KuCoin is one of the largest cryptocurrency exchanges operating in over 200 countries.

KuCoin allows users to buy, sell and trade cryptocurrencies. Also, the exchange offers different trading options, including crypto margin & futures trading.

Being a popular cryptocurrency exchange, many users are looking to trade futures with it. But if you are a complete newbie to KuCoin and not sure how future trading works on the exchange.

Then to help you out, I have created a detailed guide on how to trade futures on KuCoin.

So let’s get into the topic right away:

How To Trade Bitcoin & Crypto Futures on Kucoin?

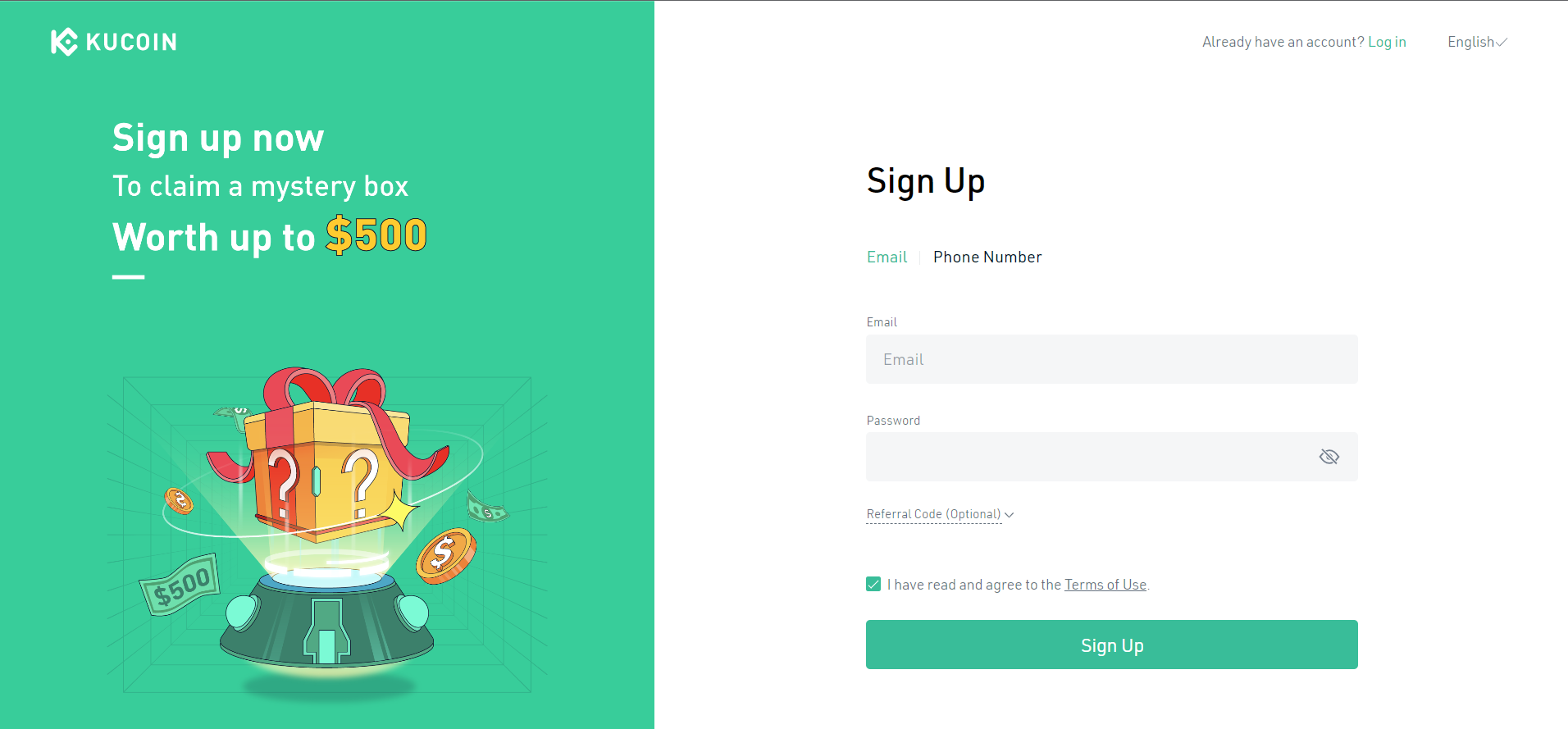

1. Create KuCoin Account

First, start by creating a KuCoin account if you don’t have an account already.

Creating an account on the exchange is a pretty simple process.

Just head over to KuCoin.com and click on the Sign-Up button. Then fill in your details and go through the screen instructions.

2. Deposit Funds

Once you are done creating your account, the next step is to deposit funds.

For this, from your dashboard, click on the Deposit option, and you will find two options- Deposit Crypto or Deposit Fiat. Alternatively, you can also buy crypto using P2P, which can be found under Buy Crypto > P2P.

Also, when you deposit funds from P2P, your funds will get added to your main account, and you are required to transfer the funds to your crypto futures trading before you can start trading.

3. Go To Crypto Futures

After adding funds to your account, the next step is to go to the crypto futures terminal. However, unlike other exchanges, KuCoin offers you two options – Futures Classic and Futures Lite.

Futures Classic is the fully-fledged crypto futures trading terminal that you get to see across cryptocurrency exchanges. It is suited for advanced crypto traders.

While the Futures Lite is a simplified version of the existing KuCoin Futures classic terminal. With this version, KuCoin wants to offer a simpler trading experience with less complexity to newbie traders.

So depending on your choice, click on Futures Classic or Futures Lite.

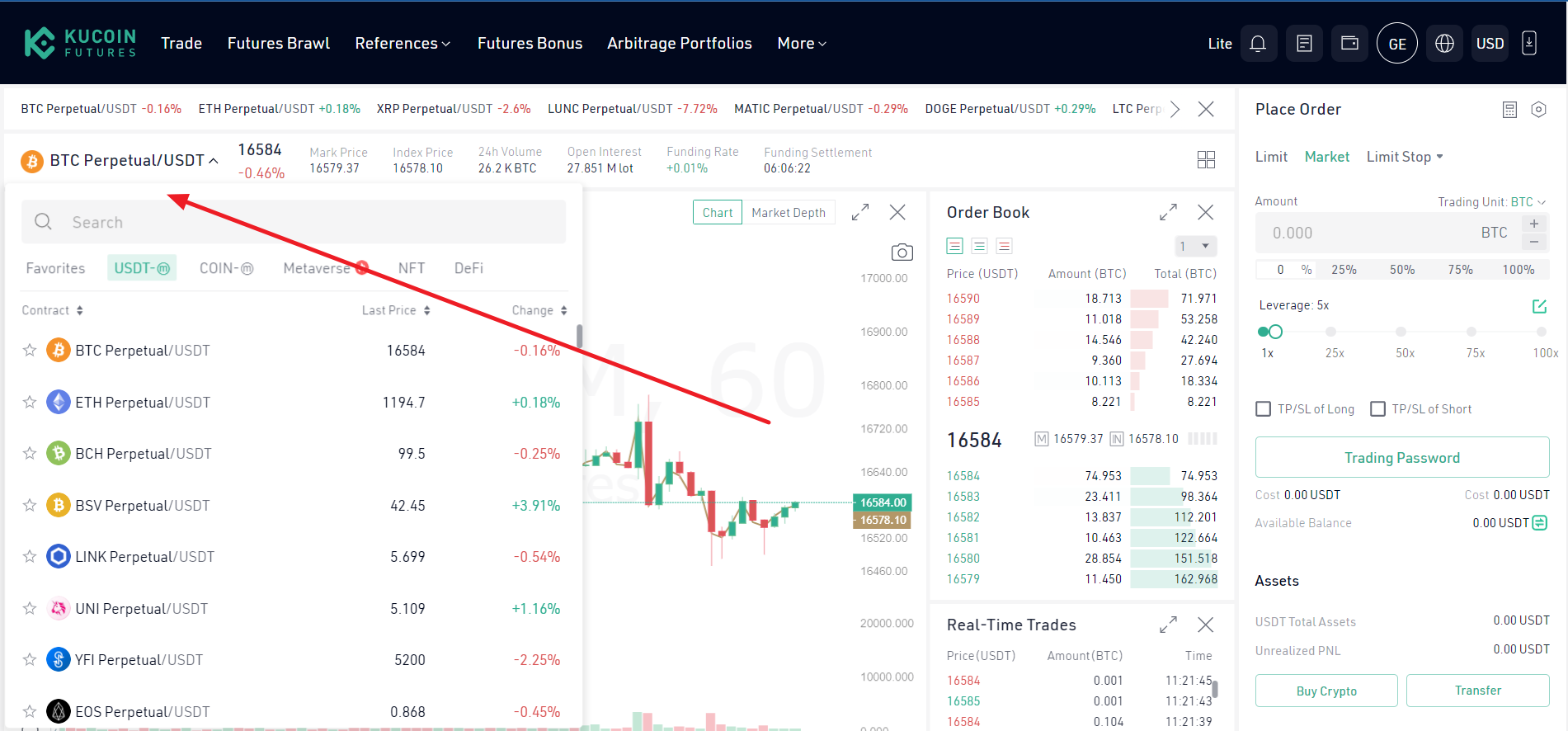

4. Select A Trading Pair

Next, you need to select a trading pair like BTC/USDT or ETH/USDT.

Now, if you have selected Futures Classic earlier, then you need to click on BTC Perpetual/USDT, and it will open a small window from where you can find your preferred trading pair.

For the Futures Lite user, you need to click on BTC PERP/USDT and then select your preferred trading pair such as Ethereum Futures.

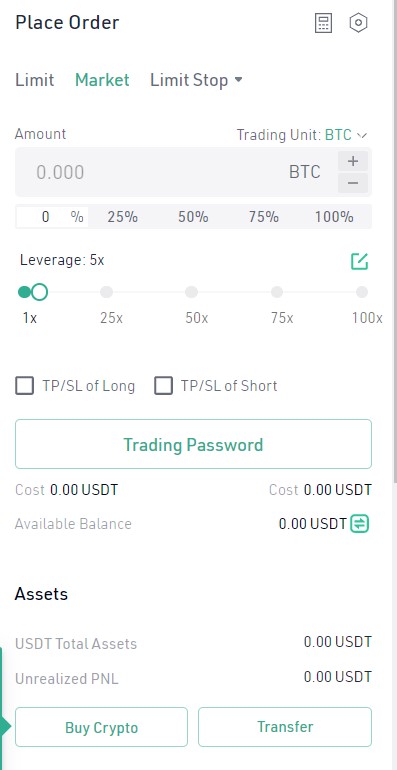

5. Fill Out The Order Form

Coming to placing an order on Futures Classic, you have the order form right on the right side of your screen. On top, you will find your market types like the Limit, Market, and Limit Stop.

Below that, you have the option to enter your trading amount, which represents how much you want to bet. And right below that, you have the leverage slider.

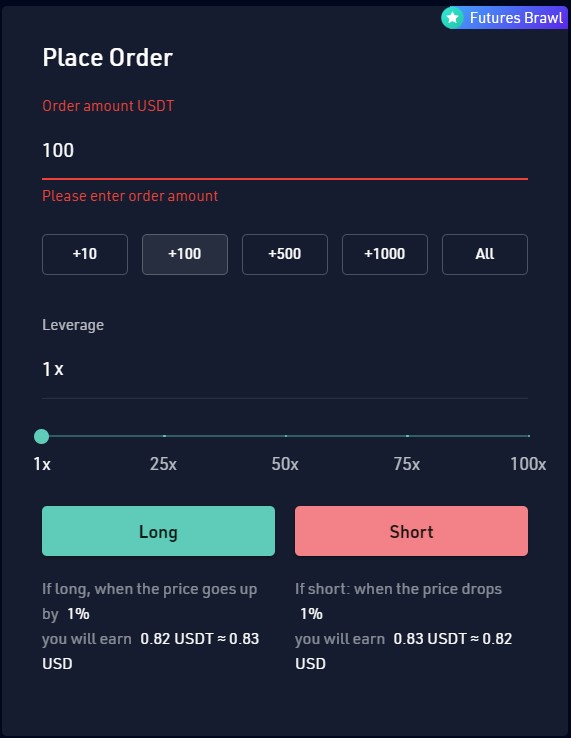

On Futures Lite, you also find the order form on the right side of your screen. It only has two options which are an amount field and the leverage slider.

6. Place Your Order

Finally, it’s time to place your order. For both Futures Classic and Lite, you will find the buying and selling below the order form.

You need to click on the Buy/Long button if you want to place a buying order. Or you can click on Sell/Short to place a sell order.

Once your order is placed, you will find it right below the technical chart. From there, you can cancel, edit or close your order. To get a detailed overview of the exchange, check out KuCoin tutorial for begginers.

What Are KuCoin Futures Fees?

KuCoin offers one of the most competitive fee structures for trading futures.

Also, like most exchanges, it has a tiered fee structure. At level 0, you are required to pay a maker and a taker fee of 0.02% and 0.06%, respectively.

As you level up, you will see a difference in the maker and taker fees. For instance, users at level 12 will enjoy a maker and a taker fee of -0.015% and 0.03%, respectively.

FAQs

- Is KuCoin Futures legal in the US?

KuCoin Spot or Futures trading is prohibited in the United States. As KuCoin doesn’t have an operating license in the country.

On top of that, US rules prohibit anyone from trading crypto futures on unregulated exchanges. So even if USA users sign up on the exchange, their account will not be verified, and they will only have access to certain features.

- What is 100x Futures on KuCoin?

100x represents leverage. The higher leverage you have, the higher the trading position you will be able to open. 100x means that your initial margin is magnified to 100x.

For instance, if you are betting 10 USDT per trade with 100x leverage, then your position size would be 1000 USDT.

This allows you to make a significant profit using a low margin. But it also comes with significant risk.

Conclusion

So that was all for how to trade futures on KuCoin.

KuCoin is one of the preferred crypto exchanges to many. It has cheap trading fees with a huge volume of trades. So go ahead and check the exchange out and see how well you find it.

Newbie in Futures Trading? Know What is expiry in Crypto Futures?