Delving into the world of cryptocurrency exchanges and considering P2B or KuCoin for your trading needs?

In this comprehensive review, I’ll examine both platforms in detail to help clarify your decision.

P2B and KuCoin boast solid reputations and diverse offerings, making the choice challenging.

I’ll dissect key features like trading options, security protocols, fee structures, and customer service, offering an insightful comparison.

Let’s embark on this journey together so that by the end, you’ll have a clearer understanding of whether P2B or KuCoin aligns better with your trading goals.

Welcome to our deep dive into the P2B vs KuCoin comparison.

P2B vs KuCoin: At A Glance Comparison

When looking at P2B and KuCoin, several factors come into play. Let’s take a glance at how these two platforms stack up against each other in key areas.

Trading Features

- P2B: Offers spot trading and a wide range of cryptocurrencies.

- KuCoin: Offers spot trading, Futures trading, margin trading, staking, and lending and has a broad range of cryptocurrencies.

Security

- P2B: Employs industry-standard security measures, including two-factor authentication (2FA).

- KuCoin: Uses multiple layers of security, including 2FA, encryption technology, and operational security procedures.

Fees

- P2B: Operates on a tiered fee schedule depending on the user’s 30-day trading volume.

- KuCoin: Implements a tiered fee structure based on the user’s 30-day trading volume and KCS holdings.

Customer Support

- P2B: Provides 24/7 customer support via email and an online help center.

- KuCoin: Offers 24/7 customer service through live chat, email, and a comprehensive online help center.

P2B vs KuCoin: Trading Markets, Products & Leverage Offered

Crypto exchanges cater to varying user needs by providing diverse trading markets and products.

Trading Markets

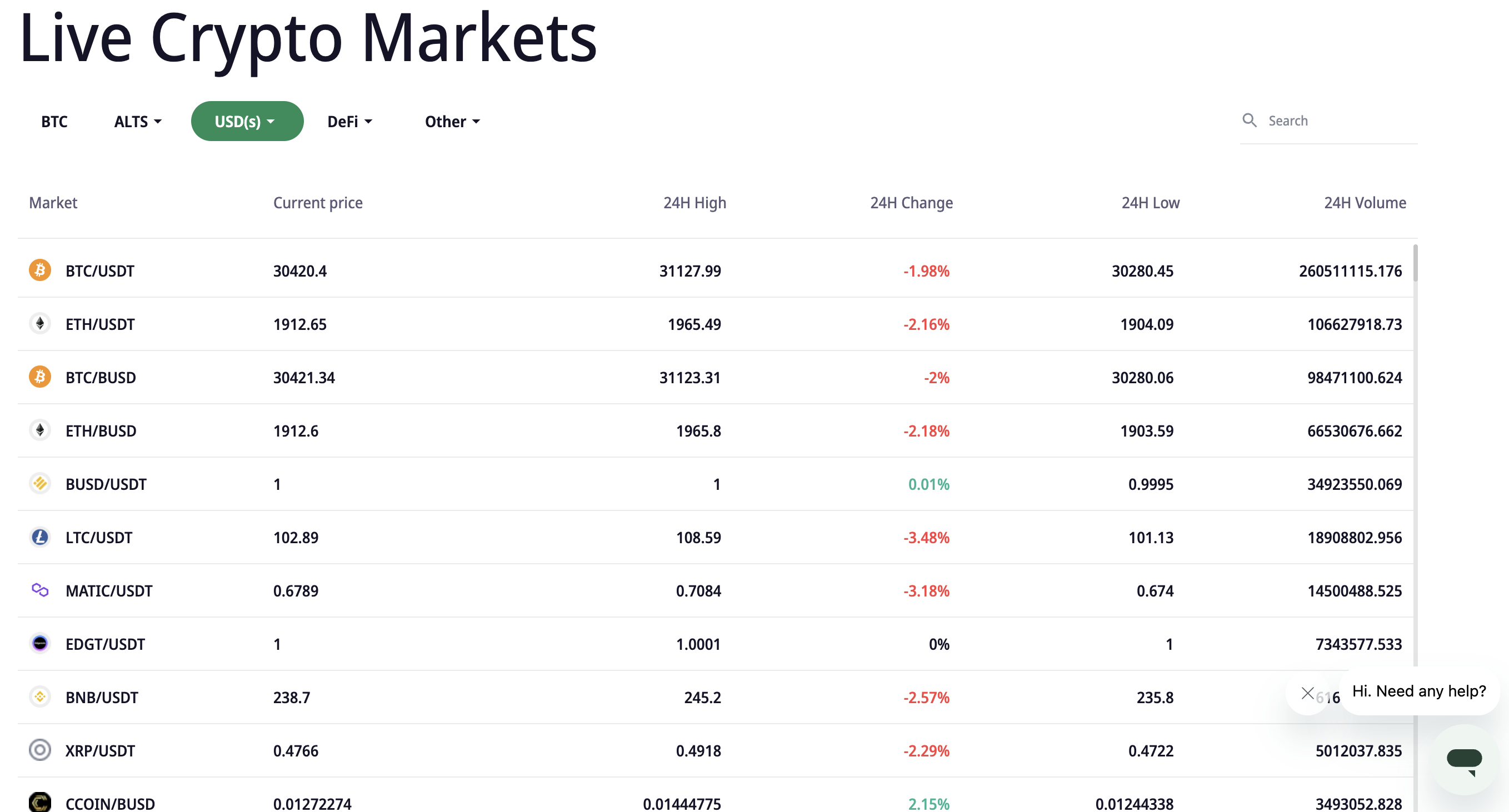

P2B primarily focuses on spot trading, giving users access to a substantial range of cryptocurrencies.

Their trading pairs involve popular cryptos like Bitcoin (BTC), Ethereum (ETH), and several altcoins, allowing traders to participate in the vibrant and dynamic crypto market.

P2B focuses on launching new projects and if you know what you are doing, this is where you can make a lot of money.

KuCoin offers a more diversified set of trading markets. In addition to spot trading, it also provides futures and margin trading.

This diversity allows traders to leverage their positions and potentially increase their profits, although it comes with higher risk.

The availability of staking and lending provides additional opportunities for users to earn passive income.

Products

While P2B’s offerings are comparatively simpler, they focus on delivering robust and reliable spot trading services. Traders can find a multitude of crypto pairs to suit their trading strategy.

If you are part of a project that needs exposure to the mature crypto market, you will want to look into P2B. They have launched more than 1000 projects in this space.

KuCoin shines in terms of product offerings. Beyond the traditional spot and Futures markets, it offers unique products like Pool-X (staking), KuCoin lending, a trading bot, and even an NFT marketplace.

This diversity caters to different user preferences and investment strategies.

Leverage Offered

P2B does not have a margin trading or Futures trading option, so there is no place to use any leverage on the platform.

KuCoin, on the other hand, offers leverage up to 100x on its Futures platform, allowing users to amplify their trading positions.

However, it’s important to note that while higher leverage can lead to increased profits, it can also result in significant losses.

Verdict: If you prefer a straightforward spot trading platform with a wide range of crypto pairs, P2B could be a good choice. However, if you’re looking for diverse trading options and products, including leverage, Futures, and margin trading, KuCoin might be more suited to your needs.

P2B vs KuCoin: Supported Cryptocurrencies

The selection of supported cryptocurrencies is a key factor when choosing a cryptocurrency day trading platform. The wider the selection, the more opportunities there are for trading and investment.

P2B supports a multitude of cryptocurrencies.

This includes widely traded coins, among others. Also, P2B does a good job of incorporating new and promising altcoins, providing a rich ecosystem for traders looking for diverse crypto coins.

KuCoin stands out for its extensive cryptocurrency support. It features all the major coins but also offers a plethora of altcoins.

It’s known for listing new and promising projects early, which can present exciting opportunities for traders and investors.

Verdict: If you’re looking for a platform with a comprehensive range of cryptocurrencies, more than just spot trading, and a proactive approach to listing new tokens, KuCoin is the better option for you.

P2B vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

Fees are an integral factor when choosing the best derivatives exchange. Understanding the fee structure can help maximize profits and minimize losses.

Trading Fee

P2B operates on a tiered fee schedule, where your trading fee decreases as your 30-day trading volume increases.

You start at Level 0 (trading volume < 1 BTC), where the maker/taker fee is 0.2%/0.2%. At Level 10 (trading volume is > 500 BTC), this fee reduces to 0.1%/0.1%.

Similar to P2B, KuCoin also uses a tiered fee structure based on your 30-day trading volume. Holding KuCoin’s native token, KCS provides you with a 20% discount on the base fees.

The base trading fee is 0.1%/0.1%, but if your trading volume is high, it can drop to -0.005%/0.02%.

Deposit/Withdrawal Fee

Deposit fees on P2B are typically free, bar a few coins. However, withdrawal fees depend on the particular cryptocurrency, with each having a different fee. These fees are subject to change based on network conditions.

KuCoin does not charge for deposits either. For withdrawals, like P2B, the fee varies depending on the cryptocurrency.

Verdict: KuCoin has an advantage with its lower base trading fee.

P2B vs KuCoin: Order Types

Understanding the types of orders an exchange offers is important, as it enables traders to execute trades based on their strategies.

P2B offers the basic order types that cater to the needs of most traders.

This includes market orders, which are executed immediately at the current market price, and limit orders, where a trader specifies the price at which they wish to buy or sell.

KuCoin offers a wide range of order types catering to both novice and seasoned traders.

In addition to the basic market and limit orders, it provides advanced order types such as stop orders and trailing stop orders.

These advanced options give traders more flexibility and tools to manage their risk and execute complex strategies.

Verdict: KuCoin stands out with its more extensive selection of advanced order types.

P2B vs KuCoin: KYC Requirements & KYC Limits

KYC, or “Know Your Customer,” requirements are security measures put in place by exchanges to prevent illegal activities. However, these requirements and the associated limits can vary greatly between platforms.

P2B’s KYC process is generally straightforward. While it allows users to trade without completing KYC verification, the withdrawal limit for such accounts is 1000 USD in 24 hours.

After completing the KYC process, which involves submitting identification documents, users can enjoy a higher withdrawal limit.

KYC is mandatory on KuCoin. Once completed, it gives you higher withdrawal limits and access to certain services.

KuCoin has additional tiers of verification that come with still higher limits and access to more features and services.

Verdict: P2B provides a degree of flexibility with its KYC requirements, allowing non-verified users to engage in limited trading and withdrawals. However, if you plan to engage in higher volume trading or withdrawals, both exchanges require KYC verification.

P2B vs KuCoin: Deposits & Withdrawal Options

The ease and cost of depositing and withdrawing funds can significantly impact a user’s experience on a crypto exchange.

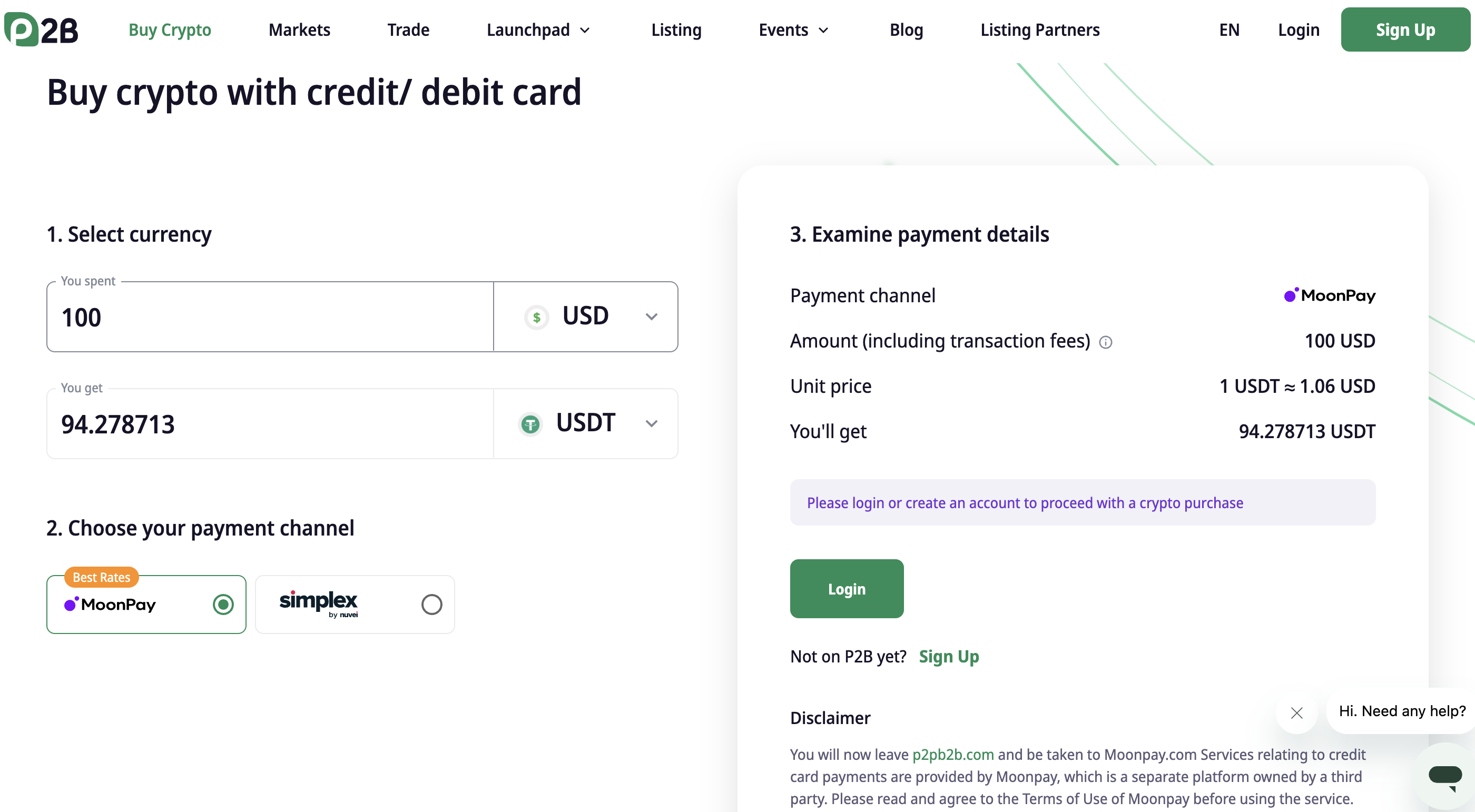

P2B offers users the ability to deposit and withdraw funds using cryptocurrencies. You can also buy crypto using your Debit/Credit card and make payments through MoonPay or Simplex.

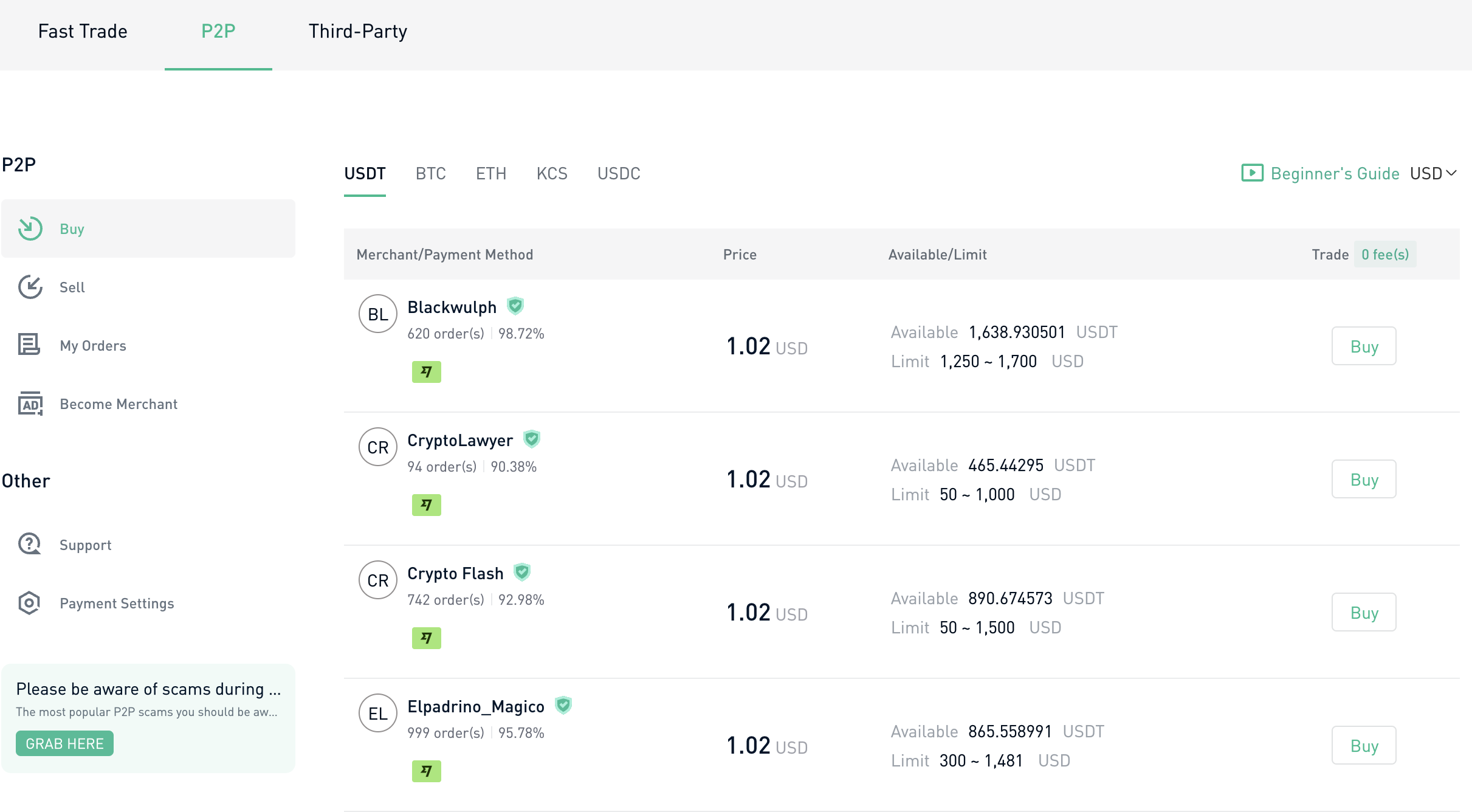

With KuCoin, you can deposit cryptocurrencies directly, use P2P services, or use a credit/debit card or bank transfer to buy cryptocurrencies, which can then be traded on the platform.

For withdrawals, users can convert their cryptocurrencies back to fiat and withdraw to their bank account or simply withdraw in crypto. It’s worth noting that each option may have different fees and processing times.

Verdict: KuCoin offers more flexibility with its support for card purchases and bank transfers, making it easier for users to switch between fiat and cryptocurrencies.

P2B vs KuCoin: Trading & Platform Experience Comparison

The usability and design of a trading platform significantly impact a trader’s experience and efficiency.

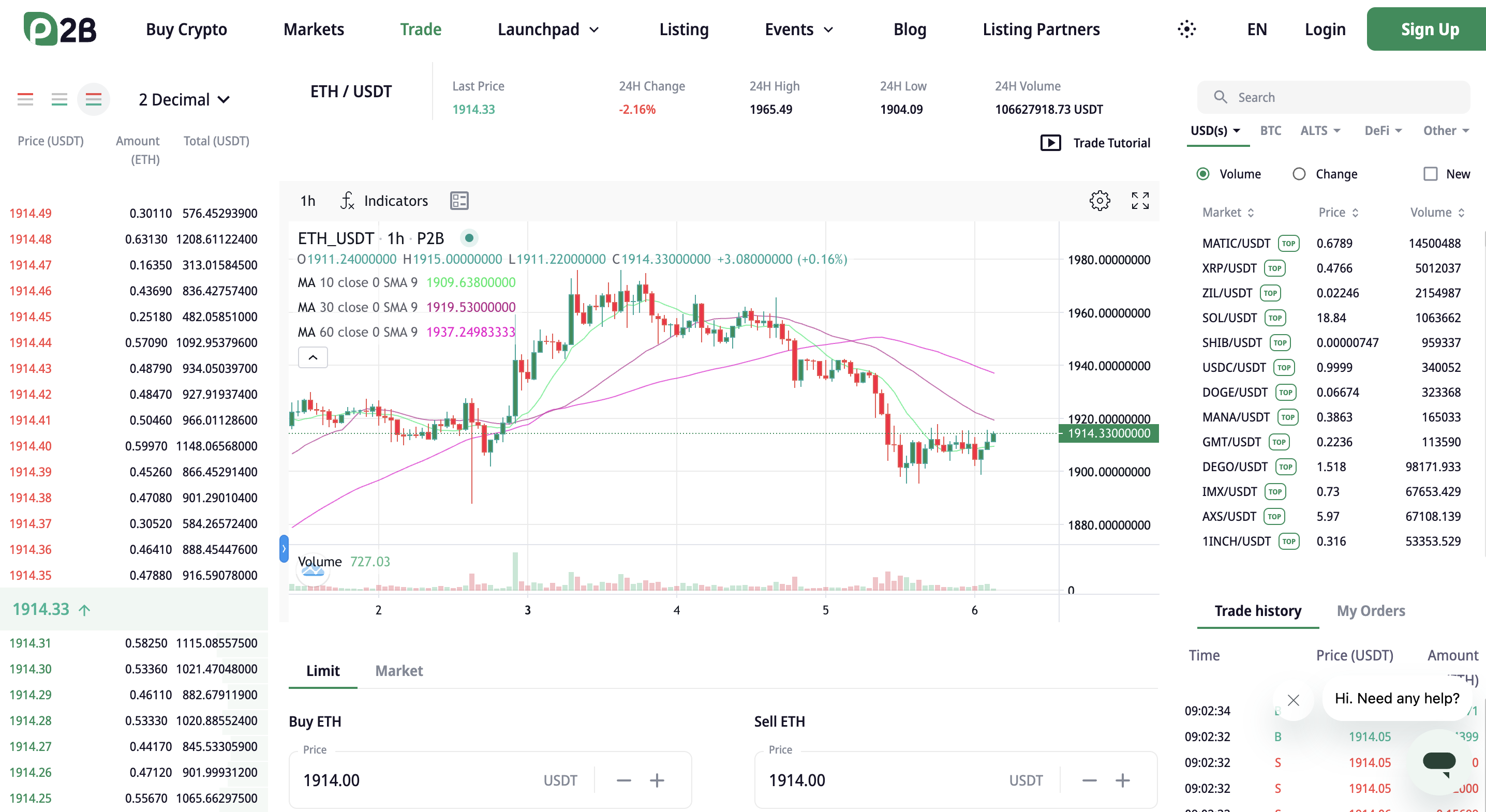

P2B offers a clean, user-friendly interface with a straightforward design.

Even for beginners, navigating through the platform and executing trades is relatively simple. The exchange also provides detailed market data, charts, and analytical tools to help you make informed trading decisions.

Furthermore, P2B has an Android mobile app that allows trading on the go, ensuring users don’t miss critical market moments.

KuCoin is known for its intuitive and feature-rich platform. It provides advanced trading features, such as margin trading and Futures, along with detailed analytical charts and tools.

The interface can be customized to a user’s preference, allowing for a more personalized trading experience. You can learn more about it by checking this KuCoin tutorial.

Like P2B, KuCoin also offers an Android and iOS mobile app, enabling users to trade anytime, anywhere.

Verdict: KuCoin has an edge due to its advanced trading features and customizable interface.

P2B vs KuCoin: Customer Support

Customer support is crucial for any crypto exchange, providing users with needed guidance and timely solutions.

P2B offers a comprehensive FAQ section that addresses common queries and issues.

If further assistance is needed, you can use the live chat option or submit a ticket through their website. While there is no phone support, they promise to respond to tickets promptly.

User reviews on the speed and quality of P2B’s customer support are mixed, which is common in the crypto exchange industry.

Along with a detailed FAQ section, KuCoin also offers 24/7 live chat support, which can provide immediate assistance for urgent issues.

Users can also submit a support ticket through their website. KuCoin is generally well-regarded for its customer service, although, like all exchanges, user experiences vary.

Verdict: It’s a tie here as both platforms offer similar customer support avenues.

P2B vs KuCoin: Security Features

The security features of a crypto exchange are of paramount importance, given the history of security breaches in this industry.

P2B emphasizes security as a top priority.

They utilize an industry-standard multi-signature cold wallet system for the storage of users’ funds, reducing the risk of hacking.

Additionally, P2B employs two-factor authentication (2FA) for account logins and transactions, adding an extra layer of security to user accounts.

KuCoin employs a combination of hot and cold wallets to store funds, with the majority of assets stored offline in cold storage.

KuCoin uses encryption and dynamic multifactor authentication mechanisms to enhance account security further.

They also regularly conduct internal and external security audits to ensure their systems remain secure.

Verdict: KuCoin provides more detailed information about its security protocols and initiatives, giving users a clearer understanding of how their funds and data are protected.

Is P2B Safe & Legal To Use?

Legality: The legality of using P2B will largely depend on your location. Before using P2B or any other exchange, it’s essential to understand and comply with your local laws and regulations regarding cryptocurrency trading.

Safety: In terms of safety, P2B emphasizes its commitment to security, implementing measures such as two-factor authentication (2FA) and a multi-signature cold wallet system to protect users’ funds.

Is KuCoin a Safe & Legal To Use?

Legality: The legality of using KuCoin varies depending on where you live. Many countries around the world permit cryptocurrency trading, while others have strict regulations or even prohibitions.

Safety: As for safety, KuCoin has demonstrated a willingness to secure user funds and data.

It employs various security measures, including encryption, dynamic multifactor authentication mechanisms, two-factor authentication (2FA), and a mix of hot and cold wallets for storing funds.

Regular internal and external security audits are also part of their strategy to ensure their system’s integrity.

P2B vs KuCoin Conclusion: Why not use both?

As we’ve explored in this article, both P2B and KuCoin have their unique strengths, offerings, and areas of focus, making them suitable for different types of traders.

While KuCoin might excel in terms of platform experience and customer support, P2B may be more appealing due to its wide range of newly launched cryptocurrencies and straightforward interface.

But why limit yourself to one? Diversifying your crypto trading platforms, like diversifying your investment portfolio, can have its advantages.

By using both P2B and KuCoin, you can enjoy the best of both worlds.

For example, you could take advantage of KuCoin’s advanced trading features and strong customer support while enjoying P2B’s expansive cryptocurrency offerings.

Here’s how P2B & KuCoin giving a tough competition to other crypto exchanges:

- P2B vs Kraken

- KuCoin vs PrimeXBT

- KuCoin vs StromGain

- KuCoin vs Binance

- KuCoin vs Phemex

- KuCoin vs Gate.io