Remitano and Binance are far from each other regarding features and product offerings.

On one side, Remitano is a peer-to-peer crypto exchange. On the other side, Binance Futures is a full-fledged crypto exchange.

But both exchanges do meet in one area, which is P2P trading. So if you are confused between Remitano vs Binance and are not sure which one to use, then I am here to help you out.

Both these crypto exchanges serve different purposes, and as a crypto trader, you need to determine your goal.

Remitano vs Binance: At A Glance Comparison

Remitano is not really like a regular cryptocurrency exchange.

Instead, it is an escrowed P2P crypto exchange that lets you buy, sell, store, and invest cryptocurrencies. You can consider it pretty much like a crypto spot trading platform.

The exchange was founded back in 2016, and the best part is that it allows you to buy and sell Bitcoin and other crypto tokens in your local fiat.

Plus, it charges you a reasonable fee and has a few other features, such as crypto swaps, lending, Gift cards, and more.

Binance, on the other hand, is one of the best cryptocurrency exchange for day trading out there.

The exchange can be used for all sorts of trading, be it spot, margin or futures. As well as you can use it for P2P trading, and that too at zero cost.

The exchange was established in 2018, and it is one of the largest crypto exchanges by trading volume. The exchange is trusted by millions of users globally, and you can use the exchange for all your crypto requirements.

Remitano vs Binance: Trading Markets, Products & Leverage Offered

Remitano

As mentioned earlier, Remintano is a P2P crypto exchange. As a result, it doesn’t really offer you trading markets except the basic buying/selling of crypto. Also, there is no leverage for crypto trading.

- P2P Trading

- Crypto Swap

Binance

Binance is a better choice if you want to day trade crypto. Even if you are looking to build a portfolio, the platform serves the purpose since it has all sorts of markets and other features that benefit both newbies and advanced traders.

- Spot Trading

- Margin Trading

- Derivatives trading in USDT, USDC & Crypto (up to 125x leverage)

- Crypto Options

- Binance Leveraged Tokens

- P2P Trading

Verdict: With Binance, you will get a complete trading experience, and it is the winner for this section. On the other side, Remitano is only meant for a single job.

Remitano vs Binance: Supported Cryptocurrencies

Remitano

From the point of view of P2P trading, Remitano is pretty good. Although, it doesn’t support hundreds of crypto tokens. But it does allow you to trade in the most popular crypto tokens. These listed tokens are:

- BTC

- ETH

- USDT

- BCH

- LTC

- XRP

- BNB

Binance

Binance supports 500+ crypto tokens and trading pairs across different markets.

It is suitable for both investors and traders as they can invest and trade in new tokens. Also, Binance adds new tokens from time to time. Some of the listed tokens are:

- BTC

- ADA

- SOL

- AVX

- SHIB

- BUSD

- DOT

Verdict: Undoubtedly, Binance is a better choice. It supports an extended number of tokens than Remitano.

Remitano vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

Remintano Deposit & Withdrawal Fees

When it comes to cryptocurrency deposits, the fee is subjective.

For certain currencies, there are zero fees, but for some, you need to pay some charges. Additionally, you need to meet the minimum deposit requirements.

Similarly, for withdrawals, you need to meet the minimum requirements. Along with that, the withdrawal fees are not fixed, and they may change depending on the state of the blockchain networks.

If you are depositing fiat, then again, it will be subjective. For certain fiat, there are no deposit or withdrawal charges.

Remitano P2P Fees

When it comes to P2P Fees, it is again subjective, and it follows a maker-and-taker fee. The fee would depend on where you live and your payment options. However, here is what the fee structure looks like in my region:

- Maker Fees: 0.5%

- Taker Fees: Free

Remitano Swap Transaction Fees

- Order Book Taker: 0.25%

- Order Book Maker: 0.25%

Note: Remitano fees can be very complex to understand and follow. So I would highly recommend you to check out their official fee page to get a better understanding.

Binance Spot Trading Fee

Binance has a straightforward fee structure with a maker-and-taker fee model. Also, it offers you an additional 25% discount on the spot trading fee if you pay the fee using BNB.

So the regular and discounted spot trading fee stands at:

| Regular Fee | 25% Discounted Fee | |

| Maker Fee | 0.1000% | 0.0750% |

| Taker Fee | 0.1000% | 0.0750% |

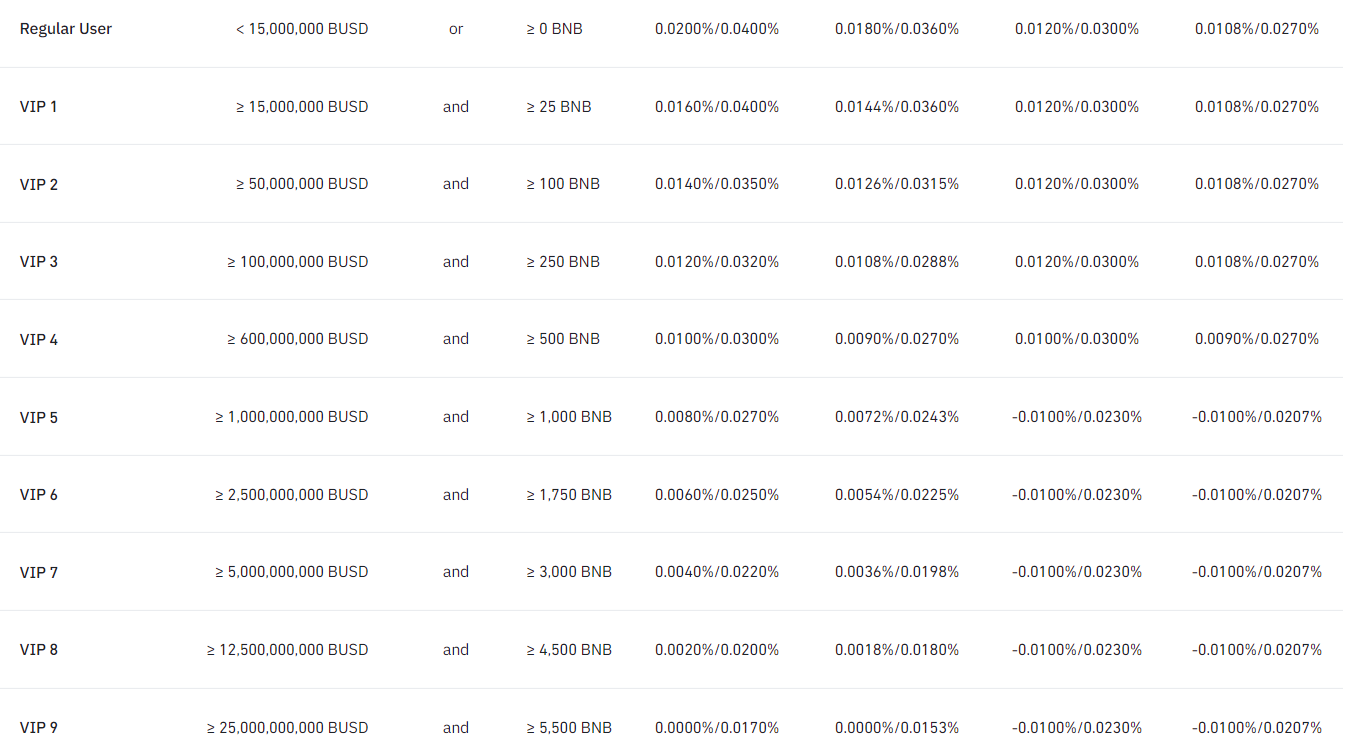

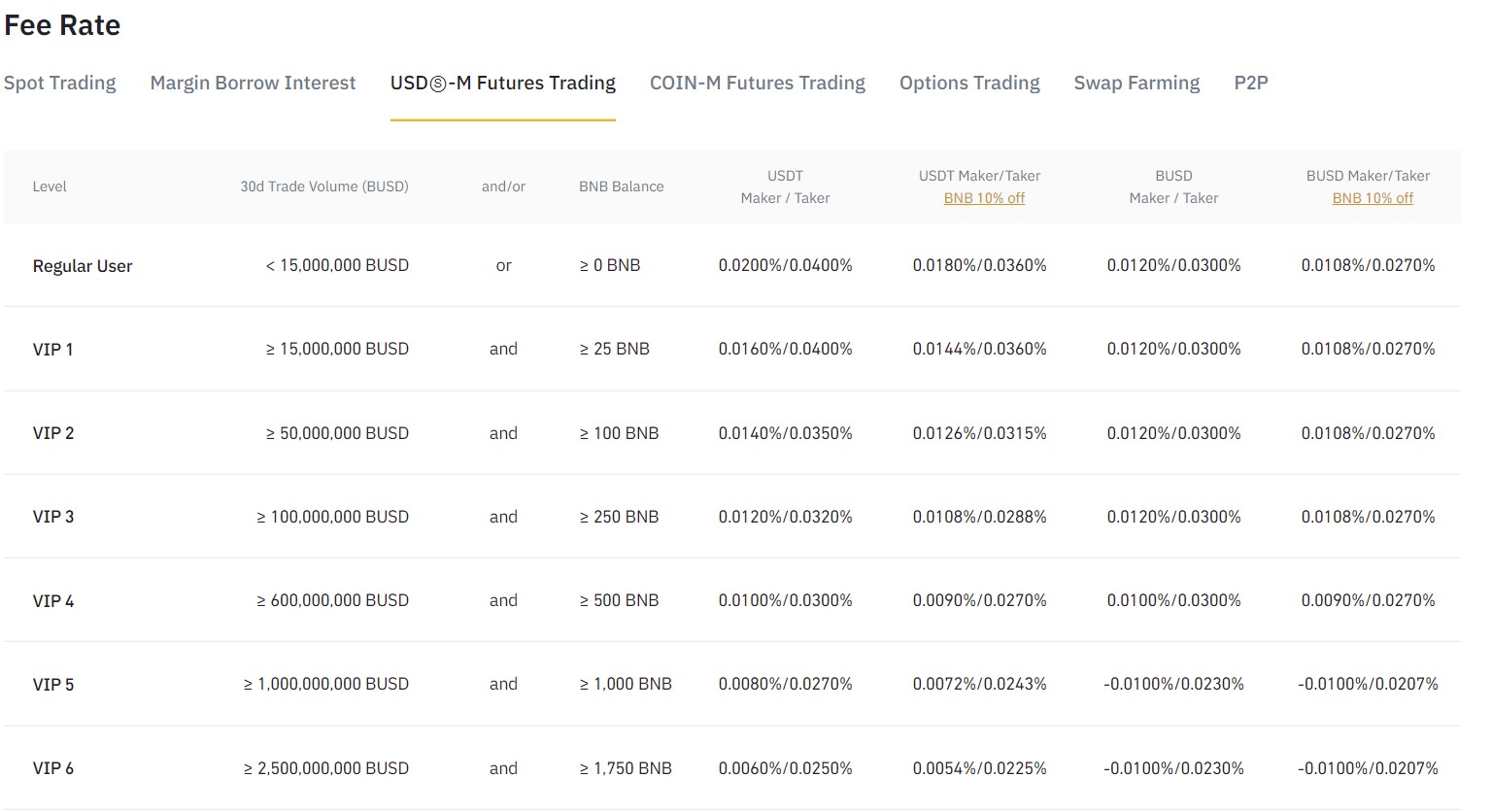

Binance Futures Trading Fee

A similar fee structure can also be seen for Binance futures trading. Additionally, you are getting a 10% discount on your futures trades.

| USD-M Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0180% | 0.0108% |

| Taker Fee | 0.0360% | 0.0270% |

| BUSD Futures Fee | Regular Fee | 10% Discounted Fee |

| Maker Fee | 0.0120% | 0.0108% |

| Taker Fee | 0.0300% | 0.0270% |

| Coin-M Futures Fee | Regular Fee | |

| Maker Fee | 0.0100% | |

| Taker Fee | 0.0500% | |

| Binance Options Trading Fee | Regular Fee | |

| Maker Fee | 0.020% | |

| Taker Fee | 0.020% |

Binance Deposit & Withdrawal Fees

When it comes to crypto tokens deposit, there are no fees. But for crypto withdrawals, you have to pay charges. The fee depends on the blockchain conditions and a few other factors.

When it comes to fiat deposits and withdrawals, it is subjected to transaction fees. Also, for certain payment methods, there are no fees.

Luckily, unlike Remitano, Binance doesn’t charge you any fee for P2P trading.

Verdict: Binance is the clear winner because the exchange has a straightforward fee structure across spot, margin, and derivatives trading. Also, unlike Remitano, it offers you free P2P trading.

Remitano vs Binance: Order Types

Remitano

Remitano being a P2P exchange, doesn’t offer you plenty of order types. Instead, the options are limited to the following:

- Market Price

- Your Price or Limit Order

Binance

Binance, on the other side, offers you tons of order types that will help you place advanced trades. Some of these order types are:

- Limit

- Market

- Stop Limit

- Stop Market

- Trailing Stop

- Post Only

- TWAP

Verdict: Clearly, Binance wins this section as the exchange is offering an extended list of supported order types.

Remitano vs Binance: KYC Requirements & KYC Limits

Remitano

Remitano doesn’t require you to complete your identity verification to an extent.

For instance, by just verifying your account with a phone number, you would enjoy a daily buying limit of $75.

However, if you want to increase your daily buying limit, then you have to verify your account using documents and bank details.

Binance

Binance made it mandatory to complete your KYC verification.

You are not allowed to use the exchange at all without going through identity verification. Also, it has different deposit and withdrawal limits depending on what kind of KYC verification level you have completed.

KYC Limits

- Verified: A daily fiat Limit of 50K USD Daily.

- Verified Plus: A daily fiat Limit of 2M USD Daily.

- Verified Plus (2): Unlimited Fiat Transactions.

Verdict: Remitano is the winner for this section. As you can use the exchange to some extent without verifying your identity.

Remitano vs Binance: Deposits & Withdrawal Options

Remitano

Remitano being a P2P trading, doesn’t have the concept of deposits or withdrawals. Instead, it allows you to buy and sell cryptocurrencies using your locally available payment methods.

For instance, you have to find sellers or buyers comfortable paying in your preferred payment method, and then you can complete the transaction.

Binance

- Method 1: You can buy crypto using your credit/debit card, bank transfer, or other payment methods.

- Method 2: You can deposit or withdraw crypto from another crypto exchange or wallet.

- Method 3: You can use Binance P2P trading to deposit and withdraw funds at zero cost.

Verdict: It is a tie between the two. As both exchanges have completely different when it comes to deposits and withdrawals.

Remitano vs Binance: Trading & Platform Experience Comparison

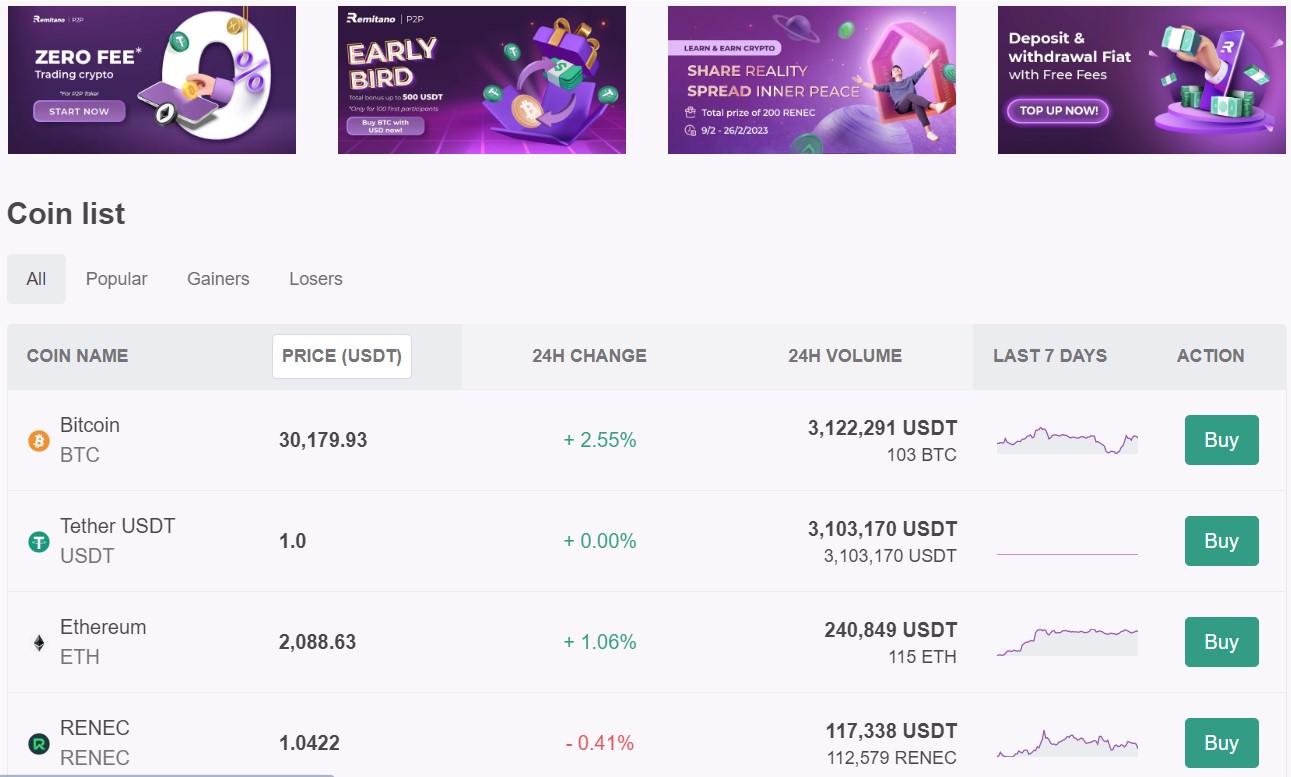

Remitano

Remitano offers a pretty basic trading experience, as the exchange doesn’t really offer any advanced trading markets. Instead, it offers you the basic Buy/sell feature.

- Coin List

- Coin Price, 24H change, 24H volume

- Crypto Swap

Binance

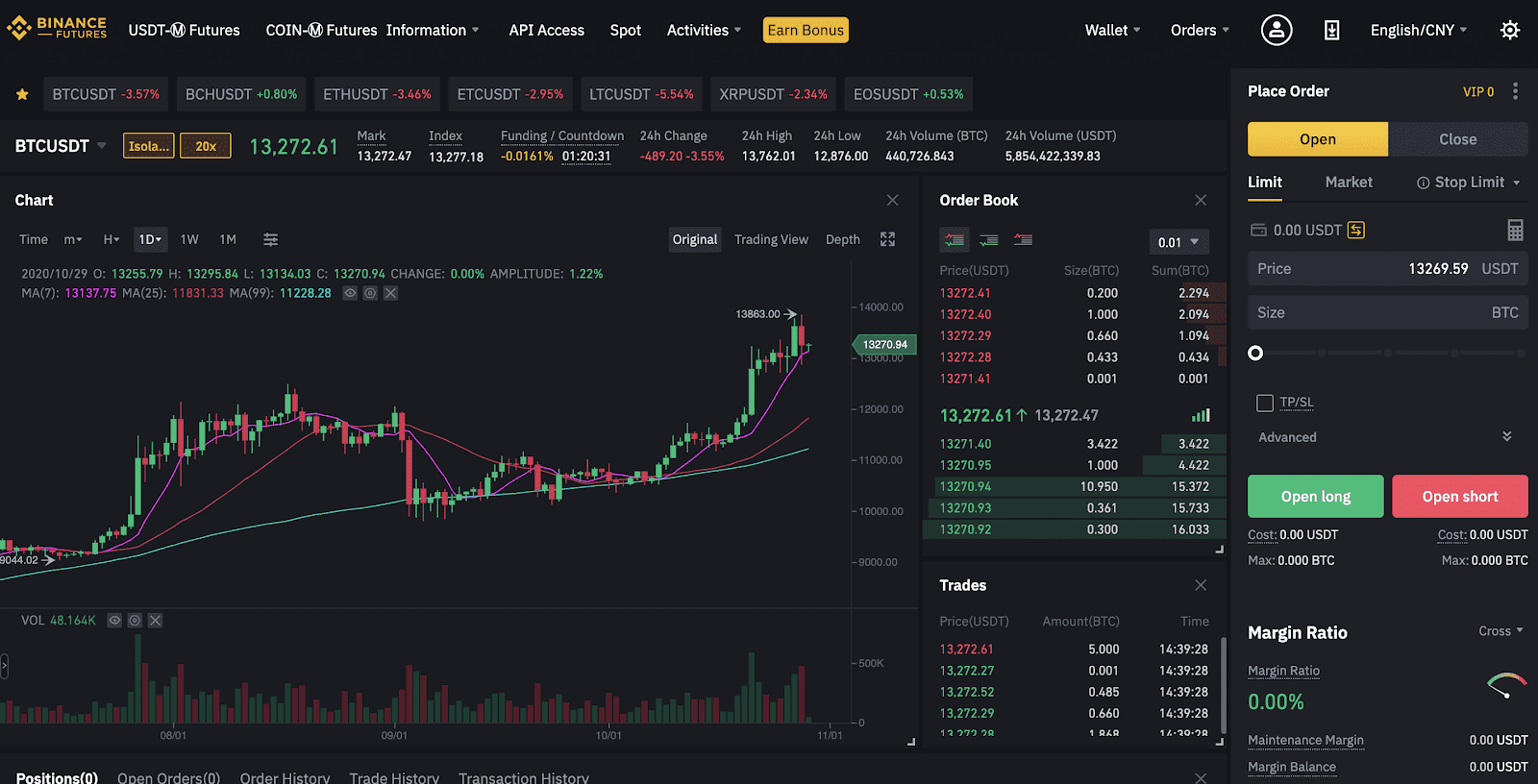

Binance is a far better choice in terms of both P2P trading and crypto trading. It has features like:

- Multiple technical chart options, including TradingView

- Pair details

- Order book

- Easy-to-use order form

- Trade history, open orders, PnL records

- User-friendly mobile app

Verdict: Binance would be the winner for this section as well because it of it’s an advanced trading platform across P2P trading and crypto trading markets.

Remitano vs Binance: Customer Support

Remitano

Remitano offers excellent customer support. They have a live chat option embedded on their website, which can be used to access different help guides or connect with a support agent instantly. The good part is that they have a quicker response time.

Furthermore, you can also get help by sending them an email. But it doesn’t offer help through its social media channels.

Binance

Binance also offers you help through its social media channels and offers you quick support. Additionally, you can also reach out to customer support via email, or you can contact them on Twitter to get quick help.

Verdict: Overall, Binance support is more convenient and easier to reach out to. So it is the winner for this section.

Remitano vs Binance: Security Features

Remitano

- Two Factor Authentication

- Emergency lock

- VPN access

- Blacklist

- Last account activities

- Anti-Phishing code

- Saved addresses

Binance

- Keeps funds in cold storage

- Two-factor Authentication

- Real-Time Monitoring

- Advanced-Data Encryption

Verdict: Remitano wins this section by offering more security features compared to Binance.

Is Remitano Safe & Legal To Use?

Remitano is one of the safest P2P crypto exchanges out there. The exchange offers you tons of security features and uses offline storage to keep your funds secure.

The transaction of funds happens instantly, and the fiat gets transferred to your bank account while the crypto tokens remain in your Remitano wallet. Also, Remitano doesn’t have any history of hacks to date.

Is Binance Safe & Legal To Use?

Binance is the largest crypto exchange trusted by millions of users globally. The exchange has been standing rock solid since its inception with no history of hacks.

Binance has implemented several security features and uses cold storage to keep users’ data and funds secure. Also, the exchange has compiled with multiple jurisdictions around the globe to offer traders a safe trading experience.

Remitano vs Binance: Why not use both?

Both exchanges are completely different from each other. But overall, Binance is the clear winner at the end of this comparison.

Why?

Because Binance cannot only be used for P2P trading, but you can use the exchange for spot, margin, and derivatives trading at low cost and high leverage, which will empower traders to make a significant profit.

However, if your only goal is to make money through P2P trading, Remitano is a great choice.

The exchange has a simple-to-use user interface and offers you cheap trading fees.

Check out how Remitano & Binance stacks up against the competition:

- Binance vs Bybit

- Binance vs Bitfinex

- Binance vs Kraken

- Binance vs PrimeXBT

- Binance vs BingX

- Binance vs Deepcoin