If you want to start crypto trading, you need to decide which crypto exchange to use. Or, you can be a veteran trader looking to change your crypto trading platform.

In either case, learning about the pros and cons of each crypto exchange is crucial. Today, we’ll compare Bybit and Deribit: two popular high-leverage crypto trading exchanges.

Founded in 2018 and based in Singapore, Bybit is a new and fairly popular cryptocurrency derivatives exchange.

It’s a Bitcoin futures and options exchange founded in 2016 and based in the Netherlands. Deribit is a different type of trading exchange – no actual buying or selling of cryptocurrencies occurs there.

Nevertheless, both exchanges offer perpetual swaps/futures, the most popular crypto trading product.

So, which exchange is the best for crypto futures trading? Let’s find out.

Deribit vs. Bybit: Crypto Derivatives Product Offerings & Leverage

Both exchanges support crypto derivatives trading. Bybit currently only offers perpetual futures. It has three types of contracts:

- Inverse perpetual contracts: BTCUSD, ETHUSD, EOSUSD, XRPUSD

- Linear perpetual contracts: BTCUSDT, ETHUSDT, LTCUSDT, LINKUSDT, BCHLINK, XTZUSDT, ADAUSDT, UNIUSDT, ADAUSDT

- Inverse futures contracts: BTCUSD quarterly

Bybit offers maximum leverage of 100x on futures trading. Furthermore, Bybit has a 24h trading volume of 310,962 BTC, translating to USD 10.479 billion. Also, you can get sign-up bonus by using Bybit coupon code.

Deribit is a cryptocurrency futures and options trading exchange that offers Bitcoin Options, Bitcoin perpetual futures, Etherium options, and Ethereum perpetual futures. Deribit also offers up to 100x maximum leverage on futures trading.

However, Deribit doesn’t disclose its daily trading volume, and it has been the object of criticism by clients and experts because of its low liquidity.

Verdict: Bybit is the winner. It offers more trading options and has a higher trading volume and thus more liquidity.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Deribit vs. Bybit Trading Fees

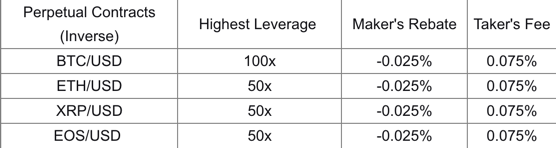

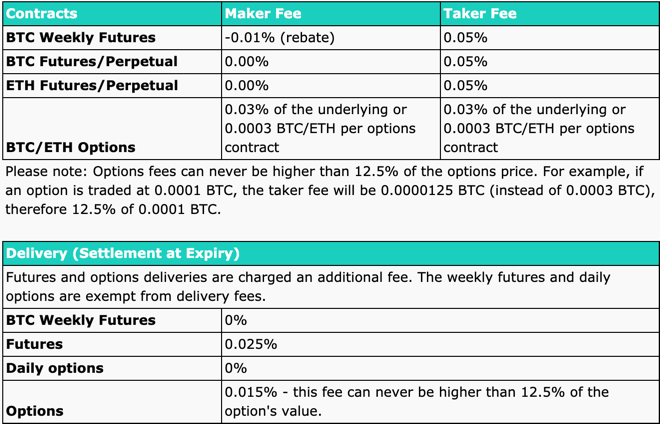

Bybit and Deribit have different trading fee structures. Bybit, for instance, has a flat fee structure. It charges a market taker fee of 0.075% and provides a 0.025% rebate to market takers.

Deribit has a differentiated commission depending on the position taken by the trader. Market makers receive a 0.02% rebate for futures contracts, while market takers need to pay a 0.05% fee. Deribit also charges a 0.35% futures liquidation fee.

Deribit provides a 0.025% market rebate to market makers and charges a 0.075% market taker fee for perpetual contracts. The perpetual contracts liquidation fee is 0.375%.

For options, Deribit charges a 0.04% or 0.0004 BTC contract fee. Besides, options traders are charged a 0.019% liquidation fee.

Verdict: Bybit is the winner, as it has a more straightforward fee structure.

Deribit vs. Bybit Funding Fees

Like all futures trading exchanges out there, Deribit and Bybit also implement a funding rate to ensure that the price of perpetual futures stays close to the underlying asset.

In case you’re new to the concept of funding fees, here’s a quick explanation. Unlike traditional futures contracts that come with weekly and monthly expiry, perpetual futures contracts have no expiry.

So, even though traditional futures contracts can trade away from the spot price, they must converge on the day of expiry.

Since perpetual contracts have no expiry date, they can trade away from the spot price forever. To avoid this, exchanges implement a funding rate mechanism.

When the contract trades above the spot price, the funding rate is positive, and long traders pay a funding fee to short traders. When the contract trades below the spot price, the funding rate is negative, and short traders pay a funding fee to long traders.

Both Bybit and Deribit deploy the Mark Price mechanism to calculate funding rates.

Verdict: It’s a tie, as both exchanges use the Mark Price mechanism to calculate the funding rate.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Deribit vs. Bybit Deposit & Withdrawal Fees

Neither Bybit nor Deribit charges a deposit fee. Deposits are free on both platforms, and only blockchain fees are payable.

Both exchanges charge a withdrawal fee. Bybit charges a flat withdrawal fee of 0.0005 BTC on withdrawal transactions. On the other hand, Deribit charges varying withdrawal fees according to the speed of the withdrawal process.

The withdrawal fee oscillates between 0.002 BTC and 0.0015 BTC. The faster the process, the higher the fees.

Verdict: Bybit has a simpler withdrawal fee structure, and thus, it is the winner.

Deribit vs. Bybit Trading Platform Comparison

Both Bybit and Deribit offer a web-based trading platform. Let’s draw a head-to-head comparison between the trading platforms of the two exchanges.

- Bybit

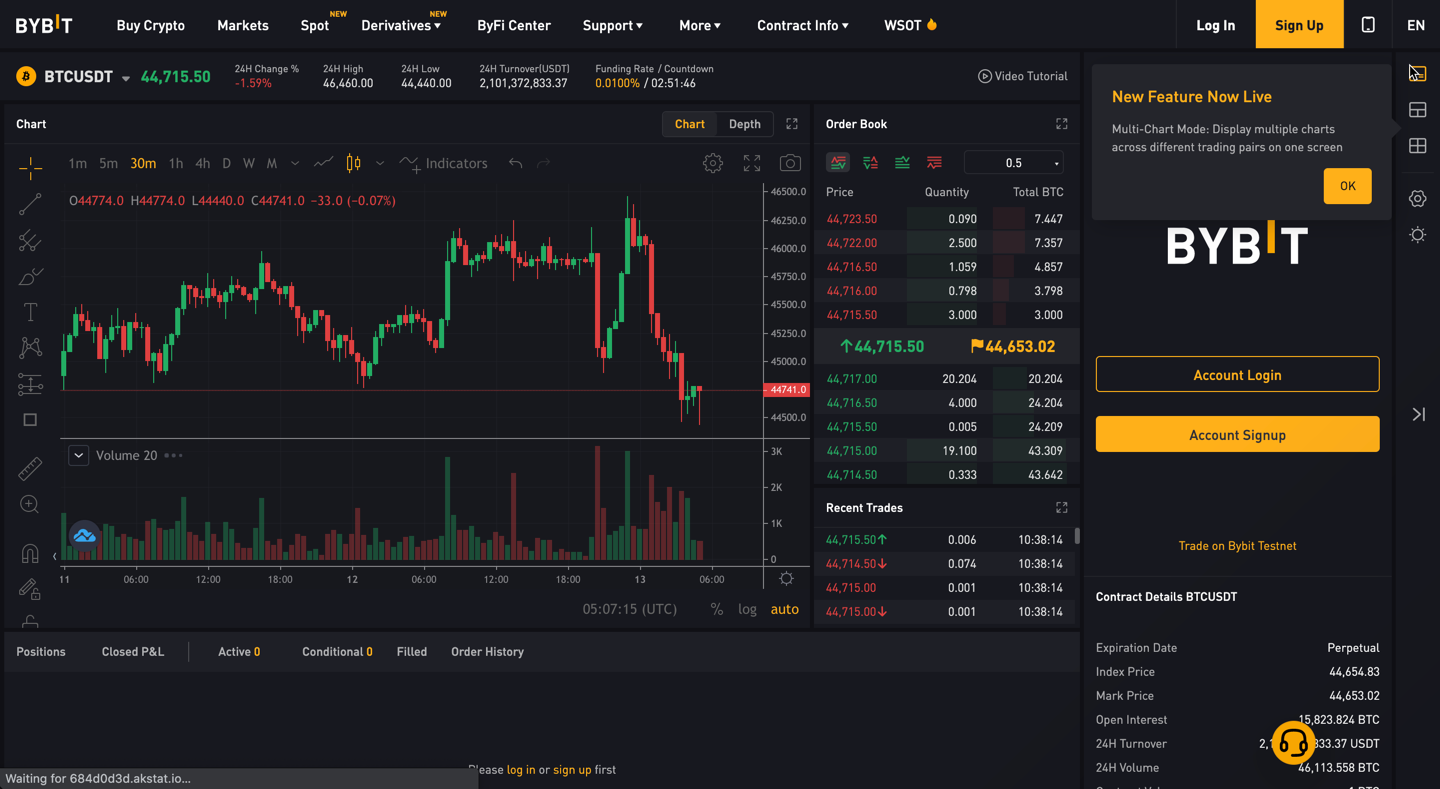

Bybit is one of the most popular exchanges and has one of the most powerful trading platforms in the industry.

The platform emphasizes speed and is capable of processing up to 100,000 transactions in a second. The speed, along with great liquidity, provides a seamless trading experience to users.

Bybit implements a TradingView charting system with various chart types, multiple time frames, and various built-in indicators. The trading dashboard also has the order book from where you can place your orders.

Bybit offers all types of orders, including Limit, Market, Conditional, Stop Loss, and Take Profit, along with advanced orders like Reduce Only.

Bybit’s trading platform also supports API for the integration of algorithmic trading, which is an essential factor that institutional traders should consider.

In all, the Bybit platform prioritizes speed, performance, and user-friendliness. It also has a mobile app that allows you to enjoy desktop-like trading features on the go. To learn more about the exchange, check this how to use ByBit guide.

- Deribit

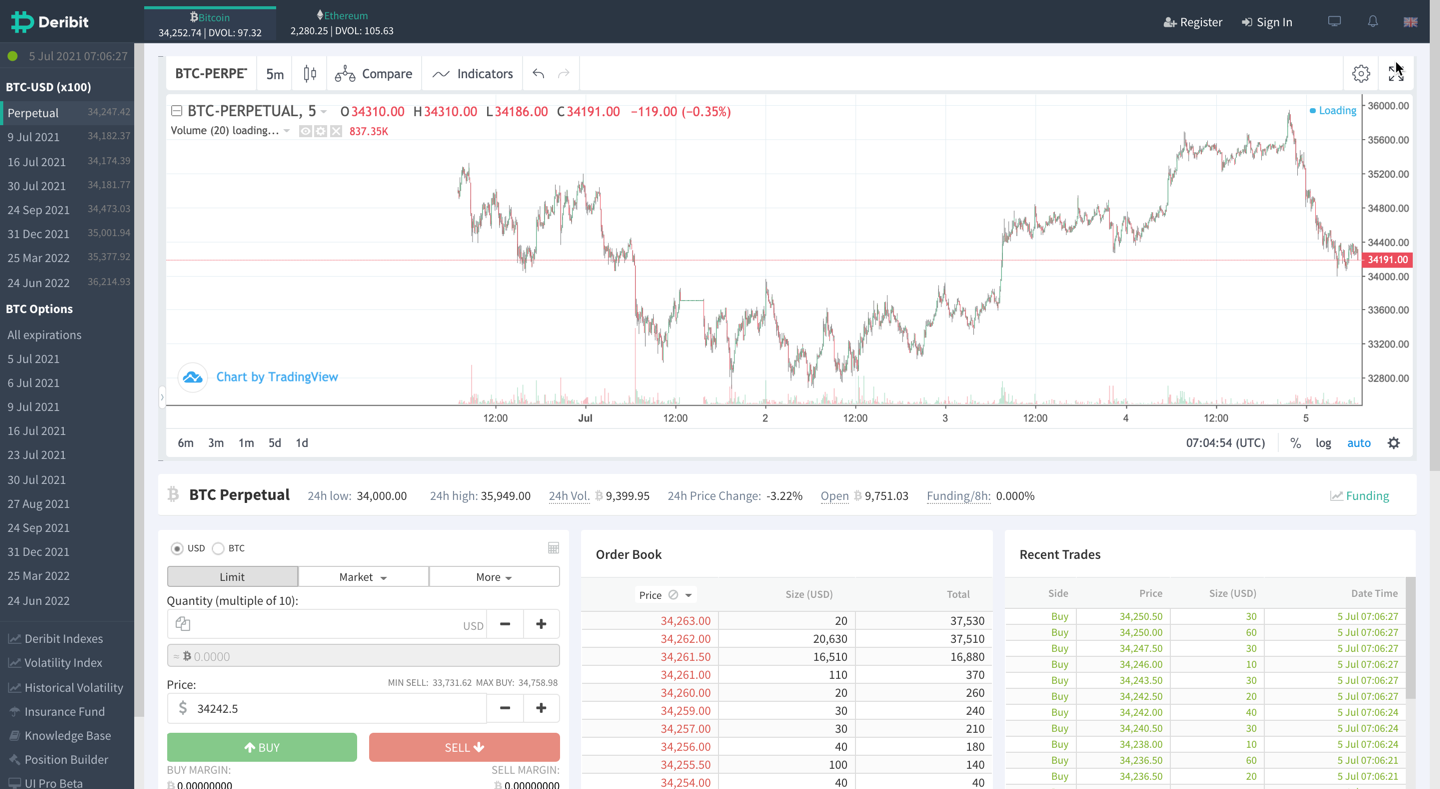

Deribit’s trading platform is simple and intuitive. The trading interface has an order book where you can place buy and sell orders. It also implements the TradingView charting system, providing you with all advanced analysis tools.

Deribit also supports all types of orders, including Limit, Market, Conditional, Stop Loss, and Take profit, along with advanced orders, such as Post Only and Reduce Only.

Deribit has a mobile app that allows you to place and manage your trades from mobile. Deribit also offers APIs for algorithmic trading and integrating with other tools.

While both Bybit and Deribit have comparable trading platforms, the Bybit platform is more intuitive and user-friendly.

Verdict: Bybit’s trading platform is more user-friendly, and thus, it is the winner.

Deribit vs. Bybit Account Opening Process

Both Bybit and Deribit are non-KYC cryptocurrency exchanges. Therefore, they offer a seamless account opening process.

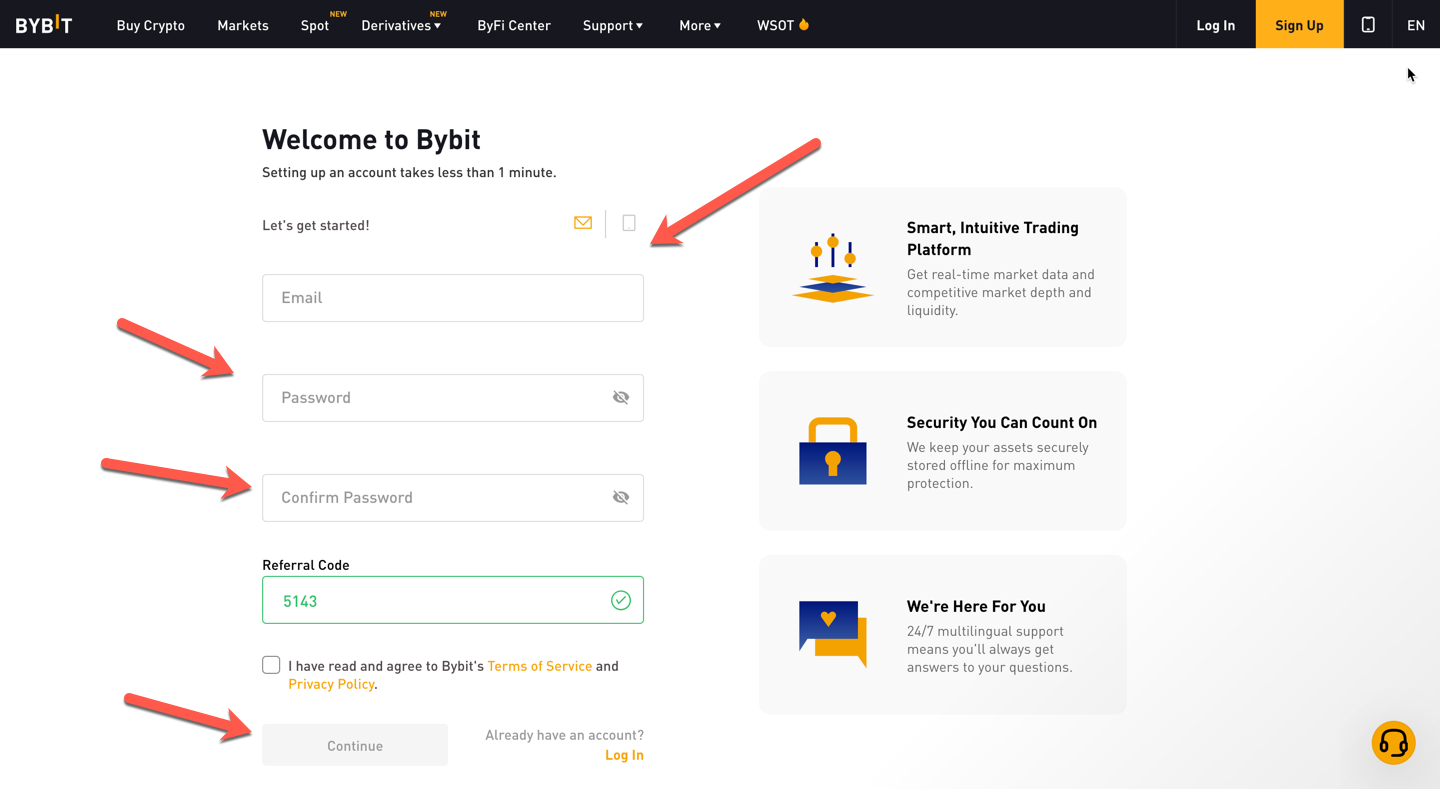

- Bybit

Bybit is a non-KYC cryptocurrency exchange, and you can open an account with only your email address.

Alternatively, you can create a Bybit account with your phone number. Once you enter your email or phone number, you’ll receive a verification code. Verify your account, and you’re all set to trade.

Since Bybit is a derivatives-only exchange, it only allows cryptocurrency trading. It doesn’t support trading for fiat currencies, and thus, no KYC is required.

However, Bybit allows you to deposit fiat currencies via third-party fiat gateways. But to do that, you’ll need to verify your identity (KYC). Also, third-party fiat gateway fees may apply when depositing fiat currencies.

Bybit also has some limits on deposits and withdrawals. Follow this page for in-depth information.

The process of depositing and withdrawing funds is simple. Head to the “My Assets” section and click on “Deposit” or “Withdraw.” Once you have funds in your Bybit account, you can start trading.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

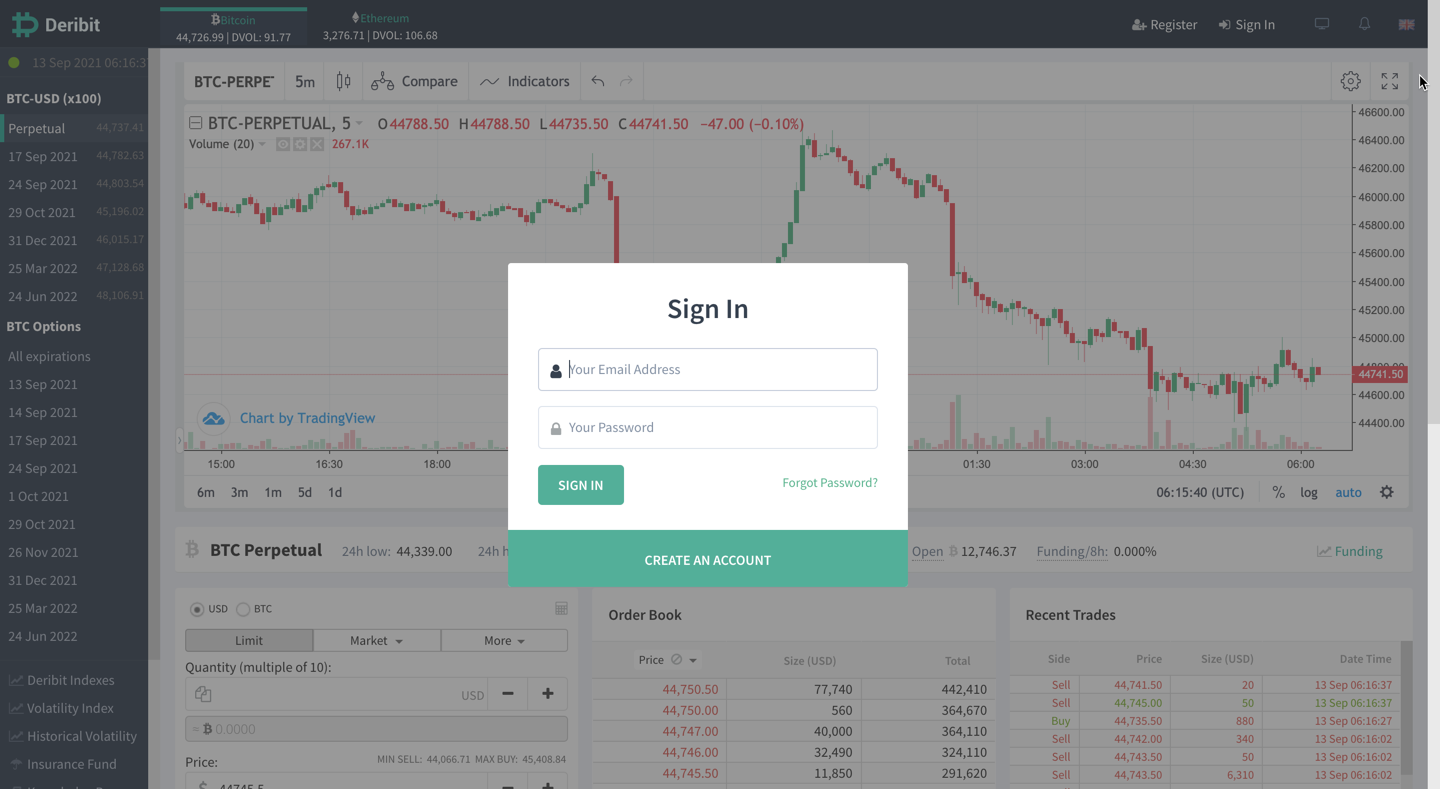

- Deribit

Deribit is an anonymous trading platform. Since it only enables trading for Bitcoin, it doesn’t require any KYC.

You can sign up using an email address, username, and password. Just like Bybit, you’ll receive a verification code. After verifying, you’ll be ready to get started.

During the registration process, Deribit allows you to opt for a dummy account, where you can use Dericon to stimulate trading and get used to the trading platform. If you’re a new trader, the dummy account can be a handy feature for you.

While KYC is entirely optional on Deribit, it may ask for identity information as per their terms and conditions.

Deribit only supports Bitcoin for depositing and withdrawing funds as far as deposit and withdrawal methods are concerned. There is no way to deposit fiat currencies.

Verdict: It’s a tie, as both exchanges don’t require a KYC and offer a seamless account opening process.

Deribit vs. Bybit Customer Support

Customer support is an important factor to consider when selecting a cryptocurrency exchange. Let’s compare the customer support available on both platforms.

- Bybit

Bybit excels in customer support. It offers 24/7 customer support via live chat functionality. The live chat support is multilingual – available in seven different languages. In case of more specific queries, you can seek email support at [email protected].

Additionally, you can contact Bybit’s team on Telegram and Reddit.

Bybit also has a large resource library with help pages, blog posts, FAQs, and guided videos to make your crypto trading journey smooth and effortless.

- Deribit

Deribit offers support via email and Telegram only. In case of general questions regarding the exchange, you can write them at [email protected]. You can also connect with them on their Telegram group.

Verdict: Clearly, Bybit is the winner as it provides 24/7 multilingual live chat support.

Deribit vs. Bybit Security Features

Along with customer support, security is another important factor to consider when looking for a crypto exchange. Let’s highlight the security features of both exchanges.

- Bybit

Bybit deploys various security features to provide a safe and secure trading experience to its users. Here’s an overview of Bybit’s security features.

- Two-Factor Authentication (2FA): 2FA requires email and SMS to authenticate login to a user’s account. While 2FA isn’t mandatory, Bybit encourages users to enable the feature for better account safety.

- Cold Wallet System: Like most renowned exchanges, Bybit stores 95% of its users’ funds in cold wallets accessible only via offline signatures. Furthermore, Bybit allows withdrawals only three times per day.

- User Activity Log: Bybit logs all user activity, including account balances, deposit records, and transaction history. It also has an Insurance Fund to protect traders against malicious volatility and price fluctuations.

Additionally, Bybit guarantees that its users’ data and funds will never be compromised due to a system-related error. Should it happen, Bybit promises to compensate all its users completely.

- Deribit

Deribit also implements various security features to protect its users’ data and funds. Here’s a quick dive into Deribit’s security features.

- Cold Storage: Like Bybit, Deribit also uses a cold storage wallet system to store 95% of its clients’ funds. Deribit implemented this feature after an algorithmic bug caused a loss of more than USD 235,000 in 2017.

- Two-Factor Authentication: Deribit allows users to turn on the two-factor authentication feature to secure the login process and prevent unauthorized access.

- IP Pinning: The Deribit website uses IP pinning technology to identify changes in the IP address. In case of a change in IP, the session is terminated. Furthermore, each session is terminated after a week by default; you can set it to as low as one hour.

While both Bybit and Deribit offer similar security features, Deribit had to absorb a USD 235,000 loss due to a liquidation algorithm bug.

Verdict: It’s a tie, as both Bybit and Deribit offer similar security features.

Conclusion

Now, this is a tough call, as Bybit and Deribit share almost the same features. They offer up to 100x leverage on derivatives trading, charge low trading fees, have robust security, and support fast account creation.

However, there are a few differences to consider. Bybit supports multiple cryptocurrencies and also allows you to deposit fiat currencies. Deribit supports Bitcoin only.

Customer service is another area where Bybit has an edge. Its live multilingual customer support could be a dealbreaker for most traders.

Lastly, you might face some liquidity issues in Deribit. On the other hand, Bybit is the fourth largest derivatives exchange in terms of 24h trading volume, so there won’t be any liquidation issues.

However, Deribit’s dummy account is a critical feature that could be helpful for new traders.

In all, Bybit is a robust exchange suited for all traders, especially professional and experienced traders. If you’re a new trader and want to get acquainted with crypto trading, Deribit can be an ideal pick.

Check out how Deribit & Bybit compares to other exchanges: