Trading futures is one of the lucrative markets in the crypto industry. Futures are a type of contract formed between two parties to sell an asset at a future date.

There are many crypto derivatives or futures available out there. However, one of the well-known future contracts is Ether Futures.

Ethereum is the second largest cryptocurrency based on market capitalization. This makes it one of the preferred contracts to trade in the crypto market. So the question is, what are Ethereum Futures?

Let’s learn all about it below:

What Are Ethereum Futures?

Ether futures are a contract that is formed between two parties to buy and sell an underlying asset at a fixed value at a future date. In the case of the ether futures, the underlying asset is Ethereum cryptocurrency.

Future traders speculate about the future cost of the underlying asset. And depending on this, one can buy the asset or sell the asset. Also, ether futures have an expiry date or settlement date when the contract will get expired, or you can say that the trade will get settled.

What makes ether futures different from regular crypto trading is that you are not buying actual assets. Instead, you are buying or selling a contract speculating about an asset’s future cost.

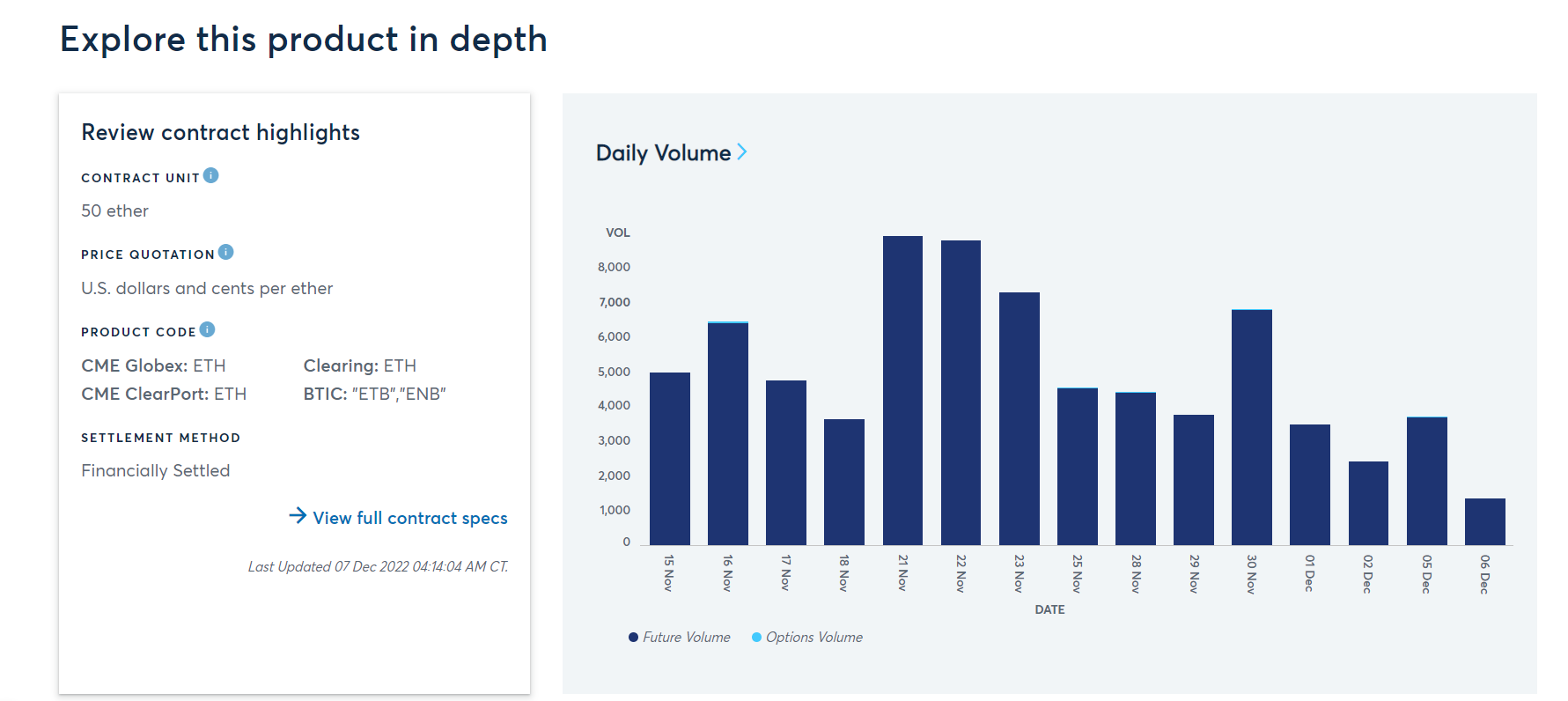

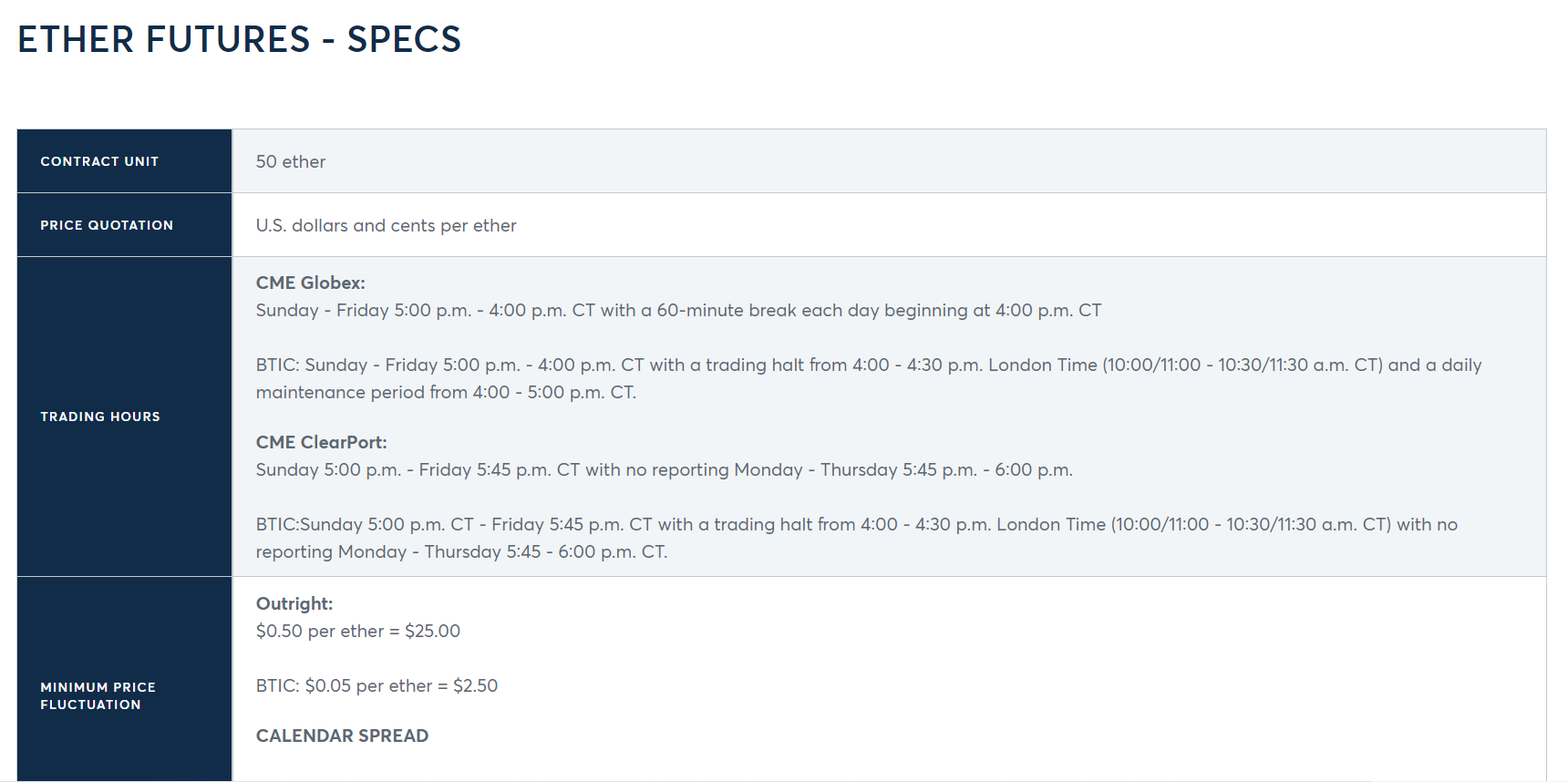

These types of Ether futures are traded in regulated exchanges like CME Group. However, you will need to invest huge amounts of funds to trade futures this way.

Alternatively, the popular types of futures trading that you get to see across cryptocurrency exchanges like ByBit, Phemex, OKX, or others is the perpetual contracts.

These contracts don’t have an expiry date. Instead, it uses a funding rate mechanism to ensure that the value always stays under control. To start trading perpetual contracts, you don’t have to invest huge funds plus the risks are low than the CME group.

Types of Ethereum Contracts

There are three types of Ethereum contracts out there. These are the USD cash-settled contract, USD-M contracts, or Coin-M Contracts.

- USD Cash Settled Contract

As you can guess by the name, USD-settled contracts are settled in USD, and regulated exchanges like the CME group offer it.

These contracts do have an expiry date, and traders are required to place bets based on their requirements. Also, these contracts can be purchased and sold before the expiration date to minimize risks or book profits.

- USD-M Contracts

USD-M Contracts are the most popular futures trading instrument. It is available across crypto trading platforms, and these contracts are settled in a stablecoin like the USDT.

Also, these contracts don’t have an expiration date. So you can hold a futures contract for as long as you wish. But the longer you hold the contract, the higher the funding fee will be.

- Coin-M Contracts

Coin-M Contracts are similar to USD-M Contracts. However, these contracts are settled in cryptocurrencies than fiat or stablecoin.

These contracts are known as ‘inverse’ contracts and allow you to use your crypto holdings for opening future trades while enabling you to earn a profit on your holding.

How Do Ethereum (ETH) Futures Contracts Work?

As mentioned earlier, Ether futures are a contract where a buyer agrees to purchase, and the seller agrees to sell an underlying asset like Ethereum or Bitcoin at a predetermined cost on a specific date.

Now, these types of contracts do have an expiry date when the contract will no longer be valid. And most commonly, the contract is settled in US dollars.

On the settlement date, the seller has to pay the dollar difference between the contract value and the settlement value.

Ether futures are settled in USD on the settlement date. If the settlement cost ends up being higher than the contract value, the seller agrees to pay the difference between the buying and selling costs.

Similarly, if the settlement value is lower than the contract value, the buyer has to pay the difference to the seller.

In other words, if you believe that the ether futures value will go up, you will open a long trading position. Or if you believe that the contract will price will go down, you have to open a shorting position. And on the settlement date, the difference between your buying price and selling cost would be your profit or loss.

To help you with an example, If you believe that ether futures value is going to rise up in the coming month, then you simply buy an Ether futures contract at the current market value of $1200.

Now when you are buying a futures contract, you don’t have to pay for the full contract price. Instead, you can have a minimum balance in your account and use leverage offered by the exchange.

For instance, the CME group Ether futures contract size is 50 Ethers, and the contract requires you to pay 50% of the purchase amount, and the other 50% can be borrowed from the exchange. (They also offer micro ether futures sized at 1/10.)

This means to open an ether futures position; you have to invest about $30,000 if you consider the Ether price as $1200.

Now during the settlement date, depending on your trade, you will either enjoy your profits if the market goes bullish or pay for the losses if the market trend is bearish.

Joining CME? Know What is CME Gap?

If you don’t have that amount of funds to invest in your futures account. You can choose to trade in perpetual contracts, which have a less amount requirement. Plus, you enjoy high leverage for your trades across multiple crypto exchange platforms.

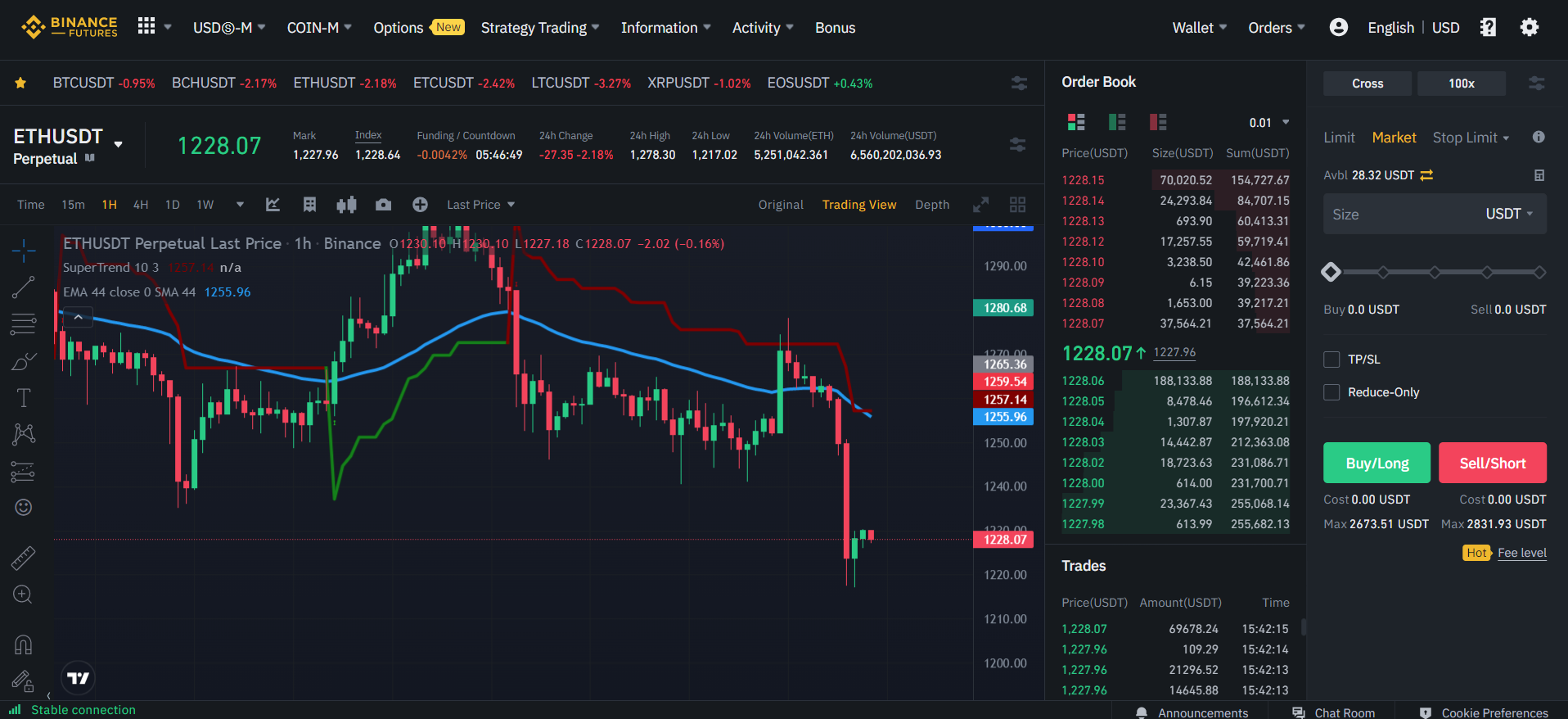

For example, Binance offers you up to 100x leverage for Ethereum.

Hence to open an ether trade, you would only need to have $12 in your trading account. Apart from this, you should be capital efficient and have enough in the exchange to support the liquidation price.

Benefits Of Ether Futures Trading?

- Flexibility

ETH futures brings you greater flexibility to trade in any market condition and take advantage of market-moving events.

Different from spot trading, you are not limited to buy low high sell principle. But you can open both long and short positions depending on how the market moves, giving you a chance to make money.

- Leverage

Futures trading has an involvement of high leverage, which increases your buying power. As a result, even with low funds, you can open trades of thousands of dollars or more.

As a result, if your trades do go in your favour, you will enjoy a higher profit or face a higher risk if your trades don’t go well.

- Hedging

With ETH futures, you can perform one of the popular trading strategies known as a hedge. In crypto hedging, you choose a trading pair that is expected to perform in the opposite direction of an existing position.

For instance, if you are long on Ethereum but want short-term downside protection then you can use enter into another trading position like Bitcoin that will yield a profit if the value of the Ether falls.

- Liquidity

Trading ether futures gives you access to high liquidity. As a result, you shouldn’t have any problem executing your buy/sell orders at your desired price, as you will always find market participants for executing a trade.

Conclusion: Is Ether Futures Trading For You?

Trading Ether futures contract is one of the best ways to make money with crypto trading.

However, ether futures is considered to be a risky area where both the profits and losses are huge.

Also, if you are going to trade in regulated exchanges, you need to have winning trading strategies in place.

But if you are a beginner and still wish to trade futures, then trading perpetual contracts would be a better choice. These are less risky contracts, and you can set the leverage to as low as 5x.

So you won’t bet much of your funds and won’t lose much. As you gain exposure in the market, you have the ability to take higher volume trades with leverage.