Both CoinEx and Binance are the industry’s giants that have captured the cryptosphere in a very short time with extraordinary trading capabilities.

But when it comes to choosing the ultimate platform for trading, things get complicated, and I know you are in the same dilemma as well.

And that is why I am here with the most sensible, short, sensible comparison between CoinEx and Binance to help you choose which one among the two will fit your trading needs the best.

I will compare them on multiple criteria and tell you everything you need to know before you get your hands on these leverage trading platforms.

So, let’s start by first learning some background about them.

CoinEx vs Binance: At A Glance Comparison

CoinEx

This crypto trading exchange was founded in 2017, with its headquarters in Seychelles.

The platform is supported in more than 10 languages and offers a variety of altcoins readily on the exchange to trade with anytime, anywhere.

CoinEx exchange is available in more than 200+ countries and regions. There are more than 1093 markets and processes, more than 351.13 million in 24h trading value.

Binance

On the other hand, is Binance Futures one of the largest cryptocurrency trading exchanges in the world.

The exchange offers a wide range of crypto trading products and features and let’s you trade in different markets like spot, futures or margin. Plus, it comes with user-friendly as well as powerful trading engine.

Binance was introduced in 2017 and currently has the highest trading volume. It holds a 24h trading volume of more than $38 billion with a more than 120 million user base.

CoinEx vs Binance: Trading Markets, Products & Leverage Offered

CoinEx

- Crypto Swap: CoinEx supports any combination of cryptos, and the price depends on the current market depth.

- Spot Trading: There is a wide range of trading pairs settled in USDT, USDC, BTC and ACH.

- Margin Trading: The platform offers a maximum of up to 100x leverage and can be adjusted under both isolated and cross-margin modes.

- Futures Trading: There are both Linear and Inverse contracts offered, settled in USDT and USDC.

Binance

On the other hand, Binance has a wide range of crypto trading products, which are:

- P2P Trading: Trade USDT with the lowest transaction fees of <0.10% for all markets accompanying 700+ payment methods.

- Staking: Flexible DeFi staking with up to 6.38% and an additional 1.5% APR.

- Leverage Trading: Up to 20x of maximum leverage available on the majority of the assets.

- Spot Trading: Trade a wide range of assets, including BTC, XRP, ETH, SOL and many more.

- Futures Trading: There are Coin-M and USD-M futures settled in USDT or BUSD.

Verdict: Both the exchanges offer similar products to trade with, but Binance has a little bit more of them, however, Binance offers less margin, so it depends upon your trading needs which one you’ll prefer.

CoinEx vs Binance: Supported Cryptocurrencies

CoinEx

When it comes to supported coins, then CoinEx will surprise you. This crypto futures platform offers more than 677 coins readily available on the exchange to trade from.

These include all of the major ones like BTC, ETH, BNB, SOL, XRP, DOGE, ADA, USDC, AVAX, MATIC, SHIB, LTC and a lot more.

New to Crypto Ecosystem? Know How many cryptocurrencies are there?

Binance

Similarly, Binance offers a long range of crypto assets, too, counting to more than 350 of them.

Though it is nearly half of what CoinEx offers, it still offers quite a decent amount, including all the latest and your favourite ones like BTC, SOL, ETH, XRP and many more.

Verdict: CoinEx is a clear winner in this segment, nearly double the crypto assets offered by Binance.

CoinEx vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

Now discussing the most important topic, what fees do you get charged for trading on these platforms?

CoinEx

Trading Fees

The trading fee on CoinEx depends on different VIP levels and market marking levels. The VIP levels depend on CET holding while market making on trading volume. To understand them better, refer to the tables below:

VIP Level

|

VIP Level |

CET Holding | Spot Fees | Spot Fees | |

| VIP 0 | ≥0 CET | 0.2000% |

0.1600% |

|

|

VIP 1 |

≥1,000.00 CET | 0.1800% | 0.1440% | |

| VIP 2 | ≥10,000.00 CET | 0.1600% |

0.1280% |

|

|

VIP 3 |

≥100,000.00 CET | 0.1400% | 0.1120% | |

| VIP 4 | ≥500,000.00 CET | 0.1200% |

0.0960% |

|

|

VIP 5 |

≥1,000,000.00 CET | 0.1000% |

0.0800% |

|

Spot Market Making Level

|

Market-Making Level |

Ranking | Maker | Maker | Taker | Taker | ||||

| LV 5 | ≤10% | 0% | 0% | 0.0500% |

0.0400% |

||||

|

LV 4 |

≤25% | 0.0100% | 0.0080% | 0.0600% | 0.0480% | ||||

| LV 3 | ≤45% | 0.0200% | 0.0160% | 0.0700% |

0.0560% |

||||

|

LV 2 |

≤70% | 0.0300% | 0.0240% | 0.0800% | 0.0640% | ||||

| LV 1 | Last 30% | 0.0400% | 0.0320% | 0.0900% |

0.0720% |

||||

|

LV 0 |

/ | 0.2000% | 0.1600% | 0.2000% |

0.1600% |

||||

Deposit and Withdrawal Fees

There are no deposit fees charged on most of the assets on CoinEx, but when it comes to withdrawal fees, there is a minimal fee charged depending on the coin you withdraw. To understand these fees in more detail, please click here.

Binance

Trading Fees

Coming to Binance, there are two types of fees associated when your trade, which is:

On Binance, when you hold BNB tokens in your wallet, you will receive an exciting flat 25% discount on spot trading and 10% off when trading USDⓈ-M futures, so if you have a high trading volume, it’s good to go for this option. But the standard fee on the platform is 0.1%.

Additionally, there is a 0% fee when trading BTC/TUSD, and the platform has also reduced their, to go through the fees, please refer to the table below:

|

Level |

30d Trade Volume (BUSD) | and/or | BNB Balance | Maker / Taker | Maker / Taker |

| Regular User | < 1,000,000 BUSD | or | ≥ 0 BNB | 0.1000% / 0.1000% |

0.0750% / 0.0750% |

|

VIP 1 |

≥ 1,000,000 BUSD | and | ≥ 25 BNB | 0.0900% / 0.1000% | 0.0675% / 0.0750% |

| VIP 2 | ≥ 5,000,000 BUSD | and | ≥ 100 BNB | 0.0800% / 0.1000% |

0.0600% / 0.0750% |

|

VIP 3 |

≥ 20,000,000 BUSD | and | ≥ 250 BNB | 0.0700% / 0.1000% | 0.0525% / 0.0750% |

| VIP 4 | ≥ 100,000,000 BUSD | and | ≥ 500 BNB | 0.0200% / 0.0400%

0.0700% / 0.0900% |

0.0150% / 0.0300% 0.0525% / 0.0675% |

|

VIP 5 |

≥ 150,000,000 BUSD | and | ≥ 1,000 BNB | 0.0200% / 0.0400%

0.0600% / 0.0800% |

0.0150% / 0.0300%

0.0450% / 0.0600% |

| VIP 6 | ≥ 400,000,000 BUSD | and | ≥ 1,750 BNB | 0.0200% / 0.0400%

0.0500% / 0.0700% |

0.0150% / 0.0300% 0.0375% / 0.0525% |

|

VIP 7 |

≥ 800,000,000 BUSD | and | ≥ 3,000 BNB | 0.0200% / 0.0400%

0.0400% / 0.0600% |

0.0150% / 0.0300%

0.0300% / 0.0450% |

| VIP 8 | ≥ 2,000,000,000 BUSD | and | ≥ 4,500 BNB | 0.0200% / 0.0400%

0.0300% / 0.0500% |

0.0150% / 0.0300% 0.0225% / 0.0375% |

|

VIP 9 |

≥ 4,000,000,000 BUSD | and | ≥ 5,500 BNB |

0.0200% / 0.0400% |

0.0150% / 0.0300% |

Deposit and Withdrawal Fees

The good news is Binance doesn’t charge you any kind of deposit fees, but when it comes to withdrawal, there is a minimum fee charged, which is dynamic and depends on the asset you are trading with.

Verdict: Binance clearly has a more affordable fee structure and is the winner in this segment.

CoinEx vs Binance: Order Types

Now let’s go through how you can take advantage of the market through different order types.

CoinEx

Starting with CoinEx, this crypto exchange has all the essential order types to trade with; these are:

- Limit Order

- Market Order

- Stop-Limit Order

- Stop-Market Order

Binance

Coming to Binance has a long list of advanced and basic order types, which include:

- Limit Order

- Market Order

- Stop Limit Order

Advanced Order Types

- Stop Market Order

- Trailing Stop Order

- Time Weighted Average Price (TWAP)

- Post Only Order

Verdict: Binance is the clear winner in this segment, as it offers a long list of crypto trading order types.

CoinEx vs Binance: KYC Requirements & KYC Limits

CoinEx

This crypto exchange offers anonymous trading capabilities but with limited accessibility and trading. Let’s have a look at how it works.

|

Function |

Account Without ID Verification | Account With ID Verification |

| Withdrawal | 24H Withdrawal Limit: 10,000 USD |

24H Withdrawal Limit: 1,000,000 USD |

|

Spot & Margin Trading |

available | available |

| Perpetual Contract | available |

available |

|

Financial Account |

available | available |

| Promotion Activity | some |

all |

To get yourself verified, upload any government-issued ID, which can either be done through mobile, webcam or directly from your device.

After that is done, you will be redirected to a face recognition page and then take a selfie holding the document and upload that.

It requires 1-3 working days to get yourself verified; for more information about the KYC procedures, click here.

Binance

Coming to Binance, on this exchange, KYC is mandatory, and as soon as you open an account, you can only trade if your account is KYC-compliant. You can submit the following documents in order to be verified:

- Passport

- Social Security Number

- Voter ID Card

- PAN Card

- Driver’s license or Government issued ID

There are 3 different verification levels on which your trading limits are set which are:

- Basic: $300 Lifetime Buy Crypto and Fiat Deposits/Withdrawal Limit and Max. 0.06 BTC withdrawal limit.

Requirements:

Personal information

- Intermediate: $50,000 Daily Buy Crypto and Fiat Deposits/Withdrawal Limit, Max. 100 BTC withdrawal limit and P2P/Over counter/Binance Card Perks.

Requirements:

Basic Information

Facial Verification

Government ID

- Advanced: $200,000 Daily Buy Crypto and Fiat Deposits/Withdrawal Limit, Unlimited BTC withdrawal limit, and P2P/Over the Counter/Binance Card Perks.

Requirements:

All intermediate requirements

10 days review time

Proof of address

CoinEx vs Binance: Deposits & Withdrawal Options

Coming to how can you fund your account, let me tell you what are the options available on these exchanges.

CoinEx

Starting with CoinEx again, the exchange supports more than 8 third-party fiat currency payment service providers, including MoonPay, Banxa, Guardarian, Simplex, Mercuryo, Paxful, XanPool, and Advcash, attributing their services through methods including:

- Visa

- Master Card

- Apple Pay

- Google Pay

- Bank Transfer

- SEPA

Binance

Coming to Binance, there are multiple account funding methods to choose from as well, which include:

- Credit/Debit Cards

- Direct Crypto Transfers

- Wire and Interac Transfers

All the payment gateways to which these methods are integrated are the industry’s best and 100% secure.

CoinEx vs Binance: Trading & Platform Experience Comparison

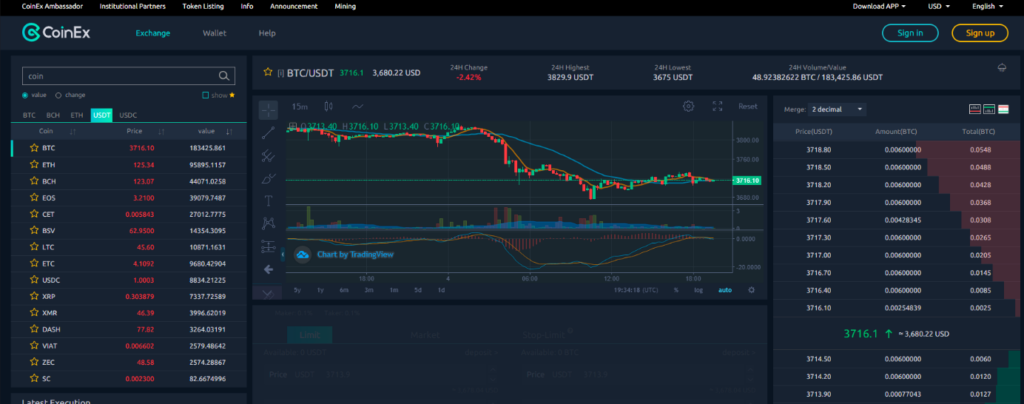

CoinEx

The exchange is equipped with a powerful trading interface, and the window is equipped with the following attributes:

- Search bar and market area

- Latest transaction area

- Current order area

- Order history area

- Trading pair and basic market information

- K-line market and depth chart

- The proportion of buying & selling

- Market handicap depth area

- Fee discount setting and rate of maker & taker

- Market selection area

- Order Placing area

The platform is equipped with all the advanced trading features and charting systems that will help you trade with ease.

Binance

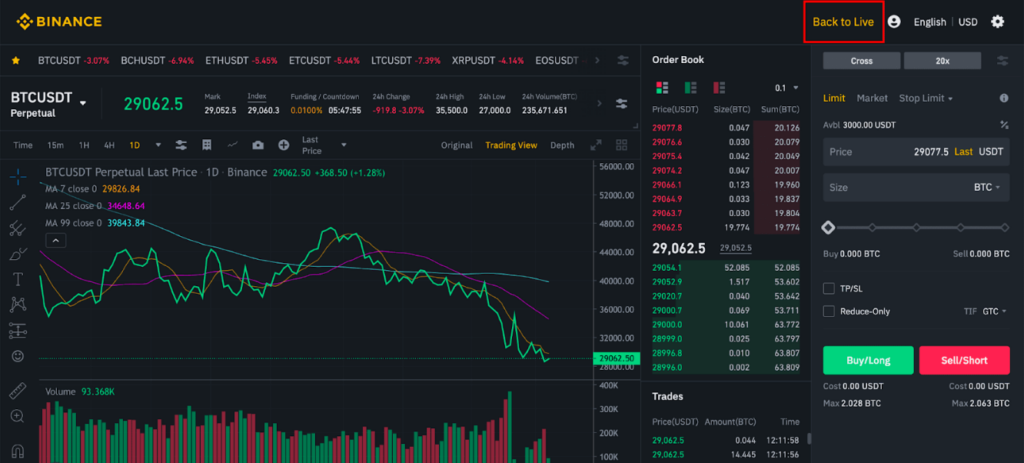

On the other hand, Binance is a full-fledged trading platform with a variety of trading features and an advanced trading ecosystem. It comes with a powerful trading engine, designed for high-volume trading.

The platform comes with two charting systems, one is Binance’s default one, and the other is the well-known and highly advanced TradingView charting system.

TradingView gives you real-time data with high precision.

Additionally, the chart comes with a variety of other features that are always handy while you trade; these include:

- Order Form

- Order Book

- Depth Chart

- Indicators

- Order Menu

You can learn more about the exchange by looking at this futures trading guide for Binance.

CoinEx vs Binance: Customer Support

CoinEx

Coming to customer support, CoinEx offers mainly two ways to get help if you have any queries. The first is the help centre, where you can get answers to most of your queries.

You can click the Help button in the lower right corner of the screen, which opens up a window where you can enter your query and look up the list of articles that could help you.

In case you don’t find the answer you were looking for, the second way is to reach out to its customer support team, either through the same help button or by emailing them.

Binance

On the other hand, Binance offers all the crucial options for customer support, which include: submitting a ticket, reaching out via Twitter and asking questions on its live chat.

- To submit a ticket and receive assistance via email, you can fill out a form on Binance’s website.

- On its Twitter account (@BinanceHelpDesk), you can directly raise your issues, and the team reaches out to you shortly.

- For the live chat, click on the bottom right corner of the support screen on the Binance website.

CoinEx vs Binance: Security Features

Now let’s discuss how good these exchanges are in terms of the security of your assets.

CoinEx

To ensure optimum security of your crypto CoinEx uses a multi-sig cold wallet storage, where most of your crypto is saved in secure cold storage wallets.

Thanks to the collaboration with the world’s top-tier security team with no record of any security breaches to date.

It comes with multi-factor authentication and address whitelisting by default which you can set up on WEB and API separately.

New to Crypto Futures trading? Know How long can you hold crypto futures contracts?

Binance

On the other hand, Binance also offers multi-factor authentication and address whitelisting. It also provides device management capabilities with the ability to restrict device access.

On top of that, the platform comes with advanced security features like:

- Advanced-Data Encryption

- Organisation Security

- Secure Cold Storage

- Regular Audits

- Real-Time Monitoring

Is CoinEx a Safe & Legal To Use?

The clear answer to this question is that, yes CoinEx is an entirely safe and legitimate platform. This exchange is regulated under Estonian law as it holds the Estonian digital asset trading license.

With state-of-the-art security features and global recognition with a huge fan base all around the world, this exchange isn’t going anywhere.

Is Binance a Safe & Legal To Use?

Coming to Binance, the user base and the well-known name this exchange has speaks for itself. The exchange is among the safest platforms out there, with no hacks or security breaches in its track record.

Additionally, this exchange is FDIC insured and offers the industry’s most secure as well as advanced security features.

Binance vs CoinEx Conclusion: Why not use both?

Binance and CoinEx are undoubtedly the industry’s best crypto exchanges with top-notch trading features.

But when it comes to choosing the ultimate crypto exchange that would fit your trading needs, there are certain points that you should know.

If you are a beginner trader and looking for an exchange where you can trade anonymously, which is easy to use and comes with a wide range of crypto offerings, then CoinEx is undoubtedly the way to go.

In contrast, if you are looking for an advanced trading platform which is pocket friendly and at the same time offers a wide range of trading products, then Binance should be your choice.

Now go out there, get your hands on these exchanges and start trading today.

Check out how Coinex & Binance stacks up against their compettiors:

- Coinex vs Bybit

- Coinex vs KuCoin

- Binance vs Kraken

- Binance vs Gate.io

- Binance vs Poloniex

- Binance vs Bitkub