Cannot decide between Nexo and Binance?

Want to know which of the two will best suit your trading needs? Or do you want to know about these exchanges in depth?

Don’t worry, you are at the right place.

I have come up with the most sensible comparison of these two exchanges highlighting all their features, and covering every single detail that you should know before you get your hands on them.

So without any further delay, let’s begin with some insight into these remarkable exchanges.

Binance vs Nexo: At A Glance Comparison

Binance

Beginning the insight with Binance Futures, a renowned crypto exchange and the world’s largest cryptocurrency exchange by trading volume founded in 2017.

A company introduced in China, creating the base of decentralization across the globe.

Binance currently holds more than 120 million users globally, accounting for more than $38 billion worth of trades every single day.

Nexo

On the other hand, is Nexo, another profound name in the cryptoverse. Founded in 2017 to offer financial benefits for storing crypto assets.

Currently, the platform holds more than 2 million users across 192 countries.

Nexo launched its very own crypto exchange just recently in 2021, introducing a long list of crypto coins shortly after that. Moreover, Nexo also offers crypto banking features with competitive pricing.

Now, let’s discuss what they have in store for you in terms of trading markets, products and leverage.

Binance vs Nexo: Trading Markets, Products & Leverage Offered

Binance

Starting with Binance again, this market leader has a long list of crypto trading products and markets that include:

- Leverage Trading: Take advantage of the maximum leverage of up to 20x.

- P2P Trading: Trade TetherUS (USDT) with the lowest transaction fees of <0.10% for all markets and 700 payment methods.

- Binance Earn: Enjoy flexible DeFi staking with up to 6.38% and an additional 1.5% APR.

- Spot Trading: Includes all your favourite ones like BTC, ETH, SOL, XRP and many more.

- Futures Trading: For futures trading, you can choose from:

- Coin-M Futures: Perpetual or quarterly futures contracts settled in crypto coins.

- USD-M Futures: Perpetual or quarterly futures contracts settled in USDT or BUSD.

Nexo

On the other hand, Nexo also has a wide range of crypto trading products that include:

- Crypto Swap: True cost with no price slippage with an easy-to-use interface.

- Spot Trading: Zero fees to instantly buy and sell more than 500+ trading pairs

- Leverage Trading: Maximum of 20x leverage on all of the assets.

- Borrow Funds: Instant approval with 40+ fiat currencies with industry-leading rates starting from just 0% APR.

Nexo doesn’t offer Margin trading and futures exchange for residents of the United States of America, Canada and Australia.

Verdict: Both the exchanges stand head to head in this segment, but with additional P2P trading and staking capabilities, Binance takes the lead in this segment. However, it depends on your trading needs which one you prefer among them.

Binance vs Nexo: Supported Cryptocurrencies

Coming to the list of crypto assets offered by these exchanges, let’s go through them.

Binance

This advanced crypto exchange is advanced in its crypto assets offering as well, counting to more than 350 of them. For your ease, I have enlisted some of the most popular ones below:

- Dash

- Bitcoin

- Cosmos

- Ethereum

- Ripple

- Litecoin

- Binance Coin

- Cardano

If you want to go through the complete list, then click here.

Nexo

Coming to Nexo, this exchange also has a long list of crypto which you can trade with, but the list doesn’t come close to that of Binance.

However, the list includes all the popular crypto assets, including:

- Bitcoin

- Ethereum

- Solana

- Dogecoin

- Litecoin

- Ripple

To know the complete list, click here.

Binance vs Nexo: Trading Fee & Deposit/Withdrawal Fee Compared

Now let us discuss the most awaited topic, which is how much trading on these exchanges will cost you.

Binance

Starting with Binance, the two fees which will be associated with your trading will be:

Trading Fees

On Binance, the standard trading fee comes to 0.1%; however, holding BNB tokens will give you a flat 25% discount on your trades.

Deposit and Withdrawal Fees

There are no deposit fees charged on Binance exchange; however, when it comes to withdrawals, the platform charges a dynamic fee depending on the assets you trade in. For instance, BTC withdrawals attract 0.0002 BTC.

To go through the complete list of them, click here.

Nexo

Now, coming to Nexo has a separate trading structure for its spot and futures capabilities following a maker-taker fee model in a tiered system. Please go through the table below:

Trading Fees

- Spot

|

Pricing Tier |

Taker | Maker |

| Up to $10K | 0.20% |

0.20% |

|

$10K – $50K |

0.18% | 0.18% |

| $50K – $100K | 0.16% |

0.14% |

|

$100K – $1M |

0.14% | 0.12% |

| $1M – $10M | 0.12% |

0.10% |

|

$10M – $100M |

0.10% | 0.08% |

|

$100M – $200M |

0.09% |

0.06% |

| $200M – $500M | 0.08% |

0.05% |

|

$500M+ |

0.07% |

0.04% |

- Futures

For futures trading, the maker fees have not been set yet.

|

Pricing Tier |

Taker | Maker |

| Up to $150K | 0.0600% |

SOON |

|

$150K – $250K |

0.0550% | SOON |

| $250K – $500K | 0.0500% |

SOON |

|

$500K – $5M |

0.0450% | SOON |

| $5M – $50M | 0.0400% |

SOON |

|

$50M – $500M |

0.0375% | SOON |

| $500M – $1B | 0.0350% |

SOON |

|

$1B – $2.5B |

0.0325% | SOON |

| $2.5B+ | 0.0300% |

SOON |

Deposit and Withdrawal Fees

All crypto transfers between Nexo accounts are instant, unlimited and free of charge. The fee structure actually follows a loyalty tier together with 1 to 5 free monthly crypto withdrawals.

Once these limits are reached, you will be charged a fee depending on the asset you choose to trade in.

The requirements for each tier are as follows:

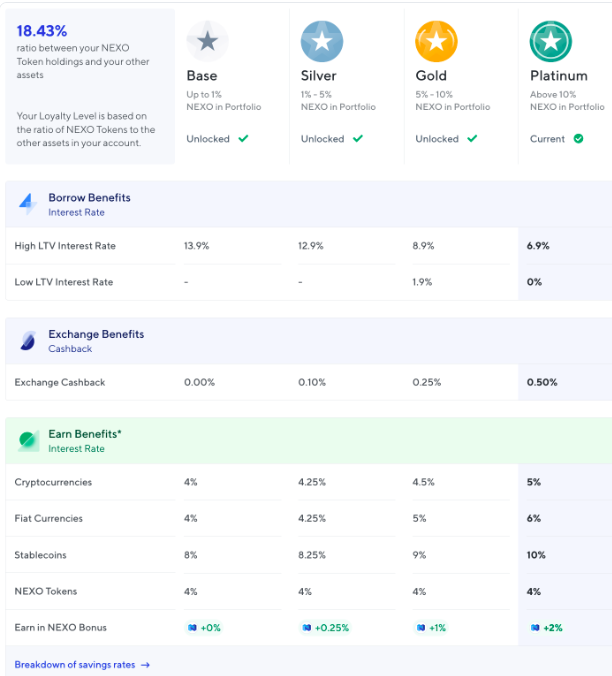

- Base: No NEXO Tokens are needed

- Silver: The ratio of NEXO Tokens in your account against the rest of your portfolio must be at least 1%

- Gold: The ratio of NEXO Tokens in your account against the rest of your portfolio must be at least 5%

- Platinum: The ratio of NEXO Tokens in your account against the rest of your portfolio must be at least 10%

To go through the benefits of each tier, you can go through the chart below.

Verdict: Both of the exchanges stand really competitive in their fee structures. Though Nexo seems more affordable with the free withdrawals though they are limited but if you stick to that limit, with withdrawals, Nexo will be a better choice for you, and the same goes for 25% discounts with BNB tokens at Binance. So it’s a tie between the two in this segment.

Binance vs Nexo: Order Types

Coming to the order types comparison, let’s see what they have for you to take advantage of the market trends.

Binance

Being the industry leader, this crypto contract trading platform has a lot to offer in this stream; it comes with both basic and advanced order types, including:

- Limit Order

- Market Order

- Stop Limit Order

Advanced Order Types:

- Stop Market Order

- Trailing Stop Order

- Post Only Order

- Time Weighted Average Price (TWAP)

Nexo

Coming to Nexo, this crypto exchange also offers a long list of order types, both basic and advanced, including:

- Market Order

- Limit Order

- Good-Till-Cancel

- Immediate Or Cancel

- Stop Loss Order

- Take Profit Order

- Time Weighted Average Price

Verdict: Both exchanges are equipped with a long list of order types, making it a tie between them in this segment.

Binance vs Nexo: KYC Requirements & KYC Limits

Now let’s discuss whether these exchanges offer anonymous trading and what are the KYC limits of these exchanges.

Binance

Starting with Binance, this exchange doesn’t allow anonymous trading, and the KYC regulations are quite rigid as well. There are three different accounts requiring different documentation levels, which are:

- Basic: $300 Lifetime Buy Crypto & Fiat Deposits/Withdrawal Limit and Max. 0.06 BTC withdrawal limit.

Requirements:

Personal information

- Intermediate: $50,000 Daily Buy Crypto & Fiat Deposits/Withdrawal Limit, Max. 100 BTC withdrawal limit and P2P/OTC/Binance Card Perks.

Requirements:

Basic Information

Government ID

Facial Verification

- Advanced: $200,000 Daily Buy Crypto & Fiat Deposits/Withdrawal Limit, No BTC withdrawal limit, and P2P/OTC/Binance Card Perks.

Requirements:

All intermediate requirements

Proof of address

10 days review time

Nexo

Similarly, Nexo doesn’t allow anonymous trading as well. Trading is only available after you verify your identity. The overall verification process is quick, easy and intuitive.

The procedure requires you to fill in personal information, like your address and contact number. Then scan your government issues ID and take a selfie holding it.

You can access the verification options by tapping on the ‘My Profile’ icon present on the top left corner of the Dashboard screen and then on ‘Verify Identity’. Then follow the guiding instructions.

Now, let’s discuss what are the deposit and withdrawal options available on these exchanges.

Binance vs Nexo: Deposits & Withdrawal Options

Binance

Binance offers all the crucial ways of withdrawal and deposits available, including:

- P2P Trading

- Credit/Debit Cards

- Direct Crypto Transfers

Nexo

Similarly, Nexo offers all of the essential funding and withdrawal options, including:

- Direct crypto transfers

- Debit/Credit Cards

- Wire transfers

Binance vs Nexo: Trading & Platform Experience Comparison

Another crucial criterion to consider is what UI and UX these exchanges offer, so let’s see what they have to offer in this segment.

Binance

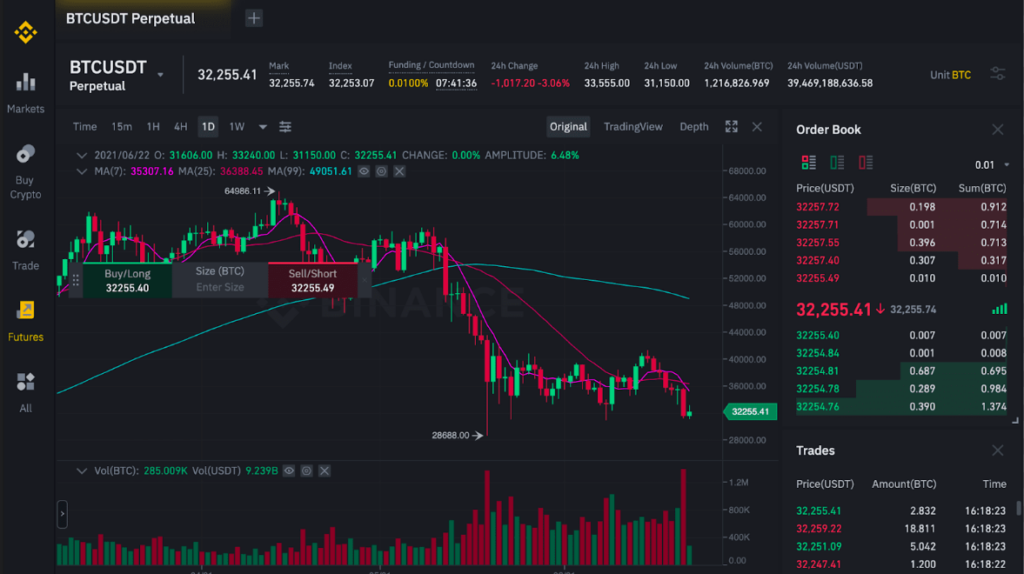

Binance is known around the world for its advanced and high-volume trading capabilities.

The trading window is readily available with top-notch toolsets with all the necessary features ready at your fingertips, which include:

- Order Book

- Recent Order

- TradingView

- Easy-to-use order menu

- Multiple Order types with advanced orders

- Easy-to-use mobile app

Binance comes with two charting systems; one is developed by the company itself, which works well enough, and the other is TradingView which is my favourite.

The charting systems provide you with precise and real-time market data. Also, you can learn more about the exchange, by checking this Binance futures guide.

Nexo

On the other hand, Nexo comes with its unique trading capabilities. The platform works like a broker letting you connect to 10+ exchanges and giving you options to select the best pricing for your trades.

Moreover, the exchange comes with built-in charting systems. It also offers a powerful trading engine to swap currencies immediately with real-time balance updates.

Nexo comes with a mobile application which is equipped with all the features of the web portal and works seamlessly with all devices, be it Android or iOS.

Binance vs Nexo: Customer Support

Binance

When it comes to customer support, Binance is considered quite reliable for that. The exchange offers extensive customer support via three different methods that are quite easy and instantaneous.

Binance offers 24×7 live chat support where you can chat with the representatives about your queries.

There is always an option to email the team available, and you can even reach out to them via their social media handles on Twitter.

Additionally, the exchange also offers a comprehensive knowledge base via an FAQ section and a learning platform to keep you updated with various tools and features of trading.

Nexo

Similarly, Nexo has a good reputation when it comes to platform reliance. On the exchange, there is a live chat window which is available 24×7. There are also email/ticket-raising capabilities for additional support.

Moreover, the exchange also offers a comprehensive FAQ section which could answer most of your questions readily on the website.

Binance vs Nexo: Security Features

Now coming to one of the most important trading systems to consider, which is the platform’s security. After all, it’s your crypto holdings and funds you are trusting these exchanges with.

Binance

Starting with Binance, the exchange comes with top-notch security features which safeguard your crypto holdings like no other. The most highlighting features include:

- Real-Time Monitoring

- Secure Cold Storage

- Multi-Factor Authentication

- Organisational Security

- Regular Audits

- Advanced-Data Encryption

Nexo

Similarly, Nexo is nowhere behind when it comes to security features.

Ranging from cold storage solutions powered by BitGo with bank-grade technology and class III vaults offered with SOC 2 Type 2-certified custodianship program.

Additionally, it also comes with built-in:

- 2FA authentication

- Biometric identification

- Address Whitelisting

- Login Alerts

Moreover, the platform is also equipped with Ledger Vault, providing cloud-based digital asset custody infrastructure for up to $150 million worth of assets.

Is Binance a Safe & Legal To Use?

The clear answer to this question is that, yes, Binance is a safe and legal crypto exchange platform.

The exchange offers top-notch security features with the industry’s best cold wallet systems and FDIC insurance readily available on the exchange to safeguard your funds.

Is Nexo a Safe & Legal To Use?

When it comes to Nexo’s safety and legality, there’s no question about it. The company offers a variety of standard safety features.

The constant monitoring and updation make this exchange ahead of time, safeguarding all your crypto holdings around the clock.

Nexo vs Binance Conclusion: Why not use both?

Both Nexo and Binance are among the finest exchanges of the cryptoverse. When it comes to choosing a cryptocurrency day trading platform that will be best for you, then the decision lies on your trading needs.

I strongly recommend Nexo if you have limited trades with lower trading volume.

So if you are a beginner and want to try different trading products or experiment with different trading techniques, then Nexo will be the best choice for you.

As with limited trading based on your account level, you will be charged zero fees for trading.

On the other hand, if you are looking for an exchange with advanced trading options, high-volume trading capabilities and a wide range of crypto assets, then go ahead and open a Binance account.

So go now on these remarkable exchanges and witness the profitability of cryptoverse today.

Check out how Nexo & Binance competing with other crypto exchanges:

- Nexo vs Bybit

- Binance vs PrimeXBT

- Binance vs Bitmart

- Binance vs Bitget

- Binance vs Deepcoin

- Binance vs Bibox