MEXC prides itself on its innovative products, while Huobi’s reputation for security and liquidity is hard to overlook.

From my own extensive experience in crypto trading, I’ve found both of these platforms to offer unique features.

Navigating the complex arena of crypto margin trading exchanges can be daunting, especially when trying to pick between renowned platforms like MEXC and Huobi.

In the following comparison, I’ll delve into the critical aspects of MEXC and Huobi, including fees, supported cryptocurrencies, user experience, and more.

Whether you’re new to trading or a veteran, this analysis aims to guide your decision-making.

Let’s dive in!

MEXC vs Huobi: At A Glance Comparison

MEXC, based in Singapore, is an exchange that has quickly grown in popularity due to its extensive list of supported cryptocurrencies and competitive fees.

But the real question is, can it match up to Huobi?

Huobi, also based in Singapore, is one of the world’s top 10 cryptocurrency exchanges in terms of trading volume.

It offers various services, including spot trading, Futures trading, and even staking services.

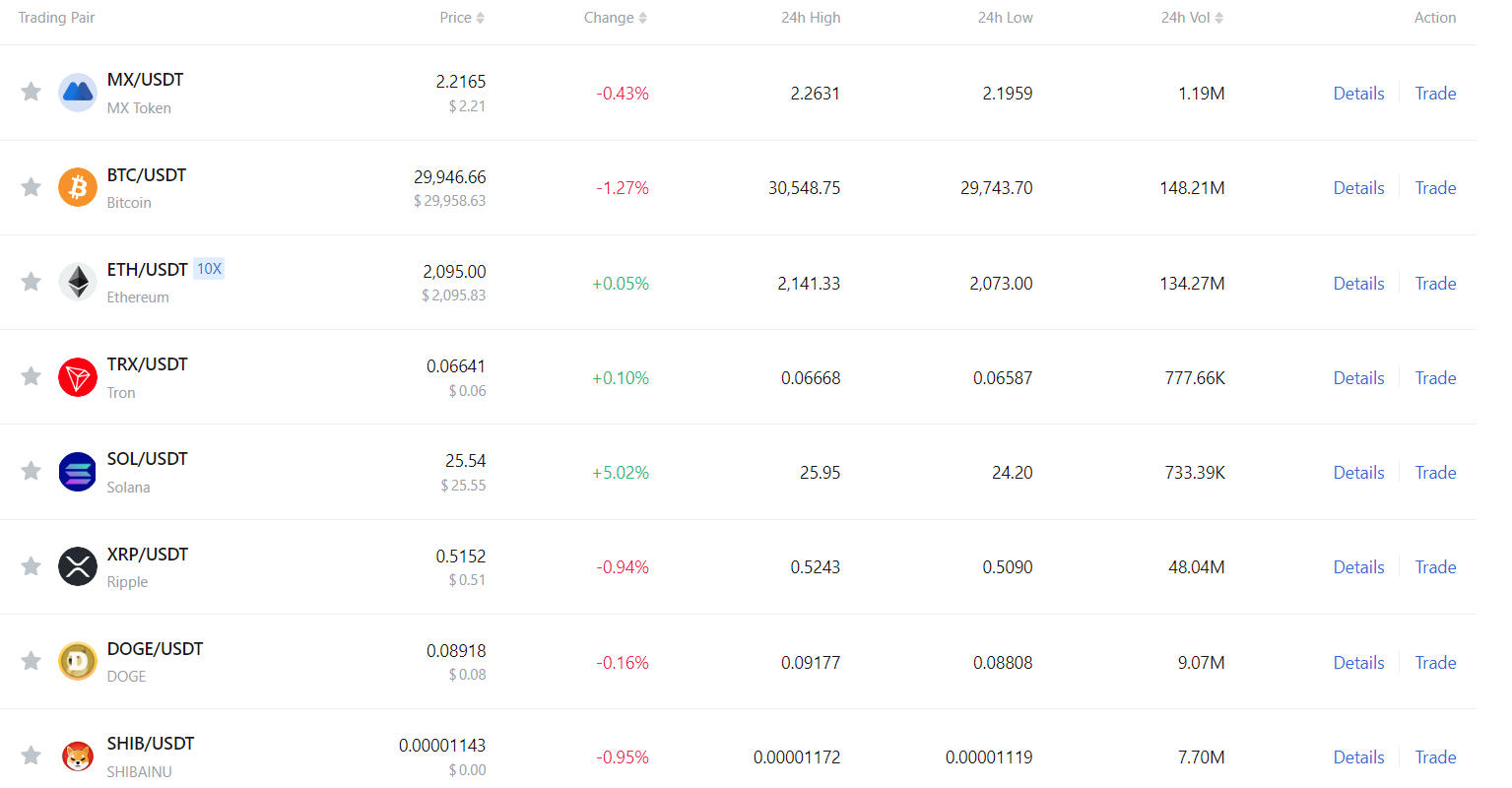

Regarding the number of cryptocurrencies offered, both MEXC and Huobi support a wide range of tokens, with Huobi offering slightly more.

As for trading volume, Huobi undoubtedly leads, making it an excellent choice for high liquidity.

However, MEXC offers decent liquidity levels and should not be disregarded for this reason alone.

Regarding the user interface, both exchanges provide a sleek and easy-to-use platform.

Yet, Huobi takes the cake with its more intuitive layout and mobile app functionality.

Now let’s talk fees.

Both exchanges have competitive fees, but MEXC edges out with slightly lower fees overall, especially when using the platform’s native token for transactions.

But don’t make up your mind just yet. We’ve got more comparisons coming up, so stay tuned!

MEXC vs Huobi: Trading Markets, Products & Leverage Offered

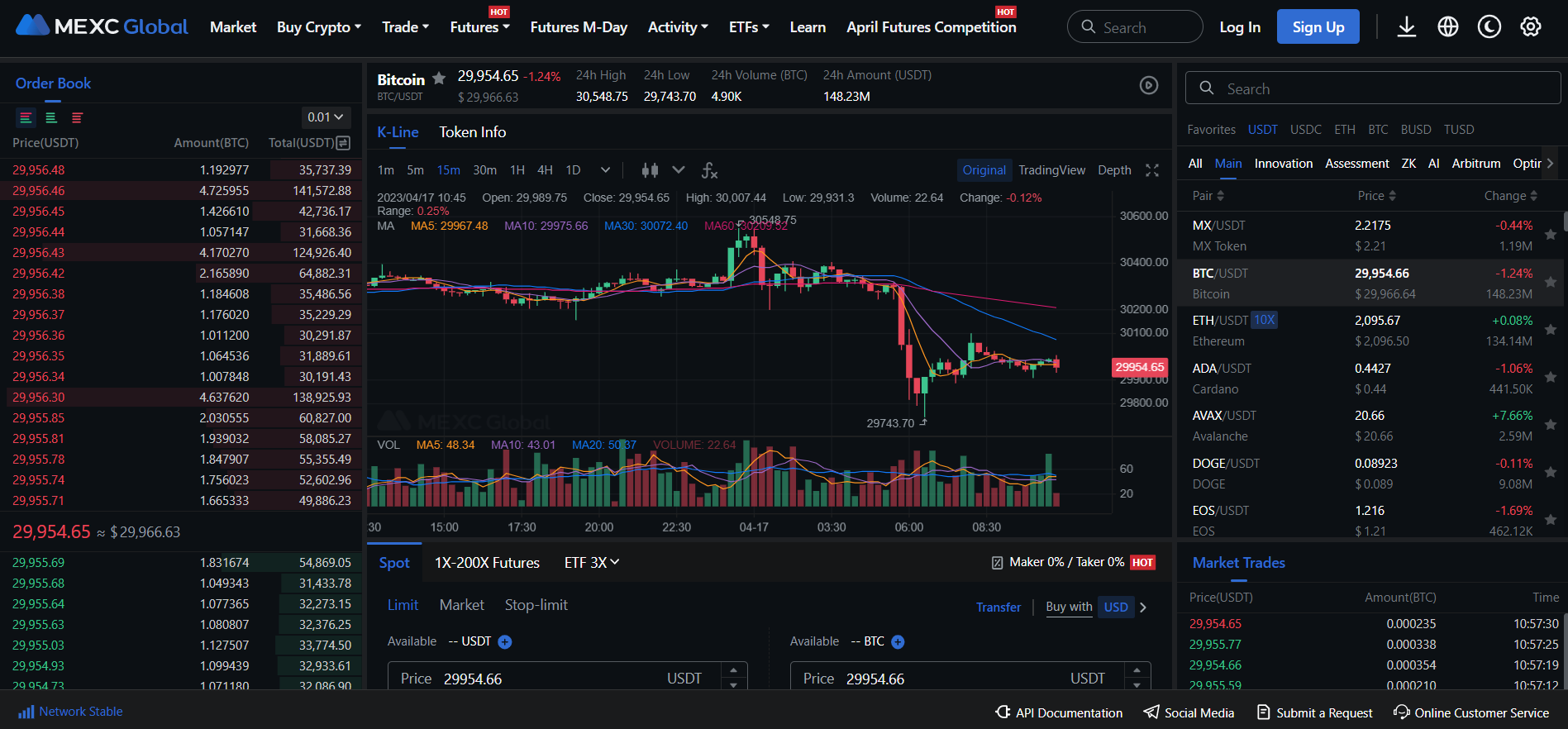

MEXC provides an extensive selection of trading markets, including spot, margin, ETF, and Futures trading.

The platform also offers leveraged ETFs allowing traders to gain exposure to price movements without owning the underlying asset.

MEXC offers leverage up to 100x on certain Futures contracts, but keep in mind with great leverage comes great risk.

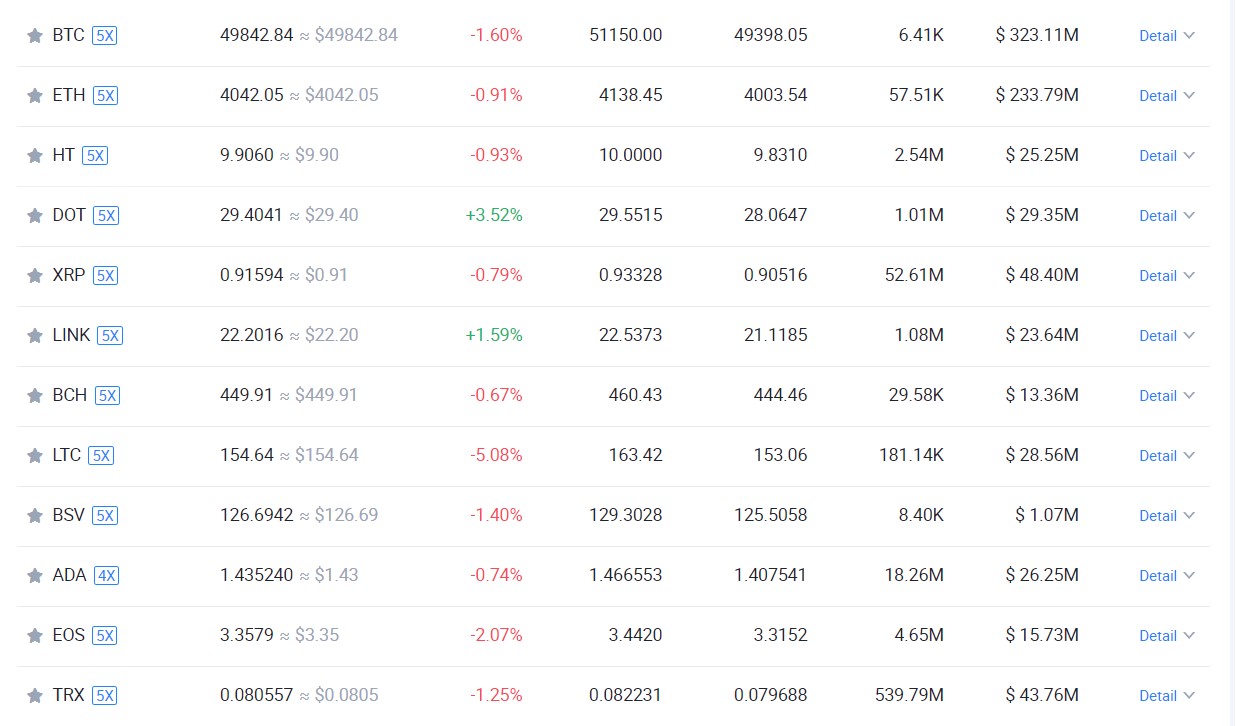

Huobi offers spot trading, margin trading, Futures trading, and swaps. Notably, Huobi’s Futures market offers leverage up to 125x, higher than that offered by MEXC.

For derivative products, both exchanges offer various options, such as Futures and perpetual contracts.

However, Huobi stands out by providing Options trading, which can be a valuable tool for risk management.

For staking and yield farming enthusiasts, both platforms offer staking services where users can earn rewards by staking their cryptocurrencies. But Huobi has a slight advantage with its well-structured yield farming program.

So, which platform is the winner?

While MEXC offers an impressive range of services, Huobi’s wider leverage options and additional offerings, such as Options trading, give it an edge in this category.

Don’t rush off just yet. There’s more to compare!

MEXC vs Huobi: Supported Cryptocurrencies

MEXC supports many cryptocurrencies, from well-known giants like Bitcoin and Ethereum to emerging altcoins.

The platform is known for listing promising projects early, allowing traders to invest in potentially high-growth assets.

Switching gears to Huobi, this platform also supports a comprehensive list of cryptocurrencies, including Bitcoin, Ethereum, and many others.

Huobi is often lauded for its commitment to variety, offering traders a vast spectrum of altcoins.

But here’s the thing: Huobi supports a massive selection of cryptocurrencies and has Huobi Token ($HT), its native cryptocurrency.

$HT offers several benefits, such as fee discounts, voting rights, and more, adding an extra utility layer to the Huobi platform.

So, who takes the cake?

The added utility of Huobi’s native token gives it a slight edge over MEXC in this category.

But remember, variety is just one factor to consider, so let’s move on to the next comparison.

MEXC vs Huobi: Trading Fee & Deposit/Withdrawal Fee Compared

Starting with MEXC, their fee structure is competitive. They operate on a maker-taker model, depending on your 30-day trading volume.

They charge no fees for spot trading and 0%/0.01% for Futures trades.

The same goes for withdrawal fees, which are relatively lower than many other exchanges. There are no deposit fees on MEXC.

On the other hand, Huobi also operates on a maker-taker fee structure charging 0.2% for both.

Huobi offers further fee reductions for users holding their native Huobi Token ($HT), which could make a significant difference for active traders.

Comparing withdrawal fees, Huobi’s rates vary based on the specific cryptocurrency, but they aim to keep them as low as possible.

Huobi also charges a minimal deposit fee, which MEXC does not.

So, who’s the winner?

Huobi’s additional discounts for $HT holders might tip the scales in its favor for active traders.

For less active traders or those not interested in holding $HT, MEXC could be a better option due to its lower withdrawal fees and no deposit fee.

Let’s keep moving to see what else these crypto futures platforms offer.

MEXC vs Huobi: Order Types

MEXC supports the basic order types, including market, limit, and stop-limit orders.

It’s quite straightforward and user-friendly, making it suitable for beginners.

However, the offerings might feel limited for seasoned traders who desire more complex strategies.

In contrast, Huobi seems to have been built with the experienced trader in mind.

Besides the basic market, limit, and stop-limit orders, Huobi also offers advanced order types like Post-Only orders, Fill or Kill orders, and Immediate or Cancel orders.

So, If you are a beginner, MEXC’s simpler interface and basic order types could be all you need to get started.

But for more seasoned traders, Huobi’s advanced order types could offer an extra edge in your trading strategy.

Keep reading. There’s more to discover!

MEXC vs Huobi: KYC Requirements & KYC Limits

MEXC takes a tiered approach to its KYC process, like many exchanges.

Unverified users can make trades but have restrictions on withdrawal limits.

To fully unlock its features, you must provide identification details for verification.

It’s a fairly standard process designed to ensure your account’s security.

On the other hand, Huobi offers a more relaxed KYC policy.

While it does encourage users to complete their KYC for better account security and higher withdrawal limits, you can still trade and withdraw a significant amount of cryptocurrencies daily without going through the KYC process.

Huobi might be more appealing if you prefer anonymity due to its more lenient KYC policy.

However, if you plan to make large transactions and security is your top concern, MEXC’s robust KYC procedures can provide greater peace of mind.

The journey doesn’t end here, though. There’s more to learn about each platform.

So, let’s move on to the next section!

MEXC vs Huobi: Deposits & Withdrawal Options

Starting with MEXC, the platform allows deposits and withdrawals in many cryptocurrencies.

However, one potential downside is that it doesn’t support fiat deposits or withdrawals.

This means you’d need to have cryptocurrencies to begin trading on MEXC.

Conversely, Huobi offers a broader range of deposit and withdrawal options.

It supports numerous cryptocurrencies, just like MEXC, but it also accommodates fiat transactions.

You can deposit and withdraw in several global currencies, which makes it more flexible and accessible, especially for new users.

While both platforms are competitive regarding cryptocurrency transactions, Huobi stands out with its support for fiat currency.

But wait, there’s more! Stay tuned!

MEXC vs Huobi: Trading & Platform Experience Comparison

MEXC flaunts a user-friendly and intuitive platform design.

It provides detailed market data and technical analysis tools to help traders make informed decisions.

Advanced trading features such as spot, margin, and Futures make the platform more appealing to experienced traders.

And guess what? Its mobile app ensures trading on the go is a breeze.

On the other hand, Huobi boasts an equally impressive platform. It offers spot trading, Futures trading, margin trading, and more.

Moreover, its interface is clean and easy to navigate, with a wealth of data at your fingertips.

It also has robust charting tools and offers a seamless mobile trading experience.

Huobi’s trading experience is slightly more polished, and its extensive features edge out MEXC in this round. To learn more about the exchange, check this guide on how to short Bitcoin on Huobi.

Hang in there. We’re almost done!

MEXC vs Huobi: Customer Support

MEXC provides round-the-clock customer support through a live chat feature, email, and a comprehensive FAQ section.

In addition, it offers a Help Center where users can access articles and guides about using the platform.

They also maintain a strong presence on social media platforms, responding promptly to queries.

In comparison, Huobi also boasts 24/7 customer support. They offer assistance via live chat, email, and a detailed FAQ section.

One thing that sets them apart is their extensive range of educational resources, from beginners’ guides to deep-dive strategy discussions.

And guess what else?

Huobi’s customer support has been praised for its fast response times and the professionalism of its support staff.

Both exchanges have robust support systems in place.

However, with its slightly faster response times and comprehensive educational resources, Huobi nabs this round.

MEXC vs Huobi: Security Features

MEXC uses a comprehensive security system that includes cold storage wallets, a multi-signature withdrawal process, two-factor authentication (2FA), and anti-DDoS protection.

It has so far managed to maintain a clean security record, with no major hacks reported.

On the other hand, Huobi implements a ‘Secure, Stable, Efficient’ security model. It includes an in-house risk control department, cold storage for funds, 2FA, and encryption technology.

They also have a Security Reserve Fund to cover losses in case of any security breach.

And the icing on the cake? Like MEXC, Huobi has an impressive security track record.

Huobi takes the slight edge because of its Security Reserve Fund, giving it that added layer of financial protection for its users.

Is MEXC Safe & Legal To Use?

Yes, absolutely. MEXC operates under the legal framework and is registered in Singapore, known for its strict financial regulations.

It upholds robust compliance with local laws and international regulations. This alone should provide you with some peace of mind.

But let’s not stop there.

Safety goes beyond legalities, right?

MEXC implements robust security measures such as cold storage wallets, multi-signature withdrawal processes, and 2FA.

Plus, it has a clean track record with no known security breaches. Quite reassuring.

Is Huobi Safe & Legal To Use?

Regarding legality, Huobi, founded in China and now headquartered in Seychelles, operates legally in many countries worldwide.

They follow local rules and regulations to provide a legal trading environment for their users.

But what about security?

This is where Huobi truly shines. It deploys a ‘Defense in Depth’ and ‘Clustering Program’ to protect users’ digital assets.

Their risk control system has also passed many security audits and testing, offering higher protection against hackers.

Moreover, they maintain a User Protection Fund as insurance against potential asset losses.

MEXC vs Huobi Conclusion

And here we are, at the finish line of our MEXC vs Huobi journey.

For savvy traders out there looking for a wide array of cryptocurrencies, MEXC seems to be the right choice.

On the other hand, if a user-friendly interface, robust security, and global reach matter more, Huobi is your go-to.

So yes, using both can open up a world of possibilities.

But remember, every trader has unique needs.

Happy trading!

Learn how does MEXC & Huobi stack up against the competition: