Poloniex is one of the oldest cryptocurrency exchanges out there. The exchange lets you trade in various trading pairs across markets like spot, margin and futures.

Plus, it has one of the lowest trading fees in the market.

If you are new to Poloniex, you might wonder how to execute your trades, especially shorting the market. If you do, then here is a complete guide on how to short Bitcoin on Poloniex:

How to Short Bitcoin (BTC) Crypto on Poloniex?

Short via Margin Trading

Margin trading stands for using borrowed funds to execute your trades.

It allows a trader to open a position without needing to pay the full price for their trades. And you can get started with margin trading on Poloniex by following these steps:

Deposit Funds

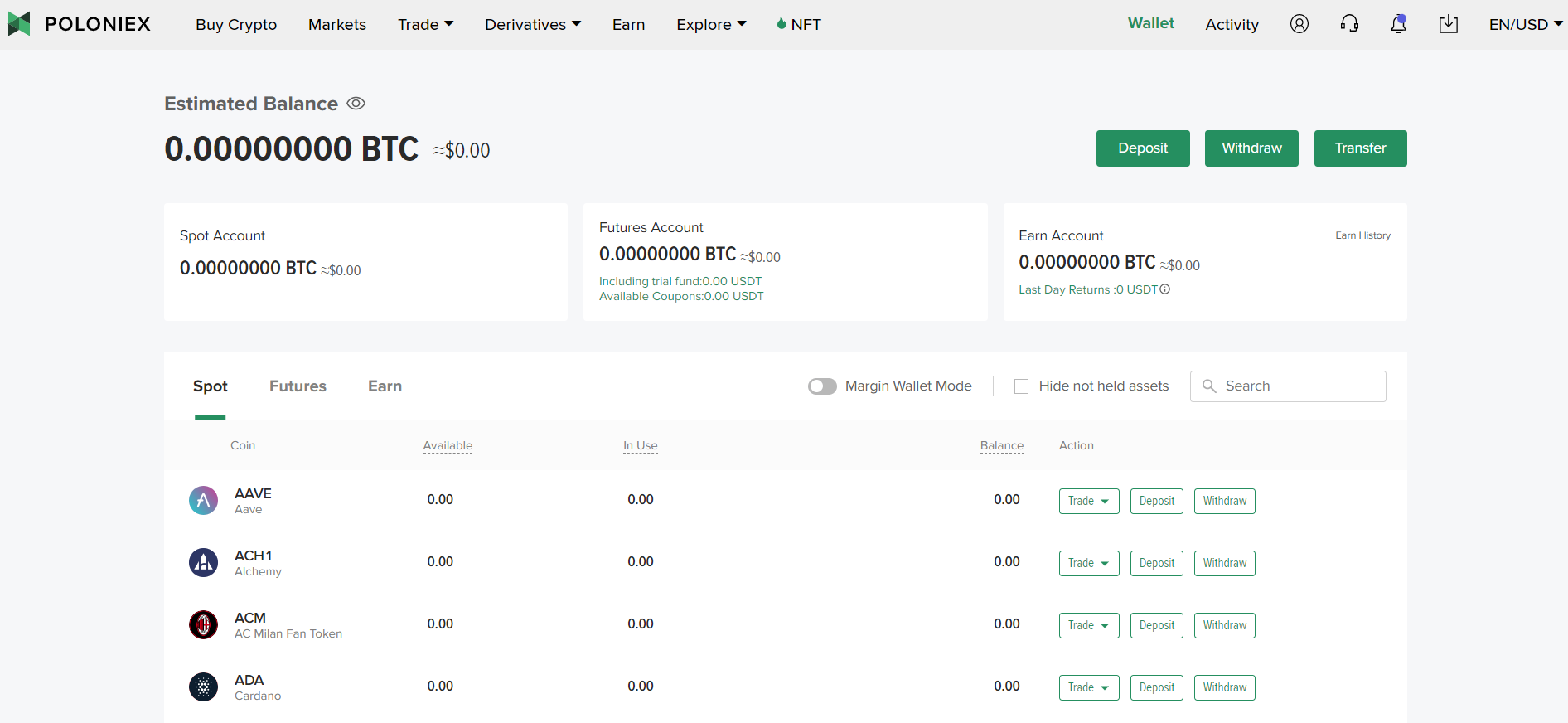

Before you can start trading, you are required to deposit funds to your Poloniex spot wallet. You can do it in two ways – first, and you can transfer funds from any other exchange or wallet to the Poloniex spot wallet.

Alternatively, you can buy crypto on the exchange itself using credit/debit cards and other payment methods.

There is no need to transfer funds between wallets inside the Poloniex exchange as the funds will get added to your spot wallet only, which will enable you to trade in the margin trading window as well.

Enable Margin Trading

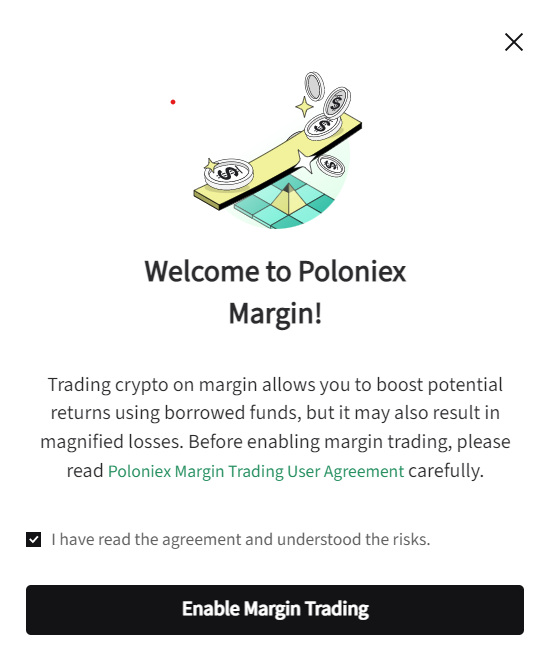

The next step would be enabling margin trading, which is pretty easy.

Go to Trade> Margin Trading.

Over here, you will see a prompt asking you to accept the terms and conditions. So do that, and follow the onscreen steps to enable margin trading, and you are all set to place your first Trade on the exchange.

Borrow

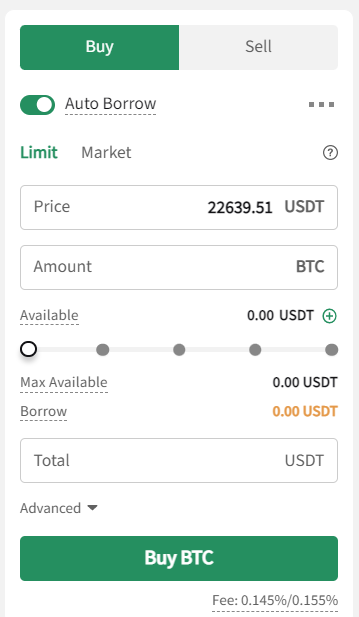

For borrowing funds, Poloniex offers you an auto-borrow feature. When the feature is enabled, the exchange determines the borrowing limit using the spot account’s margin.

Also, you should know that borrowing funds will incur interest, which could lead to forced liquidation if you fail to keep sufficient funds in your trading wallet.

The auto-borrow feature is located on the order form’s top bar. Simply toggle it on, and you are all set.

However, if you don’t want to borrow funds and use your capital for margin trading, toggle the option off.

Moreover, the actual borrowing and repaying happen when you place your order, so jump to the next part.

Trade, Borrow & Repay

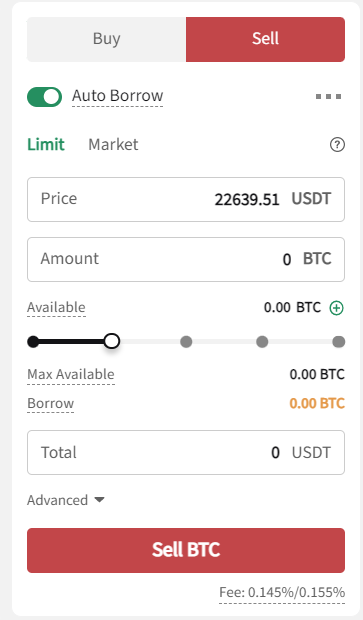

When we talk about shorting the market, we refer to placing a sell order first and then placing a buy order to close the Trade.

So to short crypto on Poloniex, select the Sell tab from the order form.

Next, you will find two order types – Limit and Market. Select an order type based on your trade requirement.

If you have selected a limit order, it will ask you to enter the price at which you want to place your order. For market order, the Trade will get executed at the asset’s current market price.

Also, you will find a slider labelled as available. You can use the slider to adjust how much funds you are willing to borrow. The borrowed capital would be displayed in orange, while your actual capital will be replaced as black.

So when the slider goes to the orange mark, you are borrowing the extra capital for your Trade, which will incur an hourly interest rate.

So the longer you hold your margin trade, the higher interest rate you will get charged.

After you enter all your trading details, you have to click on Sell BTC to place a short order. Next, you will find all the order details, such as borrowed funds, hourly borrow rate, and total amount.

To confirm the order, click on Confirm Sell order. And it will be shown under the Open orders tab located right under the technical chart.

Now it comes to repaying part. You are required to repay the borrowed funds along with the interest rate when you close your Trade. So when you close your Trade through a Limit or Market order, you will see complete order details, including the hourly rate and interest fee you are charged and what’s your profit and loss.

Click on the Confirm Buy Order to close the Trade. And the interest would get charged from the profit you made and settle down the trade. If your Trade is in loss, you have to pay the interest rate from your initial capital.

Short Via Futures Trading

Poloniex also offers you derivatives trading, and it is only limited to Futures perpetual contracts and grid trading. However, you won’t find futures trading contracts with an expiry date on the exchange.

Grid trading is similar to perpetual contracts only. You can say that it is an alternative version to futures trading only.

However, in grid trading, traders set up multiple predetermined price levels to automatically execute buy or sell orders.

However, the process of buying/selling perpetual contracts remains the same.

Anyway, to place a shorting order via the perpetual future market, follow the below steps:

Transfer Funds

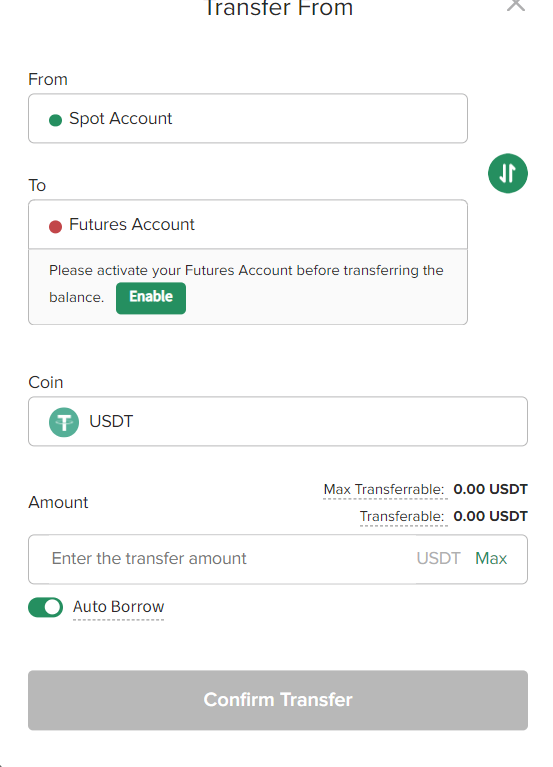

Unlike margin trading, you are required to transfer funds from your spot wallet to your futures wallet to start trading perpetual contracts.

To transfer funds, click on Wallet from the top bar.

Next, switch to the Futures tab, and over here, and you will see a transfer button – click on it.

Now since perpetual contracts are settled in USDT, you need to transfer USDT from your spot wallet to your futures wallet.

Also, you are required to enable a futures account before you can transfer funds. You can enable it from the Transfer Form itself.

Once you have enabled futures trading, simply enter the amount you want to transfer and click on Confirm Transfer.

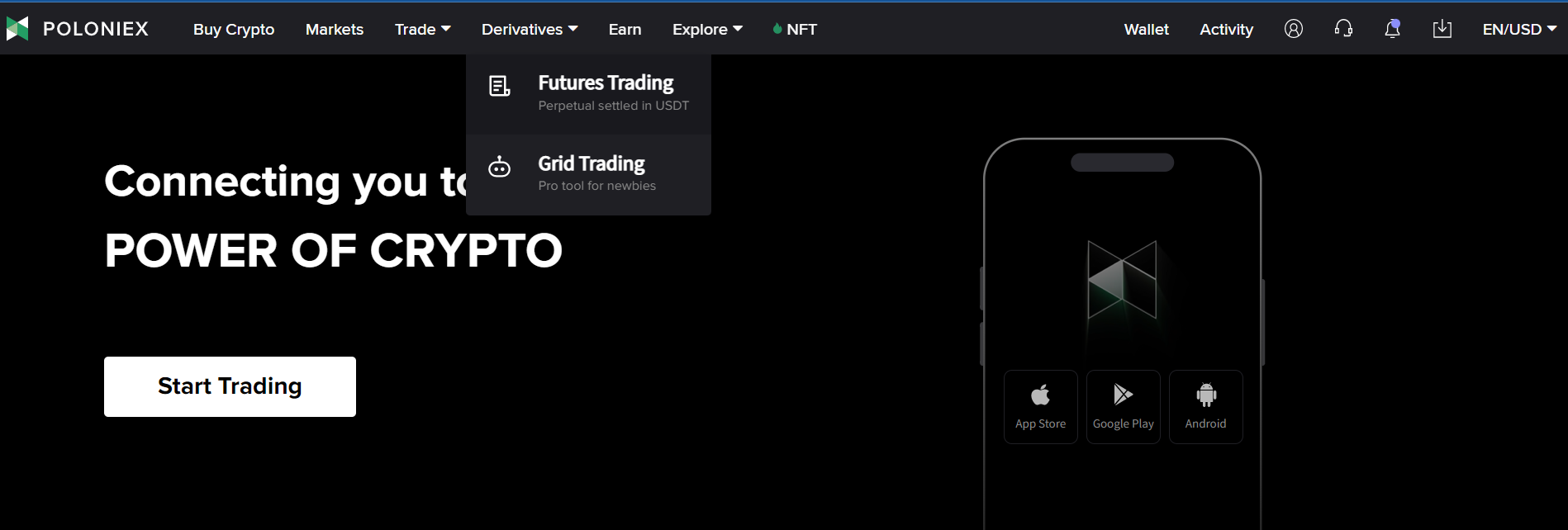

Go To Futures Trading

Now that you have transferred funds from your spot wallet to your futures wallet, you are all set to place your shorting order.

Go to Derivatives > Futures Trading.

Select A Trading Pair

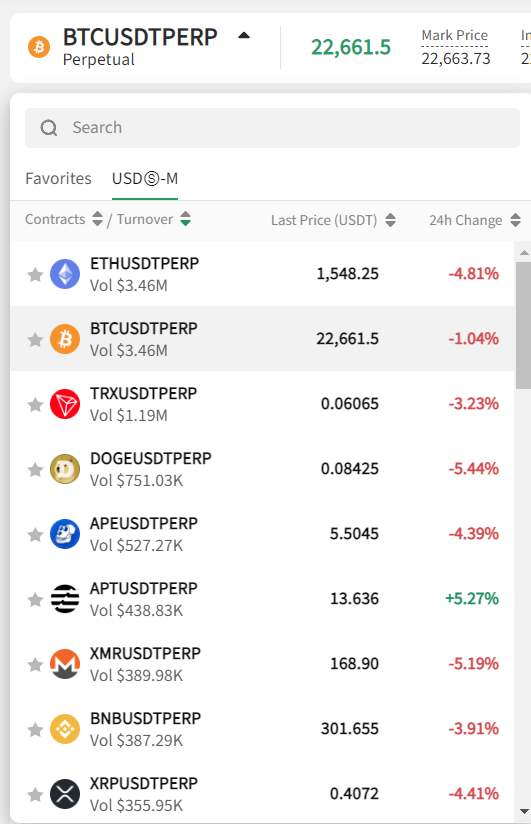

By default, you will land on the BTCUSDTPERP contract. However, if you want to trade on any other trading pairs, click on BTCUSDTPERP, and a small window will open.

Over here, you will find all the available trading pairs, such as ETHUSDTPERP, TRXUSDTPERP, DOGEUSDTPERP, and many others.

Select any of the preferred trading pairs, and its chart will open up.

Place A Shorting Order

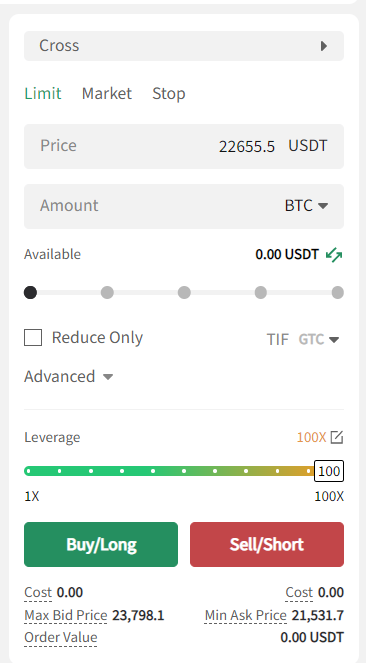

Coming to the order form, you will first find the Cross option. You will find the cross and isolated options when you click on them.

Cross refers to using the same margin balance for all your trades. While the isolated allows you to allocate a specific margin to each of your trades. By default, you should leave it as it is – which is cross.

Under cross is the market order type – Limit, Market, and Stop. Under the Limit order type, you need to enter the price you want your trade to place at and use the amount or slider to enter or adjust the order value.

Below that, you will find the Leverage slider. Using this, you can borrow funds and increase your position size. Also, the leverage varies from trading pair to trading pair.

Once you are done entering the order details, click on Sell/Short to place a shorting order. If you want to go long, click on the Buy/Long button.

After you are done placing your order, it should be visible under Open orders.

From there, you can close the order through a market or limit order. Along with that, you can also modify, close, and cancel your order.

Also, if you are holding your future trade for an extended period of time, make sure to check the funding rate.

The funding rate is similar to our interest in margin trading. However, funding rates are periodic payments made to traders that have long or short open positions.

Conclusion

Shorting in crypto trading is an essential element. It gives the traders the opportunity to trade in any market direction based on their analysis.

With Poloniex, shorting crypto is super easy, and the process works the same way across different markets. So go ahead and try placing a shorting order and see how it works for you.