Your crypto exchange platform is one of the key factors determining your experience when trading. Therefore, it is always a great idea to stick with highly reputable companies with solid financial backing like KuCoin.

While KuCoin might be a top crypto exchange that promises the best trading tools, a user-friendly interface, and high liquidity, it is still not for everybody. Therefore, it is crucial to know what the company is all about before using it to trade you crypto.

This KuCoin tutorial provides a comprehensive overview of the company, starting from what it is to other things like the fees and the registration process.

What Is KuCoin?

KuCoin is a Singapore-based crypto exchange platform that has been in the business since 2017. Initially launched in Hong Kong, it now has a global presence with active traders from more than 100 countries.

Despite being around for just over 4 years, the platform now has more than 5 million registered users. The high number of users makes it one of the largest crypto exchange platforms in the world.

KuCoin markets itself as the people’s exchange, and according to them, their main goal is to create a platform that caters to the specific needs of the traders. This goal is clear from the fact that they allow traders to trade on both popular and less known digital assets, hence ensuring they cater to all kinds of traders.

The platform supports over 370 different crypto assets. The high number of cryptocurrencies means the exchange offers one of the world’s widest ranges of tradable digital coins. Better still, they are constantly updating their portfolio by adding new assets.

What Does KuCoin Offer?

KuCoin is made for the people, and they try to cater to all kinds of traders with their product offering. They offer a highly robust spot trading market with high liquidity, and they also allow for futures and margin trading. Here is an overview of their product offering.

- Spot Market

With the over 370 cryptocurrencies in the platform and the company adding new ones now and then, KuCoin has one of the largest and most diverse spot trading markets. Traders can form over 600 trading pairs on the platform, which gives them more than enough options for making money with their crypto.

However, to access the over 370 digital assets, the traders have to trade on the market. Also, for those that prefer to buy their crypto with fiat, you can only do so for around 50 cryptocurrencies. For the others, you first need to buy USDT with fiat and then use the USDT to buy the crypto you want.

KuCoin also offers a P2P marketplace for spot trades with zero fees. In the P2P market, you can trade your crypto with another trader on the platform at an agreed price without incurring any extra costs. All you have to do is advertise what you are selling or want to buy and when another trader agrees to the offer, you can seal the deal.

- Futures and Margin Trading

If the more traditional spot market does not seem profitable or exciting enough for you, KuCoin also supports futures and margin trading. The company supports futures trading with a maximum leverage of 100x to help amplify your earnings.

You can enter into a contract to go short or long for an underlying asset in the future but at a pre-determined price and size. If you also add the leverage to your order, your potential earnings will be several times more than what you would make from the spot market if the asset price goes your way.

KuCoin makes their futures and margin trading easier to execute by allowing the traders to choose from two different interfaces. The first interface is Futures Lite that is super easy to use and allows for quick trading. Traders can also use the Futures Pro interface that gives them access to all the trading tools on the platform.

Joining KuCoin? Know How to short BTC on KuCoin?

Note: Traders need to remember that margin trading is highly risky, given you can lose your entire capital quickly. Therefore, it is always better to start with small leverages like 5x and increase it as you gain more experience.

- Cryptocurrency Lending and Borrowing

Besides trading crypto assets, KuCoin also allows traders to make money by lending out any idle assets they have. You can lend out your coins to other traders on the platform and earn interest, which is less risky than trading since your earnings are guaranteed, and you cannot lose your crypto.

You can lend out over 70 different cryptocurrencies for 7, 14, or 28 days. Also, the platform allows you to borrow crypto when you do not have enough to open the position you want. Borrowing crypto is a cheaper way of raising capital for trading crypto.

- Mobile App Trading

Many crypto traders are always looking for a crypto exchange that allows them to trade on the go or from anywhere. KuCoin caters to this group of traders by offering a mobile app available for both iOS and Android devices.

The KuCoin mobile app has a sleek and easy-to-use interface and includes handy tools like a trading bot to support trading on the go.

KuCoin Trading Bot

Another thing to watch out for on the KuCoin trading platform is their trading bot. KuCoin offers several advanced trading bots to help traders automate and improve their trading experience.

You can trade around the clock with these bots, and they are all free. Additionally, the KuCoin bots are cloud-based, meaning you do not need to use your desktop or phone to support their functioning.

KuCoin Bonus

KuCoin also runs a bonus reward program for traders that hold their native token, the KCS coins. If you have more than 6 KCS tokens, you get a daily bonus that amounts to an APR of around 22%. The bonus program provides one more way to earn without trading and assets.

Traders can also use the KuCoin native tokens to reduce their trading fees on the platform. The company will reduce your trading fees by 20% when using their native tokens. Instead of the usual 0.1% fee, you will pay 0.08%.

How do I Register on KuCoin?

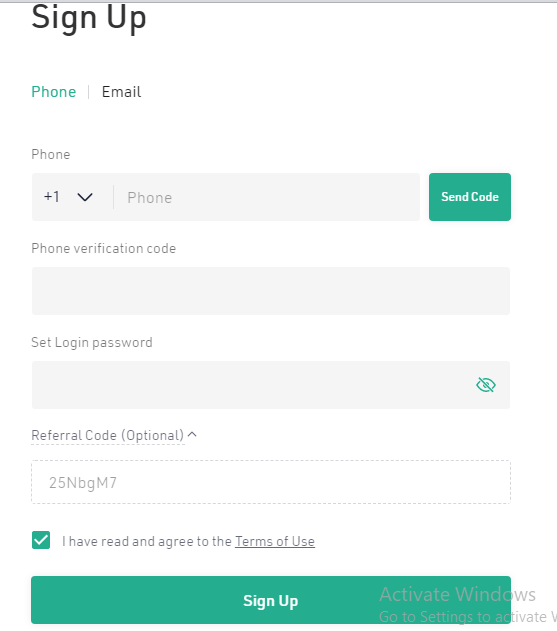

There is nothing much to do when registering on the KuCoin platform, which means you can have your account set up and ready to trade in just a few minutes. Also, it is essential to note that you will not need to do KYC verification when registering, as you can do this later on.

Here is a step-by-step guide on how to register on the platform.

- Go to https://www.kucoin.com/ and click on the sign-up button at the top right corner

- Choose to sign up with your phone or email and fill up the form below

- Once your fill the form, agree to the terms of use. Finish by clicking on the “Sign Up” button at the bottom

- Verify your account using the code you receive on your phone or email to complete the basic account setup

- Once your account is ready, go to the “Account Security” tab and set up 2FA and other things like safety phrases to secure your account

How do I Deposit and Withdraw On KuCoin?

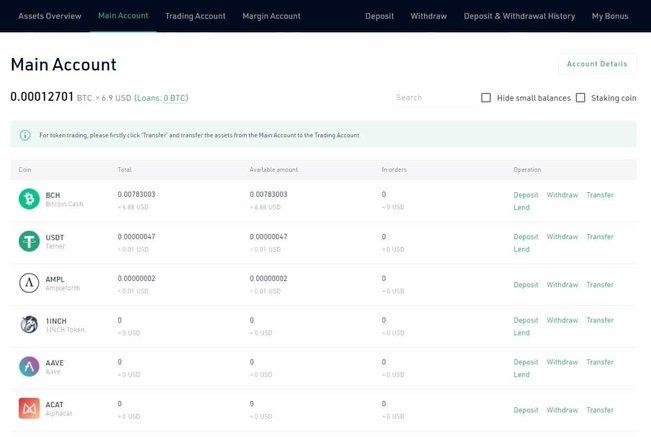

Once you have your account set up by following the steps above, you are ready to start trading. However, you need to have funds in your KuCoin. The deposit process is also relatively straightforward as there are only a few steps to follow.

KuCoin allows you to pay using PayPal, Skrill, SEPA, Debit/Credit card, Apple Pay, and cryptocurrency from your other wallets.

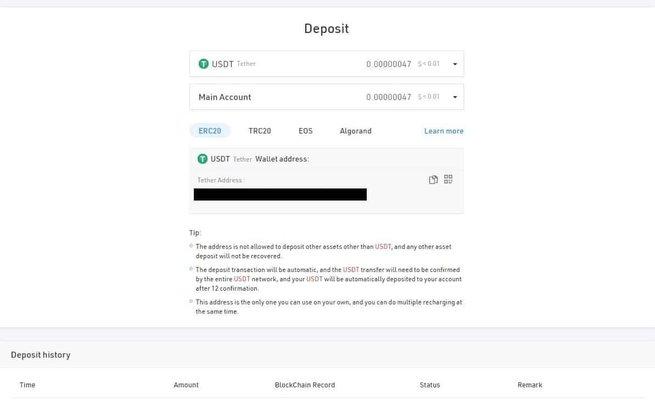

When adding funds to your wallet, you only need to go to the main account page, where you will see a list of all assets you can deposit. You should then click on “Deposit,” which will be on the right side of every asset.

On the deposit page, you will get a screen with your wallet address to send the assets you want to add to your account.

The withdrawal process is the same, but you will need to click on “Withdrawal” on the main account page.

How To Trade Bitcoin & Altcoins On KuCoin

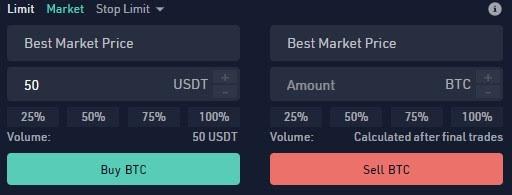

Buying and selling Bitcoins and altcoins on the KuCoin is relatively easy as you will only need to choose the asset type, order type to use, and the amount you want to buy or sell. Next, click on the buy/sell button to complete your trade.

What are the Various Trading Fees on KuCoin?

You cannot escape fees no matter what platform you choose, as there will always be something to pay for. KuCoin fees are within the industry average, and the company tries to make everything clear to ensure there are no hidden charges.

One of the main fees you will need to pay is the trading fee. The company charges 0.1% maker and taker fees, but traders using their native token only pay 0.08%.

Also, the trading fee depends on your trading volume, as it will reduce as your volume increases. For example, if you trade more than 20,000 BTC in a 30-day period, you only pay 0.0125% and 0.03% maker and taker fees, respectively.

There are no deposit fees on the KuCoin platform, and any fee that you pay will emanate from the method or channel of payment you are using to deposit.

The company will charge a flat fee when withdrawing funds from your wallet. The actual cost depends on the specific asset you are withdrawing. For example, the withdrawal fee for BTC is 0.0005, while for ETH, it is 0.01.

Does KuCoin Require KYC?

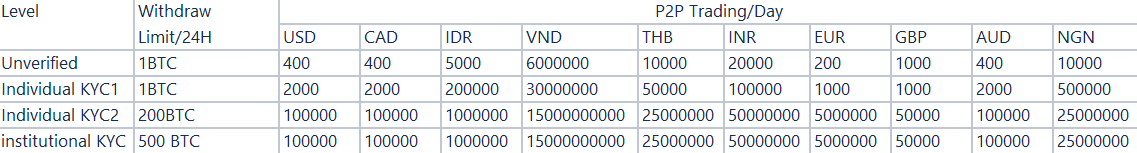

While you can register on KuCoin and start trading without completing KYC verification, you will have limits in your account, such as a smaller daily withdrawal limit of just 1 BTC.

You can withdraw up to 200 BTC per day when you complete KYC verification. Also, KYC verification increases your daily P2P trading limit, meaning you get more from the platform once you verify your identity.

KuCoin KYC Levels?

There are 4 levels of traders on KuCoin regarding KYC verification: unverified, KYC1, KYC2, and Institutional KYC.

Unverified traders have the lowest withdrawal and trading limits, while Institutional KYC level traders have the highest. Here is a table with all the KYC levels and their limitations.

How to Complete KYC on KuCoin?

Here are the steps to follow for KYC verification on KuCoin:

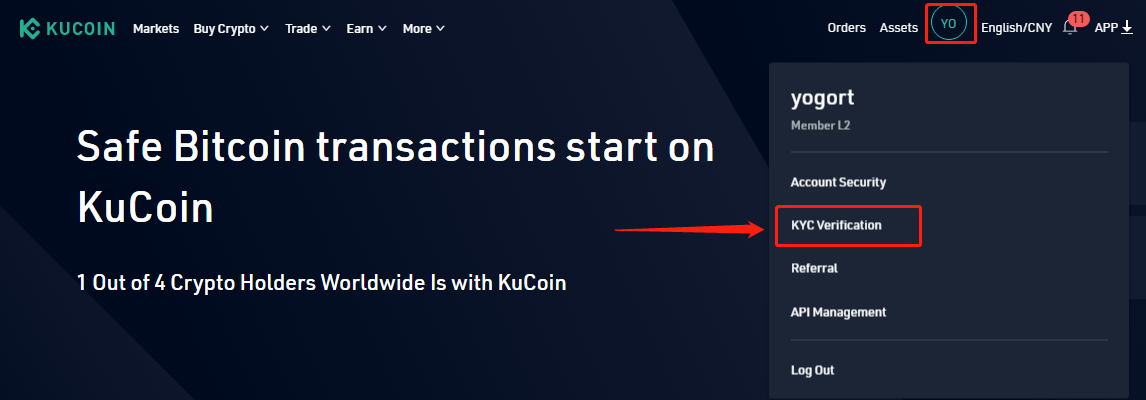

- Log in to your account and click on “Account Verification” (it will be under the avatar)

- Fill in the verification form with the required information that includes your ID documents

- The KuCoin review team will contact you via email explaining the next steps and inform you once the process is complete

- KYC verification often takes several days

Conclusion

KuCoin is a top-rated crypto exchange platform with a lot to offer. The platform has a global presence with over 5 million traders and gives you access to over 370 different cryptocurrencies. Additionally, they also have both spot and futures trading and allow for P2P trading.

The intuitive and advanced interface, free trading bots, and reasonably low trading fees also make it worth a fantastic platform. However, before jumping into the ship, you should know that you need KYC verification to remove account restrictions. But all in all, it is a great platform worth trying out.