Are you confused between Bitmart and Binance?

Cannot decide which among the two will be the best choice for your trading needs?

Don’t worry; I am here to help you. I will be comparing these exchanges to their core on various aspects that you would need to know before you get your hands on them.

So let’s begin by understanding what these exchanges are known for and some introduction about them.

Bitmart vs Binance: At A Glance Comparison

Bitmart

This crypto exchange was founded in 2017 and has supported over 60 leading projects leveraging blockchain technology to reshape myriad industries.

The exchange is available in more than 180 countries across the globe.

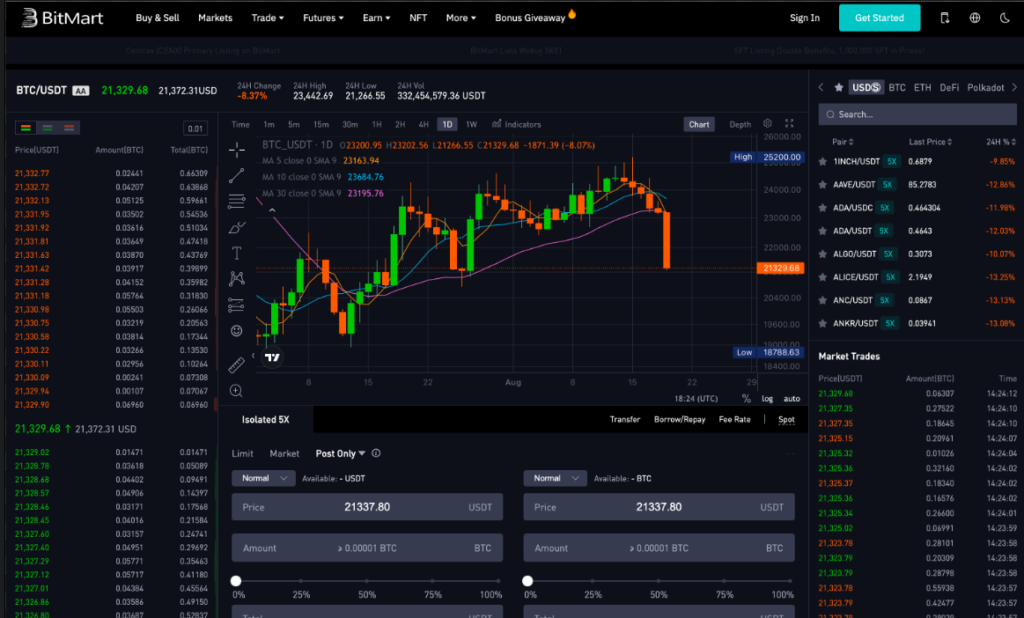

It comes with an easy-to-use interface, which is simple yet subtle, and comes with all the essential tools for trading as well has now been supported and certified on CCXT.

Binance

On the other hand, Binance is one of the world’s largest cryptocurrency day trading exchanges that was introduced in 2018.

This industry’s giant is trusted by millions of users worldwide as the exchange offers almost every crypto trading solution you can think of.

The exchange processes more than $38 billion in 24h trading volume and holds more than 120 million users on the platform.

Now, I will tell you what trading markets, products, and leverage these exchanges have to offer.

Bitmart vs Binance: Trading Markets, Products & Leverage Offered

Bitmart

- Futures Trading: It offers both USD-M and Coin-M futures are both offered with up to 125x leverage.

- Copy Trading: This lets you copy the trades of trade masters to get you going instantly.

- Crypto Staking: High-yield rewards on all the crypto coins available on the exchange.

- Spot Trading: A wide range of crypto assets that includes all your favourite ones.

- Margin Trading: Currently, Bitmart offers isolated margin trading to up to 125x.

Binance

- Spot Trading: A wide range of assets is available, including BTC, XRP, SOL, ETH and many more.

- Futures Trading: There are Coin-M and USD-M perpetual futures contracts settled in USDT or BUSD.

- Leverage Trading: Up to 20x of maximum leverage available on the majority of the assets.

- P2P Trading: Trade USDT with the lowest transaction fees of <0.10% for all markets accompanying 700+ payment methods.

- Staking: Flexible DeFi staking with up to 6.38% and an additional 1.5% APR.

Verdict: Both exchanges offer a wide range of crypto trading products with unique capabilities, so it depends on your choice and needs, making it a tie between them in this segment.

Bitmart vs Binance: Supported Cryptocurrencies

Bitmart

When it comes to available crypto assets, Bitmart will blow your mind. It has one of the widest ranges of crypto assets, counting more than 1000 of them. These assets include:

- Bitcoin

- Ethereum

- Bitmart Token

- Siba Inu

- Baby DogeCoin

- LoopNetwork

Binance

Coming to Binance, there are all the popular crypto assets counting to more than 500 crypto tokens and trading pairs, which include:

- Bitcoin

- Ethereum

- Tether

- USDC

- Ripple

- Cardano

- DogeCoin

Verdict: Bitmart is the clear winner in this segment, with a lot more crypto assets to choose from.

Bitmart vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

Now let’s discuss the most important segment, which is the fees these exchanges will charge you for trading on them.

Bitmart

For spot trading, Bitmart charges a flat 0.1% trading fee for both maker and taker. However, this fee can be reduced if you hold a BMX token or if you have a certain trading volume.

The fee is classified into the standard and professional user. I have mentioned them below:

Standard Users

|

Level |

BMX holding balance & Trading volume(30d) | Maker/Taker | Maker/Taker (BMX 25% deduction) |

| Lv 1 | BMX ≥ 0&

< 150 BTC |

0.1000% / 0.1000% |

0.0750% / 0.0750% |

|

Lv 2 |

BMX ≥ 500&

< 150 BTC |

0.0900% / 0.1000% | 0.0675% / 0.0750% |

| Lv 3 | BMX ≥ 2,000&

< 150 BTC |

0.0800% / 0.0900% |

0.0600% / 0.0675% |

|

Lv 4 |

BMX ≥ 10,000&

< 150 BTC |

0.0700% / 0.0900% | 0.0525% / 0.0675% |

| Lv 5 | BMX ≥ 50,000&

< 150 BTC |

0.0600% / 0.0800% |

0.0450% / 0.0600% |

|

Lv 6 |

BMX ≥ 100,000&

< 150 BTC |

0.0500% / 0.0600% | 0.0375% / 0.0450% |

| Lv 7 | BMX ≥ 200,000&

< 150 BTC |

0.0400% / 0.0500% |

0.0300% / 0.0375% |

|

Lv 8 |

BMX ≥ 500,000&

< 150 BTC |

0.0300% / 0.0500% | 0.0225% / 0.0375% |

| Lv 9 | BMX ≥ 1,000,000&

< 150 BTC |

0.0300% / 0.0400% |

0.0225% / 0.0300% |

Professional Users

|

Level |

Trading Volume(30d) | Maker/Taker |

| Pro 1 | ≥150 BTC |

0.0200%/0.0300% |

|

Pro 2 |

≥500 BTC | 0.0150%/0.0250% |

| Pro 3 | ≥2,000 BTC |

0.0000%/0.0200% |

|

Pro 4 |

≥5,000 BTC | -0.0010%/0.0175% |

| Pro 5 | ≥10,000 BTC |

-0.0050%/0.0150% |

|

Pro 6 |

≥40,000 BTC |

-0.0100%/0.0150% |

Coming to Futures trading fees, the following are the fees:

|

Level |

Maker/Taker |

| LV 1- LV9, Pro 1- Pro 6 |

0.0200%/0.0600% |

Additionally, Bitmart also charges withdrawal fees for each cryptocurrency. For instance, the withdrawal fee for BTC is 0.0005 BTC, while for ETH, its 0.01 ETH.

Binance

Now coming to Binance Futures, there are two types of fees associated with trading; I have enlisted them below:

-

Trading Fees

When you hold BNB tokens, you will receive a flat 25% discount; however, the standard fee on the platform for trading is 0.1%.

-

Deposit and Withdrawal Fees

There is no fee for a deposit, but when you withdraw, you’ll be charged certain fees that is dynamic and depend on the market’s trend.

Verdict: Bitmart has surely a more affordable fee structure making it the winner in this segment.

Bitmart vs Binance: Order Types

Now let’s discuss what these exchanges offer in terms of order types:

Bitmart

Starting with Bitmart, this exchange offers 4 types of order types to take advantage of market trends:

- Limit orders

- Market orders

- Stop-loss orders

- Stop-limit orders

Binance

Coming to Binance, has a long range of them that includes advanced order types as well, which are:

- Limit Order

- Market Order

- Stop Limit Order

Advanced Order Types

- Stop Market Order

- Trailing Stop Order

- Time Weighted Average Price (TWAP)

- Post Only Order

Verdict: Binance is the clear winner in this segment, offering advanced order types as well.

Bitmart vs Binance: KYC Requirements & KYC Limits

Bitmart

When it comes to KYC verification, Bitmart is quite rigid in that. It makes sense, though, as it is all done to make the exchange safer.

The verification process requires you to submit personal information, including a government-issued ID and a selfie holding it.

Once this is done, you can withdraw up to $1 million worth of crypto daily.

However, there can be a probability of submitting additional documentation and verifications if you want to increase your limits even further.

Binance

Coming to Binance, it also has a strict verification policy where in KYC is mandatory to trade on the exchange.

There are different KYC levels that require additional documents in order to be verified, which are:

- Passport

- Social Security Number

- Voter ID Card

- PAN Card

- Driver’s license or Government issued ID

There are 3 different verification levels on which your trading limits are set which are:

- Basic: $300 Lifetime Buy Crypto and Fiat Deposits/Withdrawal Limit and Max. 0.06 BTC withdrawal limit.

Requirements:

Personal information

- Intermediate: $50,000 Daily Buy Crypto and Fiat Deposits/Withdrawal Limit, Max. 100 BTC withdrawal limit and P2P/Over counter/Binance Card Perks.

Requirements:

Basic Information

Facial Verification

Government ID

- Advanced: $200,000 Daily Buy Crypto and Fiat Deposits/Withdrawal Limit, Unlimited BTC withdrawal limit, and P2P/Over the Counter/Binance Card Perks.

Requirements:

All intermediate requirements

10 days review time

Proof of address

Revolut

Revolut also doesn’t give you an anonymous trading option, and actually, from a trader’s point of view, it is necessary.

As soon as you register a free account, you’ll need to complete the KYC procedures by submitting the following documents:

- Photos of your official government-issued ID, passport or driving license.

- A clear selfie; make sure that there is no glare and that your face is clearly visible.

Bitmart vs Binance: Deposits & Withdrawal Options

Now let’s discuss what are the account funding methods available on these exchanges.

Bitmart

Starting with Bitmart, there are 3 methods of deposits and withdrawals which are:

- Method 1: Buy crypto using bank cards, bank transfers or payment methods like SEPA, SWIFT and more.

- Method 2: Use P2P trading to deposit and withdraw funds at zero cost using your local payment methods.

- Method 3: Deposit funds to a wallet from another exchange or wallet.

Binance

Similarly, Binance has quite a few options for funding as well, which are:

- Method 1: For buying crypto, you can use your credit or debit card, bank transfer, or other available payment methods.

- Method 2: Binance supports peer-to-peer or P2P trading, which is a free deposit and withdrawal method.

- Method 3: Transfer crypto from another exchange or wallet to Binance’s wallet.

Bitmart vs Binance: Trading & Platform Experience Comparison

Now let’s discuss what experience you can expect from their trading interfaces and what are the key highlights of them.

Bitmart

Starting with Bitmart again, the exchange offers a user-friendly interface that is easy to navigate, making it suitable for beginner traders.

But don’t get me wrong; the exchange is also equipped with advanced trading tools such as technical analysis indicators, price alerts and depth charts for advanced trading.

Additionally, it also offers a mobile app allowing you to trade on the go.

Binance

On the other hand, Binance has been highly rated when it comes to its trading appeal. The exchange is designed for high-volume trading, and the interface is easy to toggle as well.

It comes with multiple charting systems. One is Binance’s own, and the other is the well-known TradingView. The charting system shows you precise, real-time data with the following:

- Order Form

- Order Book

- Depth Chart

- Indicators

- Order Menu

You can learn more about Binance’s exchange platfrom by checking this Binance Futures guide.

Bitmart vs Binance: Customer Support

What if things go south? Let’s see how that can be resolved in these exchanges.

Bitmart

Bitmart provides 24/7 support via live chat. The customer support team can also be reached through email and phone whenever you need them.

Moreover, the website also comes with an extensive knowledge base that provides answers to all the FAQs and even allows you to learn different techniques and toolsets to trade with.

Binance

Similarly, Binance also offers an extensive knowledge base and a separate learning portal. Additionally, you can reach them via the chat window or connect with a live support agent.

Moreover, you also have the option to reach them via email or text them on Twitter at @BinanceHelpDesk.

Bitmart vs Binance: Security Features

Now, let’s talk about how secure are these exchanges; after all, you are trusting them with your assets.

Bitmart

On Bitmart, security is not at all a joke, that’s for sure.

It uses a combination of the industry’s best security systems to keep your crypto holdings and privacy secure.

For that, it stores the majority of the funds in cold storage and uses advanced encryption methods.

2FA, email verification logins and withdrawals are set by default on the exchange with regular security audits to ensure top-notch security of the exchange.

Binance

Coming to Binance, being the brand ambassador of the cryptosphere, this exchange becomes pretty rigid when it comes to the platform’s security. It also offers security through a combination of top-notch security systems that include:

- Regular Audits

- Advanced-Data Encryption

- Real-Time Monitoring

- Multi-Factor Authentication

- Organisational Security

- Secure Cold Storage

Is Bitmart a Safe & Legal To Use?

A short and simple answer to this is yes. Bitmart is, for sure, a safe and legitimate trading platform that not only integrates top-notch security systems but also has regulatory licenses for countries worldwide.

Additionally, they have not faced any hacking attempts to date.

Is Binance a Safe & Legal To Use?

Now, when this question arises for Binance, the answer is yes; it is a safe and secure exchange which is for sure legal to use in countries around the world.

Binance also has no record of any security hacks as well as keeps a majority of funds in cold storage.

Additionally, this crypto exchange also has a Secure Asset Fund for Users or SAFU, which is an emergency insurance fund that holds a percentage of all trading fees on the exchange to help in case of financial loss.

Binance vs Bitmart Conclusion: Why not use both?

Both Binance and Bitmart are among the best crypto futures platforms in the market. But when it comes to choosing the best among them, the decision depends on your trading needs.

If you are trading for an exchange that offers a vast range of crypto assets, then Bitmart is the way to go. This exchange offers a wide range of crypto coins, and that too, at affordable prices.

On the other hand, if you want an advanced trading exchange that offers a variety of trading products, different market types such as Margin or Futures with best-in-class charting systems, then Binance should be your choice.

So, get your hands on any of these exchanges that fit your trading requirements and start trading today!

Know how Bitmart & Binance gets compared to other cryptocurrency exchanges in the market:

- Bitmart vs Phemex

- Bitmart vs Bybit

- Binance vs Phemex

- Binance vs PrimeXBT

- Binance vs Swissborg

- Binance vs Abra