Undoubtedly, the whole crypto ecosystem won’t be able to survive without the crypto exchanges. Cryptocurrency exchanges are one of the crucial parts of the whole ecosystem as it allows users to buy and sell digital assets.

There are quite a lot of crypto exchanges out there in different forms. So, how many crypto exchanges are there?

It is quite hard to pinpoint precisely the number of crypto exchanges available out there. As there are many cryptocurrency exchanges are being launched each day. But here is what the estimation says:

How Many Crypto Exchanges Are There?

Talking precisely about the number of cryptocurrency exchanges in operation is always challenging. New exchanges keep occasionally emerging while many existing crypto exchanges close down due to various reasons like bankruptcy, hacks, and more.

Talking about the current number of crypto exchanges, as per CoinMarketCap, there are more than 620 crypto exchanges across spot, derivatives, and DEX markets as of today.

Out of this 620 number, only about 220+ cryptocurrency exchanges are what we know as the traditional cryptocurrency exchange. The rest is DEX or decentralized exchanges.

However, this number constantly changes depending on what’s happening in cryptocurrencies.

Which Is the Biggest Crypto Exchanges?

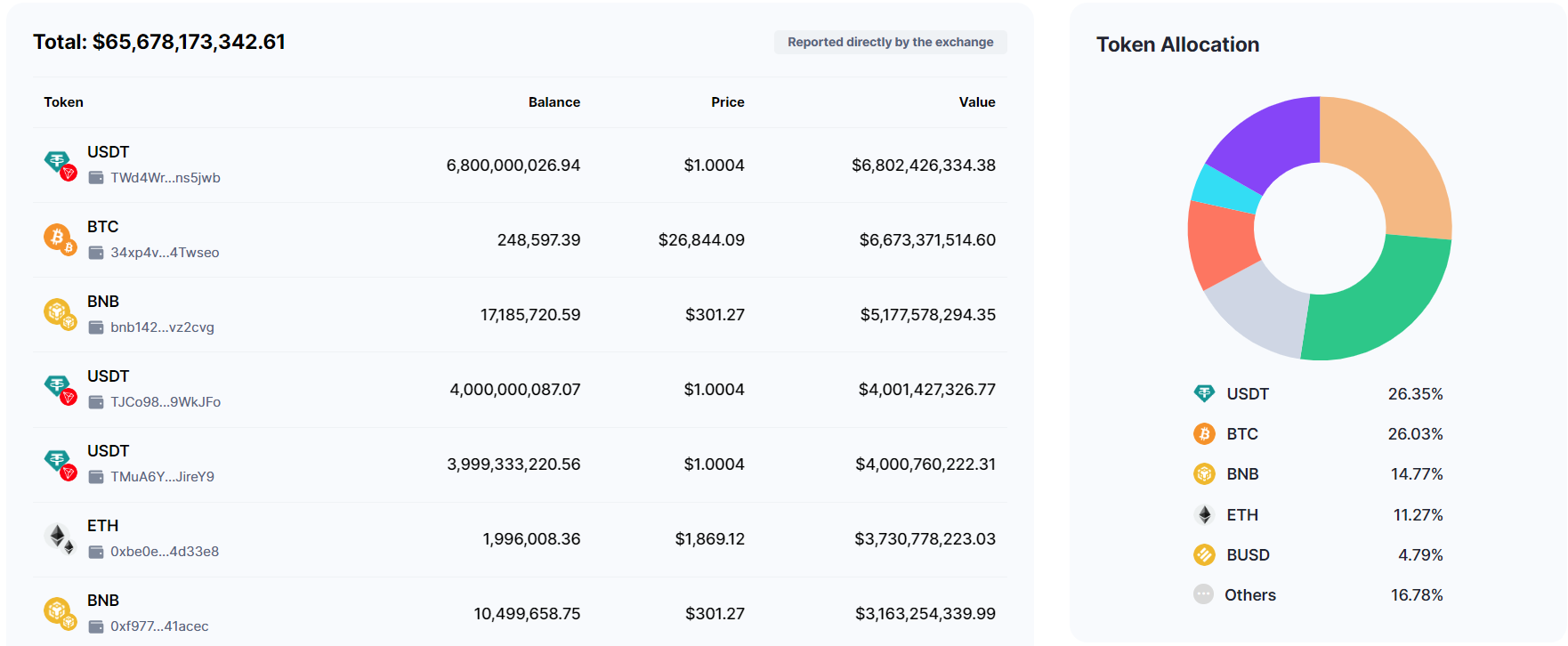

As per CoinMarketCap, Binance is the world’s largest cryptocurrency exchange by trading volume. The exchange has a daily trading volume of $76 billion. Plus, it servers a user base of 90 million worldwide.

The exchange was launched in 2017, and it took only 180 to become the largest cryptocurrency exchange in the world.

Binance Futures is known as one of the trusted platforms for buying, selling, and trading cryptocurrencies. The exchange allows you to trade in a wide range of crypto tokens and has many advanced features for both crypto investors and traders.

Which Are the Largest Crypto Exchanges in The US?

In the United States, Crypto Exchanges need additional licenses to operate in the region. As a result, many global crypto exchanges don’t offer their services in the region. Even if they do, they have a separate entity for US only.

One such example would be, Binance.com and Binance.US. While Binance.com is the largest crypto exchange worldwide, Binance.us is a separate platform for US crypto traders and investors.

So what are the largest crypto exchanges in the USA? Well, here are the top 10 names according to Statista:

- Coinbase

Coinbase is one of the leading US-based crypto trading and investment platforms out there. The exchange was established in June 2012 in San Francisco, California, U.S. It has a daily spot trading volume of around $1,112,104,692. The exchange has gained the trust of U.S. regulators. However, it doesn’t have any physical head office, and all of its employees work remotely. As of today, Coinbase offers its services in 100 countries.

- Crypto.com

Crypto.com has a daily spot trading volume of $98,676,957.32. The exchange was established in Hong Kong back in 2016. However, as of today, the exchange is operational in the USA, Europe, Canada, and other regions. Crypto.com offers its services in 49 states in the United States and is known for offering one of the lowest trading fees in the industry.

- Robinhood

Robinhood is a popular investment app in the USA. With this platform, one can trade stocks, options, EFTs, and cryptocurrency at zero commission fees in the USA. According to Statista, Robinhood serves about 17.8% of USA customers with their trading needs.

- eToro

eToro is one of the oldest and leading crypto CFD exchanges and an online brokerage platform. It offers a limited selection of cryptocurrencies, stocks, and ETFs. The exchange is known for offering features like copy trading and demo trading. Also, as per eToro’s claim, the exchange is used by 30m users. While as per Statista, holds a 16.4% market share.

- Gemini

Gemini is a New York-based cryptocurrency centralized exchange or CEX. The exchange is regulated by the New York State Department of Financial Services, available in all 50 U.S. states and over 60 countries. The exchange has a 24hrs spot trading volume of around $23,412,577.73.

- Coinmama

Coinmama is also one of the leading crypto exchanges, established in 2013. The exchange is based in Israel, and it offers one of the easiest ways to buy/sell cryptocurrencies using fiat currencies like USD, EUR, and others. As per Statista, it holds a market share of around 12.8%.

- Kraken

Kraken is one of the oldest crypto exchanges, founded in 2011. It was one of the first few crypto exchanges that offered spot trading. With Kraken, users can trade various crypto tokens in 7 fiat currencies that, include USD, CAD, EUR, GBP, JPY, CHF, and AUD. In today’s time, the exchange offers its services in spot trading, derivatives, and index products. Also, it has a daily spot trading volume of around $608,440,498.49.

- SoFi

SoFi is a popular American online personal finance company and online bank. The company is based in San Francisco, and it offers various products. You can use SoFi to get different loans, open checking or savings account, or invest in areas like IPO, ETFs, retirement accounts, or Crypto. As per Statista, the platform holds a market share of 8.9%.

- Webull

Webull is another popular platform that offers online brokerage services in stocks, ETFs, options, and cryptocurrencies. The platform was founded in 2017, and it is headquartered in New York City, USA. However, it is not really a full-fledged crypto exchange, but it can be used for crypto trading. And as per Statista, it holds a market share of 8.6%.

- Swan Bitcoin

Swan Bitcoin is one of the recently launched crypto exchanges founded in 2019 and is based in the United States. The exchange focuses on helping individuals accumulate and invest in Bitcoin systematically and disciplined. As of today, the exchange holds a market share of 7.9%.

What Are the Top Cryptocurency Exchanges? (Top 10)

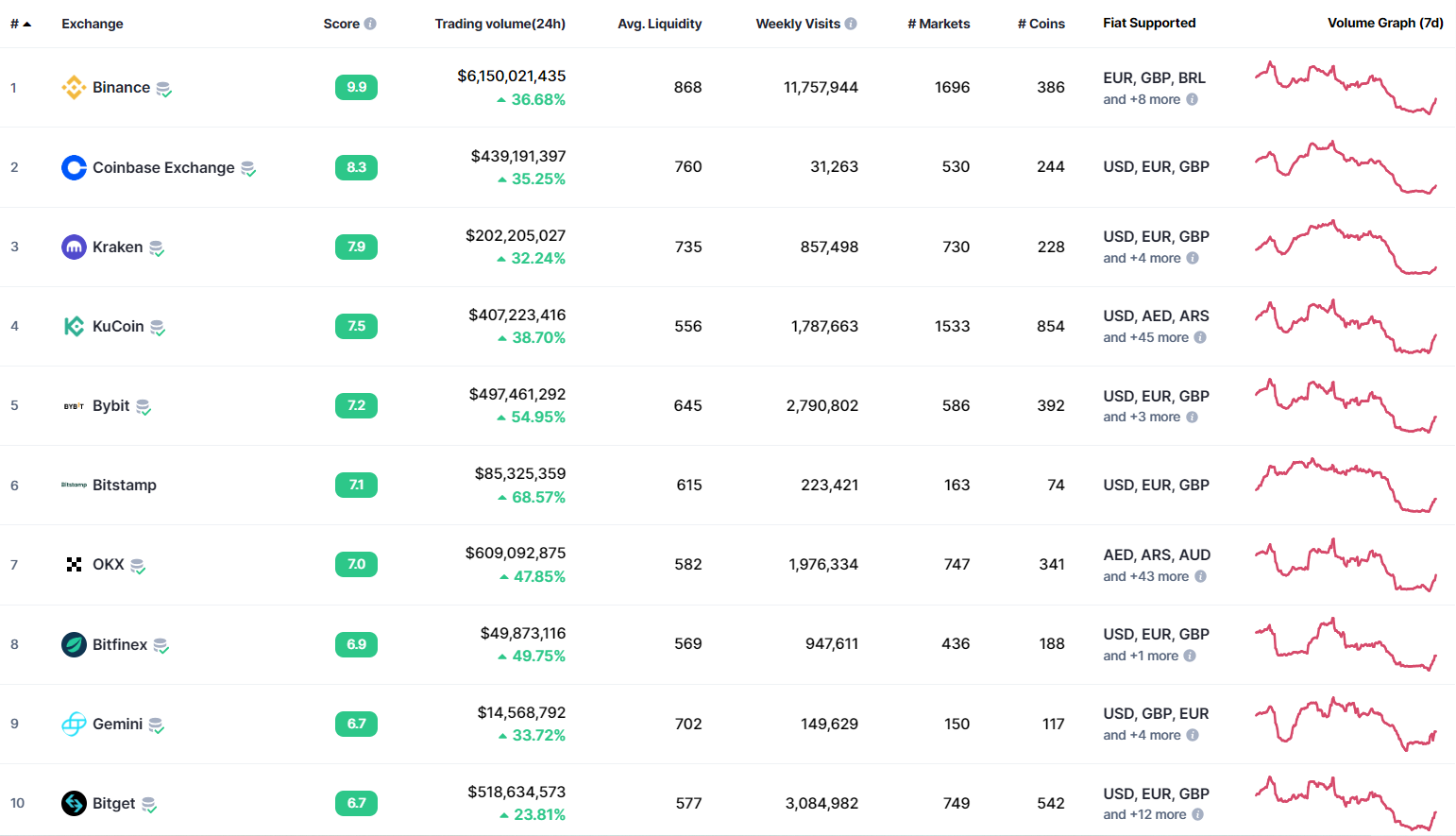

As per CoinMarketCap, here are the world’s top 10 cryptocurrency exchanges based on their average liquidity:

- Binance

Binance is the world’s largest crypto exchange by trading volume. It has a daily spot trading volume of around 316,336 BTC. The exchange was established in 2017, and within 180 days, it became the largest crypto exchange in the world. While the exchange offers its services around the globe, it is restricted to the United States, Singapore, and Ontario.

- Coinbase

Coinbase is the second largest crypto exchange, with a daily spot trading volume of around 42,212 BTC. It is a US-based crypto trading and investment platform founded back in 2012. The exchange is available in over 100 countries and allows you to trade in 150 different crypto assets.

- Kraken

Kraken is the 3rd largest crypto exchange with a daily spot trading volume of around 23,306 BTC. Kraken is also a US-based crypto exchange founded in 2011. The exchange is available to all U.S. residents. However, it doesn’t offer its services in New York and Washington. Also, Kraken Futures’ services are not available to U.S. residents.

- KuCoin

KuCoin is also one of the leading crypto exchanges founded in 2017. The exchange has a daily spot trading volume of around 19,665 BTC. The exchange operates at an international level and provides services in countries like Turkey, Japan, Canada, the U.K., and many more. However, it is not licensed to operate in the United States.

- ByBit

ByBit is a widely popular crypto exchange that gets often compared with exchanges like Binance. It is a centralized crypto exchange established in 2018. The exchange is headquartered in Singapore and serves customers at a global level. However, it doesn’t serve in countries like the US, Cuba, Singapore, and others. The exchange has a daily spot trading volume of around 26,819 BTC.

- OKX

OKX, formerly known as OKEX, is a Seychelles-based cryptocurrency centralized exchange founded in 2017. The exchange is operational in more than 200 countries. However, U.S. citizens don’t have access to the platform’s services. With OKX, you can trade in more than 350 cryptocurrencies, and it supports 500 trading pairs. Also, the 24hrs spot trading volume stands around 34,713 BTC.

- Bitstamp

Bitstamp is one of the oldest crypto exchanges, founded in 2011. It has a daily spot trading volume of around 5,884 BTC. Also, the crypto exchange is operational in 100 countries. However, some features might be restricted in certain areas. The exchange allows you to trade in 80 different crypto tokens.

- Bitfinex

Bitfinex was founded in 2012. The exchange is operated by the Hong Kong-based company iFinex Inc. It is the same company that owns the largest stablecoin by market cap, USDT. The exchange offers you 270+ cryptocurrencies. However, it has restricted users from countries like Canada, the U.S., and many more. Also, it has a daily spot trading volume of around 4,206 BTC.

- Gemini

Gemini is one of the largest Centralised cryptocurrency exchanges based out of New York. The exchange is regulated by the New York State Department of Financial Services. The exchange was founded in 2014, and as of today, it offers its services in all 50 U.S. states and over 60 countries. The exchange has a daily spot trading volume of around 965 BTC.

- Gate.io

Gate.io was launched in 2017, and it offers one of the highest numbers of supported crypto tokens and trading pairs. It offers you access to 1400 cryptocurrencies with 2500 trading pairs. The exchange is available in all the regions except countries like Cuba, Sudan, Iran, and a few others. Also, some of its services are not available to resistants in the U.S. (In Washington, New York). The exchange has a daily spot trading volume of 20,045 BTC.

Why Are There So Many Cryptocurrency Exchanges?

There are various reasons why we often see new cryptocurrency exchanges being launched. Some of the key reasons are:

Regulations

We all know the fact countries all around the globe have different rules and regulations for crypto investing or trading. As a result, it becomes hard for global exchanges to comply with each and every region’s rules and provide their services in all countries.

Hence, many global crypto exchanges only function in selective countries. But it also creates an opportunity for new exchanges to comply with the rules and regulations and provide crypto services in a specific region. This is why we see many country-specific exchanges.

Market Demand

In recent years, more and more people are getting aware of the crypto space. It has created a huge market cap where users are continuously looking for crypto exchanges with better trading fees, availability of tokens, and other services. And to fulfill this demand, there is also a rise in the number of crypto exchanges.

Different Trading Markets

In crypto, buying/selling digital assets isn’t the only thing. Instead, there are different markets that exist in the crypto market, such as Crypto futures, crypto options, margin trading, P2P trading, and more. And there are quite a lot of crypto exchanges that only operate in one of these areas. As a result, we get to see a good amount of crypto exchanges.

Are Crypto Exchanges Legal?

Crypto exchange’s legality varies from one country to another. For instance, in the United States, the Financial Crimes Enforcement Network (FinCEN) does not consider cryptocurrencies as legal tender. However, it does recognize cryptocurrency exchanges as a money transmitter.

As a result, Cryptocurrency exchanges are legal in the United States, and they fall under the regulatory scope of the Bank Secrecy Act (BSA). To be recognized as a crypto exchange in the United States, the exchange must register with FinCEN, implement an AML/CFT program, maintain appropriate records, and submit reports to the authorities.

However, in many other countries, the rules and regulations around cryptocurrencies and crypto exchanges aren’t as clear as in the USA.

For instance, in India, there is a 30% tax on the earnings from the transfer of digital assets. But the country doesn’t have any rules and regulations around crypto in place. Also, many crypto exchanges are operating in the country.

Also, if we talk about China, the country has completely banned cryptocurrencies. However, many crypto exchanges still serve Chinese users and allow them to trade in digital assets.

Overall, the subject of crypto exchanges being legal or not is country-specific. One must check their country’s laws and available options before proceeding with their activities in the crypto ecosystem.

Are All Crypto Exchanges the Same?

No, not all crypto exchanges are the same. There are many different factors that separate one crypto exchange from the other one.

One such factor is functionality. For instance, we have different types of crypto exchanges such as CEX, DEX, IEO, and so on.

On one side, CEX or Centralized Exchange offers you a simple way to trade crypto tokens. DEX stands for decentralized exchange which offers a completely different crypto trading experience. Or, if we talk about IEO or Initial Exchange Offering, it is known for providing early access to various crypto tokens.

Similarly, spot and derivatives crypto exchanges are different from each other. For example, spot trading allows basic buying/selling of cryptocurrencies, and derivatives crypto exchanges come with concepts like perpetual swaps, futures expiry, funding rate, crypto options, leverage, and more.

Is It Possible to Buy Crypto Without a Crypto Exchange?

Yes, it is absolutely possible to buy crypto without a crypto exchange. A crypto exchange definitely makes it super easy for you to buy or sell your digital assets, as you get access to both buyers and sellers instantly.

The most popular option for buying crypto using fiat is P2P trading. P2P trading offers you a quick way to buy and sell digital assets directly with each other on a crypto exchange or website.

But since we are talking about not using a crypto exchange or crypto platform for buying crypto, here are the two options that you have:

In-Person P2P Trading

If you know someone who is selling cryptocurrencies, then you can deal with them in person to buy crypto. However, the challenge, in this case, is finding crypto sellers around your location who’d be interested in dealing in the offline world.

Alternatively, you can also look for crypto sellers on social media platforms. There are many crypto sellers and buyers who like to deal with social media platforms. However, the only disadvantage is the trust factor.

Bitcoin ATMs

Bitcoin ATMs can be another way to buy crypto without a crypto exchange. Bitcoin ATMs allow you to buy crypto for fiat and vice versa.

All you have to do is deposit fiat using your debit/credit card and buy crypto using the ATM. For this, you would need your BTC wallet address to get the funds in your account.

However, the only drawback of Bitcoin ATMs is that you might need to verify your identity to use a Bitcoin ATM. As a result, you may not get an anonymous crypto-buying experience.

Things to Consider While Choosing a Crypto Exchange

There are a lot of cryptocurrency exchanges available out there. Hence, it becomes extremely confusing for many newbies to choose the perfect crypto exchange for their needs. Hence to help you with that, here are a few points that you must consider while opting for a crypto exchange:

- Liquidity

If your primary goal is crypto trading, you must look for an exchange with good liquidity. Liquidity refers to the amount orders in its order books on any given day. If there is a huge volume of orders being executed each day, it simply means the exchange has good liquidity.

As a result, your orders will get executed faster and at your desired price. It will come in handy in the highly volatile market and will help you control your losses.

- Trading Fees

Trading fees are the second most crucial factor when choosing a crypto exchange. Almost all crypto exchanges charge you a trading fee on both buy and sell orders. And it can significantly impact your profits and losses.

Make sure to go with a crypto exchange with the lowest trading fees for maximum profit and reduced loss. Also, there are crypto exchanges that offer zero trading fees.

Additionally, you must be aware of concepts like maker and taker fees. As it will help you cut down your trading fees further.

- Security

The next thing you should look for is how secure the crypto exchange is. Make sure the exchange has implemented high-end security measures, have up to date systems, hosts regular bug bounty programs, and more.

Crypto exchanges are always under the radar of hackers. As a result, we have seen several crypto exchanges being hacked and closing down in the last decade.

Also, whenever a crypto exchange gets hacked, there is always a lesser chance of users recovering their funds. So to prevent that, going with an exchange that gets regularly audited, having insurance funds, and tough security measures would be helpful.

- Investment and trading options

Depending on your goals, you might want to look for a crypto exchange that lets you trade in different markets. If you are just looking for crypto investing, any exchange will do.

However, if your primary goal is crypto trading, you want to go with an exchange that offers you margin trading or derivatives trading. Plus, the exchange should have multiple trading pairs, higher leverage, and great liquidity.

- User Interface

The last thing you consider is how advanced the trading platform is. The exchange should provide you with enough details to make informed and efficient decisions. Also, when you use an advanced trading platform, it comes with advanced order types, multiple charts, trading indicators and other trading tools—all of which help you trade effectively. Also, you get access to a progressive mobile app for trading.

What Is the Difference Between a Crypto Wallet and an Exchange?

The difference between a crypto wallet and an exchange is pretty huge as they are meant for two separate purposes.

However, both crypto wallets and crypto exchanges offer each other’s services. For instance, crypto exchanges do come with a crypto wallet. On the other side, many crypto wallets allow you to buy/sell or swap crypto.

However, to help you understand better, here is what both these terms mean:

Cryptocurrency Wallet:

Cryptocurrency Wallet is a digital tool that allows you to securely store and manage your cryptocurrencies. You can use your crypto wallet to send or receive crypto funds or build your crypto portfolio.

Also, there are different types of crypto wallets available out there: Hot wallets and Cold wallets.

Hot wallets are internet-enabled crypto wallets such as mobile-app-based wallets. On the other hand, cold wallets keep your funds offline, away from the internet, such as a hardware wallet.

Cryptocurrency Exchange:

A cryptocurrency exchange is a platform that allows you to buy, sell and trade various cryptocurrencies. Exchanges work as intermediaries that connect both buyers and sellers and provide a marketplace for their trading activities.

The crypto exchange also comes with a crypto wallet (hot wallet) that allows you to store your funds on the platform safely.

Conclusion

The number of crypto exchanges that are currently in operation and existed since the time Bitcoin launched but discontinued can go up to 1600+. However, it is always hard to talk about the exact crypto exchanges that are in operation. As there are always new crypto exchanges that are getting launched in the form of CEX or DEX.