Are you stuck in a dilemma between BitMEX and eToro? Cannot decide which of the two will be the best for your trading needs?

You don’t have to worry anymore.

I am here with the most sensible comparison between them that will help you decide the best exchange between them and also will let you know everything you should know before getting your hands on them.

So without further delay, let’s go through what makes them the exchanges they are known for today.

BitMEX vs eToro: At A Glance Comparison

BitMEX

Introduced in 2014 is this mighty crypto exchange which is Seychelles-based. BitMEX stands for Bitcoin Mercantile Exchange, launched to provide a professional-grade Bitcoin derivatives trading platform.

Being the benchmark in the P2P trading space, BitMEX holds millions of users worldwide and offers crypto-only trading capabilities at affordable pricing.

eToro

On the other hand, eToro is a comparatively younger platform that was founded in 2017 and is also a popular choice for crypto traders from around the world.

eToro was founded as a multi-securities platform that allows you to invest in both commodities and cryptocurrencies.

eToro is a well-regulated trading exchange with licenses from multiple authorities and offers various trading markets.

Moving to the segment of trading markets, products, and leverage, let’s see what these exchanges have in stock for you.

BitMEX vs eToro: Trading Markets, Products & Leverage Offered

BitMEX

- Spot Trading: Choose between 11 trading pairs

- Futures Trading: Variety of assets ranging from XBT, ETH, BCH, EOS, LTC, and many more, as well as more than 55 perpetual contracts.

- Crypto Swap: Swap between a long list of assets.

- Leverage Trading: Maximum leverage of up to 100x.

eToro

- Spot Trading: Invest in a wide variety of crypto assets.

- Crypto CFD Trading: Upto 30x leverage with competitive spreads and customizable stop-loss.

- Crypto Staking: Upto 90% of monthly staking yield rewards; choose between ADA, TRX, or ETH.

- Crypto Copy Trading: Zero additional charges; start/stop copying and add/ remove funds anytime.

BitMEX vs eToro: Supported Cryptocurrencies

Coming to one of the most important trading aspects, let’s discuss what are the available crypto assets to trade with on these platforms.

BitMEX

This crypto exchange supports more than 30 cryptocurrencies. However, perpetual swaps are available in three assets, which are:

- XBT

- ETH

- XRP

Traditional Futures contracts are available on the following coins, which are:

- XBT

- ETH

- BCH

- EOS

- LTC

- TRX

- XRP

- ADA

eToro

Coming to eToro, the exchange comes with a comparatively long list of assets, counting more than 80 of them. The list includes all of the renowned crypto assets, including:

- BTC

- ADA

- ETH

- BNB

- IOTA

- LTC

Verdict: eToro is for sure a better choice in this segment, with a more extensive crypto assets range available to trade with.

BitMEX vs eToro: Trading Fee & Deposit/Withdrawal Fee Compared

Now let’s discuss the most vital segment of comparison, which is how much these exchanges will cost you for trading.

BitMEX

Starting with BitMEX, this exchange has a standard trading fee structure across all spot products for simplicity.

However, for high-volume traders, there are discounted taker and maker fees which will apply to all products automatically based on your 30-day average daily volume (ADV).

Spot trading Fees

|

Fee Tier |

30D Rolling ADV (USD) | Taker Fee | Maker Fee |

| B | 0 | 0.0750 % |

0.0200 % |

|

I |

1,000,000 | 0.0500 % | 0.0100 % |

| T | 5,000,000 | 0.0400 % |

0.0000 % |

|

M |

10,000,000 | 0.0350 % | 0.0000 % |

| E | 25,000,000 | 0.0300 % |

0.0000 % |

|

X |

50,000,000 | 0.0250 % | 0.0000 % |

| D | 100,000,000 | 0.0240 % |

-0.0030 % |

|

W |

250,000,000 | 0.0230 % | -0.0050 % |

| K | 500,000,000 | 0.0220 % |

-0.0080 % |

|

S |

1,000,000,000 | 0.0175 % |

-0.0100 % |

To go through the derivatives trading fees in detail, please click here.

Deposit and Withdrawal Fees

BitMEX doesn’t charge you any deposit or withdrawal fees for Bitcoin. There are only Bitcoin network fees that apply for withdrawals.

Moreover, Tether USD deposits are also free of charge.

However, BitMEX does charge withdrawal fees for USDT, which vary depending on Ethereum network fees.

eToro

When it comes to eToro, the fee structure is relatively straightforward.

The platform charges a flat fee.

When you buy/sell crypto, you are charged a flat 1% fee. Additionally, converting one crypto token to another will attract a conversion fee of 0.1%.

Deposit and Withdrawal Fees

There are no deposit fees on eToro. However, you must meet the minimum deposit limit set by the platform.

However, eToro attracts a $5 fee for withdrawals for each withdrawal request. Moreover, the withdrawal limit is set at $30.

Other than that, bank wire transfers also attract a $5 fee.

Verdict: Looking at the overall fee structure of both the exchanges eToro seems a little expensive and restrictive, especially for those users with a low trading volume. So in this segment, BitMEX takes the lead with affordable pricing.

BitMEX vs eToro: Order Types

Now, let’s quickly discuss what are the order types available on these exchanges to take advantage of the market trends.

BitMEX

BitMEX is famous for its wide range of order types available, which are:

- Market Order

- Limit Order

- Stop Order

- Take Profit Order

- Post Only Order

Advanced Order Types

- Hidden Orders

- Iceberg Order

eToro

On the other hand, eToro has pretty basic order types, which are:

- Limit Order

- Market Order

- Stop-loss Order

Verdict: BitMEX is undoubtedly a lot of steps ahead of eToro in this segment, with a wide variety of order types to trade with.

BitMEX vs eToro: KYC Requirements & KYC Limits

Now let’s discuss the KYC requirements and whether or not these exchanges allow anonymous trading.

BitMEX

BitMEX didn’t require KYC till September 15, 2020. Abiding by the US government regulations, BitMEX launched a mandatory verification program.

If you want to open a BitMEX trading account, you’ll need to complete the verification procedures. On the verification window, you’ll need to upload a photo ID and proof of residence, with a selfie holding the document.

Once registered, you can add funds to your trading account and start trading.

eToro

In the same way, eToro has mandatory KYC procedures as well. In order to create an account on eToro, you need to enter your basic details.

Once your account is created and set up, you can now proceed to the verification procedures.

To get verified, similar to BitMEX, submit the identification documents approved by the country of your residence as well as proof of residence and then upload a selfie holding your ID.

BitMEX vs eToro: Deposits & Withdrawal Options

BitMEX

BitMEX has very stringent and limited account funding options available. The only one available, actually, and which is:

- Method 1: Direct Crypto deposits.

However, you can use an external wallet if you want to deposit or withdraw through fiat currencies.

eToro

On the other hand, eToro offers a variety of deposit and withdrawal options, which are:

- Method 1: Through credit/debit card transfers.

- Method 2: Bank wire transfers.

- Method 3: e-wallet transfers or Klarna/ Sofort.

- Method 4: eToro money or online banking as well as direct crypto transfers.

BitMEX vs eToro: Trading & Platform Experience Comparison

Now let’s quickly discuss what are the trading capabilities and toolsets available on these exchanges.

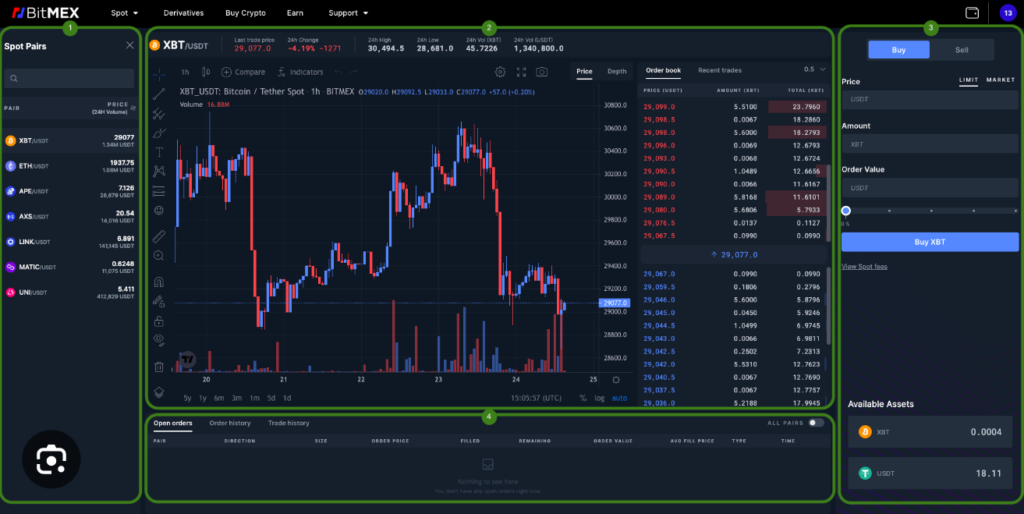

BitMEX

This crypto trading exchange stands out with its institutional-grade trading capabilities.

It comes with a professional setup with all the features and a wide range of crypto derivatives to trade with different strategies. Some of the highlighting features include:

- Low latency market data and trade execution.

- State-of-the-art crypto trading and pricing APIs.

- Supports TradingView charting system.

- The order book consists of a BitMEX margin calculator.

To get a detailed overview of the exchange, check this BitMEX tutorial.

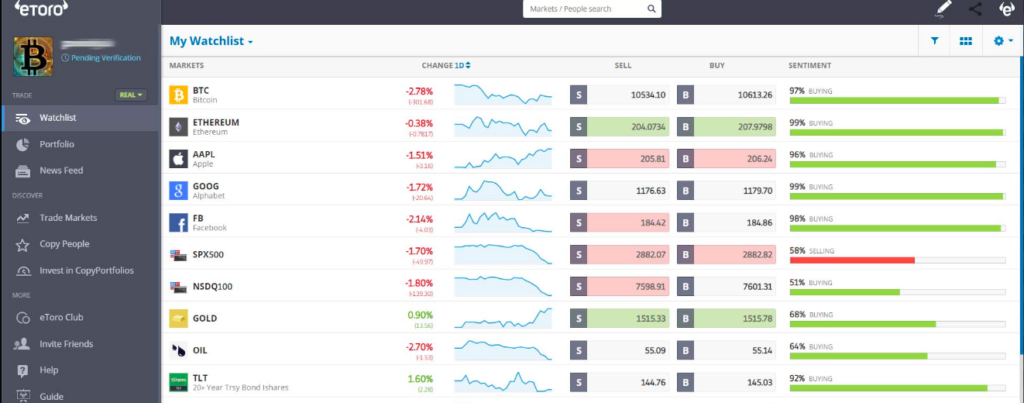

eToro

On the other hand, eToro has a reasonably standard yet subtle crypto trading ecosystem. It readily offers all of the essential tools like charts, stats, and trading pair details on the trading window.

The overall trading experience has been designed to ease trading for beginners. It includes all the essential and industry’s best trading systems that include:

- Technical charting system powered by TradingView

- Overview, stats, and asset’s top news

- Order form consisting of all the necessary tools

BitMEX vs eToro: Customer Support

BitMEX

The exchange offers live chat support as well as you can email them.

However, the response time through email is comparatively late. Moreover, you can also reach them via their Twitter and Reddit handles, where you can communicate with them.

eToro

Similarly, customer support at eToro is nowhere behind. The exchange offers both live and ticketed support. However, eToro is known for its quick response time, solving your queries at the earliest.

Additionally, the exchange also has a comprehensive Frequently Asked Questions page where you can find answers to almost all your basic queries with a lot of other content to gain knowledge about trading.

BitMEX vs eToro: Security Features

Now, let’s discuss what are the security features offered by these exchanges.

BitMEX

Starting with BitMEX again, the exchange stores most of your funds in a multi-sig cold wallet and additionally offers a withdrawal scheme for wallet security.

The security systems are powered by Amazon Web Services (AWS).

Moreover, the BitMEX platform is coded with kdb+ to enable secure communications and enhance the platform’s stability as well as security.

eToro

Coming to eToro, this exchange takes a proactive approach to its exchange security and constantly works on developing and updating its features.

With a thorough verification process and close monitoring of AML procedures, your crypto holdings are not going anywhere.

Additionally, it also comes with, by default, two-factor authentication and phone verification.

Is BitMEX Safe & Legal To Use?

The clear and precise answer to this question is that, yes, BitMEX is a safe and legal platform.

The exchange offers all of the advanced security features. However, there was a security breach at the exchange in 2019 that leaked customers’ data.

The company is now excellently safeguarding its user’s data by implementing top-notch security features.

Is eToro Safe & Legal To Use?

Answering the same question for eToro, the response remains the same. The exchange comes with all the advanced security features as well as is a regulated platform by renowned institutions, holding licensing.

The company has zero history of any kind of cyber security breach and is undoubtedly a safe and legal platform.

eToro vs BitMEX Conclusion: Why not use both?

Both eToro and BitMEX are excellent choices for trading exchanges in the crypto sphere. Both are well-renowned platforms offering a wide range of crypto trading toolsets.

But when the question arises, which of the two is the best, the decision lies upon your trading needs. eToro is a beginner-friendly platform, and if you are new to crypto trading, then eToro is the best choice for you.

The exchange comes with all the essential toolsets, affordable pricing, and a long list of crypto assets.

On the other hand, BitMEX will be the best option if you are looking for a professional trading platform with all the advanced trading capabilities.

Choose the best crypto exchange platform that suits you, and start your trading journey today.

Learn how does BitMEX & eToro stack up against the competition:

- Phemex vs BitMEX

- BitMEX vs Deribit

- BitMEX vs Coinbase

- eToro vs Binance

- eToro vs Bybit

- eToro vs AscendEX

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023