KuCoin and OKX are two of the well-known crypto exchanges out there used by millions of users worldwide.

Hence, for many newbie traders, it really gets confusing to choose one between the two.

But not to worry, as I am going to compare KuCoin vs OKX at various factors, it will be super easy for you to make the right decision and settle down with a crypto exchange that serves you the best.

So let’s get into the comparison right away:

KuCoin vs OKX: At A Glance Comparison

KuCoin is one of the popular cryptocurrency exchanges founded in 2017. The exchange is based in Seychelles, and it offers you various crypto products.

Using the exchange, you can buy, sell or trade various cryptocurrencies. The exchange allows you to trade in the spot, margin, and derivatives markets.

The exchange is also known for its low trading fees and fast transaction speed. Plus, it offers you additional crypto features and products such as crypto lending, cloud mining, etc.

OKX is also the leading crypto derivatives exchange out there. The exchange is based in Malta, and it was founded in 2017.

The exchange also allows you to buy, sell and trade a wide range of cryptocurrencies. Plus, you can use it for trading in a wide range of markets, such as spot, margin, futures, and options.

OKX also helps you with lower trading fees, faster transaction speed, and APIs.

Additionally, it offers you a great mobile app that helps you with crypto trading, web3, and crypto wallet.

KuCoin vs OKX: Trading Markets, Products & Leverage Offered

Starting with the trading markets offered by both exchanges, there are many similarities with a few differences. These product and trading markets offerings are:

KuCoin

- Spot Trading

- Margin Trading (up to 3x leverage)

- USD-M Margined Contracts (up to 125x leverage)

- Coin-Margined contracts (up to 125x leverage)

- Leveraged Tokens

- P2P Trading

OKX

- Spot Trading

- Margin Trading (up to 10x leverage)

- Perpetual Swaps (up to 125x leverage)

- Futures contracts (up to 125x leverage)

- Crypto Options Trading

- Block Trading

- Demo Trading

- P2P Trading

Verdict: OKX is clearly the better choice compared to KuCoin. The exchange has more product offerings than KuCoin. So you can participate in different markets and trade.

KuCoin vs OKX: Supported Cryptocurrencies

Both exchanges allow you to trade in various digital assets and trading pairs under spot and derivatives markets. These crypto tokens include:

KuCoin

On KuCoin, you will find more than 700 tradable crypto assets across different crypto markets. Also, it has a mix of both popular crypto tokens and newly launched tokens. Some of such tokens are:

- BTC

- FIL

- WBTC

- SOL

- ATOM

- ETH

OKX

In terms of available crypto tokens, OKX is lacking behind in competition with KuCoin. As the exchange only supports more than 400 crypto trading pairs for spot and futures trading. But you can be assured that you will have access to majorly traded crypto tokens. Some of the listed tokens are:

- BTC

- USDT

- OKB

- DOGE

- XRP

- USDC

Verdict: KuCoin wins the section by offering more than 700 tradable assets. Whereas OKX only supports 400+ crypto tokens and trading pairs.

KuCoin vs OKX: Trading Fee & Deposit/Withdrawal Fee Compared

When it comes to choosing a crypto leverage trading platform, the trading fee is the most crucial factor.

It is always a good idea to go with an exchange with the lowest trading fee. And here is how both exchange’s trading fees compare:

KuCoin Spot Trading Fee

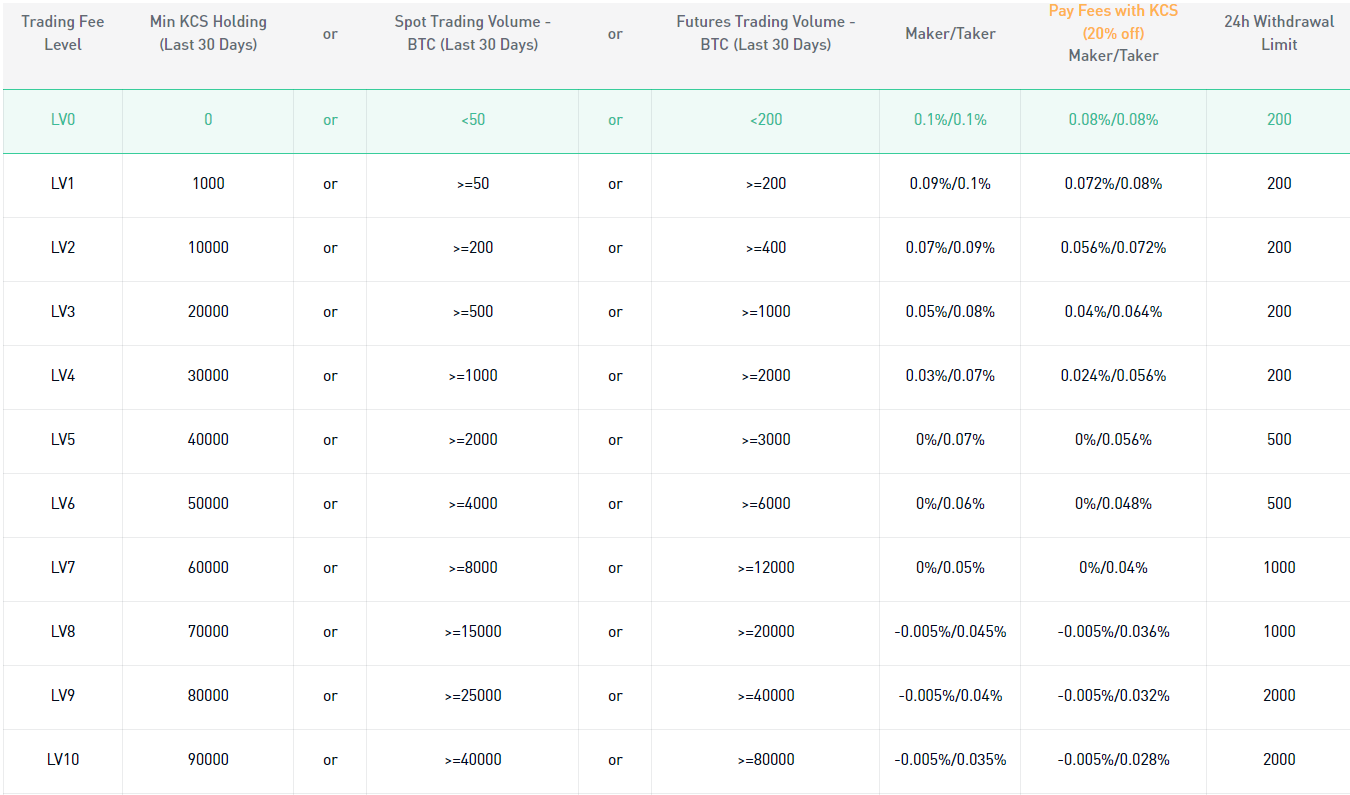

KuCoin has a tiered fee structure and follows the usual maker-and-taker fee model. Also, it offers you a 20% additional discount on spot trading fees when you pay the fees using KCS. And here is how the trading fee compares:

| Regular Fee | 20% Discounted Fee | |

| Maker Fee | 0.1% | 0.08% |

| Taker Fee | 0.1% | 0.08% |

KuCoin Futures Trading Fee

For futures trading, KuCoin also follows the same tiered fee structure, which is based on your 30 days spot trading volume or KCS holding.

However, for futures trading, you don’t get any additional discounts for holding KCS. So the regular fee stands at:

- Maker Fee: 0.02%

- Taker Fee: 0.06%

KuCoin Deposit & Withdrawal Fee

Crypto deposits on KuCoin are free. However, when it comes to the withdrawal of crypto tokens, there will be some charges.

The charges depend on what cryptocurrency you are withdrawing, the blockchain network, etc.

Talking about fiat deposits and withdrawals, it is not really free. Depending on what deposit methods you have selected, you will get charged a transaction fee.

But since KuCoin offers you p2p trading – you can deposit and withdraw fiat at zero cost using your locally available payment options.

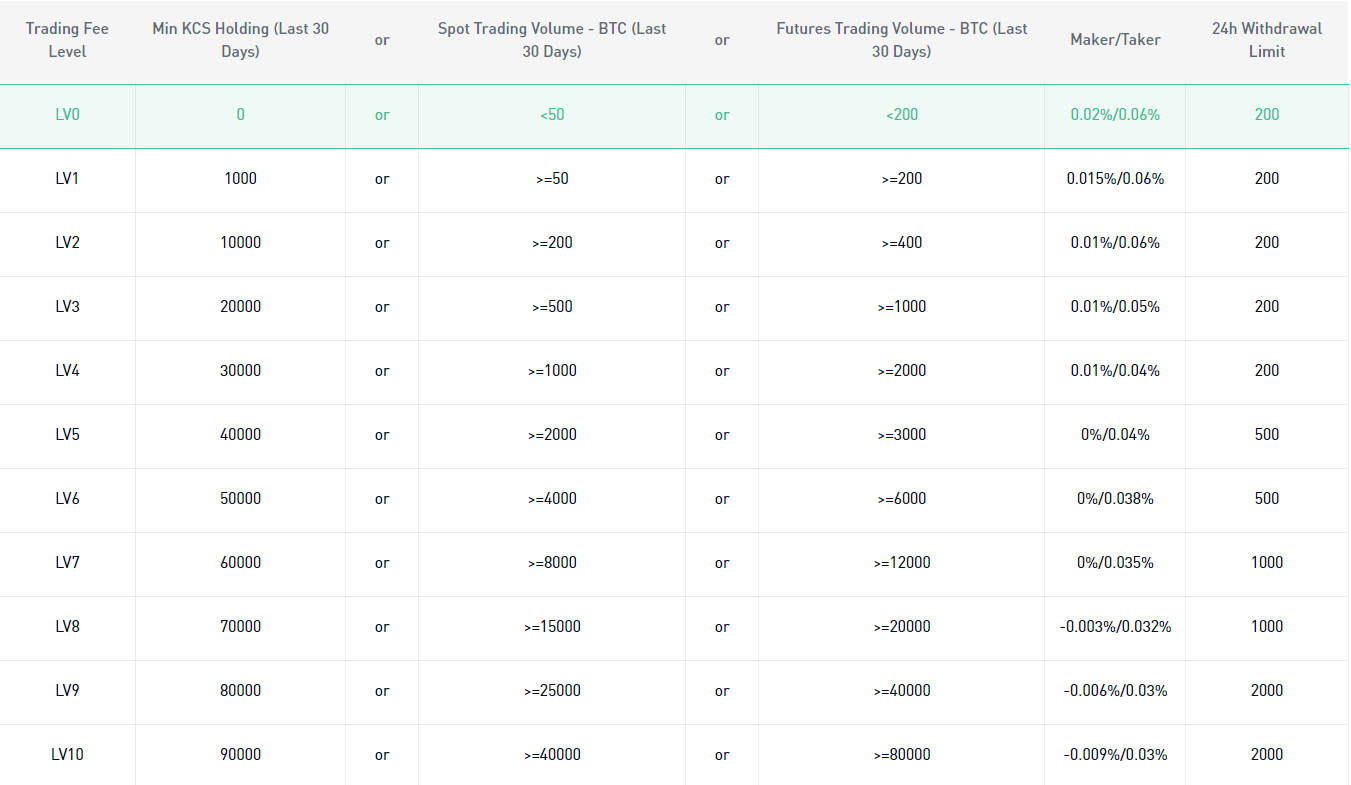

OKX Spot Trading Fees

OKX has different trading fees for regular and VIP users.

Regular users are categorized into tiers by their OKB holdings, whereas VIP users are categorized by 30 days trading volume. Depending on your trading activities, you will automatically get selected for any of the tiers.

However, it doesn’t offer any additional discounts like KCS. So the regular fee stands at:

| Tier | Maker Fees | Taker Fees |

| Regular Users | 0.080% | 0.100% |

| VIP Users | 0.060% | 0.080% |

OKX Futures & PERP Fees

| Tier | Maker Fees | Taker Fees |

| Regular Users | 0.020% | 0.050% |

| VIP Users | 0.010% | 0.030% |

OKX Options Trading Fees

| Tier | Maker Fees | Taker Fees |

| Regular Users | 0.020% | 0.030% |

| VIP Users | 0.010% | 0.020% |

OKX Deposit & Withdrawal Fee

There are no fees charged when it comes to depositing crypto tokens.

But you have to pay a fee when making a withdrawal fee. The withdrawal fee would vary from one token to another and the selected blockchain.

Also, for fiat deposits and withdrawals, the fee is subjective. For certain deposit/withdrawal methods, there are no fees. But for some options, there is a transaction fee.

But you can always use OKX P2P trading to deposit and withdraw funds at no cost.

Verdict: Overall, OKX has a cheaper trading fee compared to KuCoin for both spot and derivatives trading – Hence it is the winner for this section.

KuCoin vs OKX: Order Types

KuCoin

- Limit

- Market

- Limit Stop

- Market Stop

OKX

- Limit

- Market

- Conditional/OCO

- Trailing Stop

- Advanced Limit

Verdict: OKX is the winner for this case, as it supports a few additional order types.

KuCoin vs OKX: KYC Requirements & KYC Limits

KuCoin

To start trading on KuCoin, you don’t need to go through any identity verification. However, if you verify your account through KYC, it would only enable you fiat deposit and withdrawal abilities.

KYC Limits

Talking about the KYC levels, there are two KYC levels:

- Basic Features: With a daily withdrawal limit of 1BTC and 2,000 USDT for P2P Trading. But your account won’t be able to access fiat deposits.

- Advanced Features: With a daily withdrawal limit of 200 Bitcoins and a daily P2P trading limit of 500,000 USDT. Also, you will get access to fiat deposits.

OKX

OKX also doesn’t require you to complete your KYC.

Without verifying your account, you can deposit and withdraw using another crypto exchange or wallet. However, if you wish to buy crypto on the exchange itself, you are required to verify your account.

KYC Limits

OKX has two different KYC levels, these are:

- Basic verification (Level 1): With a deposit and withdrawal limit of 1,00,000 USD lifetime.

- Advanced verification (Level 2): With unlimited deposits and a daily withdrawal limit of 1,00,00,000 USD.

Verdict: As you can use both exchanges with completing user verification, it is a tie between the two.

KuCoin vs OKX: Deposits & Withdrawal Options

KuCoin

- Method 1: You can use your credit/debit card, bank transfer or other third-party payment solutions to buy crypto.

- Method 2: Deposit or withdraw crypto using another crypto wallet or exchange.

- Method 3: Make deposits and withdrawals using your local payment methods using P2P trading.

OKX

- Method 1: You can use your credit/debit card, bank transfer, or other third-party payment solutions to buy crypto.

- Method 2: Deposit or withdraw crypto using another crypto wallet or exchange.

- Method 3: Make deposits and withdrawals using your local payment methods using P2P trading.

Verdict: As both exchanges offer to deposit and withdraw funds in similar methods, it is a tie between KuCoin and OKX.

KuCoin vs OKX: Trading & Platform Experience Comparison

KuCoin

The overall trading experience of KuCoin is great.

For spot trading, you get a regular trading platform. But for futures trading, KuCoin offers you two separate platforms – Futures Classic and Futures Lite.

With Futures Classic, you will get an advanced trading experience, and it has all the trading tools you can think of.

On the other side, the Futures Lite version offers you a simple way to trade futures. Overall, with KuCoin, you are getting features like:

- Technical charts by TradingView

- Trading pair details

- Order book

- Easy-to-use order form

- Open orders, stop orders, order history, realized PNL

To learn more about the exchange, here is a quick KuCoin tutorial.

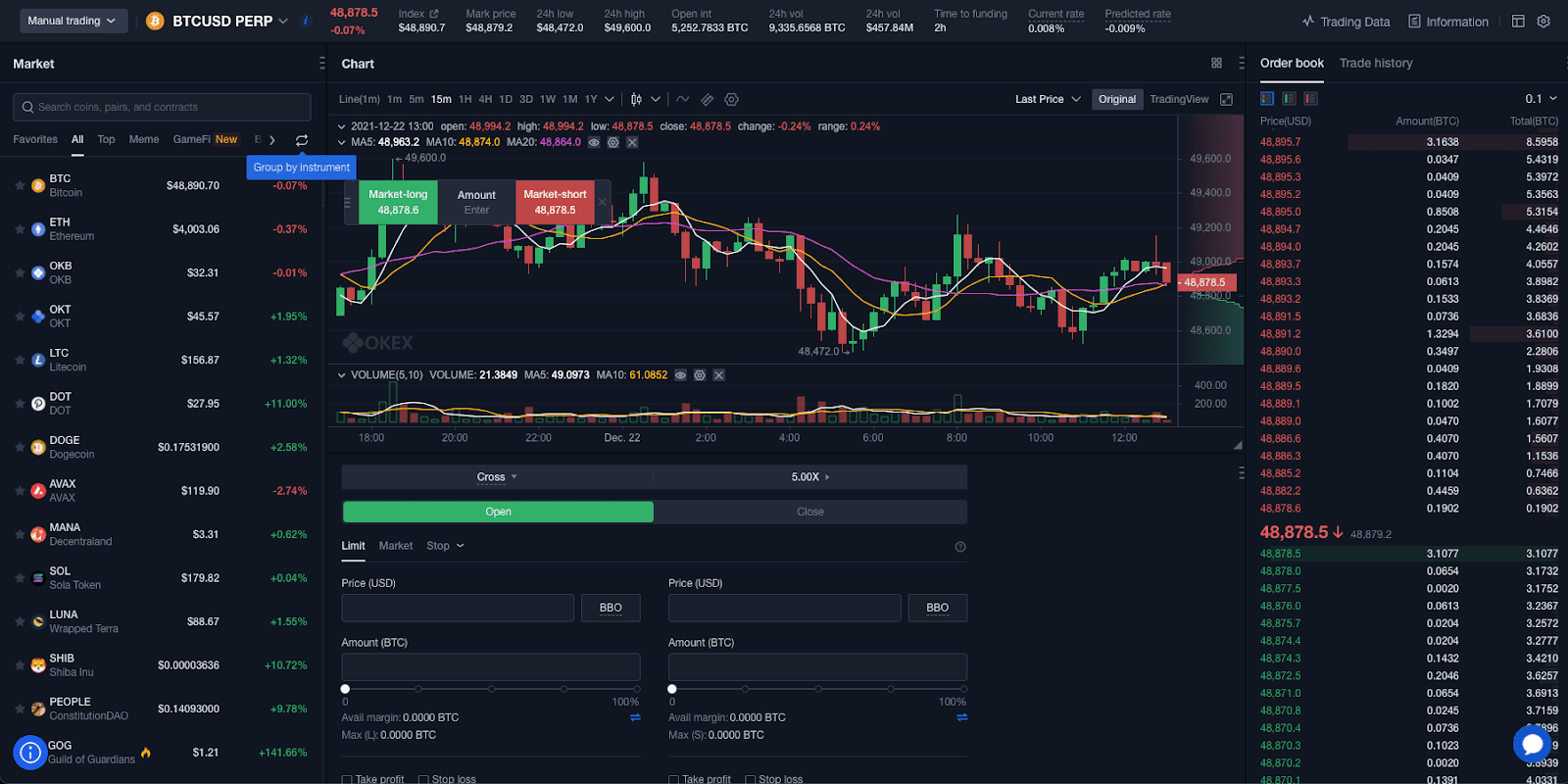

OKX

OKX doesn’t have multiple trading platforms like KuCoin. In fact, the exchange has a pretty simple trading platform that allows you to trade across spot, margin, perpetual, futures and options. And it offers you features like:

- Easy to switch between different markets

- Multiple technical charts, including TradingView

- Order book and last trades

- Easy-to-use order form

- Powerful mobile app

- Open orders, order history, positions, positions, position history etc

To learn how to place trades on the exchange, you can check this guide on how to trade crypto futures on OKX.

Verdict: Both of the exchanges offers pretty much the same trading experience. However, I personally prefer OKX because of its mobile app and the simplicity of switching between multiple markets from a single window.

KuCoin vs OKX: Customer Support

KuCoin

KuCoin support can be reached via their live chat support, which will instantly connect with a support agent. Also, you can use the same chatbot to access helpdesk guides to solve your queries quickly.

Additionally, you can also raise a support ticket to get help. But it doesn’t offer help through its social media channels like Twitter.

OKX

OKX also offers help in a similar manner. You can reach out to the support via its live chat support. It also offers support through email. Or you can reach out to OKX at their Twitter handle @OKXHelpDesk.

Verdict: OKX support is much more convenient to reach out to, so it is the winner for this section.

KuCoin vs OKX: Security Features

KuCoin

- Google verification

- Trading password

- Restrict login IP

- Email anti-phishing code

- Withdrawal anti-phishing code

- Freeze account

OKX

- Two Factor Authentication

- Anti-phishing code

- Trading clearance settings

- Device management

- Freeze account

Verdict: Both exchanges offer pretty much the same security features. Hence it is a tie between the exchanges.

Is KuCoin Safe & Legal To Use?

KuCoin is definitely a safe platform to trade crypto.

The exchange is widely used, and it uses several security features to offer its users a safe trading experience. Along with that, it also uses cold storage to store users’ funds.

Is OKX Safe & Legal To Use?

OKX is a trusted crypto exchange that operates globally and holds licenses under various jurisdictions. Additionally, the exchange also has implemented several security features to protect its users.

Also, it uses cold storage to protect its users’ funds. Also, the exchange doesn’t have any history of security breaches.

KuCoin vs OKX Conclusion: Why not use both?

Both KuCoin and OKX give neck-to-neck competition to each other with not many differences.

However, I would still prefer OKX as the winner as the exchange has more trading markets to offer and lower trading fees. Also, the exchange is widely trusted and regulated in certain regions.

But KuCoin cannot be ignored.

The exchange is also widely used, offers a great trading experience, and requires no KYC.

Learn how does KuCoin vs OKX stack up against the competition.