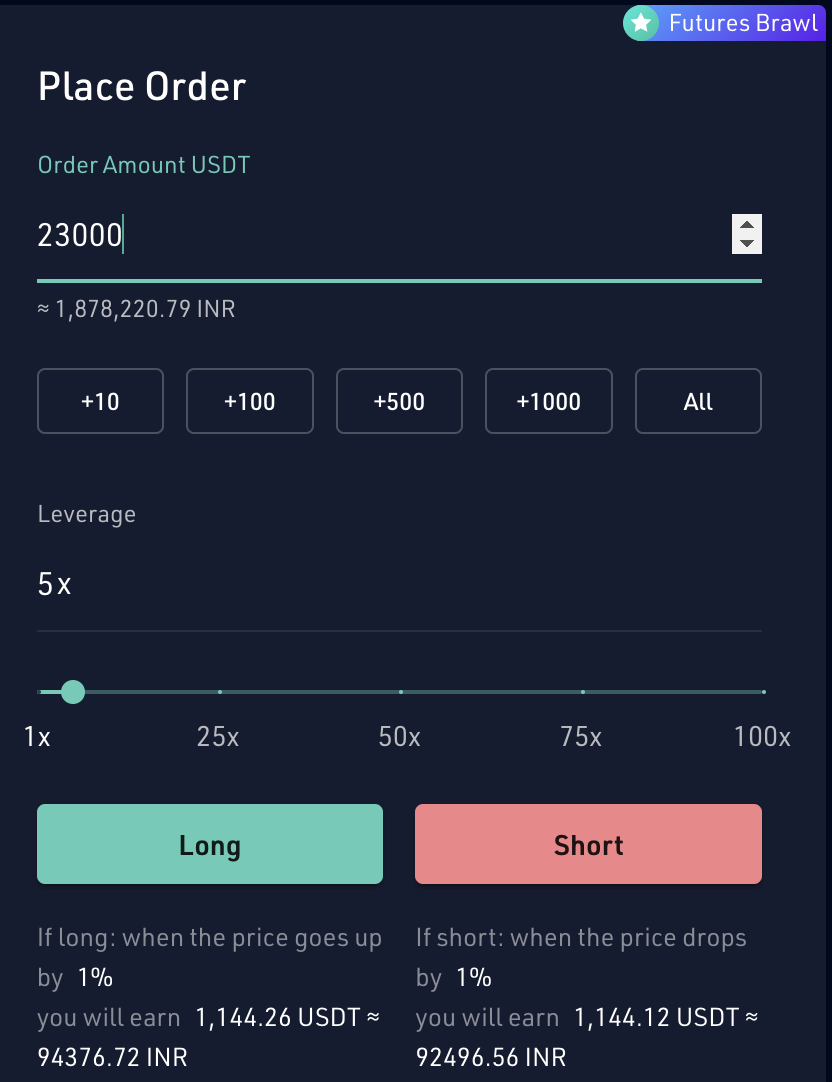

This simplified Futures contract trading interface does not provide you with options in terms of the types of orders you would like to place, and the system only places market orders for you.

Take, for example, that you have 23,000 USDT to invest in a Bitcoin short position at 5x leverage.

Depending on your price target, you will place a Long order when the price of Bitcoin is near it. There is no option to place a Limit order in this interface.

As the screenshot above tells you, a 1% price drop for Bitcoin will net you 1,144.12 USDT.

So if you close your position when the price of Bitcoin goes from 23,000 USDT to 22,770 USDT, the result will be a profit of 1,144.12, not considering the fees to be paid to the exchange.

Shorting Bitcoin using Leveraged Tokens

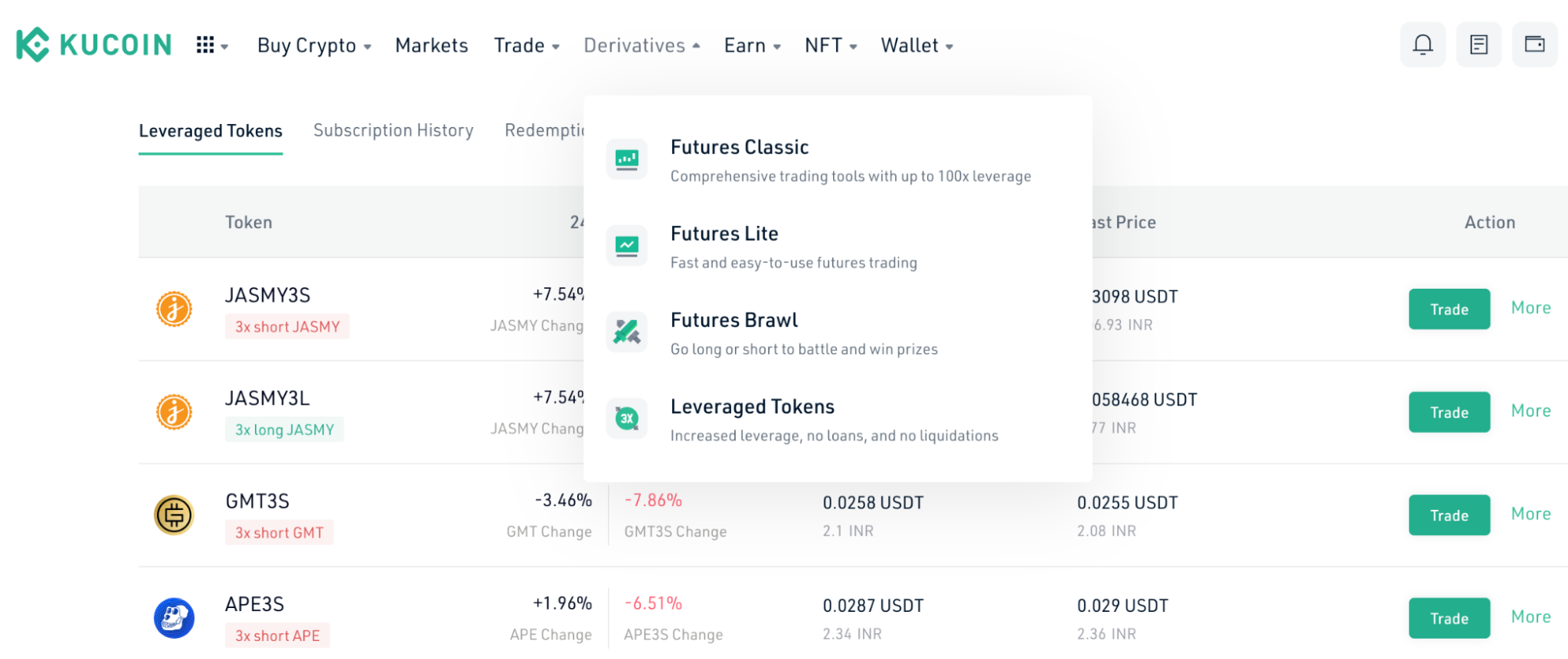

Leveraged tokens are a concept that you will see in some cryptocurrency exchanges, but KuCoin is one of the leading and trusted exchanges that carry the product.

Simply said, Leveraged Tokens are tradable assets that leverage your profits (and also losses) by not having to enter a Futures contract but still going long/short on the underlying asset.

They are different from Margin or Futures trading in the way that there is no collateral or margin maintenance required to hold them, and the best part is that there is 0 liquidation risk.

You can find these tokens under the ‘Derivatives’ section in the Navigation bar on the KuCoin homepage.

Most of the available tokens are 3x longs and 3x shorts on the assets available on the platform.

So, for example, if you buy the BTC3S token, then a 2% price drop for Bitcoin will result in a 6% positive movement for the BTC3S token.

As a rule, you should not hold leveraged tokens for the long term as the rebalancing mechanism, and management fees of the token mean that you will have to pay fees proportionate to how long you have held the token.

So if you want to short Bitcoin in this way, you will buy the BTC3S token at a major resistance or when your analysis tells you to.

When Bitcoin has reached your intended price, you can sell the token and keep the profit after paying the fees to the exchange. Also, to learn more about KuCoin trading, you can check KuCoin tutorial.

Conclusion

Shorting as a concept can be very powerful for a trader because you can then make money when the price of Bitcoin goes up or down.

You have your technical analysis and trading strategies to guide you through when you should take a long position or when you should take a short position.

KuCoin claims to have 1 out of every 4 worldwide crypto traders on their platform.

What this does is create a large order book and consequently liquidity so that your trades can get filled at the appropriate prices and your profit calculations are not thrown off because your sell order filled at a different price from what you expected.