Seeking a comprehensive comparison between Bybit and Kraken?

As someone well-versed in cryptocurrency exchanges, I’ve closely analyzed both platforms to guide you toward a better choice.

With their strong reputations, it might seem challenging to pick one.

However, there are key differences that may influence your decision.

I’ll dig deep into essential aspects such as liquidation mechanisms, fees, security, and customer support to offer insightful details.

Let’s dive in so you can decide whether Bybit or Kraken suits you best.

With a detailed attribute-by-attribute assessment, we can effectively compare these two exchanges.

Let’s explore what I’ve found in this Bybit vs Kraken comparison.

Introduction: Bybit vs. Kraken

Bybit exchange, a Singapore-based peer-to-peer (P2P) crypto Futures market, launched in 2018 with over a million crypto traders and, at the time of writing, boasts 18.3 million crypto investors.

Bybit has a 24h spot trading volume of $994 million.

And besides, there aren’t many platforms devoted to this niche where you can earn interest if you stake your crypto with the exchange.

However, Bybit’s edge is more than just providing a necessary service of crypto trading.

The organization also has a strong team with a wealth of experience in financial and blockchain technologies.

As a result, Bybit has established a competitive position with other exchanges like BitMEX and Deribit.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Kraken was formed in 2011 and then established in San Francisco in 2013.

Kraken is available in all the states of the USA, and it is one of the oldest cryptocurrency leverage trading exchanges in the USA.

More than 250 trading pairs are on the exchange, allowing users to buy or sell crypto.

These include the ability to trade crypto on margin.

The platform is valued for its solid security features and massive liquidity, and it is a cryptocurrency exchange that offers trading in both Spot and Futures markets.

This makes it one of the premier crypto exchanges in the space.

Kraken Offer: Get upto 5X Leverage for US citizens using this link to sign up. |

Bybit vs. Kraken: Crypto Derivatives Product Offerings & Leverage

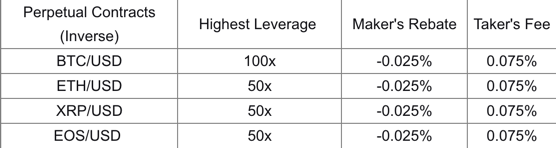

Kraken only supports trading in 95 perpetual contracts like XRP/USD, BCH/USD, XBT/USD, ETH/USD, and LTC/USD.

In Futures trading, Kraken offers a token that can be traded with up to 50x leverage.

Bybit, on the other hand, allows up to 100x leverage on the BTC/USDT trading pair, and on the other inverse perpetual contracts, it offers up to 50x leverage.

Bybit is a derivatives trading platform that includes perpetual Futures contracts like LTC/USDT, XRP/USD, BTC/USDT, ETH/USDT, BTC/USD, EOS/USD.

Bybit vs. Kraken: Trading Fees

Regarding some crypto exchanges, calculating fees might be complex.

Still, as a customer, you always want an exchange that offers lower fees, primarily making the exchange the better choice.

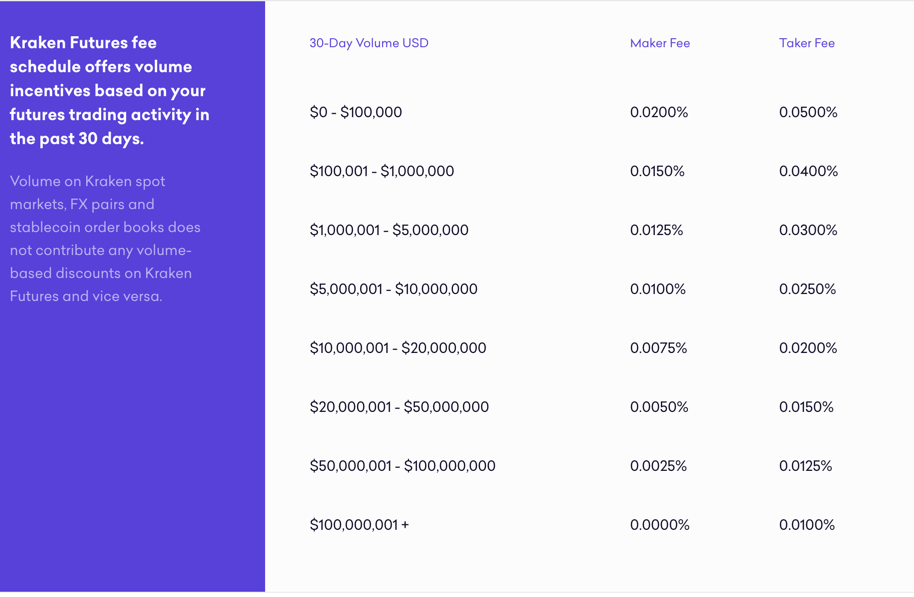

Kraken, like Bybit, charges based on the maker-taker model.

They do, however, have one of the lowest transaction fees in the industry, contra Bybit.

The calculation of the Kraken fee is based on a 30-day trading volume.

The maker charge will be 0.02%, and the taker cost will be 0.05 percent at Level 1 (trading volume up to $100,000).

The trading fees drop as trade volume increases.

Traders and intelligent investors will also find ways to save money.

Makers who supply liquidity to the exchange through limit orders, for instance, will enjoy further fee reductions.

Deposits are generally free when using Kraken.

However, Kraken may demand a small fee for setting up the address, so check with them before making any transactions.

Bybit fees are calculated prominently and straightforwardly on the platform, and you are only charged when you remove liquidity from the market.

Market takers will be charged a 0.06% taker fee, and a 0.01% market maker fee is applicable for Perpetual and Futures contracts trading.

Verdict: The taker fee is higher by 0.01% in the case of Bybit, while Kraken charges a higher market maker fee by the same margin as previously stated. So you can take a call based on which side of the market you see yourself more frequently, and low fees are applicable as the trading volume increases.

Bybit vs. Kraken: Deposit & Withdrawal Fees

Each withdrawal has a minimum requirement and a flat charge to cover the costs of getting the Bitcoin, ETH, or other coins out of your Kraken account and into cold wallet storage.

On the other hand, 0.0002 BTC is the withdrawal fee, and 0.0005 BTC is the minimum withdrawal amount.

The minimum deposit requirement on Kraken is 0.0001 BTC, with no additional fee.

You must pay the required fee when withdrawing BTC or other coins from the Bybit trading platform.

There is no minimum deposit requirement for all coins other than SOL, for which you must deposit at least 0.01 SOL.

The deposit will not go through if the amount is less than 0.01 SOL.

There is no minimum withdrawal amount for any coins traded on Bybit.

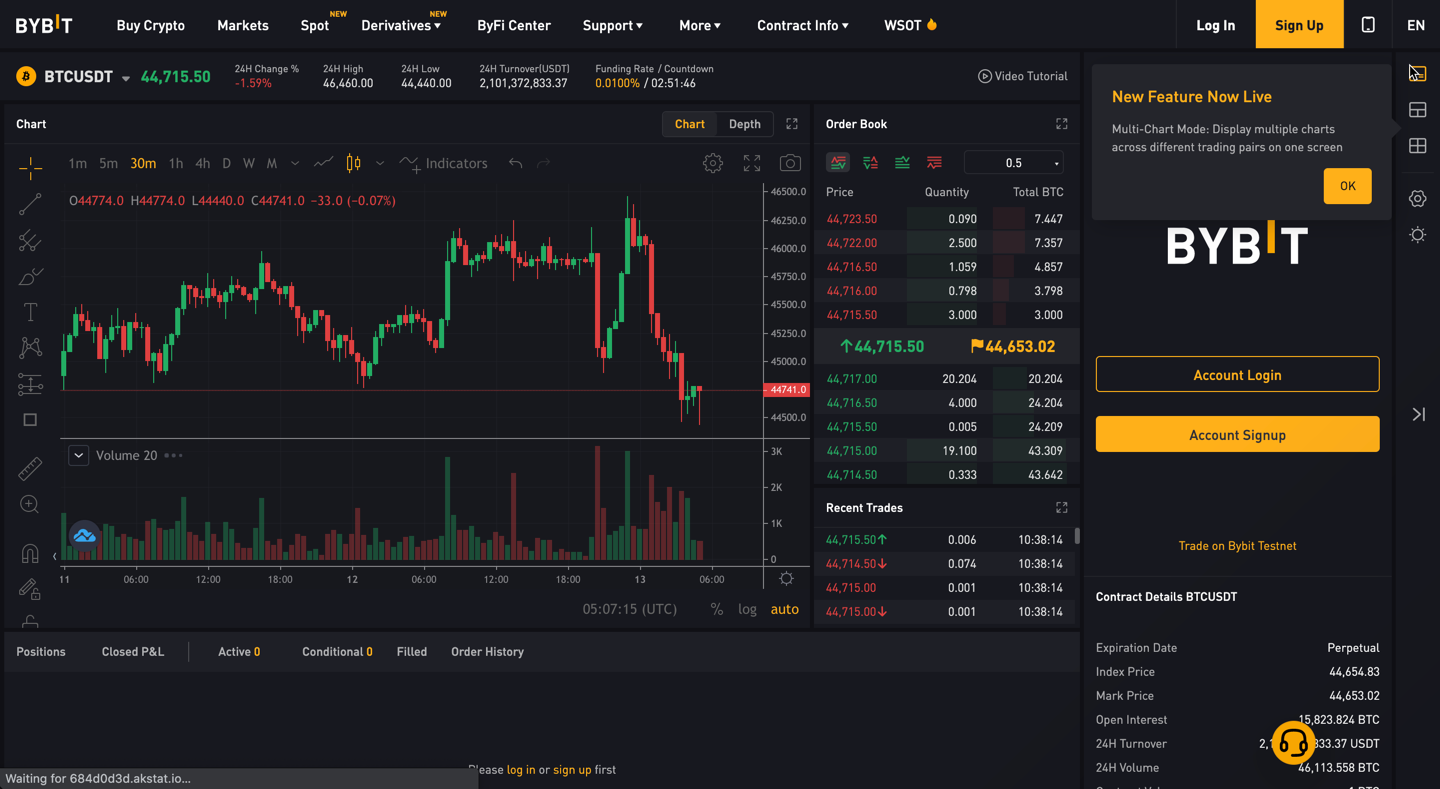

Bybit vs. Kraken: Trading Platform Comparison

The most crucial element to consider when picking a cryptocurrency Futures trading platform is the ease of use, and user-friendly platform, especially when dealing with Futures trading.

Bybit’s innovative trading desk can handle 100K operations per second, allowing it to handle a spike in activity during periods of high volatility.

The platform’s dual price system helps prevent unfair liquidation; strong liquidity allows trades to complete quickly and with little price impact.

Furthermore, due to solid APIs, market data changes every 20ms.

A comprehensive, user-friendly trading interface and a complex order method enable you to place stop-loss and take-profit (TP/SL) entry orders quickly.

You can use API Keys to combine bot trading settings like 3Commas into the program.

To know more about the exchange, you can check out this ByBit tutorial.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

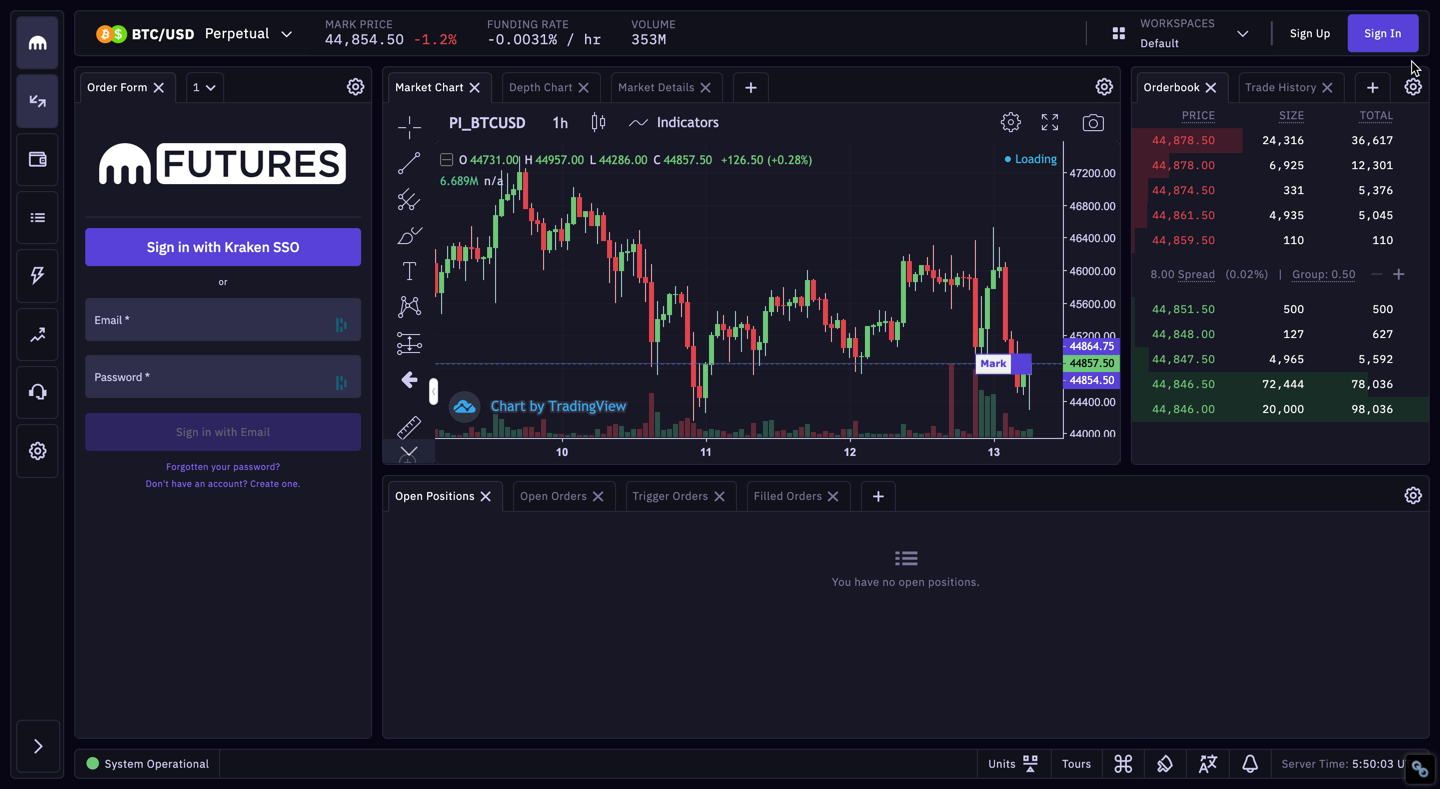

Kraken is a flexible and user-friendly trading site.

One significant benefit is the seamless transition between the Futures market and Kraken Spot.

Kraken’s platform is straightforward and user-friendly.

However, the website has limited technical data regarding the technology behind cryptocurrency and blockchains.

Also, you can read our Kraken tutorial to get a detailed overview of the exchange.

Verdict: When Kraken Futures is compared to Bybit’s trading platform, Bybit is the winner because of its technical superiority.

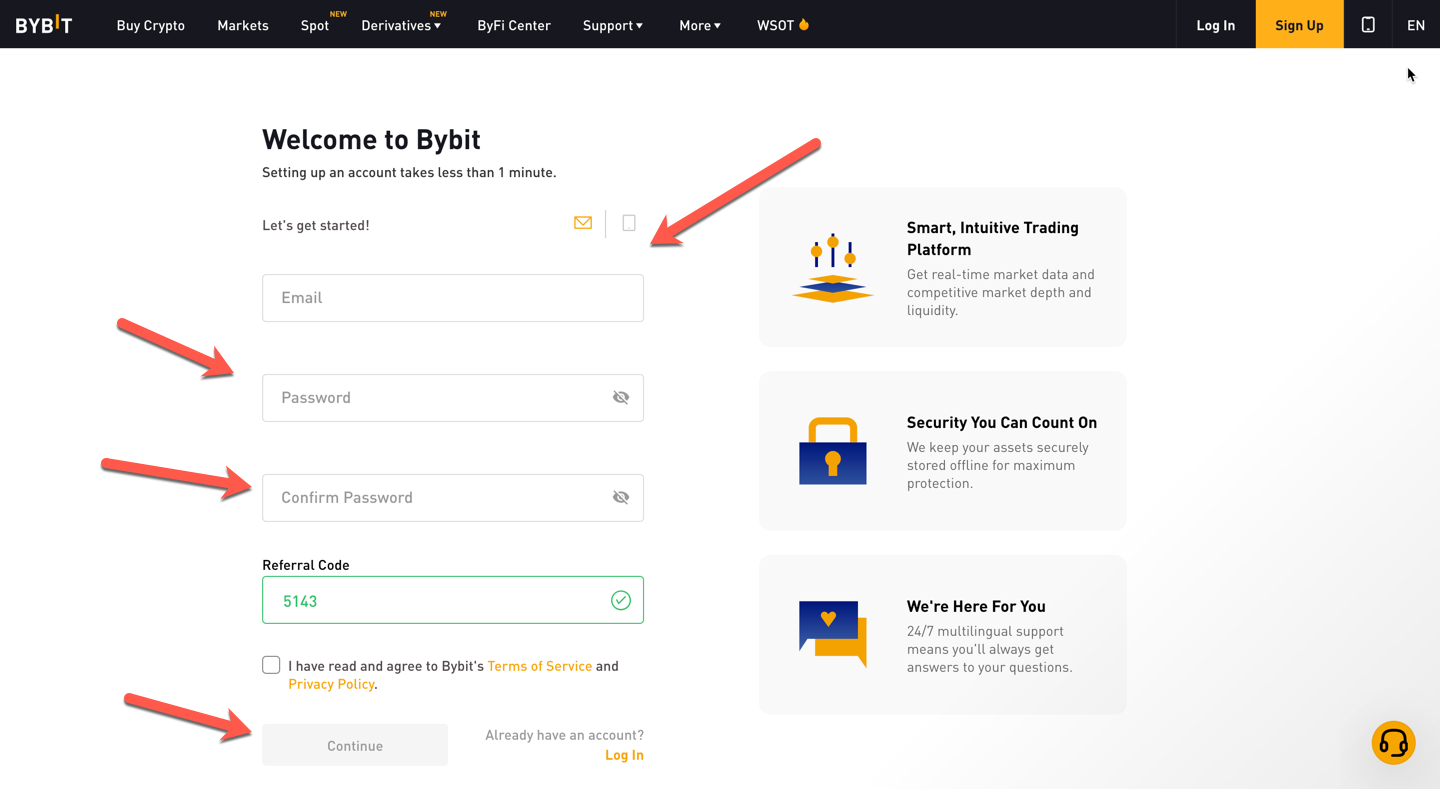

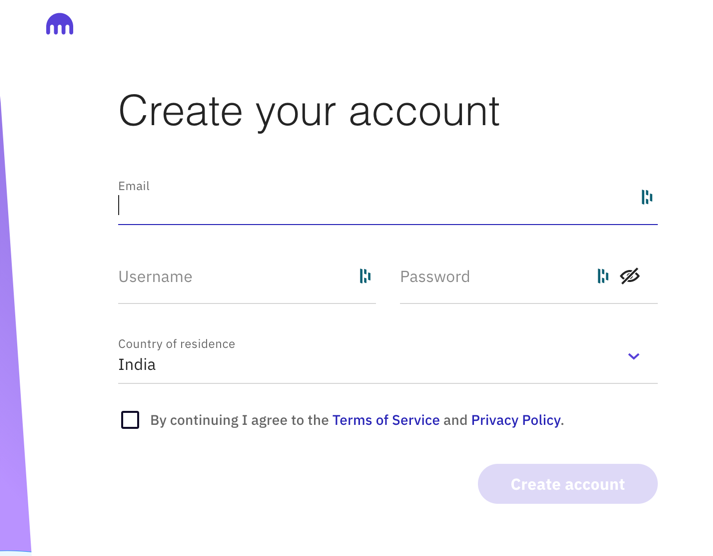

Bybit vs Kraken: Account Opening Process

Bybit registration is simple, and because it now requires every customer to complete KYC, the registration process is a little cumbersome.

Still, they have made an effort to make the process faster.

Tip: If you do not want to go through KYC, you can go through our list and select your favorite non-KYC exchange

You can activate your trading account with simply an email address and a password, along with basic KYC details.

Bybit offers wallet transfers and a fiat-to-crypto buy option to start trading, where you can either transfer your USDT from another exchange or your cold wallet.

Bybit also offers the option to use your debit card or Apple Pay to buy fiat currencies like USD and GBP to buy any stablecoins and start your trading journey.

Kraken also does not allow unverified accounts to trade Futures.

To access the Futures sector and enable bank transfer (SEPA), or wire transfer capability, you must first complete the identity verification process.

Ten million users around the globe have already done so as of now, so it should not be that difficult.

Verdict: It is a tie as both platforms require you to complete KYC procedures to start trading Futures contracts, so they are equally cumbersome.

Bybit vs Kraken: Customer Support

Bybit features a multilingual customer support system that lets you get immediate answers to your questions using the platform’s live chat function.

Separately, you can email [email protected] and describe the problem you’re having.

Bybit has created a repository on its website where a new entrant in the crypto world can learn the ins and outs of the game.

The page is for educational purposes, and even though the information should be updated regularly, don’t trust all the information you see apart from the one about the exchange.

Kraken has a live chat feature with its customer care team, or you may submit requests through the website’s help page.

The platform has multiple pages of information similar to Bybit that helps customers understand the intricacies of the exchange and answer any Frequently Asked Questions (FAQs).

The page is there for informational purposes and is free of charge.

If done well, most beginners do not need other resources to get started in the crypto trading game.

Verdict: Both have excellent customer support, but Bybit’s multilingual customer service helps it wins over Kraken.

Bybit vs Kraken: Liquidation Mechanism

Regarding the vital aspect of a cryptocurrency exchange’s performance, the liquidation mechanism holds a critical place.

The liquidation process is crucial in safeguarding users from negative account balances and managing the risk of leveraged trading.

Bybit implements a dual-price mechanism to prevent unfair liquidation.

This mechanism includes a Mark Price (global spot price index) and a Last Traded Price.

Liquidations are triggered by the Mark Price, not the Last Traded Price, mitigating possible manipulative actions.

This system aims to protect profitable traders and provide a fair, transparent environment.

Kraken, on the other hand, uses a slightly different approach. Kraken begins liquidation when the margin level falls below the 80% Maintenance Margin Requirement.

Unlike Bybit, Kraken doesn’t operate on the dual-price mechanism.

Instead, Kraken uses a liquidation warning system where traders are notified if their margin levels fall below a certain level, offering a chance to add more collateral or close positions before forced liquidation.

Additionally, Kraken implements partial liquidations, which reduce position sizes rather than closing them entirely, minimizing the impact on the trader and the market.

Verdict: Bybit’s dual-price mechanism provides a robust protection measure for traders, mitigating potential market manipulation and ensuring that only profitable traders with high leverage are impacted in the event of deleveraging.

Kraken, however, offers a more proactive approach with its margin warning system and partial liquidation process.

This approach allows traders to react to margin calls by adding more collateral or closing positions to prevent total liquidation.

Each mechanism has advantages and potential pitfalls, depending on a trader’s risk tolerance, trading strategy, and understanding of the markets.

However, given the comprehensive protective measures and proactive approach to liquidation, Kraken’s liquidation mechanism is slightly more advantageous for the average user.

Due to its preventive nature, it offers a better risk management system for new and experienced traders.

Bybit vs Kraken: Security Features

Security is perhaps one of the most critical topics for new digital currency investors and crypto fans.

All cryptocurrency exchanges have a high priority on security to protect themselves from fraud and hacking.

Learning and adopting the best practices in user safety is the first step in keeping funds safe.

To ensure the platform’s security and safety, Bybit has implemented an advanced security management design to keep its user’s money safe.

It has a high-density cold wallet offline technology to ensure the user fund’s complete security with encryption.

This crucial yet straightforward step creates a nearly impenetrable barrier between your finances and hackers.

To make it more difficult for hostile elements to track user transactions, the Bybit team uses a multi-signature address approach.

As a typical feature, the website includes an SSL certificate.

All data sent between the exchange and its clients is encrypted with this certificate.

The company also places a premium on coin safety when moving assets from a secure vault is needed.

Kraken also uses cutting-edge security techniques to protect the funds and privacy of their clients, both the platform and the money.

It also employs two-factor authentication (2FA) to block unwanted logins.

You’ll notice it when making withdrawals and when you need to verify your identity before transferring money.

Kraken also follows a top-notch security mechanism.

Kraken’s Global Settings Key prevents non-affiliated IP addresses from accessing your account.

95% of assets are held offline and geographically spread cold storage devices for coin protection.

Individuals who invest in cryptocurrency can rest easy knowing that these additional layers of security protect them.

Bybit provides a powerful antidote to sniffing and phishing attacks.

Kraken also has armed guards patrolling their data centers in each geographical location to ensure no physical attacks on the information and crypto stored in them.

Conclusion: Bybit vs. Kraken

Kraken is a stable platform that is also beginner friendly.

Kraken is a good option for trading Futures and Spot contracts, although fewer contracts and lower leverage are disadvantages for traders.

Bybit, on the other hand, is the ideal platform for professional traders who wish to maximize their revenue through Futures trades.

Bybit has a distinct edge over Kraken regarding trading options, trading costs, platform interface, and, most significantly, the purchase of major cryptocurrencies.

Bybit has created numerous platform enhancements and analyzed crypto derivatives dealing over the years.

Bybit is one of the few platforms that offer XRP and EOS Futures contracts.

Also, you can use ByBit’s referral code to enjoy a sign-up bonus.

Do not take any of the opinions as investment advice.

Just use factual information to decide which exchanges suit your trading style better.

Learn how Bybit and Kraken stack up against the competition.

- Bybit vs Binance

- Bybit vs StormGain

- Bybit vs BitMEX

- Kraken vs Binance

- Kraken vs KuCoin

- Kraken vs Phemex