When it comes to cryptocurrencies, Ethereum is one of the top crypto coins out there by market capitalization.

You get to see a high volume across cryptocurrency exchanges which makes it one of the top pairs to trade out there.

But the question is, how to short Ethereum on Binance?

Shorting Ethereum, or cryptocurrency in general, is one of the two activities in trading. You either take a long position when the market moves up. Or you take a short position when the market goes down.

However, you cannot short cryptocurrencies like Ethereum in the Spot market. As spot market only lets you take a long position. Instead, to short Ethereum, you have to trade using a margin account or use trade in the crypto futures market.

So let’s know about all of these below:

How To Short Sell Ethereum (ETH) on Binance?

In trading, when you talk about short selling, you simply mean that you will first sell an underlying asset like ETH at first and then buy it at a lower price than your sell price. By doing so, you will get to earn a profit depending on the price difference between your sell and buy price.

However, if we talk about the theory, when you sell an asset at first, you are borrowing the assets from a third party like the crypto exchange itself. And you will need to return the assets back to them at a later date.

For instance, if you sold Ethereum when it was priced at $1000 and purchased it when it was priced at $950, then you will make a profit of $50.

But in case the price moves to $1050, then you will make a loss of $50. Since you have to return the assets that you borrowed initially.

How to Short Ethereum on Binance?

No matter which type of contract or in which market you wish to short Ethereum, the process is the same.

You need to analyze the charts and then take a selling or buying call. To help you out, here is a step-by-step guide below:

Create Binance Account

If you don’t have a Binance futures account, then you should create one right away. Creating a Binance account is fairly easy, and you can follow these steps:

- Go to Binance.com.

- Click on Sign Up and follow all the on-screen steps to create your account.

- Next, it will ask you to complete KYC verification.

- Do submit any of your government ID and other details to complete the KYC.

- Then wait for Binance to verify your details and approve your account.

Once your account is activated, you have to deposit funds into your account. There are multiple ways to do so.

For instance, you can go to Trade > P2P and use their peer-to-peer network. Alternatively, depending on where you live, you will find other ways to deposit funds into your account.

Also, you should know that you need to transfer your Binance funds into different Binance accounts.

For instance, if you want to short ETH using margin trading, then make sure to transfer your funds into your margin wallet, and the same goes for future trading.

Short ETH Via Margin Trading On Binance

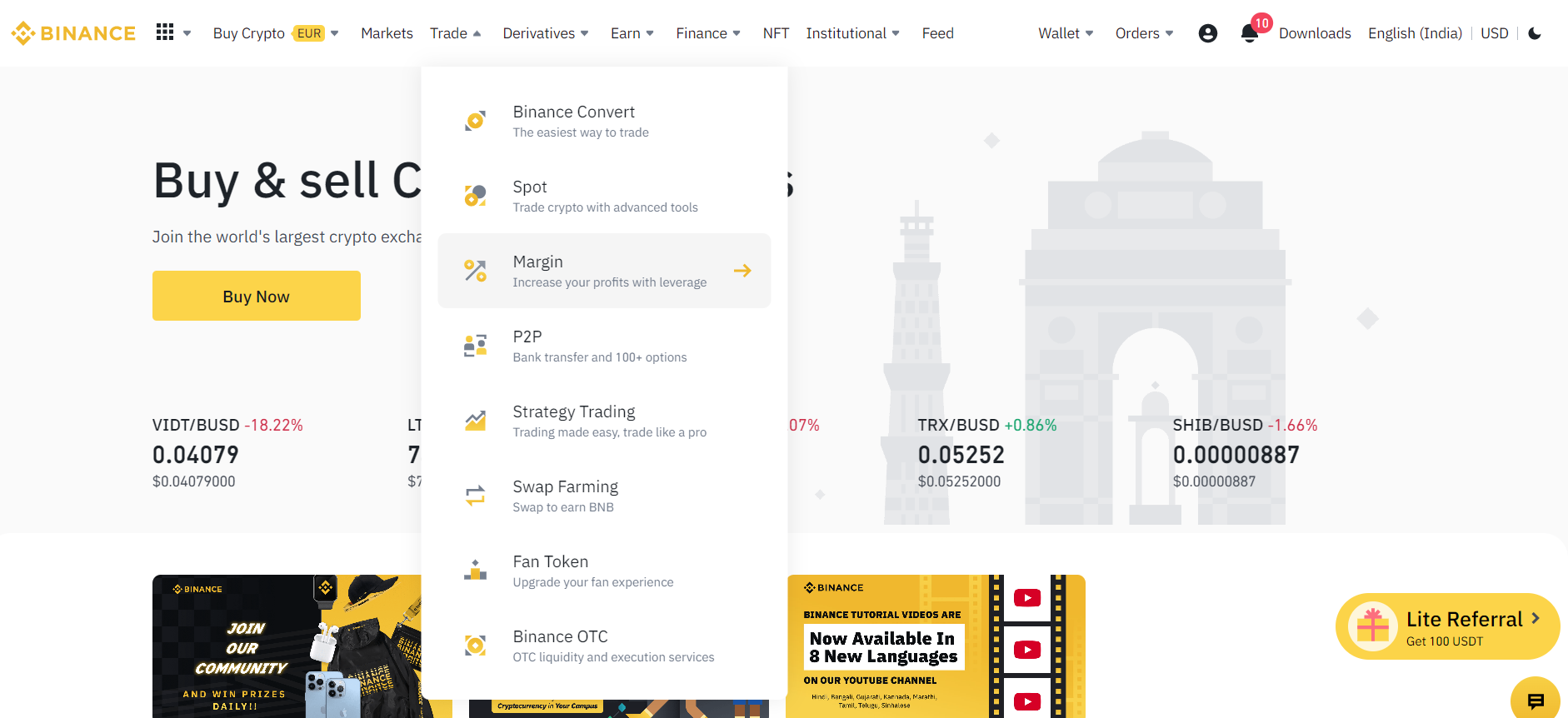

- From Binance’s dashboard, click on Wallet > Margin.

- If you are visiting Margin Trading for the first time, it will ask you certain questions. So go through them.

- After that, you will see the main Margin trading terminal.

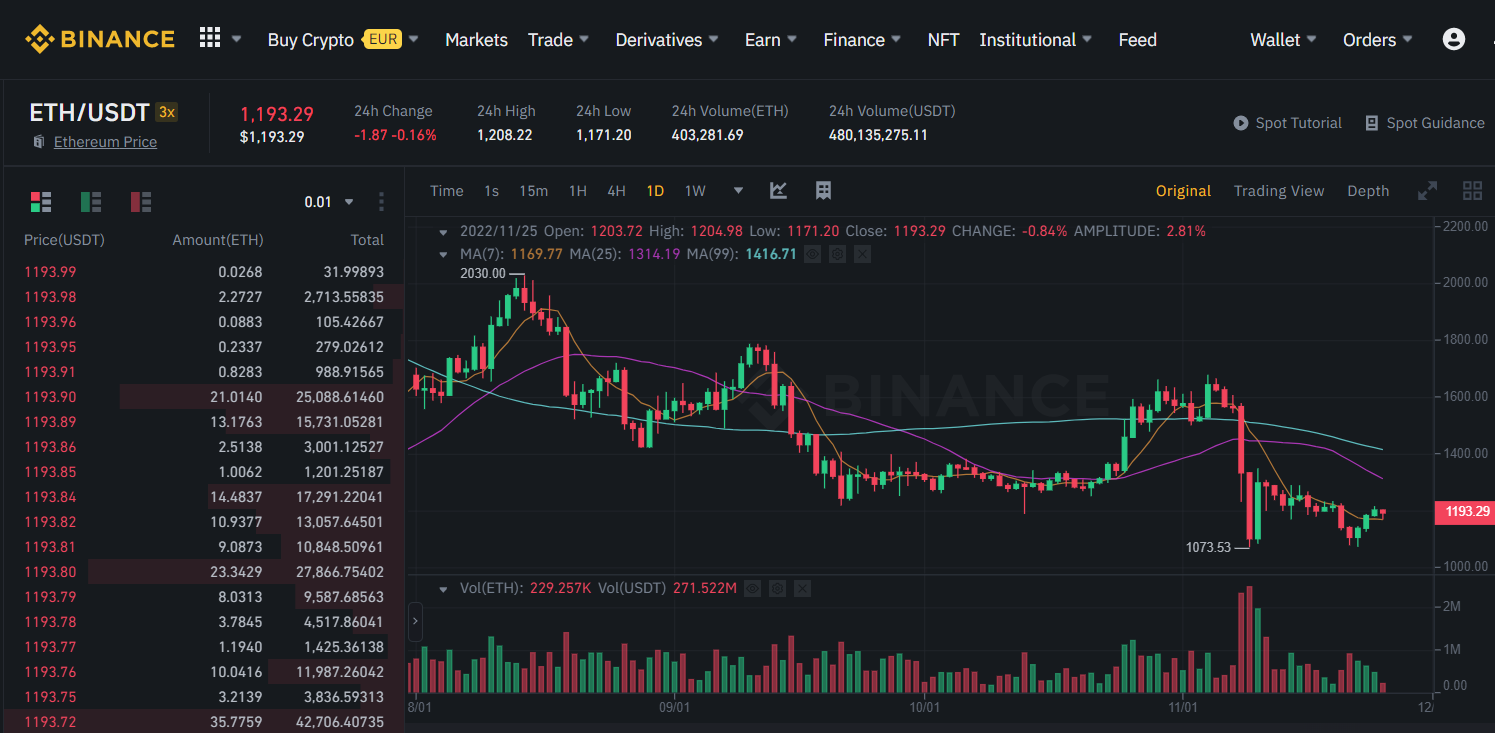

- On the right side of your screen, you will see all the available pairs for trading. From here, select ETH/USDT, ETH/BTC, or any other pair of your choice.

In the centre, you will see the trading chart, and right below it, you will find the buy and sell window.

- If you scroll down a bit, then you will see all your current positions, order history, trade history, and other details.

- Now in order to short Ethereum on Binance, you need to come to the buy/sell Window.

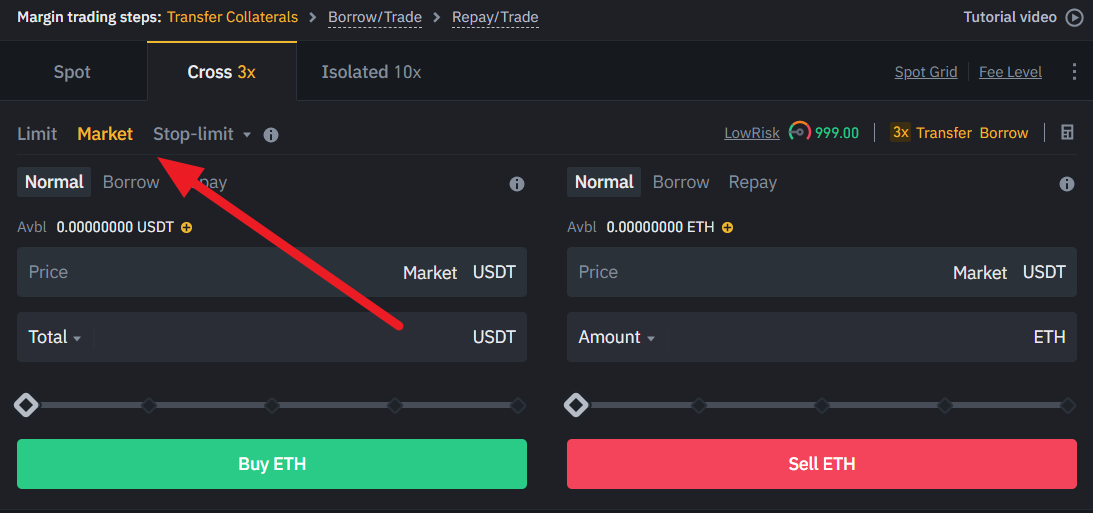

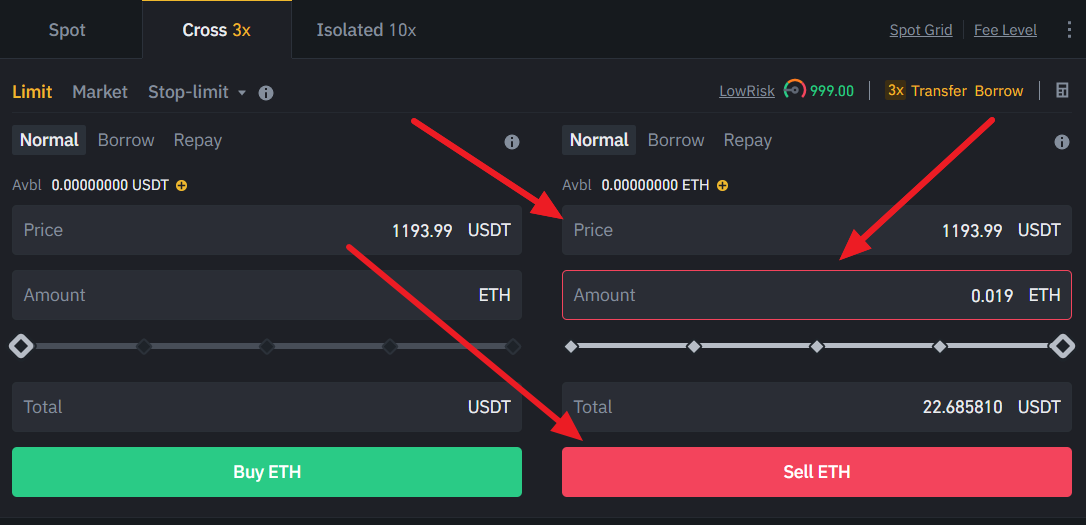

- To place an ETH short order, you first have to select the order type, such as Market, Limit, or Stop-Limit. Limit and Stop-limit will execute your order at your desired price, while the market order will execute your trade at the current market price.

- For short-selling crypto, you will need to enter your desired price, or you can place a market order which doesn’t require you to specify a price. Also, you need to enter the amount, which refers to the ETH quantity you wish to sell.

- Once you have entered the price and amount, click on Sell ETH to short Ethereum.

Short ETH Via Futures Trading

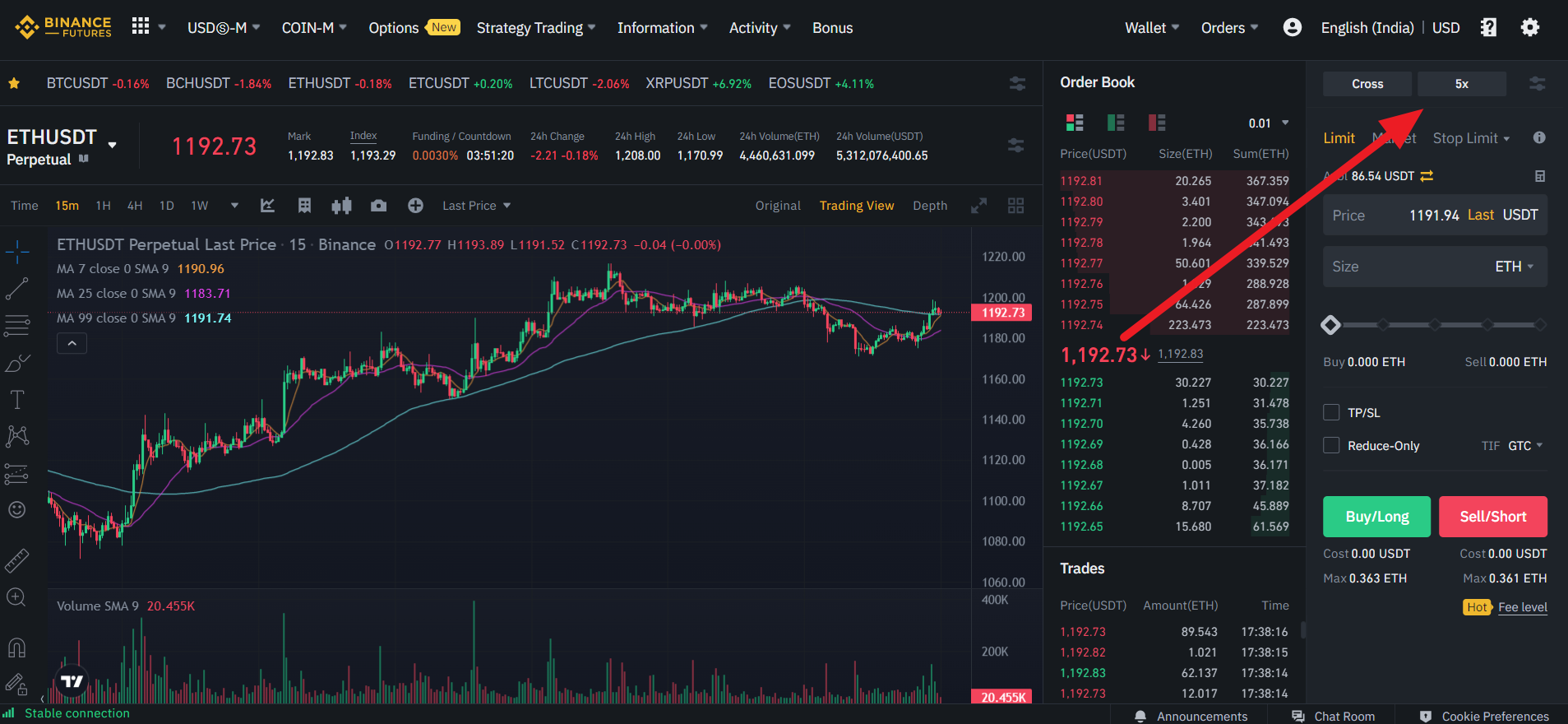

Just like margin trading, futures trading has a similar user interface. To trade futures on Binance, follow these steps:

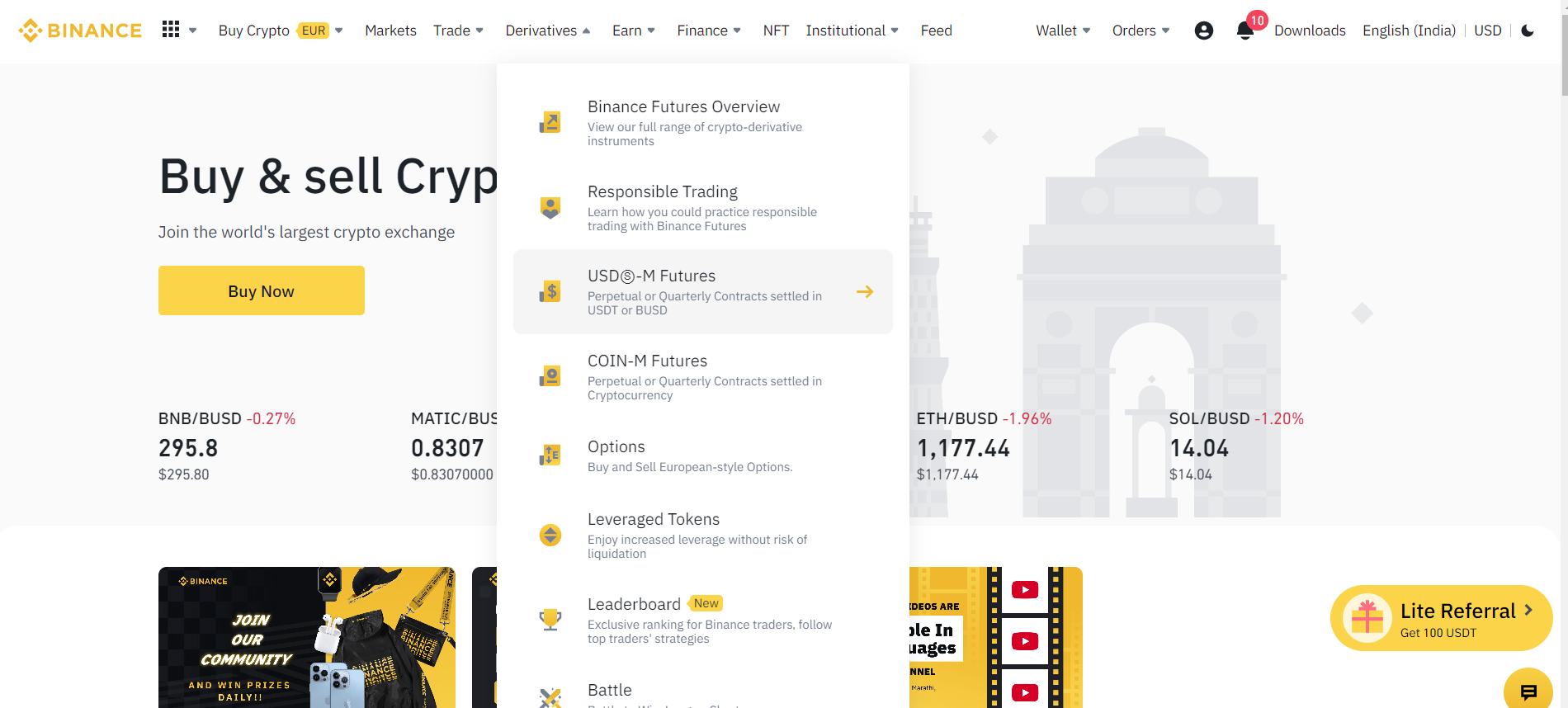

- From Binance’s dashboard, go to Derivatives > USD-M Futures.

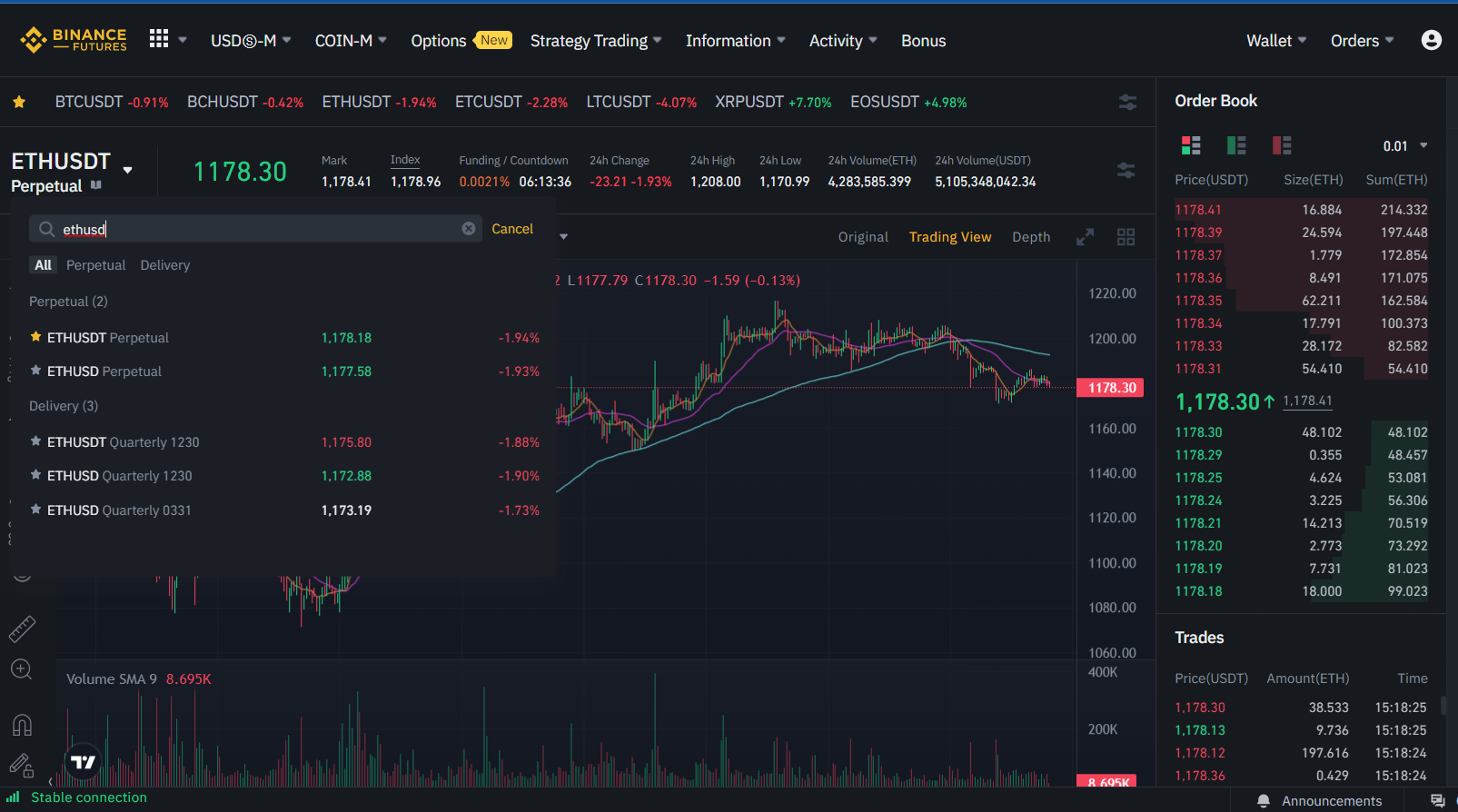

- Unlike Margin trading, you won’t see a list of available trading pairs. Instead, click on BTC/USDT and then search for ETH/USDT trading pair.

- Once selected, on the right side of your screen, you will see different order types like limit, market, stop limit, etc.

- Below the order limit option, you can enter your preferred price and size. The preferred price stands for the price you want your trade to get executed, and the size limit refers to the ETH quantity you wish to sell.

- Once you have entered the details, click on Sell/Short to place or execute your order.

In Which Market Can I Short Ethereum?

There are mainly two types of a market where you can short Ethereum – Margin Trading & Futures market on Binance. Although, some exchanges do allow you to short in the spot market as well.

So what are these two markets? Let me share a quick explanation below:

- Margin Trading

Margin trading is one of the easiest ways to short ETH. Binance does offer you margin trading, where you can borrow funds from a broker and execute a trade on the platform. It also offers you leverage or borrowed money, which can increase your profit and losses.

- Futures Market

The futures market is another way to short an underlying asset. However, it is a bit of a complicated market to deal with and understand.

You can say that futures are a type of derivative contract agreement to buy or sell a specific asset like Ethereum at a set future date for a set price. Since it lets you buy or sell an asset, you can short Ethereum.

It does not matter if you are going to short Ethereum in the margin trading or futures market; you will get leverage with it. Leverage can be a great help to maximize your profits, but also it poses a high risk.

So let me give you a quick understanding of it and how you can adjust leverage on Binance below:

Leverage Ethereum (ETH) on Binance

Leverage refers to using borrowed funds to trade cryptocurrencies on the exchange. It will increase your buying and selling power.

As a result, with even a small capital, you can execute high-value trades and enjoy high-value profit if a trade goes in your favour. If it doesn’t, then you will end up losing a significant amount in losses.

Binance offers you Ethereum leverage for the futures market up to 100x and offers you 3x leverage for Margin trading. This means you can use $1 of capital to trade a value of $100 with 100x leverage.

Hence, experts suggest you keep your leverage as low as possible when you are starting out to minimize your losses.

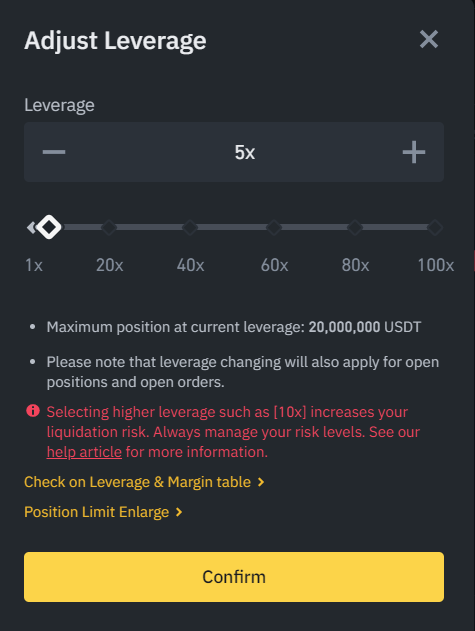

How To Adjust Leverage on Binance?

When it comes to adjusting leverage on Binance, it is only possible with the crypto futures market. Binance doesn’t allow you to adjust leverage for the margin trading account.

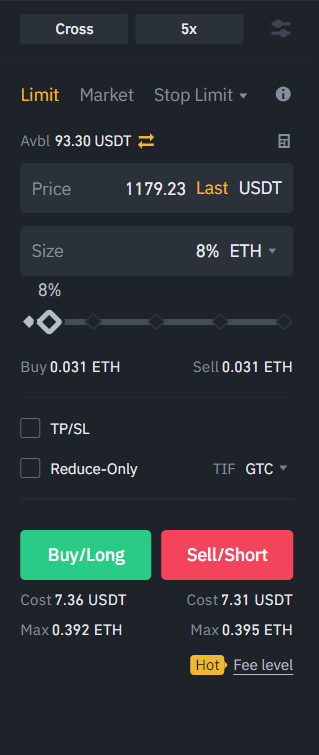

To change leverage in the Binance futures market, you first need to select the ETH/USDT or ETH/BUSD Futures pair.

Then on the left side of your screen, you will find the buy and sell a window, and on top of that, you will find something as 100x (the number could be different, depending on the default leverage setting).

Click on that, and you can adjust the leverage between 1x to 100x to trade Ethereum. Also, note that Binance offers you different leverages for different trading pairs.

Types of Ethereum Futures Contracts

There are also different types of Ethereum futures contracts that you can short. These contract types are:

- Ethereum Perpetual (USD-M Futures)

An Ethereum perpetual contract is a special type of futures contract which is not like the traditional form of futures.

Traditional futures contracts have an expiry date, but perpetual contracts don’t. One can hold a perpetual contract like Ethereum for as long as one wishes to.

Instead of an expiry date, they are looped into an endless cycle of funding that occurs after every eight hours.

- Ethereum Inverse Contracts (Coin-M Futures)

Ethereum inverse contracts are also known as coin Margined contracts. These contracts are priced in USD and settled and margined in an underlying asset like Ethereum.

- Ethereum Options Contracts

There are also the Ethereum options contracts which is another type of derivative. The core functionality of the derivative product remains the same. It allows the buyer the option to buy or sell an asset at a predetermined time and price.

Also, there are two types of options available in the market, a call option and a put option. The call option is used for buying crypto options, while the put option is used for selling or shorting a crypto option.

Moreover, the main difference between an options contract and a futures contract is that options give you the right to buy/sell an asset, while futures obligates you to purchase a specific asset.

Conclusion

So that was a quick tutorial on how to short Ethereum on Binance.

Short-selling Ethereum or any other currency pair is pretty simple. You need to sell the asset first and then close your position, which will automatically buy the respective assets for you.

But before you do so, make sure to learn about the market’s functionality you are trading in.