Not sure what to choose between Bitget vs Binance?

If you also have this dilemma, then I am here to help you out. Binance and Bitget are two of the most popular and best crypto exchanges for day trading out there.

Both exchanges have similar market offerings and features. Hence, for any newbie to the derivatives market, it becomes really confusing to choose an exchange.

But even though both exchanges seem quite similar, you will find a lot of differences that can impact your overall trading journey.

Hence to help you choose the right exchange, I have compared both exchanges below. So go ahead and check it out:

Binance vs Bitget: At A Glance Comparison

Bitget is one of the leading crypto exchanges out there, founded in 2018. The exchange is giving competition to a giant like Binance by also serving institutional clients.

The exchange offers you lots of cool and useful features like derivatives trading. Apart from basic buying/selling crypto on the digital asset trading platform, you can trade in Futures or Spot markets.

Also, the exchange is known as one of the top exchanges for crypto traders looking to accomplish copy trading. This has brought on the crypto social trading revolution and allows you to maximize profits if you pick the correct people to follow.

Binance is known as the world’s largest crypto exchange by trading volume. The exchange is trusted by millions of users and institutional clients globally, and it offers almost every crypto solution you can think of.

On the exchange, you cannot only buy or sell cryptocurrencies. But you can also trade in spot, margin and Futures markets at affordable trading costs without any hidden fees.

The exchange also offers you high leverage, deep liquidity, and an advanced trading platform with lots of crucial trading features.

Binance vs Bitget: Trading Markets, Products & Leverage Offered

In terms of product offerings, both exchanges are pretty similar, but there are slight differences.

Bitget

- Spot Trading

- Spot Margin Trading with leverage between 5x to 10x

- USDT-M Futures with leverage up to 125x

- USDC-M Futures with leverage up to 125x

- Coin-M Futures with leverage up to 125x

- Copy Trading

Binance

- Spot Trading

- Margin trading with leverage ranging from 3x to 5x

- USD-M Futures contracts with up to 125x leverage

- Coin-M Futures contracts with up to 125x leverage

- BUSD Futures Contracts with up to 125x leverage

- European-style Crypto Options

- Binance Leveraged Tokens with up to 4x leverage

Verdict: As both exchanges have similar market offerings and leverage, it is a tie.

Binance vs Bitget: Supported Assets

Bitget

Bitget also offers you a wide range of tokens. However, the official number of how many tokens there are keeps changing on a daily basis as some are added and other crypto assets are removed.

But it is estimated to be around 500+ tokens. So again, it stands in an equal position with Binance.

Binance

Being one of the largest crypto exchanges, Binance supports over 500+ crypto tokens and trading pairs.

Also, Binance is at the forefront when it comes to launching new tokens for many upcoming projects.

Verdict: Although both exchanges sort of have an equal number of tokens, Binance wins this section as it is a popular destination for new crypto tokens to be launched.

Binance vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

Now let’s talk about the trading fees charged by both exchanges.

Trading fee is a crucial element of choosing a crypto exchange as they can significantly impact your overall P&L.

Bitget Spot Trade Fee

For a spot trade, Bitget charges you 0.1% whether you are a market maker or a market taker. If you use $BGB to pay for the fees, you can get a discount and will need to pay 20% less as the maker or taker in the trade.

| Regular Fee | 20% Discounted Fee | |

| Maker Fee | 0.1% | 0.8% |

| Taker Fee | 0.1% | 0.8% |

Bitget Futures Trading Fee

For Futures trade, Bitget has a standard fee structure. But there are no additional discounts. So the regular futures fee stands at:

| Regular Fee | |

| Maker Fee | 0.02% |

| Taker Fee | 0.06% |

Bitget Deposit & Withdrawal Fees

There are no fees for crypto deposits on Bitget.

But again, if you want local fiat access through bank transfer, credit/debit cards, or any other payment options, then transaction fees will have to be paid.

Talking about the withdrawal fees to a self-custodial wallet, all cryptocurrency exchanges will charge you a certain fee. The withdrawal fees are automatically adjusted based on the status of the crypto market.

Also, Bitget has P2P trading that can be used for free deposits and withdrawals of crypto.

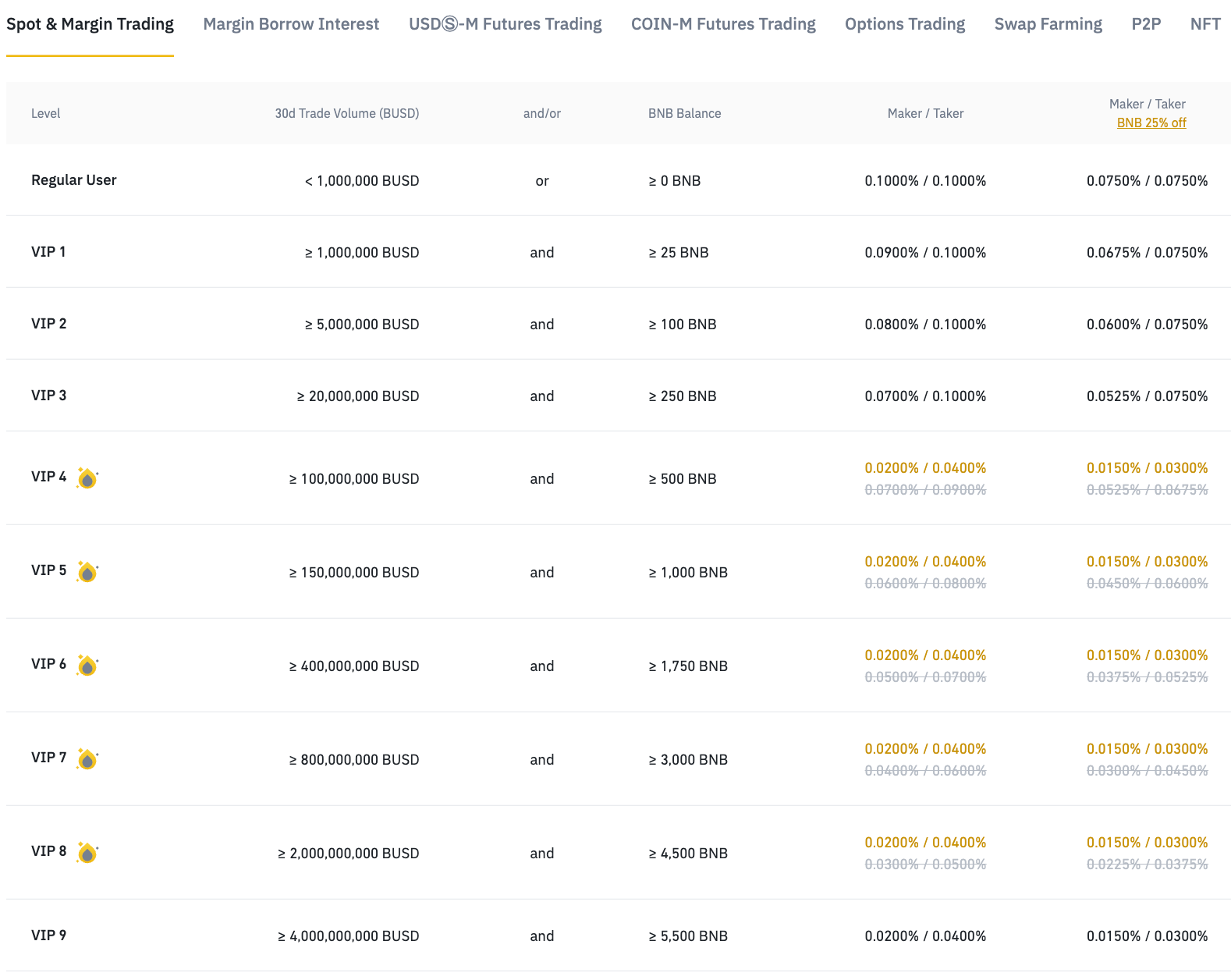

Binance Spot Trade Fee

Binance has a straightforward trading fee structure with different tiers and follows the standard maker-and-taker fee model.

Along with that, you will get a 25% discount on fees for a spot trade if you pay your fees using Binance’s native token BNB.

So the regular and discount fee for a spot trade stands at:

| Regular Fee | 25% Discounted Fee | |

| Maker Fee | 0.1000% | 0.0750% |

| Taker Fee | 0.1000% | 0.0750% |

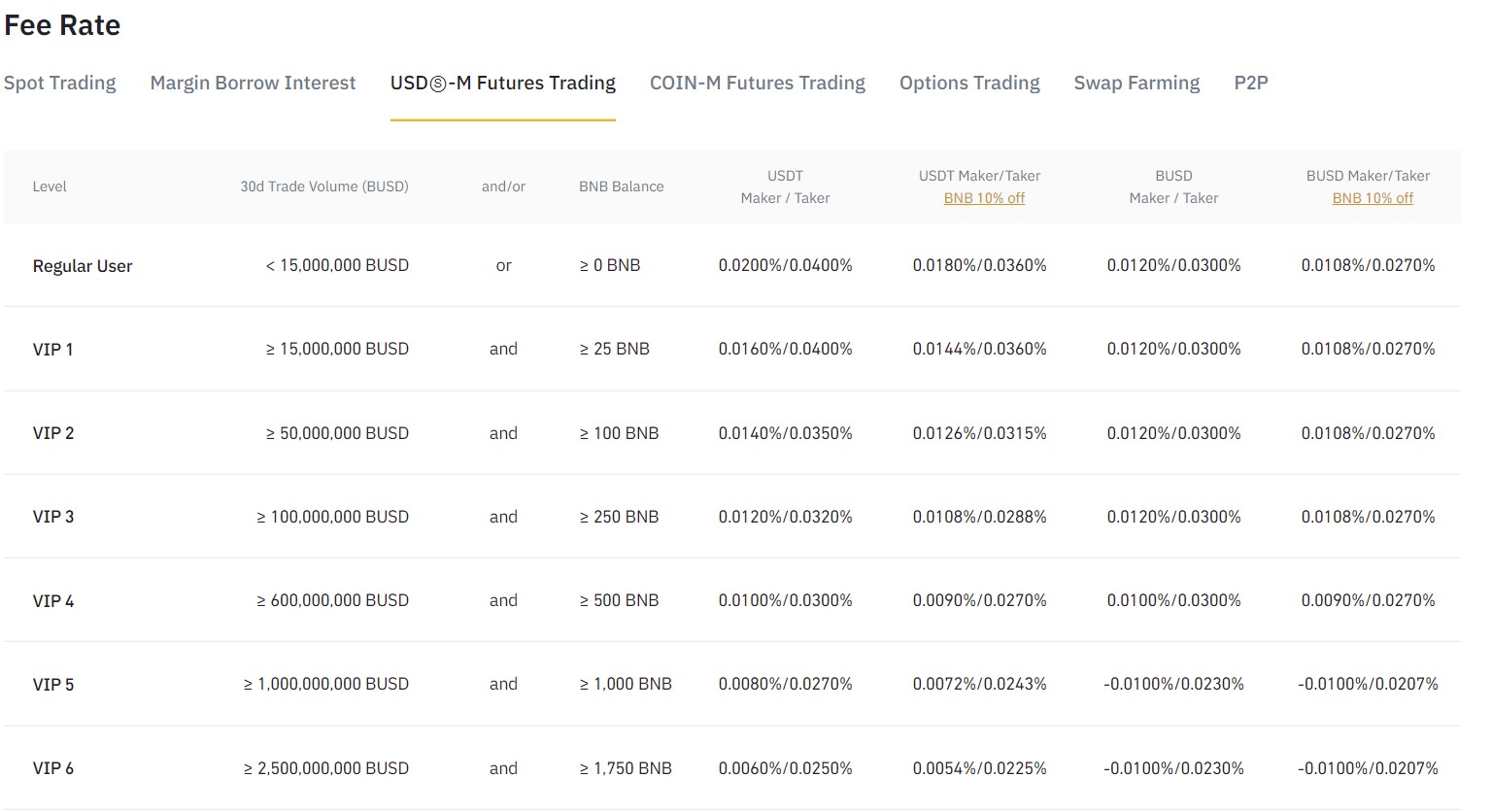

Binance Futures Trading Fee

For Futures trading, too, you have a tired fee structure. Plus, you are getting 10% off on futures trades for only USDT and BUSD contracts.

So the regular fee stands at:

| USD-M Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0180% | 0.0108% |

| Taker Fee | 0.0360% | 0.0270% |

| BUSD Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0120% | 0.0108% |

| Taker Fee | 0.0300% | 0.0270% |

| Coin-M Futures Fee | Regular Fee | |

| Maker Fee | 0.0100% | |

| Taker Fee | 0.0500% | |

| Binance Options Trading Fee | Regular Fee | |

| Maker Fee | 0.020% | |

| Taker Fee | 0.020% |

Binance Deposit & Withdrawal Fees

There are no fees for depositing crypto.

But if you are depositing fiat through a credit/debit card, bank transfer, or any other method, it will be subjected to a transaction fee.

Similarly, for withdrawals, Binance does charge you fees. The fee depends on what currency you are withdrawing.

Fortunately, Binance has P2P trading that can be used for deposits and withdrawals.

Verdict: Binance is a clear winner in terms of trading fees. It not only has a lower trading fee but offers you heavy discounts on it.

Binance vs Bitget: Order Types

Coming to supported order types, you will again find a few similarities between Bitget and Binance.

Binance

- Limit

- Market

- Stop Limit

- Stop Market

- Trailing Stop

- Post Only

- TWAP

Bitget

- Limit

- Market

- Trailing Stop

- Trigger

- Post Only

Verdict: As Binance has a large number of supported order types, it is the clear winner for this section.

Binance vs Bitget: KYC Requirements & KYC Limits

Bitget

Bitget does require you to complete KYC to start trading on the exchange. Without verifying your account, you can not add or withdraw funds, use P2P trading, or deposit funds.

But unlike Binance, it doesn’t have different KYC levels.

Instead, it has one KYC level only, which comes with a daily withdrawal limit of 200 BTC and enables your account for fiat currency trading.

Binance

Binance has a strict policy on user verification. As a result, they made KYC a mandatory process. Without verifying your account, you won’t be able to add funds, trade, or withdraw.

But it has different KYC levels, which enhances your account limits.

KYC Limits

- Verified: You will enjoy a daily fiat Limit of 50K USD Daily.

- Verified Plus: You will enjoy a daily fiat Limit of 2M USD Daily.

- Verified Plus (2): It offers you unlimited Fiat Transactions.

Verdict: Both Bitget & Binance require you to complete KYC. So for users looking for non-KYC exchanges, you might want to keep looking.

Binance vs Bitget: Deposits & Withdrawal Options

Both exchanges are quite the same when it comes to depositing and withdrawal options.

Bitget

- Method 1: Buy digital assets using credit, debit cards, bank transfers, or other payment methods like SEPA, SWIFT, Fast Payment Poli, and many more.

- Method 2: Use P2P trading to deposit and withdraw funds at zero cost using payment methods in your local market.

- Method 3: Deposit funds to your Bitget crypto accounts from another exchange or wallet for cryptocurrency trading.

Binance

- Method 1: For buying crypto, you can use your credit or debit card, bank transfer, or other available payment methods.

- Method 2: Binance supports peer-to-peer or P2P trading, which is a free deposit and withdrawal method in the crypto world.

- Method 3: Transfer digital currencies from other crypto exchanges or wallets to Binance’s wallet for cryptocurrency trading.

Verdict: As both the exchanges have similar deposit and withdrawal methods, it is a tie between Binance and Bitget.

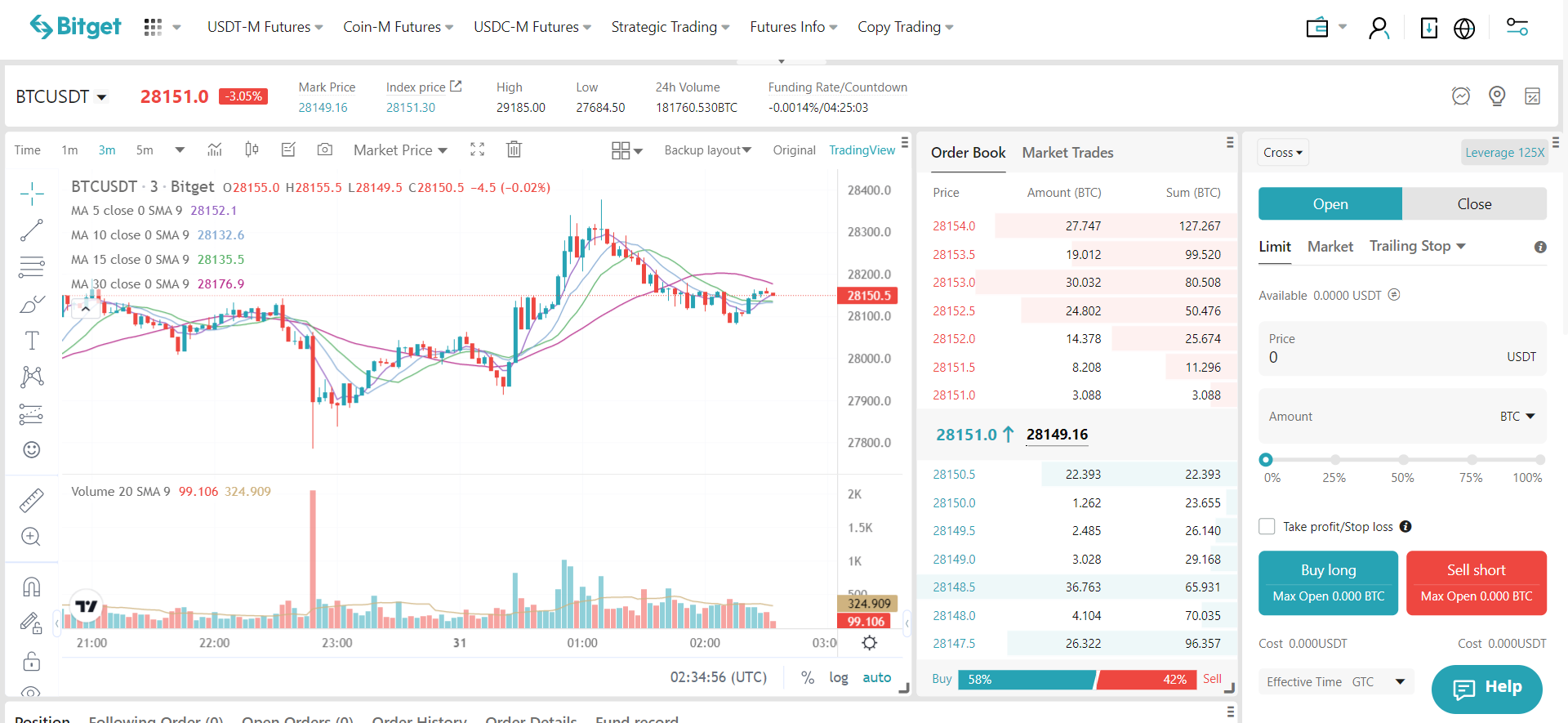

Binance vs Bitget: Trading & Platform Experience Comparison

In terms of trading platform experience, both exchanges are pretty identical.

And here are all the features, including the advanced trading features you are getting under these respective trading windows:

Bitget

- Technical chart powered by TradingView

- Trading pair details

- Order book

- Market trades

- Easy-to-use order form

- Position, following order, open orders, order history, order details & fund record

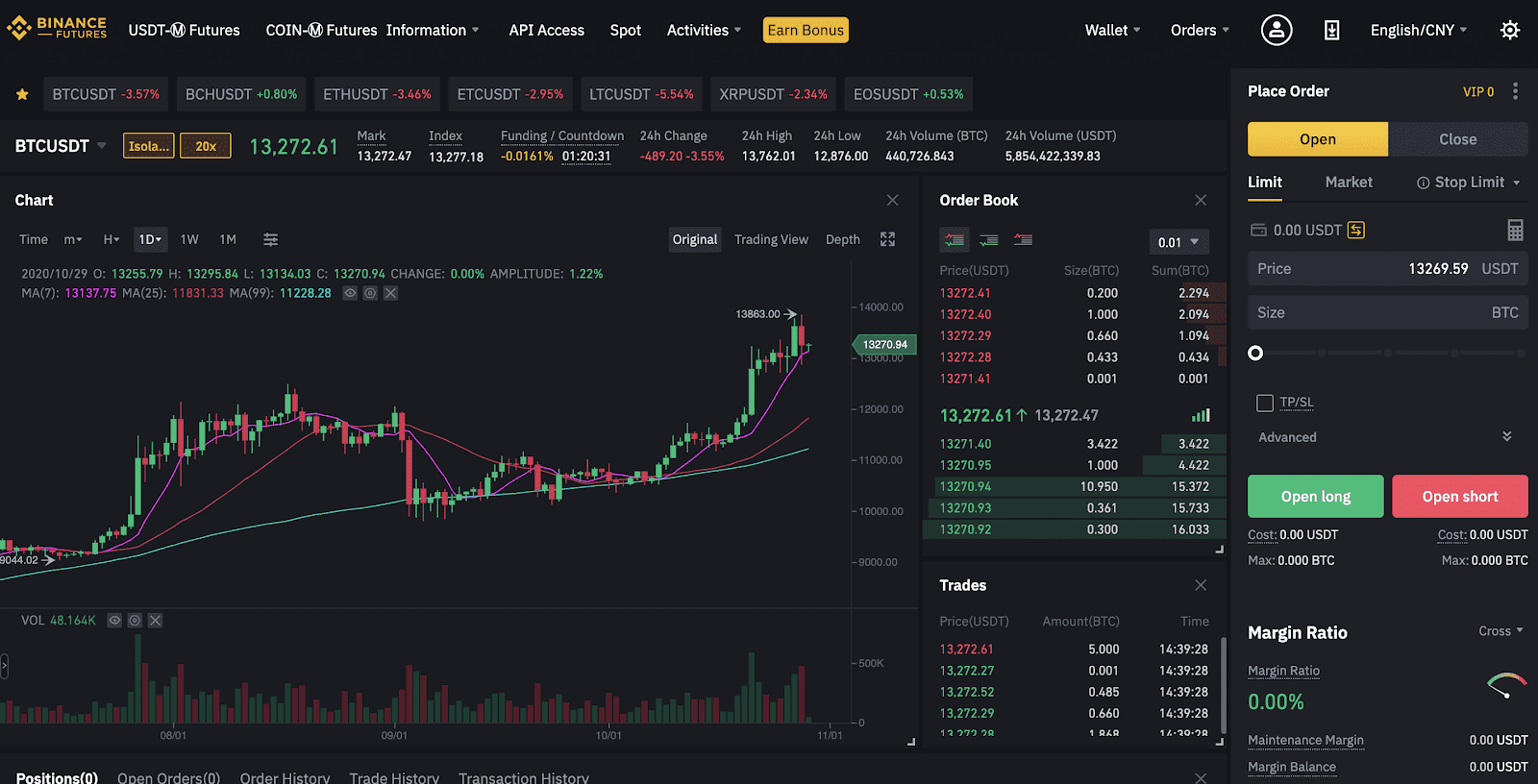

Binance

- Multiple technical chart options, including TradingView

- Pair details

- Order book

- Easy-to-use order form

- Trade history, open orders, PnL records

- User-friendly mobile app

- Paper trading

To know more about Binance, check this Binance Futures guide

Verdict: In terms of trading features, there is hardly any difference between the two. Hence it is a tie.

Binance vs Bitget: Customer Support

Bitget

Bitget offers customer support via their live chat window on their website, which can be used for connecting with a live support agent.

Alternatively, you can also use their support email to raise your issues. However, Bitget doesn’t offer support through its social media channels like Twitter.

Binance

Binance offers you excellent customer support with a quick response rate.

Plus, you get several ways to reach out to Binance for help. For instance, you can use their chat window to access different support articles or connect with a live support agent.

In addition to that, you also have the option to get help over email. Or you can reach out to Binance help through Twitter at @BinanceHelpDesk.

Verdict: Overall, Binance is a better choice in terms of customer support. As it is more convenient to reach out and has a faster response time.

Binance vs DyDx: Security Features

Bitget

- Two-Factor Authentication

- Anti-phishing code

- Fund code

- Device management

Binance

- Keeps funds in cold storage

- Two-factor Authentication

- Real-Time Monitoring

- Advanced-Data Encryption

Verdict: As Binance offers slightly more security solutions compared to Bitget, it is the winner for this section.

Is Bitget Safe & Legal To Use?

Bitget is one of the safe and legal cryptocurrency exchanges to trade crypto and avail of derivatives trading services for institutional and individual trading.

The exchange has regulatory licenses for many countries worldwide.

Also, they have a policy of storing digital assets in cold storage to protect against any loss of funds.

Moreover, the exchange has not faced any hacking attempts to date, and it is offering several security features to the end users.

Is Binance Safe & Legal To Use?

The Binance platform is one of the trusted and widely used cryptocurrency exchanges with no history of hacks since 2019.

The exchange offers several features to the user’s end to protect their account and funds.

Plus, it keeps a majority of the funds in cold storage and has implemented several security features.

Additionally, Binance also has a Secure Asset Fund for Users or SAFU, which is an emergency insurance fund that holds a percentage of all trading fees on the digital asset company, Binance’s platform, to help users in case of financial loss.

Is your crypto safe with exchanges?

If you have been in the crypto space for some time, it is common knowledge that only self custodial wallet can keep your coins safe in this blockchain economy.

Exchanges are good for doing things like crypto loans, where you can get instant crypto credit lines against your coins.

But if the exchange were to go under tomorrow, the collateral for the crypto loans goes away with it. You need to have an impeccable risk assessment to make sure that the exchange you have picked will stay liquid.

For this reason, you should have a large part of your portfolio stored in a secure crypto wallet, preferably one that is a security-first technology provider and prides itself on data protection.

Some examples of secure crypto wallets that come to mind are the Nexo wallet app or Bitgo.

Bitgo has one of the first digital asset companies that provides a SaaS platform for your crypto. In 2018, they launched BitGo trust company which is a qualified custodian for your crypto with no seed phrase vulnerability.

So if you are an institution looking to keep your crypto suite safe and dabble in derivatives trading services, the blockchain infrastructure of Bitgo is the one you want to get behind.

Conclusion: Why not use both?

Overall, it is a close match between Binance vs Bitget.

Both Binance and Bitget exchanges are pretty equal at many key points. But Binance is still a winner as it gives you global cryptocurrency trading capabilities.

Binance offers you different trading markets and has lower fees compared to Bitget.

Plus, you get additional discounts on your fees if you use their native coin. Also, the overall trading experience across Binance Web and their free mobile apps are easy to understand and use.

But Bitget is not a loser.

The exchange allows P2P trading and has several other key features, just like the multiple exchanges that have been out there for more than a decade.

Check out how Binance & Bitget compete with other crypto exchanges:

- Binance vs StormGain

- Binance vs Poloniex

- Binance vs KuCoin

- Binance vs PrimeXBT

- Binance vs Bitrue

- Bitget vs Bybit