As someone deeply immersed in the cryptocurrency world, I’ve navigated through numerous trading platforms, each presenting its unique features and complexities.

It’s this experience I bring as I dissect two prominent exchanges, Gemini and Bybit, in this article.

We’ll delve into the intricacies, comparing their supported cryptocurrencies, fees, security measures, and overall user experience.

This comprehensive exploration aims to provide clarity, helping you make an informed decision on the platform that best suits your trading aspirations.

Strap in, and let’s decode the world of Gemini and Bybit together.

Gemini vs Bybit: At a Glance Comparison

| Feature | Gemini | Bybit |

| Supported assets | 90+ cryptocurrencies | 1600+ cryptocurrencies |

| Margin trading | Yes | Yes |

| Leverage | Up to 100x | Up to 100x |

| Trading fees | Maker: -0.01% to 0.02%

Taker: 0.03% to 0.07% |

Maker: 0% to 0.02%

Taker: 0% to 0.05% |

| Trading platform | Web, mobile app | Web, mobile app |

| Security features | 2-factor authentication, SSL encryption, Address whitelisting | 2-factor authentication, cold storage |

| Customer support | Email support | 24/7 live chat, email support |

Gemini vs Bybit: Trading Markets, Products & Leverage Offered

Gemini, based in the United States, is a regulated cryptocurrency day trading platform that offers a secure platform for individuals and institutions to buy, sell, and store cryptocurrencies.

It supports spot trading for a variety of digital assets and recently introduced price-pegged stablecoins. However, Gemini does not offer any form of leverage trading for currency pairs other than BTC/GUSD.

On the other hand, Bybit, headquartered in Singapore, is primarily a crypto derivatives platform specializing in perpetual contracts.

It offers up to 100x leverage on Bitcoin and Ethereum contracts, allowing traders to maximize potential returns.

It’s important to note that while leverage can amplify profits, it can equally multiply losses, making it a risky strategy suitable for seasoned traders. To get started with the exchange, you can also use Bybit referral code to get sign-up bonus.

Verdict:

If you’re seeking a platform for basic spot trading with a variety of cryptocurrencies, Gemini is a solid choice.

However, for traders interested in derivatives and leverage trading, Bybit offers a broader range of products tailored to those needs. As always, understand the risks associated with leverage trading before diving in.

Gemini vs Bybit: Supported Cryptocurrencies

Gemini provides a vast selection of cryptocurrencies for trading. A

s a licensed and regulated exchange, it supports a wide range of well-established cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many others.

It also offers several ERC-20 tokens and a range of its own stablecoins pegged to different fiat currencies.

Bybit supports the major cryptocurrencies, but its primary appeal lies in its derivatives offerings, specifically its perpetual contracts.

Bybit also supports inverse perpetual contracts and USDT perpetual contracts, which are settled in USD-pegged stablecoins.

Verdict:

If the variety of supported cryptocurrencies is a priority for you, Gemini clearly takes the lead with its wider selection.

However, if you are mainly interested in trading the major cryptocurrencies through derivatives, Bybit would be a more suitable choice.

Gemini vs Bybit: Trading Fee & Deposit/Withdrawal Fee Compared

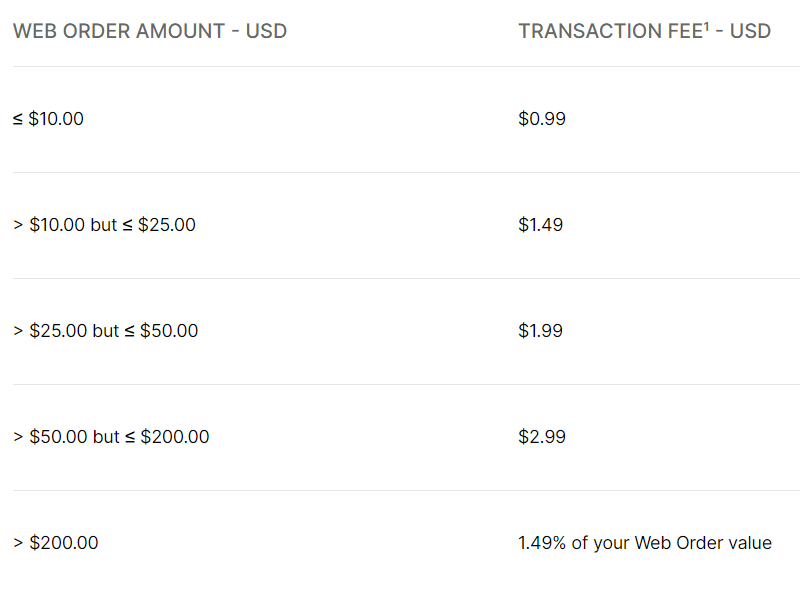

Gemini operates on a maker-taker fee schedule, with fees ranging from -0.01% to 0.02% based on your 30-day trading volume.

The more you trade, the lower your fees.

For deposits and withdrawals, Gemini does not charge any fees for bank and wire transfers, but digital asset withdrawals may incur fees based on the network’s mining fee.

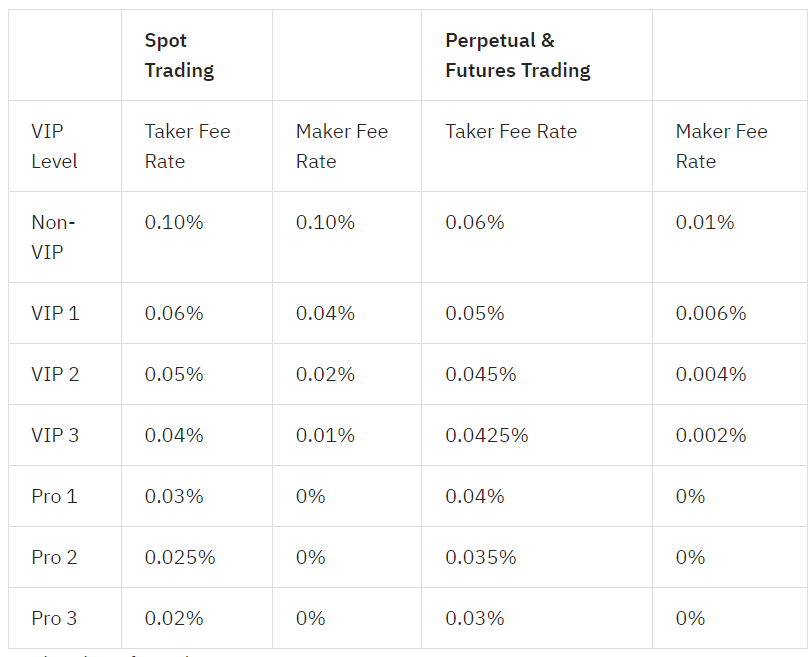

In the same way, Bybit follows fee structure based on your trading volume with maker fee ranging between 0%-0.02% and a taker fee of 0% to 0.05% for its futures contracts.

In terms of deposits and withdrawals, Bybit does not charge any fees, but network transaction fees apply.

Verdict:

For traders who perform large volumes, Gemini’s tiered fee structure could be advantageous. However, for most retail traders, Bybit’s lower fee structure makes it a more cost-effective option. Always remember to consider the network fees when depositing or withdrawing digital assets on any platform.

Gemini vs Bybit: Order Types

Gemini offers

- Market Order

- Limit Order

- Limit: Immediate-or-Cancel (IOC) Order

- Limit: Fill-or-Kill (FOK) Order

- Limit: Maker-or-Cancel (MOC) Order

Bybit offers

- Limit Order

- Market Order, and

- Conditional Order

Verdict:

In terms of order types, Gemini wins over Bybit in the number of different type of orders available to you.

Gemini vs Bybit: KYC Requirements & KYC Limits

Gemini, as a regulated exchange in the United States, requires all users to complete a KYC process before they can trade.

This process involves submitting proof of identity, such as a passport or driver’s license, and proof of address. There are no limits on deposits or withdrawals once you are verified.

Bybit also requires all their users to complete a basic level of KYC which will need you to provide personal information about yourself.

Verdict:

Both of the exchanges need KYC to be completed, so there is not really too much to choose between them in this regard.

Gemini vs Bybit: Deposits & Withdrawal Options

Gemini offers a variety of deposit and withdrawal options. You can fund your account using a bank transfer, wire transfer, or deposit cryptocurrencies directly.

As for withdrawals, you can transfer funds back to your bank account, wire transfer, or withdraw cryptocurrencies to your external wallets.

Bybit also accepts deposits in cryptocurrencies, and there is no minimum deposit limit.

However, it does not support fiat deposits, which may be a limitation for those looking to buy cryptocurrencies directly with fiat currency. For withdrawals,

Bybit processes them three times a day and requires multiple signatures for increased security.

Verdict:

Gemini and Bybit both have on and off-ramps for crypto and fiat currencies. This makes it difficult to choose between either of these exchanges.

Gemini vs Bybit: Trading & Platform Experience Comparison

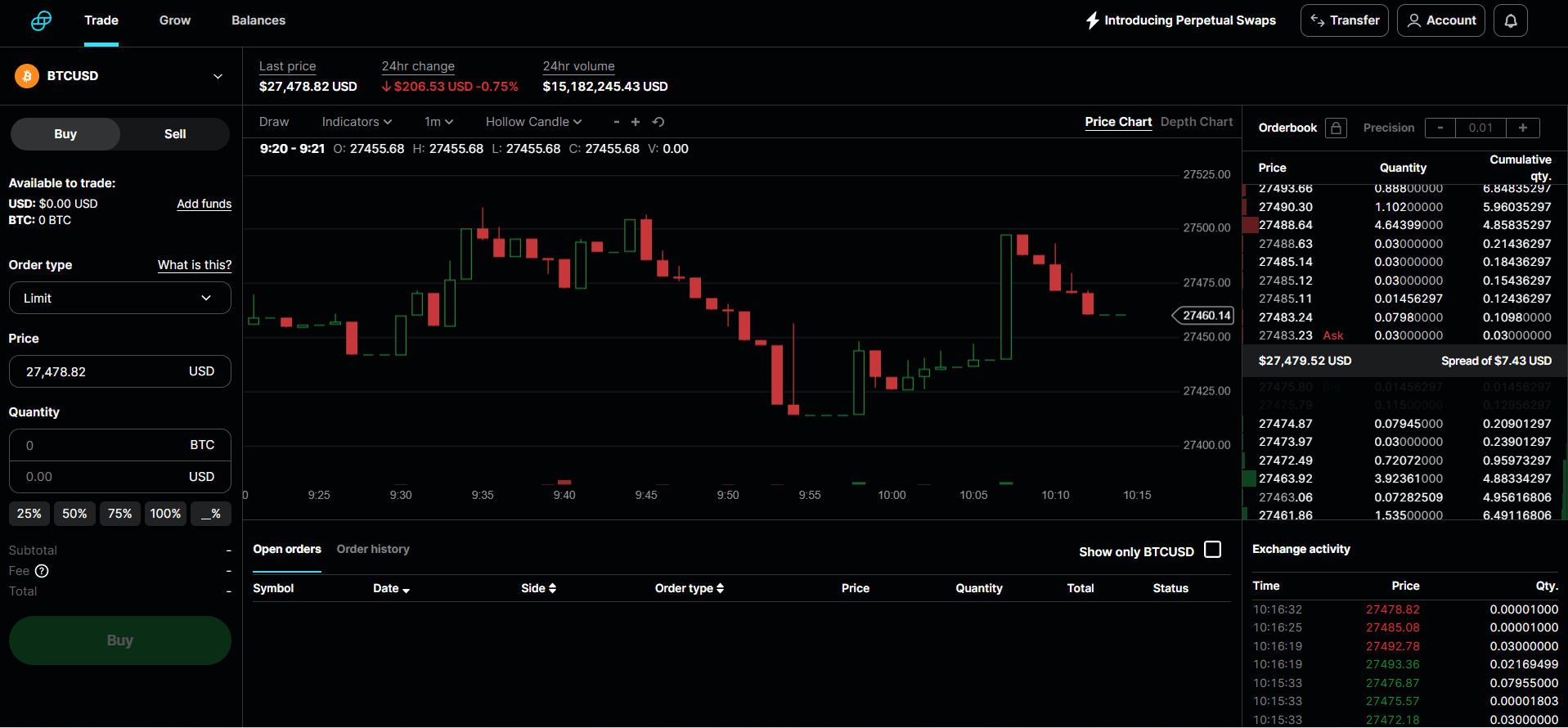

Gemini’s platform is designed with simplicity and user-friendliness in mind. It offers a clean, intuitive interface that even beginners can navigate with ease.

The platform provides basic trading features, real-time price tracking, and advanced charting tools. Gemini also has a mobile app for trading on the go.

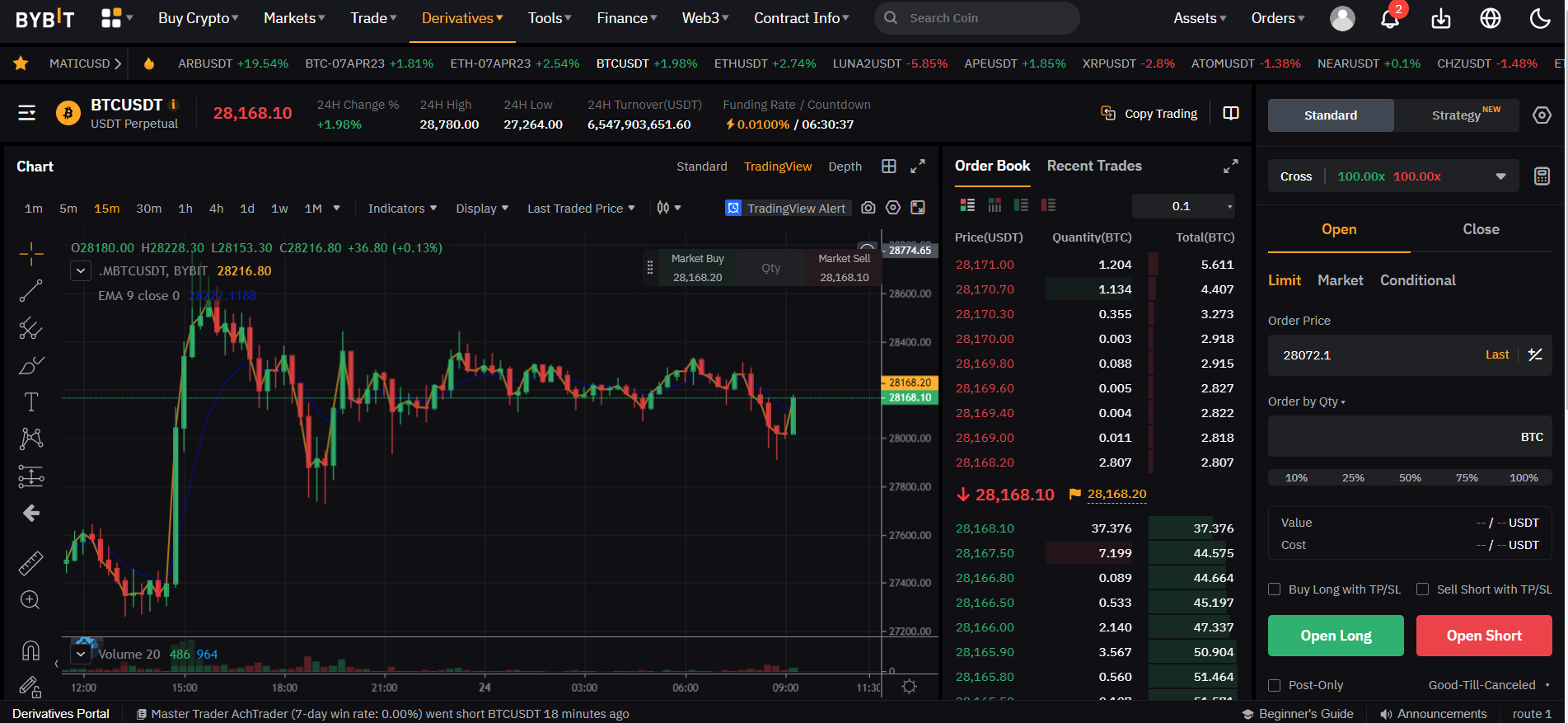

Bybit, however, caters more to advanced traders.

The platform offers a robust trading experience with advanced charting tools, customizable widgets, and a plethora of technical analysis indicators and offers technical chart powered by TradingView.

The interface might seem overwhelming to beginners but offers a high degree of customization to seasoned traders. Bybit also offers a mobile app for trading anytime, anywhere. To know more about the exchange, check this guide on how to short on Bybit.

Verdict:

If you’re a beginner or prefer a straightforward, easy-to-navigate platform, Gemini would be a better choice. However, if you’re an advanced trader seeking a platform with more sophisticated trading tools and customizable features, Bybit is the way to go.

Gemini vs Bybit: Customer Support

Gemini offers several customer support channels.

You can reach out to them via email or their request form. They also have an extensive FAQ section and various guides to assist you. However, they do not offer live chat or phone support.

Bybit, on the other hand, prides itself on providing 24/7 customer service.

They offer live chat support, which is often the quickest way to get help. In addition, they have a comprehensive Help Center that covers a wide range of topics, and you can also reach them via email.

Bybit places a strong emphasis on customer support and offers a variety of channels for users to obtain assistance. The platform features an extensive knowledge base and FAQ section, as well as a support ticket system.

Verdict:

While both exchanges provide solid support resources, Bybit takes the edge with its 24/7 live chat support, offering immediate assistance when traders need it most.

Gemini vs Bybit: Security Features

Gemini implements a robust security system, leveraging both hardware security modules and multi-signature technology.

Additionally, a large portion of their digital assets are kept in cold storage, minimizing the risk of online hacks.

Gemini is also the world’s first cryptocurrency exchange and custodian to complete a SOC 2 Type 2 examination, emphasizing its security commitment.

Bybit also employs stringent security measures, including a multi-signature withdrawal process, cold storage for the majority of their assets, and an insurance fund to cover potential losses from unforeseen circumstances.

Moreover, Bybit uses a Hierarchical Deterministic Cold Wallet System, ensuring that all assets are safely stored in an offline environment.

Verdict:

Both exchanges exhibit a strong commitment to security. Gemini’s SOC 2 Type 2 certification demonstrates a high standard of operational and security controls, which may appeal to security-conscious users.

However, Bybit’s Hierarchical Deterministic Cold Wallet System and insurance fund are attractive security features, particularly for traders dealing with large volumes.

It’s a close call, but Gemini’s regulatory compliance gives it a slight edge in this category.

Is Bybit Safe & Legal To Use?

Bybit is a legal cryptocurrency exchange registered in the British Virgin Islands and operates within the legal framework of its jurisdiction.

The platform is open to users globally, but it does restrict users from certain countries, including the United States, due to regulatory limitations.

As for safety, Bybit implements industry-standard security measures, including two-factor authentication (2FA), a hierarchical deterministic cold wallet system, and SSL encryption.

The platform also utilizes a multi-signature withdrawal process and keeps the majority of its assets in cold storage, protecting them from online threats.

It’s also worth noting that Bybit operates an insurance fund designed to cover potential losses due to extreme market volatility.

However, no platform is completely immune to risks, and users should employ best practices, such as using strong, unique passwords and enabling 2FA, to bolster their account security.

So, is Bybit safe and legal to use?

Yes, as long as you are not in a restricted country, Bybit is a legal and safe platform for cryptocurrency trading. However, you should always be vigilant about your security practices.

Is Gemini Safe & Legal To Use?

Gemini is a fully regulated cryptocurrency exchange based in the United States.

It’s compliant with the Bank Secrecy Act, and the USA Patriot Act, and is registered as a money services business with FinCEN.

Furthermore, Gemini is licensed to operate in multiple U.S. states and countries around the globe, making it a legal platform for most users.

Regarding safety, Gemini goes to great lengths to secure its platform and user assets.

It employs advanced security measures like two-factor authentication, withdrawal whitelist, and hardware security keys.

Moreover, a significant portion of user funds are stored in cold storage, adding another layer of security.

Gemini is also the first crypto exchange and custodian to complete a SOC 2 Type 2 examination, which attests to its high level of security control and operational performance.

Despite these measures, it’s critical to remember that no platform can guarantee 100% safety, and users should always exercise best practices, such as using complex passwords and enabling two-factor authentication.

In conclusion, Gemini is not only legal but also highly committed to providing a safe trading environment for its users.

As with any platform, individual user precautions are necessary to ensure the maximum level of security.

Conclusion

In wrapping up this comparison, I’ve found that both Gemini and Bybit present strong platforms for cryptocurrency trading, each with its unique strengths.

Gemini stands out with its rigorous regulatory compliance and emphasis on user security, making it an excellent choice for those prioritizing safety and legality.

Bybit, on the other hand, shines with its advanced trading tools and 24/7 customer support, which may appeal more to seasoned traders.

Ultimately, the choice between Gemini and Bybit should align with your trading needs, comfort with risk, and the legal requirements in your jurisdiction.

Happy trading!

Learn how does Gemini & Bybit stack up against the competition:

- Gemini vs Phemex

- Gemini vs Kraken

- Bybit vs Kraken

- Bybit vs MEXC

- Bybit vs Deribit

- Bybit vs Independent Reserve

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023