OKX and Huobi have etched their names into the trading landscape, each boasting a range of unique attributes and advantages.

But here’s the deal:

In this article, we’ll dissect OKX and Huobi layer by layer, exploring everything from their supported cryptocurrencies to their security protocols.

My detailed comparison will illuminate the path to choosing the best suits your trading needs.

So grab your virtual seat, and let’s dive right in!

OKX vs Huobi: At A Glance Comparison

| Factors | OKX | Huobi |

| Trading Fees | Competitive and Volume-based | Competitive and Tier-based |

| Supported Cryptocurrencies | Large Selection | Vast Range |

| User Interface | User-friendly and Intuitive | Complex but Comprehensive |

| Security | Advanced Security Measures | State-of-the-art Security |

| Customer Support | 24/7 Support with Live Chat | 24/7 Support with Quick Response Time |

| KYC Requirements | Simple and Quick Process | More Comprehensive Process |

| Trading Markets and Products | Extensive | Highly Diverse |

| Deposit & Withdrawal Options | Wide Range | Wide Variety |

There you have it – a quick snapshot of both exchanges.

It’s a neck-and-neck competition, but Huobi edges out OKX regarding security and the variety of trading markets and products.

However, for a novice trader who prioritizes a user-friendly interface and simple KYC process, OKX might be a more comfortable fit.

Like anything else in life, the devil’s in the details. So, let’s take a closer look at the individual features, shall we?

OKX vs Huobi: Trading Markets, Products & Leverage Offered

On OKX, you’ve got the option to trade in a multitude of markets. Here’s where things get interesting.

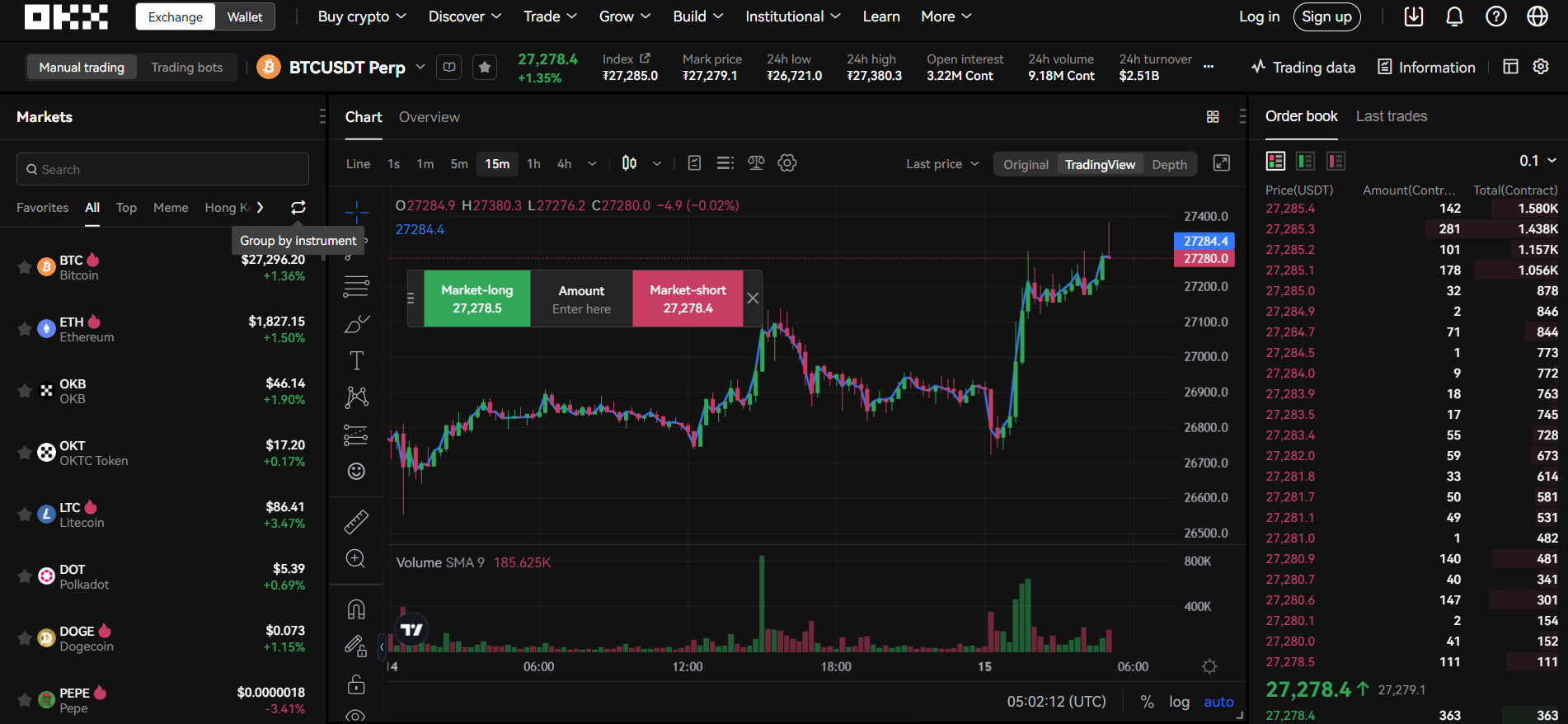

The platform offers spot trading, Futures trading, perpetual swaps, and crypto options trading.

You even have the luxury of indulging in DeFi and PoS pool investments.

Moreover, OKX provides a leverage of up to 100x on Futures and perpetual swap trading. Quite impressive.

But wait until you hear about Huobi.

Huobi presents an equally vast selection of trading markets, including spot trading, Futures trading, perpetual swaps, Options trading, and leveraged trading.

Like OKX, Huobi also offers the convenience of investing in DeFi and staking pools.

But here’s the catch – Huobi provides incredible leverage of up to 125x on Futures trading.

And believe me when I say this can significantly amplify your profits (or losses).

Verdict: Huobi has a slight edge over OKX if high-leverage trading gets your adrenaline pumping.

Shall we proceed to the next comparison?

OKX vs Huobi: Supported Cryptocurrencies

Starting with OKX, the platform lists an impressive range of over 400 cryptocurrencies for trading.

You’ll be spoilt for choice, from mainstream coins like Bitcoin and Ethereum to various altcoins and tokens.

This vast selection is a significant advantage for those wanting to diversify their crypto portfolio.

But before you make up your mind, consider this: Huobi goes even further by offering over 700 cryptocurrencies.

Yes, you heard that right.

Whether you’re an investor looking to stick with popular coins or an adventurous trader seeking lesser-known tokens, Huobi has covered you.

Verdict: When it comes to the sheer number of supported cryptocurrencies, Huobi takes the crown.

Now, let’s keep the ball rolling, shall we?

OKX vs Huobi: Trading Fee & Deposit/Withdrawal Fee Compared

First up, OKX.

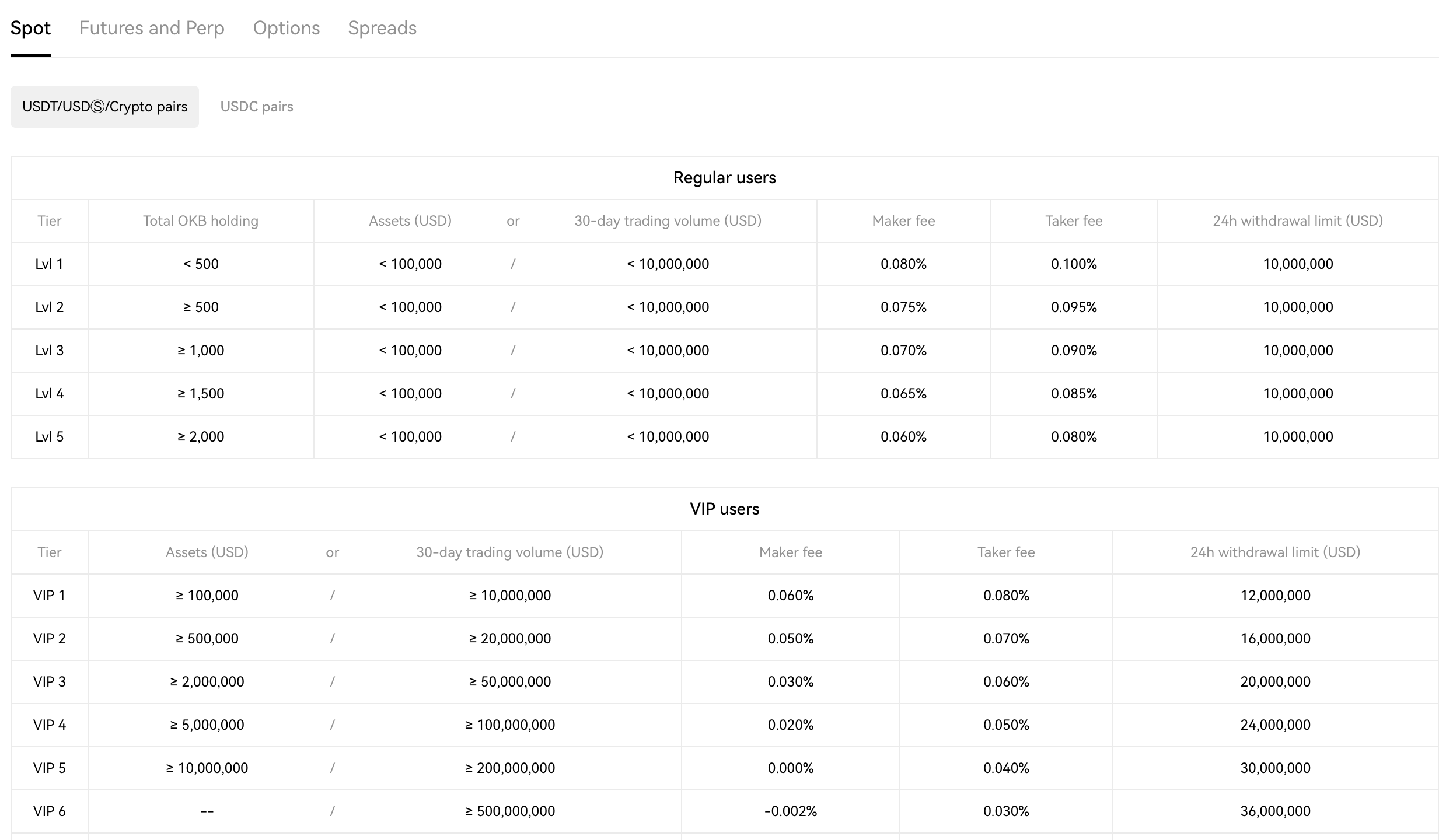

The platform operates a tiered trading fee structure based on your 30-day trading volume and OKB holdings, with maker fees ranging from 0.08% to 0.005% (rebate) and taker fees from 0.10% to 0.02%.

Furthermore, deposits are free, while withdrawal fees depend on cryptocurrency.

But wait, there’s more. Let’s look at Huobi now.

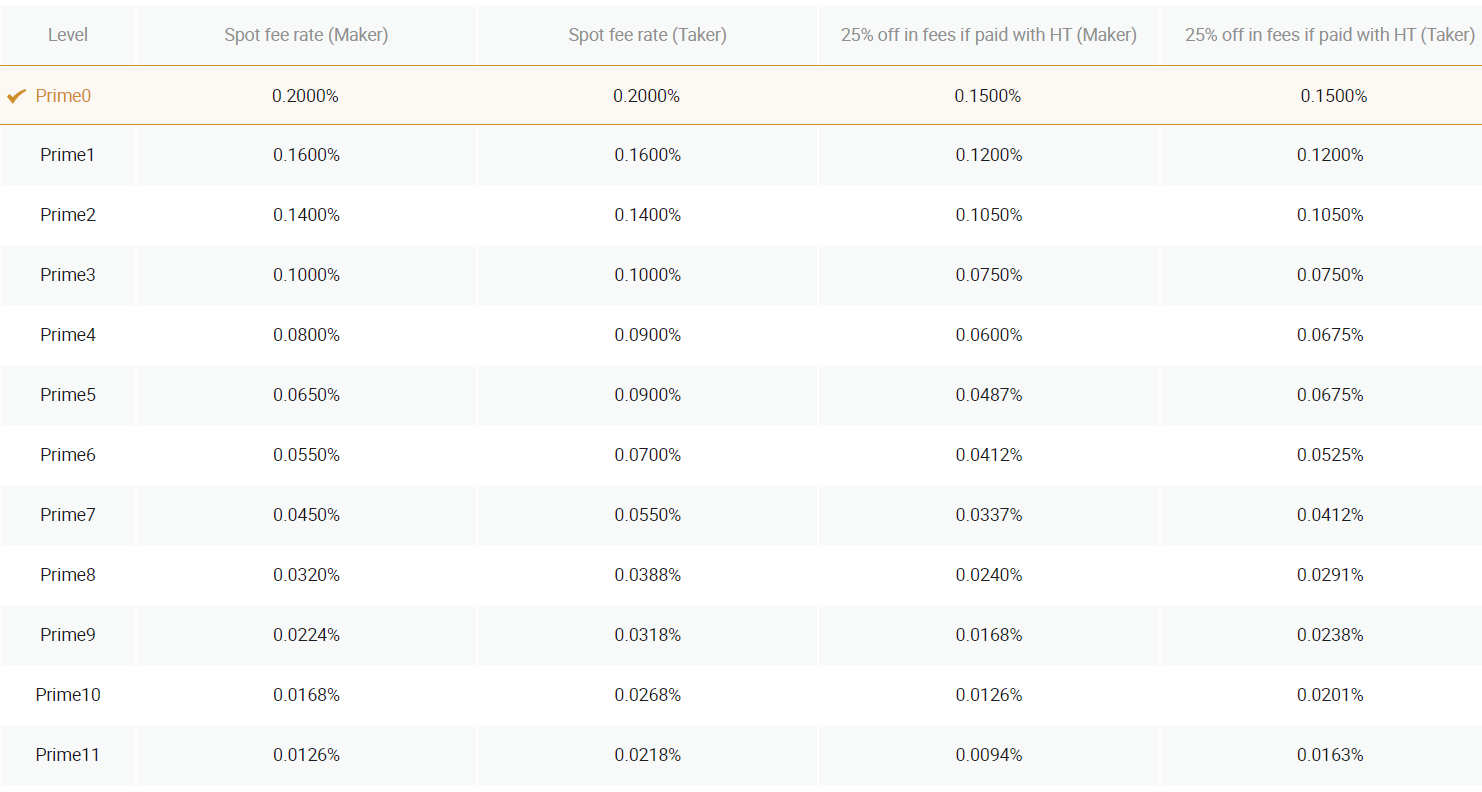

Their trading fees follow a similar tiered structure with maker fees from 0.2% to a rebate of 0.07% and taker fees from 0.2% to 0.07% based on the 30-day trading volume and Huobi Token ($HT) holdings.

Huobi also offers free deposits, with variable withdrawal fees depending on the cryptocurrency.

Verdict: While both crypto futures trading platforms have competitive trading fees, OKX offers slightly lower rates, especially for those trading in high volumes. On the other hand, Huobi’s withdrawal fees are generally considered to be more favorable.

Next up, we’ll talk about order types, so keep reading!

OKX vs Huobi: Order Types

OKX impresses us with a wide variety of order types.

They offer market orders, limit orders, stop limit orders, and trailing stop orders.

But that’s not all.

They also support advanced orders like TWAP (Time-Weighted Average Price) and iceberg orders, giving traders more flexibility and control.

Meanwhile, Huobi also does not disappoint in this department.

They offer market orders, limit orders, and stop-limit orders.

And guess what?

They also offer a unique order type known as the ‘trigger order’, which automatically places a market or limit order when a certain price level is reached.

Verdict: OKX seems to have a slight edge with their inclusion of advanced order types such as TWAP and iceberg orders. So, if diverse order types are your thing, OKX might be the platform for you.

Stay with me as we dive into each platform’s KYC requirements and limits.

OKX vs Huobi: KYC Requirements & KYC Limits

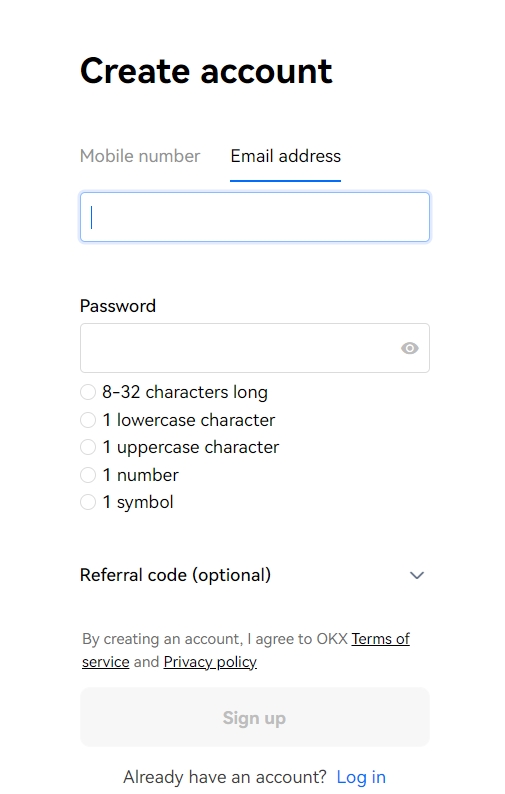

OKX follows a tiered KYC policy on paper where the higher your verification level, the more benefits you unlock.

But both KYC tiers must be completed for essential account functions such as deposits and trades.

But hold on. Huobi follows a similar tiered approach. Users can deposit, trade, and withdraw up to 2 BTC daily without KYC.

Full KYC, including proof of identity, address, and a selfie, is required for higher limits.

Verdict: OKX has a slightly less invasive process for higher withdrawal limits, meaning it may be a better fit if privacy is your top concern.

Next, we’ll examine the deposit and withdrawal options for both platforms. Are you ready?

OKX vs Huobi: Deposits & Withdrawal Options

With OKX, users can deposit funds in cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and more.

Fiat currency deposits are supported via various payment providers like Visa, Mastercard, and Apple Pay. And here’s the best part.

OKX supports multiple withdrawal options, including crypto and fiat withdrawals via partnered payment platforms.

Now, let’s shift gears to Huobi.

Huobi also supports crypto deposits in various cryptocurrencies and fiat deposits via credit card and wire transfer.

However, here’s where it gets interesting.

Huobi also offers withdrawal options in crypto and fiat, but the supported fiat currencies are slightly more limited than OKX.

Verdict: OKX seems to have a slight edge due to its broader range of supported fiat currencies.

Stay tuned. The platform and trading experience comparison is coming up next. And believe me, you won’t want to miss it.

OKX vs Huobi: Trading & Platform Experience Comparison

First up, OKX. The platform provides a seamless trading experience with its well-designed interface. Traders can easily navigate through different trading markets and place orders.

But wait, there’s more. OKX’s platform also offers a variety of advanced charting tools, providing a sophisticated trading experience for professional traders. To help you learn more, here is a quick guide on trading futures on OKX.

Huobi boasts a user-friendly platform suitable for beginners and experienced traders.

What’s more, Huobi’s platform provides users with many trading tools and features, such as advanced charting, spot trading, Futures trading, and more.

Plus, the platform’s quick load time and the app’s easy navigation add to its appeal. To learn how to place trades on the exchange, check this guide on how to short BTC on Huobi.

Verdict: Huobi’s intuitive design and rich feature set give it a slight edge. Whether you’re a beginner dipping your toes into crypto trading or a seasoned trader, Huobi offers an adaptable platform for all skill levels.

OKX vs Huobi: Customer Support

When you find yourself in a tight spot, OKX offers 24/7 customer support through email and live chat.

You can also access an extensive help center filled with FAQs and guides.

And don’t forget. There’s also the OKX community, where you can discuss issues and get advice from other users.

Quite comprehensive, wouldn’t you say?

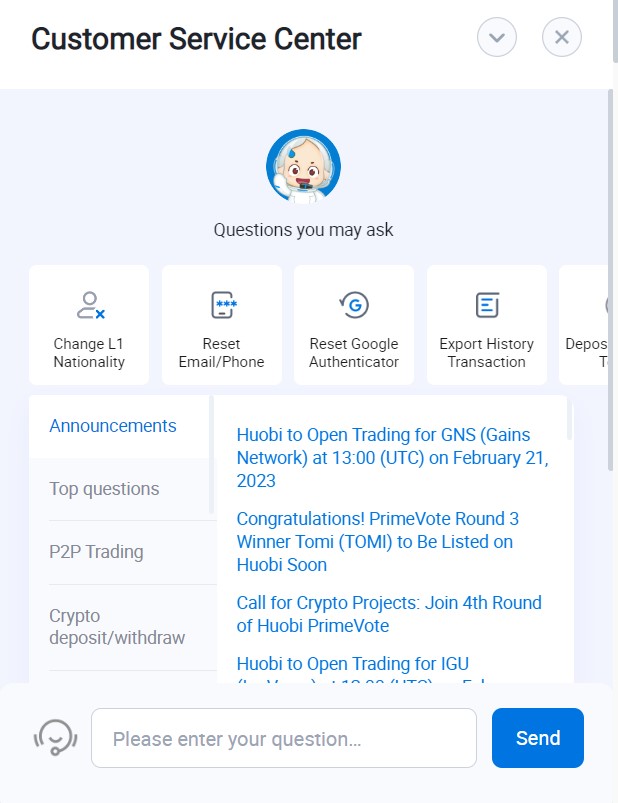

Like OKX, Huobi provides round-the-clock customer support through live chat and email.

Furthermore, they have a highly detailed FAQ section and a help center to assist you in self-diagnosing and fixing common issues.

And guess what else? Huobi goes a step further by offering phone support for immediate assistance.

Verdict: Huobi’s additional phone support takes the cake. Whether you’re a novice trader or a seasoned crypto enthusiast, the availability of real-time, personalized assistance can be a game-changer, wouldn’t you agree?

Hold onto your seats because up next, we’re diving into the critical aspect of security features.

OKX vs Huobi: Security Features

The platform uses hot and cold wallet technologies to secure users’ funds.

Furthermore, it has implemented anti-phishing measures and two-factor authentication (2FA) to protect your account from unwelcome visitors.

Huobi also utilizes hot and cold wallet storage for maximum fund safety.

Additionally, it employs industry-grade encryption technology and 2FA for account security.

But guess what sets Huobi apart?

Their risk control system monitors suspicious activity and their dedicated 20,000 BTC security reserve fund, which can be used to cover any unexpected losses.

Doesn’t that give you an added layer of peace of mind?

Verdict: Huobi’s dedicated security reserve fund gives it an edge. Because an extra layer of protection can make all the difference regarding security.

Next, we’ll tackle the often tricky question of legality and safety. Keep your eyes peeled because you won’t want to miss it!

Is OKX Safe & Legal To Use?

Based on available information, OKX is licensed and regulated in multiple countries and territories.

This means they comply with the regulations set by the authorities in these areas.

So, in the context of legality, yes, it’s perfectly legal to use OKX in most regions, provided you’re of legal age and not residing in a sanctioned country.

From a hot and cold wallet storage system to employing anti-phishing measures and two-factor authentication, OKX demonstrates a solid commitment to user safety.

Plus, they perform regular internal audits to keep things in check.

Up next, we shift the spotlight to Huobi. Stick around because you don’t want to miss this!

Is Huobi Safe & Legal To Use?

Huobi is a Singapore-based exchange and operates in over 130 countries, meaning it’s legal to use in those jurisdictions.

Remember, this doesn’t mean it’s legal everywhere, so always check your local regulations to stay safe.

In terms of safety, Huobi appears to take its user’s security very seriously.

They employ a ‘Safety Risk Control System’ using a multi-level firewall to monitor system data.

They also use cold storage for funds, secure SSL encryption to protect your data and mandatory 2FA for account security.

It’s worth remembering that the ultimate responsibility for security rests with you.

Always follow best security practices like using strong and unique passwords, enabling 2FA, and being wary of phishing attempts.

Trust me. You’re going to want to read the conclusion!

OKX vs Huobi Conclusion

Okay, here’s the moment of truth, folks!

After considering all factors, you might ask, “Why not use OKX and Huobi?”

Let me explain.

If a vast array of trading products and competitive futures fees appeal to you, then OKX should be your go-to.

If you prioritize a top-notch customer service experience and a diverse selection of cryptocurrencies, Huobi may be your preferred choice.

But why limit yourself?

Embrace the best of both worlds!

Diversify your trading experiences, expand your crypto portfolio, and maximize your potential for success.

Learn how does OKX & Huobi stack up against the competition: