If you are new to crypto derivatives trading, you first need to find a crypto derivatives exchange.

Unfortunately, with hundreds of crypto exchanges out there, finding one that offers various trading products, has a low trading fee, and is secure can be challenging.

We have done the hard lifting for you and picked two of the most popular crypto derivatives exchanges out there: Binance and Phemex.

While Binance is the most popular crypto exchange globally, Phemex is gaining significant popularity among derivatives traders.

So, which one is the better? Let’s find out.

Phemex vs. Binance: Crypto Derivatives Product Offerings & Leverage

Phemex is a futures-only cryptocurrency exchange and allows trading in futures contracts only. The contracts are settled in both BTC and USD. The following trading pairs are available on Phemex.

- BTCUSD

- ETHUSD

- CRPUSD

- BCHUSD

- LTCUSD

- DOGEUSD

- LINKUSD

- ALGOUSD

- UNIUSD

- ADAUSD

- DOTUSD

- COMPUSD

- YFIUSD

- AAVEUSD

The daily crypto derivatives trading volume on Phemex is USD 4.01 billion – the eighth-highest in the world.

Talking about leverage, Phemex offers up to 100x leverage on the BTCUSD futures contracts and up to 20x on other pairs.

On the other hand, Binance offers one of the most comprehensive product offerings in the crypto market. Trading products available on Binance Futures include:

- USDT-M Futures: Quarterly and perpetual contracts settled in USDT

- COIN-M Futures: Quarterly and perpetual contracts settled in BTC

- Binance Leveraged Tokens: Tradable assets that allow you to take leveraged exposure to an underlying asset

- Binance Vanilla Options: European-style Options contracts traded and settled in USDT

The daily crypto derivatives trading volume on Binance is USD 68.28 billion – the highest in the world. Speaking about leverage, Binance offers up to 125x leverage on all futures contracts.

Phemex vs. Binance Trading Fees

Both Phemex and Binance follow the standard market maker-taker fee system. However, the two exchanges have different fee structures. Let’s discuss the two in brief.

- Phemex

Phemex has a flat fee structure. It charges a 0.075% market taker fee and offers a 0.025% maker rebate to all the traders.

- Binance

Binance has a tiered trading fee structure. It has ten tiers (VIP 0 – VIP 6) based on the last 30d trading volume and/or BNB balance.

Traders with a 30d trading volume of less than 250 BTC and/or BNB balance of less than 50 BNB fall into the VIP 0 tier.

For VIP 0 traders, the maker and taker fee is 0.02% and 0.04% respectively for USD-M futures and 0.01% and 0.05% respectively for COIN-M futures.

Traders with a 30d trading volume of more than 750k BTC and/or BNB balance more than 11,000 BNB fall into the VIP 9 tier.

For VIP 9 traders, the maker and taker fee is 0.0% and 0.017%, respectively, for USD-M futures and –0.09% (rebate) and 0.024% respectively for COIN-M futures.

You can avail of an extra 10% discount on trading fees by paying through BNB tokens.

Verdict: It’s a tie. While Binance charges a lower fee, Phemex has a more straightforward fee structure.

Phemex vs. Binance Deposit & Withdrawal Fees

Phemex doesn’t charge any deposit or withdrawal fee. However, blockchain network fees may be payable when withdrawing funds. Furthermore, if your first deposit on Phemex is more than 0.02 BTC, you receive a registration bonus of $60.

Binance doesn’t charge any deposit fee, but it charges a nominal withdrawal fee of 0.0005 BTC. The withdrawal fee is different for each cryptocurrency.

Phemex vs. Binance Trading Platform Comparison

The trading platform and trading experience are important factors to consider when choosing a cryptocurrency exchange. Here’s a head-to-head comparison of the trading platforms of Phemex and Binance.

- Phemex

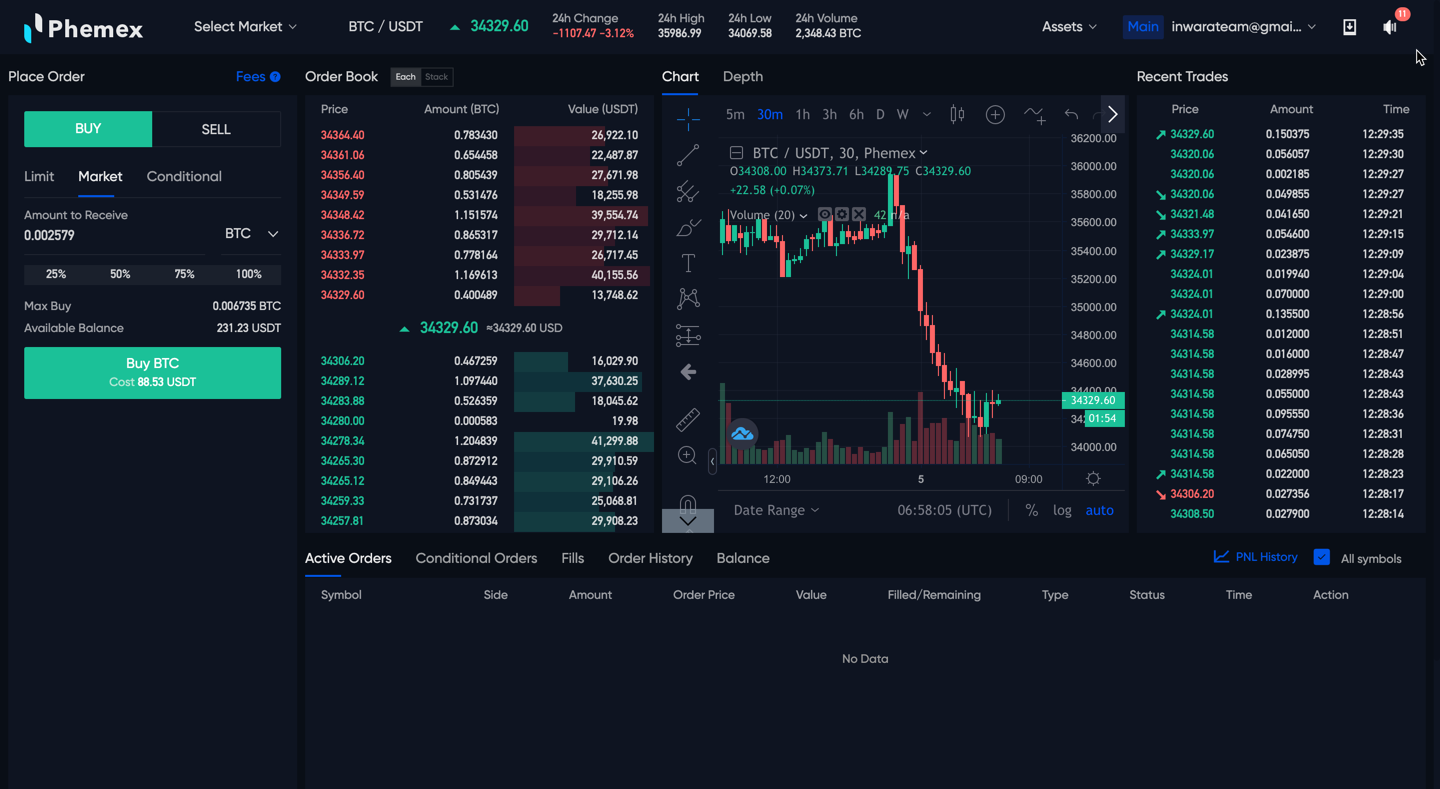

Phemex has a straightforward and easy-to-use user interface that offers a seamless trading experience to users.

However, unlike Binance Futures and Bybit exchange which use a modern-looking trading view with a black background, Phemex uses a white background. It may not be a dealbreaker but can certainly affect your trading experience.

On the positive side, the platform is customizable, and you can adjust it as per your preferences. You also get a demo trading feature to get acquainted with the platform and test your strategies.

With that said, let’s look at the key features of the Phemex trading platform.

- TradingView charting system

- Market, limit, and conditional orders

- Multiple chart types and timeframes

- Built-in indicators for in-depth technical analysis

Phemex also has a mobile app that allows you to open an account and trade cryptos from your mobile device.

- Binance

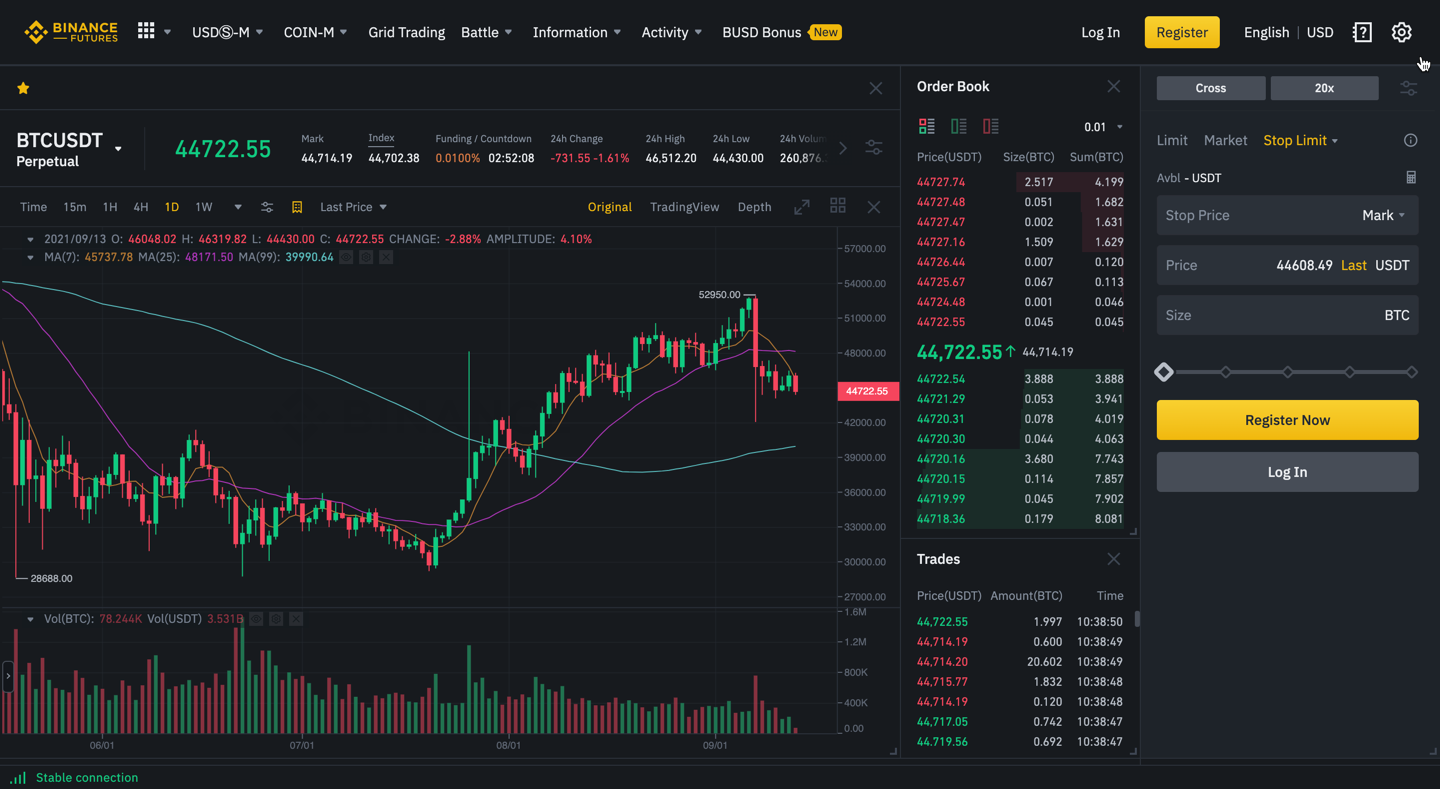

Binance deploys a professional-grade trading system used by many institutional traders across the world.

There are three trading platform types to choose from – basic, advanced, and OTC (for peer-to-peer trading). This makes it ideal for all kinds of traders, from beginners to professionals.

The Binance team does a great job of keeping the platform intuitive and user-friendly despite having so many features and functionalities.

That said, the Binance platform could be slightly complex for some traders compared to Phemex. It comes with a small learning curve, but once you get past that, you’ll be able to enjoy excellent features that will enhance your trading experience.

Binance also implements a TradingView charting system, and thus, it has similar features as Phemex. These include multiple order types, various chart types, multi-timeframe analysis, and several indicators.

Binance also has a mobile app that provides a seamless trading experience on the go.

Verdict: It’s a tie. While Binance has a more robust trading platform, Phemex gets a slight edge in user-friendliness.

Phemex vs. Binance: Account Opening Process

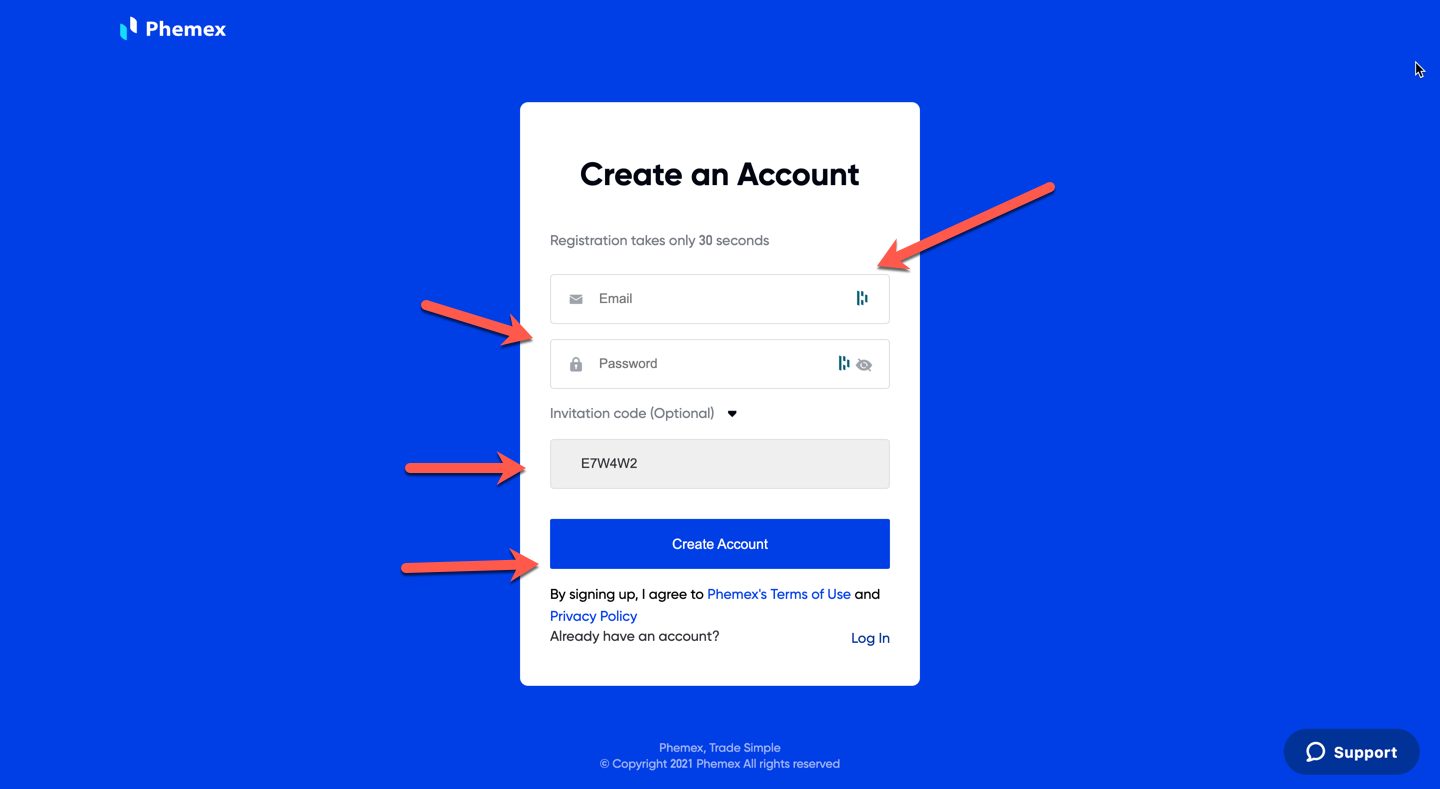

Both Phemex and Binance are non-KYC exchanges, and therefore, they offer a seamless account opening process.

To register on Phemex, you’ll need to visit the Phemex Registration Page and create an account using an email address and password. You can also add an invitational code to get a sign-up bonus.

Similarly, you can visit the Binance Registration Page and create an account using an email address and password. Alternatively, you can register using your mobile number as well.

Binance also allows you to enter a referral ID while registering to avail of a bonus. If still confused, make sure to read our in-depth guide on How to open a Binance Futures account.

Verdict: It’s a tie. Both Binance and Phemex are non-KYC exchanges and have an effortless account opening process.

Phemex vs. Binance Customer Support

Customer support is something every new trader should consider when selecting a trading platform. New traders often face technical issues associated with depositing and withdrawing funds, using the platform, etc.

Hence, customer support can make a massive difference in your trading experience.

That said, let’s compare the customer support of the two exchanges.

- Phemex

Phemex offers 24/7 live chat support through its website. You can also reach them out through email or at their Telegram group. Phemex also has a comprehensive knowledge base to get FAQs, blogs, and help articles addressing common issues.

- Binance

Binance also offers a virtual chatbot feature that can answer basic queries related to the exchange. For personal assistance, you can send them an email or reach out to their team on Telegram.

Verdict: Phemex is the winner. Its 24/7 live chat feature gives it an edge over Binance.

Phemex vs. Binance Security Features

Every trader wants a secure trading experience. Hence, it’s essential to examine the security features of a crypto exchange before using it.

Let’s compare the security features of the Phemex and Binance.

Phemex

Phemex implements industry-grade security features and functionalities to offer a safe and secure trading experience to its users. Some key security features of the platform are:

- Hierarchical deterministic cold wallet system to securely store funds

- Two-factor authentication to prevent unauthorized login

- System infrastructure secured by Amazon Web Services.

- Secure trading engine with 99.99% availability

Binance

Binance also deploys similar security features. It has a multi-tiered security architecture that enables a safe and secure trading infrastructure. Binance uses a cold wallet system to store users’ funds.

Binance encourages its users to activate two-factor authentication. It also uses IP whitelisting, encryption, and other techniques to ensure top-of-the-line security.

Verdict: It’s a tie, as both Phemex and Binance deploy robust security features.

Conclusion

Both Binance and Phemex are quite similar in most aspects. Both have a secure trading infrastructure and a robust trading platform. Both the exchanges offer good quality customer support and have high daily trading volumes.

However, there are a few differences as well. For instance, Binance offers more trading options and better leverage, whereas Phemex provides a simpler trading fee structure.

No exchange is better than the other, and you can make a choice based on your preferences.

Here is How Binance and Phemex Compares To Other Crypto Exchanges