You’ve heard of bitbank and Bybit, two names that ring loud, but which is the right fit for day trading cryptocurrency?

It’s not just about picking one; it’s about understanding how these platforms align with your goals and strategies.

In this article, we’ll dive deep into bitbank and Bybit, pulling apart their offerings, fees, security measures, and more.

Whether you seek high leverage or diverse trading pairs, your needs are unique.

So, grab a seat, and let’s start this exciting journey through the twists and turns of bitbank vs Bybit.

Your perfect match awaits!

bitbank vs Bybit: At A Glance Comparison

| Features | bitbank | Bybit |

| Founding Year | 2016 | 2018 |

| Headquarters | Japan |

British Virgin Islands

|

| Supported Cryptocurrencies | 7 | 6 |

| Trading Volume | High | Very High |

| Trading Fee | 0.12% (Taker), 0.02% (Maker) |

0.075% (Taker), -0.025% (Maker)

|

| KYC Required | Yes | No |

| Mobile App | Yes | Yes |

| Customer Support | Email, FAQ |

24/7 Live Chat, Email

|

| Security Features | 2FA, Cold Storage, SSL Encryption |

2FA, Cold Storage, Multiple Signatures, SSL Encryption

|

Verdict: If you prefer trading in a KYC-compliant environment, bitbank is your guy. If, on the other hand, you’re after a high-volume exchange with rewarding fee structures, Bybit is the one for you.

The decision lies in what fits your trading style and preferences best.

So, what will it be?

bitbank vs Bybit: Trading Markets, Products & Leverage Offered

bitbank specializes in the spot market and offers trading pairs majorly between BTC, XRP, LTC, ETH, MONA, BCH, and XLM.

There’s no doubt that bitbank focuses on providing a stable and reliable environment for cryptocurrency enthusiasts.

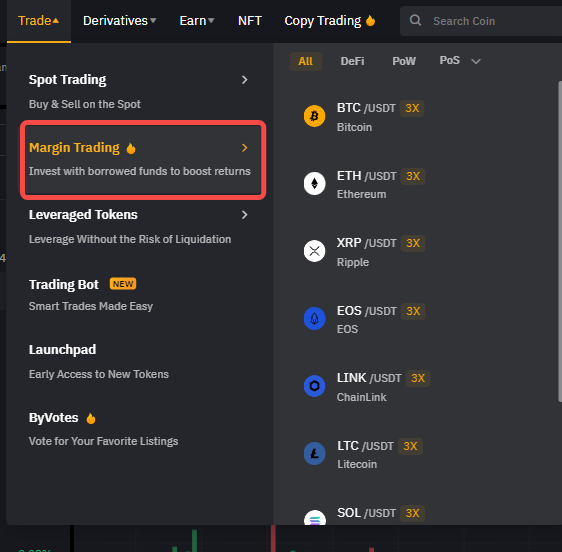

But hold your horses; here comes Bybit.

It is a well-known crypto derivatives trading platform. Bybit provides crypto-based perpetual contracts for BTC, ETH, XRP, EOS, and more.

Moreover, Bybit offers impressive leverage of up to 100x on its products.

Verdict: If you are an avid spot trader looking for stability, bitbank is your go-to. However, if you’re more of an adrenaline junkie looking to leverage high-risk and high-reward opportunities, Bybit undoubtedly takes the cake.

Ultimately, your trading style and risk appetite are the ultimate deciders.

So, which is it going to be?

bitbank vs Bybit: Supported Cryptocurrencies

bitbank, primarily focusing on major cryptocurrencies, supports a handpicked selection including BTC, ETH, XRP, LTC, BCH, MONA, and XLM.

Bitbank plays it safe, supporting the most well-established coins in the market.

However, hang on for a moment!

Bybit isn’t far behind.

It, too, supports an array of cryptocurrencies, including BTC, ETH, XRP, and EOS.

But the real kicker is the range of derivative products that Bybit offers for these cryptos, opening up more possibilities for traders.

Verdict: If you prefer trading with major cryptocurrencies and require spot trading, bitbank serves you well. But if you’re ready to dive into the dynamic world of derivative trading with the key players in the crypto market, Bybit is your knight in shining armor.

So, which platform ticks your boxes?

bitbank vs Bybit: Trading Fee & Deposit/Withdrawal Fee Compared

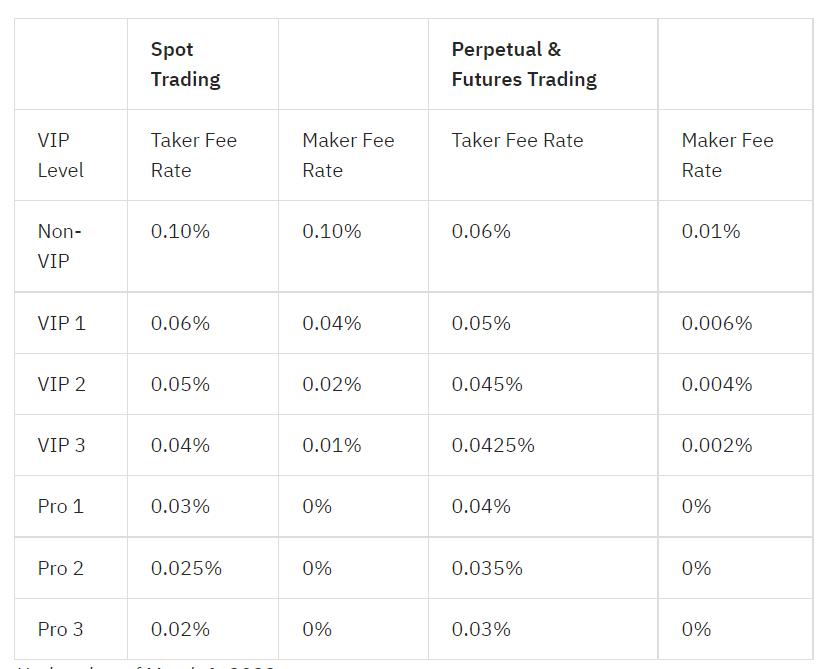

bitbank uses a maker-taker model, with a trading fee of 0.12% for takers and an impressive 0.02% rebate for makers, which is pretty low compared to the industry average.

Furthermore, bitbank charges a flat withdrawal fee of 0.0006 BTC for BTC withdrawals and 550 yen for any JPY value below 30,000.

But wait, there’s more!

Bybit has an entirely different strategy.

For perpetual contracts, Bybit charges a taker fee of 0.06% and a maker fee of 0.01%, which is an attractive offering for frequent traders.

Furthermore, there are no deposit or withdrawal fees except for the blockchain network fee, which is not charged by the platform itself.

Verdict: If you’re a frequent trader or a ‘market maker’, Bybit’s rebate can be quite a boon. However, bitbank’s low fees may serve you better if you’re more into conventional trading.

bitbank vs Bybit: Order Types

bitbank offers a solid lineup of basic and advanced order types. You get the common market and limit orders.

Additionally, they offer stop orders which can be a real lifesaver in volatile markets.

Plus, the added advantage of iceberg orders allows large orders to be hidden.

Bybit, on the other hand, goes the extra mile.

Alongside the standard market, limit, and conditional orders, Bybit offers advanced types like Take Profit and Stop Loss orders.

This allows you to manage risks better and lock in profits when the market moves in your favor.

Verdict: If you value simplicity and ease of use, bitbank’s standard lineup of order types should suffice. However, if you prefer having more advanced features and risk management tools, Bybit could be the way to go.

Remember, trading is not just about profits but also about managing your risks.

And the right set of order types can make all the difference!

bitbank vs Bybit: KYC Requirements & KYC Limits

bitbank has a strict KYC process, requiring users to submit personal information such as name, address, and proof of identity.

bitbank enforces these regulations to adhere to global compliance norms.

Meanwhile, Bybit takes a more relaxed approach.

Basic trading functionality can only be accessed after completing KYC verification, providing more privacy to its users.

Verdict: If you value strict compliance and the security it brings, bitbank’s rigorous KYC procedure will appeal to you. However, if you favor ease of use and privacy, Bybit’s flexible approach to KYC may be more appealing.

Remember, a thorough KYC process is a strong sign of a serious, law-abiding exchange.

Make your choice wisely!

bitbank vs Bybit: Deposits & Withdrawal Options

bitbank, based in Japan, supports deposits and withdrawals in JPY and six major cryptocurrencies.

However, it’s essential to note that bitbank does not support other fiat currency deposits or withdrawals.

You can perform bank transfers for JPY deposits and withdrawals, but the options remain limited.

Bybit, on the other hand, is a crypto-only exchange and does not support any fiat currency deposits or withdrawals.

Cryptocurrency deposits and withdrawals are quick and smooth, supporting major cryptos such as BTC, ETH, XRP, and USDT.

Bybit also offers the advantage of no deposit fees.

Verdict: If you’re looking for fiat currency support, specifically JPY, bitbank takes the lead. However, if you’re okay with crypto-only transactions and desire a wider range of cryptocurrencies, Bybit’s ease and flexibility are hard to beat.

It all boils down to your specific needs and preferences, so choose the one that suits you best!

bitbank vs Bybit: Trading & Platform Experience Comparison

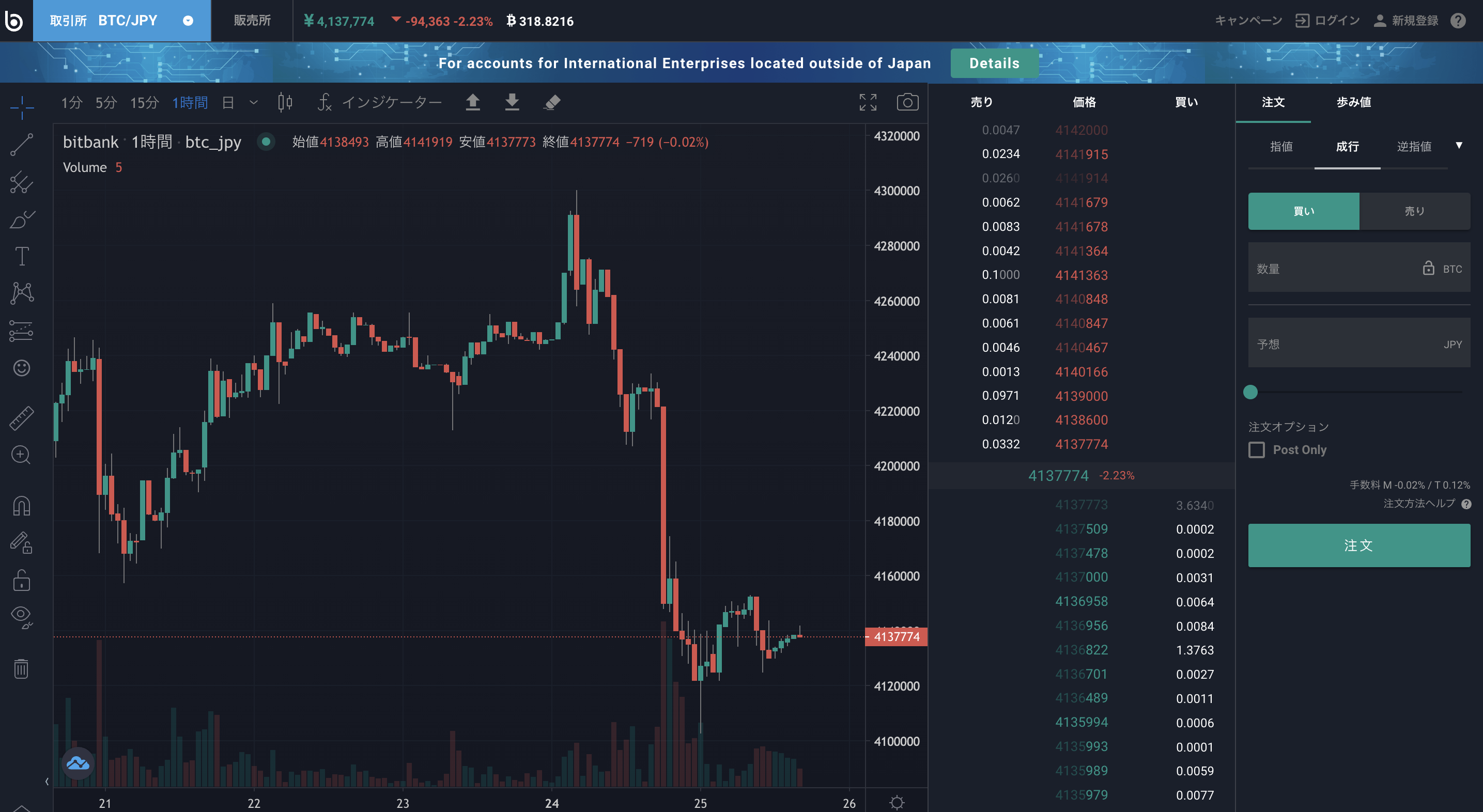

Starting with bitbank, the exchange provides a straightforward and intuitive interface, which is beneficial for newcomers.

The platform offers features like real-time charting tools, order books, and trade history.

However, bitbank’s platform might seem too basic for more advanced traders.

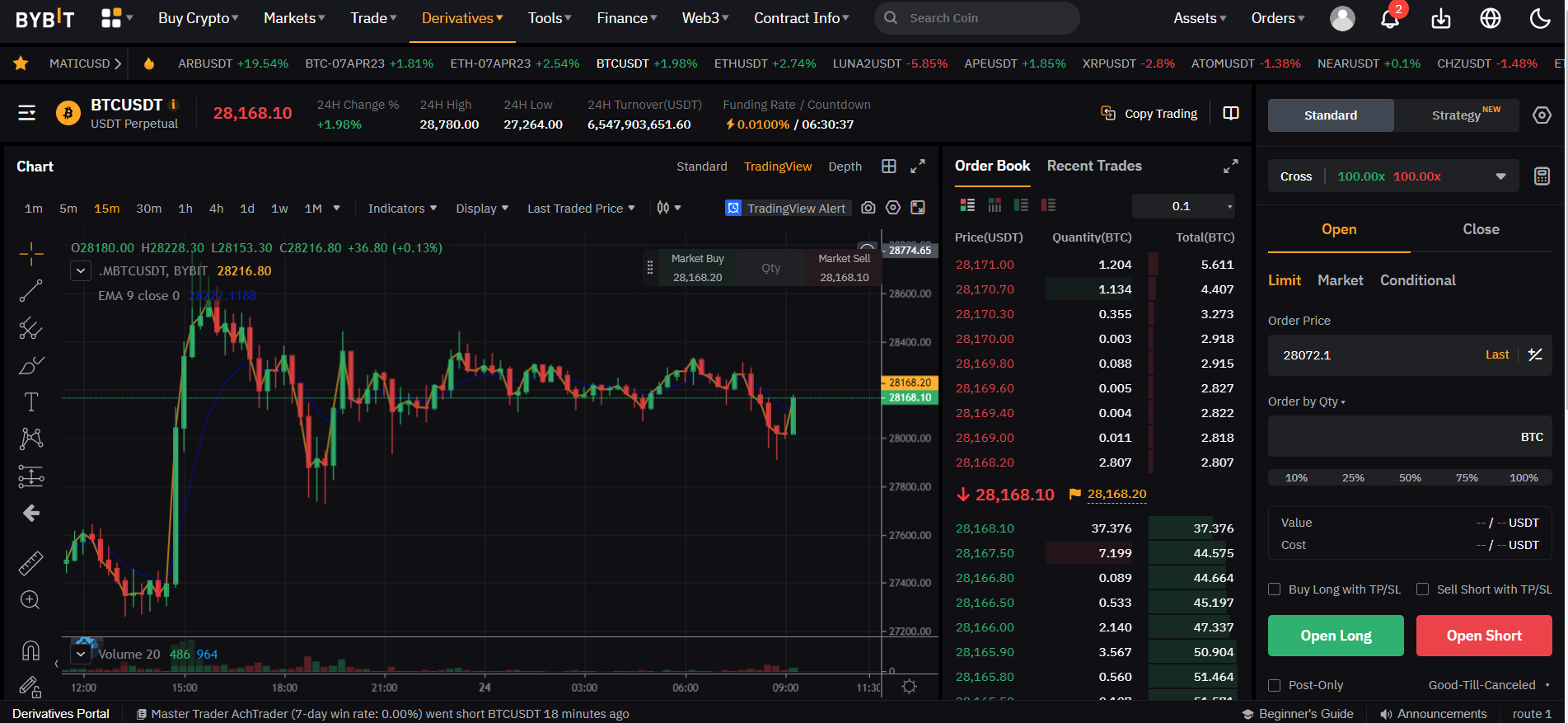

Conversely, Bybit’s platform has been praised for its user-friendly interface and design.

Not only that, but it also offers TradingView support for advanced charting tools, which is a big plus for experienced traders.

And here’s the kicker, Bybit provides a seamless trading experience with minimal downtime, even during high market volatility. To learn more about the exchange, you can check this guide on how to trade crypto futures on Bybit.

Verdict: If you’re a beginner, bitbank’s simple design might be more your speed. But if you’re an experienced trader looking for advanced tools and a platform that can handle high volatility, Bybit is the clear winner.

All in all, regarding the overall trading and platform experience, Bybit seems to have the edge in 2023.

bitbank vs Bybit: Customer Support

bitbank’s customer support is reasonably good. They provide a FAQ section and a ticketing system to handle any issues.

However, they lack live chat or phone support, which can be frustrating if you need immediate assistance.

Now, let’s look at Bybit.

Bybit steps it up a notch, offering 24/7 live chat support, an extensive FAQ section, and email support.

This comprehensive approach makes it easier for users to get the help they need when they need it.

Verdict: It’s clear that Bybit takes the cake here. While both platforms have reliable support systems, Bybit’s round-the-clock live chat feature gives it the edge.

So in 2023, Bybit is the way to go for robust and quick customer support.

bitbank vs Bybit: Security Features

bitbank takes security seriously.

They have a robust security framework with features like two-factor authentication (2FA), cold storage for user funds, and encrypted transactions.

Additionally, bitbank regularly audits to ensure its security infrastructure is up-to-date.

Shifting our gaze to Bybit, you’ll be pleased to know they offer the same level of security as bitbank and even go the extra mile.

They offer withdrawal protection alongside 2FA, encrypted transactions, and cold storage.

This feature means all withdrawals are manually processed and scrutinized, adding an extra layer of security.

Verdict: It’s a tight race, but Bybit pulls ahead with its withdrawal protection feature. Thus, for top-notch security that goes above and beyond, Bybit is the superior choice.

Is bitbank Safe & Legal To Use?

Firstly, bitbank is indeed legal to use.

The exchange operates under Japan’s Payment Services Act and is regulated by the Financial Services Agency (FSA), Japan’s financial watchdog.

This means it adheres to strict guidelines to provide services, adding an extra layer of trust.

Security-wise, bitbank doesn’t skimp. It utilizes advanced encryption techniques, two-factor authentication, and cold storage for user funds.

Moreover, regular audits are carried out to ensure the platform’s safety.

On the downside, no exchange is entirely immune to risks.

However, bitbank’s consistent adherence to legal regulations and focus on robust security measures surely make it a reliable platform in the crypto world.

In short, if you’re looking for a secure and legal platform for your trading needs in 2023, bitbank certainly seems like a worthy contender.

Is Bybit Safe & Legal To Use?

To start, Bybit operates legally in its jurisdiction.

While registered in the British Virgin Islands, the platform accepts users from around the globe.

Now, let’s talk about security.

Bybit takes this seriously.

The platform leverages multiple security measures, such as two-factor authentication, cold storage for user assets, and advanced SSL encryption.

Additionally, Bybit implements measures like withdrawal whitelists, ensuring enhanced protection of user assets.

But, like any crypto platform, it isn’t invincible to threats.

Therefore, it’s crucial to adopt good security practices at the user’s end.

In a nutshell, Bybit seems to tick the boxes for legal operation and robust security measures.

If these factors top your priority list for a crypto trading platform in 2023, Bybit should be on your radar.

bitbank vs Bybit Conclusion

Ultimately, it boils down to what you need as a trader.

If you value a wide array of cryptocurrency options and a well-established reputation, bitbank is the obvious choice.

Conversely, if you’re looking for high leverage, innovative trading tools and 24/7 customer support, Bybit will serve you well. Also, you can use Bybit referral code to get sign-up bonus.

Each platform has its strengths and could be the perfect fit depending on your priorities.

Remember, having more than one reliable platform at your disposal in the rapidly evolving crypto space could be a strategic move in 2023.

Learn how does bitbank & Bybit stack up against the competition: