I’m often asked which is the best crypto future trading platform: MEXC or Binance.

Both exchanges are popular and offer many features, so deciding which is right for you can be challenging.

In this article, I’ll compare and contrast MEXC and Binance on key factors, including fees, trading volume, security, and support assets.

I’ll also share my opinion on which exchange is the better choice for most users.

So whether you’re a beginner or a seasoned crypto trader, read on to learn more about MEXC and Binance and determine which exchange is right for you.

MEXC vs Binance: At A Glance Comparison

| Features | MEXC | Binance |

| Location | Headquartered in Singapore | Maintains a decentralized structure with multiple locations |

| Trading Markets | Offers spot, margin, and futures trading | Offers spot, margin, futures, and options trading |

| Supported Cryptocurrencies | Provides access to more than 850 cryptocurrencies | Supports over 1,500 cryptocurrencies |

| Order Types | Advanced order types available | Offers a broader range of order types |

| User interface | Mobile and web platform | Mobile, web, and desktop platform |

| Customer Support | 24/7 customer support via live chat and email | 24/7 customer support through live chat, email, and a comprehensive FAQ section |

| Security | 2-Factor Authentication (2FA) for enhanced security | 2FA, AI risk control system, and SAFU (Secure Asset Fund for Users) for heightened security |

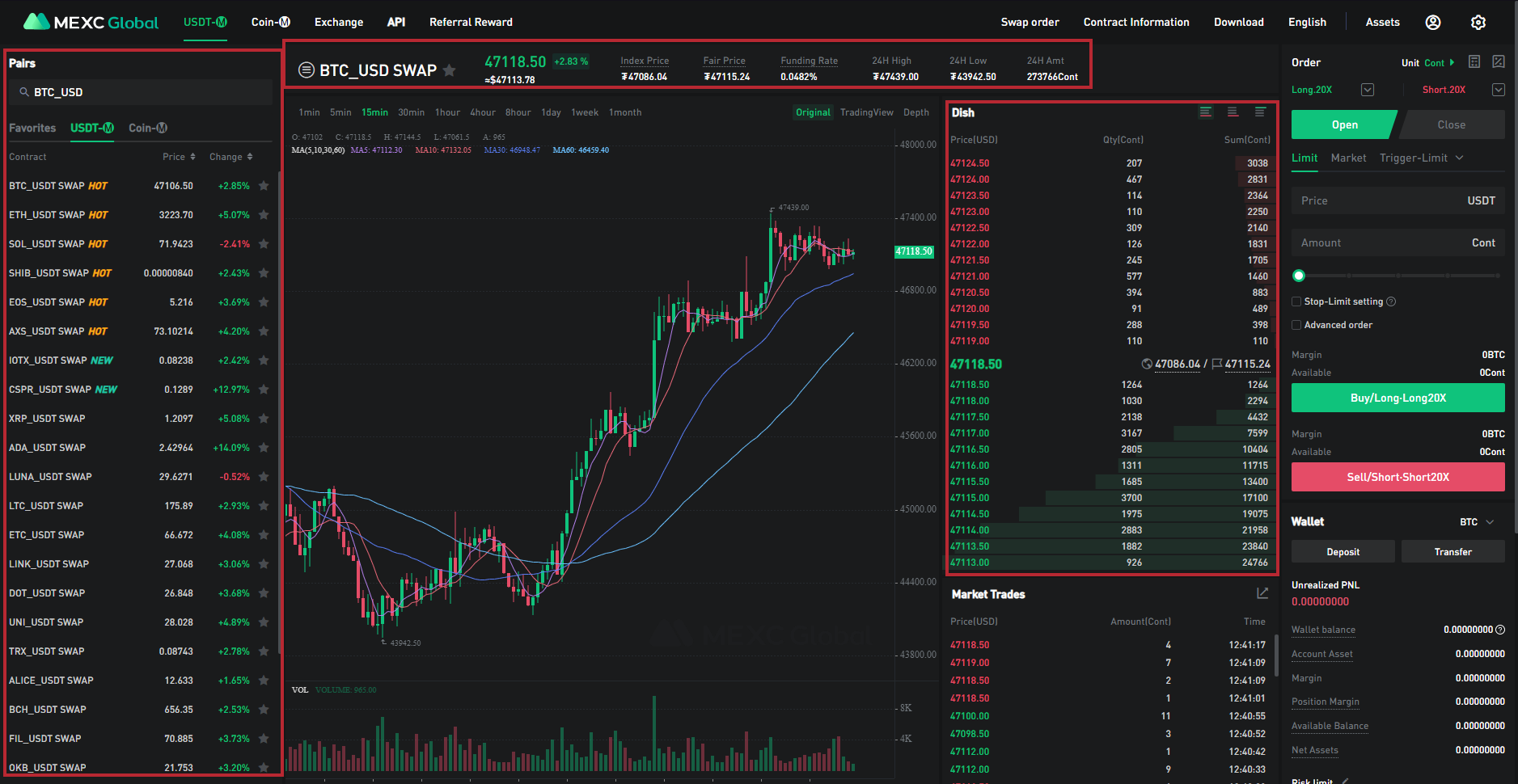

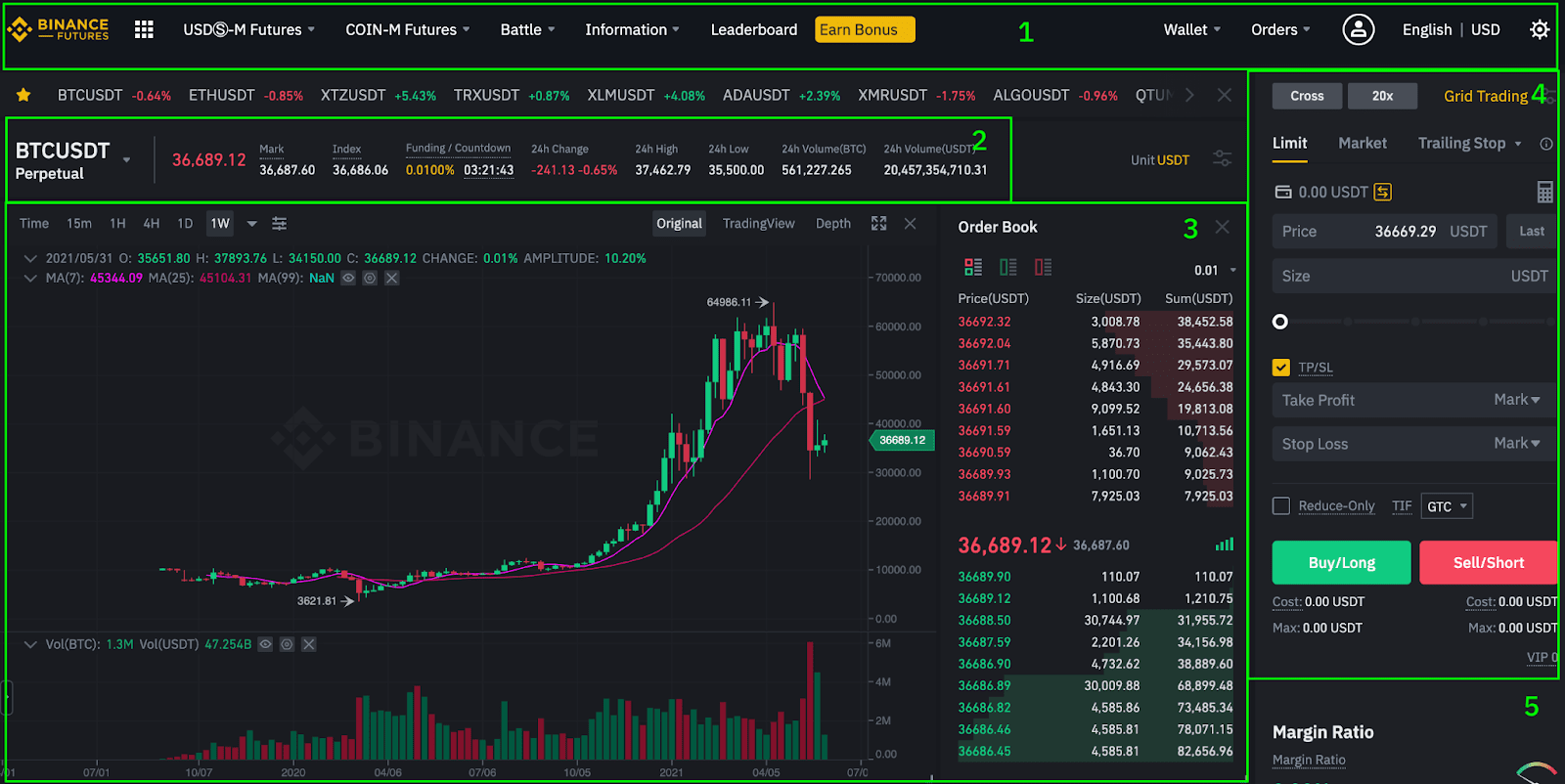

MEXC vs Binance: Trading Markets, Products & Leverage Offered

MEXC and Binance both offer a wide range of trading markets, allowing their users to trade various cryptocurrencies against each other or against fiat currencies.

MEXC offers spot, margin, and Futures trading, which should satisfy the needs of most traders.

Binance, however, takes it a step further by offering Options trading as well.

This provides traders with more flexibility in terms of the strategies they can use and could be particularly appealing to advanced traders who are comfortable using more complex financial instruments.

In terms of leverage, both platforms offer leverage trading. MEXC allows leverage up to 100x on certain Futures contracts, which is quite competitive.

Binance, on the other hand, offers up to 125x leverage on Futures contracts, providing even more potential for traders who know how to manage risk effectively.

Verdict: Binance stands out with its Options trading and slightly higher leverage limits. Therefore, if you are looking for more trading options and higher leverage, Binance would be a better choice.

MEXC vs Binance: Supported Cryptocurrencies

MEXC supports over 850 cryptocurrencies, including popular ones such as Bitcoin, Ethereum, and Ripple, as well as lesser-known altcoins.

Binance, being one of the largest cryptocurrency day trading platform in the world, provides access to an even larger pool of cryptocurrencies, boasting over 1500 coins and tokens.

This includes popular mainstays as well as a number of niche and emerging cryptocurrencies.

The number of trading pairs offered by both exchanges is also quite extensive.

This allows users to trade directly between many different cryptocurrencies without having to go through a common intermediate like Bitcoin or Ethereum.

Verdict: If the number of supported cryptocurrencies is your primary concern, Binance takes the lead with its wider selection.

MEXC vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

Binance Futures operates a tiered trading fee structure, where the more you trade, the lower your fees will be, whereas MEXC has a flat fee structure.

MEXC does not charge you for spot trading. For Futures, the fee starts at 0%/0.01% for makers and takers. Deposit fees on MEXC are generally free, while withdrawal fees vary depending on the currency.

On the other hand, Binance starts at a slightly lower standard spot trading fee of 0.10%/0.10%, which can go as low as 0.012%/0.024% for high-volume traders.

Like MEXC, Binance also generally does not charge for deposits, but withdrawal fees are different for each cryptocurrency.

Verdict: In terms of trading fees, MEXC holds an advantage due to its lower rate. Withdrawal fees depend on the currency, so it would be wise for traders to look into the specific fees of the cryptocurrencies.

MEXC vs Binance: Order Types

Understanding the range of order types provided by an exchange can give traders more control and flexibility in their trading strategies.

MEXC offers basic order types including market orders, limit orders, and stop orders. It also offers more advanced types, such as trailing stop orders and One Cancels the Other (OCO) orders.

Binance, on the other hand, provides an even wider array of order types. In addition to those offered by MEXC, Binance also supports iceberg orders, post-only orders, time-in-force orders (GTC, IOC, FOK), and margin trading orders.

This makes Binance a versatile platform for both novice and advanced traders.

Verdict: When it comes to the range and sophistication of order types, Binance has a clear edge over MEXC. However, MEXC’s selection might be more than sufficient for beginners and casual traders.

MEXC vs Binance: KYC Requirements & KYC Limits

KYC, or Know Your Customer, is a mandatory process for many exchanges to verify the identity of their users. This process can affect your trading limits and may determine how you can interact with the exchange.

MEXC implements a tiered KYC system, which increases your privileges as you provide more verification details.

For instance, level 1 verification requires your personal details along with an email address and grants a daily withdrawal limit of 40 BTC.

To achieve level 2, users need to provide additional information, such as their facial recognition information, which raises their daily withdrawal limit to 100 BTC.

Binance also operates on a similar tiered system, but you need to complete KYC before you can start trading. The basic level requires personal information, your government-issued ID, and facial recognition.

After this, you are allowed a daily withdrawal limit of up to 8 million BUSD.

Higher levels of verification, requiring proof-of-address documents, increase this limit substantially. The highest verification level offers a withdrawal limit of up to 8 million BUSD and $2 million in fiat deposits and withdrawals.

Verdict: Both MEXC and Binance have similar KYC procedures, but Binance requires you to be verified before you can place a trade. So MEXC wins this one if you want to safeguard your identity and still be able to trade.

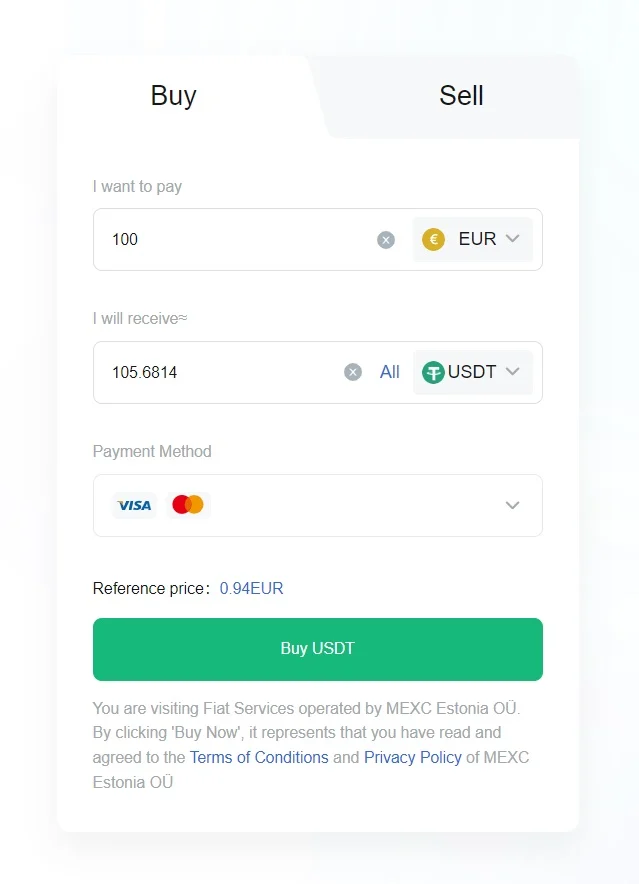

MEXC vs Binance: Deposits & Withdrawal Options

Deposits and withdrawal options, including the variety of available methods, speed, and costs, are key determinants when choosing an exchange.

MEXC allows deposits in a vast array of cryptocurrencies, ranging from Bitcoin and Ethereum to various altcoins.

There are options for credit/debit cards or bank transfers to have an on-ramp for fiat. Withdrawals are made in cryptocurrencies, and the withdrawal fee depends on the specific coin.

Binance offers a more flexible deposit and withdrawal system.

In addition to a wide array of cryptocurrencies, it accepts fiat deposits through multiple methods, such as bank transfers, credit/debit cards, and third-party payment processors.

The exchange has also partnered with Simplex to facilitate purchases using Visa and Mastercard. Binance’s withdrawal options mirror the deposit options, and the fees vary with the method and coin chosen.

Verdict: It is a tie as both exchanges have similar options for deposits and withdrawals.

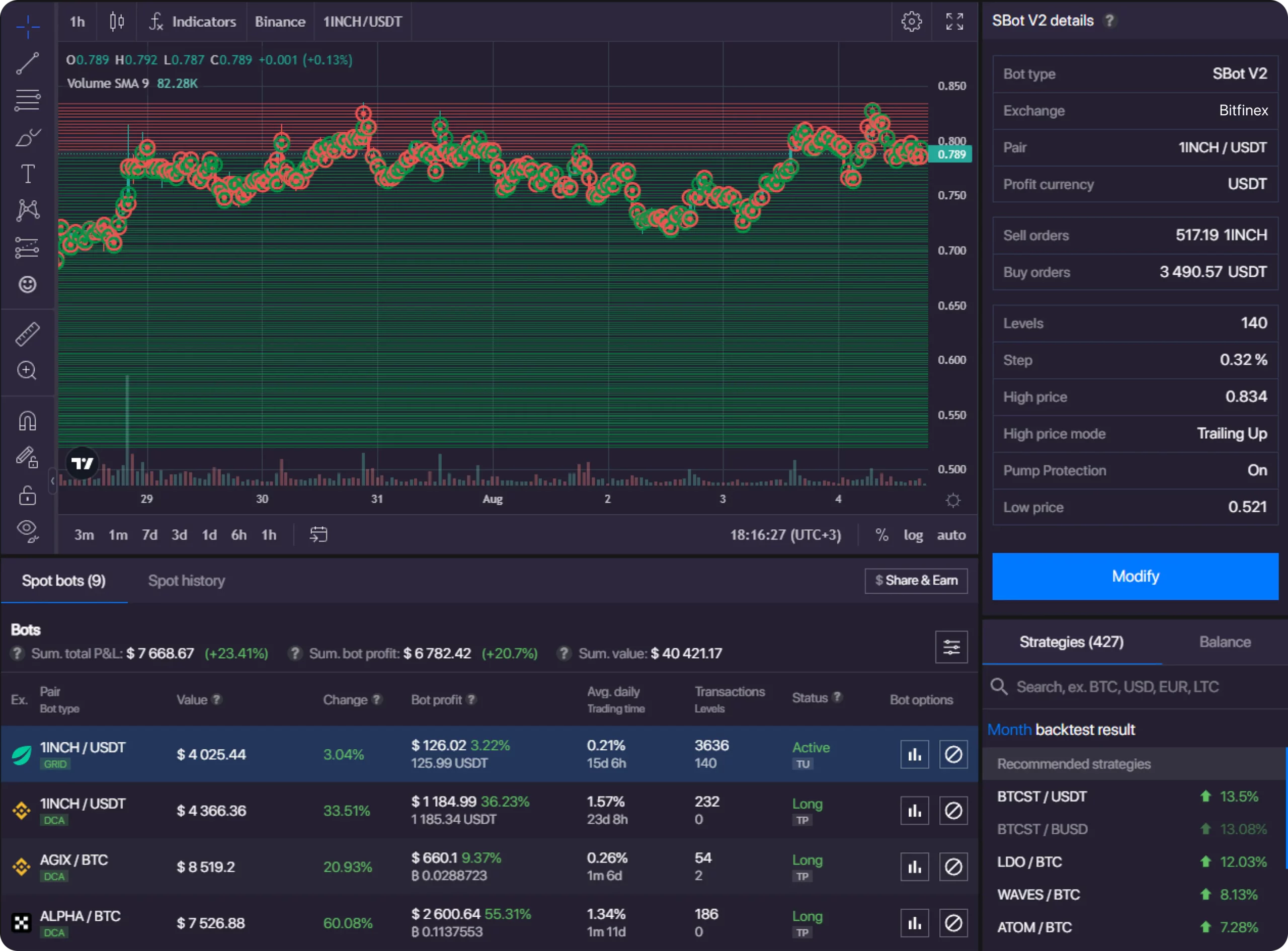

MEXC vs Binance: Trading & Platform Experience Comparison

In terms of platform and trading experience, both MEXC and Binance offer intuitive interfaces that cater to beginners and experienced traders alike.

MEXC’s platform is clean, user-friendly, and easy to navigate. Trading features include spot trading, margin trading, ETF trading, futures trading, and leveraged ETFs.

Its trading engine is reliable, and orders are executed swiftly. However, compared to other leading exchanges, its tools for analysis and trading might be somewhat limited.

Binance, on the other hand, is renowned for its advanced trading interface, offering a variety of trading options such as spot, margin, Futures, and peer-to-peer (P2P) trading. To learn how to trade on the exchange, check this how to trade margin on Binance tutorial.

It provides a comprehensive suite of analysis tools, charting capabilities, and indicators to help users make informed decisions.

The platform also supports algorithmic trading and provides APIs for custom-built trading bots. The Binance mobile app is highly rated and available for both iOS and Android devices.

Verdict: Binance comes out ahead in this aspect due to its sophisticated and comprehensive trading tools, variety of trading options, and top-notch mobile app.

MEXC vs Binance: Customer Support

Customer support is a crucial aspect to consider when choosing a cryptocurrency exchange.

MEXC offers customer support through email and live chat on its platform. The exchange is also active on social media platforms like Telegram and Twitter, where it responds to user queries.

However, some users have mentioned delayed responses during high-traffic periods.

Binance has a comprehensive help center with guides and FAQs that address the most common issues. They also offer 24/7 live chat and email support and have a presence on multiple social media platforms.

Binance also offers telephone support in some countries – a feature not commonly found among exchanges.

Despite this, there have been reports of slow responses and unresolved issues, especially during intense market activity.

Verdict: Binance slightly edges out MEXC due to its more comprehensive range of support options, including telephone support.

MEXC vs Binance: Security Features

When dealing with digital assets, security is a top priority.

MEXC incorporates multi-layered security protocols such as a multi-signature withdrawal process, cold storage, and two-factor authentication (2FA).

Their system runs regular risk assessments and security audits to identify and deal with potential threats.

MEXC also has an insurance fund to provide some level of compensation in case of unforeseen losses.

On the other hand, Binance also employs state-of-the-art security measures.

These include AI risk control systems, cold storage, 2FA, withdrawal whitelist, and an advanced Secure Asset Fund for Users (SAFU) that acts as an emergency insurance fund.

Binance, with its considerable resources, has invested heavily in its cybersecurity, employing a dedicated in-house risk control team to monitor the platform 24/7.

Verdict: Binance slightly edges out MEXC. The establishment of the SAFU fund, together with advanced AI risk control mechanisms and a dedicated risk control team, makes Binance a tad more secure than MEXC.

Is MEXC Safe & Legal To Use?

MEXC is a globally recognized cryptocurrency exchange that adheres to legal regulations in the jurisdictions where it operates.

It maintains a valid license and complies with anti-money laundering (AML) and know-your-customer (KYC) protocols.

Security-wise, MEXC is reliable. As previously mentioned, it employs robust security measures like a multi-signature withdrawal process, cold storage, 2FA, and regular security audits.

They also have an insurance fund to cushion users from potential losses.

However, as with any crypto exchange, safety also depends on the users’ practices. Users are advised to secure their accounts, avoid sharing sensitive information, and be wary of phishing attempts.

Is Binance Safe & Legal To Use?

Binance, as one of the largest and most popular cryptocurrency exchanges globally, is committed to providing a safe and legal trading environment.

It complies with the legal requirements of many jurisdictions worldwide and demands that its users also adhere to the laws of their respective countries.

In terms of safety, Binance has built a reputation for having a robust security system. It employs multi-tier and multi-cluster system architecture for maximum security.

It also features two-factor authentication (2FA) and utilizes AI technologies to detect suspicious activity.

Moreover, Binance has a “Secure Asset Fund for Users” (SAFU) which is used to cover potential losses in extreme situations.

MEXC vs Binance Conclusion: Why not use both?

Conclusively, MEXC and Binance both offer robust leverage trading platforms that cater to a wide variety of investors’ needs.

MEXC’s friendly user interface, and its range of low-cost trading options, make it an excellent choice for novice traders.

On the other hand;

Binance’s extensive range of supported cryptocurrencies, advanced trading features, and top-tier security measures make it an attractive option for experienced traders seeking a more comprehensive trading experience.

You could potentially use both exchanges to capitalize on the strengths of each.

For instance, MEXC could be your go-to platform for straightforward trades and fundamental investment strategies, while Binance could serve your needs for more complex trades and diversified crypto assets.

Learn how does MEXC & Binance stack up against the competition: