Phemex and BitMEX are two of the most popular crypto derivatives exchanges in the crypto space.

Founded in 2014, BitMEX is one of the oldest and most established crypto exchanges globally and was the most popular exchange in the mid-2010s.

Phemex is a relatively newer exchange founded in 2019. However, in less than two years, Phemex has become one of the top ten exchanges in 24h daily volume.

Both Phemex and BitMEX are derivatives-only exchanges and offer up to 100x leverage on BTC futures contracts.

So, which exchange is better to trade cryptos and why? Here’s all you need to know.

Phemex vs. BitMEX: Crypto Derivatives Product Offerings & Leverage

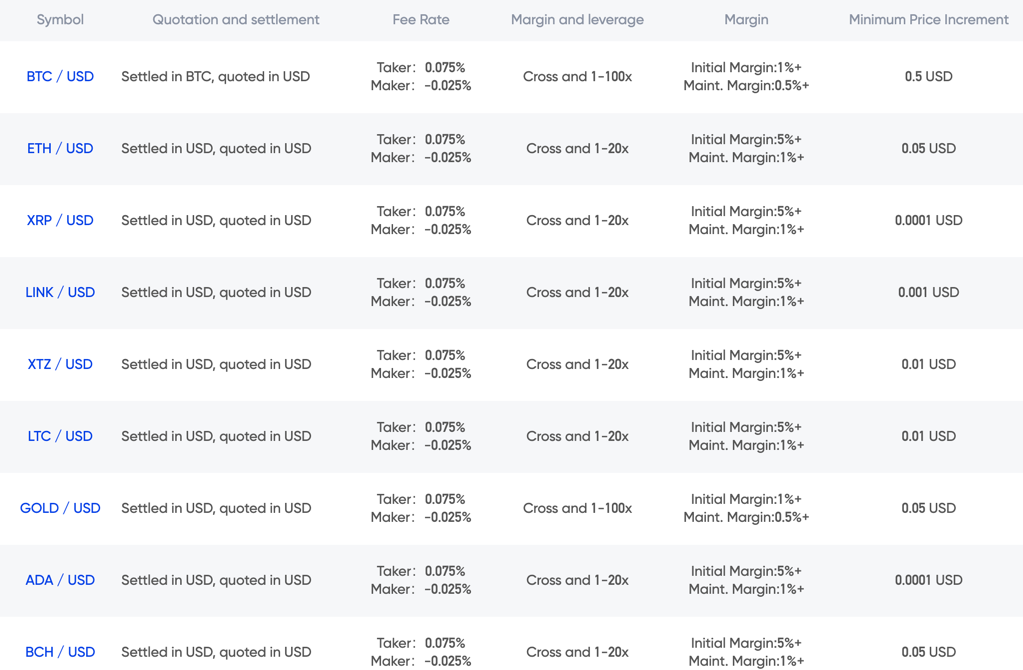

Phemex offers six trading pairs, including:

- BTCUSD

- ETHUSD

- XRPUSD

- LTCUSD

- LINKUSD

- XTZUSD

Additionally, Phemex has a GOLD/USD futures contract as well.

The 24h crypto derivatives trading volume of Phemex is USD 1.4 billion – the ninth-highest in the market.

Phemex provides a maximum leverage of 100x on BTC and GOLD/USD contracts, while the maximum leverage is limited to 20x on the remaining crypto pairs.

is a crypto derivatives-only exchange. It offers three perpetual swaps in XBT, XRP, ETC, while traditional futures contracts are available in:

- XBT

- ETH

- XRP

- BCH

- TRX

- LTC

- ADA

- EOS

The 24h derivatives trading volume of BitMEX is USD 981 million – the 12th-highest in the world.

BitMEX offers up to 100x leverage on all BTC contracts, upto 50x leverage on ETH and XRP perpetual and ETH traditional futures, and 20-33.33x on all other pairs.

Verdict: It’s a tie, as both exchanges provide similar trading pairs and leverage.

BitMEX Offer: Crypto traders who sign-up using this exclusive link will receive a 10% fee discount for six months and believe me, 10% is a lot when you see it over a period of time. |

Phemex vs. BitMEX Trading Fees

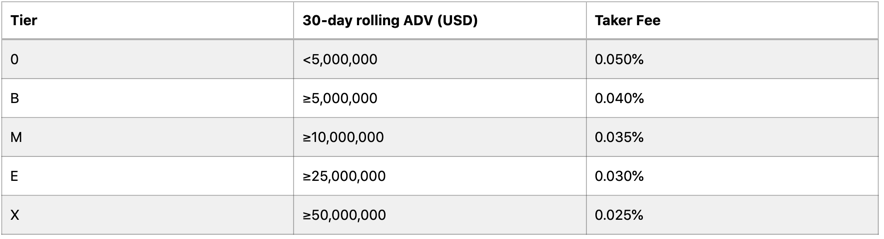

Both Phemex and BitMEX follow a market maker-taker fee model.

Phemex has a flat-fee structure. It offers a market maker rebate of 0.025% and charges a 0.075% market taker fee.

BitMEX also has a flat-fee structure, offers a 0.025% maker rebate, and charges a 0.075% taker fee on all futures orders.

Users new to crypto futures trading may not be familiar with the market maker and market taker concept. Here’s a quick explanation.

Liquidity is crucial for a crypto exchange. When the liquidity is high, the orders get executed quickly. In events of low liquidity, orders may take a while to execute.

Orders that don’t immediately execute and enter the order book (limit orders, stop-limit orders, take-profit orders) add liquidity to the market. These orders are known as market maker orders.

On the other hand, orders executed immediately (market orders, IOC orders) take liquidity away from the market. These orders are known as market taker orders.

Verdict: It’s a tie, as both the exchanges follow the same fee structure and charge similar fees.

Phemex vs. BitMEX Deposit & Withdrawal Fees

Phemex does not charge any deposit or withdrawal fees. However, blockchain network fees will apply based on the blockchain network load.

BitMEX also doesn’t charge any deposit or withdrawal fee.

Talking about the limits, Phemex has a withdrawal limit of 2 BTC for standard and premium trial users. BitMEX, on the other hand, has no withdrawal limits. However, it does have a minimum deposit requirement.

If you prefer more deposit methods, Phemex has an edge here. Phemex allows users to buy bitcoin with credit/debit cards, while BitMEX allows crypto deposits only.

Verdict: It’s a tie, as neither Phemex nor BitMEX charges a deposit or withdrawal fee.

Phemex vs. BitMEX Trading Platform Comparison

The trading platform is a key factor to consider before choosing a crypto derivatives exchange. While most exchanges have TradingView charting systems and offer multiple order types, there are certain nuances you must be aware of.

Here’s a head-to-head comparison between the trading platforms of Phemex and BitMEX.

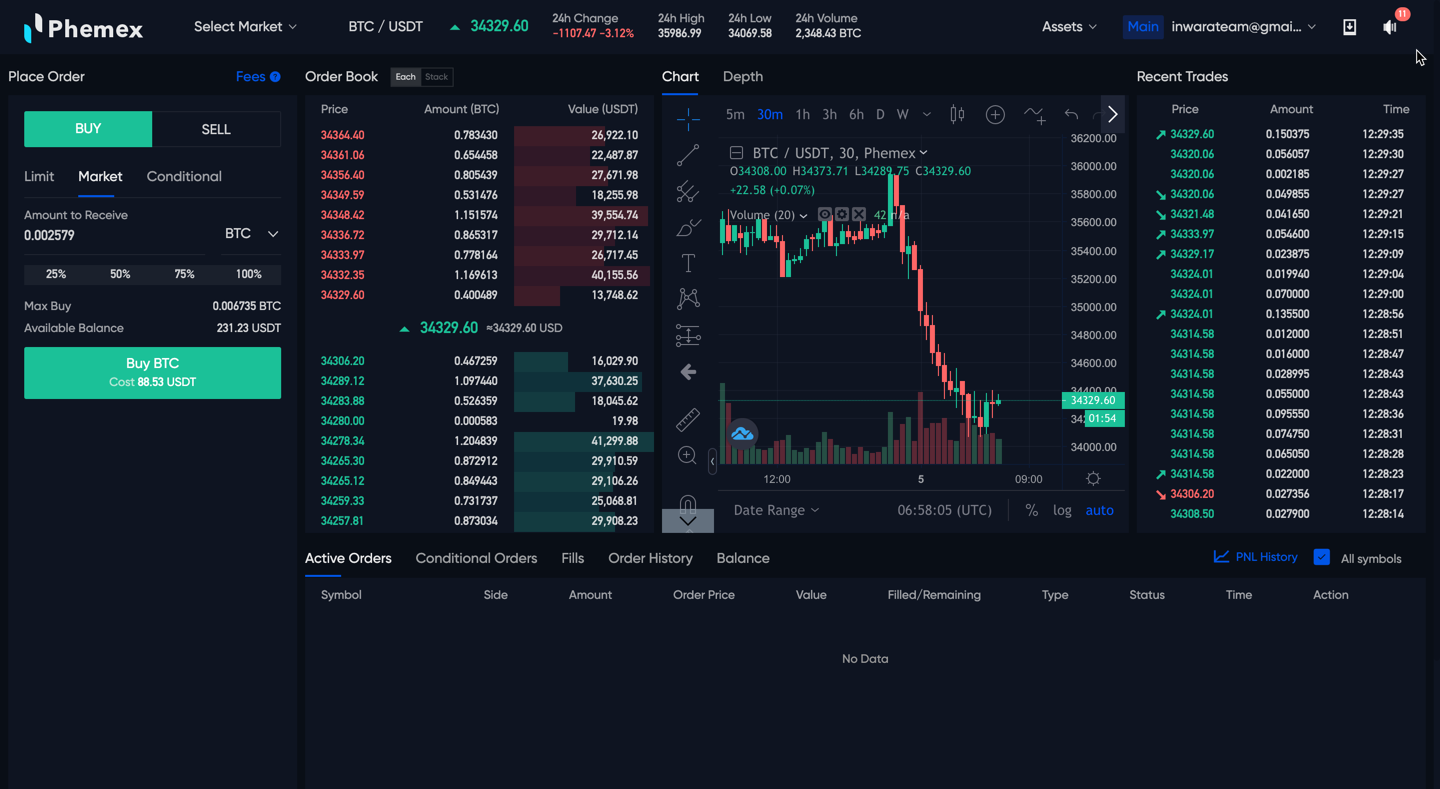

Phemex

Phemex has a simple and easy-to-use trading platform. It has an intuitive user interface that is ideal for traders of all proficiency levels. Moreover, the interface is fully customizable, and you can adjust your trading panel as per your needs.

One of the key features of Phemex’s trading platform is its minimalist design, which makes it easy on the eye and eliminates distractions. This allows traders to focus on the chart and make the right trading decisions.

Phemex, like most trading platforms, has a TradingView charting system and comes with features like:

- Multiple chart types, such as line, area, candlesticks, Hekin-Ashi, etc.

- Multiple time frames

- Numerous indicators

- Drawing tools

In addition, you get features like the order book, order form, market depth, tickers, and more. Phemex supports three order types:

- Market order

- Limit order

- Conditional order

Advanced order types, such as post-only and close-on trigger, are also available.

Phemex has a mobile app available on both iOS and Android platforms. The app offers a seamless mobile trading experience.

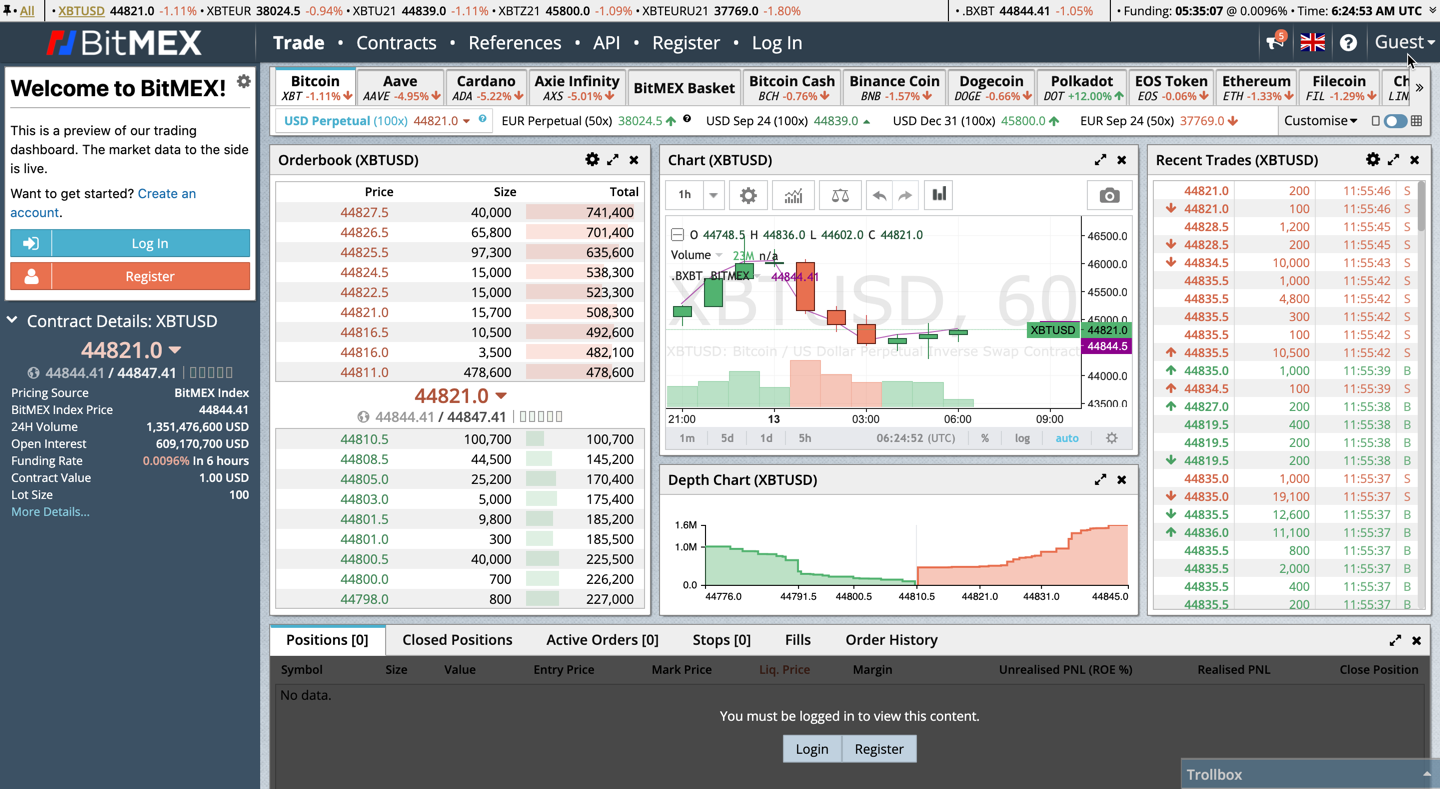

BitMEX

BitMEX also has a robust trading platform. It integrates two leading futures trading systems – Ninja and Sierra – which provide highly specialized trading experience to traders.

However, some users have reported platform-related issues, like downtimes, lag, delay in order execution, and other performance-related issues.

BitMEX also implements the TradingView charting system and has the same features as Phemex, including various chart types, time frames, indicators, and drawing tools.

BitMEX supports all order types, including:

- Market order

- Limit order

- Stop order

- Limit order

Advanced order types, including hidden orders, iceberg orders, post-only orders, and close-on trigger orders, are also supported.

BitMEX also has a mobile trading app that allows you to take and manage positions from a mobile device.

When you compare the Phemex and BitMEX trading platforms head-to-head, BitMEX’s platform seems a bit outdated. The user interface isn’t as smooth as Phemex. Moreover, the mobile app offered by Phemex has crashing issues and doesn’t provide a great user experience.

Verdict: Phemex is the winner, as it has a more robust and user-friendly trading platform.

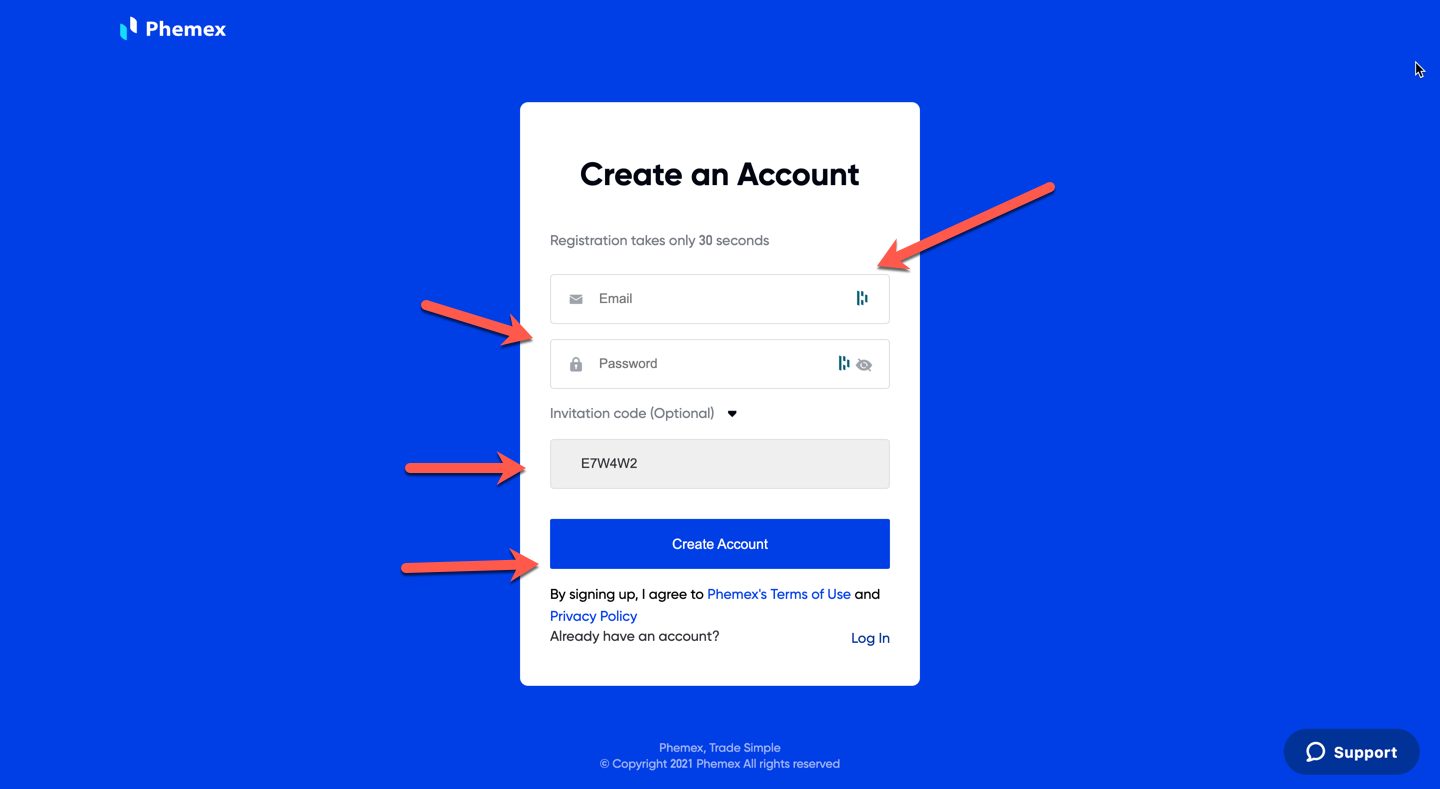

Phemex vs. BitMEX Account Opening Process

A quick and seamless account opening process is essential when looking for a crypto derivatives exchange. Let’s compare the account opening process of Phemex and BitMEX.

Phemex

Phemex has mandatory KYC requirements and requires every user to complete identity verification to start trading. Phemex facilitates KYC through Onfido, and hence, it provides a fast account opening process. To sign-up on the exchange, you can use this Phemex invite code.

BitMEX

BitMEX also requires users to complete identity verification. Once you upload the required identity verification documents, it would take a few hours for the BitMEX team to confirm your identity.

Verdict: It’s a tie, as both Phemex and BitMEX require users to complete KYC to use the platform.

Phemex vs. BitMEX Customer Support

Customer support is a vital element to consider before choosing a crypto futures exchange. Here’s a quick overview of the customer support offered by the two exchanges.

Phemex

Phemex offers 24/7 multilingual customer support through live chat that is accessible on their website. For more comprehensive issues, you can send them an email by raising a ticket from their helpdesk.

In addition, Phemex has a presence on various social media platforms and a vast knowledge base to help the users.

BitMEX

BitMEX also supports 24/7 multilingual customer support via email. However, no live chat feature is available, and the email response can sometimes take upto hours. BitMEX, too, has a vast knowledge base and a presence on social media.

Verdict: Phemex is the winner, as it offers a live chat feature and has faster response times.

Phemex vs. BitMEX Security Features

Security is one of the most critical aspects of a cryptocurrency exchange. It’s essential to review the security features in-depth before registering on any crypto platform. Let’s quickly compare the security features of Phemex and BitMEX.

Phemex

Phemex is one of the most secure crypto exchanges out there. It implements a hierarchical deterministic cold wallet system to protect its users’ funds. Additionally, standard users can withdraw funds only three times a day post manual authorization.

Other security features include two-factor authentication, IP whitelisting, encryption, AWS engine, and trade engine security.

BitMEX

BitMEX doesn’t lag behind Phemex in terms of security. It uses a multi-sig cold wallet system to protect users’ funds. Withdrawal requests are manually authorized. BitMEX also uses AWS for system security.

Other security features of BitMEX are IP whitelisting, SSL encryption, two-factor authentication, and more.

Verdict: It’s a tie, as both the exchanges have similar security features.

Conclusion

Phemex and BitMEX share a lot of similarities.

They offer similar trading products and leverage. They have the same trading fee structure and implement robust security features.

However, there are a couple of areas where Phemex beats BitMEX.

First, Phemex has a significantly better trading platform. The platform is modern-day, intuitive, and user-friendly. The BitMEX platform, on the other hand, is outdated and has performance issues.

Second, Phemex offers live chat support, which could be a dealbreaker for many users. Not many users want to send an email and wait for a few hours for the response. Hence, live chat has become a necessity in today’s time.

Overall, both exchanges are great, but Phemex has a slight edge as it has a more powerful trading platform and better customer support.

Here is How Phemex and BitMEX Compares To Other Crypto Exchanges

- Phemex vs Coinbase

- Phemex vs Bybit

- Phemex vs Kraken

- BitMEX vs PrimeXBT

- BitMEX vs Binance

- BitMEX vs Coinbase