Since 2018, the trading of cryptocurrency derivatives has been on the rise. This is a very positive development for the cryptosphere, which is a sign of a maturing market and good for the long-term growth of the cryptosphere.

This year derivatives trading will dominate the crypto market because, as per the trends, mostly the year is going to be uncertain and volatile. And, for experienced traders, such conditions provide a unique opportunity to profit massively.

And, platforms like Bybit and PrimeXBT are emerging as go-to platforms for crypto derivatives trading. Both platforms have been operating in this segment from the early days of the evolution of this market.

On first look, they might appear similar, but there are underlying differences, which I want to point out in this guide based on the following salient points:

- Leverage & Trading Pairs Comparison

- Product Offerings

- Trading Fee Comparison

- Funding Fee Comparison

- Withdrawal & Deposit Fee Comparison

- Liquidity Comparison

- Order Book Comparison

- Order Types Comparison

- Trading Platform Comparison

- TA Tools & Indicators Comparison

- Deposit Limits

- Funding Options

- Mobile Trading Functionality

- Security Features

- Customer Support

PrimeXBT vs. Bybit: Comparison In A Glance

| Exchange Features | PrimeXBT | Bybit |

| 🚀 Maximum Leverage | 100x (on all pairs) | 100x (only on BTC) |

| 📈 Trading Fees | 0.040% | 0.075% |

| ⚖️ Minimum Withdrawal | 0 | 0.001 BTC |

| 🔧 Withdrawal Fees | 0.0005 BTC | 0.0005 BTC |

| 💳 Supported Deposit Methods | Fiat and Crypto | Credit Card and Crypto |

| 🎁 Joining Bonus | 35% Deposit Bonus | up to $30,000 |

Launched in March 2018, ByBit is a centralized derivatives exchange that allows traders to trade cryptocurrencies like BTC, ETH, XRP, and EOS. It is registered in BVI, headquartered in Singapore, and has offices in Hong Kong and Taiwan.

Currently, Bybit offers a varied range of trading products, including inverse perpetual, USDT perpetual, and inverse futures with up to 100x leverage.

But, this leverage is not available on all the assets. It also has over two million users worldwide, but fees wise it is a bit more costly than PirmeXBT.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

PrimeXBT has quickly made a stronghold in the crypto space by providing high leverage up to 100x to trade cryptocurrencies. It is a Bitcoin-based exchange registered in Seychelles and operating in this space since 2018.

The exponential growth has taken it to 150+ countries with 200,000+ customers around the world. The exchange provides the option of 100x leverage on currencies such as BTC, ETH, LTC, XRP, and EOS with low fees.

Moreover, you can bet on traditional assets like stock indices, commodities, and forex through a single-use platform, i.e., PrimeXBT.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

Leverage & Trading Pairs Comparison

PrimeXBT provides through and through 100x leverage on all the pairs listed on its platforms, i.e., BTC, ETH, LTC, XRP, and EOS against USD & BTC pairs.

You can also trade traditional assets, including stock indices, commodities, and forex on the platform with leverage beyond 100X.

On the other hand, Bybit provides only these pairs for trading, i.e., BTC/USD, ETH/USD, XRP USD, and EOS/USD contracts.

Though the leverage option is upto 100x in reality, 100x is only available on the BTC/USD and BTC/USDT pair, and the rest all maximum can go up to 50x only, which isn’t the case while trading with PrimeXBT.

Product offerings

Bybit offers trading services in a wide range of crypto derivatives products that include:

- Coin-margined inverse perpetual contracts (BTCUSD, ETHUSD, XRP USD, and EOSUSD)

- USDT-margined linear perpetual contracts (BTCUSDT, ETHUSDT, BCHLINK, LINKUSDT, LTCUSDT, XTZUSDT, ADAUSDT, DOTUSDT, UNIUSDT, AAVEUSDT, SUSHIUSDT, XEMUSDT, XRPUSDT, and DOGEUSDT)

- Coin-margined inverse futures contracts (BTCUSD quarterly and ETHUSD quarterly).

PrimeXBT is a Bitcoin-based margin trading platform that lets you go short and long on crypto CFDs, including Bitcoin, Ethereum, Litecoin, Ripple, and EOS.

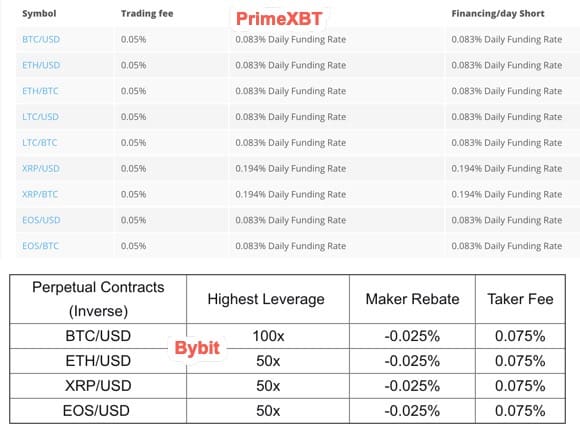

Trading Fees Comparison

When you compare these two products’ trading fees, too, PrimeXBT has the upper hand because its universal trading fees are nominally set at 0.05% per trade for all assets and types of traders.

Whereas ByBit has a maker and taker fee model. It offers a rebate of 0.025% to the makers and charges 0.075% from the takers. Since most traders are takers on any exchange, 0.075% is 50% more than PrimeXBT charges.

Funding Fee Comparison

On Bybit, the funding fee is exchanged between buyers and sellers every 8 hours starting at 0:00 UTC, which changes as per the market condition.

The funding rate can be negative as well as positive. When the funding rate is negative, the short position holders pay to long position holders. And, when it is positive, long position holders pay the short position holders.

The funding rate is indicated in the top section of the trading platform, with time remaining for the rate to refresh and in the contract details window.

For calculation of the funding fee, you need to multiply the position value with funding rate. The position value is the number of contracts divided by the mark price.

PrimeXBT levies overnight financing fees when the trades are carried forward to the next day. The trading day on PrimeXBT closes at 0:00 UTC, and it has a daily financing rate for both long and short positions, which is dynamic and changes as per the status of market liquidity.

Withdrawal & Deposit Fee Comparison

Bybit has no minimum deposit amount threshold on the platform and accepts BTC, ETH, EOS, XRP, and USDT (ERC-20 & TRC-20). Also, Bybit doesn’t charge any fees for deposits.

If you use the fiat option to deposit funds into the account, you need to pay the payment gateway and conversion charges.

However, Bybit levies withdrawal fees for all withdrawals and also has a minimum withdrawal amount. For instance, for BTC withdrawal, the minimum withdrawal amount is 0.001BTC, and the withdrawal fee is 0.0005 BTC.

PrimeXBT also has no minimum deposit and withdrawal threshold, but on every withdrawal, it charges a withdrawal fee of 0.0005, primarily to cover the BTC transaction cost.

(Result: Tie)

Liquidity Comparison

While comparing the exchanges, liquidity-wise, both stand neck to neck. Liquidity is one of the critical factors to consider when deciding on a crypto derivatives exchange.

PrimeXBT is hitting $550 million+ in daily trading volume on five assets, whereas ByBit is fetching $10 billion+ in daily trading volume at the time of writing.

However, PrimeXBT is integrated with 12+ liquidity providers, which helps execute orders at the requested quote and reduce order slippage. Therefore, despite low trading volume compared to Bybit, there is no impact on trading quality.

Order Books Comparison

PrimeXBT is more like a Bitcoin-settled CFD product, and the trading platform is fully automated through STP. PrimeXBT acts like a counterparty always whether you buy or sell and has simple order books with internal order books.

On the other hand, ByBit has open order books for its futures contracts, which anyone can select to buy/sell as per their guiding research. But this way, trading takes a lot of load on the infrastructure and is generally believed to be a bit slow.

Order Types Comparison

Bybit has three order types- Limit Order, Market Order, and Conditional Order. Under the conditional order type, it offers three trigger price types:

- Last Price: The price last traded on the exchange

- Index Price: The average price of the crypto asset of multiple exchanges

- Mark Price: The combination of index price and funding fees

The conditional orders are mostly used to limit losses using the option like closing on the trigger. Additionally, you can set up stop loss and take profit levels with every trade.

PrimeXBT has four main order types- Market Order, Limit Order, Stop Order, and OCO (One cancels the other). And, two protection orders include a stop-loss order and take profit order.

A stop order is an order to buy and sell an asset once the asset has reached the specified price, known as the stop price. Once the price is reached, the order becomes a market order. This order type is used for two purposes: risk management to limit losses and enter the market at the desired level.

And, the OCO is a conditional order, which allows you to combine two different orders. One order is executed, and the second order is cancelled.

(Result: Tie)

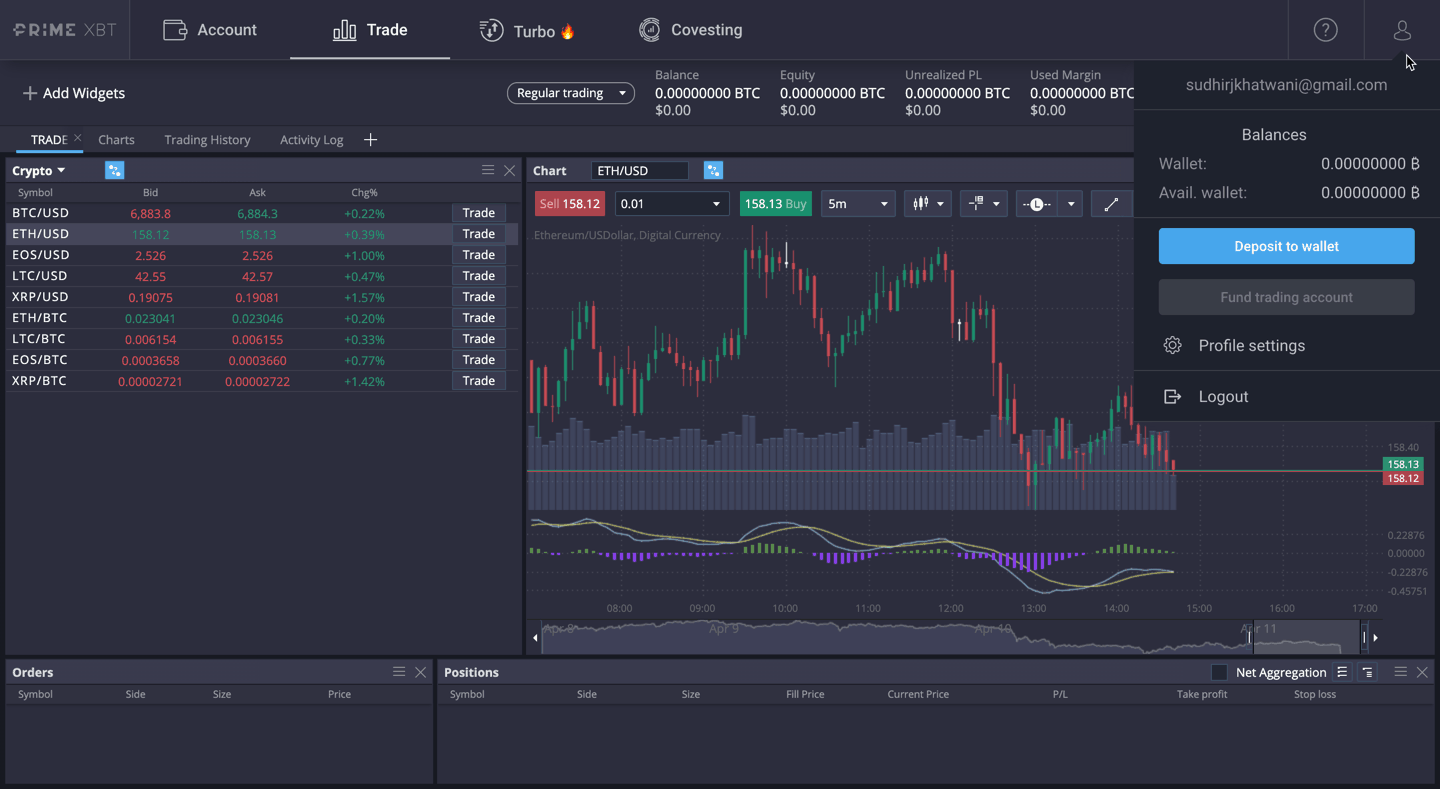

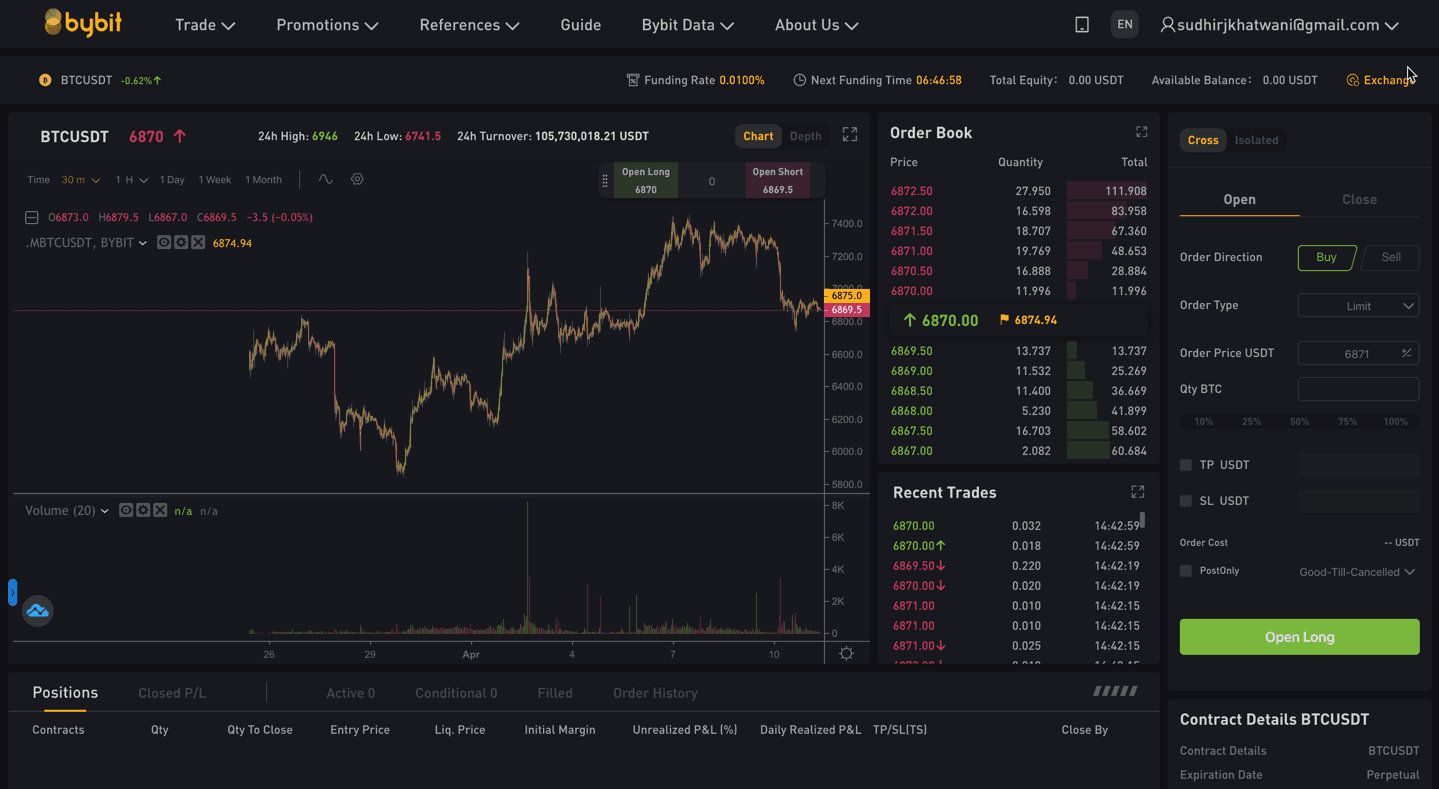

Trading Platform Comparison

I have briefly used both platforms, and I must say both have taken adequate steps to keep the trading process intuitive through simple UI.

I think both the exchanges make a tie as the UI is excellent at both ends. The order books are clean, and a customizable experience on both platforms helps traders set their trading stations the way they like.

PrimeXBT also provides its pro-traders the ability to set multiple windows so that they can execute in one while monitoring and strategizing in another.

TA Tools & Indicators Comparison

The two platforms seem to be providing similar charting experience and tools on the first look, but I have found PrimeXBT’s charging experience and tools handy to use. Their limited order books provide a lot of space on the working station to put your technical analysis into perspective.

Bybit’s charting and tools, I found tedious to use, but some people love it too. So it comes down to the individual choice in terms of indicators and tools. These tools are built right into the platform so that traders not need leave the platform for technical analysis.

Deposit Limits

In terms of deposit limits, ByBit seems to be leading the way because there is no minimum deposit limit as such on the platform, whereas on PrimeXBT, you are required to have a minimum of 0.001 BTC deposit to start trading.

Funding Options

PrimeXBT seems to be winning the battles in terms of funding options because PrimeXBT accepts other currencies, such as USD, EUR, etc., through a third-party integration and lets you deposit BTC in exchange for it.

Whereas ByBit allows traders to fund their accounts only using the five currencies, including BTC, ETH, XRP, EOS, and USDT. They do not support fiat deposits as of now.

Make sure to use PrimeXBT Promo code to get 35% deposit bonus and Bybit’s Referral code to get $1000 Welcome Bonus.

PrimeXBT vs. Bybit: Mobile Trading

Both Bybit and PrimeXBT enable trading through mobile apps and are available on both Android and Apple smartphones. It helps you trade, and keep track of all your orders/positions and the market on the go.

The apps offer access to all the top features and functions available in a web-based trading interface and are very easy to use.

In terms of users rating on Google Playstore, Bybit has a rating of 3.4 stars, and PrimeXBT has a rating of 2.2 stars.

Security Features

Both exchange platforms are committed to ensuring a high standard of security for the trading platform. Speaking about Bybit, the security features of the platform include:

- Multi-sig cold wallet system, which it keeps over 90% of the users’ fund

- Full SSL encryption to secure website traffic from online snoops and phishing attacks,

- Insurance fund to manage the risks of shortfalls in the futures contract settlement

- Two-factor authentication (Google Authenticator) for account login, passwords, withdrawals, API management verification, and change of security settings

PrimeXBT also uses an extensive range of security tools that include:

- Over 90% of the funds are stored in a multi-sig cold wallet system

- Two-factor authentication using Google Authenticator to prevent unauthorized account logins and changes in account security

- Full SSL encryption to secure website traffic

- All sensitive data are encrypted, and account passwords are cryptographically hashed.

- Cloudflare to prevent potential DDoS attacks

(Result: Tie)

Customer Support

Bybit has a 24/7 multilingual customer support team. The support is offered in languages in which the website content can be translated.

You can reach the customer support team live chat function for instant communication and redressal of issues. Also, you can reach them via email by sending mail to [email protected], and for tech support, you need to send mail to [email protected].

There are social channels as well, which include Twitter, Facebook, Telegram, Reddit, etc.

PrimeXBT offers 24/7 customer support service through the live chat function, which you can find in the account menu. Also, you can reach them via email at [email protected].

The exchange also offers a Telegram bot to check core account statistics, active orders, and current market rates and reach the customer support team.

It also has social accounts on Twitter, Facebook, Youtube, etc.

PrimeXBT vs. Bybit: Which is a Better Choice?

While testing and researching for this PrimeXBT vs Bybit guide, I have found both exchanges giving each other an eye for an eye, but I still feel both exchanges are perfect for their purposes.

If you are someone who is looking for high leverage and low fees, PrimeXBT is the way to go because it offers the same benefits as contracts while going long or short.

On the other hand, if you prefer trading contracts ONLY for going long/short, ByBit is the product for you, but with lesser leverage to benefit from!!

Learn how does Bybit and PrimeXBT stack up against the competition.

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023