A crypto exchange is a ‘market’ where customers like you can buy, sell, or exchange crypto for other currencies or fiat money.

In these virtual trading posts, the value of various cryptocurrencies is determined, much like how traditional stock exchanges function.

The challenge lies in finding the proper exchange that aligns with your needs, budget, and security preferences.

This article will explore the following types of crypto exchanges available in the market and help you delve deeper into their features, benefits, and potential risks.

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Hybrid Exchanges

- Peer-to-Peer (P2P) Exchanges

- Derivatives Exchanges

- Instant/OTC Exchanges

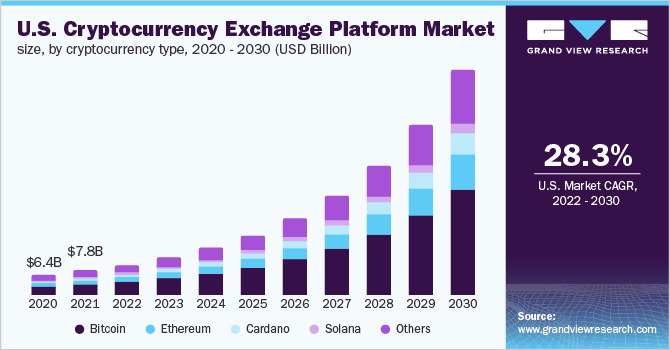

How Many Different Crypto Exchanges Are There?

There’s no doubt that the cryptocurrency world has grown exponentially in the past few years, but how many different crypto exchanges are there?

The answer might surprise you.

To start, hundreds of crypto exchanges are out there, each with unique features, fee structures, and security measures.

But before we delve into the specifics, let’s break it down further.

Crypto exchanges can be broadly categorized into three types: centralized exchanges (CEX), decentralized exchanges (DEX), and hybrid exchanges.

Centralized exchanges, as the name suggests, are managed by centralized organizations that act as intermediaries for transactions. Some famous examples include Coinbase, Binance and Kraken.

On the other hand, crypto decentralized exchanges operate without intermediaries, enabling peer-to-peer trading directly between users. Examples of DEXs include Uniswap and SushiSwap.

Hybrid exchanges, as you might guess, combine features of both centralized and decentralized exchanges.

And there’s more.

Apart from the three main types, some derivatives exchanges allow users to trade contracts based on the price of cryptocurrencies.

Moreover, peer-to-peer (P2P) exchanges facilitate direct trading between users without an intermediary.

There are also instant exchanges that allow users to swap one crypto for another without creating an account.

#1. Centralized Exchanges (CEX)

Centralized exchanges, as the name implies, are platforms that operate under a centralized authority or company.

Like traditional stock exchanges, these platforms act as intermediaries between buyers and sellers.

They provide a user-friendly interface, high liquidity, and a wide range of cryptocurrency pairs.

It’s worth noting that centralized exchanges are responsible for maintaining the order book and matching buy and sell orders.

When you place an order, the exchange executes it at the best price.

The advantage here is the speed and efficiency of trading and access to advanced trading tools.

But there’s a catch.

Since CEXs are controlled by centralized entities, they’re also prone to hacking and security breaches.

Several high-profile exchanges have suffered from cyber-attacks, leading to significant investor losses.

That’s why it’s crucial to research and choose a reputable exchange with robust security measures.

#2. Decentralized Exchanges (DEX)

Unlike centralized exchanges, decentralized exchanges operate without a central authority or intermediary.

Instead, they use smart contracts and blockchain to make peer-to-peer trading possible.

In essence, DEXs allow users to trade directly with one another without giving up control of their funds.

Now, let us get down to the unique features of DEXs.

First and foremost, DEXs eliminate the need for a third party to hold your funds.

When you trade on a DEX, you always maintain control of your private keys and assets.

This reduces the risk of being hacked and other security breaches that plague centralized exchanges.

But there’s more.

Since DEXs operate without intermediaries, they also offer greater privacy and anonymity.

On a DEX, you can trade without undergoing the extensive verification processes required by centralized exchanges.

However, it’s essential to consider the trade-offs.

One downside of DEXs is the lower liquidity compared to centralized exchanges.

With fewer users and trading pairs, executing large trades at favorable prices may be more challenging.

Also, DEXs have less user-friendly interfaces and fewer advanced trading tools.

#3. Hybrid Exchanges

As the name suggests, hybrid exchanges are a fusion of centralized and decentralized exchanges.

They combine the best of both worlds, offering the security and privacy of DEXs while providing the high liquidity and user-friendly experience of CEXs.

But how do hybrid exchanges accomplish this?

The answer lies in their architecture.

Hybrid exchanges use blockchain technology to provide a decentralized, peer-to-peer trading platform.

At the same time, they employ centralized elements to improve liquidity and user experience.

It’s a win-win situation for traders who want the advantages of CEXs and DEXs without drawbacks.

Let’s dive into the other benefits of hybrid exchanges.

First and foremost, these exchanges offer higher security than centralized platforms.

By utilizing smart contracts and decentralized ledgers, hybrid exchanges minimize the risk of hacking and fraud.

Plus, you remain in control of your private keys, adding an extra layer of protection.

Another advantage is the increased liquidity.

Hybrid exchanges typically have more users and trading pairs than DEXs, making executing large trades at favorable prices easier.

Additionally, these platforms tend to have more advanced trading tools and a more user-friendly interface than DEXs, making them a better option for new and experienced traders.

#4. Peer-to-Peer (P2P) Exchanges

P2P exchanges directly connect buyers and sellers, allowing them to trade cryptocurrencies without going through a third party.

These platforms provide a virtual marketplace where users can negotiate trade terms, execute transactions, and transfer funds.

And the best part?

P2P exchanges offer privacy and control over your trades.

Regarding security, P2P exchanges typically employ an escrow service to ensure that both parties meet their obligations.

When a trade is initiated, the cryptocurrency is held in escrow until the agreed-upon payment is received.

The crypto is released to the buyer once both parties fulfill their end of the deal.

But that’s not all.

P2P exchanges also offer more flexibility in terms of payment methods.

Unlike centralized exchanges, which usually have a limited number of payment options, P2P platforms allow users to choose from a range of methods to pay, including bank transfers, debit, and credit cards.

Of course, there are some drawbacks to consider.

P2P exchanges can be less intuitive for new users, and trades can take longer than centralized platforms.

Additionally, the lack of a single central authority can make resolving disputes or recovering funds harder in case of fraud.

#5. Derivatives Exchanges

Derivatives exchanges are platforms where traders can buy and sell contracts that derive value from an underlying asset, such as Bitcoin or Ethereum.

Unlike spot trading, where you’re purchasing or selling cryptocurrency, derivatives trading involves speculating on the price movements of these digital assets without owning them.

You might be thinking, “What’s the point?”

Well, here’s the deal:

Cryptocurrency derivatives trading platform offer various financial products, including Futures, Options, and Perpetual Swaps.

These contracts allow traders to profit from rising and falling markets, allowing for more sophisticated trading strategies.

You can also use leverage to amplify your potential returns – but be aware that leverage also increases the risk.

The catch is that while derivatives exchanges can offer exciting opportunities for seasoned traders, they’re not for the faint of heart.

Trading derivatives, be it in the world of fiat finance or crypto, is complex and involves a high level of risk.

It’s crucial to have an understanding of the market and the specific contract terms and trading mechanics.

But wait, there’s more.

Before jumping into derivatives trading, choosing a reputable exchange with solid security measures, transparent fee structures, and reliable customer support is essential.

Some of the most well-known crypto derivatives exchanges include Binance Futures, BitMEX and Bybit.

These platforms provide a range of trading options and educational resources to help you get started.

#6. Instant/OTC Exchanges

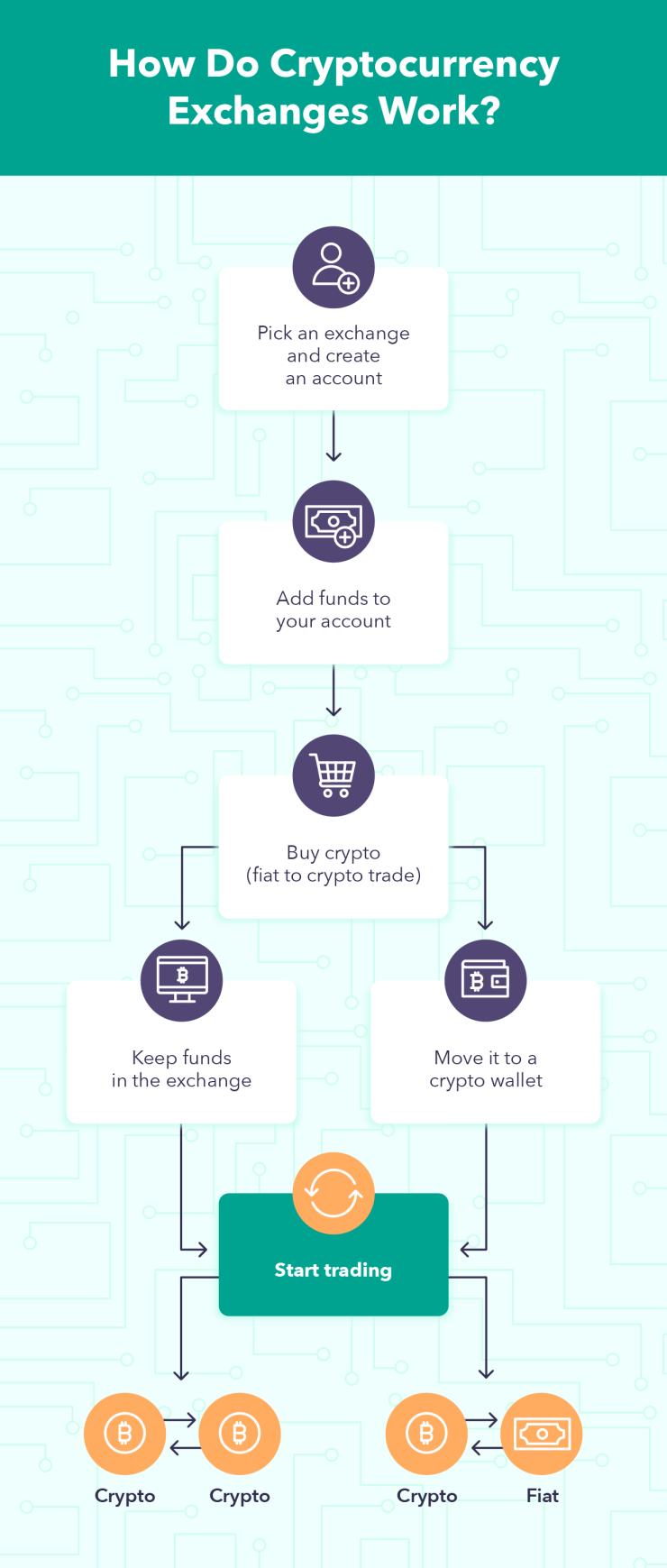

Instant exchanges are platforms that facilitate immediate cryptocurrency transactions.

Unlike traditional exchanges, where you place orders on an order book, instant exchanges match buyers and sellers directly.

And here’s the kicker: you don’t have to create an account or undergo lengthy verification processes.

Here’s how it works: You select the cryptocurrency you want to buy or sell, provide the necessary information, and the transaction happens instantly.

It’s as easy as Sunday morning.

The exchange determines the price based on market conditions, ensuring you receive a fair and competitive rate.

But that’s not all.

OTC exchanges are a special instant exchange catering to traders looking to make large-volume trades.

Why go OTC?

When dealing with large amounts of cryptocurrency, executing trades on traditional exchanges can cause significant price slippage, which can be costly.

OTC exchanges, on the other hand, can handle substantial volumes without affecting the market price.

Now, you might be wondering, “What’s the catch?”

Here’s the deal: while instant exchanges are convenient, they tend to charge higher fees than traditional exchanges.

Moreover, prices might not be as competitive, given that they’re set by the platform rather than market demand and supply.

Before you dive in, consider this: choosing a reputable instant or OTC exchange is crucial.

Look for platforms with an unblemished track record, transparent fee structures, and a user-friendly interface.

Some popular instant exchanges include Changelly and ShapeShift, while OTC options include Circle Trade and Kraken OTC.

Conclusion

From centralized and decentralized exchanges to hybrid, P2P, derivatives, and instant/OTC exchanges, each has unique features, benefits, and limitations.

But the bottom line is this: the security of your funds and the platform’s reliability should be your top priorities.

In addition, don’t forget to consider fees, costs, and regulatory compliance when making your choice.

Ultimately, it’s all about being thoughtful and cautious in the ever-evolving world of cryptocurrency trading.

After all, with the right tools and platforms, you can optimize your trading experience, maximize profits, and confidently navigate the world of crypto.

Happy trading!