Welcome to the world of inverse Futures contracts in cryptocurrency, where trading gets an exciting twist.

They’re contracts where you trade based on the future price of a cryptocurrency, but they’re settled in the cryptocurrency itself and not in dollars.

If you bet right and the price increases, you earn more Bitcoin. If the price falls, you end up with less Bitcoin. This is different from normal trading, where you focus on earning more dollars.

Inverse futures contracts are important in crypto because they offer a different trading method.

I will walk you through everything step by step.

You’ll learn how these contracts work, why they’re essential in the crypto world, and how they can be a valuable tool in your trading arsenal.

So, let me show you what I found during my research about inverse Futures contracts in cryptocurrency!

Breaking Down Inverse Futures Contracts: The Basics

Let’s dive into the basics of inverse Futures contracts in cryptocurrency.

First off, what makes these contracts “inverse”?

Unlike regular Futures contracts, which are settled in dollars (USD), inverse Futures contracts are settled in cryptocurrency.

It’s like playing a game where the score is kept not in points but in the game pieces you use.

Here’s how it works: when you enter into an inverse Futures contract, you agree to buy or sell a certain amount of cryptocurrency at a predetermined price but at a future date.

The twist is that the profit or loss from this contract is calculated and paid out in cryptocurrency, not in dollars.

Imagine you’re predicting that the price of Ethereum will go up.

You’ll earn more Ethereum than you initially put in if you’re right.

If the price goes down, though, you’ll have less Ethereum.

It’s a bit like fishing; you throw your line hoping to catch a big fish (a profit), but there’s always a risk you might come back with something smaller (a loss).

This makes them an attractive tool for those who believe in the potential of their chosen digital currency.

Next, I will explain what I found while exploring how these contracts work.

The Mechanics of Inverse Futures Contracts

Learning the mechanics of inverse Futures contracts in crypto is like learning the rules of a new board game.

At first glance, it might seem complex, but once you understand the basics, it all makes sense.

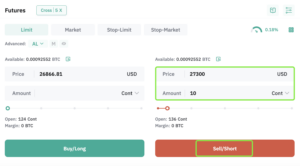

Let’s say you’re dealing with a Bitcoin inverse Futures contract.

Imagine you buy a contract when Bitcoin is worth $30,000.

If the price of Bitcoin goes up, say to $35,000, when you close the contract, you’ll end up with more Bitcoin than you started with.

But if the price falls, you’ll have less Bitcoin.

Another important part of these contracts is leverage.

Leverage in crypto trading lets you control a big position with a smaller amount of your own money.

It can amplify your gains but also increase the risk of bigger losses.

In essence, the mechanics of inverse Futures contracts revolve around predicting the price movement of a cryptocurrency and using leverage to increase your returns.

It’s a strategy that requires a good understanding of the market and careful risk management.

Next, I will cover the benefits of trading these types of contracts.

Benefits of Trading Inverse Futures Contracts

Trading inverse Futures contracts in the crypto world comes with some cool benefits.

Let’s check out what these benefits are.

- Higher Profits

First, there’s the potential for higher profits.

With inverse Futures, you’re not just limited to earning when the price of a cryptocurrency goes up.

You can also profit when prices go down.

It’s like being able to score points whether your team is on offense or defense by taking a long or short trade.

- Leverage

Then, there’s the leverage factor.

Leverage in inverse Futures lets you control a larger position than your initial investment would normally allow.

This means your potential for gains is amplified.

But remember, while it can boost your winnings, there are risks associated with crypto leverage trading.

It’s like pedaling a bike downhill – you go faster but must be careful.

- Hedging

Another benefit is the chance to hedge your investments.

You can use inverse Futures to protect against price drops if you own cryptocurrency.

It’s like having an insurance policy for your digital coins.

In short, trading inverse Futures contracts can be a smart strategy for those who understand the market.

They offer flexibility, the potential for high returns, and a way to protect your investments.

Like any powerful tool, they’re best used with knowledge and caution.

Next, I’ll take you through the risks associated with these contracts.

Risks Associated with Inverse Futures Contracts

Trading inverse Futures contracts isn’t all smooth sailing.

Like any adventurous journey, it comes with its risks. It’s important to know these risks before you dive in.

- Market Volatility

First up, there’s the big one: market volatility.

Crypto prices can jump up and down fast, like a rollercoaster.

This can make trading inverse Futures unpredictable.

You might face significant losses if the market moves against your position, especially because of the leverage involved.

It’s like playing a video game on hard mode – the rewards can be great, but so can the challenges.

- Leverage

Leverage, while a potential benefit, is also a risk factor.

Sure, it can magnify your gains, but it can also magnify your losses.

Imagine borrowing a friend’s super-powered skateboard.

You could go fast and have a great time, but if you fall, it will hurt a lot more.

- Complexity

Another risk is the complexity of these contracts.

They can be hard to understand if you’re new to trading.

It’s like trying to solve a difficult puzzle – you must understand what you’re doing.

So, while trading inverse Futures contracts can be exciting and profitable, it’s also risky.

It’s essential to approach these trades with caution, knowledge, and a solid trading strategy.

Remember, it’s not just about the potential gains; it’s also about how much you can afford to lose.

Next, let’s delve into the role of leverage in inverse Futures trading and how it impacts these risks.

The Role of Leverage in Inverse Futures Trading

Leverage in inverse Futures trading is like using a super-powered tool – it can help you achieve more but also adds more risk.

When you use leverage, you’re essentially borrowing money to increase the size of your trade.

It’s like playing a video game where you can use a power-up to boost your performance, but it can backfire if you’re not careful.

In inverse Futures, leverage lets you control a much larger position than your initial investment would allow.

For example, with 10x leverage, you could control a position worth ten times your money.

This can be great when the market moves in your favor, amplifying your profits.

It’s like hitting a home run in baseball – your score goes way up. However, leverage is a double-edged sword.

If the market moves against you, your losses are also amplified.

You could end up losing more than your initial investment.

This is why leverage in inverse Futures trading is risky, especially in the volatile crypto market.

That power-up in the game suddenly makes you more vulnerable to attacks.

Using leverage requires careful consideration and risk management.

Understand the market and have a clear strategy before leveraging your trades.

Think of it as being like driving a fast car – it’s exciting and can get you to your destination quicker, but you need to know how to handle the speed and be prepared for unexpected turns.

In summary, leverage can be a powerful tool in inverse Futures trading, but it’s vital to use it wisely.

By understanding and respecting the risks, traders can use leverage to their advantage while minimizing potential downsides.

Next, I’ll show you how inverse Futures contracts impact the crypto market and why they’re becoming increasingly popular.

Market Impact and Popularity of Inverse Futures Contracts

Inverse Futures contracts are making a big splash in the crypto market, like the new hit song everyone’s talking about.

Their popularity is growing fast, and they’re having a big impact on how people trade cryptocurrencies.

- Excitement

One reason for their popularity is the excitement they bring to trading.

It’s like adding a new, thrilling ride to an amusement park.

Traders are drawn to the potential for higher profits, especially when the market is volatile.

It’s the chance to make significant gains that keep traders coming back.

- More Options

These contracts also add more options to the crypto market.

It’s like having more tools in your toolkit.

With inverse Futures, traders can bet on price movements differently, making the market more dynamic and interesting.

In essence, the growing popularity of inverse Futures contracts is changing the game in crypto trading.

They offer new strategies and opportunities, making the market more diverse and lively.

This trend will likely continue as more traders discover the potential of these innovative contracts.

Next, we’ll wrap up our discussion and look at the future of inverse Futures contracts in cryptocurrency trading.

Conclusion: The Future of Inverse Futures Contracts in Cryptocurrency Trading

As we wrap up, it’s clear that inverse Futures contracts are like a new frontier in cryptocurrency trading.

They’ve opened up exciting ways for traders to engage with the market, offering high-risk and high-reward opportunities.

With their growing popularity, these contracts are set to become a key part of the crypto trading world.

We can expect more traders and future trading crypto exchanges to embrace these contracts like a new technology catching on.

The future of inverse Futures contracts looks bright, promising more innovation and dynamic trading in the ever-evolving world of cryptocurrencies.