All of you must know that there is a bit of complexity faced by FTX currently, and there is news of it being acquired or maybe going bankrupt. And I am sure this is why you are here, wanting to know which are the best alternatives of FTX in the cryptosphere you can choose.

That is why I am here with an up-to-date comparison of the top 9 alternatives of FTX that you should definitely consider with everything you should know before you start trading on them, so, without wasting much time, let’s first know what exchanges these are.

Top 9 Alternatives of FTX

- Bybit

- Stormgain

- Phemex

- Binance

- PrimeXBT

- Delta Exchange

- Kraken

- KuCoin

- OKX

#1. Bybit

Beginning the list with the most famous crypto exchanges that skyrocketed in mere 4 years of its launch. Bybit offers crypto to perpetual fiat swaps with a maximum leverage of 100x. It is also pretty renowned for its crypto-based perpetual contracts with a bunch of unique features:

- Bybit’s clean and powerful trading engine supports up to 100,000 transactions per second, settling each transaction in just 10 milliseconds.

- Funding options in BTC, ETH, EOS and XRP.

- Anonymous trading with no KYC and a withdrawal limit of up to 2 BTC/day.

Fee Structure- Trading Fees

Fees can be constituted into 3 categories:

| Spot Trading Fees | Futures Trading Fees | USDC Options Trading Fees | |

| Maker | 0% to 0.1% | 0% to 0.01% | 0.012% to 0.03% |

| Taker | 0.02% to 0.1% | 0.03% to 0.06% | 0.015% to 0.03% |

Funding Fees

You are charged every 8 hours between the buyer and seller, depending on the funding rate. To receive or pay the funding fees, you should hold a position at funding time stamps which are 00:00 UTC, 08:00 UTC and 16:00 UTC.

Deposit and Withdrawal Fees

There are no deposit fees on the exchange; however, while withdrawing BTC, a 0.0005 BTC is charged.

Bybit provides dedicated 24×7 customer support where you can get your queries clarified instantly or else opt for an email service as well. It also offers two-factor authentication with cold wallet storage, safeguarding funds from cyber-attacks using SSL encryption.

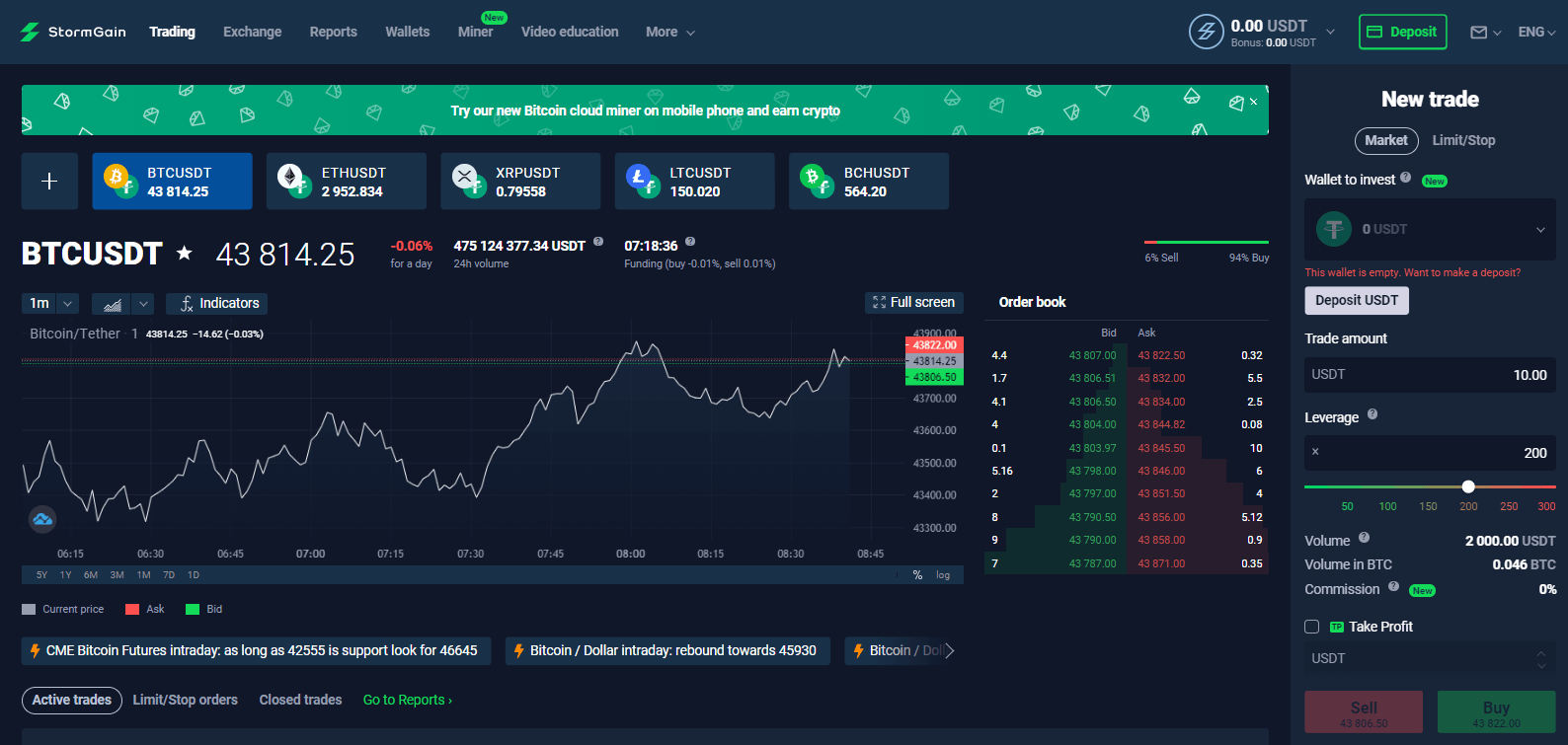

#2. StormGain

Now, coming to StormGain, another major cryptocurrency exchange that was launched in 2019, registered in Seychelles with its headquarters in London. The platform currently offers almost all the industry-leading crypto coins.

Let’s now look at some of the highlighting features of StormGain:

- The exchange also offers the highest floating leverage of up to 500x but only for the BTC/USDT pair.

- For other USDT pairs, the maximum leverage available is up to 100x, and the standard leverage for all the remaining trading pairs is up to 50x.

Fee Structure

There is a flat 10% fee charged on every profitable trade and no charges for OTC trading. Additionally, the platform also charges a 5% deposit commission when using a debit/credit card.

When withdrawing, a fee depending on the currency is charged, and a 0.1% fee is charged on each withdrawal.

This platform also has an exceptionally responsive and dedicated customer support team available around the clock. The website also consists of a comprehensive FAQ section and video tutorial to help you easily learn to use the platform.

StormGain also has impenetrable security features with all the advanced security systems like SSL encryption, PCI-DSS and GDPR compliance, Real-time monitoring, quarterly security audit and two-factor authentication, making the platform a fortress.

#3. Phemex

Following is Phemex, another huge crypto derivatives exchange that acquired its place in the market in just 3 years. It offers maximum leverage of up to 100x with some of the highlighting USPs:

- Phemex is integrated with 30+ liquidity providers.

- API integrated with Analytical Finance Information for institutional traders and sub-accounts for quantitative traders.

Fee Structure-Trading Fees

The spot and future contracts trading fees depend on the last 30-day trading volume, which further decides your account’s user level. There are 7 VIP levels on Phemex. And the good news is that Phemex is currently not charging any fee for spot trading.

| Spot Trading Fees | Contract Trading Fees | |

| Maker | 0% to 0.1% | 0% to 0.01% |

| Taker | 0.04% to 0.1% | 0.0325% to 0.06% |

Funding Fees

Funding fees are charged every 8 hours and depend on the pay and who receives the compensation. The interchanging is used to ensure the last traded price of the asset gets close to its mark price.

Deposit and Withdrawal Fees

There are no depositing fees, but a withdrawal fee depending on the asset, is charged.

Phemex has 24×7 live chat support available in multiple languages. You can also reach them through social media platforms like Twitter, Telegram and Facebook.

There are state-of-the-art security measures implemented, which include two-factor authentication for login and withdrawal, as well as can be used via a VPN.

The exchange also has Amazon Web Service Cloud as well as several advanced firewall encryptions, and bank-level double-entry bookkeeping.

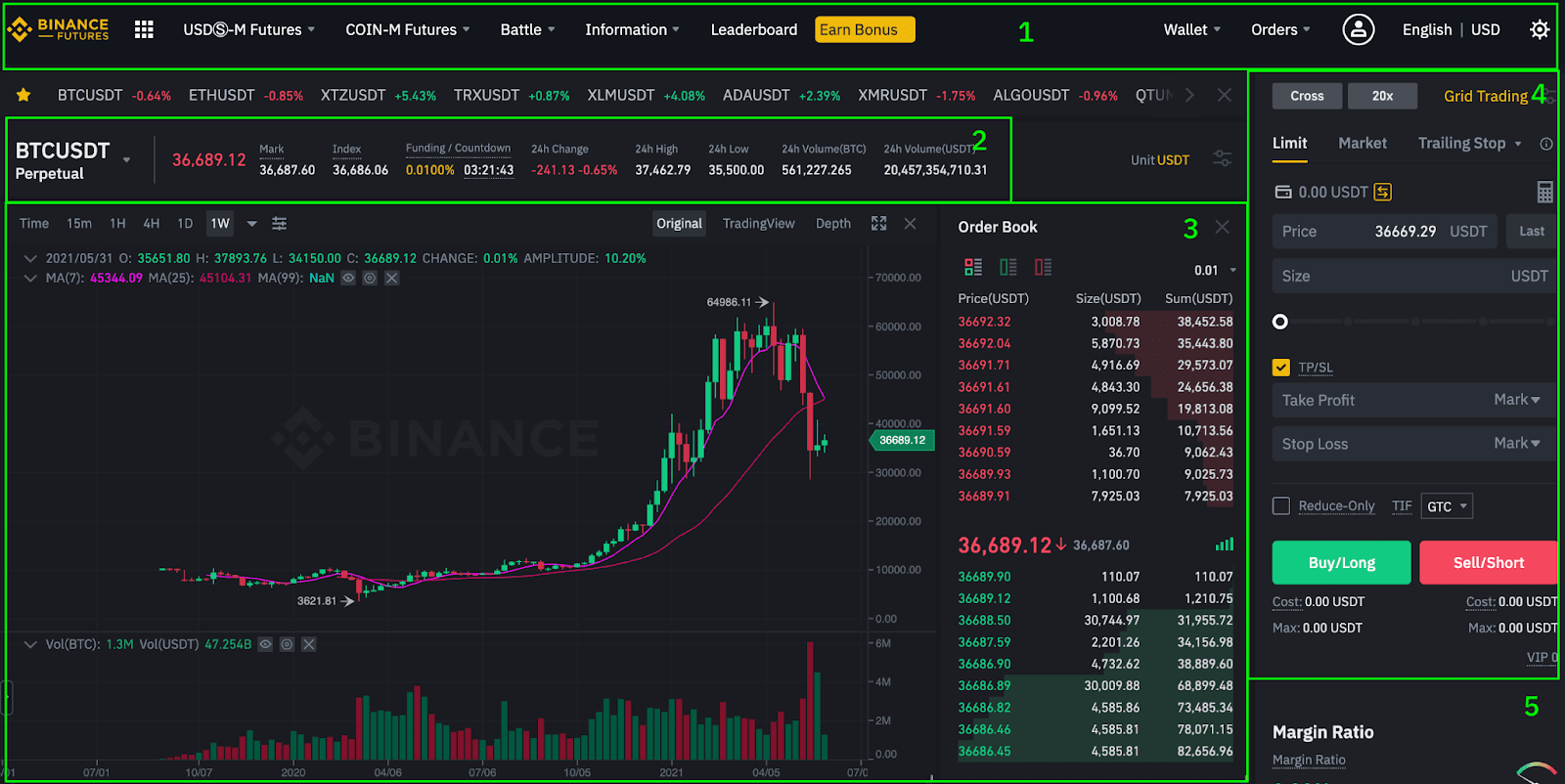

#4. Binance

Now coming to the biggest and one of the most renowned cryptocurrency exchanges, founded in 2017, Binance Futures. Ranked number 1 in terms of trading volume and offering more than 200 trading pairs with a maximum leverage of up to 125x. Let’s get to its highlighting features quickly:

- Advanced toolsets with state-of-the-art charting systems.

- Limited accessibility via anonymous trading and no KYC.

Fee Structure-Trading Fees

The regular trading fees follow a maker/taker fee model being 0.020%/0.040. Holding BNB tokens will bring down your trading fees, costing you a 0.1% standard fee.

| Spot Trading Fees | Futures Trading Fees | |

| Maker | 0.02% to 0.1% | 0.01% to 0.02% |

| Taker | 0.04% to 0.1% | 0.017% to 0.04% |

Funding Fees

These fees are charged every 8 hours and have a fixed interest rate of 0.03%.

Deposit and Withdrawal Fees

There are no deposit fees on Binance, but the exchange charges a flat fee for withdrawals which is 0.0005 BTC depending upon the coin you are trading with.

Customer Support on Binance is also top-notch, with a chatbot, email and support ticket service. There is also quite a comprehensive knowledge base which provides you with information about almost all your queries.

Binance also offers multi-level security infrastructure with two-factor authentication as well as fund storage in a combination of hot and cold wallets.

The exchange also offers insurance protection and, at the same time, provides an option of crypto exchange without KYC but with limited accessibility.

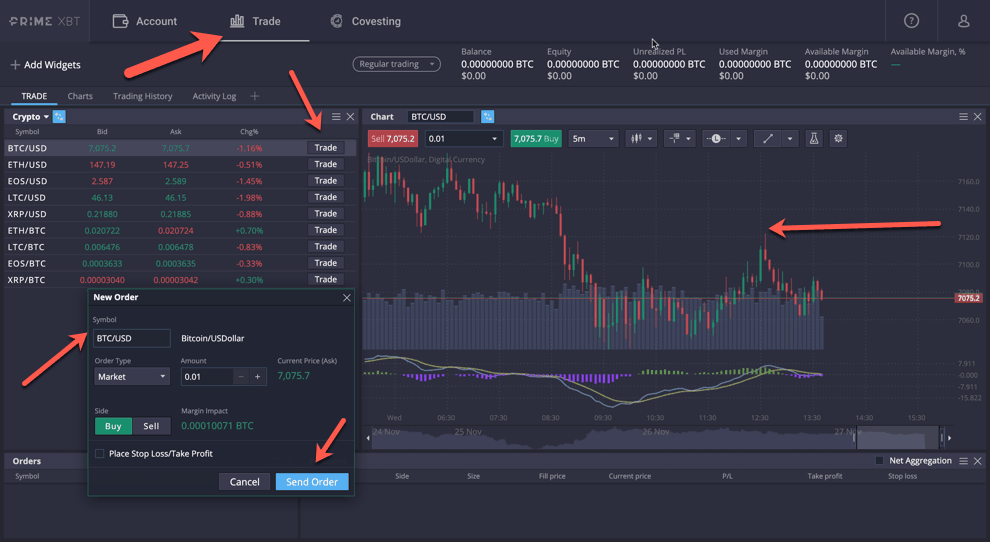

#5. PrimeXBT

Coming to another great option in the cryptosphere, which has been in the industry since 2018 and registered in Seychelles, PrimeXBT.

With the highest leverage of up to 100x on crypto derivatives and 1000x on the EUR/USD pair, the features of this exchange are just phenomenal; let’s discuss them quickly:

- Easy Bitcoin Deposit and Withdrawal

- Integration with 12 liquidity providers and execution within 7.12 milliseconds.

Fee Structure – Trading Fees

There are two trading conditions available on PrimeXBT, which are Margin and Copy Trading, where the commission starts at 0.0001%. There are no minimum deposits for the margin, whereas 0.01 BTC is for copy trading. PrimeXBT also charges a flat 0.05% fee per transaction.

Funding Fees

There is an overnight funding rate charged when trades are continued to the next day. The trading day closes at 0:00 UTC with a financing rate for both long and short positions, which alters depending on the market’s liquidity.

Deposit and Withdrawal Fees

As I said, there are no deposit and withdrawal limits, but 0.0005 BTC is charged on each Bitcoin withdrawal.

Prime XBT provides dedicated and around-the-clock customer support, which you can easily access through the account menu and reach them via their official email as well as a Telegram bot. Prime XBT also have a strong social media presence on Twitter, Facebook, Youtube, etc.

PrimeXBT stores 90% of your funds in cold wallets via a multi-sig cold wallet system. Two-factor authentication through google authenticator and full SSL encryption with account passwords cryptographically hashed are also readily available.

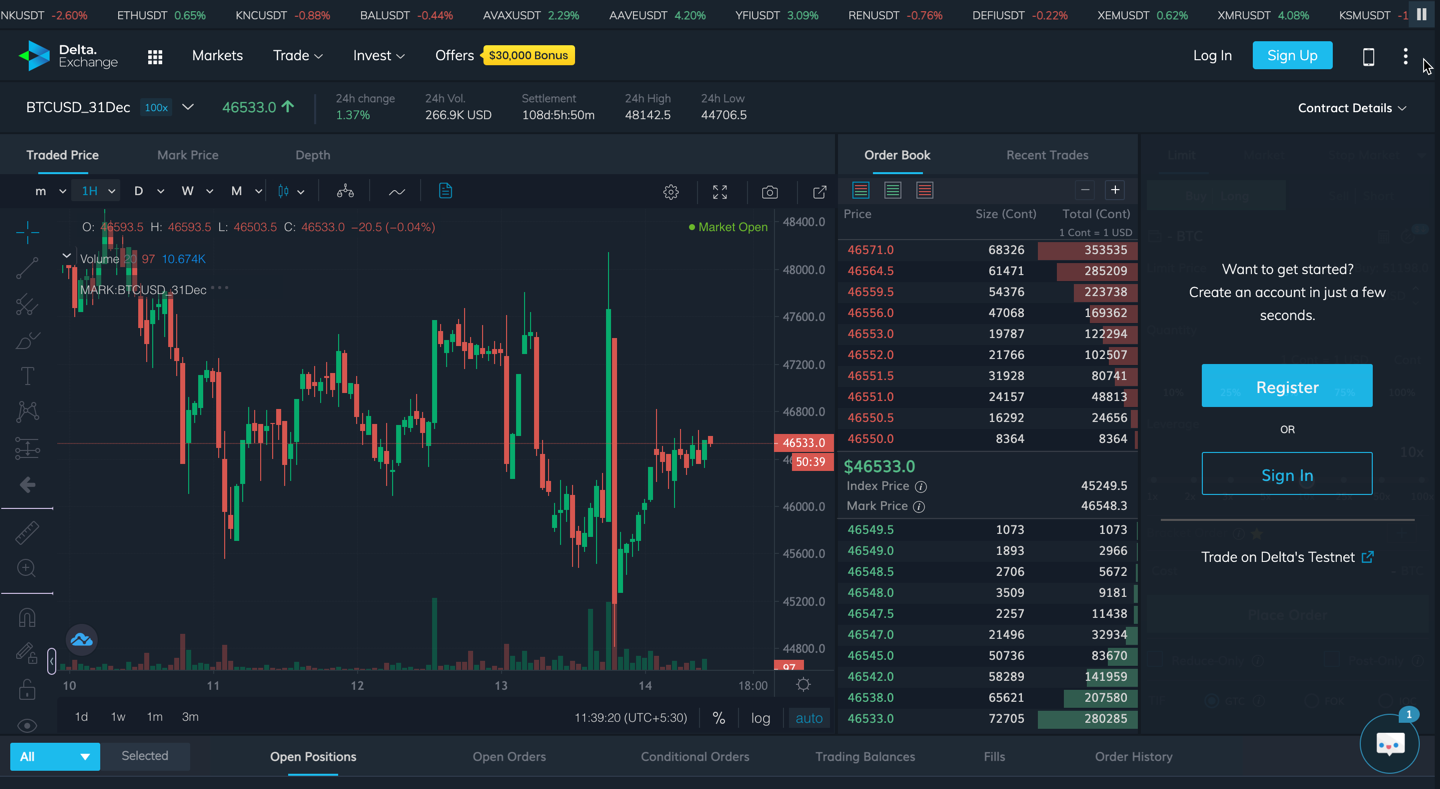

#6. Delta Exchange

Now, let’s get to another young crypto derivatives exchange Singapore based and founded in 2018. There are futures and perpetual swaps on 35+ crypto assets with a maximum leverage of up to 100x and options trading on BTC, ETH, LTC, XRP, BCH, BNB and LINK, MOVE contracts, and interest rate swaps.

Now let’s discuss some of its highlighting features:

- Powerful and intuitive trading interface both beginner friendly and sophisticated enough for experienced traders.

- State-of-the-art security features.

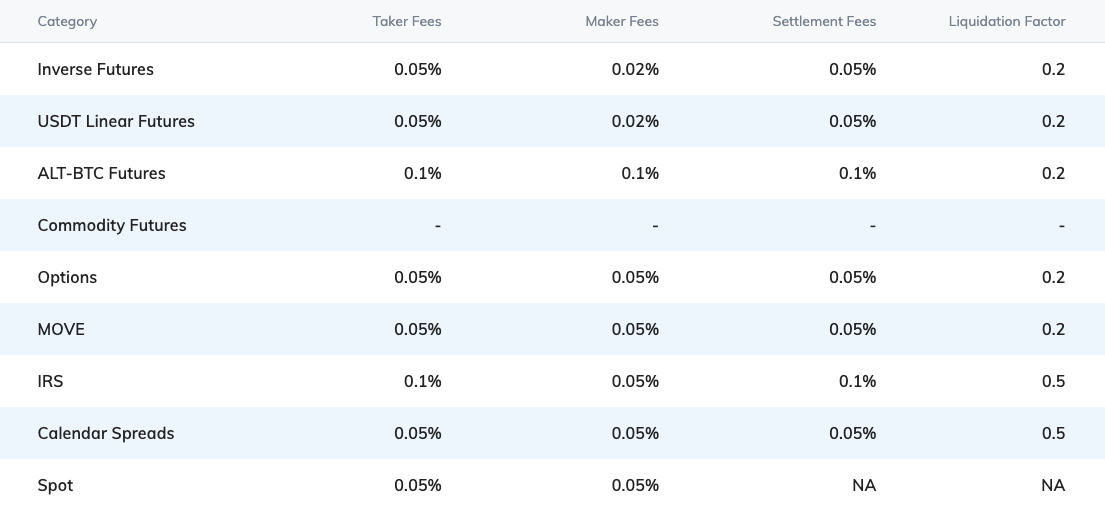

Fee Structure

Delta Exchange charges a flat fee of 0.02% maker and 0.05% taker fee on all perpetual and futures contracts and USDT settled contracts. For the altcoin-BTC futures pair, it charges a 0.10% maker/taker fee; please refer to the table below for more information:

Customer support on Delta Exchange is offered via Telegram only. It offers quite a comprehensive knowledge base for all the products and features of the exchange.

Delta exchange also provides two-factor authentication with IP whitelisting, SSL encryption, traffic monitoring and a multi-signature cold wallet system, providing you with a very secure trading ecosystem.

#7. Kraken

Now coming to another big wig of the cryptoverse, which was founded in 2011 in San Francisco. This exchange is available in more than 190 countries with over 9 million registered users.

Kraken also offers a dedicated platform for active users designed for high-volume trading. The exchange offers more than 185 crypto coins and a maximum leverage of up to 5x on most of them. Let’s look at some of its emphasizing features:

- Multiple order and product types to trade with.

- Dedicated and lag-free servers for high-volume trading.

Fee Structure

Kraken’s fee structure follows a maker/taker fee model that depends on the 30-Day Trading volume; go through the table below for a better understanding:

| Spot Trading Fees | Futures Trading Fees | |

| Maker | 0.0% to 0.16% | 0.0% to 0.02% |

| Taker | 0.10% to 0.26% | 0.01% to 0.05% |

Kraken offers 24×7 customer support with a live chat option and appoints personal representatives to handle the account of active traders.

When it comes to security, Kraken stands by the industry’s best security standards as well. It implements cold wallet storage and two-factor authentication by default on the platform.

#8. KuCoin

Next on the list is yet another famous name in the cryptoverse that was founded just 5 years back in 2017 and is a Seychelles-based exchange offering a wide range of products, more than 500 coins and trading pairs for the spot as well as derivatives markets.

The exchange offers up to 100x leverage, and the exchange holds more than 10 million traders worldwide, being available in more than 192 countries. Let’s discuss some of its highlighting features:

- Direct crypto deposits from your already existing wallet addresses, third-party apps, credit/debit cards, Google Pay and Apple Pay.

- Unique leverage trading capabilities and security features.

Fee Structure

KuCoin uses a tiered fee structure for its trading fees, depending on the 30-day trading volume of the users. It has 10 tiers; the lowest volume is charged 0.1% in maker and taker fees.

| Spot Trading Fees | Margin Trading Fees | Futures Trading Fees |

| 0.1% | 0.1% | 0.03% to 0% |

High-volume traders (<20,000 BTC of trading volume) are charged 0.0125% and 0.03% in maker-taker fees, respectively.

KuCoin provides one of the best customer services via its help centre on the platform and a comprehensive knowledge base that you can refer to anytime for your queries. You can also raise a ticket if your query isn’t listed.

KuCoin also offers impenetrable security features with two-factor authentication and advanced encryption, as well as third-party custodians, to protect your assets on the platform.

#9. OKX

Finally, one of the most prominent names in the cryptosphere was introduced in 2017. It is currently the world’s 18th-largest crypto exchange which is quite phenomenal for an exchange so young.

There are more than 300 cryptocurrencies, including all your favourite assets. Moreover, there are also 30 fiat currencies conveniently. Some of the USPs of this crypto exchange are:

- Variable products and order types.

- 5X leverage on almost all the assets and easy-to-use interface with advanced charting systems.

Fees Structure

OKX has a different fee structure which is separate for Regular and VIP users:

Spot Trading Fees- Regular Users

There are 5 levels categorized based on your OKB holding, which further decides your trading fees. The fee follows a maker/taker fee model where the maker lies between 0.060% to 0.080%, whereas the taker lies between 0.080% to 0.100%.

Spot Trading Fees- VIP users

In this, there are 8 VIP levels based on the 24h trading volume, which further decides the fees. The maker lies between -0.005% to 0.060%, whereas the taker lies between 0.020% to 0.080%.

Customer support on OKX is available 24×7, and you can connect via phone call. The platform also offers two-factor authentication, anti-phishing mode, as well as mobile and email verification to secure your OKX account.

Conclusion

These were the best FTX alternatives available in the crypto market. All these exchanges offer the best ecosystem giving you a safe and secure trading experience.

Choosing any of them will be a decision based on your trading needs and strategies. So what are you waiting for? Get your hands on these exchanges now!!